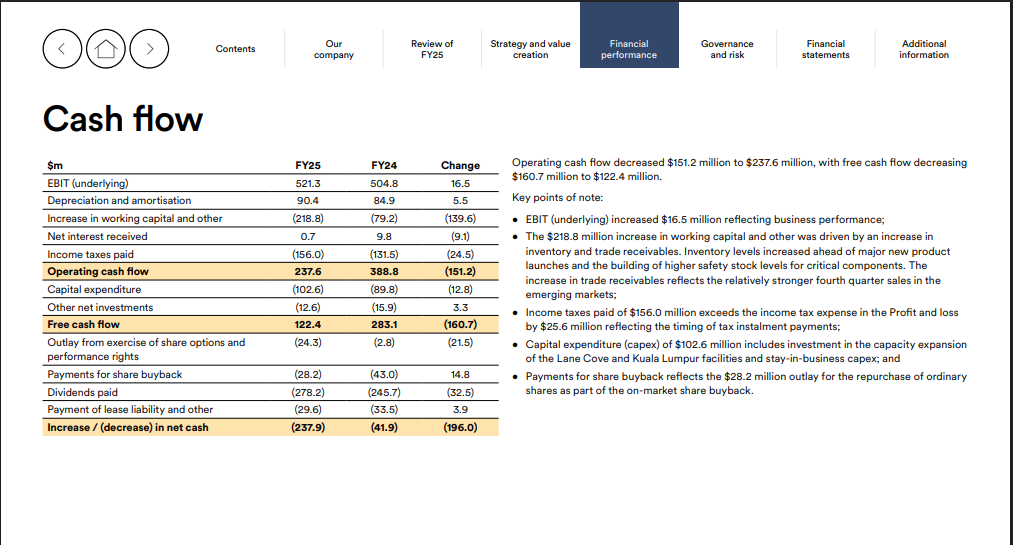

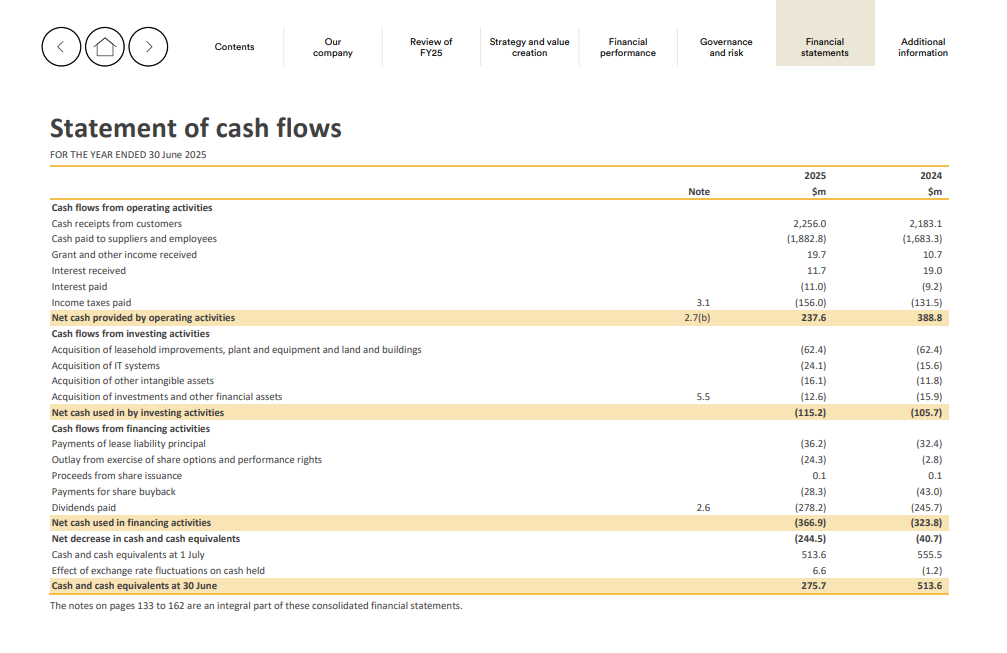

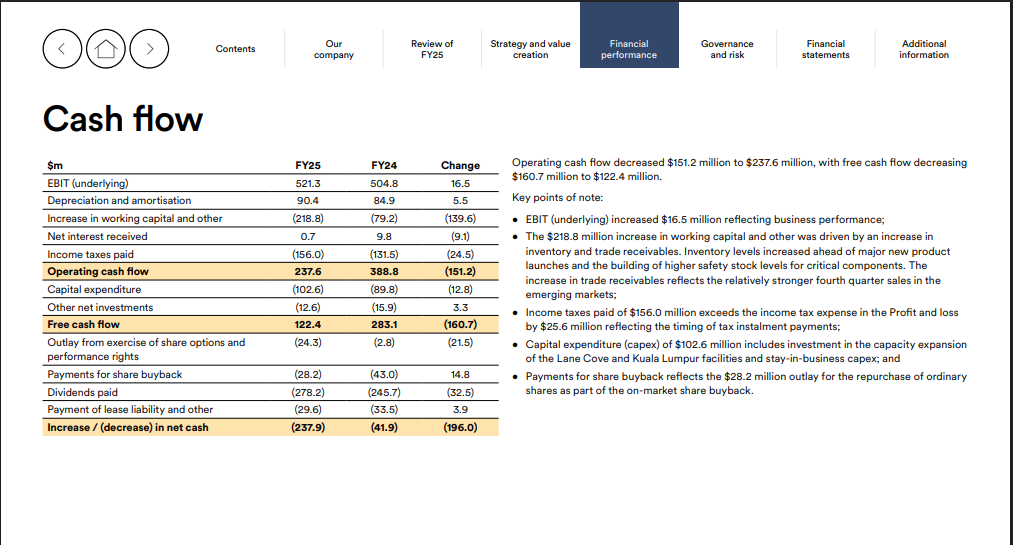

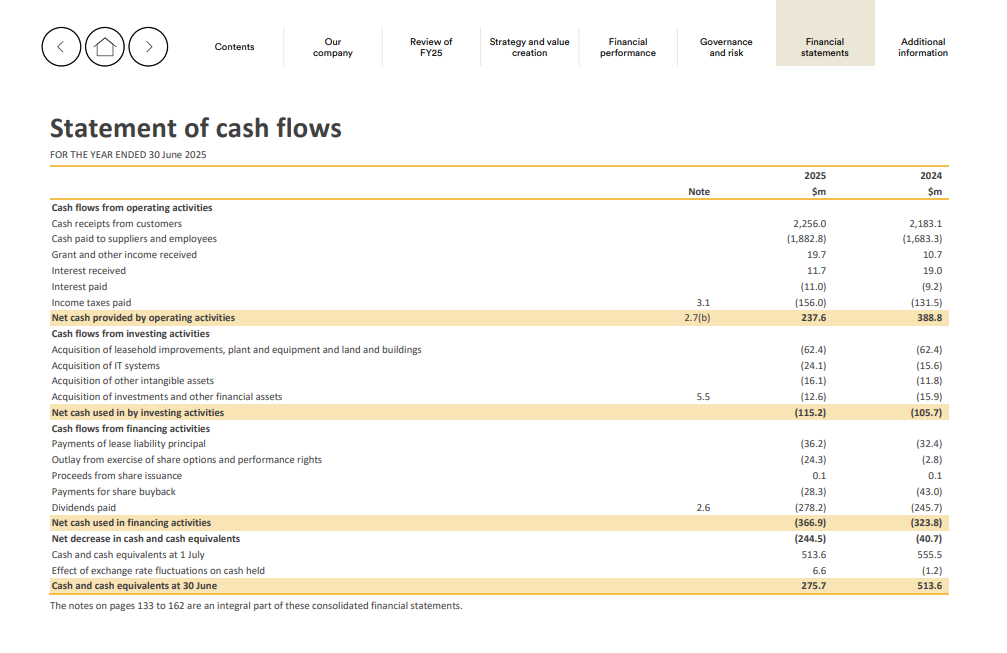

Operating cash flow decreased $151.2 million to $237.6 million, with free cash flow decreasing $160.7 million to $122.4 million.

https://hotcopper.com.au/threads/ann-annual-report-incl-sustainability-reporting.8712706/

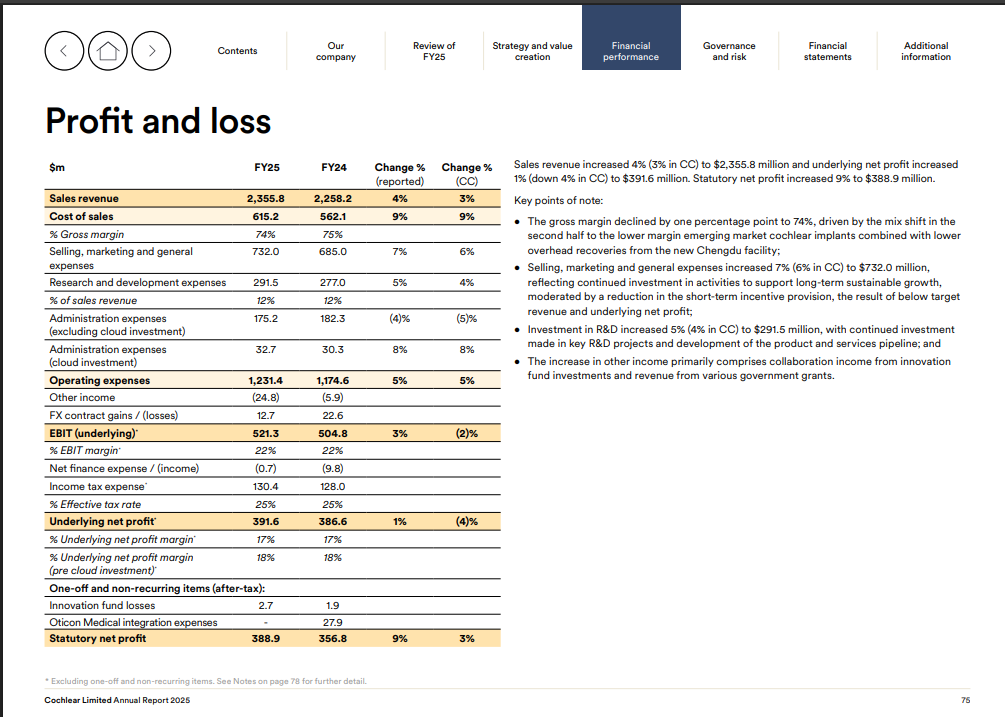

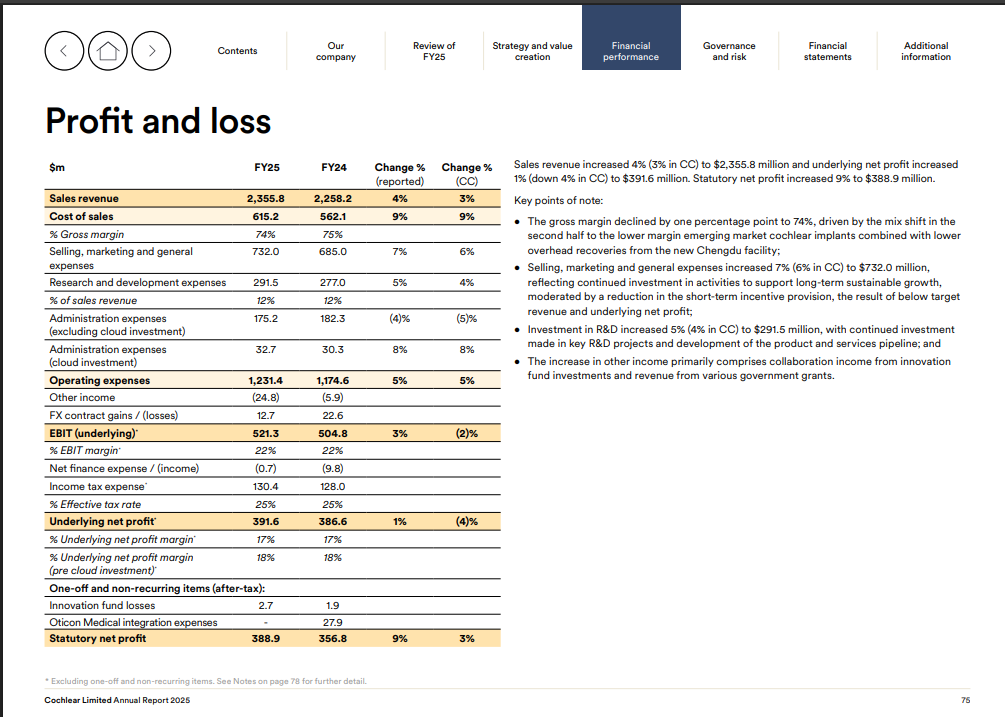

The Cochlear Ltd (ASX: COH) share price is in focus today after the company reported FY25 sales revenue up 4% to $2,356 million and a 9% jump in statutory net profit to $389 million, with a 5% increase in full-year dividends.

What did Cochlear report?

- Sales revenue rose 4% to $2,356 million

- Statutory net profit up 9% to $389 million

- Underlying net profit increased 1% to $392 million, margin steady at 17%

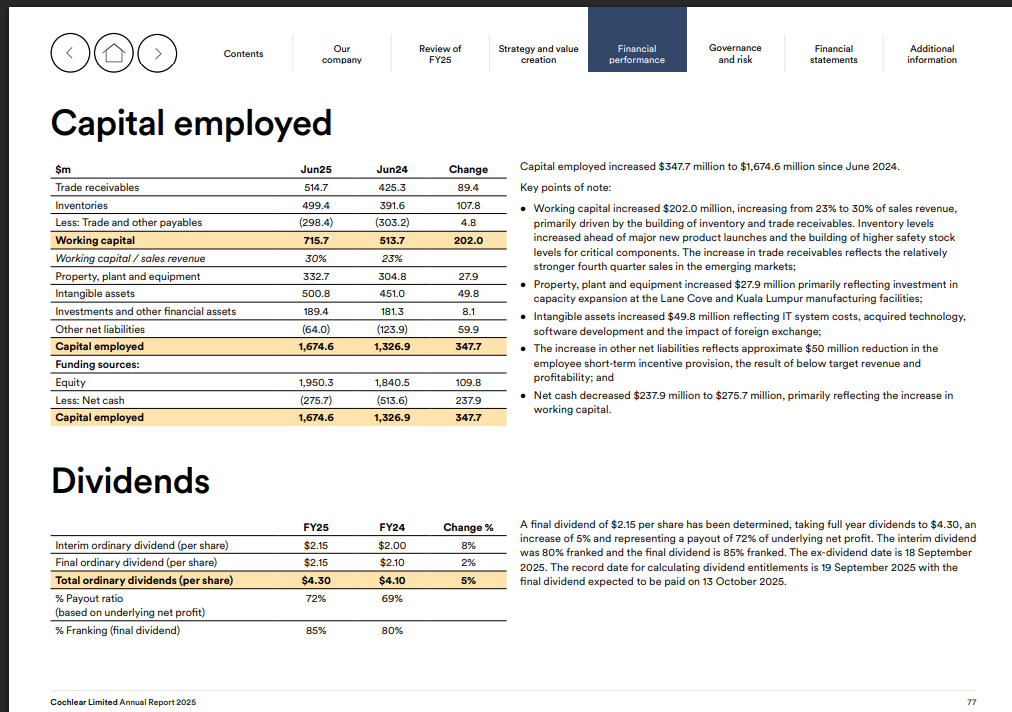

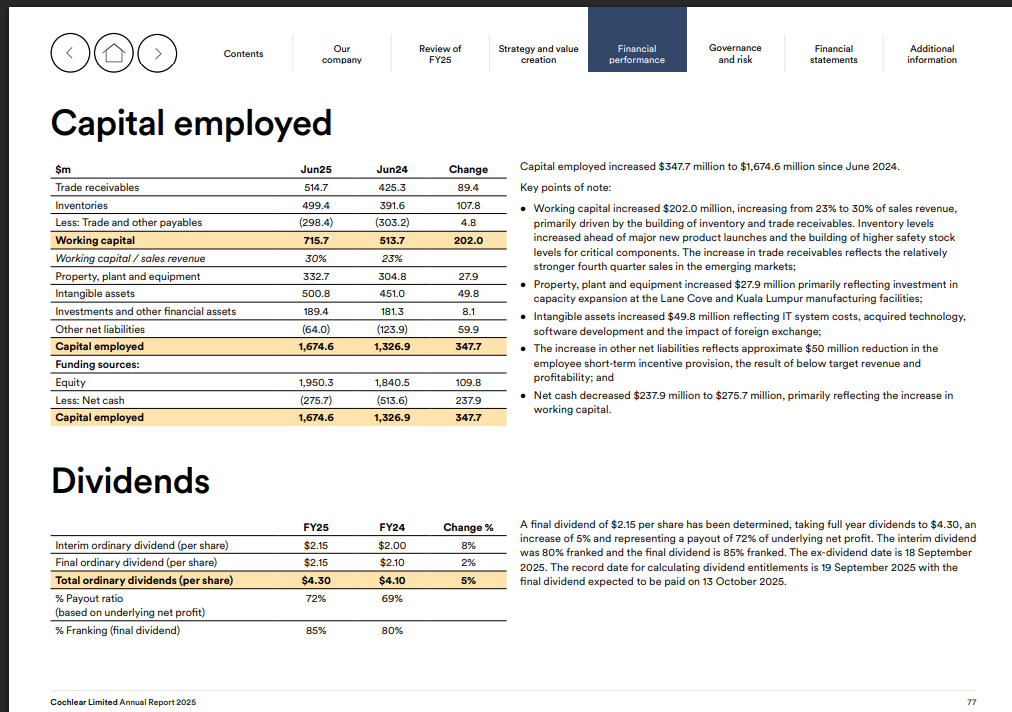

- Final dividend of $2.15 per share, full-year dividend up 5% to $4.30 per share (72% payout)

- Cochlear implants shipped: 53,968 units, up 12%

- FY26 underlying net profit guidance: $435–460 million, up 11–17%

Return (inc div) 1yr: -8.01% 3yr: 13.44% pa 5yr: 10.23% pa