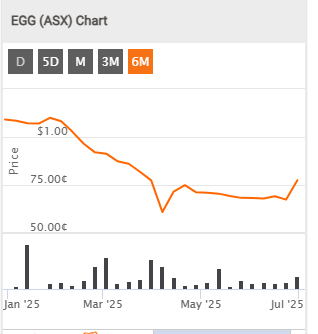

Outlook: FY25 Update Enero is pleased to announce that it is expecting to deliver an EBITDA1 at the upper end of its previously stated guidance range of between $22 million - $26 million on an underlying basis and between $18 million - $20 million on an economic interest2 basis.

This result has been driven by new client wins in the Australian agencies, strong cost control and improved operational excellence across the group. Enero will be announcing its FY25 results on 29 August 2025 and will be providing additional financial detail on each of the three agencies.

Noted this EGG is carrying some debt as per announcement here:

ASX Announcement Replacement of debt facility 23 June 2025.

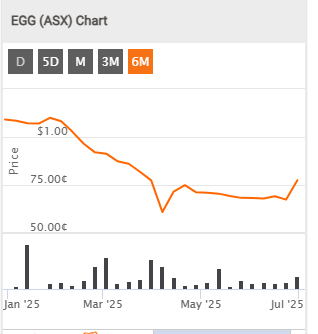

Enero Group Limited (ASX: EGG) (Enero) today announced it has entered into an agreement for a new $15 million revolving secured bank facility with National Australia Bank (NAB) for 16 months expiring in October 2026.

This replaces the previous $50 million facility. The scaled back facility reflects reduced capital needs with the facility available to fund short-term working capital and general corporate requirements of Enero.

The facility is on terms that Enero considers market standard and appropriate for a facility of this size and duration. As at 31 May 2025, Enero had a cash balance of $38.8 million and a debt draw down of $2.5 million.

the eps growth has been falling in recent times so a no go investment here for me. plus the lack of cash flow at the moment..

Last

86.5¢

Change

0.180(26.3%)

Mkt cap !

$78.48M