Thought I'd take a look at this company following their announcement yesterday regarding 1H22 result.

DTL expect a 30% increase in NPBT compared to 1H21 which would be approximately $18.1m. This just above their top end of guidance. Management did mention that 1H22 would be a good half due to the backlog at the end of FY21.

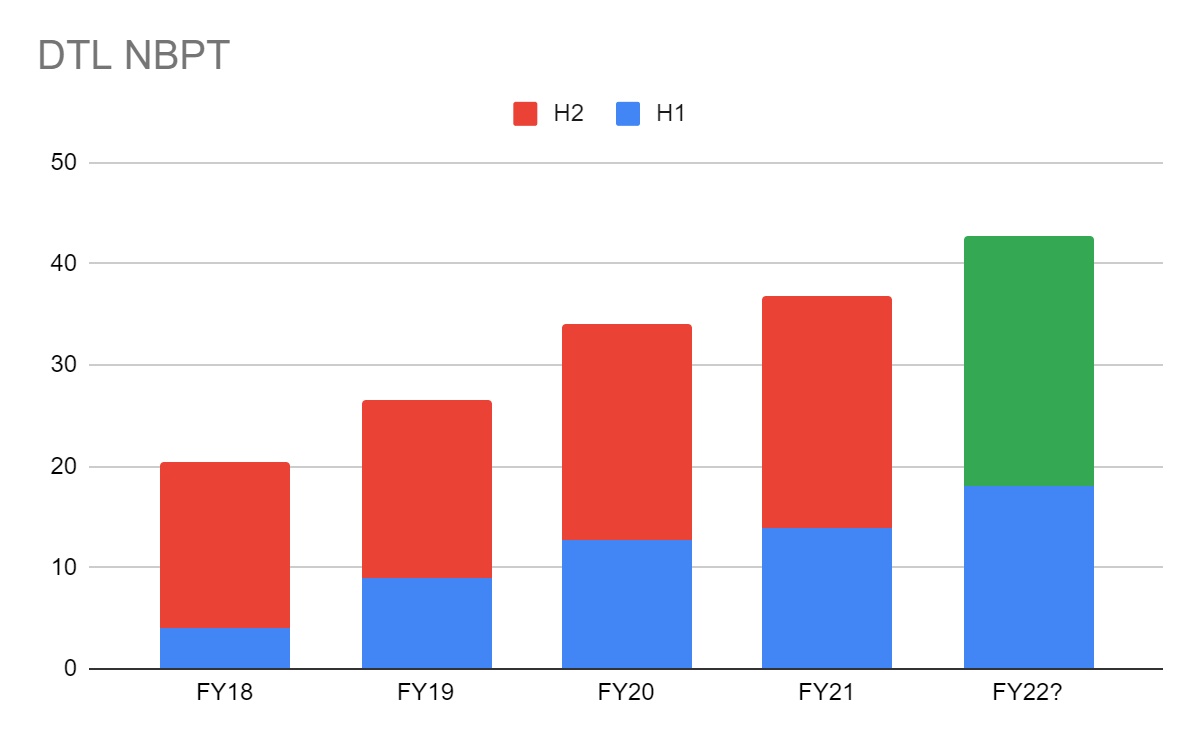

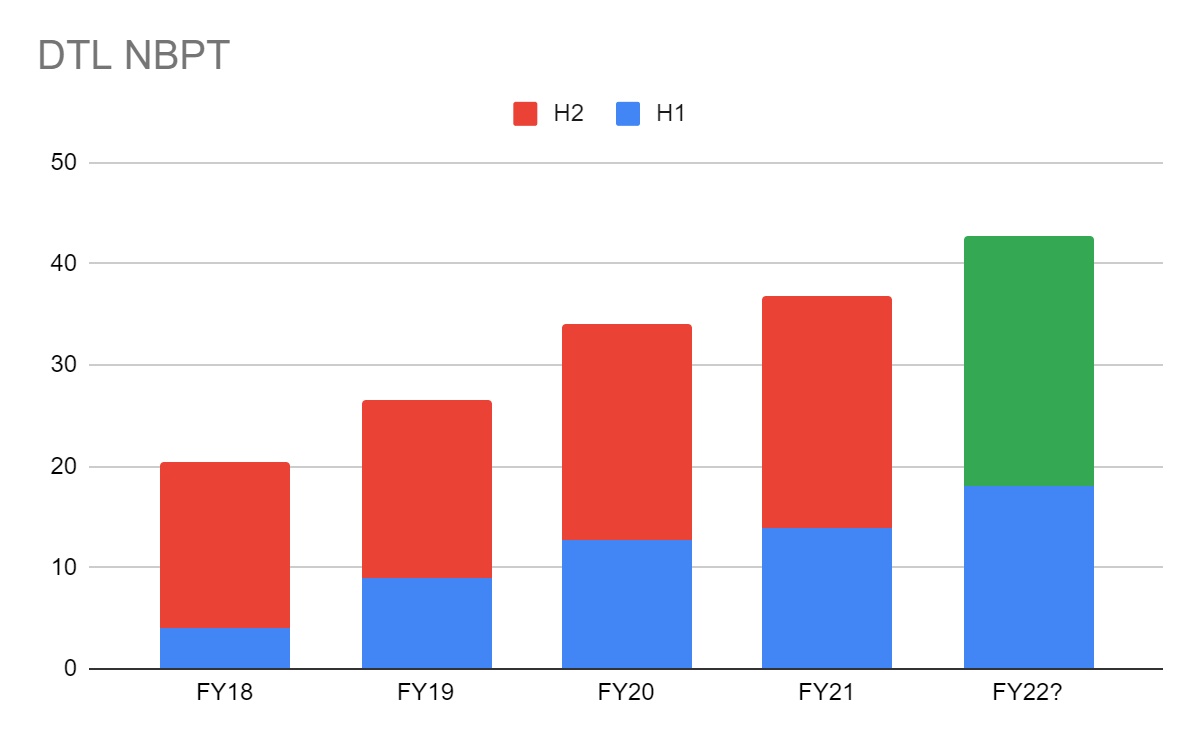

Reading back through their past results, DTL usually have markedly more activity in the backend of the year as shown in the below graph so the large increase in profit for the 1H is definitely encouraging.

I have assumed only slight growth for 2H22 which would bring their total NPBT for FY22 to around $42m. NPAT would therefore come in at around $29.5m.

At the current share price this represents a forward PE of around 32x.

In the past 4 years DTL have averaged NPAT growth of 20% PA although there has been a slow down in FY21 (may be related to COVID). FY19 and 20 NPAT growth was 28% and 32% respectively. At my calculated NPAT for FY22, growth was around 16%.

Obviously if DTL can recover their NPAT growth back to FY19 and 20 rates then the current share price is very attractive however I find it very hard to determine if this is possible. DTL, whilst are profitable, operate a very low margin business with net margins around 2%. Therefore they would need to increase revenue markedly in order to be able to increase their NPAT at rates above 20%.

I will look at this company again following their full year 22 results to see if their second half of the year can continue the momentum of the first half.

Disc: Not held IRL or on Strawman.