Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Most projects are well behind my previous forecast timeline, so my valuation will need to be updated to account for these timelines. With the PLS project now on hold indefinitely, first project revenues will now be at least a year further out. With $43m in cash and a burn of $31m in FY24 further delays will be costly.

A good high level overview of decarbonising the steel industry.

https://podcasts.apple.com/au/podcast/catalyst-with-shayle-kann/id1593204897?i=1000664116736

A webinar was run by Phil today on the Zesty project. Not much in the way of new information was presented except for some of the following notes.

Slide Deck:

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02815944-2A1528298

There is a distinct feeling that Calix is in a position where is going to need to start fronting up some decent chunks of cash to get all these projects in the works off the ground. This is only reinforced by the Heidelberg JV announcement also today.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02815913-2A1528288

During the presentation Phil did state that for Zesty, they would be looking at primarily investment in the Zesty subsidiary as there was now appetite for further capital raises in Calix at the current share price. So potentially he is also shopping Leilac around as well.

There were lots of large TAM figures thrown around for ZESTY, which were based on a $7.5/t royalty rate. Phil did get a little cagey when asked about where it comes from, but said that they wouldn't use it unless they were confident that it was a realistic target.

The project pipeline outside of LEILAC was discussed for Sustainable Processing business, which hasn't been displayed before (as far as I am aware). It shows multiple projects across all mineral types that Calix is targeting. These project pipeline numbers always need to be taken with a hefty dosing of salt as the timelines for the projects tend to run years before they get off the ground.

Happy to pay if Price to Sales is around 6x

At $1, market cap will be $185m trading at current Price / Sales of around 6.37x

If sales goes from 29 to 31m, then forward Price / Sales is 5.9.

Also if sales from crop protection start emerging again, I'm happy to increase the multiple to 7x

At the moment I don't value Leilac or ZESTY until they do a proper DFS with NPV and more detailed financial figures and pricing that I can fully understand.

Given the holding in Australian Super also consists of retail, I'm happy to continue waiting.

We don't need to buy Calix to invest in saving the world. There are other stocks on the ASX that play that tailwind too.

Valuation date: 5 June 2024

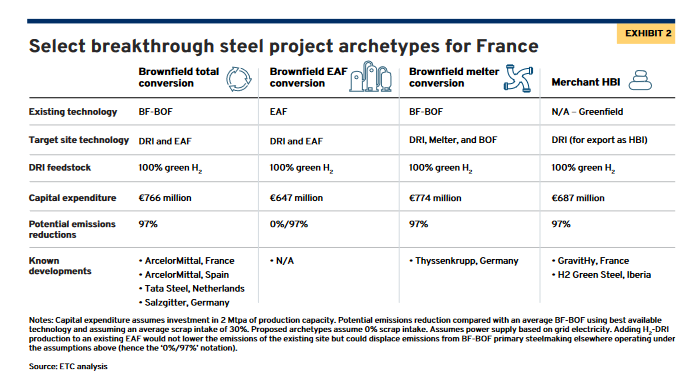

Some references on Green Steel projects in France which is well worth checking from Energy Transitions

Unlocking the first wave of investments in Green Steel

Calix Zesty is not in the paper but there is good information on where Zesty sits against more advanced green steel projects.

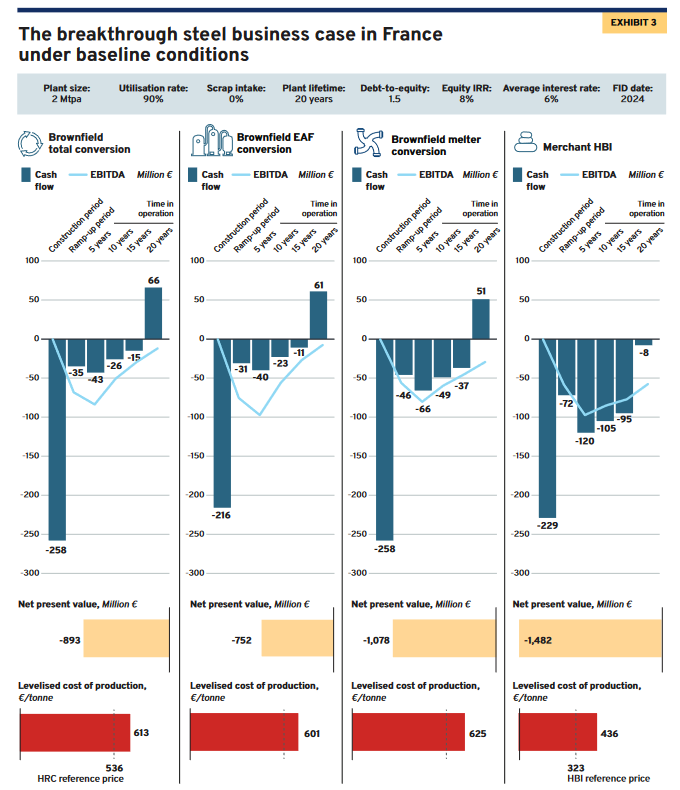

NEGATIVE NPV for all projects!

The paper also include the privately listed H2 Green Steel project in Sweden which is currently well advanced to produce Green Steel in 2025. In addition, they are doing studies to produce Green Steel in North America and Latin America. H2 Green Steel has had a fair wack of money chucked at it already (in the billions)

Anyway, from the above, 436 EUR is about 715 AUD give or take which sits in the midpoint of Zesty pilot (between 600 and 800 AUD)

Another issue with ZESTY is it is too early in the cycle and won't be able to catch up to these european projects like H2 Green Steel. By the time studies are complete, H2 Green Steel will already be ahead and it will be difficult to justify switching from them and spending money on ZESTY.

Hence it is better to go with the "first past the post" than the one that is still being developed despite the cost advantages.

In addition, I'm also worried Calix in general is just rushing in to projects (such as the PLS JV, Heirloom and Leilac Cement) without doing DFS or PFS along with showing NPV, Payback and IRRs like what is done above. Bear in mind I can't find a DFS or PFS from H2 Green Steel but I guess the France Green Steel project is a good reference point. Ir probably isn't surprising as most of the board members don't have a solid finance or corporate background.

Interesting the share price has rallied? Something not right there... At 300m, it is now trading 11x revenue (although the last grant might skew this lower assuming the revenue from IER stays level).

[not held]

The Good

- Trending improvement across revenues from the main business divisions to $12.2m, this is the highest to date.

- Project pipeline increased to 82 with several projects moving into the initial and detailed scoping stages. There has still been a long waiting time for projects in the Pre-Feed stage.

- First significant revenue contribution in CO2 Mitigation from project income. This will be a hard area to continue to increase revenue significantly as it would largely be driven by increasing engineering resources which is challenging in the current market.

- Both new IER plants have been completed and are in commissioning / operational. This should facilitate continued growth in IER revenue across the U.S market.

The Not So Good

- LEILAC 2 still delayed whilst a new location for the trial plant is determined by Heidelberg Materials. Once determined, there will be a 6 month integration design and construction can then re-commence. What wasn’t mentioned was the potential impacts of any additional permits that may be required for a capital works project. Phil indicated that the 6 month timeframe is conservative

- Cash outflows are at the highest in recent years at -$26.8m for the half. This has left the cash position at $47.8m, which at the current spend rate is enough to get through to H1FY25.

- Several slides of the investor presentation were dedicated to company valuation. I’m not a fan of when companies are promoting share price rather than focusing on the business performance. There was also some adjustment on slides to present information in a more favourable light. For example on the projects pipeline Feb 2024 compared to August 2022.

Watch Status

- No Change

Value Status

- Change in Weightings - Improvement in Bull Case due to higher than expected revenue (annualised and excluding grants)

What To Watch

- Improvement in cashflows in H2. There could be a raise on the horizon to facilitate further projects if cash outflows continue at the current rate.

- Ongoing revenue contribution from CO2 Mitigation.

- Engineering work commenced on Heirlooms first commercial module - Heirloom have already opened a 1000Tpa plant? No time frames provided

https://www.heirloomcarbon.com/news

https://www.energy.gov/oced/regional-direct-air-capture-hubs-selections-award-negotiations

- Leilac 2 not impacting fully electrified projects, if this is the case, can expect to see projects progressing down the pipeline even with delays to the Leilac construction.

- During Q&A Phil indicated that the Cemex licence agreement is awaiting Cemex to agree to Calix’s terms. It is good to see the company holding out to not devalue the technology, however there is risk in this approach, as negotiations have been ongoing since 2022.

- ZESTY 30kTpa plant Final Investment Decision progressing, pending site selection and commercial agreements.

- Construction of Lithium demonstration plant to start in Q4FY24, with first production targeted in Q4FY25.

- Electric Scooter battery module delivery and testing due in Q4FY24. Batteries have now moved into Sustainable Processing to market the process rather than the product so it is unlikely there will be any further R&D in the cathode materials.

- Vast secured funding for SM1 (Calix HyGATE project)

- Progress in plant designs for new applications - Alumina, Manganese Metal and Battery Cathode Plant (Carried Over). Alumina pre-FEED nominated as on-track, Mg Metal BOD as watch

Haven't really been following Calix closely so this will be brief

Posted on that HC forum as well but thought I'd give a bit more detail

No half year consensus but still full year consensus.

Will be interesting to see if Calix can match the FY24 consensus

Actual results below:

Revenues grew to $16.3m, up 28% on the same period last year.

• Products & service revenues up 41% to $12.2m.

• Grants & other income of $4.1m was in line with prior period.

On the transcript they were asked about Cemex license agreement for Leilac and replied stating that they could not give any guidance but will announce something when a decision has been made.

In addition, Hodgson still thinks Leilac is more competitive than the others such as Svante reiterating that Calix has a lower energy penalty than the others while ignoring other aspects such as Capex, implementation etc..Perhaps need to do a bit of digging here.

[not held]

Been more than a year since the Cemex update

I'm guessing the licence agreement has probably fallen through.

As an FYI, CG had a valuation of $8 for Leilac alone from the 8-mar-23 note

On a more positive note, PLS appears to be progressing with the Midstream processing

However we still do not have details on the royalty payable to Calix. But since Lithium spot prices have fallen, the contribution won't be much.

Also if we strip out a large part of Leilac valuation and 100% of the batteries (since there has been little progress here), then the valuation by @Bradbury is probably on the money. (10.51-8.50-0.44=1.57)

Another interesting bit of info - if you do a search on carbon capture cement you will find lots of other companies doing their own implementations.

Leilac & Heirloom Announcement (30/10/23)

The announced MOU in Feb23 has moved to an agreement with terms in line with MOU.

Very interesting potential application for the feasibility of Direct Air Capture (DAC) technology to stop the world boiling, but little tangible value adjustments for Calix at this stage... Market hates it currently for some reason (down 11% as I write) and price is under half what it was then the MOU was announced in Feb.

Agreement Summary:

· Leilac and Heirloom will work together exclusively for DAC applications.

· Leilac will receive a royalty of US$3/tonne or 3.5% of the prevailing CO2 price for each tonne of CO2 separated for lime decarbonisation.

· US$3m contribution by Heirloom towards mutually agreed upon DAC lime-related R&D activities.

· Leilac will retain all intellectual property relevant to its technology.

· Heirloom: investors include Leilac shareholder Carbon Direct Capital Management, as well as Bill Gates-backed Breakthrough Energy Ventures, Ahren Innovation Capital and Microsoft

How it works (well the theory):

· Heirloom have developed a process of re-carbonising Lime (CaO), effectively using it to suck CO2 out of the atmosphere in a process that takes 3 days rather than years, effectively reverting it back into Limestone (CaCO3).

· Problem is you release a lot of CO2 getting that Limestone (CaCO3) into Lime (CaO), so all you do is waste a lot of energy and time.

· Leilac has a kiln that allows for the capture of CO2 during the process of Lime production and can be powered by renewable energy, the extracted CO2 can then be stored in existing natural underground geological structures which allows for CO2 reduction over the process.

· So if it works, then you have a rinse and repeat process for extracting CO2 from the air, at relatively economic rates and practical power use.

· BUT: Carbon Capture & Storage (CCS) processes and infrastructure are going to be a challenge, and ultimately it needs to be funded via Carbon Credits or direct government funding to be economically viable.

What’s the agreement worth? Unsure, but initially not a lot given they cite the Heirloom deal with Microsoft to remove 315k metric tons of CO2 over a multi-year period as one of the largest carbon dioxide removal deals to date. A royalty of US$3/tonne for Leilac only produces about US$1m in revenue… BUT it is very early days for DAC and mitigation is going to be part of the solution.

Valuation: Current revenues and even announced possible agreement revenues do not justify the current or higher valuation, but are also mostly irrelevant relative to the potential revenues. Cement production generates around 2.7bn tonnes of CO2 each year – the Heirloom deal offers US$3 per tonne, so it’s all about the opportunity!

Disc: I own RL & SM

Lithium Demonstration Plant

- Construction Commence - Apr-Jun 2024

- First Production - Apr-Jun 2025

Leilac 2

- Commissioning 2025

Heirloom DAC

- Microsoft deal with Heirloom 315,000T carbon removal to be generated at Heirlooms next 2 commercial deployments in the U.S

ZESTY

- Ore testing until Nov 23

Full Year Review

The Good

- IER revenues back up to the highest levels since 2021.

- Project pipeline has grown to 75 (76? There may be an error on the slide?). The increase is positive, however it looks as though 2 projects have been removed from the Pre-Feed stage.

- (Post Full Year) Pilbra Minerals Lithium Phosphate plant passed the FID. Timelines in the announcement indicate the first product to be ready in FY26.

The Bad

- Revenues are up 42% over FY22, however this is mostly due to the significant difference in R&D incentives in FY23. IER is starting to show signs of growth again.

- 42% increase in total losses to $23.4m. This will only continue for FY24 as the first projects start to require more significant capital expenditure, without any revenue contribution.

- Further delays to the 2 new US hydration plants. Previously targeted for H1FY23 completion, currently 1 plant is in commissioning and the other is still under construction. Once completed these will allow IER to more easily service a wider geographical region.

- Delays to the start of the LEILAC 2 construction with commissioning now targeted for 2025. This is likely a best case scenario given that construction is never a straightforward activity.

- Windship competition partnership withdrawn. This was never a major use case for the LEILAC tech, so the potential upside from this is the engineering resources can be used in more productive areas.

Watch Status

Signs of improvement from IER which is the primary revenue source, but delays appearing across most of the technology verticals

What To Watch

- Both new IER magnesium hydration plants are expected to be operational in H1FY24 (Revised twice)

- Moving from a MoU to a binding global licence with Heirloom, now that Heirloom is part of the Project Cypress consortium. Project Cypress aims to remove over 1 million tons of CO2 annually when in production. Not a lot of clear detail is available yet on this project. Future project updates may provide some indicative project timelines. Currently in community consultation so very early days yet.

https://www.projectcypress.com/news

- Targeting a BOD for the HyGATE Green Methanol project. As the Calix / Adbri lime plant is an ancillary part of this project for the CO2 supply, this will be dictated by the progress from Vast.

Latest update from May.

- Further ore testing for ZESTY due to be completed in H1FY24. (Previously FEED Study targeted for completion at this time)

- Results from the LMO cathode commercial battery testing. Likely use would be in power tool batteries or similar, which is change from original target EV use (Delayed)

- Progress in plant designs for new applications - Alumina, Manganese Metal and Battery Cathode Plant

- Potential news upcoming for partnership with a marine coating manufacturer (Carried Over)

- Third distribution agreement in the works for BoosterMag (Carried Over)

FY24 Targets

Although I do like the CEO, the results miss and delays to Leilac is a big concern

Delay to Leilac-2. But Calix hoping will be ready FY25. This delay is a miss as I thought this will be ready around FY24 but I am still trying to find reference on that statement.

Stripping out all misc grants, I believe Calix is trading around 33x revenue. Adding on the recent misses, Calix might be overvalued

Will need to reassess and sell if I find better opportunities.

[held]

FID (Final investment Decision) for Midstream demonstration plant with Pilbara Minerals

One month late but better than never..

No extra additional funding needed from Calix - funded through existing cash.

Project timeframes, 2026 go live date

[held]

Key takeaways from the presentation and following Q&A

- Leilac - FID for several companies in the pipeline are waiting for the Leilac 2 proof of operation in 2025.

- Leilac licence opportunities in the works in the near term. Cemex & several others

- Zesty - Targeting 30tpa plant FEED by end of the year (Previously indicated as H1FY24). Capital costs for construction of the demonstration plant will be ~$30m. Options for this are ongoing ARENA funding or looking at the sale of equity in Zesty similar to the LEILAC business.

- Zesty - Testing multiple ores, every major ore producer has sent a product for testing which has extended the testing program through to the end of Q1FY24, with the objective to achieve the same metalisation as the initial tests.

- Site selection for the Zesty demonstration plant will be determined by access to ore, green power and hydrogen… Fortescue Future Industries anyone?

- Pilbra Minerals JV FID update sounded positive and likely to be announced in June.

- Other applications may look at the same LEILAC equity sale model.

Received 19.4m gov grant for Solar Methanol project. Marked as not price sensitive but shares still up on open

[Held]

Have only started looking into Calix but initial impressions on valuation are that it looks overvalued - I suspect I have not done enough of a deep dive to see where some extra value comes from. P/S seems excessive so I am assuming there are high expectations.

Assuming P/S drops but still remains high, current price assumes 20-25%+ growth. A drop in sentiment would drive valuation even lower. Not for me at this price, but am interested where the company goes long term. Watch list for me.

Equity Mates recently featured Theresa Milkota the CFO of Adbri. Calix get a brief mention as one of their partners Adbri's efforts reduce their carbon footprint, but it is interesting to hear of the challenges the industry faces from the one of Calix's partner companies. From the way Theresa talks about the technology, it sounds quite awhile off.

Full Year Results

The Good

- The pipeline of lime and cement projects increased to a total of 54 over the half, with existing projects shifting down further down the project timeline. These are still a long way from generating consistent revenue, but the ongoing increase in interest in technology confirms the appetite in the industry for workable solutions to the industries carbon problems. In the Q&A Phil said they are close to commercial agreements in this space but want to ensure that the first one sets the precedence in terms of the value attributable to the technology.

- Results from the zero emissions steel trials appear positive. These have taken precedence over other trials through the plant given the size of the issue and potential market. This is still a long way off though and it’s looking like an operational demonstration plant won’t be in place until 2025 on an accelerated timeline.

The Bad

- $41m in grant funding from the previous federal government under review. I would imagine these are likely to remain in place, but given some of the recent political events who knows. While the reviews are carried out, these projects will be on hold impacting overall end dates.

- Reduction in overall sales revenues from $19.2m to $18.5m. Commentary was provided around the reasons behind reductions but with a market cap hovering around $1.1B more expectations are built into the price. One positive to take away is that Calix is now beginning to generate revenue from sources outside of water & IER businesses. ($1.6m in FY22 compared to 86k in FY21). This is evidence that projects are reaching a phase where Calix can start to charge out engineering and technical resources to clients.

- Reduced revenues for IER and the water business. This was offset by increasing margins but demonstrates IER is having a hard time getting further traction with their MHL products. Entry into European markets for the is also under review and removed from FY23 targets due to external cost pressures. This will reduce growth rates going forward, but likely avoids incurring excessive losses to achieve growth. I don’t view this as a major issue as I see the IER business as a key to providing funding for Calix’s other operations but as a minor part of the business in the long term.

- Overall company revenues now prevent access to the R&D cash rebate which will impact cash flows in the short term. Cash balance is currently sitting at $25m. Some staff and operational costs will be offset going forward from the Government grants across several sectors, but this now starts the clock on each of the operating divisions starting to generate revenue or funding will need to be sourced through a capital raise or debt facilities.

What To Watch

- 1 to 2 new Hydration plants in the U.S targeted for completion in CY22

- Traction with MHL distribution agreements in SEA. This has been on the promotional slides for several updates now but sales in for Australia & SEA combined decreased from FY21.

- Leilac - Commercial agreements signed

- Trials for Aluminium Oxide processing scheduled for H1FY23. (Previously scheduled for H2FY22) Now that Calix is branching out into further industries, time on their Bacchus Marsh reactor is getting hard to get, particularly with the changes that would be required to the equipment for each new set of trials.

- Completion of BOD for ZESTY (Zero Emissions Steel) 30kT demonstration plant.

- Pilbara Minerals Lithium Salt Project Milestone - JV formation

- Boral - Grant funding approved

- Adbri - Grant funding approved

- Integration of full scale demonstration battery into EV for trials in Q1CY23. This will be key at proving the battery materials and the energy efficient production method work at commercial scale

As a follow up to Chagsy's post on the podcast there's also an interesting article covering this in todays AFR

The ‘mad scientist’ who could turn Australia’s iron ore green

Last in the series. Another good overview of the the tech and story behind the company. A couple of tantalising hints of big things to come….

https://podcasts.apple.com/au/podcast/tech-zero/id1626215592?i=1000569822392

not held - but will look into it a bit more if there is concrete traction as there will likely be a very long runway if this gets going.

Article in todays AFR attached which covers some of the debate on Carbon Capture and Storage (CCS). Also, Federal Energy Minister Angus Taylor will be announcing on Friday $23m for three new CCS project grants in WA, the largest of which is for $11m is for Calix.

Article: CSIRO says it should have spoken out on viability of CCS.pdf

CCS is a vexed issue in addressing climate change, but what is not up for debate is that a lot of money is being directed to it as part of the path to net zero across the world and Calix is in the mix.

This news comes on the back of the two other announcements this week by Calix in relation to the $20m Pilbara Minerals/Calix project grant and $30m Boral/Calix CCUS project.

Disc: I own CXL

Seems Regal can't make up it's mind whether to hold CXL.

On 11/5 they were holding less than 5% then 13/5 they popped back to 5%.

Have to always be on guard whenever Regal is around especially if you bought at over $5+

I believe Regal got into CXL at around $3 or maybe slightly more. That would be the bottom end when I would back up the truck.

Held (and rather disappointed that Regal is on the register playing games with the share price)

Following on from my previous straw, SaltX is now pushing hard into the calcination space. I haven't followed up Calix about this but I think it will be worth the question as this appears to have followed the collaboration with Calix last year.

22.04.07

SaltX and ABB in cooperation to explore new innovative electric calcination technology

22.05.12

New technology from SaltX enables production of “green quick lime” – results verified by the industry

Multiple pages were also dedicated to this in the Q1 Investor update.

Competitors were always going to be in the space given the size of the market and need, and Calix was always upfront about other technologies available and their progress. What does concern me is how this has appeared to directly follow the collaboration between companies. It doesn't look like SaltX have a patent yet, but their progress in this space has been quick.

Calix has the benefit of many industry partnerships as can be seen on their Project LEILAC page but what this does highlight is that now Calix has spent the last ~10 years developing the technology, it looks like doesn't take much from other large industrial equipment providers with access to capital to come in and create their own kiln. The size of the moat was always a area of concern for my position in Calix and this will be an area to watch closely.

A joint update on CXL’s scoping study with Pilbara Minerals (PLS) for the use of the Calex Flash Calcinator (CFC) to provide value add to Lithium phosphate processing. Intention to proceed with negation for a JV to develop a demonstration plant

Potential benefits of the Mid-Stream project in Lithium processing are:

· Reduced Carbon: Ability to use renewables to power the process.

· Logistical Savings: provides a denser Lithium product to transport

· Improved Lithium Recovery & improved ability to treat very fine spodumene concentrates at lower lithia grades.

Progress on the project will be subject to the negotiation of a JV, market feedback from samples and a final investment decision on a demonstration plant.

Other recent events for CXL:

8 March: Received regulatory approval for its safe, environmentally-friendly crop protection product BOOSTER-Mag. CXL is developing relationships with global crop protection companies to tap the 500k ha global market.

21 March: CXL added to ASX300 & All Ordinaries

23 March: LEILAC-2 project passed its Final Investment Decision and expect to commence construction in 2023.

Dics: I hold CXL

A good intro and explanation on the Calciner tech from interview with Phil Hodgson

Disc: Held IRL since Feb 2021. Not really a buyer at current price.

As a number of members here hold CXL I thought the following release earlier today by Barrons may be of interest to some. If you're not up to reading the entire doc I've highlighted the paragraph where CXL are mentioned specifically but in essence the entire article highlights where significant monies have, are and will be invested.

News SummaryDJ The Case For Carbon Removal -- Barron'sCXL$6.95$0.16 (2.4%)$6.90$7.00

12 Mar 2022 13:30:242 ViewsBy Lauren Foster

Nili Gilbert has always loved solving hard problems. As a young girl, she spent hours poring over the mind-bending book, The Lady or the Tiger? And Other Logic Puzzles. Years later, while working as a quantitative investor, it was modeling human behavior that turned out to be a particularly difficult puzzle. Today, as vice chairwoman of Carbon Direct, a firm that invests in climate technology and supports companies in meeting their decarbonization commitments, she is tackling one of the hardest problems of all: climate change.

Gilbert's journey from portfolio manager to decarbonization champion took root in college when she had the opportunity to design her own course of study. She focused on the interplay between social and cultural progress over time, and economics and markets. After starting her career in international development at Synergos, Gilbert discovered the world of quantitative investing. She went on to co-found Matarin Capital Management, a hedge fund and equity asset manager for institutional investors, where she spent the next decade.

These days, Gilbert spends much of her time thinking about the intersection of climate and capital, and how to reduce greenhouse-gas emissions and remove carbon dioxide from the atmosphere. Barron's recently spoke with her about why carbon removal is part of the solution to getting the planet to net-zero emissions by 2050. An edited version of our conversation follows.

Barron's: We're in the midst of a global energy crisis where there is renewed focus on carbon-intensive fossil fuels. How should investors be thinking about carbon removal in the current climate?

Nili Gilbert: The energy crisis has caused countries around the world to focus more intensely on short-term needs for fossil energy, as well as long-term clean energy transitions. Our energy transition will remain difficult and complicated. The more that we overshoot the pathways we have ahead for decarbonization, the more CO(2) will need to be removed. And the need for removal already greatly outpaces what we're doing today.

For investors, the opportunities for carbon management have risen in recent weeks. We need to increase our investments, both in managing carbon emitted by traditional energy and, even more importantly, in accelerating the investments that we're making in clean fuels, like hydrogen.

What prompted you to focus on carbon removal?

As I learned more about the climate challenge, as a quant, the numbers really spoke to me. We are emitting about 50 gigatons of carbon a year. When you think about removals, we have to work on first reducing the emissions that we're still putting into the atmosphere. We need to get our emissions down to net zero. The emissions we're putting out annually are the flow. If we look at the stock, the amount of CO(2) already in the atmosphere is 1.6 trillion tons, so it's 40 times the flow.

We need to do a huge amount of work both on reducing the flow and getting our hands around the stock. When we talk about getting to net zero, we're never going to be able to reduce those 50 gigatons of emissions we're putting into the atmosphere all the way down to zero. When we talk about net zero, it's the work of reducing emissions as much as possible, and then focusing on the need to remove.

Why is net-zero emissions the goal?

It's not so much that net zero is the driving logic. It's that limiting global warming to 1.5 degrees Celsius [2.7 Fahrenheit] is the driving logic. And in order to do that, we have to get global emissions down to zero by 2050. We won't be able to get it down to zero just by reducing; we're also going to have to remove, and that's why we say "net."

How do carbon credits fit in?

We know that we're going to have to remove a significant amount of emissions in order to achieve a 1.5-degree goal. So for me, all of this starts with the emissions themselves. But in order to get capital into those removals, especially at the scale that we need, we need to create a financial market for greater efficiency. So, that's what carbon credits represent. For carbon credits to be able to serve their role, there needs to be a focus on high-quality removals that are financing high-quality credits. And that is what we focus on in our work at Carbon Direct.

How do we remove carbon from the atmosphere?

We have nature-based solutions. Nature itself acts as a carbon sink: healthy forests, sustainable agriculture, the blue-carbon economy -- our seas and oceans.

It's still not getting us all the way up to the 10 gigatons that we need to remove. Thus, another big part of what we need to focus on is advancing the practice around durable engineered removal, which is also permanent removal.

Some say there is a moral hazard in focusing on carbon removal versus lowering emissions.

The moral-hazard conversation can't stop us from doing everything we need to do to combat climate change. In order to soften concerns around moral hazard, it will be helpful to be clearer about standards for high quality and how we account for removals. We must make sure that removals are additional, and that we're applying high-quality accounting standards in how we measure the carbon impact.

How is Carbon Direct investing?

We are investing in and working on both sides of the equation, focusing on reductions and removals. When you think about investing in removals, the equation can be challenging for investors because we don't have a price on carbon. In order for carbon management to really scale, we need to see that the revenue for doing the work is commensurate with the cost. This is what makes certain carbon capture -- which we're investing in via the cement industry -- more economically ready to scale right now than pure removals.

What is the opportunity in cement?

As impact investors focused on the carbon theme, we want to go to where the emissions are. That's what brings us to the cement space. Cement production accounts for about three billion tons of CO(2) per year. But there are more than 30 cement producers around the world that have made net-zero commitments. We see opportunity to invest in the technologies that will help to advance the solutions they need to be able to achieve those ambitions.

Multiple parts of the production process are emitting carbon. The kiln is a key locus, accounting for more than half of the total emissions. One of the investments we have made is in the Leilac Group, which focuses on eliminating emissions in the design of the kiln. Leilac is owned by Calix [ticker: CXL. Australia], which has been developing this technology and approach for over a decade. It has now reached a commercial proof point with HeidelbergCement (HEI.Germany) that's going into commercial pilot. There are about 2,000 cement plants around the world.

How can investors participate?

I've mentioned Calix and HeidelbergCement, one of the world's largest cement producers by far. It has made a net-zero by 2050 commitment, and is investing in technologies to be able to decarbonize its product. It has also pledged to develop the world's first net-zero cement plant by 2030.

Were you encouraged by what you heard at the United Nations Climate Change Conference, or COP26?

I sit in the leadership group of the Glasgow Financial Alliance for Net Zero, or GFANZ, and I chair the advisory panel of technical experts that advises GFANZ and its standards. It was so exciting to be at COP26 when GFANZ announced that over 450 financial firms, including asset owners, asset managers, banks, and insurance companies, had made net-zero commitments. These institutions represent $130 trillion in assets.

Securing commitments is one thing. Deploying the capital is another.

Exactly. I'm excited about the hard work of figuring out the strategies and how best to deploy that capital to achieve our net-zero ambition. We don't have any choice because of the systemic risk that climate change presents to all of our investments across all asset classes.

The Swiss Re Institute estimates an 18% hit to global gross domestic product if we stay on our current path, and so this ties fundamentally to fiduciary duty. We also don't have a choice because of the planetary risks.

There's a lot of talk about decarbonizing investment portfolios. But does this have any effect on the ground, in the real world?

This is where we need to be active owners and true stewards of our portfolios, and understand what the decarbonization pathways are for companies in the real economy. Then, we must support those companies down this path as owners.

What is the role of the asset-management industry in reshaping the economy?

Asset management has a design opportunity ahead of it, thinking creatively about how to design new products across asset classes to support clients in getting their portfolios to net zero. As the CEO of an asset-management institution, one can't just flip a switch to get to a net-zero target. You're going to have to advocate with the clients to support them in changing how they're investing in the products they're selecting. You need your clients to get their portfolios to net zero to get the firm to net zero. It's innovation in offerings, and communication and education for the market to be able to support net-zero selection.

Thanks, Nili.

Write to Lauren Foster at [email protected]

To subscribe to Barron's, visit http://www.barrons.com/subscribe

Calix today announced that they have received Australian Pesticides and Veterinary Medicines Authority (APVMA) approval for Booster-Mag to be used in crop protection applications. This application has been under review for over 2 years and approval is a significant step forward for the Biotech business.

So far I have not attributed any value to this part of the company as sales have not been significant. It will likely need to wait until after the full year results, but between this announcement and being a recommended replacement for a banned product in the Netherlands, there may be enough of a contribution to revenues to adjust valuations.

In March 21 Calix formed a partnership with SaltX, a Swedish company developing energy storage technologies. This month SaltX has made two announcements regarding their 200kW pilot plant.

The first announcement on 11th of Feb confirms that the plant has been commissioned and is showing positive results in line with the initial expectations. It is good news to hear the installation and commissioning has been completed within the scheduled time frame and that the using the Calix technology the plant is performing as expected.

In the initial Calix announcement it was mentioned that there is provision to collaborate on a larger 1MW unit if the results are successful. The subsequent announcement from SaltX on 17th of Feb indicates that further collaboration will go on between the two companies, however, it looks like SaltX has been developing their own reactor in conjunction with the development of the pilot plant and have mentioned other applications for their reactor includes calcination. I hope we hear some more from Calix on this in the update this week, but to me it sounds like SaltX have gone and copied Calix’s homework and are now applying for their own patents.

I may be misinterpreting the announcement, but will continue to watch this space closely. Would like to hear what anyone else following Calix thinks of this.

Presentation available via ASX, regarding voting matters:

I asked the question on why are the options zero priced? Will the board consider pricing to set threshold targets?

Phil Hodgson (CEO) answered saying that they were replacing employee rights with options, so zero price was the equivalent. Also that the options were capped to a % of overall salary (% unknown) so were quite modest. The matter was noted by the board and will be considered for future rounds which is some concession and at least causes them to consider the issue.

In general I like options incentives but only where there is a strike price that aligns to improved shareholder returns, not were a benefit is had even when shareholders have negative returns.

ZESTY (Zero Emissions Steel TechnologY)

Iron & Steel Patent: Phil Hodgson talked a bit more about this

· Calix process allows the blast furnace to run at 1000 degrees less than a conventional blast furnace due to not having the CO2 from coal firing causing a back draft that reduces the efficiency of the extraction of oxygen from the iron ore.

· This is still early stage and requires testing but patent a step forward in what would be a similar business model to that of the LEILAC (ie 30% royalty + equity share).

Disc: I own (RL + SM)

Dan Rennie has been appointed CEO of the LEILAC Group, an internal appointment following a global search and supported by partner Carbon Capture

“Dan worked in the electricity sector, prior to moving to the Global Carbon Capture and Storage Institute. He also ran the European Commission’s CCS Network, then joined Calix in 2014 to investigate how Calix’s technology could be applied to the cement and lime industries”

His CCS connections are critical for this tech, so seems like a good option.

Also today director Mark Sceats declared the purchase of 49.5k shares to add to his 8.6m, seems he can’t get enough CXL…

Disc: I hold CXL (RL + SM)

The report is out for LEILAC-1 and here are the key findings:

· Full scale LEILAC plant should capture CO2 at a cost of €14-24 per tonne (the lowest reported for any other tech which is €39-80, and below current pricing of €62.

· Further cost savings identified and a fully electric installation has been shown to have a net energy saving against current best available technology cement plants.

· Capacity is 25kTpa CO2 separation and was build on time and on budget.

· LEILAC-2 is currently in Front-End-Engineering and Design (FEED) stage and is testing alternative fuel and energy uses, targeted commissioning late 2023/early 2024.

This report is more a formalisation of what management have been saying for some time. It increases the value of CXL because it validates those claims and reduces the risk, so I expect a favourable market reaction.

I hold CXL

To summaries the deal – Calix gets to have it’s cake and eat it and eat someone else’s.

Phil Hodgson (CEO) at this morning’s investor presentation explained how the Carbon Direct deal worked. The key takeaways are:

· Calix’s current European entity becomes the “LEILAC Group” which Carbon Direct now owns 7% of. Will be operated independently by a dedicated management and board.

· All technology IP is transferred to an entity called “Calix Technology Pty Ltd (Aust)” and fully owned by Calix (Calix gets to have it’s cake)

· 30% of revenue from the LEILAC Group is passed onto Calix Technology as royalties, in addition to it’s ownership share of profits from the group (Calix gets to eat its cake).

· Any new IP that the LEILAC Group creates is also transferred to Calix Technology (Calix gets to eat someone else’s cake) and can use for other applications of its tech.

· The LEILAC Group only has rights over exploiting the IP as it relates to Lime and Cement. Any other CO2 mitigation for other materials is still fully controlled by Calix (eg Lithium Salts)

· Carbon Direct was chosen via a competitive bidding process and they see them as the perfect partner to commercialise the technology and the model used as the one suitable for commercialising the many other applications Calix’s technology is suitable for.

Hopefully they will add the presentation to their investor page soon for those who missed out, try:

https://www.calix.global/investor-news/

I own CXL, bough more yesterday and looking for more (particularly if the price drops)

The Carbon Direct deal announced today provides tangible valuation information, possibly the first market-based transaction that helps investors value part of their business. The 40% price increase today shows how discounted the value has been without this type of information.

As such I am updating my valuation for this deal and also adding a value for the Sustainable Processing division which I had a nil value due to a lack of information and traction. However, recent announcements and the investor day showed traction and an indication a likely TAM.

IV = $10.97 (up 29% from 21/4/21 valuation of $8.50)

Attached is the updated valuation calculation with a reconciliation of the move in value on the right, but I will walk through the value adjustments made:

Carbon Direct – CO2 Business Value

This division I had a value of $1.78 using a probability based assumption driven by the TAM for Cement and Lime. Lithium salts may offer additional TAM but I am ignoring for the time being and just valuing based on what the Carbon Direct deal tells us. Walking through the calc:

· A $A24.5m price for 6.98% of the LEILAC business implies a value of A$351m for the total LEILAC business.

· Calix will continue to receive 30% of royalty revenue of LEILAC directly, irrespective of ownership %. Hence the LEILAC business only represents at best 70% of the value (probably less given costs will be incurred in running it).

· So the total business (CO2-LEILAC + Royalties direct to Calix) are worth A$501.4m (being the LEILAC value of A$351m divided by 70%).

· Take away the A$24.5m that Carbon Direct own and Calix is left with A$476.9m

· Divide by 159m shares and you get $3.00 per share in value.

· This should be a low-ball estimate if you assume Carbon Direct got a bit of a bargain to take on risk and for what it offers as a strategic partner. Also upside with additional CO2 applications like such as Lithium salts.

Sustainable Processing

Recent announcements around deals in the Refactory Industry provide access to a $20b TAM for Calix. As such I have added this value to the probability calculation (removing the CO2 business to replace it’s valuation with the above Carbon Direct figures). SaltX may also add value, but no TAM is added for this yet.

Assuming they can achieve a 40% NPAT rate (due to licence/JV business model), a 6% probability of success and a 5% market share by 2030, this will add $1.25 per share in value.

There are still many commercial opportunities Calix has in the pipeline that I have not provided any value for. All business lines are high risk, due to being early in commercialisation or yet to be proven/commercialised. These factors offset each other, but at current prices I see an asymmetric investment proposition in Calix.

I own CXL and bought more today at $4.75 (add to winners and on a valuation basis was the reason)

Calix announced today the sale of a 7% stake of their LEILAC business (CO2 Mitigation) for €15m (A$24.5m) to Carbon Direct a world leading decarbonisation investor. Further validation of the technology (still in commercial development – ie no sales) and gives us some additional valuation insights given it effectively values the LEILAC part of Calix at A$350m which is over half the market capitalisation. To give context, my valuation has this part of the business worth about 20% of the value (expect a large price pop today)

Announcement Details:

· Investment to accelerate LEILAC development

· Carbon Direct will advise LEILAC – ie they are a strategic investor that will add value.

· LEILAC piloted at 25,000tpa scale successfully and moving to 100,000tpa testing

· Calix will retain 30% of royalties earned by the LEILAC Group regardless of Calix’s equity stake and the LEILAC Group will operate autonomously.

· Comments to the effect that this will be the model Calix uses (farm in equity) to commercialise other applications of its technology going forward.

I own CX

A few Strawpeeps obviously dialled into the Calix investor day this week. I won't go over the potential solutions discussed as others have done an admirable job at this. I will, however, speak to the level of expertise demonstrated. Some of commented on how impressed they were by the knowledge and enthusiasm of the experts. They're not wrong BUT I wasn't expecting anything other than that. That sounds like a negative and it's not meant as one per se. However, these guys (largely guys but at least they acknowledged they need to work on diversity) are generally scientists. My circle of expertise is not huge but I do understand scientists and the research environment more broadly. I work with them pretty much daily, including one who was presenting on the investor call as a guest of Calix.

The knowledge of scientists (and I am generalising here, there are of course exceptions) is extremely deep, but typically pretty narrow. Seldom do you get scientists who are both experts in their field AND commercially savy. Their skillsets just typically aren't that broad. To a university or research centre those ones that can do both are absolute gold. As a holder of Calix my biggest concern isn't the science and it isn't even that the science can be made commercial. It's that this management and these scientists can effectivey commercialise it.

There are some indicators that they can. The water business is profitable. They bought it rather than build it from scratch but they have grown it both at the top line and the bottom line. Their commercial partners are also throwing serious money at them to build pilot plants under their other technology verticals, which they wouldn't be doing unless they had already demonstrated proof of concept at a scaled down level. For the second time their MD also alluded to positive results from LEILAC-1, which were waiting for EU consent to release. I think the key is to really watch these guys on execution and if they can execute successfully then they could be right place, right time. Hope so anyway...

[Held]

Notes and reflection on the Calix investor presentation this week.

Just to follow on from others, here are my thoughts on this week's presentation.

I didn’t know much about Calix before viewing the presentation other than I’d heard they were doing something with low-emission cement. I’m currently exploring companies in the cleanttech/renewable space so thought I’d listen in.

I wasn’t expecting it to run for nearly 2.5 hours(!) but there was plenty to cover.

One thing that struck me was the enthusiasm of the team. This is hard to quantify (can’t really plug it into a valuation model) but the tone was different to many other presentations I’d heard. There was a real sense of drive. That’s not enough on its own to grow a business but definitely helps.

Calix calls itself a technology business. They have a novel kiln which can heat powdered materials up to ~900?. Carbon dioxide is vented from the kiln and can be captured (and sold or sequestered). The kiln is fuel-agnostic, so can be powered by zero emission electricity.

They have a dizzying array of opportunities and applications where they believe this kiln process can be utilised. The core areas are:

- Water treatment

- Co2 mitigation

- Biotech

- Batteries

- Sustainable processing

Water treatment is the most developed and is currently an actual business for them. They provide magnesium hydroxide liquid to water treatment plants as a safe and sustainable alternative product to conventional products. They bought US business to distribute this in North America and appears to be growing well. Plans to expand into the aquaculture market in Asia have been delayed by COVID.

CO2 mitigation is also advancing with pilot plants in Europe that involve fitting the Calix kiln (called CFC) to cement plants. Smaller test facility LEILAC-1 has concluded successfully. Currently funded by the EU and industry to build LEILAC-2 through to 2023. LEILAC-3 to follow which is expected to be a full scale facility. Clearly this is a large market if they can pull it off, but still some years away.

Biotech involves using the magnesium products for crop protection and marine anti-fouling. Promising test results in both areas but from what I understand no commercial activity here yet.

Advanced batteries involves developing a magnesium based cathode for lithium ion batteries. Very early stage and they expect to have more testing conducted next year. No doubt battery demand is only going up, but again this is pretty early stage.

It all looks very interesting, and there are clearly large opportunities in these markets. It’s impossible to say how many of these ventures will pay off. With increasing demand for decarbonisation technology in the coming years I’m going to follow Calix with interest. They already seem to have successfully engaged partners for joint ventures and funding which is encouraging.

Below are my key points from todays (2/9/21) investor day Calix presented, slides are available via the ASX. The key takeaway is the expanding and untapped opportunities Calix’s core technology (CFC) presents. CO2 mitigation is obviously huge and highly topical, but it’s the molecular structure of the materials created by the process that either enhances efficacy or offers expanded application of those materials which is as big and possibly a bigger opportunity.

If you have 2hrs to watch the recording it is worth it for those invested in Calix or thinking of investing. They have a large team and are pushing in a lot of directions, each could be a $1b business alone, but they need a bigger team and to push in more directions.

Notes:

Core technology: Calix Flash Calciner (CFC), radiant heat on powdered materials, separates CO2 and captures it, also maximises the surface area of materials extracted, fuel agnostic.

R&D costs covered by grant income rather than shareholder funds and all R&D is expensed currently but once commercialised it will start to be capitalised.

Water: Magnesium Hydroxide Liquid (MHL) has advantages in terms of properties with handling, servicing and chemical benefits. Business in Australia (Councils) and US with IER (non-CFC sourcing), struggling in Asia due to Covid. NEW: freshwater treatment not just waste water treatment optionality. Fluorides and P-Fas is captured and may be able to treat it.

CO2: €55 per tonne in EU, US looking to move to US$50-85 per tonne. 2.2b tonnes of Lime+Cement every year. LILACE 3 plants deal with 1m tonnes. What do you do with the CO2 captured? Logistic solutions being developed, pump into dis-used oil and gas wells, on back of Hydrogen CO2 storage system. CFC is targeting being the lowest cost, LILACE 1 report due out in days. NEW: Work with international experts to develop new products. Extensions of products due to the reactive nature of the output of Lime to capture CO2 in other processes.

Sustainable Processing: SaltX (Mineral looping energy storage), Refractory, Spodumene (Lithium), Concepts in development (LC3-Next Generation Clay Cement 1.1b tonne market, Alumina-Electrifying aluminium Oxide production, …). NEW: CFC could in theory be used for all processes requiring the heating of materials.

Bio: Crop protection (replacement of now band chemicals with acceptable efficacy), Marine protection (replacing copper-based treatment, more effective, cheaper and addresses environmental impact).

Batteries: more effective and resilient materials, Lithium Maganise Oxide.

Skunkworks: Opportunity to make new materials which have never been made before. The high surface are of the CFC process is what provides the opportunity.

Call Notes (presentation slides attached):

· Electrification of CFC Kiln is being proven, on top of effectiveness of materials and CO2 capture this further enhances ESG value as heating materials can sustainable.

· Plan to continue to target operating profit break even to invest in development and growth. Conservative expensing of R&D, ie all R&D is expensed due to long commercial lead times.

· Hold margins going forward in face of US market competition, expansion it to new state will offer higher margins, targeting over 30% GM%.

· Lowest cost carbon capture technology is the desired outcome from LEILAC.

· Share compensation costs associated with share price increases on pre-IPO issues of shares rather than increased issues of shares.

· Talked to cash position and cash flows as being timing related and the balance sheet is strong and able to support growth. Support from funded R&D that offsets a lot of capital spend and spending commitments.

· Business Line FY22:

o Water: expansion in US and start in EU and re-establish China

o CO2: Looking forward to releasing results of LEILAC-1, pushing for 2 MOU’s for license agreements.

o Biotech: 2nd license agreement targets and soon to release a new biotech application

o Advance Batteries: following up on successful full cell results with product trials

o Sustainable Processing: Targeting the conversions of MOU’s to license agreements plus expect new sustainable processing applications.

· Investor Webinar: Webinar Registration - Zoom Line of business deep dive 2 September 10-12am

· Competition is not based on copies of CFC process, but rather alternatively manufactured materials. IP is protected by worldwide patent. 25 pattern families to protect core technology and process.

· 2023 carbon tariff to be introduced in EU, will impact aluminium industry in Australia, and CFC may have an application to aluminium so is of interest for the company to pursue.

Full year results published today, key points noted below, however the current financials provide little guidance to the future value of the company and represent sales for what are probably the two business line opportunities that offer the lowest future margin and revenue opportunity. The most interesting thing in the results is on page 11 of the presentation: “Successful test campaign conclusion – LEILAC-1 Results into public domain soon…” which relates to the CO2 Mitigation opportunities, probably the biggest value opportunity for CXL.

Results webinar at 2pm today: Webinar Registration - Zoom

Results Notes:

· Activity: The attached announcement walks through the activity for the year which has seen significant steps forward in it’s 5 business line opportunities: Advanced Batteries, Water, CO2 Mitigation, Biotech and Sustainable Processing.

· Revenue: +22% to 29.9m, excluding grants and other income it’s +36% to 19.2m, all but a tiny fraction relates to the Water line and mostly the US IER business. Alone the potential of the Water line could justify the current valuation, but high growth rates would be needed.

· Margin: 27%, up 4%, hardly an inspiring margin, but to be expected for sub-scale Water line, but its early days and provided it continues to increase then things are on track.

· Profit: Break even operating profit (excludes depreciation 7.0m and sharebased payments 1.9m), NPAT loss of -$9.1m, $2m worse than last year, but not an issue at this stage.

· Cash: burn rate is very high with -$15.1m in FCF which is under a 1 years cash run way given current net cash of 14.6m. However working capital (AR+Inv-AP) increases of $8.5m caused most of the FCF impact and $8m in grant funding is expected in 3 months, so FCF should improve and also CXL have no trouble raising cash, so I don’t see cash as a problem but expect many more capital raises (which I am fine with provided things move forward at a good pace).

I own CXL, the financials provide little new information on which to change my $8.50 valuation due to the probabilistic nature of it. News on the LEILAC and the need to add the Sustainable Processing business opportunity will require a valuation review in the next couple of months.

Calix completed the trifecta today with their third announcement in a week: “RHI Magnesita and Calix Limited execute MOU to advance CO2 emissions reduction in the refractory industry” attached.

Nice to see, but little to no detail on what it may mean for future revenue. So who is RHI Magnesita, what are refractory products, how big a market is it and how relevant is Calix’s offering to it (all new to me)? My notes and sources used below, but there is a lot of info available so DYOR.

RHI Magnesita: is a supplier of refractory products, systems and services (high-grade). It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index, headquarters in Vienna Austria and with Euro2.25b in sales in 2020. RHI Magnesita, the leading global supplier of high-grade refractory products, systems, and solutions. The company produces roughly 3 million tons of refractory products each year at 35 main production and 10 main raw material sites around the world. RHI’s market share in the range of 7-10% of the refractories market.

Refractory Products: is a material that is resistant to decomposition by heat, pressure, or chemical attack, and retains strength and form at high temperatures. Refractory materials are used in furnaces, kilns, incinerators, and reactors. Refractories are also used to make crucibles and moulds for casting glass and metals and for surfacing flame deflector systems for rocket launch structures. Today, the iron- and steel-industry and metal casting sectors use approximately 70% of all refractories produced.

Market Size: $30b in 2018 and estimate to grow to $41b by 2025. The refractories market is fragmented in nature, where the top five companies cater to about 31%-33% of the global market demand.? The major players include RHI Magnesita GmbH, Vesuvius, Krosaki Harima Corporation, Shinagawa Refractories Co. Ltd, and Saint-Gobain, among others. Refractories market is segmented by Form (Bricks & Shapes, Monolithic), Composition (Clay-based, Nonclay-based), Type (Acidic, Basic, Neutral), Manufacturing Process (Dry Press Process, Fused Cast, Hand Molded, Formed, Unformed) and End-user (Iron & Steel, Non-metallic Materials, Non-ferrous Metals).

Calix Opportunity: Note that RHI Magnesita is European based and as such is subject to the EU carbon regulations and tax/credit system. Hence there is a financial incentive to reduce carbon emissions from manufacturing processes, something Calix processes are offering. RHI Magnesita has a 2025 target of reducing CO2 emissions by 15% and in 2019 had only achieved 5% (Sustainability - RHI Magnesita). If Calix can prove it’s technology with RHI Magnesita it opens up a $30-40b industry to them, however their revenue opportunity will only be a very small % of that. Note that magnesium based products is where Calix has first cut it’s teeth and the basis of it’s current revenue generating products. Magnesium is a key ingredient for basic refractories, not sure what % this makes up.

So looks good, it’s promising but very hard to determine value. My valuation is probabilistic and the announcements of the last week show the direction is right and progress but not a lot to add to my current valuation which assumes these things keep happening on the road to commercialisation.

Sources:

RHI Website

RHI Magnesita WIKI: https://en.wikipedia.org/wiki/RHI_Magnesita

Refractory WIKI: https://en.wikipedia.org/wiki/Refractory

Mkt Analysis: https://www.gminsights.com/industry-analysis/refractories-market

Mkt Analysis: https://www.mordorintelligence.com/industry-reports/refractories-market

The Calix MD Phil Hodgson interview on Ausbiz on this weeks annoucement on the Government funding of the Heavy Industry Low-carbon Transition Cooperative Research Centre (HILT CRC) which Calix is partnering in.

Given the current price ($2.15), $8.50 is a high valuation, but note the process it is more to see what value potential there is rather than estimate current value, which is impossible. The key question is: if this company does ok, what might that look like, and what price might be ok if it dose. For me that is what it may look like in 2030.

So I have taken the TAM for each technology application from the prospectus A$94b and rolled it forward to 2030 to get A$162b, mostly on a modest 3% growth rate, but 7% for Cement (due to guidance) and 13% for Li-Ion Batteries from other market size projections. Note that I have no TAM for Sustainable Processing opportunities, leaving this as a potential upside and which can be add if and when substantive guidance is available.

Next I have assumed the earnings % (NPAT%) from each product area as if they are separate businesses, assigned a probability that it will achieve this and assumed a 5% market share is achieved. All totally debatable and subject to review (they are thumb sucks), but in line with the promise the company has. The multiple of these gives the % of the TAM Calix may see as earnings in 2030, which is 0.14% of the total TAM or $231.8m in earnings.

I have used a PE of 15 as modest price multiple to get a market cap of A$3.5b in 2030. I have left share count around where it is now because I have assumed dilution will be offset by cash generated between now and 2030. This gives a share price in 2030 of A$21.94, which if you discount at 10% is $8.50 today. Note that a discount rate of 23% will get back to around todays share price of $2.15, hence the IRR is 23% if you accept the valuation (which you shouldn’t because it’s all guess work and you should do your own ;)

CONCLUSION: There is sufficiently large market and opportunity for Calix to justify the current and higher valuations. It is unlikely we will ever get a clear view of value, but updates on progress and performance will help us refine our view of the opportunity and Calix’s ability to capitalise on it.

I welcome any constructive comment and critique of this valuation as well as other methods and ideas on valuing it. It is such a hard company to form a view of value on I am sure I have missed some key factors. Cheers.

01-Apr-2021: Canaccord Genuity: Calix Ltd (CXL): Capturing growth optionality

Analysts:

- Seth Hoskin | Analyst | Canaccord Genuity (Australia) Ltd. | [email protected] | +61 3 8688 9146

- Aaron Muller | Analyst | Canaccord Genuity (Australia) Ltd. | [email protected] | +61.3.8688.9103

Capturing growth optionality

Investment Recommendation

CY21 is shaping up to be a transformational year for CXL with i) strong momentum in its US-based water treatment business, coupled with a potential European acquisition, ii) the foundations of commercialisation of its CO2 mitigation vertical in the cement/lime industries beginning to form, and iii) strong early results in other verticals (advanced batteries, sustainable processing, and biotech) which are supportive of accelerating timelines. ESG and decarbonisation are multi-decade structural thematics in their infancy and underpin demand for CXL's technology across multiple industries, which is a unique position on the ASX/globally. Moreover, the wide range of applications highlight significant growth optionality with large multi-billion-dollar TAMs in each vertical. In our view, CXL is developing a track record of execution, and we expect as the company completes targeted milestones, investors will incrementally update risk weightings associated with its pre-commercialisation/R&D projects, which should bring about strong share price momentum. We reiterate our BUY rating and our target price has lifted to $2.60 (prev. $2.50).

1 April 2021: Raising Target Price: Calix Ltd: Sustainability

- Rating: BUY (unchanged)

- Price Target: A$2.60 (up from A$2.50)

- Price: A$2.16 (closed at A$2.28 on 1-Apr-2021)

- 52-Week Range (A$): 0.61 - 2.47

- Avg Daily Vol (M): 0.2

- Market Cap (A$M): 336.6

- Shares Out. (M): 155.9

- Enterprise Value (A$M): 326

Click on the link at the top for the full report. (the file is too large to attach here)

Calix is an Australian materials company that aims to develop and commercialise new materials and production processes through their patented calcination technology. Calcination is the process of heating solid materials to remove impurities or volatile substances. This process is key in the production of calcium oxide from limestone for cement, with the main byproduct of this process being CO2. The Calix technology allows for the CO2 generated in the cement process to be captured. The kiln technology can also be used for other materials, creating new “active” nanostructure materials that have a wide range of uses from water treatment to crop protection.

Founded in 2005, Calix has been steadily developing their technology through a series of government grants and industry partnerships. In the last several years overall revenues have been propped up heavily by the grants received, with the acquisition of American company Inland Environmental Resources (IER) in 2019 providing a significant boost to product sales. (327% Growth in product sales of $14.1m and a further 150% growth at HY21 product sales)

2020 proved to be a vital year in the growth of the company with several key developments with the potential to act as catalysts for future growth:

Completion of first testing phase of LEILAC (pilot cement plant project started in 2016) with results demonstrating commercial viability. Note - Further trials at plant extended into 2021

Commencement of LEILAC 2 project (4 x Size of LEILAC 1) funded by the EU and industry joint venture. (Scheduled to run until 2024)

First shipment for Afepassa of BOOSTERMag (Part of 10yr agreement)

Upgrades to IER (main contributor to revenue) production plants to increase output with construction of an additional facility underway

First preliminary results from battery materials research with positive results

At the current market cap of $297m the company is overvalued compared with other companies in the materials sector. Based on the HY21 results, estimating a FY21 revenue of ~$35m and EBITDA of ~$7m for valuation comparison. However with upgrades to production facilities in progress and if further commercial agreements in works are successful, the valuation will be offset by continued revenue growth.

Calix is in an industry with a heavy focus as countries and companies try to offset and reduce their carbon production. As the production of cement is one of the highest CO2 contributors globally and the growth of infrastructure projects around the world only increases, Calix is well positioned to take advantage of the race to upgrade and amend production facilities worldwide.

Disclosure: Hold

Calix appoints ex-Booz Principal as Head of Strategy and Portfolio

Sydney, Australia | February 16, 2021 – Multi-award-winning Australian technology company Calix Limited (ASX: CXL) (“Calix” or “the Company) is pleased to announce is the appointment of Hinne Temminck Tuinstra as GM – Strategy and Portfolio, becoming a key senior member of the Calix executive team.

Calix Managing Director and CEO Phil Hodgson said “We are indeed fortunate to have attracted talent of the calibre of Hinne to the Calix team, just as we are seeing increasing opportunity to leverage our platform technology into different applications and increased interest from counterparties in decarbonising their industrial processes. Hinne’s background experience in managing the deal pipeline, as well as strategy development, will be a key ingredient in our success moving forward, as we develop new applications of our platform technology into increasingly diverse industries, all driven by the same sustainability tailwinds.”

Hinne Temminck Tuinstra said “I am very excited to join this impressive Company and help them solve global sustainability challenges!”

01-Feb-2021: Canaccord Genuity: Calix (CXL): Sustainability: Cemex joins the Green Machine

- Analysts: Seth Hoskin | Analyst | [email protected] | +61 3 8688 9146

- Aaron Muller | Analyst | [email protected] | +61.3.8688.9103

Cemex joins the Green Machine

Investment Recommendation

We expect CY21 will be a strong year for CXL with momentum in its water treatment business, coupled with a potential European acquisition (M&A), as well as numerous catalysts in the CO2 vertical including licencing agreements with Lime partners. We believe as CXL completes milestones associated with proving-up operational robustness and scaling in its LEILAC projects, investors will incrementally update risk weightings which will bring about continued share price momentum. We reiterate our BUY rating and our target price is A$1.70 (up from A$1.09) on the back of rolling forward of our 10x target EV/Rev multiple (FY22e).

- Rating: BUY (unchanged)

- Price Target: A$1.70 (up from A$1.09)

- Ticker Code: CXL

- Share Price: A$1.47 ($1.695 on 05-Feb-2021)

- 52-Week Range (A$): 0.52 - 1.75

- Avg Daily Vol (M): 0.1

- Market Cap (A$M): 218.3

- Shares Out. (M): 148.5

- Enterprise Value (A$M): 207

--- click on the link at the top for the full CG report on CXL --- [I do not hold CXL shares]