Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

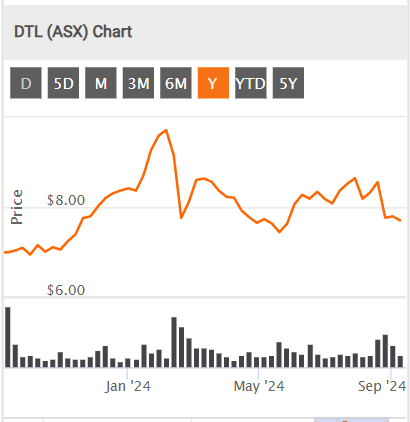

I've sold my holding in DTL DTL are, and have been, a very well run company for a long time. My decision is more about me increasing cash with the current strength of markets and the real risk of a re-rating of DTL (from a high P/E) and the Fed Govt tendering for a panel of Microsoft Licence Providers. They dropped 9% a couple of years ago when Microsoft changed the licence revenue model. DTL have always been very cagey about how material the Fed Govt MS Licence deal is worth. This lack of transparency means the risk is hard to quantify and I've erred on the side of caution.

The whole of Fed Govt Microsoft licensing expires in June this year. The govt has shifted its model to a panel based arrangement. The tender for the panel closed in Sept and is being evaluated.

The Fed Govt has had panels in place before but DTL got 100% of the sales due to lack of competition being able to handle the complexity. Now they have competition with Insight Enterprises.

- Insight is listed in the US and is Microsoft's largest global LSP with 25+ years of Microsoft licensing expertise.

- It has won major state government contracts in South Australia and Western Australia in 2025.

- Microsoft's largest global partner and worldwide solution assessments partner of the year.

- It was also 2023 Microsoft Australian Partner of the Year.

Insight also bought (Nov 25) Sekuro - an AUS cybersecurity company. Sekuro had $200M revenue annually with 300 employees. Security services in Fed Govt is also a revenue earner for DTL. The risk here is Insight being able to grow in this sector but this would be incremental.

DTL revenue only grew 6% last FY but EPS was up 11%. This isn't sustainable on a high P/E, especially if there is more than one member on the panel when announced. But if they are sole supplier again then I'll probably lose out.

Update 26/08/2025

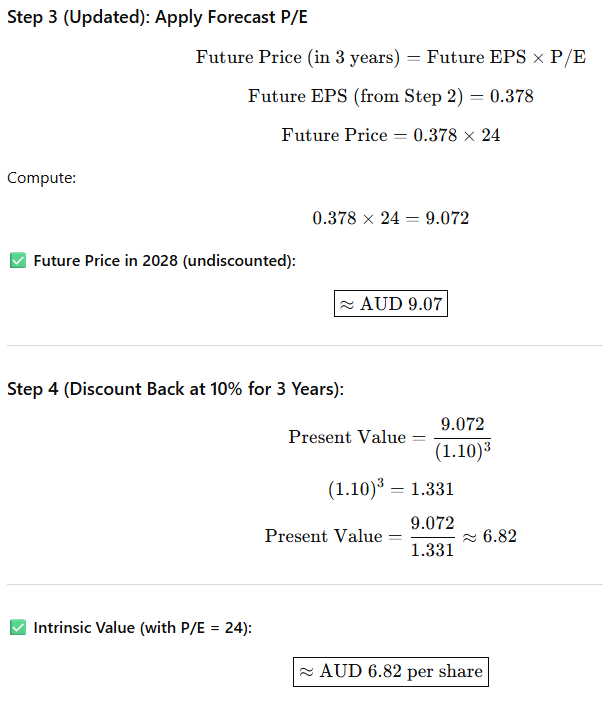

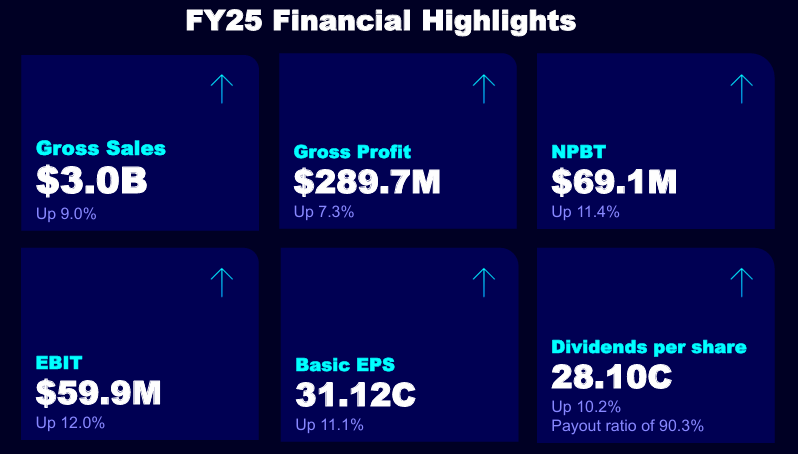

Updating based on FY25 results.

- NPBT = $69.1m

- NPAT = $48.2m

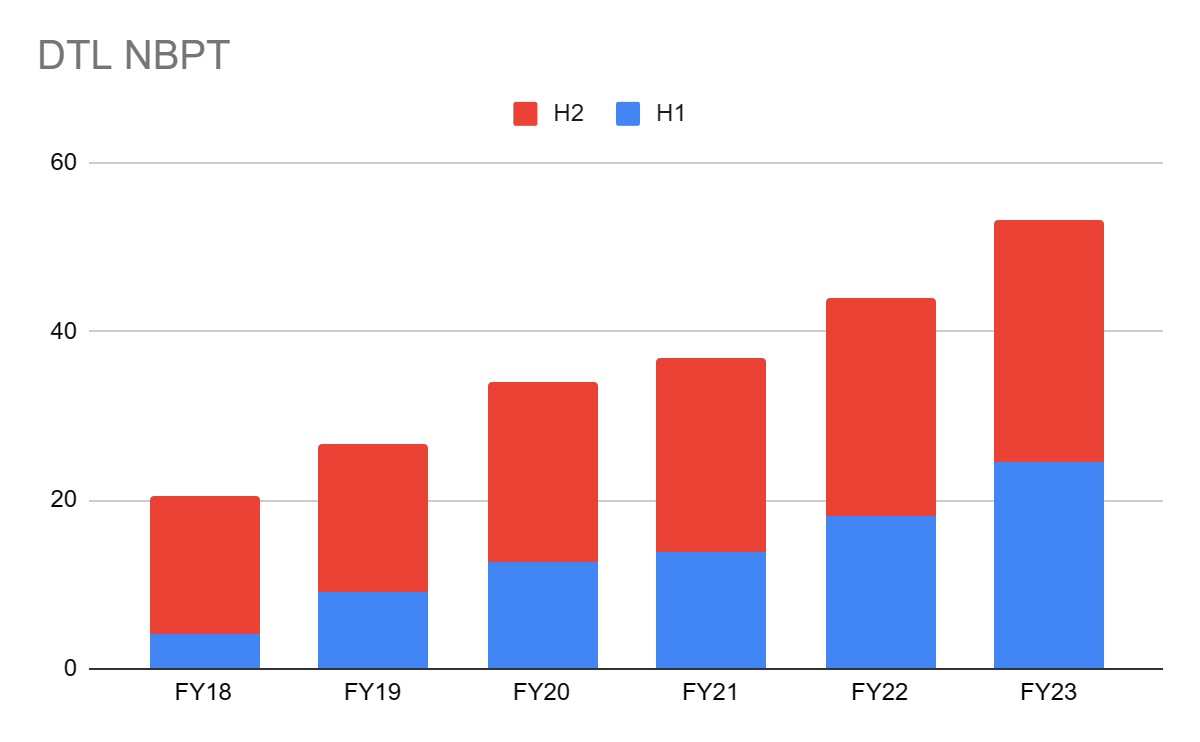

Updated chart below:

2H coming through similar to the trend in previous years of being the stronger half.

Will keep the valuation at 25x PE which gives a valuation of $7.78. Although Management did mention some potential headwinds going into 1H FY26 which if the result shows it being flat could show some risk to the share price

Disc: Held IRL and on Strawman.

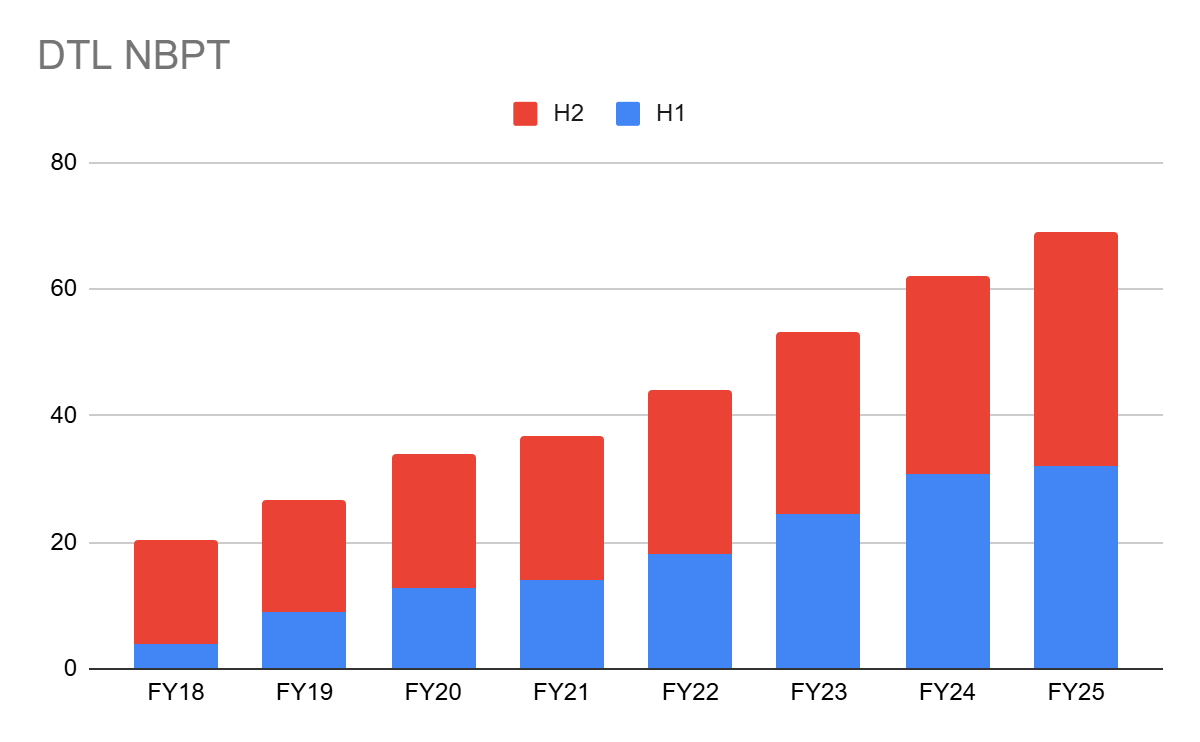

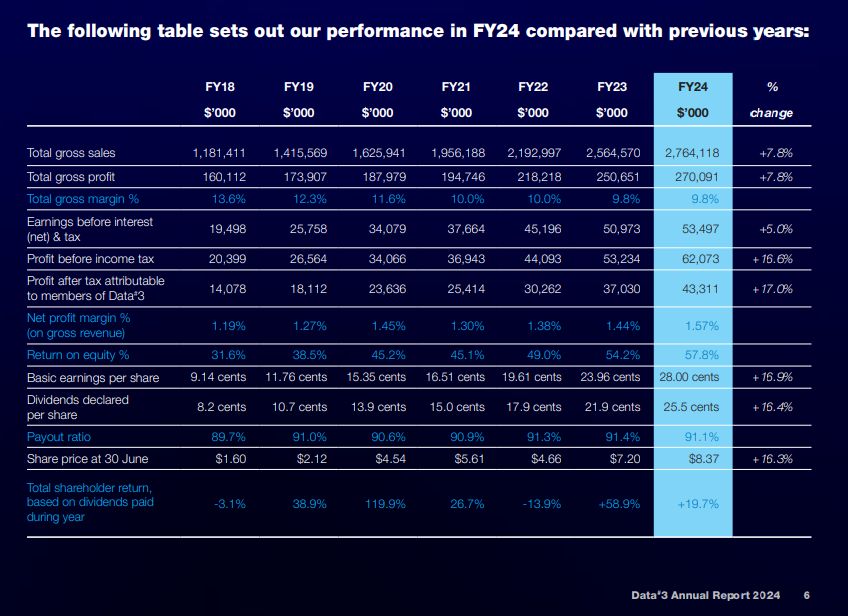

Update 22/08/2024

Updating based on FY24 results.

- NPBT = $62.1m

- NPAT = $43.3m

Updated chart below:

Must say that I was quite surprised by the market's reaction yesterday. I agree that the performance was ok given tough economic conditions but potentially shows the cyclicality involved in this industry.

The 2H FY24 was quite weak given that management have mentioned that their sales cycle usually peaks in May and June however NPAT was basically flat compared to 1H FY24.

Using a 25x PE on EPS of 28cps, gives a valuation of $7.

Disc: Held IRL and on Strawman.

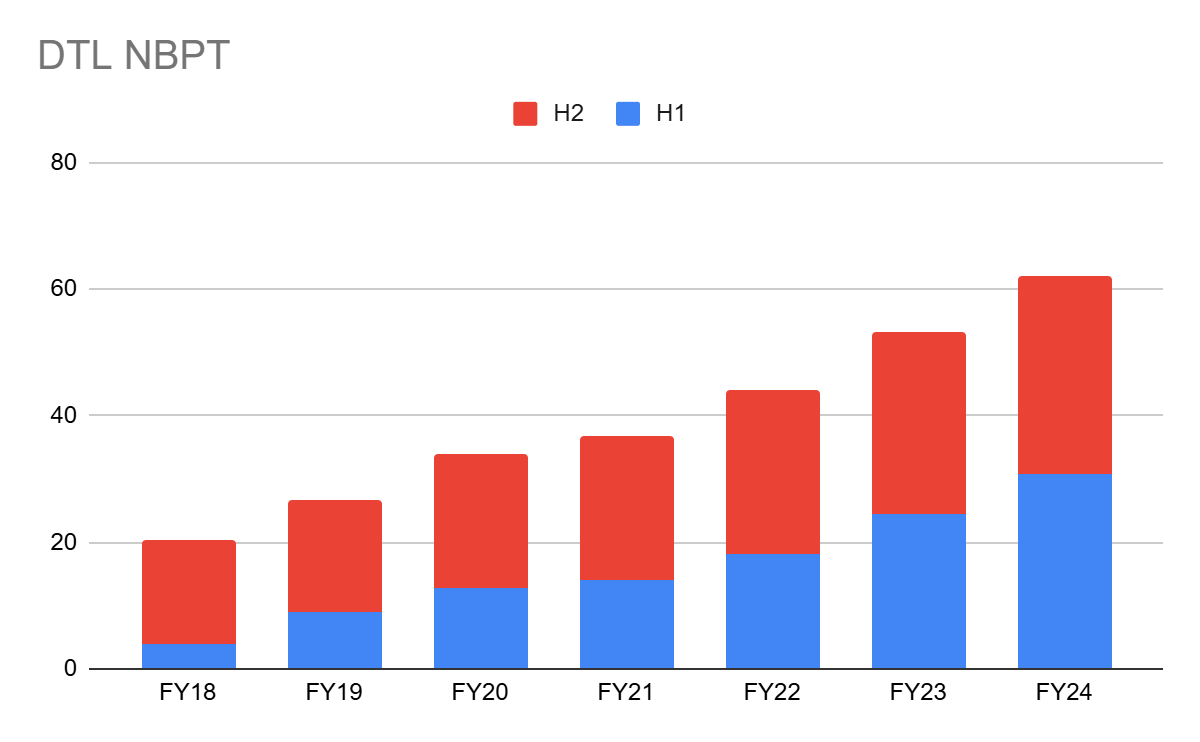

Update 15/02/2024

Updating based on 1H FY24 results.

- NPBT = $30.8m

- NPAT = $21.4m

Updated chart below:

Based on historic seasonal strength in 2H, I'll assume around $45m NPAT for the full year.

25x fwd PE would give a valuation of around $7.27.

Disc: Held IRL and on Strawman.

Update 22/08/2023

Updating based on FY23 results. Below is the graph of their NPBT results.

Maintaining a 25x PE on the current set of numbers, gives me a valuation of $5.98.

I think I will likely top up at around $6.

Disc: Held IRL and on Strawman.

Update 20/01/2023

More of a target buy price to top up my current holdings. A 25x PE would equate to a share price around $6.20.

$6.20 is also the valuation for DTL assuming 15x EPS growth for 5 years and discounting back 10%pa.

Disc: Held IRL and on Strawman

Update 14/07/2022

DTL are reporting NPBT of $44m for FY22. NPAT ~$30.36m

$5.75 valuation would give a fwd PE of ~30x

For a company that has grown NPAT YOY by 19% this isn't too demanding IMO

Disc: Held IRL and on Strawman

Original Report

Assuming NPAT of $29.5m for FY22 (See my Straw)

PE of 30x = 885m MC

SOI = 154.3m

Valuation = $5.75

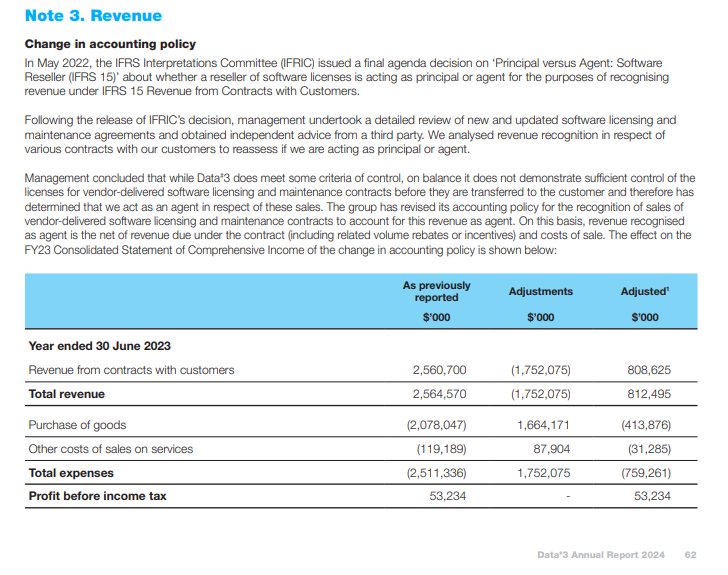

Data #3 reported earnings yesterday. From their presentation:

Overall a solid result given some small sector headwinds which they have mentioned at previous reports. Continued EPS and DPS growth proving that their business is maybe more resilient rather than cyclical.

Good growth in the managed services division which is their higher margin segment offset some difficulties in the consulting segment impacted by QLD state election.

No specific guidance was given which is normal at FY results, there is usually a small guidance given at the AGM. They did mention that some headwinds in 1H will be offset in the 2H which may indicate that FY26 could be more of a flat result YOY? Will have to watch how the year plays out.

Overall still happy to hold.

Disc: Held IRL and on Strawman.

Update Aug 2025

A solid second half of the year with revenue up 9% and EPS up 11%. Was expecting a reasonable half, so the real watch comes in FY26 as the changes to Microsofts pricing model for them fully kick in. That said, they appear confident they can still deliver solid growth. Interest income continues to be a significant part of the total profit / EPS, so will probe into that at the AGM around impacts in a falling interest rate environment.

Valuation in Aug 2025 based on 31c EPS and 9% growth rate for next 5 years with PE of 25. (PE of 25 is in bottom quartile of its trailing 5 year history.)

Update Feb 2025

After doing some more digging following @Trancer excellent insights on what the Microsoft pricing changes announced in December mean, I am lowering my valuation to $6.00 and exiting my position for now.

My thesis required EPS growth of more than 10% p.a. for the next 5 years and it seems likely to me that DTL are in for at least a couple of tough years moving forward as they adapt to the Microsoft fee change. This half might be ok. But the next few at least look a lot tougher for profit growth. Which means we may get flat or small declines in EPS and then probably some multiple compression. The recent PE range is double what it used to be 5 years ago.

In addition, a negative change to their deal with Microsoft was one of my key risks to watch for. I do now wonder if the long serving CEO and Chair, who both exited voluntarily last year, were worried the coming years were going to be a lot tougher…

Valuation in 2023 based on 28c EPS and 12% growth rate for next 5 years with PE of 25. (PE of 25 is in bottom quartile of its trailing 5 year history.)

Why do I own it?

# Mid cap and market leader which provides IT hardware and software from mostly Microsoft to predominantly commercial and government customers across Australia and NZ. Also provide support services.

# Has 10 years of 20% p.a. earnings growth

# Founders have all exited the business now as it was created 45 years ago. But still has a strong founder like mentality with insiders holding 15% of the company and the "new" CEO having worked at the company for 28 years before his appointment this year!

# Strong staff engagement across their 1400 employees, with average tenure of over 5 years and consistently awarded as an employer of choice.

# Consistently high ROE / ROC of over 50 / 40% as it's a capital light operation.

# Acceptable MOS at current price of $7.85 in Feb 2024 at almost half the previous growth rate.

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed my 15% p.a. + target

# They were recently added to the ASX200 providing indexing tailwinds to the historical multiple.

# Probably has structural tailwinds as Australia keeps growing and spending more on IT / AI and in particular cyber and security products that have been a source of good growth in recent years.

What to watch

# Low net profit margin of 1.5%. This is probably a moat though as given their large volume it will be tough for competitors to undercut them. They have been able to maintain this for many years now.

# Any significant change or approach from the new CEO and new Chair, that may add risk or distractions to what is a well proven business model.

# Loss of supply/service contract with major suppliers, especially Microsoft.

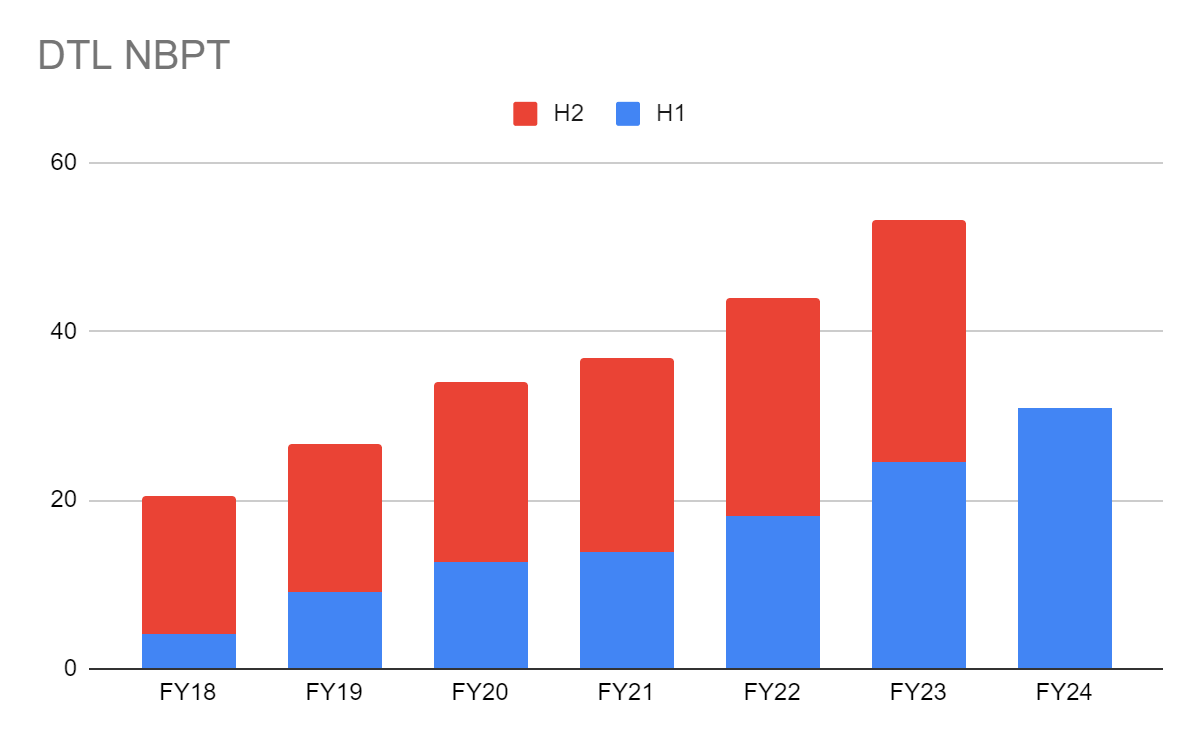

Base case Valuation

1/ starting eps: $0.30 grows at 8%pa computed below:

Best case 'bullish' Valuation by Macquarie article via Motley fool -

Data3# posted gross sales of $2.8 billion for FY24, up 7.6% on the previous year.

That saw the company report a gross profit of $270.1 million for the financial year, an increase of 7.8% on FY23's result.

Where to next?

Macquarie has a price target of $9 on Data#3 shares.

That represents a potential total shareholder return of 24% over the next 12 months.

The broker is expecting Data#3 to steadily increase profits over the coming years.

The IT company's gross profit is forecast to grow to over $350 million for FY27.

In the near term, Macquarie expects Data#3's business to benefit as cloud migration and AI adoption continues.

Demand for Data#3's services will further increase as customers require support when Windows 10 reaches its end-of-life date in October, according to the broker.

*so Macquarie are targeting an eps growth of 24%pa ..which is very attainable.

15 Feb 2024

1H FY24 Highlights

• Gross Sales up 13.4% to $1.3 billion

• Statutory revenue up 11.1% to $450.1 million

• NPBT up 25.3% to $30.8 million

• NPAT up 25.5% to $21.4 million

• Basic EPS up 25.5% to 13.85 cents per share

• Interim fully franked dividend up 26% to 12.60 cents per share

• Strong balance sheet with no borrowings

Data #3 Limited (DTL) Reported 1H FY25 results this morning.

From their presentation:

A solid result despite some headwinds that have been previously disclosed. Continued strong growth in higher margin Services sector of the business.

No specific guidance given for the remainder of FY25 although as seasonal, sales peak in May/June which usually leads to a stronger 2H result.

Overall I thought this was a solid result albeit maybe showing growth may be slowing although overall sector tailwinds should be strong with continued IT spend. Will watch to see if services can continue to grow allowing for a more stable revenue base which should alleviate any fears of this being too cyclical.

Disc: Held IRL and on Strawman.

17/12 - Updated based on revised Microsoft pricing.

Listened to the DTL call this morning and picked up a learnt a few interesting items that I used when considering my :

- Wage inflation over the past year and an increased headcount of 2%. Are expecting wage expenses to normalise from here unless the business scales significantly in the managed services area.

- Election in Queensland (large volume government customer) which may result in some sales or contracts in that region taking longer to execute.

- Pre-payments from work contracted in 2023 impacted the revenue generated for this FY (DDR said the same thing this morning).

- Company focussing on more managed services revenue which has high margins.

- Best ever June on record, with revenue to be recognised next FY.

- Gross profit increase of 7.8% YOY.

What wasn't on the call, but a learning from my former workplace in SA is that servers for some large organisations (including government) are approaching end of life over the coming years and will need to shift to a cloud based solution. Companies like DTL with existing integrated services with these organisations are well placed to benefit from a transition to a cloud based solution and data centre hosting. A familiar face and resistance to change can be good for business.

My valuation is as follows, based on a forward looking a couple of years into the future.

Future NPAT = $46,000,000 (working on a conservative NPAT of 4% growth, however lower overall base to reflect lower margins from Microsoft and expansion into other business.

Future PE = 23-25x EPS to reflect the lower growth rate potential.

Valuation = $7-7.5 per share.

A higher than expected growth rate over or some big contract wins in the managed services space could warrant a higher multiple and value in the future.

Disclosure: shares Held in RL and SM

So DTL added a market update suggesting Microsoft is changing their pricing model, with an estimated reduction in gross profit by 3% based on current Hy. Wasnt sufficient enough to even warrant a price sensitive announcement.

Share prices today dropped 13%.

Not sure what I'm missing here?

Disc. Held IRL.

Marked non-price sensitive as it won't be material - clear negative and highlights the issue of being a reseller. Feel this would be a positive for DDR given they have more of a focus on SME.

.........

Australia’s leading IT services and solutions provider Data#3 Limited (ASX:DTL) wishes to advise that Microsoft has announced changes to its partner incentive program, as follows: • The changes will reduce the incentives earned by Data#3 on its Microsoft Enterprise agreements, effective 1 Jan 2025 • Microsoft will increase its focus on Small, Medium and Corporate (“SMC”) initiatives • Microsoft is also increasing incentives for its Copilot, Security, Azure Migrations and Cloud Solutions Provider (CSP) programs

.........

In isolation, if the full effect of the changes in Microsoft Enterprise Channel Incentives had applied throughout all of FY24, that effect would have reduced FY24 Gross Profit by about 3%.

However, this is not a forecast on the future impact of these changes as the effect in future years will depend on various other factors. The changes do not influence Data# 3’s Infrastructure Solutions, however they will provide the opportunity to increase revenue and improve profitability in Services.

There is no change to the FY25 H1 guidance provided at the Data# 3 AGM in October of $31 to $33 million of pretax profit, and the FY25 financial impact of the incentive changes is expected to be immaterial. With other areas of the business growing, Data# 3 still currently expects to achieve sustainable earnings growth for the full 2025 financial year.

Fundamentals ROE 57.8 great profitability, EPS 28c up17%

% Outlook Optimistic for 2025

See how the 'market' reads / reacts to this report.

Outlook no Quantitative # projections here. But DTL are Optimistic :

We are expecting to see continued momentum in As-aService and recurring revenue solutions through FY25, ensuring customers have access to different consumption approaches. Demand for end user devices will be driven by the need to support Windows 11, and AI-enabled edge, in addition to postcovid refresh cycles.

Our Device as a Service offerings gained momentum in FY24, and we see this continuing into FY25.

Our Security practice will only strengthen as customers are challenged by ongoing cyber threats, in addition to security related challenges presented by their gradual adoption of AI.

Cloud and data centre will likely see growth in response to security and data concerns, and in determining how AI is best utilised in the right location for workloads and use cases.

Sustainability will be a focus as customers navigate the increase in AI-enabled infrastructure, which can potentially be high in its environmental footprint. Vendors such as Microsoft and HP who are leading the way in sustainability practices will be an important influence on customer decision making

There is some optimism that the challenging trading conditions caused by a highly inflationary and high-interestrate economic environment will ease early in calendar year 2025, resulting in improved consumer sentiment and a return to more normal levels of sales growth. Investments by the Public Sector in new infrastructure projects should also help to grow our pipeline across all lines of business.

The foreseeable risks (and any available mitigants) to achieving our short to medium-term financial growth aspirations, specific to Data # 3 and in addition to the general macro-economic risks that would impact most organisations, include the following:

• Major changes to customer and reseller sales strategies and vendor incentive programs that would negatively impact future profitability. Mitigant: Data # 3 works closely with vendors to stay abreast of any potential changes and adapts sales strategies and vendor management processes accordingly.

• Access to skilled technology labour to enable us to deliver contracted work and achieve growth in areas of strategic focus. Mitigant: Our talent attraction and retention policies, including staff benefits and people development initiatives.

• Any negative geopolitical influence on the region or supply chains. Mitigant: We work with vendors to expedite deliveries (where possible), utilise distributors with available stock, and provide customers with ongoing updates, as evidenced with the pandemic-related supply chain challenges.

• Delayed decision making due to state government elections. Mitigant: We work with Agencies in the lead up to the election to ensure customer requirements have been addressed prior to lock down periods and again after an election to ensure any technology requirements for Machinery of Government Changes are addressed.

• Government change in policy with regards to the use of contractors. Mitigant: We provide both contract resources and outcome-based project offerings. While some governments may prefer to reduce contractors in preference of employing full time staff, the limited access to skilled resources means outcome-based projects are still a solution for public sector customers

Return (inc div) 1yr: 12.95% 3yr: 16.75% pa 5yr: 25.67% pa

BRISBANE, 26 July 2024: Australia’s leading IT services and solutions provider, Data#3 Limited (ASX: DTL) will release its audited results for the financial year ended 30 June 2024 (FY24) on Wednesday 21 August 2024.

Brad Colledge (CEO & MD) and Cherie O’Riordan (CFO) will present a market briefing on the results at 10:00am (AEST) that morning. The full year reports and presentation will be lodged with the ASX and available on Data#3’s website.

JP Morgan Research note from February 2024

Been a volatile period for holders and the below explains the factors quite well.

Tempting to add at the lows but I always get distracted by some other shiny new thing now and then.

[held]

It seems these results are not meeting shareholder's approval with a sudden price drop of 10%!! To be fair, DTL has been on a strong Bull run lately, but 10% in one foul swoop, the market is certainly fickle. I'll be sticking with them for a while yet.

1H FY24 Highlights

• Gross Sales up 13.4% to $1.3 billion

• Statutory revenue up 11.1% to $450.1 million

• NPBT up 25.3% to $30.8 million

• NPAT up 25.5% to $21.4 million

• Basic EPS up 25.5% to 13.85 cents per share

• Interim fully franked dividend up 26% to 12.60 cents per share

• Strong balance sheet with no borrowings

Data#3 to report strong 1H FY24 earnings growth BRISBANE, Tuesday 16 January 2024: Australia’s leading IT services and solutions provider, Data#3 Limited (ASX: DTL) announces that its consolidated net profit before tax for the first half of FY24 is expected to be between $30 million and $31 million (1H FY23: $24.6 million), exceeding the $27 million to $29 million guidance range provided at the AGM in October 2023. The final result is subject to the completion of the interim accounts and audit review. The result reflects increased activity and is inclusive of interest income substantially higher than FY23, earned as a result of the company’s effective working capital management, improved deposit rate and strong debt-free balance sheet. The Board intends to announce the detailed audited first half results and interim dividend on 15 February 2024. Management will also host a market briefing at 11:00am (AEDT) following the release.

52 Week high today

Checking the investor day presentation , apart from having the MD for Microsoft Australia as guest speaker, the word "AI" was mentioned several times on the 15 November call from the new CEO

The CFO Cherie O'Riordan also mentioned focusing less on margins and more on improving profitability. They believe by not growing gross margins, Data#3 will be more competitive in winning new business and hence increase profitability.

Data#3 also mentions they are able to still pass price and wage inflation into their customer contracts. Several measures mentioned include:

- Reseller agreements that allow the company to pass price increases to the customer

- Professional services contracts being more time and materials based while managing fixed price contracts

- Periodic price reviews of managed services contracts

Finally for Working capital, they have no issues with drawing down this component as it is mostly current and there is a low default rate from customers

Lots to unpack from the call transcript so above is just a summary of the main points..

There was also a special call today which I do not have access to the transcript so not sure who was invited here.

Note: I've been cashing on the dividend reinvestments in SRL only. If only I bought more during that mini crash months back.

[held]

This was announced at the AGM a few days ago, long time CEO and MD Laurence Baynham is stepping down from his position and will be replaced by Brad Colledge who is the current Executive General Manager of Software Solutions, Infrastructure Solutions and Services.

The transition will occur over a 4 month period with Brad formally stepping into the role on March 1 2024.

Guidance for 1H FY24 was also given at the AM with expected NPBT to come in between $27m-29m:

I've updated my chart below showing the earnings growth over the last 5 years:

If they meet midrange of guidance then this represents growth of around 13% to pcp.

As expected, H2 will be the stronger half and management did state that they expect to have overall earnings growth, although the level of growth may not be as large as previous years. Nonetheless this remains a solid company with good growth prospects.

AGM meeting address here

Disc: Held IRL and on Strawman.

Looks like some index buying incoming.

The company's response to the ASX Aware query on the price action post its FY result report is an example of how to deal with this sort of request professionally. Strengthens my conviction in management.

Strong Day 2 rebound today on good volumes, which is bittersweet as it leaves me with only half a position.

Lends credence to the theory that the selloff was caused by punters hoping for ASX 200 inclusion and closing out their positions when the company fell short of consensus.

Data #3 (DTL) released their results. From their presentation:

The market has not liked their results giving them a 15%+ sell off.

By my estimates, 2H profit which has often been very strong compared to 1H missed by around 5% (I had them growing NPAT by around 15% compared to 2H FY22, they grew by only 10%). I suspect this is the reason for the sell off today. Overall NPAT was still up by 22.4% which was on the back of strong growth in the 1H of the year.

The breakdown of revenue by sector was interesting. The increase in higher gross margin sectors had an overall increase in the gross profit and net profit margins for the business. As this increases further we may see less seasonality in the overall profit timing for the business. The increase in gross profit margins is also pleasing given the relatively low overall margins that DTL runs on.

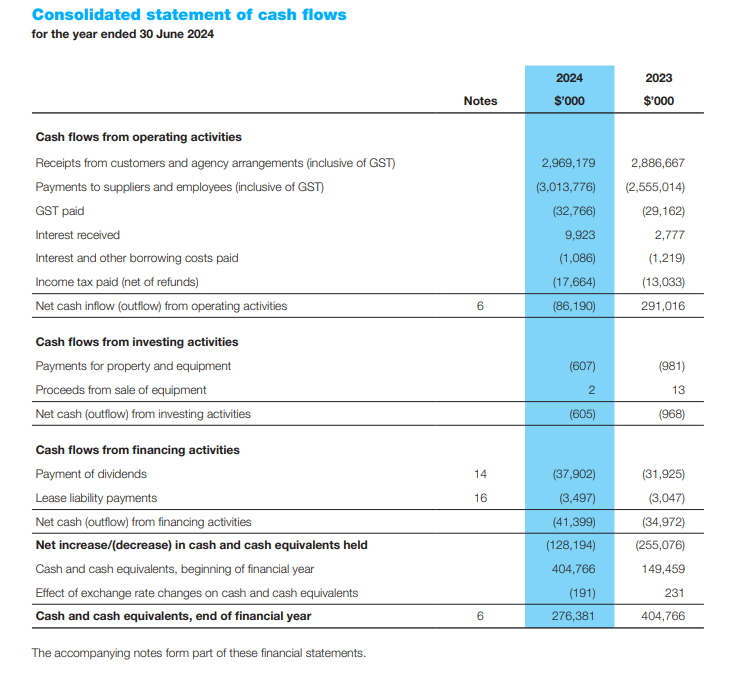

Cash flow seasonality was as usual with a high cash balance at June 30 reflecting the increased receipts prior to the end of the FY. The next half will be the one to watch in terms of working capital concerns as stated in my straw from 1H FY23. As long as they can receive cash from their customers quickly enough to pay off their payables I don't think there should be any concerns. Management of their cash flows has always been solid so I'll give them the benefit of doubt for now.

Overall I think this result was solid even though profit was a slight miss in the 2H. Will likely adjust my valuation down slightly but don't see any reason to sell as yet. May even look to add with the current share price weakness.

Disc: Held IRL and on Strawman.

Data3 down 17%

Looks like they missed in something on their results

They did lift the dividend

[Held]

Data #3 Limited released their 1H FY23 result today. Results were basically as expected as they had pre-released unaudited results about a month ago.

From their presentation:

NPBT came in just under their top end of guidance as expected with another record half.

Once again management stated that profit would likely be skewed again towards the 2nd half of FY23. I don't expect 2H FY23 to have another 38.1% increase on PCP like 1H but if they increased on the previous half by 20% then 2H FY23 NPBT would come in at around $31m giving full year NPBT of around $55.6m. EPS for the full year would be around $0.25 giving DTL a fwd PE of around 29x.

Probably the only thing I'm keeping an eye on is the cash position of the business. DTL typically operate on a short of negative working capital basis and so the timing of cash receipts is usually elevated around the FY year end (May, June). Operating cash flow is very often negative for the 1H as a result of this as evidenced in the current report (operating cash outflow of $88m). However in the last few years, full year operating cash flow has also been negative and the cash balance has decreased down to a level not seen since Dec 2019. With increasing supply chain issues, the company has stated that cash flow collection has slowed to around 33 days (up from around 27 days) and inventory is inflated but will be allocated to non-cancellable orders. The below chart from the presentation shows the slow increase in the working capital requirements of the business. If working capital goes above cash, will DTL be able to fund its operation? Something to look out for in the next half. I expect management to be able to work through this issue as shown in the past.

I will maintain my valuation at $6.20 as a potential top-up price.

Disc: Held IRL and on Strawman.

Strong half year results with EPS of $0.11 or $0.22 annualised.

Mean PE over the last 10 years is 19.4x - higher last few years.

Call it 22x gives me a price of around $4.84 and round up to $5 as think the business has improved with increased recurring revenue over time.

Will keep holding my parcel IRL but I've haven taken profits. Would look to buy more at $5 or slightly above.

Data 3 limited (DTL) held their AGM today and released an outlook for the 1st half of FY23:

Taking the midrange of guidance would equivalate to around 24% growth to NPBT. This does include a backlog of $6m which could not be invoiced in FY22 due to supply constraints (normal backlog is around $3m). Management did mention that they would once again be heavily skewed towards 2H of the FY as is seasonal so to achieve good growth in the 1H is a good result.

Updated chart below of trending NPBT. Note the FY23 figures are estimates.

Disc: Held IRL and on Strawman

Data #3 Limited (DTL) release their FY22 results today. From their release:

- Revenue = 2.19b (up 12% YOY)

- NPAT = $30.26m (up 19.1% YOY)

- Final Dividend of 10.65c bringing the final dividend to 17.9c for the year (up from 15c in FY21)

Not much news considering they released a market update around a month ago. They have continued to avoid giving guidance for FY23 given supply chain issues and other covid related disruptions however they did mention that there was a backlog of $6m of NPBT that will be realised in 1H23.

Some charts given from their results presentation.

I also found it interesting that they are changing their revenue mix with increasing high gross margin revenue.

This may help with profitability in the long term and already shows with increasing profit compared to increase in revenue.

Disc: Held on Strawman and IRL

Data #3 released their results today. From their release:

- Revenue up 16.6% to $999.3 million, with public cloud up 34.8 % to $466.7 million

- Gross profit up 17.5% to $105.4 million, boosted by services growth

- NPBT up 33.0% to $18.5 million

- NPAT up 31.7% to $12.4 million

- Basic EPS up 31.5% to 8.01 cents per share

- Interim fully franked dividend up 31.8% to 7.25 cents per share

- Strong balance sheet with no borrowings

Results were actually stronger than what they were expecting at their market update last month and above their NPBT guidance of $15-18m.

They have not provided any guidance for the rest of the year due to "pandemic-related uncertainties" but are expecting 2H to be stronger than 1H as is the seasonal trend (See my last Straw).

Disc: Held IRL (have ended up buying some shares since my last straw), not held on Strawman

Thought I'd take a look at this company following their announcement yesterday regarding 1H22 result.

DTL expect a 30% increase in NPBT compared to 1H21 which would be approximately $18.1m. This just above their top end of guidance. Management did mention that 1H22 would be a good half due to the backlog at the end of FY21.

Reading back through their past results, DTL usually have markedly more activity in the backend of the year as shown in the below graph so the large increase in profit for the 1H is definitely encouraging.

I have assumed only slight growth for 2H22 which would bring their total NPBT for FY22 to around $42m. NPAT would therefore come in at around $29.5m.

At the current share price this represents a forward PE of around 32x.

In the past 4 years DTL have averaged NPAT growth of 20% PA although there has been a slow down in FY21 (may be related to COVID). FY19 and 20 NPAT growth was 28% and 32% respectively. At my calculated NPAT for FY22, growth was around 16%.

Obviously if DTL can recover their NPAT growth back to FY19 and 20 rates then the current share price is very attractive however I find it very hard to determine if this is possible. DTL, whilst are profitable, operate a very low margin business with net margins around 2%. Therefore they would need to increase revenue markedly in order to be able to increase their NPAT at rates above 20%.

I will look at this company again following their full year 22 results to see if their second half of the year can continue the momentum of the first half.

Disc: Not held IRL or on Strawman.

Data# 3 expects to report strong 1H FY22 earnings growth

Estimated first half earnings growth of approximately 30%

BRISBANE, Tuesday 18 January 2022: Australia’s leading IT services and solutions provider, Data# 3 Limited (ASX: DTL) has advised that its consolidated net profit before tax (NPBT) for the first half of FY22 is expected to be slightly ahead of the top end of the $15 to $18 million guidance range provided at the AGM in October 2021

Subject to finalising the interim accounts and the audit review, 1H FY22 NPBT and earnings per share are expected to be approximately 30% higher than the record 1H FY21 results.

The Board intends to announce the detailed audited results and interim dividend on 17 February 2022.

The company will present a market briefing on the results starting at 11:30am (AEDT) on 17 February 2022. The following URL will provide access to the live event, and to an archived webcast following the event: https://webcast.openbriefing.com/8302/

Approved for distribution by Mr Richard Anderson, Chairman.

ENDS

Disc: Iown share on SM and IRL

DTL has again delivererd another record Full Year Result

Highlights

- Revenue up 20.3% to $1.96 billion, with public cloud up 36.2 % to $791.6 million

- NPBT up 8.4% to $36.9 million

- NPAT up 7.5% to $25.4 million

- Basic EPS up 7.5% to 16.51 cents per share

- Total fully franked dividend up 7.9% to 15.0 cents per share

- Strong balance sheet with no borrowings

DTL just keeps on keeping on... Still a happy holder....has been a growth & dividend stock for me

Edit spelling

DISC~ I Hold

This was one of the companies studied in my MBA. That was back when the shares were less than $1. It is not a business I follow, so I wanted to look and see how much the business had changed. Back about 10 years ago, Data#3 were large resellers with a reasonably small services division.

The Brisbane based information technology company first listed way back in 1997 and has been operating for more than 35 years. There are also some management that have been there for almost that amount of time. The CEO, who has been in the seat 7 years, has been with the business since inception.

Continuity of management can be a great thing, but it also (potentially) means you get lost in your own ideas. Not pointing to Data#3 with this thought, it is just something I have observed too often. I’ll come back to this.

With revenues now exceeding 1.6B they have done a good job continuing to grow the business. This revenue is more than double since I last looked. It is also good to see they have continued to grow the dividend.

Back 10 years ago they were a large licence reseller. Now they are the largest in Australia. Impressive to retain the mantle for so long. It is through low margin. The service business has been significantly increased.

The business carries almost zero debt.

Back to the management. They are currently executing on a three year strategic plan. Everything contained seems really sensible to me.

What we are looking at is a modestly growing, sensible, stable business. Employing a thousand or so Australians. This is the kind of business the management team should be proud to run.

Is it going to shoot the lights out. Probably not. It is going to halve overnight. Doubt it. If that is what you are looking for this one might be suitable.

Growth across all key metrics:

- Total revenue up 19.2% to $856.7 million, including $346.1 million of public cloud revenues • NPBT up 10.2% to $13.9 million

- NPAT (excluding minority interests) up 7.9% to $9.4 million

- EPS up 7.9% to 6.09 cents per share

- Interim fully franked dividend up 7.8% to 5.5 cents per share

- Strong balance sheet with no debt

DISC: long term happy holder...also in Strawman

Data# 3 expects to improve on previous 1H record result

First half pre-tax profit estimate of approximately $13.7M, up 8 to 9% on the PCP

Disc: I hold

Overreaction

It seems that some people weren't happy with aspects company update even though guidance was reaffirmed for FY21 at the AGM.

This prompted a selldown which was probably cascaded further from the ruthless shorting by MUFG.

I still think this is a solid business which is managing to adapt itself during this difficult period.

Just remember the director bought at 5.85 back in September.