Cochlear announced their 1H FY22 results today. From their release:

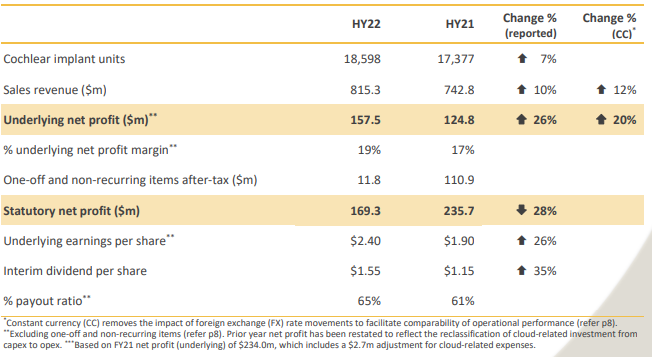

- Sales revenue increased 10% (12% in CC) to $815m.

- Cochlear implant units increased 7% to 18,598.

- Statutory net profit of $169m includes $12m in innovation fund gains after‐tax.

- Underlying net profit increased 26% to $158m, driven by the combination of strong sales growth and improved gross margin, with some benefit from lower‐than‐expected operating expenses.

- The interim dividend increased 35% to $1.55 per share, representing a payout of 65% of underlying net profit. We expect the dividend payout to be around 70% for the full year, in line with our target payout.

- FY22 underlying net profit guidance range maintained at $265‐285m, a 13‐22% increase on underlying net profit for FY21. Guidance now incorporates cloud computing expenses and anticipates continuing COVID impacts for the balance of the year. A more material disruption from COVID than experienced in the first half remains a risk factor that does not form part of guidance.

Overall I think this is a pretty good result given the continued covid headwinds it is facing. Guidance was reaffirmed so perhaps they are expecting a weaker 2H?

See my valuation for more details.

I still think it is quite expensive, especially after the jump after results were released. At the current price it is around 50x the mid range ($275m) of their guided underlying NPAT.

Disc: Not held