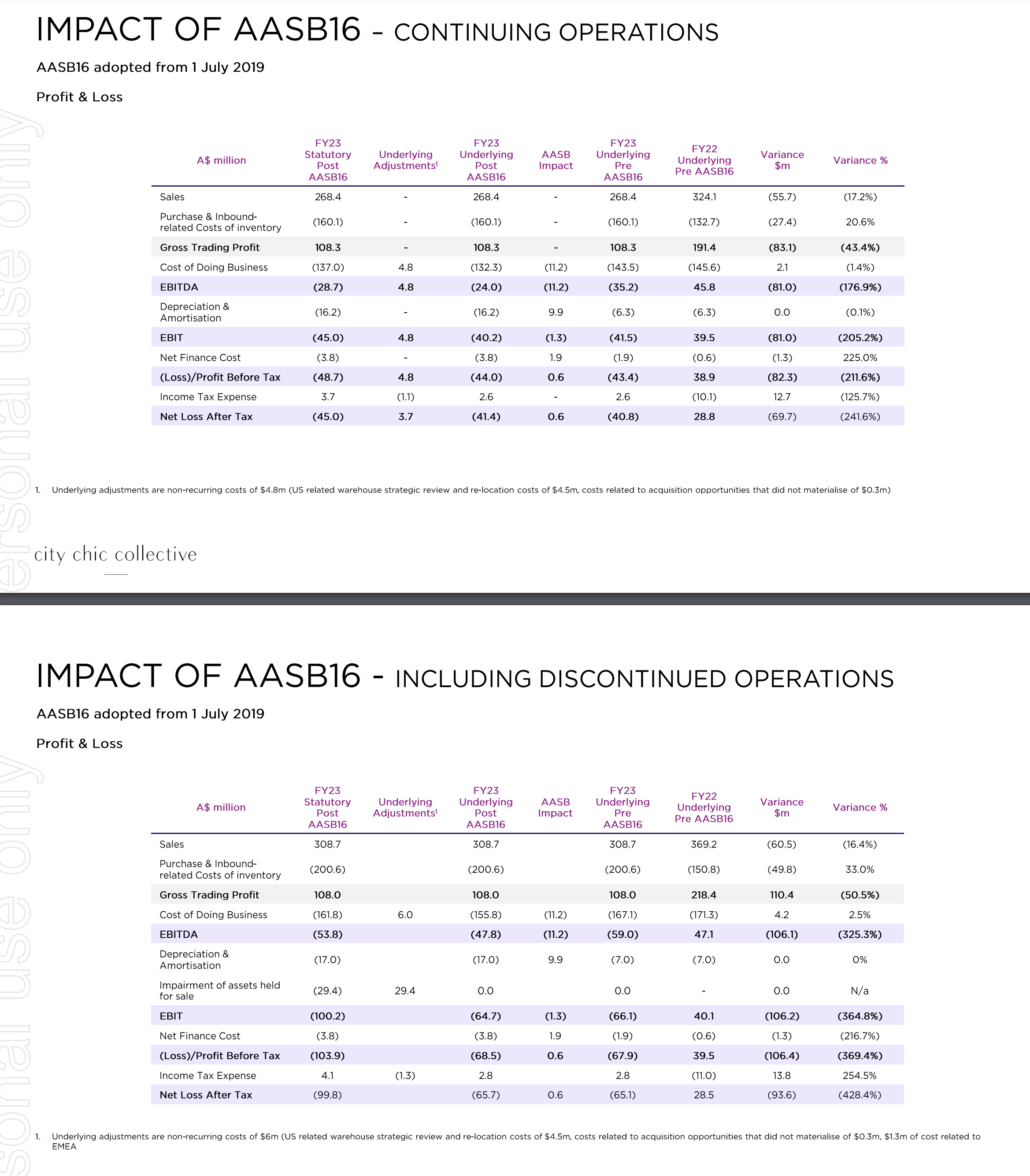

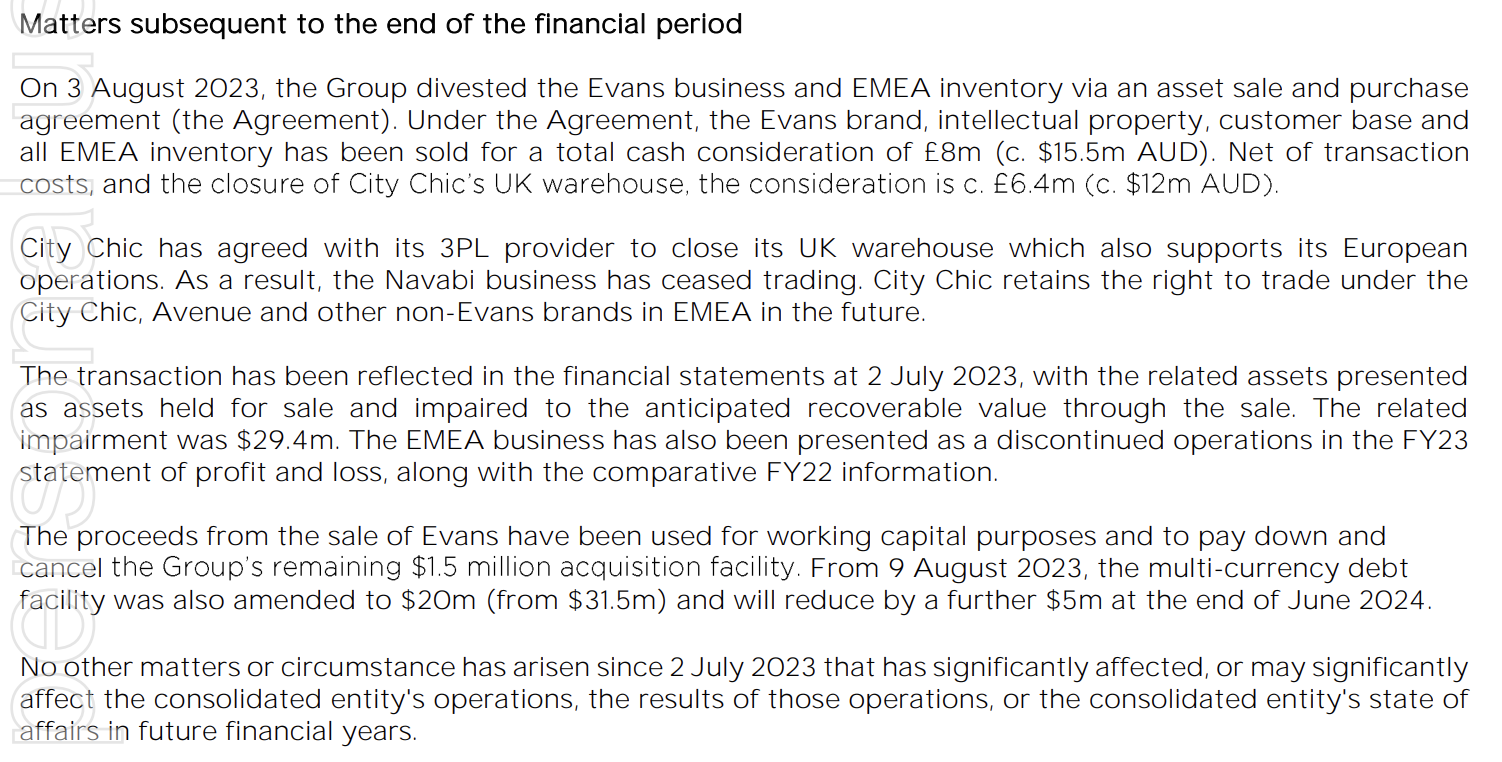

I'm finding the FY23 results particularly difficult to read given they have decided to report on only the part of the company that remains (following the post EOFY decision to divest the EMEA assets and exit that part of the market).

Please correct me if I'm wrong but it looks like they have divested $40.3m worth of sales in EMEA (308.7-268.4) as well as $40.5m worth of costs (200.6-160.1). That seems like a good idea to me.

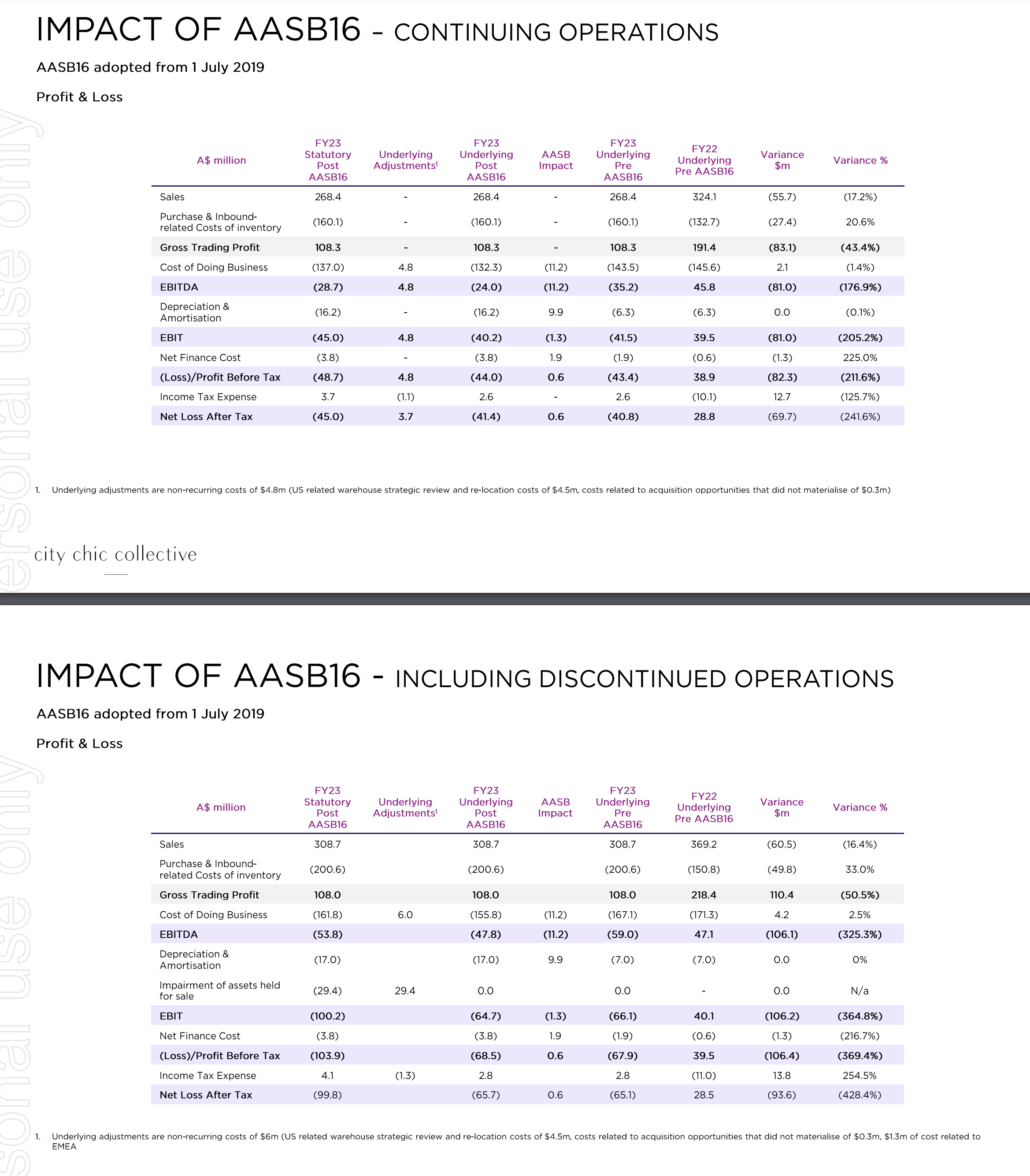

Any accountants out there who understand how the asset impairment of 29.4m impacts them moving forward and any other losses from the divestment of the EMEA business and how they might show up in FY24 numbers. That deal only closed 3 August 2023 according to ASX announcement so I'm not sure how to interpret the accounting moving forward.

DISC: Held IRL and in Strawman