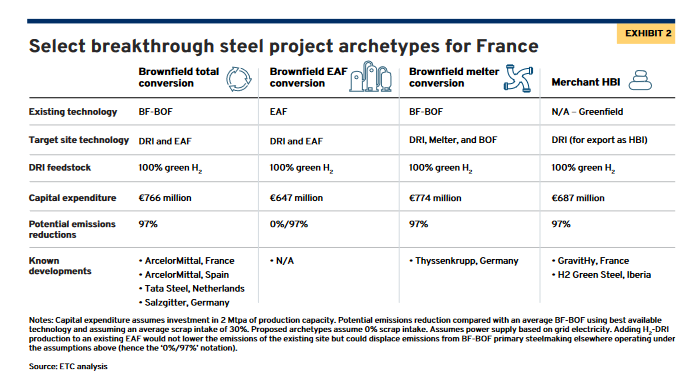

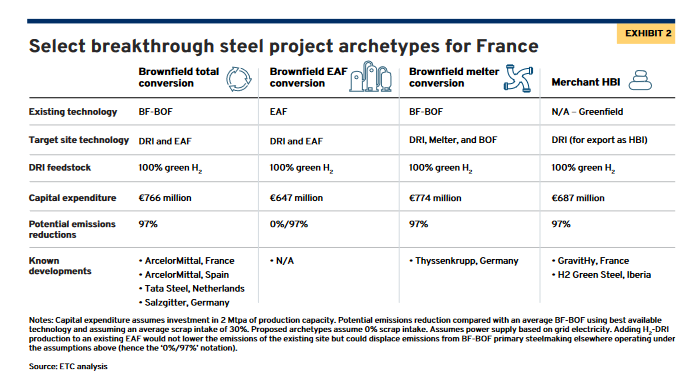

Some references on Green Steel projects in France which is well worth checking from Energy Transitions

Unlocking the first wave of investments in Green Steel

Calix Zesty is not in the paper but there is good information on where Zesty sits against more advanced green steel projects.

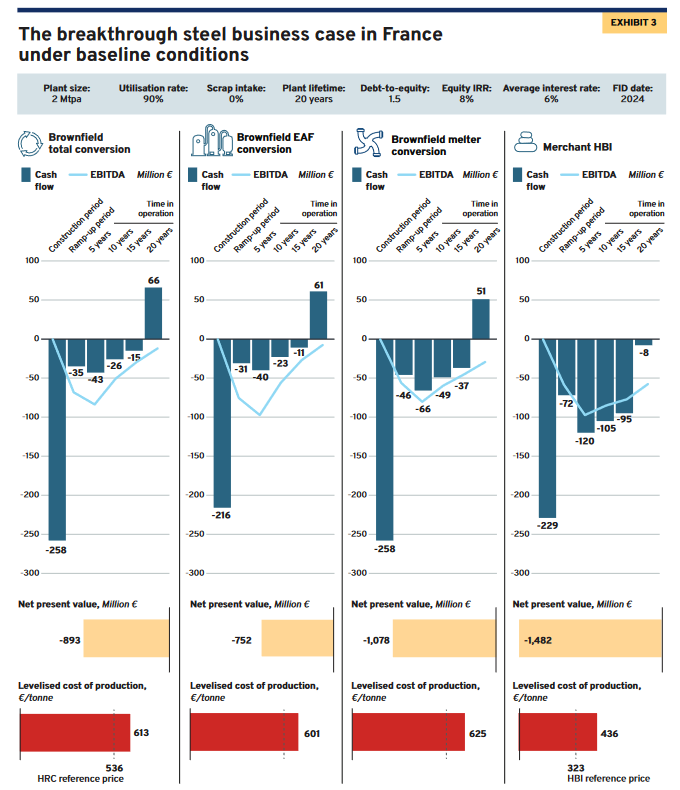

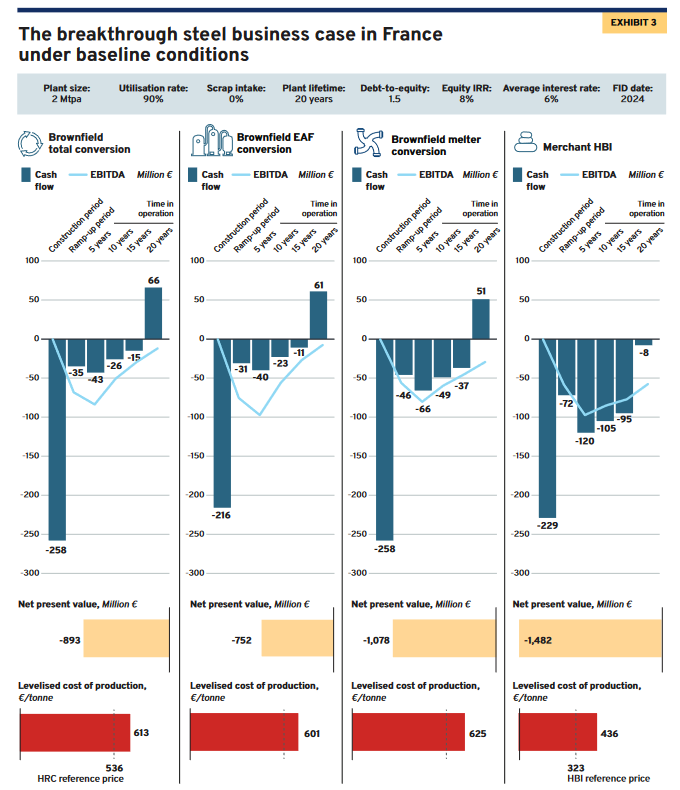

NEGATIVE NPV for all projects!

The paper also include the privately listed H2 Green Steel project in Sweden which is currently well advanced to produce Green Steel in 2025. In addition, they are doing studies to produce Green Steel in North America and Latin America. H2 Green Steel has had a fair wack of money chucked at it already (in the billions)

Anyway, from the above, 436 EUR is about 715 AUD give or take which sits in the midpoint of Zesty pilot (between 600 and 800 AUD)

Another issue with ZESTY is it is too early in the cycle and won't be able to catch up to these european projects like H2 Green Steel. By the time studies are complete, H2 Green Steel will already be ahead and it will be difficult to justify switching from them and spending money on ZESTY.

Hence it is better to go with the "first past the post" than the one that is still being developed despite the cost advantages.

In addition, I'm also worried Calix in general is just rushing in to projects (such as the PLS JV, Heirloom and Leilac Cement) without doing DFS or PFS along with showing NPV, Payback and IRRs like what is done above. Bear in mind I can't find a DFS or PFS from H2 Green Steel but I guess the France Green Steel project is a good reference point. Ir probably isn't surprising as most of the board members don't have a solid finance or corporate background.

Interesting the share price has rallied? Something not right there... At 300m, it is now trading 11x revenue (although the last grant might skew this lower assuming the revenue from IER stays level).

[not held]