Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Not great for humanity but good news for Cochlear.

US pharmaceutical company Moderna failed in Phase 3 for their CMV Vaccine which was a potential threat to the size of COH’s market for newborn deafness.

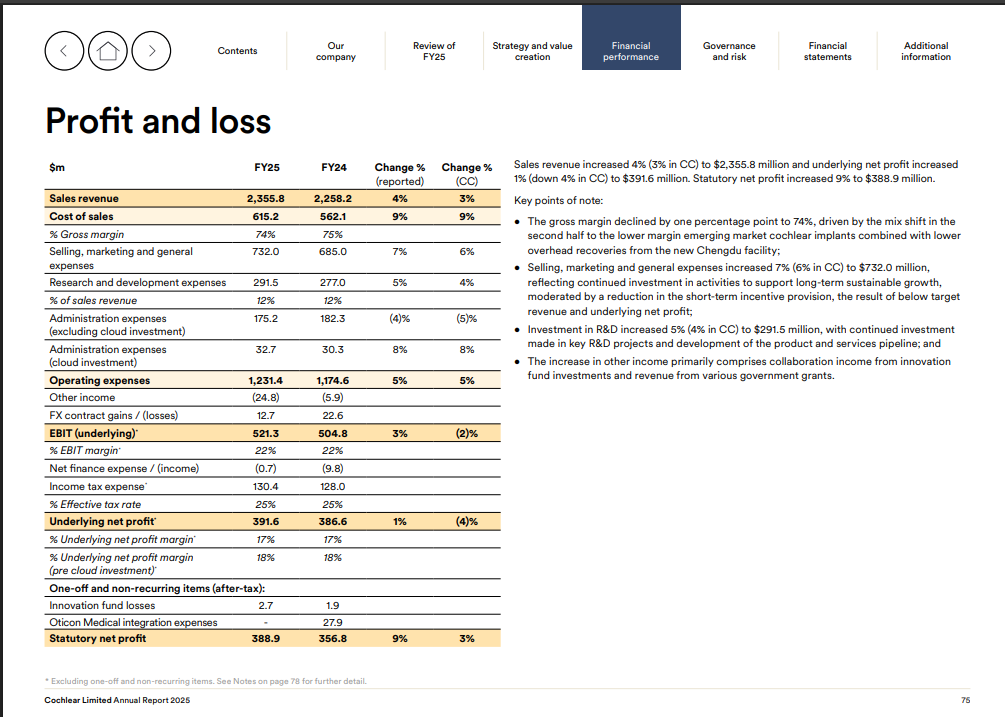

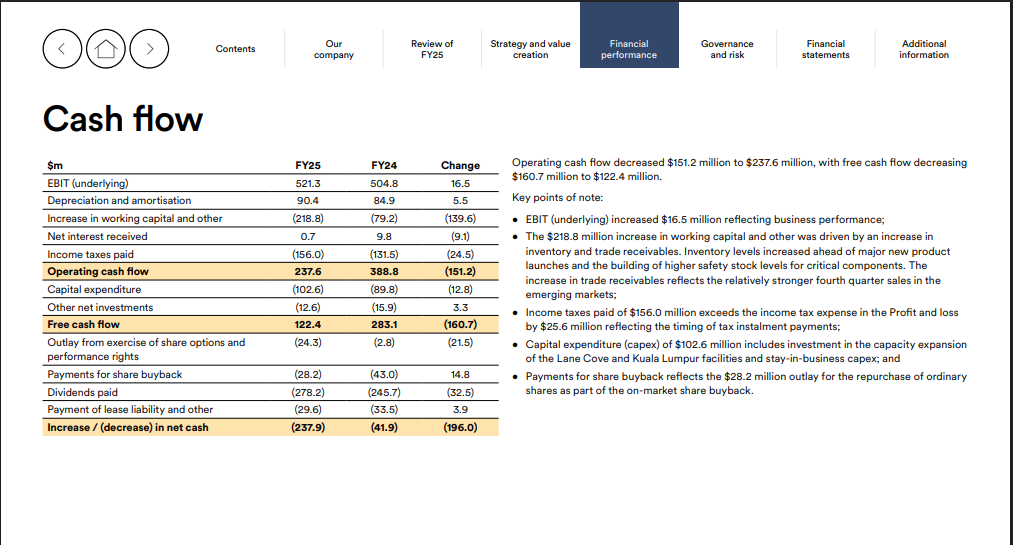

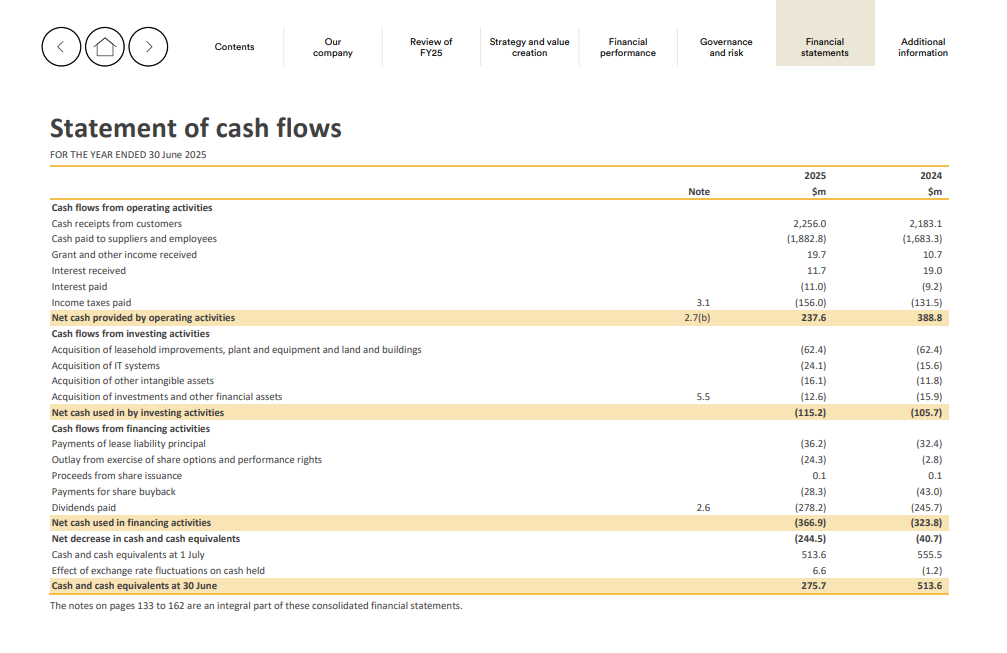

Operating cash flow decreased $151.2 million to $237.6 million, with free cash flow decreasing $160.7 million to $122.4 million.

https://hotcopper.com.au/threads/ann-annual-report-incl-sustainability-reporting.8712706/

The Cochlear Ltd (ASX: COH) share price is in focus today after the company reported FY25 sales revenue up 4% to $2,356 million and a 9% jump in statutory net profit to $389 million, with a 5% increase in full-year dividends.

What did Cochlear report?

- Sales revenue rose 4% to $2,356 million

- Statutory net profit up 9% to $389 million

- Underlying net profit increased 1% to $392 million, margin steady at 17%

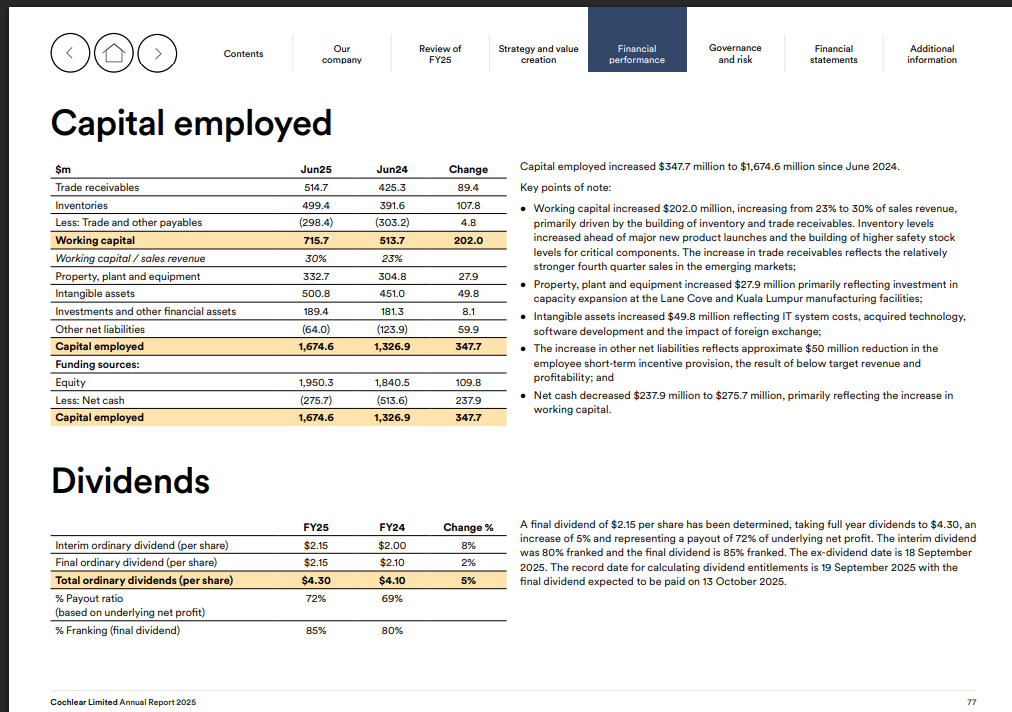

- Final dividend of $2.15 per share, full-year dividend up 5% to $4.30 per share (72% payout)

- Cochlear implants shipped: 53,968 units, up 12%

- FY26 underlying net profit guidance: $435–460 million, up 11–17%

Return (inc div) 1yr: -8.01% 3yr: 13.44% pa 5yr: 10.23% pa

Cytomegalovirus Vaccines in development

CMV is the major cause of congenital deafness; mothers infected during their pregnancy can transmit the virus to their foetus, inducing a wide range of problems in the unborn baby, including deafness. This impacts 1:200 babies, 1:5 of whom develop some congenital complication.

At least one vaccine is in phase 3 trial that i can find (Moderna's mrna vaccine, CMVictory trial).

https://trials.modernatx.com/study/?id=mRNA-1647-P301

Results anticipated 2026. If positive, I'd expect rapid approval and probably government-funded rollout to women of childbearing potential, given the public health problem. If so, would expect significant decreases in congenital deafness by 2030-2031. This might seem a long way away (7/10 years of a DCF model!), but my opinion is that the risk has not been adjusted-for by the market. Based on current multiples, the assumption for COH is that it will continue to grow with a locked-in user base for decades to come.

If congenital CMV is eradicated, the game isnt over for COH. There are other causes of comgital deafness, it can continue to sell devices to people with implants already installed, and can continue expanding to developing economies where the deafness is under-treated. It can also keep pushing for a piece of the age-related deafness market, although implants are not really accepted therapy here yet. In those cases, COH continues to have a market but much lower margins and growth potential.

Im positive on COH but with these risks caution against buying too at current multiples within the next 18 months

Seems the market demanded more from Cochlear and has marked it down 10% so far today, based on the financial info below that was released overnight.

As a long term holder (probably forever... I've had them since they were a $20 trade) IRL portfolio, I would expect them to bounce back in the short term.

Just amazing how the market thinks the company is worth 10% less today versus yesterday........ but that's the market madness doing its thing I guess ????

ASX Announcement

15 August 2024

Cochlear Limited Financial Results

For the year ended June 2024

In FY24, we helped over 47,000 people hear with one – or two – of our cochlear or acoustic implants, providing an estimated net societal benefit of more than $8 billion over the lifetime of the recipients from improved health outcomes, educational cost savings and productivity gains.1

Sales revenue increased 15% (12% in constant currency*) to $2,258 million, with growth across all business units. Cochlear implant units increased 9% with strong growth across the developed markets driven by the adults and seniors segment. Services revenue increased 15% (12% in CC) driven by strong upgrade demand for the Cochlear™ Nucleus® 8 Sound Processor.

- Sales revenue increased 15% (12% in CC) to $2,258m

- Statutory net profit increased 19% (8% in CC) to $357m

- Underlying net profit** increased 27% (15% in CC) to $387m

- Underlying net profit margin was 17% (18% pre cloud investment)

- One-off and non-recurring items after-tax of $30m primarily relate to restructuring costs for acquired Oticon Medical cochlear implant business

- Strong balance sheet and cash flow generation supports the 24% increase in full year dividends to $4.10 per share, a payout of 69% of underlying net profit

- FY25 underlying net profit guidance range is $410-430 million, a 6-11% increase on FY24

Update 15/08/2023

FY23 underlying NPAT came in at the top range of guidance finishing at $305.2m, representing a 10% increase compared to last year. Updated chart below:

FY24 outlook has been given with guidance of $355-375m underlying NPAT which would represent an increase of 16-23%.

Basing my valuation using the midpoint of this guidance ($365m) and forecasting out 5 years at 10% for years 2-5. Assuming a terminal PE of 40 gives a valuation of $202.02.

Disc: Not held.

Update 02/03/2023

Updating based on 1H FY23 results. Underlying NPAT was around $141m which was a decrease compared to PCP

Guidance for the full year for underlying NPAT was maintained at $290-$305m. Assuming full year NPAT is around $300m, then growth for the year would be around 8.35%. Below is the updated chart.

I'm gonna give them the benefit of the doubt that they can maintain 10% growth pa for the next 4 years to FY27. A PE of 40x and then discounting would give a valuation of $182.65. Still think this is too expensive for a company with slowing growth albeit in a very defensive sector.

Disc: Not held.

Update 19/08/2022

Updating based on FY22 results. Underlying NPAT came in at $277 which is in the midrange of guidance. Below is the updated chart

If I assume 12.5% growth for 5 years, a terminal PE of 40x and discount back 10% pa, then valuation comes in at around $188.70

Disc: Not Held

Original Valuation

Cochlear is one of Australia's real success stories and is the global leader in hearing implants.

Underlying net profit has been hit hard by Covid and in FY20 they also had to deal with issues in regards to a patent litigation. I have graphed out their reported underlying net profit for the last 4 years and also included an FY22 estimate of $265m which is at the low end of their guidance.

If we assume that Cochlear will be a beneficiary of a Covid reopening, and we assume a 10% increase to NPAT for the next 5 years, After discounting back 10% per annum, I have a price target of $161.34. This is assuming they are still trading at a PE of 40x in FY26.

Currently I feel the share price is a bit rich. The reported historic PE is 38.5x but this is based on the reported NPAT in FY21 of $326.5 which included $89.8m of one-off profit items related to their patent litigation. So based on their underlying NPAT they are currently trading at around 53x.

The average PE prior to FY20 was around 40x. So based on a forward PE of 40x their lower end of guidance of $265m, that gives us a share price of around $161.09. Similar to my price target as calculated above.

COH are due to report their 1H22 earnings on February 22. So I may edit my valuation based on what they report.

Disc: Not held

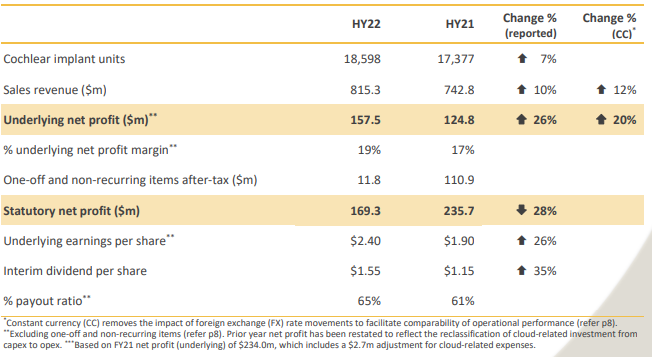

Cochlear announced their 1H FY22 results today. From their release:

- Sales revenue increased 10% (12% in CC) to $815m.

- Cochlear implant units increased 7% to 18,598.

- Statutory net profit of $169m includes $12m in innovation fund gains after‐tax.

- Underlying net profit increased 26% to $158m, driven by the combination of strong sales growth and improved gross margin, with some benefit from lower‐than‐expected operating expenses.

- The interim dividend increased 35% to $1.55 per share, representing a payout of 65% of underlying net profit. We expect the dividend payout to be around 70% for the full year, in line with our target payout.

- FY22 underlying net profit guidance range maintained at $265‐285m, a 13‐22% increase on underlying net profit for FY21. Guidance now incorporates cloud computing expenses and anticipates continuing COVID impacts for the balance of the year. A more material disruption from COVID than experienced in the first half remains a risk factor that does not form part of guidance.

Overall I think this is a pretty good result given the continued covid headwinds it is facing. Guidance was reaffirmed so perhaps they are expecting a weaker 2H?

See my valuation for more details.

I still think it is quite expensive, especially after the jump after results were released. At the current price it is around 50x the mid range ($275m) of their guided underlying NPAT.

Disc: Not held