Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

CBO announced before Xmas that they were going to take over the 4th largest Olive oil producer in the US. This is a pretty bold move, and the market seems to think it is a great idea:

I am less sure.

There are several reasons to be optimistic which have been summarised by Perplexity below, as well as the key risks. My prompt for company summaries, after loading up the last 12 months of announcements and presentations, always starts with "you are a brilliant analyst ...!" (not sure if flattery works onLLMs but i'm willing to give it a go.)

The issue for me is mostly one of valuation. I can't seem to come close to 4 bucks even if execution and proposed synergies are perfect. I am mindful of the fact that long term this is likely to be a huge winner if they manage to pull off a successful integration and improvement in yields and productivity as they have elsewhere. But the SP has got ahead of itself. I am going to mull it over for a day or so but likely trim 25%. I suspect next year's results are going to be disappointing and there will be a pullback, but hate trying to be too clever about position sizing.

Overall judgement for a fund manager

Main positives

• Strategic fit is excellent: same category, same vertically integrated model, contiguous geography, and clear brand/asset complementarities.

• The acquisition materially shifts CBO from a supply‑constrained to a more appropriately scaled US platform, with meaningful step‑change in groves, processing capacity and distribution reach.

• Medium‑term EPS accretion (c.9% guided from FY27F) looks achievable if even a conservative portion of synergies are realised.

• Strong asset backing and long‑duration agricultural exposures provide some inflation hedge and underpin downside over multi‑year horizons.

Main negatives

• Execution and integration risk are significant; synergy targets are ambitious relative to COR’s current profitability.

• Balance sheet risk increases at a time when CBO is already investing heavily in new US groves and plant, while also exposed to volatile water costs and biennial bearing in Australia.

• Warrants introduce “shadow dilution” that becomes material in precisely the scenario where the equity performs strongly, capping part of the upside.

• The recent share price spike leaves little short‑term valuation margin of safety versus fundamental estimates, and embeds a good portion of synergy and growth expectations.

Probability of a successful acquisition

• Strategic/operational success: high probability (around “more likely than not”) that CBO integrates COR effectively and achieves a majority of guided synergies by FY30F, given the operational fit and track record.

• Financial success for equity at A$3.9–4.0: more balanced; returns look acceptable if synergies land close to plan and US growth continues, but at this price the equity is carrying clear execution, agricultural and funding risk with limited valuation headroom.

For a fundamental fund with a multi‑year horizon, this looks like a solid strategic move but a name to approach with position‑size discipline: attractive if one accepts execution risk and can tolerate volatility in agricultural earnings, but not obviously mis‑priced after the recent rally and with warrant dilution still to crystallise.

Here's the link to the presentation

This update is placed at the top of the straw so members don't have to scroll all the way to bottom to read the new info.

CBO reported today and it was good one, though the recent run up in the SP had pretty much anticipated these results.

Here are the highlights:

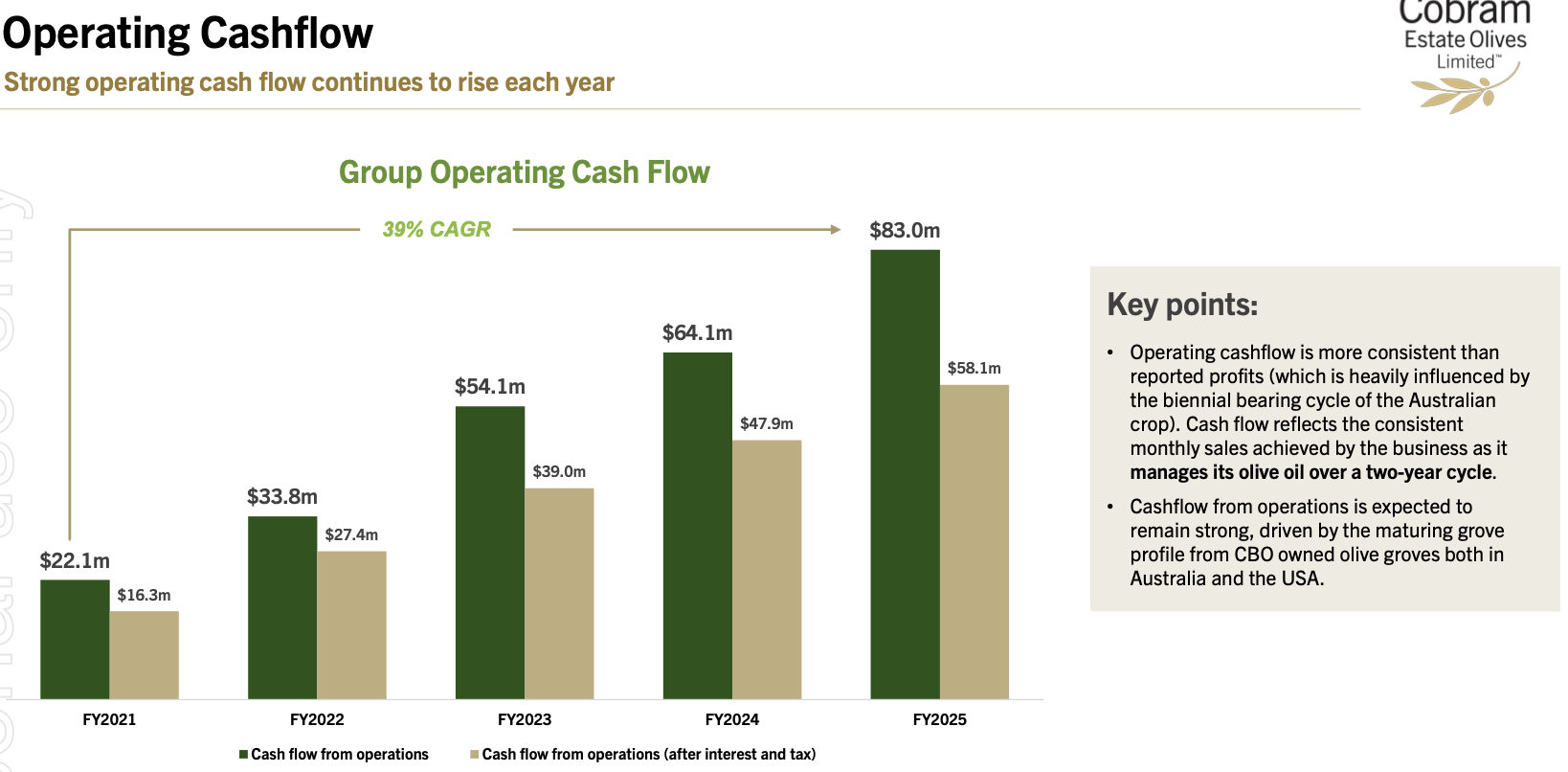

Because the oil is harvested once a year (in each country) and for accounting reasons they need to report the market value of the oil on the date it is harvested, not as it is sold, FCF is a better and more accurate measure of progress. As per above that is growing at a healthy 39% p.a.

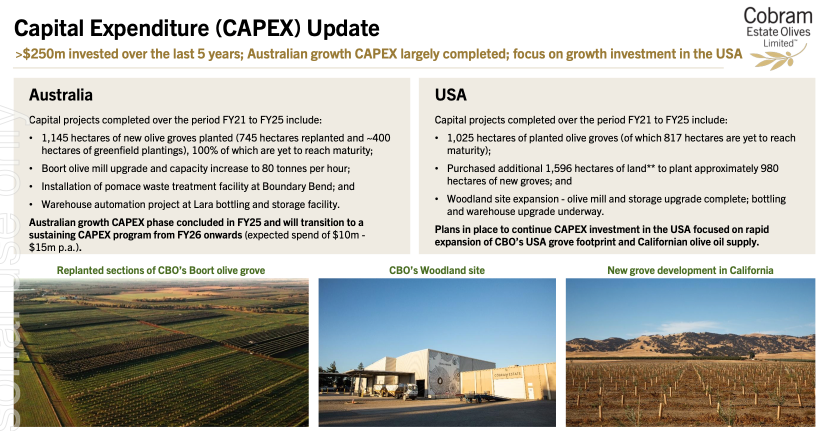

They have a reasonable amount of debt to support their aggressive growth and upgrade plans but interestingly, they are basically done with CAPEX in Australia and will be on maintenance CAPEX for the foreseeable future meaning $10-15m pa

For the Australian business, as the immature trees transition to mature trees, that extra yield will drop to the bottom line. How much are we talking about? An extra 40%.

The US is still in its infancy but will be half the size of the Australian operation in a few years: they are picking up land parcels at reasonable prices and developing this in a measured way as debt and FCF allow them to. There is a long runway to go.

I mistakenly told @Karmast last night that they are the #3 olive oil brand in the US. That was wrong, they are #9, but were #3 in California (now #2). They are the leader in Australia by some margin. They are now the largest vertically integrated olive oil company in the world.

Interesting macro snippets from the call

- regarding the US olive oil market - 95% is imported (mostly from Europe), which will of course now be subject to tariffs.

- the olive oil commodity price has doubled in 5 years

- Spain (Europes largest producer) has had another bad year which will likely impact prices once more

I fully anticipate a sell off in 12 months time as it will be an off year in Australia and they are somewhat constrained by a lack of 3rd party growers/suppliers in the US this year which will crimp the US result.

Excitingly, FY 2027 will herald a large increase in harvest yield both in AU and US trees and will likely be a cracker.

See valuation for 2027 which I believe is conservative.

Held IRL and SM

--------------------------------------------------------------------------------------------------------

CBO reported last week and it was a really good result. The summary of the big numbers is:

Of particular note, this is an "off year" in Australia where the bulk of the crop comes from. Olive trees have a biennial harvest: on years produce a much larger crop than off years. On years in Australia are 2021,2923, 2025 etc. The US has the opposite.

The company is relatively early in its return from an earlier period of significant capex - they have spent up large planting groves, building processing and bottling plants and branding the new US business (66m this year). This process is still ongoing and they have increased borrowing to 225m from 191m last year, This gives a gearing of 25%, but it will be worth keeping an eye on debt serviceability, but the cashflow trend is pretty good

The other thing that needs to be noted is how early on we are assessing this company in the life and productivity of the trees they own:

Australia:

USA:

The big picture is of a company that is currently profitable with a a rapidly improving profitability and a long runway for growth.

So far they are executing well, the US business is now selling as a higher margin branded product rather than as bulk oil and gaining market share in US supermarkets. The Australian business has the number 1 supermarket brand.

RISKS

Currently olive oil prices are increasing rapidly benefitting CBO, because of poor climate and olive tree infestations in Europe. Being an agricultural company, this risk could also cause a catastrophic collapse of the industry here in Australia as well. We have brilliant border security but recently Varroa mite arrived on our shores which will decimate the bee keeping industry. Other exotic pests cannot be discounted.

I think it is a reasonable time to buy into CBO. They have demonstrated that his is business that could scale rapidly and very profitably.

The numbers for next year are likely to fantastic being an "on" year in Australia. The SP is likely to wobble around a fair bit with the biennial production until the US production catches up with the Australian one, so there may be further buying opportunities along the way.

See valuation straw for a very rough sketch

ASX Announcement – 14 December 2023

Completion of USA harvest and Business Update USA Harvest

Cobram Estate Olives Limited (“CBO” or “the Company”) has completed its 2023 Californian harvest. The 2023 Californian harvest led to the production of 3.2 million litres of olive oil (89% higher than 2022 and 48% higher than 2021 – the previous ‘on’ year). This growth in production is driven by the larger area under supply contract from 3rd party olive growers and the maturing profile of our groves in California and was in line with our expectations and likely to place CBO as the largest olive oil producer in the USA. The increased olive oil availability will enable the Company's USA operations to continue to grow sales.

It is important to highlight that currently only 14% of CBO’s USA groves are mature, 36% are immature, and 50% are yet to come into production. Milling extraction efficiencies and extra virgin olive oil quality were excellent, delivering above average results on both parameters.

During the same period, we have also completed the development of phase 2 of the Dunnigan Hills Ranch development with 149 hectares of olives planted between October and November 2023 adding to the 205 hectares planted in phase 1 during May and June 2023.

Australian Groves - Flowering

Flowering for the 2024 crop commenced in mid-October on CBO’s Australian groves, with full bloom at our Boundary Bend grove occurring during the last week of October and during the first week of November at our Boort grove. This was just a few days earlier than the long-term average.

Slightly lower than expected flowering levels on certain areas of the Boort grove linked to wetter than average conditions during the past growing season have been offset by above average fruit set levels across all our groves, due to the favourable conditions during the flowering period. The 2024 crop season is shaping up well, with initial estimates in line with expectations. It is important to remember that 2024 is a lower yielding crop year on many of our Australian groves and that final yields are subject to the normal risks associated with agricultural production.

Sales – Australia and USA

Packaged goods sales in both Australia and the USA continue to remain in-line with expectations and well ahead of the comparative period for the first 5 months of the financial year. Pleasingly, following the c12% price rise of Australian Cobram® bottles in early October 2023, sales rates remain strong.

Olive oil, that is.

Clearly, these are tailwinds for CBO, as is having a a now geographically diversified production base.

Being a primary producer, is not something I would normally be interested in but haver recently taken a small nibble. I just don't see the old world production being robust in the near, medium or distant future and bringing new sources on line has a significant lag. CBO would appear to be ideally positioned to benefit from this scenario. (see most recent announcement)

Why the price of olive oil is soaring

Climate change, export controls and soaring fertiliser costs leave a bitter taste

Dec 13th 2023

image: Getty Images

HOMER CALLED it liquid gold. To Hippocrates it was “the great healer”. These days olive oil is used to sauté vegetables or dress salads—but it is once again becoming a luxury. In September prices reached their highest level since records began, rising by 117% year-on-year according to the International Monetary Fund. Olive oil is seventeen times as valuable as crude oil weight for weight; in 2019 it was seven times cheaper. Why has the price shot up?

Olive oil has been a central part of the Mediterranean diet for thousands of years. Hippocrates was onto something: as the world has begun to recognise the health benefits of the region’s diet, appetite for olive oil has grown. Spain is the world’s biggest producer of the stuff, accounting for almost half of the yearly total, followed by Italy and Greece. Southern Europe’s baking summers and mild winters provide an ideal climate for olive trees. But rising demand has coincided with supply shortages. Prolonged heat waves, droughts and extreme weather are stymying production.

Last season was particularly bad. Spain had a hot spring: in April, some regions were 5°C warmer than the average for that month, meaning that olive groves failed to bloom. Summer offered no respite. According to the environment ministry, one-third of the country suffered a “prolonged drought” in June, damaging the few olive trees that had flowered. Meanwhile in Italy, where temperatures were also scorching, Xylella fastidiosa, a bacterium, ravaged trees. The disease, which is spread by insects, is thought to have been introduced by an ornamental plant from Costa Rica in 2008. It has since killed an estimated 21m trees. Research has found that extreme climate events make olive groves more vulnerable to outbreaks.

As a result, production in the EU fell by around 40% last year, causing prices to surge. Two factors pushed them higher still. First elevated interest rates and the surging cost of fertiliser squeezed farmers’ margins. Second Turkey, one of the few countries that enjoyed a good olive harvest, banned the export of olive oil in bulk in an effort to bring domestic prices down. That kept prices stable in Turkey, but drove them up elsewhere.

Some responses to these soaring prices have been drastic. Spain has witnessed a spate of olive-oil heists. In August thieves stole $500,000-worth from a warehouse in the province of Córdoba. The country’s authorities removed 11 brands of olive-oil from supermarket shelves after they were found to be low-quality and unfit for human consumption. Next year’s harvest looks set to bring more strife. In September rain ravaged olive trees in Puglia, the heel of the Italian boot. Another drought is looming in Spain. Production in 2024 will be one-third lower than the previous four-year average, according to the country’s agriculture ministry. Thousands of salads may once again go undressed. ■

Just a few initial thoughts following the meeting today with CEOs Sam & Leandro.

Look, it's an ag business and will have all the usual ups and downs associated with that -- as much as they try and mitigate. Weather, pests, disease, costs (fertiliser, labour, water etc), market pricing are all variable factors. Plus there's just the usual biannual fluctuations with olive yields.

The positives however are certainly noteworthy.

As Leandro pointed out, Olive trees are the "Eucalypts of the Mediterranean" -- very hardy. A tough year will impact yield, but the plants will typically survive. And, clearly, with 8-9x the cost advantage of the industry average, they have a lot of smarts in growing and harvesting olives.

There is a growing demand and awareness for quality olive oil (fwiw i genuinely think the science is pretty solid on the health benefits vs seed oils). And given it takes at least 3-4 years before a tree will start producing, and 7-8 before it properly matures, it will take a long time for any meaningful supply side response.

In fact, there's a significant pipeline of supply we should expect to come to Cobram in the years ahead as their current assets mature. Assets, it should be noted, that are very conservatively accounted for on the balance sheet.

I think they are also smart in how they manage the quality of their products. The best stuff goes to the Cobram brand, the next best goes to the Red Island brand, with the rest going to outside brands. Someone told me a long time ago that when it comes to retail, you either want to be at the premium end, or the bargain end -- but never the middle. And Cobram certainly seem aware of this.

While it'd not be part of the core thesis, I think it's sensible that they are looking at other value-adds, be that in farming carbon credits or developing uses for waste products (eg feed stock).

All told, Cobram will likely be a lumpy performer, but over time it seems to have some good tailwinds. It's the kind of business I could see a short-term focused market heavily discounting in bad years, and overvaluing in good years. For a long-term oriented patient investor, there could well be some good buying opportunities.

At present you have a 2% odd yield (70% franked). I suspect, based on their guidance for "materially higher EBITDA" in FY23 the forward yield could be closer to 2.5% or perhaps closer to 3% grossed up. That feels about fair -- not expensive, but not super cheap either. Although I'm shooting from the hip on that.

Recording should be available on the meetings page shortly

Refer to @Noddy74 Straw. Below just additional notes/facts I found interesting on Olive Oil from the prospectus.

Olive oil is the broad term used to describe the oil extracted from the fruit of an olive tree. Extra virgin olive oil is the highest quality grade of olive oil. Most of the olive oil produced by Cobram Estate Olives is extra virgin olive oil. It is simply the fresh, natural juice extracted from the olive fruit and is made with minimal processing, which preserves both its nutritional benefits and complex flavours. In Australia, products labelled simply as “olive oil” primarily consist of refined olive oil, which are made by refining (further processing) lower quality olive oils.

Olive oil production

The main olive oil producing countries are Spain, Italy, Greece, Tunisia, and Turkey. In recent times, the olive tree has spread outside the Mediterranean and is now grown and harvested in many countries including Argentina, Australia, Chile, South Africa, Peru, USA, Japan, and China.

Olive oil shelf life

Olive oil has a relatively long shelf life, and this allows for the orderly sale of stock over one to two growing seasons. However, unlike wine, olive oil does not improve with age. Over time olive oil, like any other cooking oil, will oxidise, eventually leading to the product becoming rancid. As a result, olive oil cannot be stored for extended periods and global stock levels are continuously being depleted and replenished. Exposure to light, heat, and oxygen will accelerate the process of oxidation.

Sustainable olive farming practices

Olive trees have one of the lowest water requirements compared to many permanent crops such as most nut and fruit trees. In addition, the International Olive Council estimates that producing one litre of extra virgin olive oil captures an average of 10.65kg of CO2 from the atmosphere, with one hectare of the average olive grove neutralising the carbon footprint of one person. Olive crops are the only mainstream edible oil crop which acts as a carbon sink. The most efficient crop in terms of use of water, nitrogen, and phosphorus fertilisers.