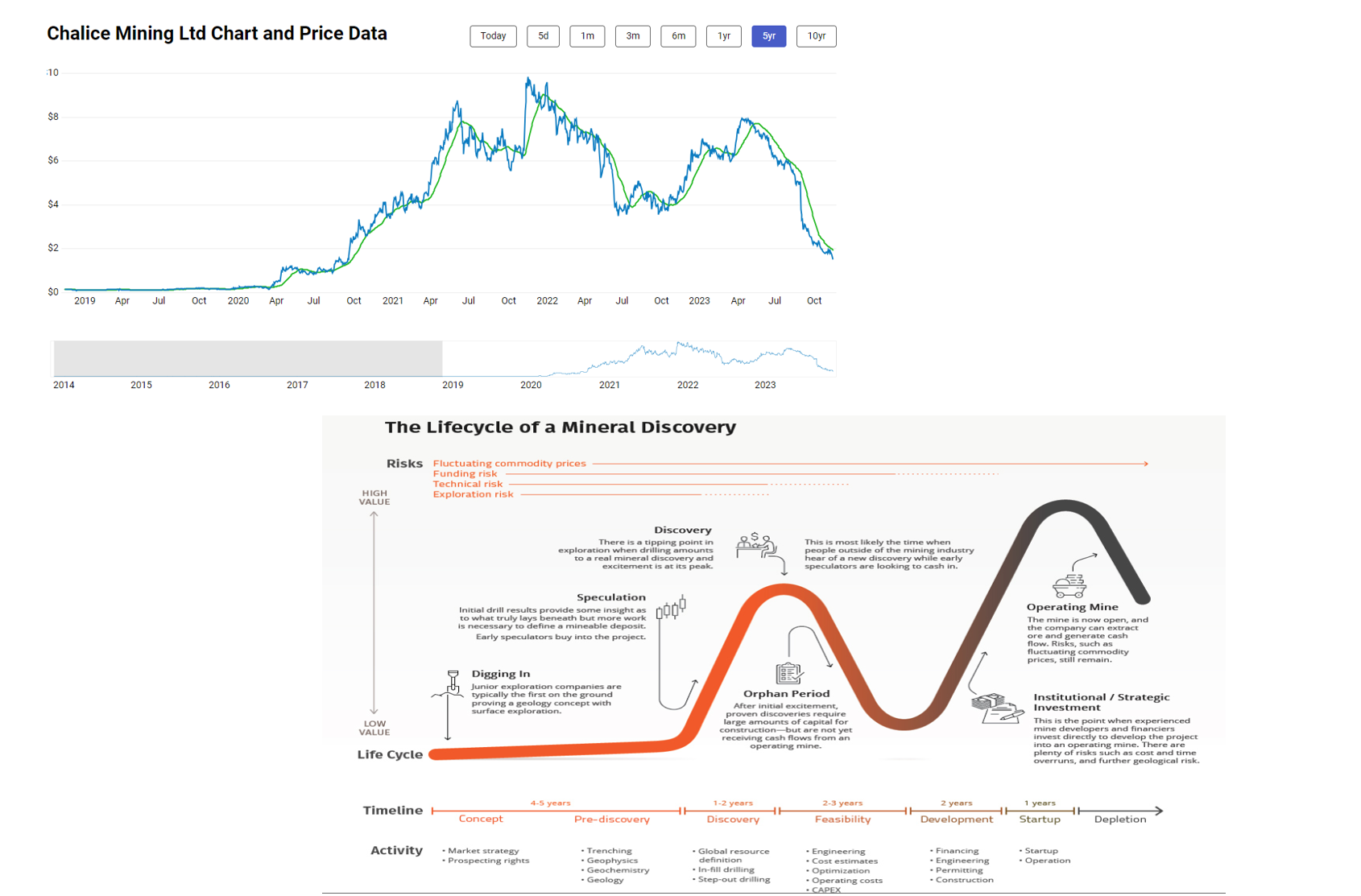

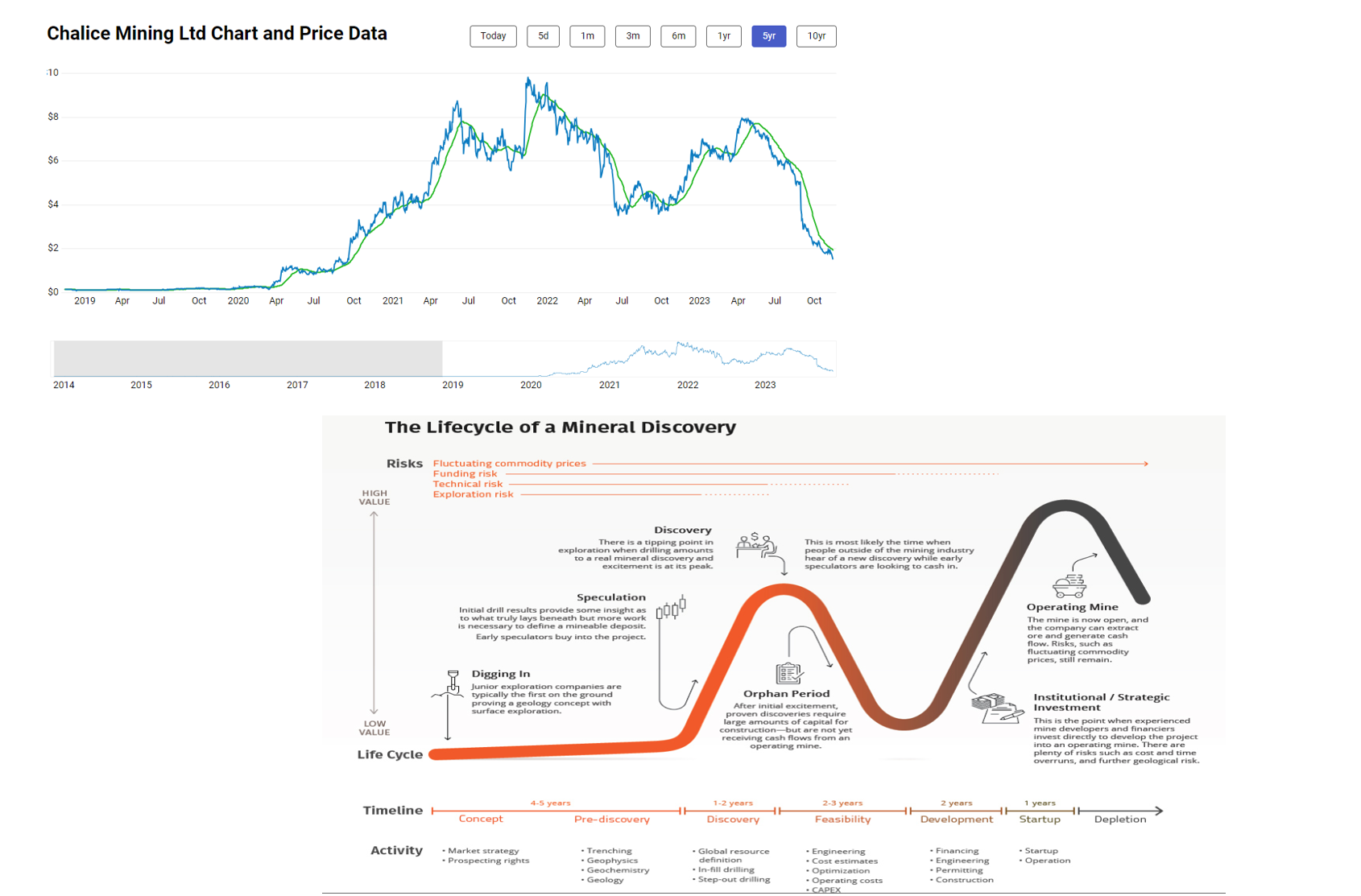

Strategic Partnering & the Lassonde Curve.

I wonder how the partnering process is going and what that would mean for the share price, looking at the Lassonde Curve Chalice are in a spot where if the right partner is found it would support the share price, if no partner is found the share price would be supported in the other direction.

A lot of risk at this moment, if it works out and a partner is onboarded it would de risk the project, i feel it would need to be a large partner as construction costs with the current interest rates would be challenging.

As per the most recent release, a positive improvement of 2-3% in hydrometallurgical recoveries, you would assume with further work and testing this could improve again. Once again i think about the strategic partnering.

Ni & Palladium price drop, the current price vs scoping study price is a little bit apart.

Interesting articles -

Palladium's slide accelerates on prospects for surplus next year | Reuters

Palladium price drops below $1,000 as demand from key car sector wanes - MINING.COM

I am holding.

Have a great day all!