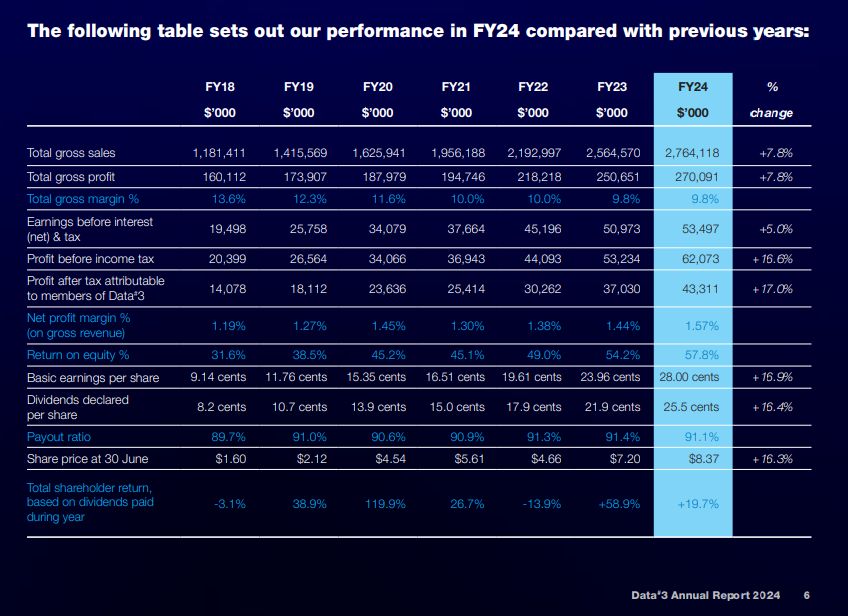

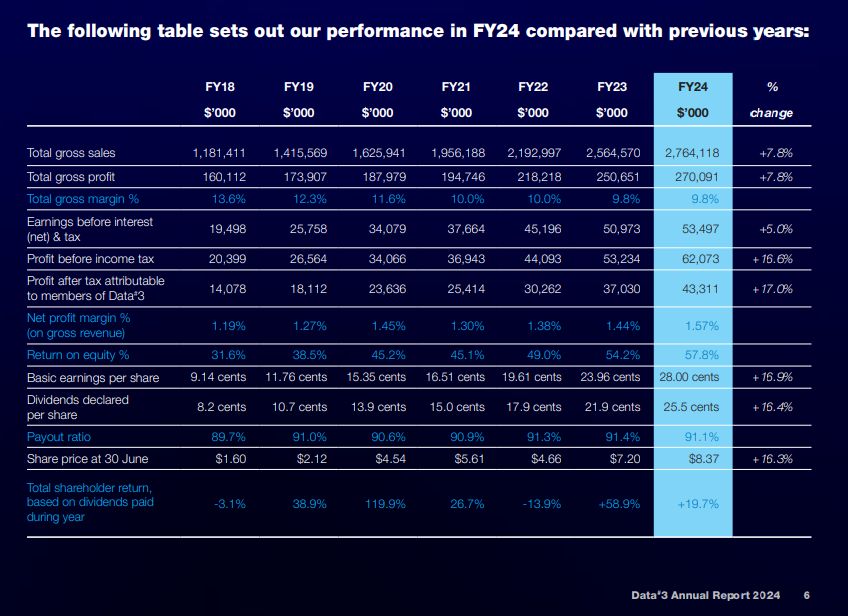

Fundamentals ROE 57.8 great profitability, EPS 28c up17%

% Outlook Optimistic for 2025

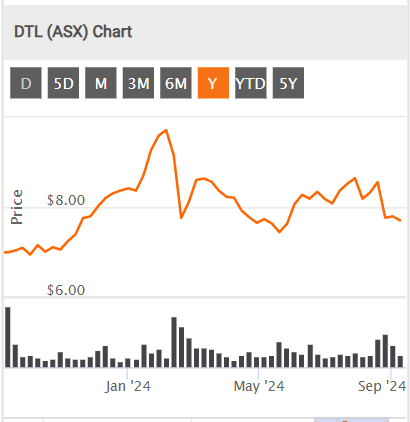

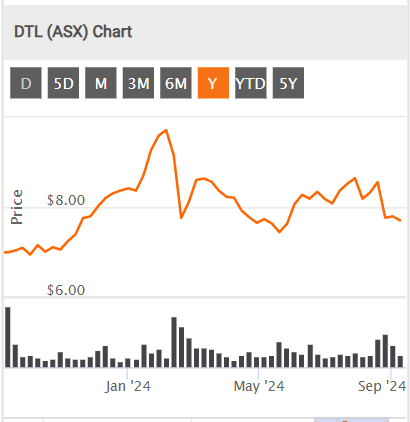

See how the 'market' reads / reacts to this report.

DATA#3 LIMITED (ASX:DTL) - Ann: 2024 Annual Report, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

Outlook no Quantitative # projections here. But DTL are Optimistic :

We are expecting to see continued momentum in As-aService and recurring revenue solutions through FY25, ensuring customers have access to different consumption approaches. Demand for end user devices will be driven by the need to support Windows 11, and AI-enabled edge, in addition to postcovid refresh cycles.

Our Device as a Service offerings gained momentum in FY24, and we see this continuing into FY25.

Our Security practice will only strengthen as customers are challenged by ongoing cyber threats, in addition to security related challenges presented by their gradual adoption of AI.

Cloud and data centre will likely see growth in response to security and data concerns, and in determining how AI is best utilised in the right location for workloads and use cases.

Sustainability will be a focus as customers navigate the increase in AI-enabled infrastructure, which can potentially be high in its environmental footprint. Vendors such as Microsoft and HP who are leading the way in sustainability practices will be an important influence on customer decision making

There is some optimism that the challenging trading conditions caused by a highly inflationary and high-interestrate economic environment will ease early in calendar year 2025, resulting in improved consumer sentiment and a return to more normal levels of sales growth. Investments by the Public Sector in new infrastructure projects should also help to grow our pipeline across all lines of business.

The foreseeable risks (and any available mitigants) to achieving our short to medium-term financial growth aspirations, specific to Data # 3 and in addition to the general macro-economic risks that would impact most organisations, include the following:

• Major changes to customer and reseller sales strategies and vendor incentive programs that would negatively impact future profitability. Mitigant: Data # 3 works closely with vendors to stay abreast of any potential changes and adapts sales strategies and vendor management processes accordingly.

• Access to skilled technology labour to enable us to deliver contracted work and achieve growth in areas of strategic focus. Mitigant: Our talent attraction and retention policies, including staff benefits and people development initiatives.

• Any negative geopolitical influence on the region or supply chains. Mitigant: We work with vendors to expedite deliveries (where possible), utilise distributors with available stock, and provide customers with ongoing updates, as evidenced with the pandemic-related supply chain challenges.

• Delayed decision making due to state government elections. Mitigant: We work with Agencies in the lead up to the election to ensure customer requirements have been addressed prior to lock down periods and again after an election to ensure any technology requirements for Machinery of Government Changes are addressed.

• Government change in policy with regards to the use of contractors. Mitigant: We provide both contract resources and outcome-based project offerings. While some governments may prefer to reduce contractors in preference of employing full time staff, the limited access to skilled resources means outcome-based projects are still a solution for public sector customers

Return (inc div) 1yr: 12.95% 3yr: 16.75% pa 5yr: 25.67% pa