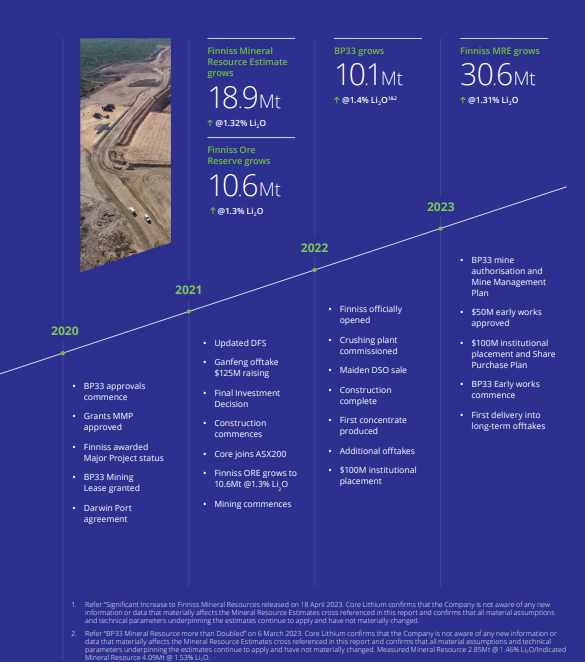

Australia’s newest lithium producer

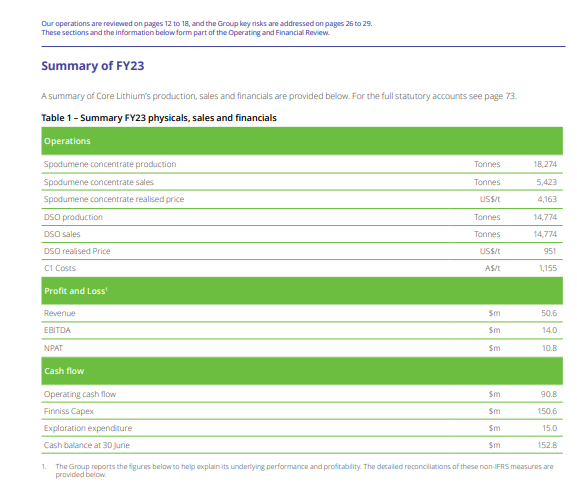

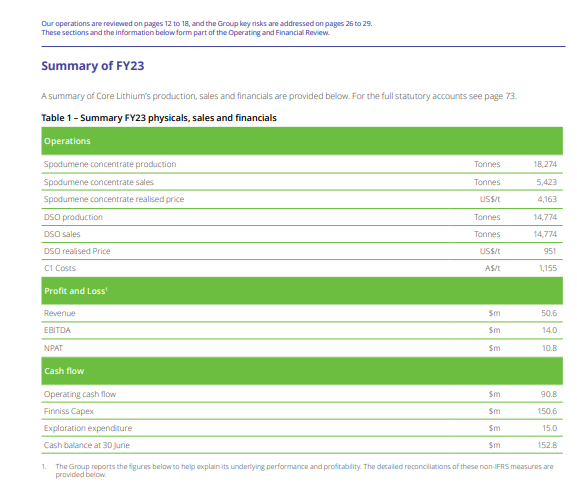

Operational outlook By the end of the financial year sufficient operational experience and data was gathered from integrated but campaigned pit to plant operations, to complete a detailed budgeting and forecasting process. Our first production guidance of 90,000 to 100,000t of concentrate sales, was provided to market as a result of this work. While this forecast for FY24 was below expectations from study work, it is important to note that the reasons for this are understood.

Metal recoveries from the DMS plant are lower than expected, a revised mine plan required the pit walls to be laid back to improve wall geotechnical stability and the wet season impact is better understood. Importantly, Core now has a baseline of operational performance at Finniss to build on, and a clearer picture of the journey ahead as we ramp up operations.

Our priority now is to undertake plant trials and engineering studies to identify near, medium and long-term initiatives to lift recovery rates and improve mining operations. While this improvement work is underway, the sale of a lithium fines product generates revenue from a new product which would otherwise have been unsold.

: Gareth Manderson Chief Executive Officer Core Lithium Ltd

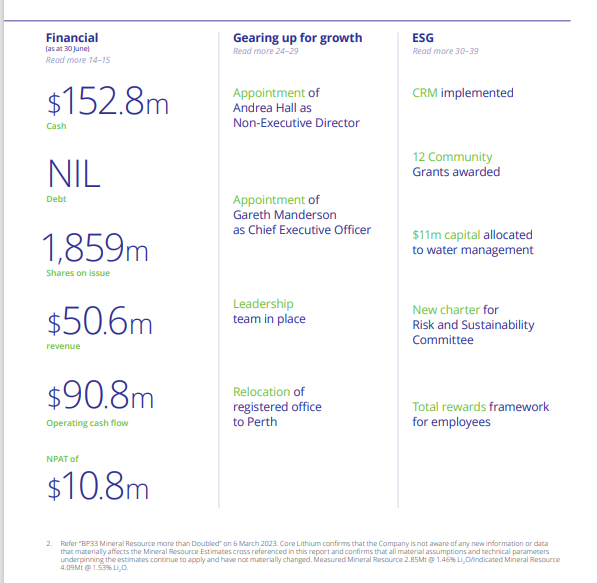

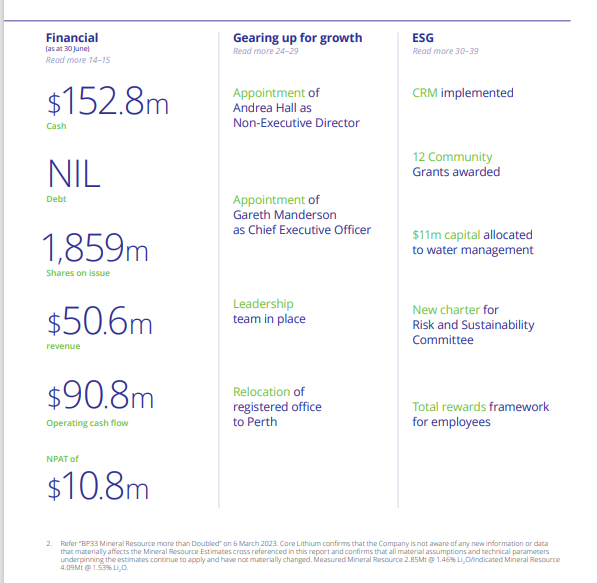

Grade Li2O at 1.48% not a high-grade resource but is making the money.

Return (inc div) 1yr: -63.45% 3yr: 110.66% pa 5yr: 52.97% pa

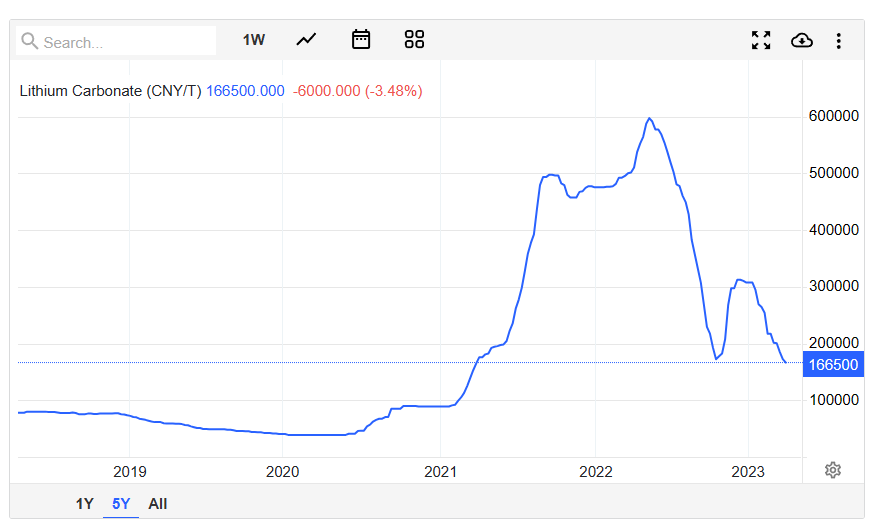

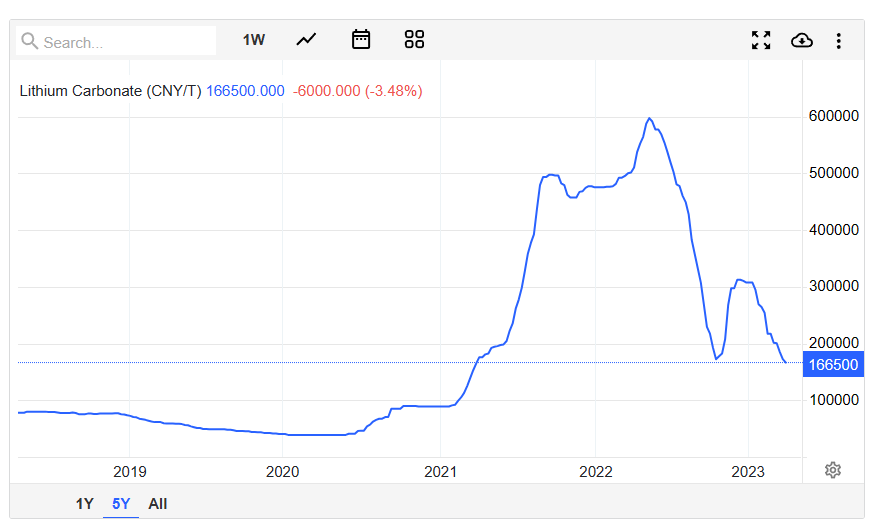

But the underlying market price below:

Li2O market price is difficult to track the price chart below is a fair indicator)