Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

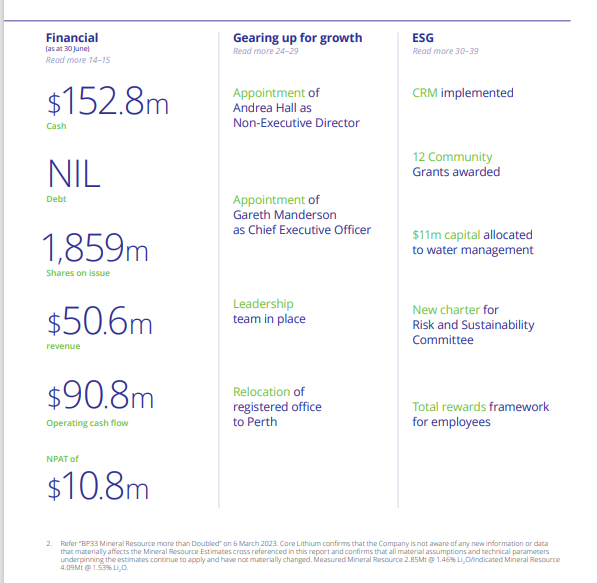

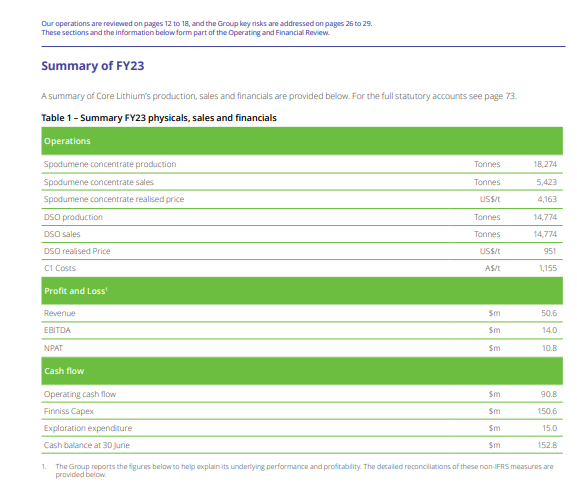

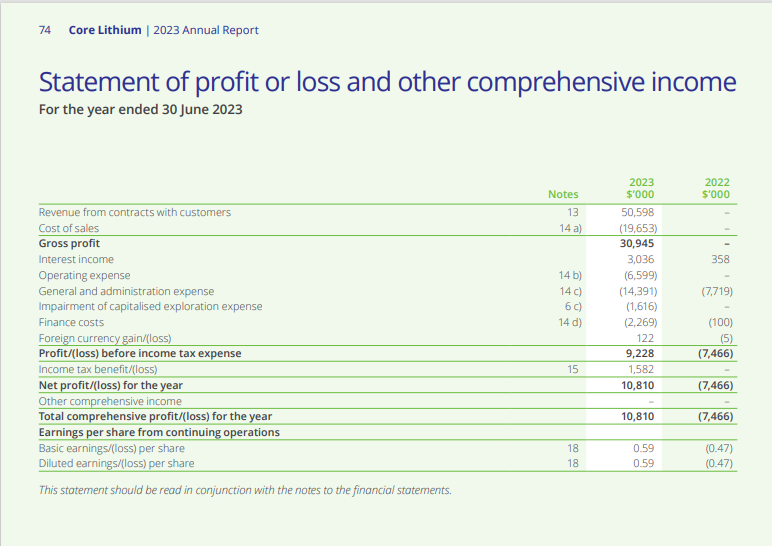

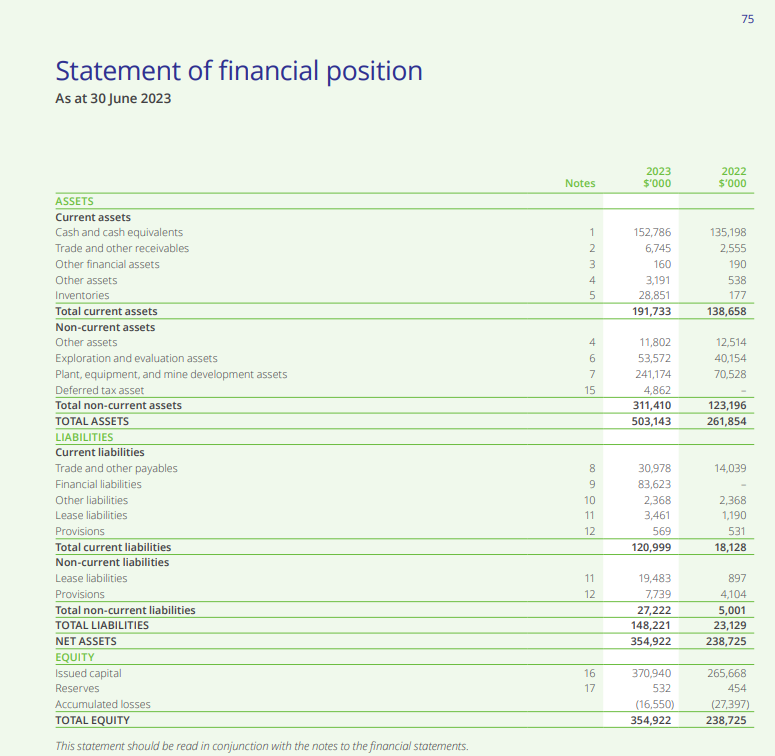

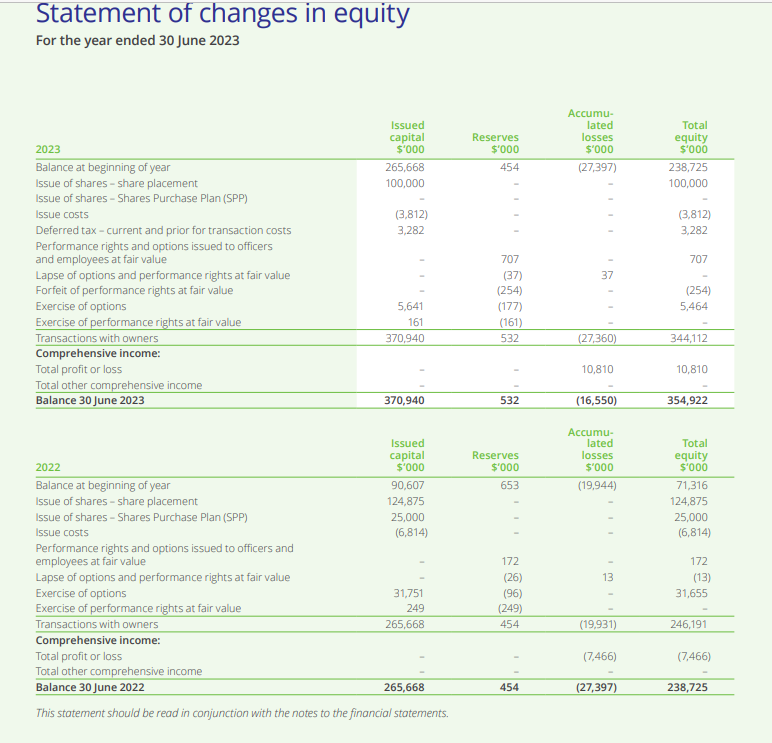

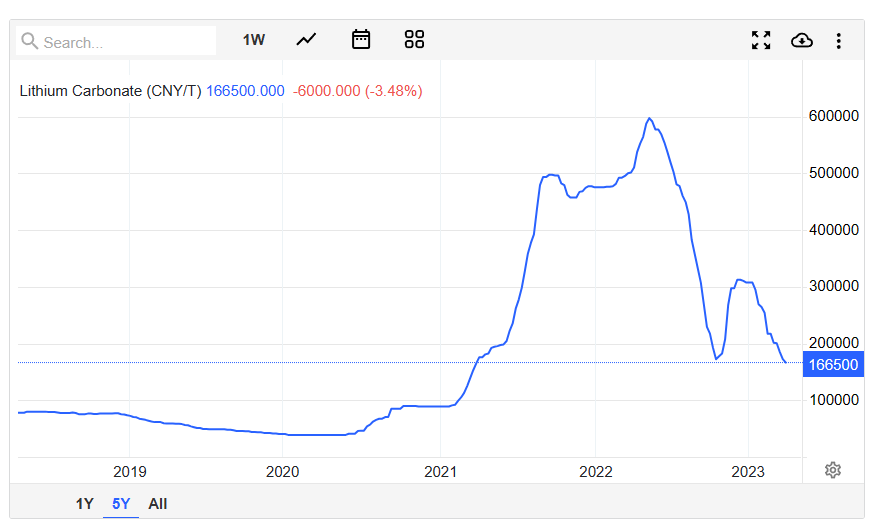

29/9/23 FY23 report

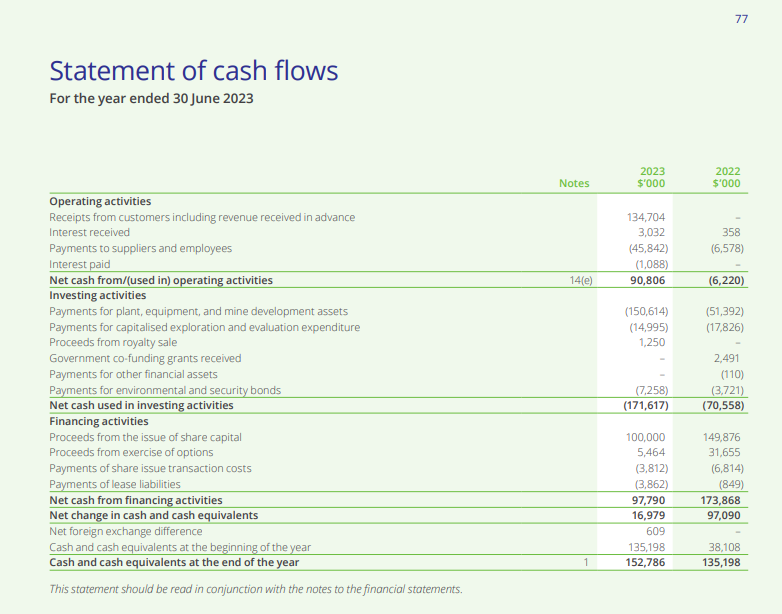

29/9/23 Li2O market price on the slide at 166,500 CNY/T (via TE)

at 40.8cps

2022 the business is at the pre-earnings stage.

Australia’s newest lithium producer

Operational outlook By the end of the financial year sufficient operational experience and data was gathered from integrated but campaigned pit to plant operations, to complete a detailed budgeting and forecasting process. Our first production guidance of 90,000 to 100,000t of concentrate sales, was provided to market as a result of this work. While this forecast for FY24 was below expectations from study work, it is important to note that the reasons for this are understood.

Metal recoveries from the DMS plant are lower than expected, a revised mine plan required the pit walls to be laid back to improve wall geotechnical stability and the wet season impact is better understood. Importantly, Core now has a baseline of operational performance at Finniss to build on, and a clearer picture of the journey ahead as we ramp up operations.

Our priority now is to undertake plant trials and engineering studies to identify near, medium and long-term initiatives to lift recovery rates and improve mining operations. While this improvement work is underway, the sale of a lithium fines product generates revenue from a new product which would otherwise have been unsold.

: Gareth Manderson Chief Executive Officer Core Lithium Ltd

Grade Li2O at 1.48% not a high-grade resource but is making the money.

Return (inc div) 1yr: -63.45% 3yr: 110.66% pa 5yr: 52.97% pa

But the underlying market price below:

Li2O market price is difficult to track the price chart below is a fair indicator)

In case no one knew, CXO share price has fallen dramatically

In summary it is still generating cash,

50% recovery rates. Higher cash costs.

Production guidance reduced.

I think it will be hard to bridge the gap on Lithium supply if mines like this underperform. Simple solution to that is buy something that has a bigger deposit than Core.

Only thing to look forward to is exploration upside at BP33 but that is an underground operation.

Tempting to buy here but this is still at a market cap of 1.1 billion.

Interesting bubble chart. CXO in top right corner

Source: https://twitter.com/_H00PZ

Couple of non-exec sells on market

22/12/22 Malcolm McComas Sell +800,000 $1.05 ($837,581) On-market trade

22/12/22 Gregory English Sell +300,000 $1.04 ($311,280) On-market trade

Source: Market index

Mr Iacopetta has said, “My tenure at Core Lithium has been the highlight of my career to date. It has been hugely rewarding to see the Company move from an exploration opportunity to a project and now an operating mine.

Some of the Report here below:

State Street Corporation and subsidiaries named in Annexures to this form

Attempted downramp failed when citing CEO resignation although this was known for some time. Amazing price action today, but not sure if I'll buy even at these levels.

Adding further to my last straw.

I believe I bought this for the Strawman Classic competition years ago in October 2020

The share price did nothing during the competition and I thought nothing about it. But shortly after the comp ended, the price bagged 200%+.

The original thesis for buying CXO was simple and I used some concepts borrowed from the Core Econ online text that was used for our economics classes.

# Economic Rent? Yes. The resource had lots of good infrastructure including being close to port. So would be quite easy to develop.

# Competitive advantage? Yes. Again due to infrastructure and being close to port and a major city. Also had an MOU which turned into an offtake agreement (I forget who but it was some chinese company that time). Plus a growing resource as well.

Only missing element was economies of scale as they were only starting up and had nothing built yet. Plus lithium needs lots of chemical processing.

These are a few important points to think about when buying any resource stock other than looking at what the mineral deposit is.

I see the flywheel is still strong on Core Lithium (up again today versus every other mining company).

But I'll make no secret and I'll be selling some here to get some cash back and rebalance my holdings.

Have this on strawman but can't believe i don't hold irl when i saw this at 30c. Congrats on anyone that held and ignored the noise.

Guess I'm still hurting on my experience with Kidman resources.

- 110,000 dmt of spod' Going forward- CXO to complete negotiations for the Full form binding offtake agreement..

- so off-take not cast in stone yet

- Release Date: 29/08/22 09:28

- Summary: Core and Tesla Extend Offtake Term Sheet

- Price Sensitive: Yes