Discl: Held IRL 17.38% and in SM

The positive news keeps on rolling at EOS, this time, the acquisition of MARSS, a Europe-based defence and technology provider of the NiDAR (Network Integrated Detection and Response) C2 (Command and Control) system.

I appreciate, very much, the detail that EOS management goes into to explain new deals or acquisitions, which has now become standard practice: https://investorhub.eos-aus.com/webinars/NPw9pe-marss-acquisition

SUMMARY

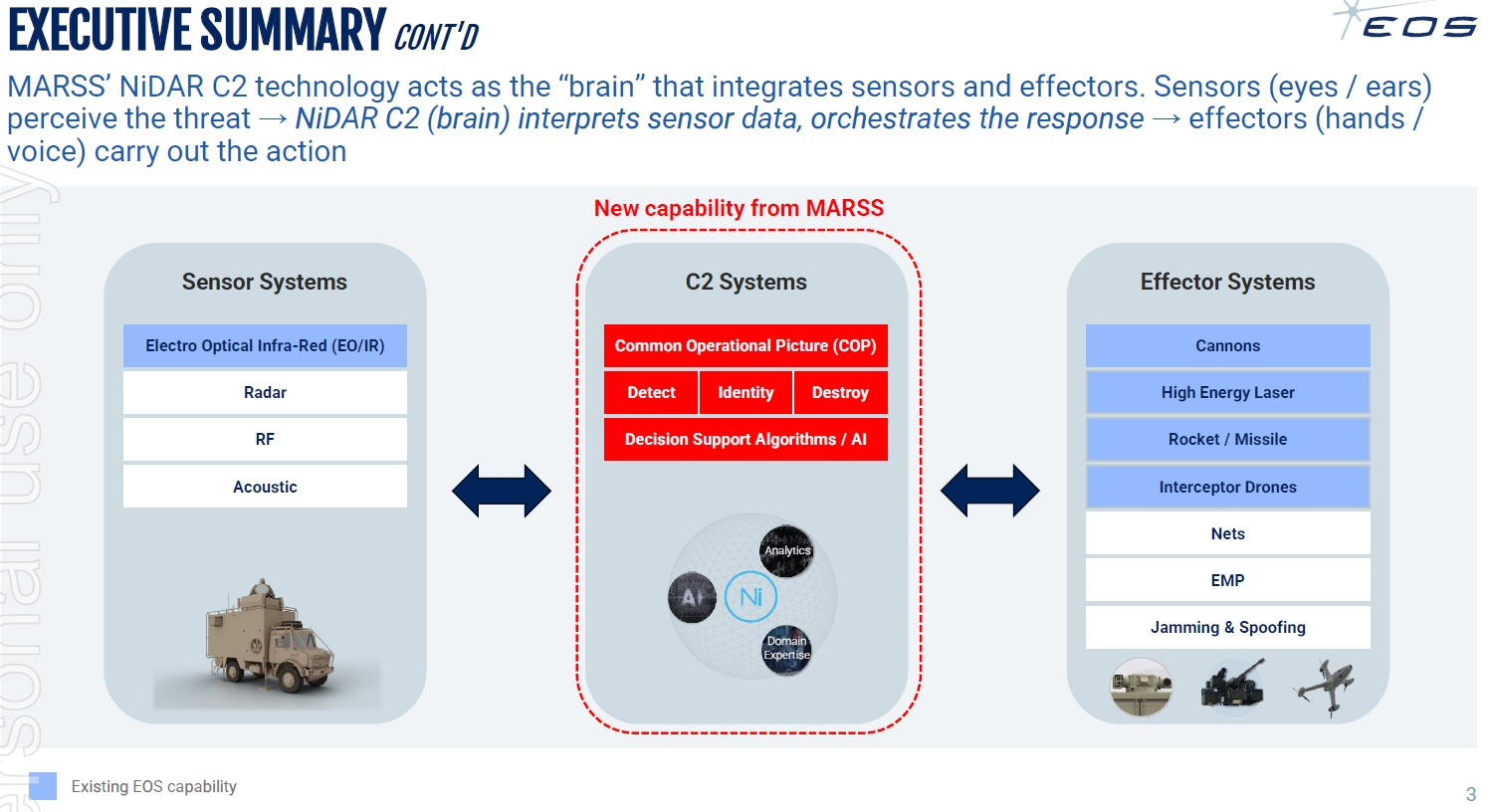

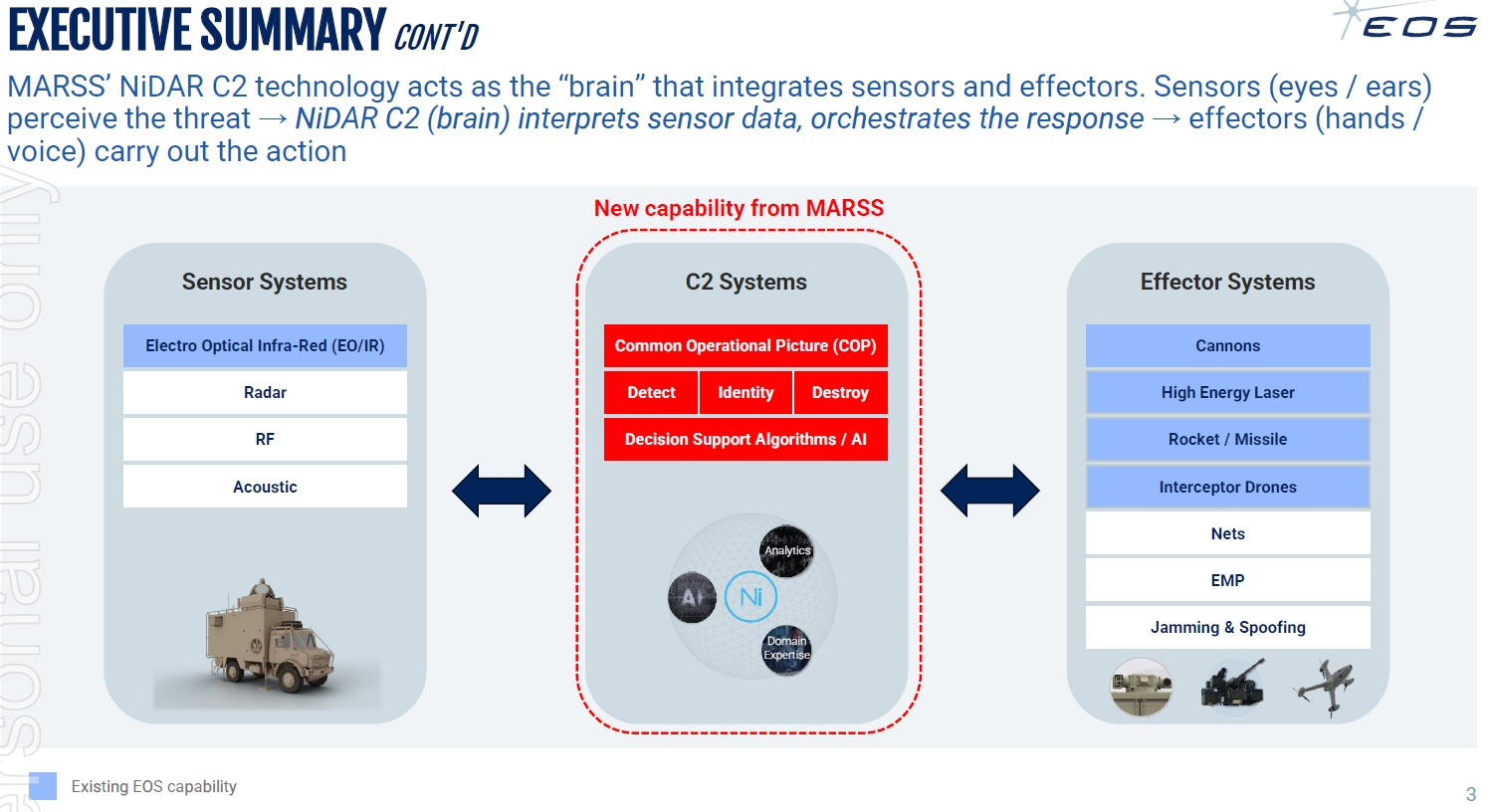

1. Plugs a big capability gap in between the 2 EOS product lines - Sensors (detect drones) and Effector (the kinetic weapons that take out drones) systems - the NiDAR C2 sits squarely in the middle of the sensors and effectors and addresses the human constraint in detecting and understanding aerial movement patterns, make sense of the pattern and then make decision based on the pattern - helps the human operator understand (1) What It Is and (2) What To Do

2. NiDAR C2 is proven technology and battle-tested with 60 installations

3. Transformational as it turns EOS from a company which sells Sensors and Effectors, into a fully integrated end-to-end Counter UAS company which has end-to-end capability to Detect -> Identify -> Decide -> Defeat, with or without a human to make the final decision

4. Very decisively opens up the non-military market - Homeland security and civil installations, and expands EOS global geographic footprint

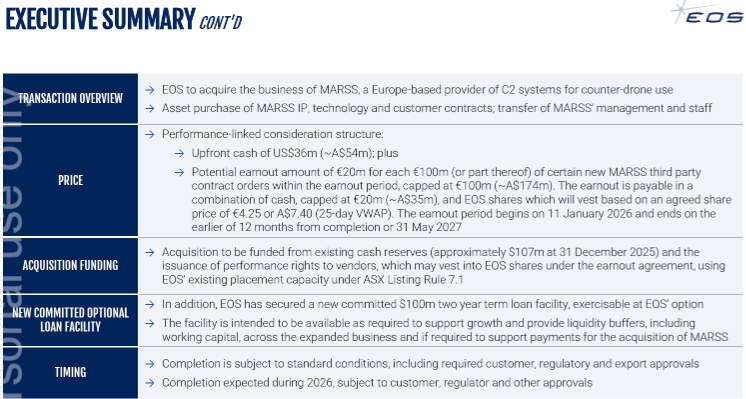

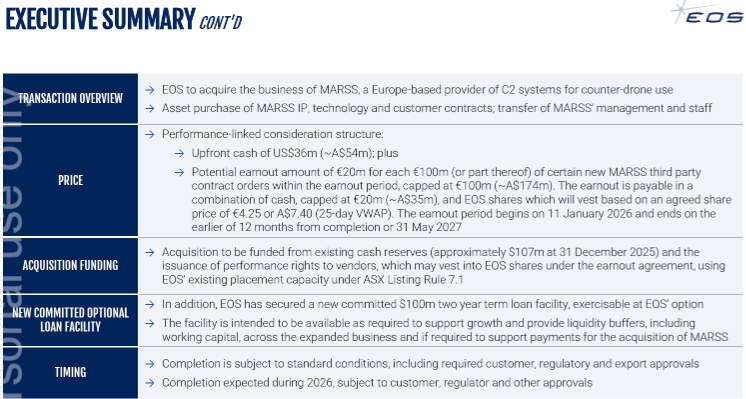

- Deal is structured with capped earn outs to capitalise on MARSS’ strong ~EUR 500m pipeline in the next 18 months

- MARSS is an established business with revenue ~EUR240m/year over the last 5 years but lumpy, EBITDA positive at various times

- Significant growth opportunity ahead

- Funding is comfortable

MY VIEW

- A very sensible and logical acquisition of proven technology which fills a clearly identified capability gap - this significantly enhances EOS market offerings and which continues management’s very clear and consistent strategy for EOS.

- Ord Minnett said in its note today that “the acquisition represents a sound strategic shift for EOS from being an optical sensor and effector systems provider to becoming a full counter-drone solutions provider” - I disagree with that as I think the strategy was always to be a full end-to-end provider, management cleared the decks to ensure focus and build financial capacity, and the MARSS acquisition is really another step in a logical, well-established strategy

- There is a really good management vibe at play - Andreas is all over the technical details, Clive is all over the commercial/financials - this partnership provides very good technical/capability clarity and financial management discipline - this inspires significant confidence in management.

- This comes on top of an already significantly enhanced order book with the recent wins.

The market seems to have recognised this as EOS made an all-time new high today of $11.20 from the previous Feb 2020 all-time high of $10.80. This decisively ended the almost 6-year period in the wilderness where the price lost 96% of its value when the low of $0.415 was reached in end-Mar 2023.

What is exciting is that this new levels are coming on the back of (1) a significant ~60% de-frothing drop between Oct and Dec 2025 from $10.42 to $4.27 (2) supported by ~$312m of new committed contracts since the Oct 2025 peak AND (3) pre-MARSS revenue impacts.

EOS is now firing on all cylinders - a really, really great place to be as a shareholder!