I recently watched the meeting we had with the CEO's of Cobram Estate and I think I see an interesting opportunity and would like to test it here.

First a summary of that meeting:

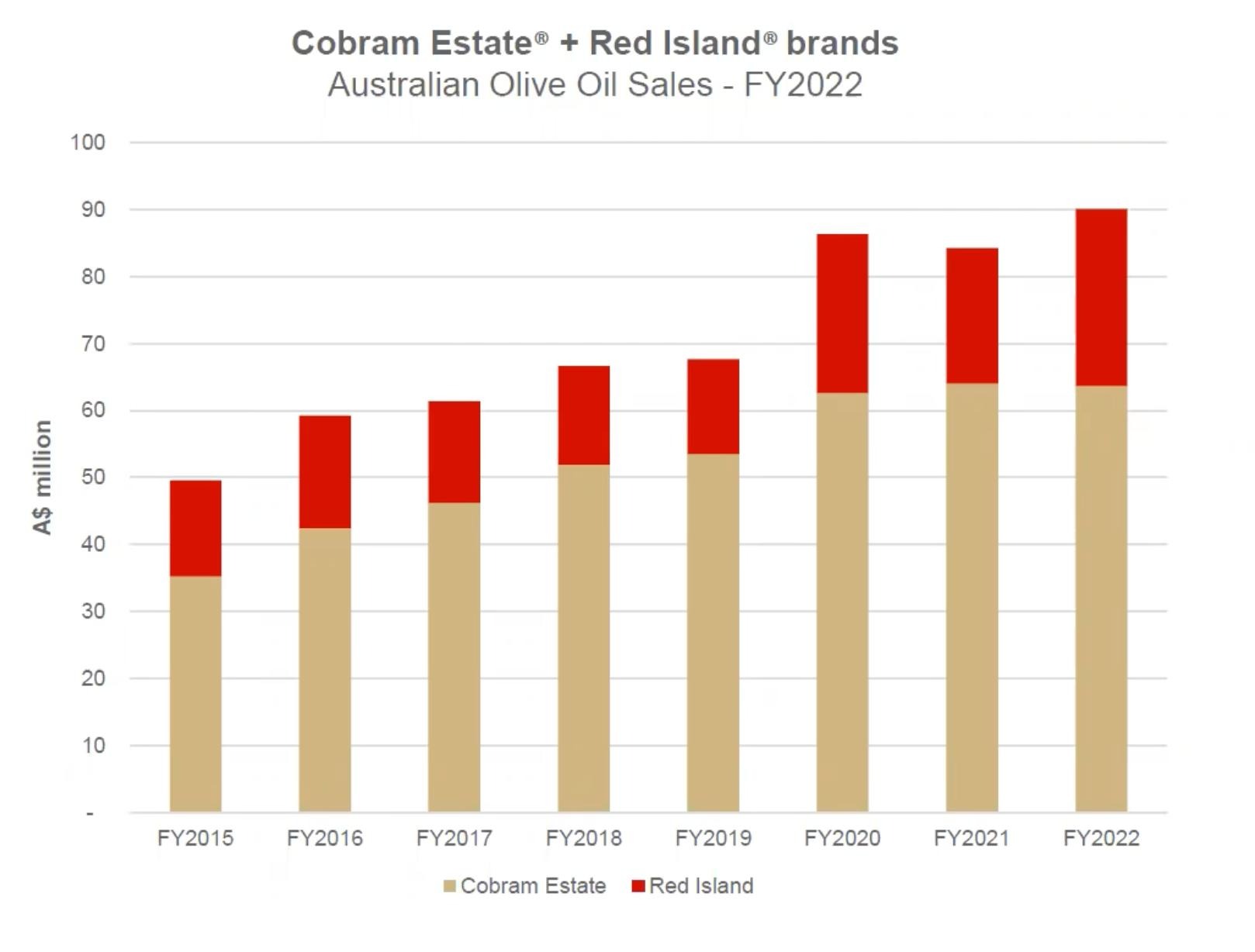

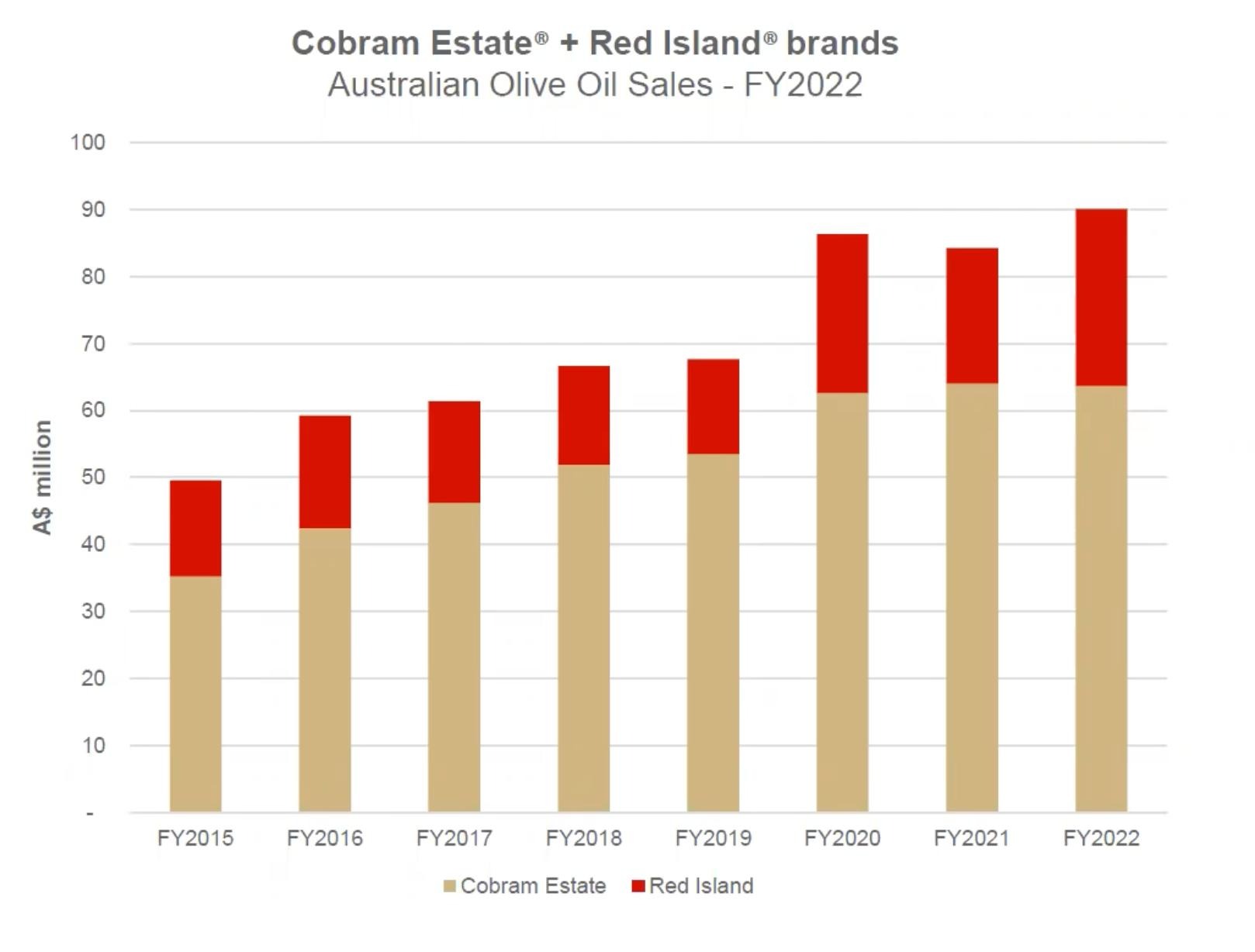

CBO are Australia's largest producer with about 80% of the market share

They have free hold title over about 98% of their land and only lease about 2%

They farm about 6500 hectares in Australia and about 350 in th US

Olives grow on a two year cycle meaning yields are poor evey second year and the revenue is cyclical

Australian operations were EBITDA positive FY2022 $32m however the US operations EDITDA was -$4.7m with an overall loss of $0.7m last FY

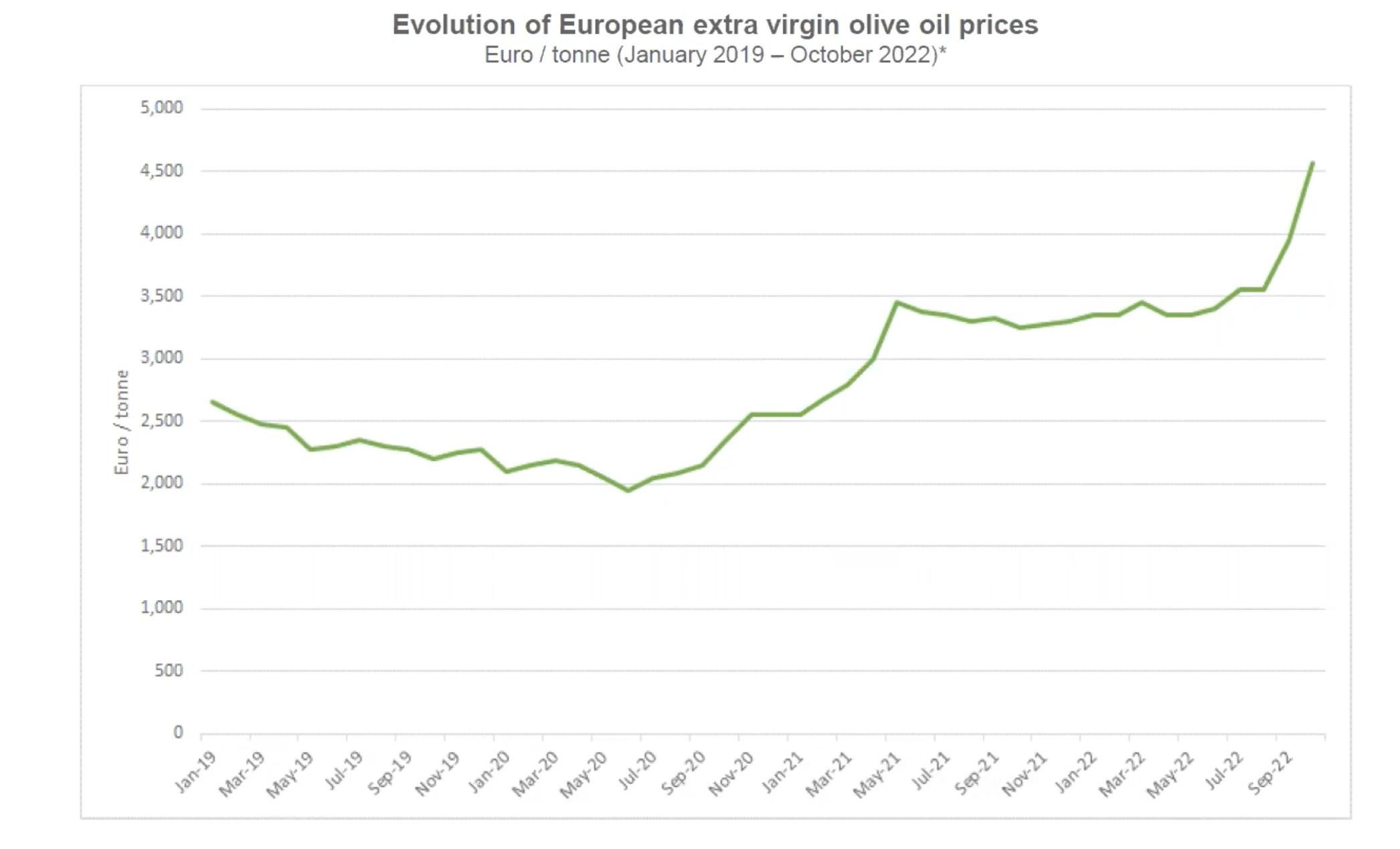

Input costs eg fertiliser, electricity etc have been squeezing margins and they intend to put up prices this year

They invested $37m last FY into growth which was paid for with a share issue

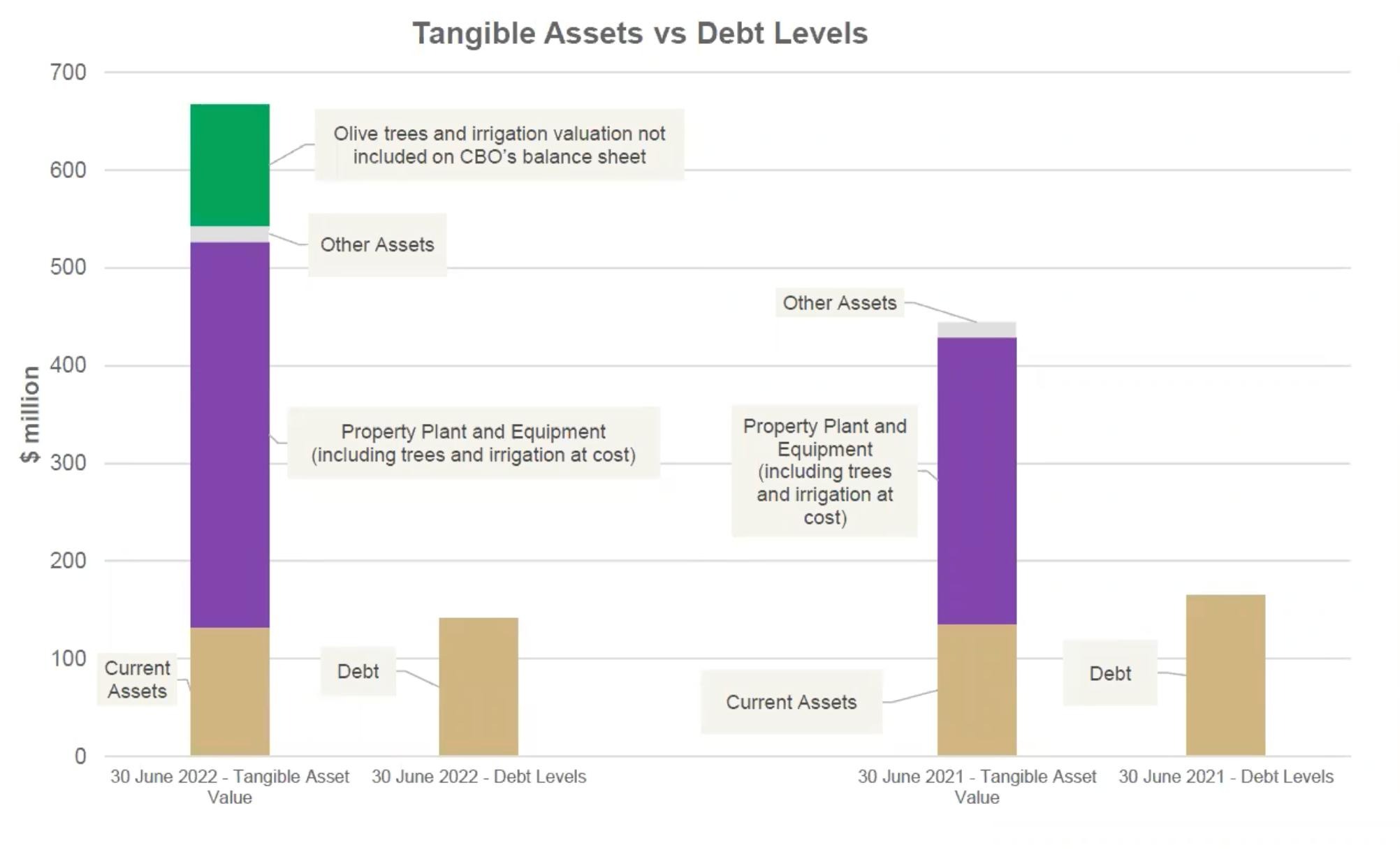

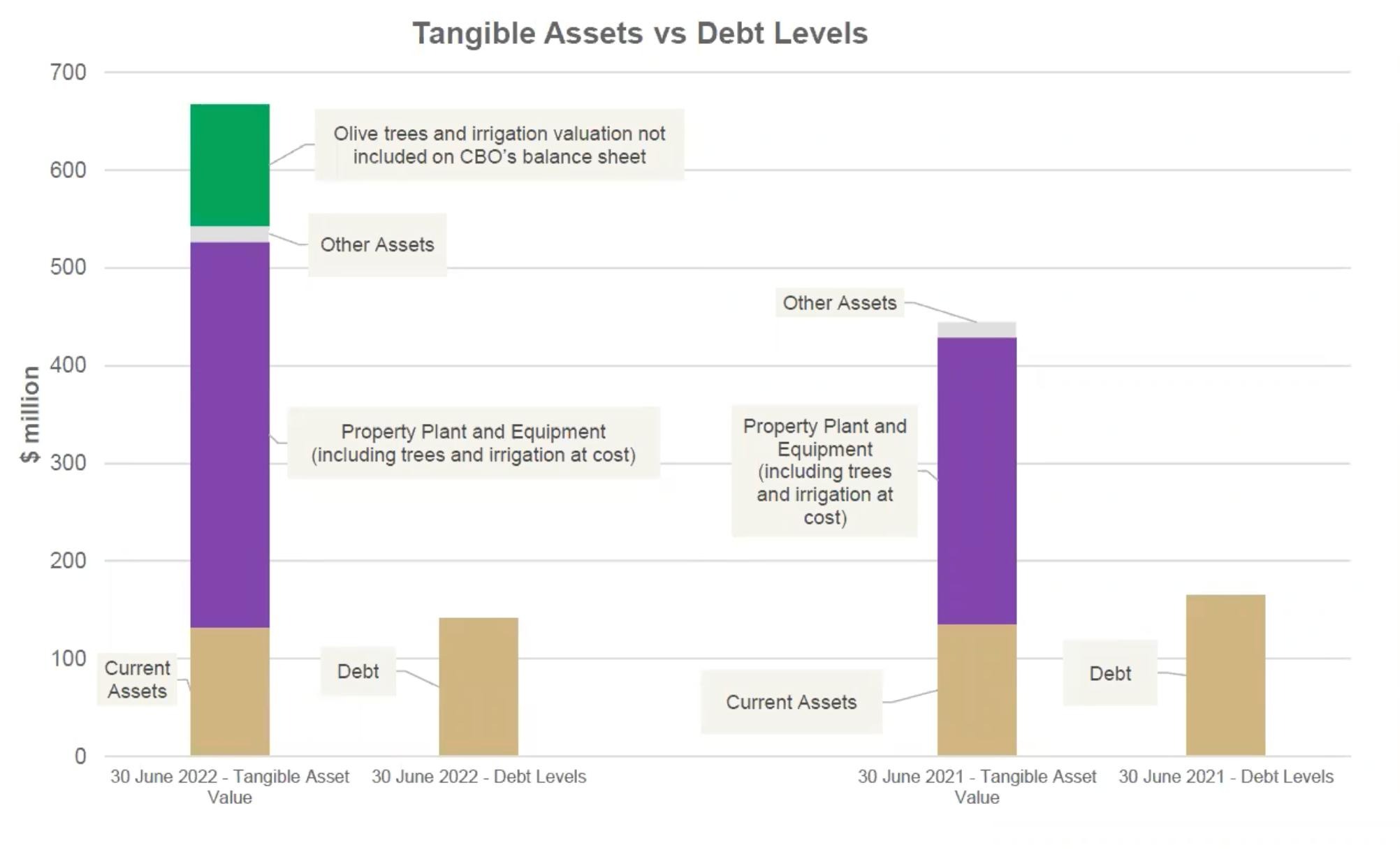

Property assets have significantly appreciated on the balance sheet by about $100m compared with PCP

The real value of the trees is not carried on the balance sheet therefore undervaluing total assets by about $150m (independently valued)

Carrying a pretty solid tax liability of $74m which is deferred

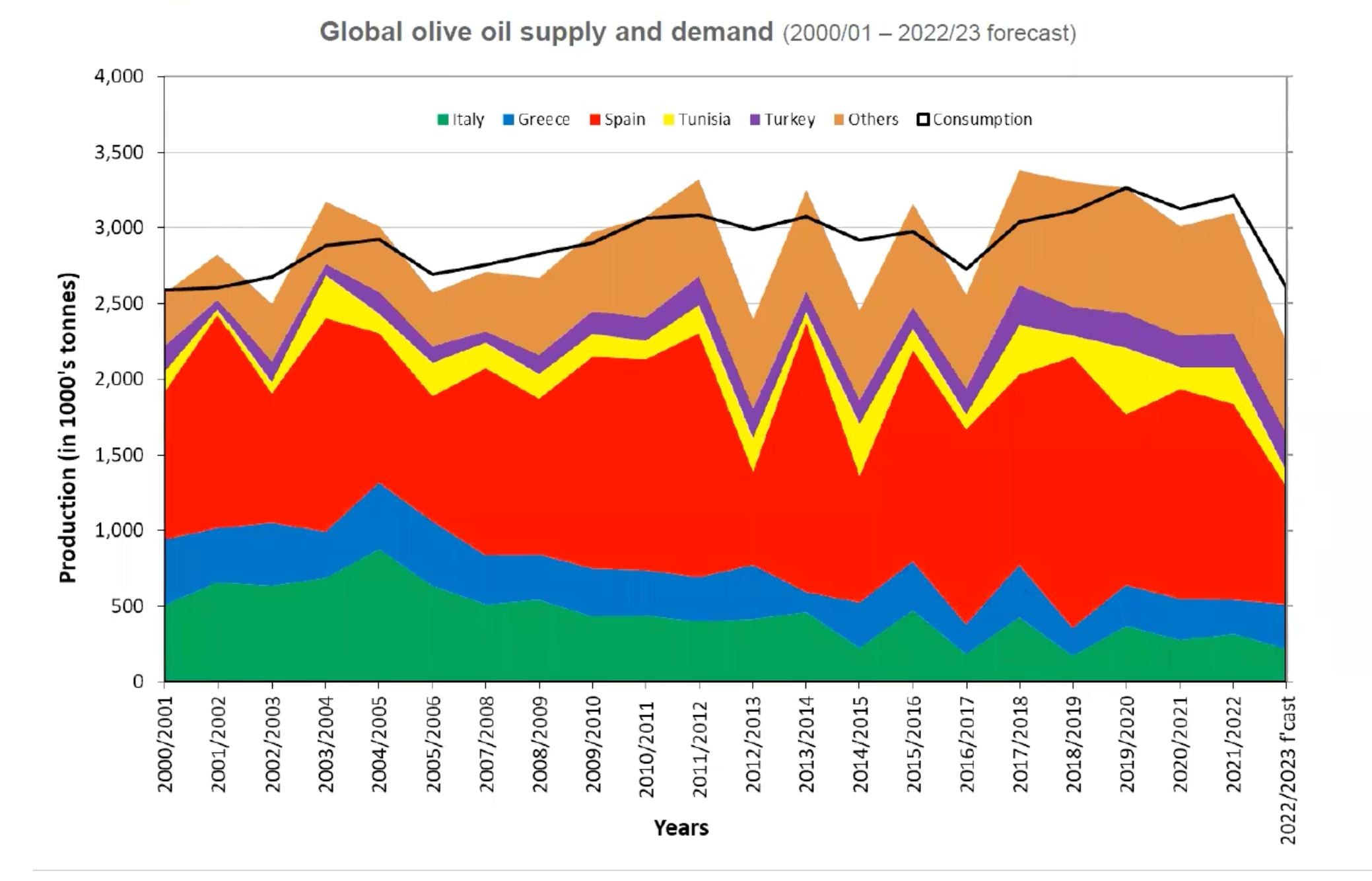

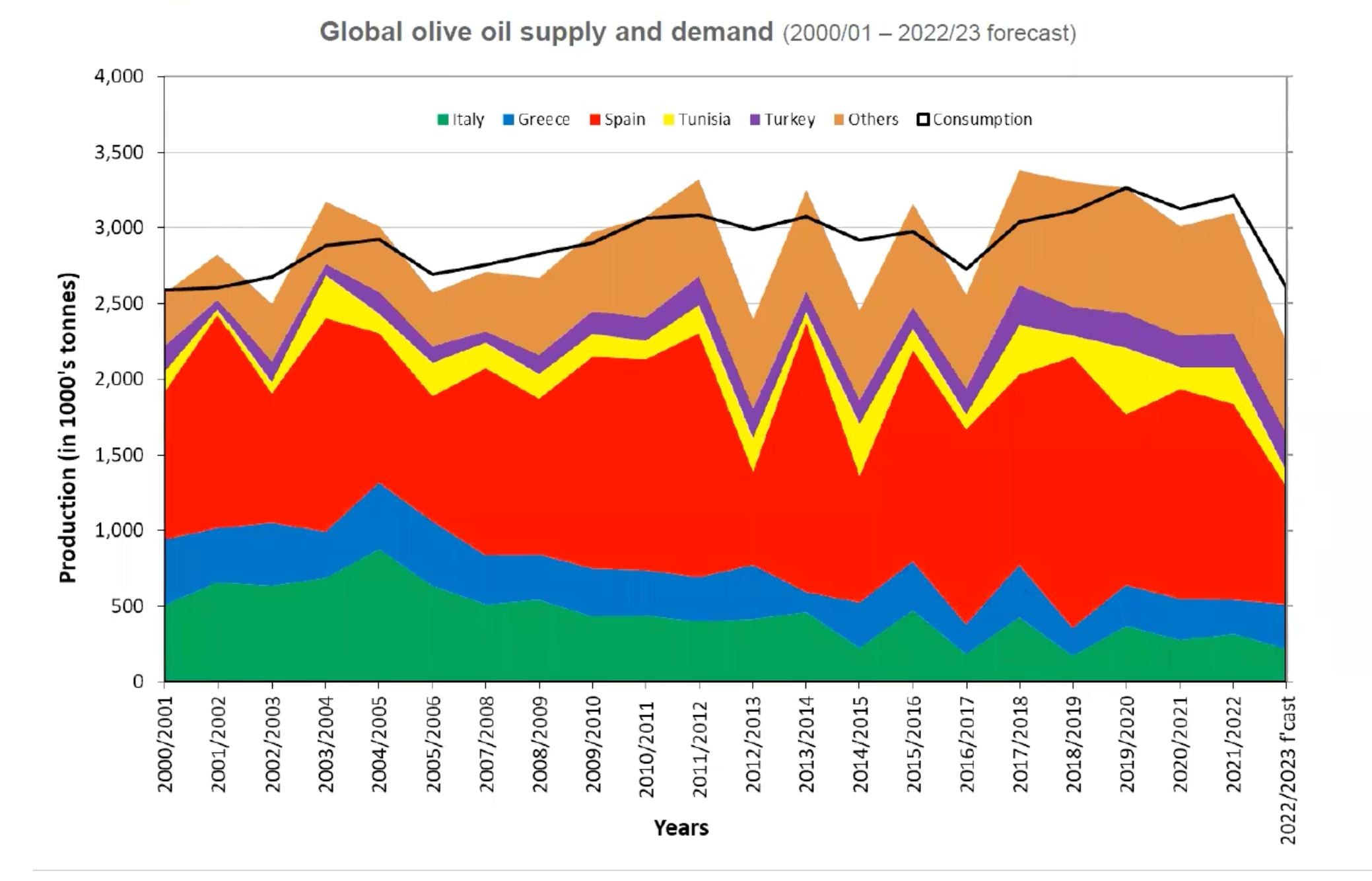

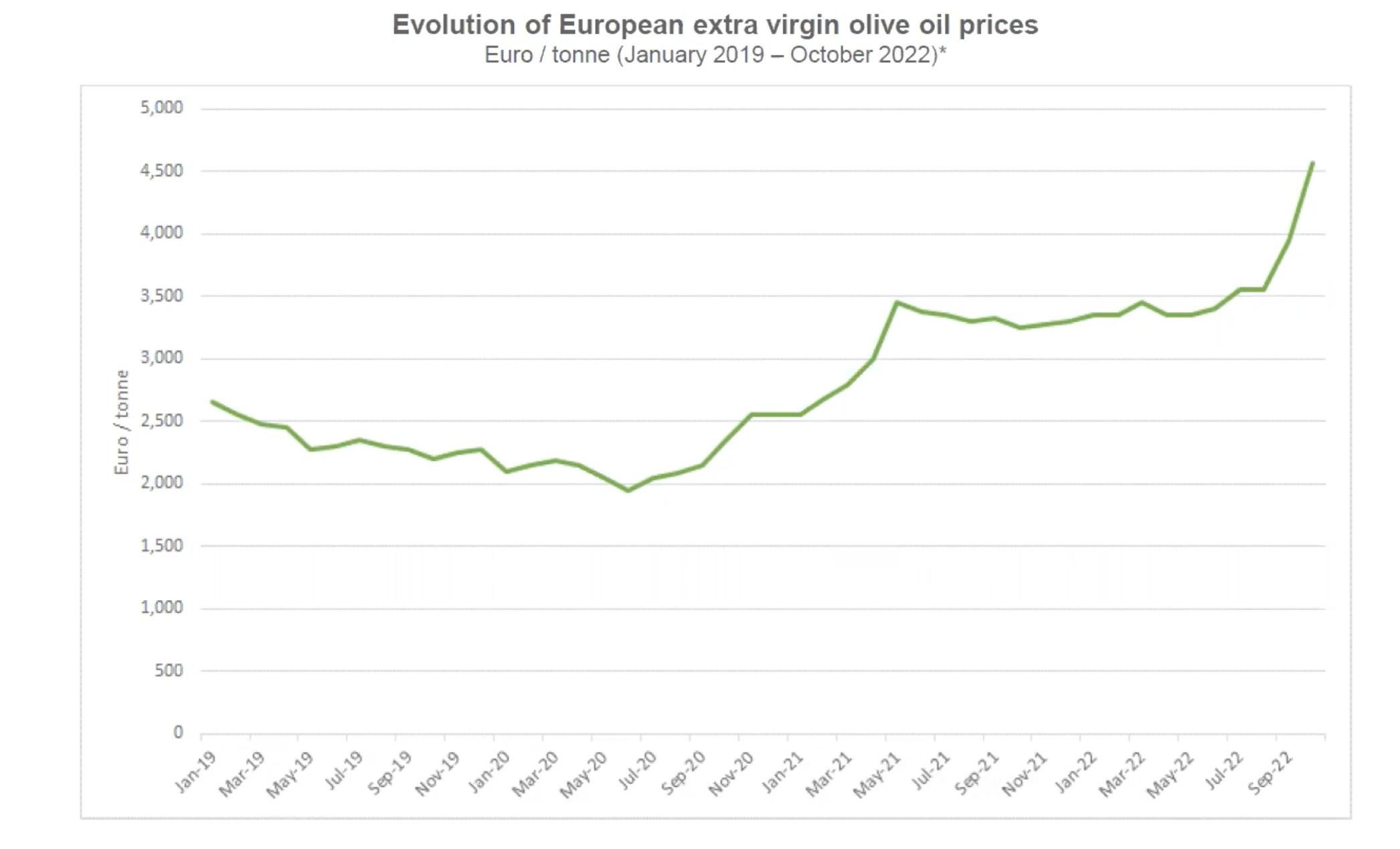

Low rainfall and high heat from climate change are limiting world production

Olive oil prices have doubled in two years

Water is a large input cost

They have dodged the damaging flooding rains that occured last year

The see growth coming from the maturing of the Australian groves and the development of the US groves and also pricing power as the brand grows

Olive oil yields have increased 16% from 2018 to 2021

They are in the process of almost tripling the output of one of their mills

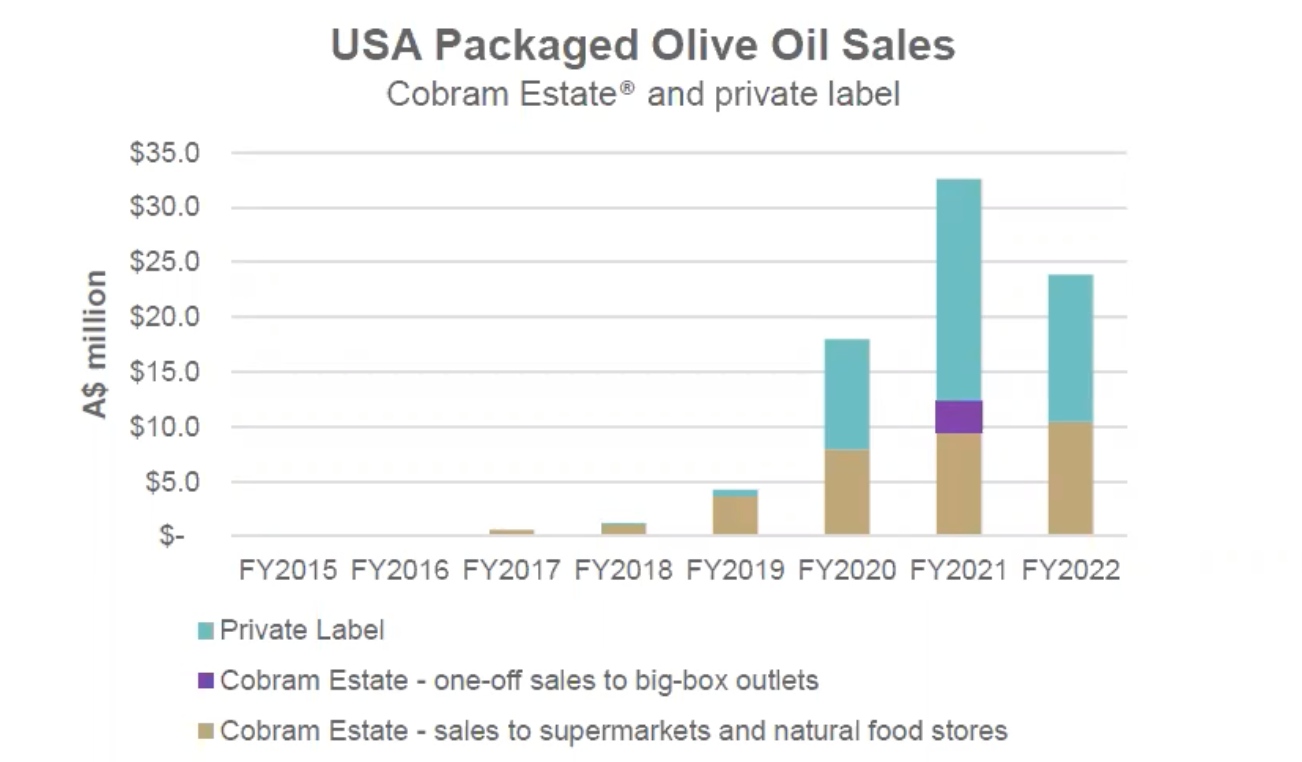

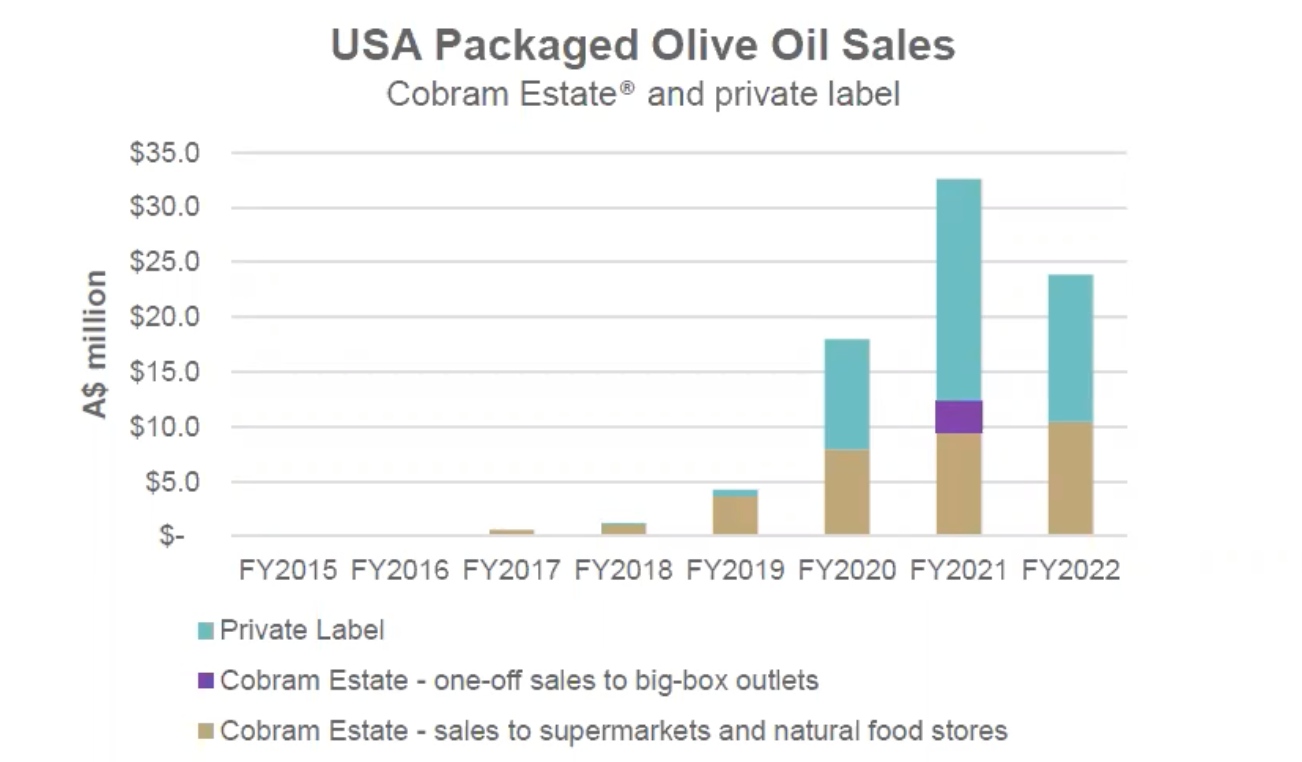

The US business is supply constrained where they are 10th in the market

Decline in US FY2022 due to loss of supply from 3rd party when COVID ended

Overall thoughts:

(Positive)

A well managed business with a strong brand

Already at a good scale in Australia, early stage in the US

Balance sheet is in good shape

They own a big property portfolio

On a forward price to sales of 2.5

Tailwinds on the health benefits of olive oil (vs seed oils)

(Negative)

An agriculture business at the whims of mother nature

Input prices have squeezed margins

They did dilute shareholders to invest in growth

Relatively high cap ex business

Management have continued to pay a dividend despite making a loss last FY

The opportunity:

The market misunderstands that this business moves over a two year cycle. Last FY was a low yield year. This year is a high yield year.

There are some unrealised assets not on the balance sheet. The maturing olive trees are only at cost on the balance sheet. The irrigation equipment not included on the balance sheet.

CBO report on the 23 February. I suspect they will surprise the market to the upside as this is a high yield year.

I started taking a position IRL and on strawman today.

Is olive oil discretionary or is it a staple?