Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 17.38% and in SM

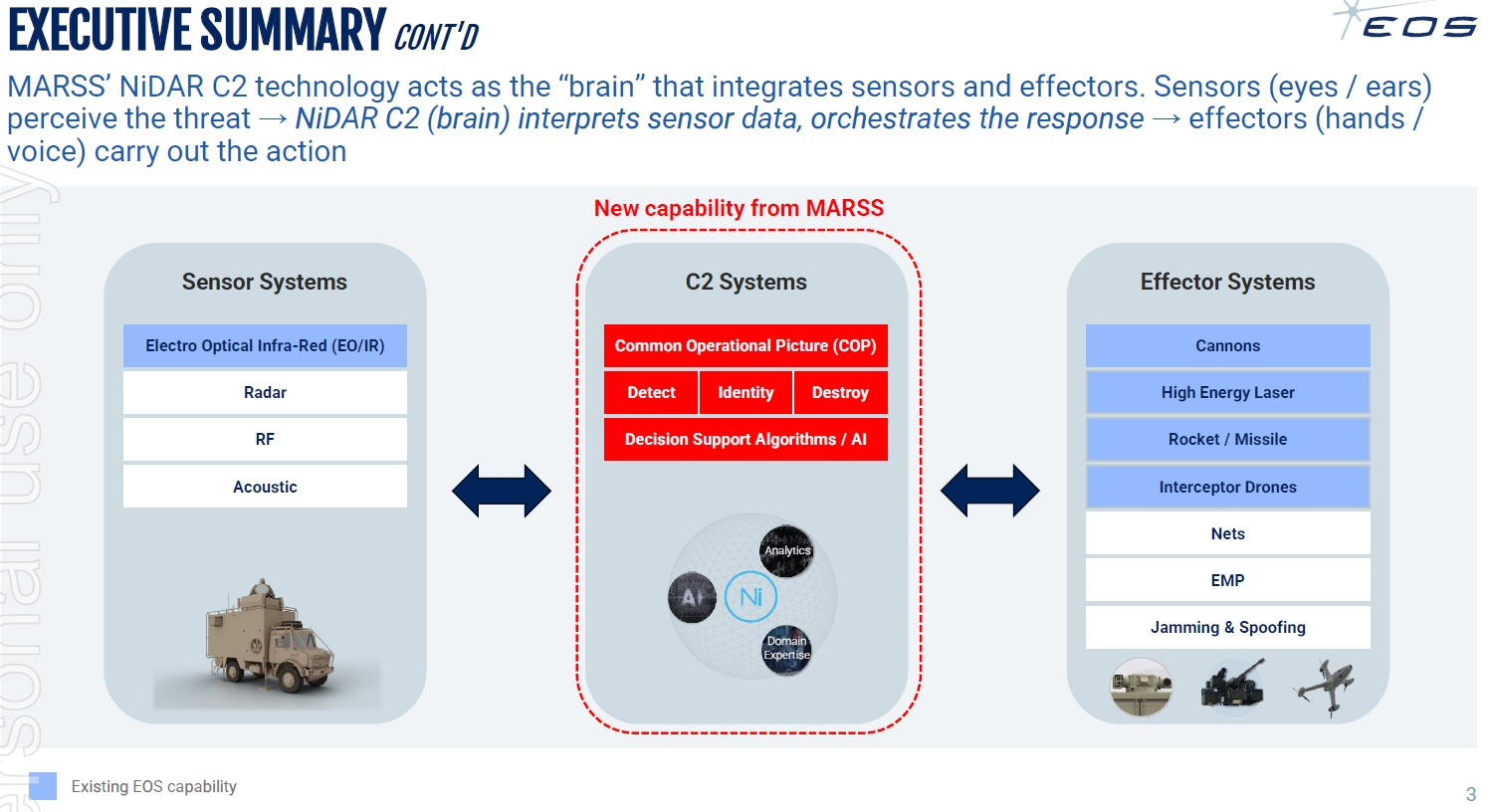

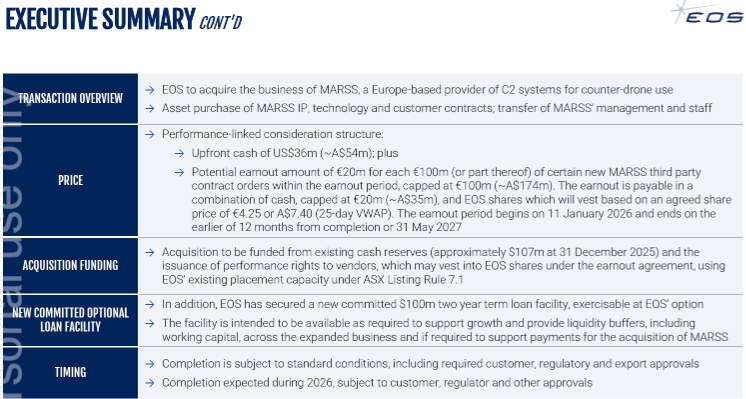

The positive news keeps on rolling at EOS, this time, the acquisition of MARSS, a Europe-based defence and technology provider of the NiDAR (Network Integrated Detection and Response) C2 (Command and Control) system.

I appreciate, very much, the detail that EOS management goes into to explain new deals or acquisitions, which has now become standard practice: https://investorhub.eos-aus.com/webinars/NPw9pe-marss-acquisition

SUMMARY

1. Plugs a big capability gap in between the 2 EOS product lines - Sensors (detect drones) and Effector (the kinetic weapons that take out drones) systems - the NiDAR C2 sits squarely in the middle of the sensors and effectors and addresses the human constraint in detecting and understanding aerial movement patterns, make sense of the pattern and then make decision based on the pattern - helps the human operator understand (1) What It Is and (2) What To Do

2. NiDAR C2 is proven technology and battle-tested with 60 installations

3. Transformational as it turns EOS from a company which sells Sensors and Effectors, into a fully integrated end-to-end Counter UAS company which has end-to-end capability to Detect -> Identify -> Decide -> Defeat, with or without a human to make the final decision

4. Very decisively opens up the non-military market - Homeland security and civil installations, and expands EOS global geographic footprint

- Deal is structured with capped earn outs to capitalise on MARSS’ strong ~EUR 500m pipeline in the next 18 months

- MARSS is an established business with revenue ~EUR240m/year over the last 5 years but lumpy, EBITDA positive at various times

- Significant growth opportunity ahead

- Funding is comfortable

MY VIEW

- A very sensible and logical acquisition of proven technology which fills a clearly identified capability gap - this significantly enhances EOS market offerings and which continues management’s very clear and consistent strategy for EOS.

- Ord Minnett said in its note today that “the acquisition represents a sound strategic shift for EOS from being an optical sensor and effector systems provider to becoming a full counter-drone solutions provider” - I disagree with that as I think the strategy was always to be a full end-to-end provider, management cleared the decks to ensure focus and build financial capacity, and the MARSS acquisition is really another step in a logical, well-established strategy

- There is a really good management vibe at play - Andreas is all over the technical details, Clive is all over the commercial/financials - this partnership provides very good technical/capability clarity and financial management discipline - this inspires significant confidence in management.

- This comes on top of an already significantly enhanced order book with the recent wins.

The market seems to have recognised this as EOS made an all-time new high today of $11.20 from the previous Feb 2020 all-time high of $10.80. This decisively ended the almost 6-year period in the wilderness where the price lost 96% of its value when the low of $0.415 was reached in end-Mar 2023.

What is exciting is that this new levels are coming on the back of (1) a significant ~60% de-frothing drop between Oct and Dec 2025 from $10.42 to $4.27 (2) supported by ~$312m of new committed contracts since the Oct 2025 peak AND (3) pre-MARSS revenue impacts.

EOS is now firing on all cylinders - a really, really great place to be as a shareholder!

Discl: Held IRL 15.68% and in SM

A really nice way to end what was a sterling FY25 for EOS with the 30 Dec 2025 announcement of EOS' Minimum Shareholding Policy for Non-Executive Directors, CEO and CFO/COO. It is another good trust-building step in EOS' very good Corporate Governance "rehabilitation" journey.

Discl: Held IRL 14.15% and in SM

A very Merry Christmas it is, indeed, for EOS shareholders with another A$33m RWS contract. I initially thought that this was a mistake as the contract value was the same as the RWS contract announced on Friday ...

The EOS Backlog from FY2025 deals is ~$502m, of which ~$400m is unconditional. The unconditional Contract Backlog at 31 Dec 2024 was $136m. The jump is significant.

The EOS price has climbed rapidly since mid-Dec 2025. To put this in context:

- In the run up to the 1 Oct 2025 price peak of $10.42, A$189m of contracts were locked in

- The EOS price then sank back to $4.27 in early Dec 2025 - a ~60%+ drop

- But since that low on 2 Dec 2025, EOS has signed on a further $312m contracts, 1.65x MORE than the pre-1 Oct 2025 contract total. This should provide very good support for this price move.

There was clearly a lot of defence-sector froth in the run up to 1 Oct 2025, and the de-frothing since was very necessary, but it wasn’t a fun ride at all.

But as the price attempts to break the 1 Oct 2025 peak, all of this recent steep move is back by a solid record of unconditional contracts. This is a really, really good place to be, at the end of FY2025.

Discl: Held 12.29% and in SM

Another EOS order announcement this morning, this time for its R400 Remote Weapon System (RWS), $US21m (A$32m), extending the momentum from the HELW Korean order earlier this week.

The “North America” in the headline was initially interesting as EOS has a stated objective to NOT supply North America, so that it does not get caught up with any US-related restrictions on defence sales. But the RWS is to be supplied to an end-customer in South America, so all good.

No impact on FY26 revenue given that EOS’ FY26 ends on 31 Dec.

Contract Backlog Update

The announcement recapped the FY2025 orders, $458m in total, including today’s new order. What is very nice about this backlog is the good split between HELW and R400 orders which helps spread out delivery as the RWS is manufactured in Australia, the HELW will be manufactured either EOS Singapore or in the home-country of the JV partner

Discl: Held IRL 8.63% and in SM

Very nice announcement from EOS this morning for an order of the 2nd export order for a 100kW class High Energy Laser Weapon.

While conditional, the conditional terms do not look unreasonable.

The deal is exactly the sort of deal EOS has been flagging as its differentiated offering - initial order, then licensing of IP for JV’s to be established in the country so that the country controls the end-to-end manufacture and supply chain for the HELW.

Looking forward to more continued momentum of the 100kW HELW ..

Conditions of the Contract, to be completed by 31 Jan 2026:

- Payment of the initial US$18m deposit

- Customer prcuring the issuance of a Letter of Credit for the remaining contract amount

- Customer inspects and being satisfied with the EOS’ Singapore facility

Other Conditions

- Delivery is by the end of 2027

- Licensing of the IP of the the 100kW HELW and establishment of a Korean JV

Discl: Held IRL 7.51% and in SM

2 announcements from EOS this morning:

Interceptor Acquisition Completed

No excitement around this - it was a simple, small acquisition that nicely fills a gap in EOS’ product portfolio.

Settlement of ASIC Investigation

- $4m settlement of an ASIC investigation around “continuous disclosure obligations in the period 25 July 2022 to 31 October 2022”

- This was all pre-Andreas and the current management team, who joined back end of CY2022

This is good news as (1) it removes a management distraction and should clear the closet of pre-Andreas shennanigans (2) it removes the overhang of litigation costs, greater penalties and (3) locks in a small penalty.

I topped up IRL last week at $4.56 as I think the hot air around the defence thematic has mostly be taken out.

It will now be down to converting the strong sales pipeline, with all the tailwinds of defence spending and urgent need for the EU to be self-sustaining in protecting itself, anchored by baseline growing revenue that has been locked in for the next 2 years.

Discl: Held IRL 7.90%

EOS just released news of its acquisition of a UK-based “Interceptor” business from MARSS Group.

This acquisition makes good sense.

- A$10m - no stress to the cashed-up EOS balance sheet

- Expects 12-24M of further development before full commercial launch - faster and lower risk than in-house development

- Further investment of up to A$10m over the next 3 years, with potential for customer development funding - this is nothing BAU money, really

- The Strategic Rationale is very much aligned to EOS’ overall strategy which Andreas has been very clear and consistent about

Discl: Held IRL 7.55%

Nice new $20m order for EOS for its Slinger Counter Drone Remote Weapon Systems from a “Western European NATO country”.

To put this in context, EOS' revenue:

- FY24 for Continuing Operations (post the sale of EM Solutions) was $176m

- Full-year FY25 revenue is expected to between $115-$125m.

This sold and unconditional backlog means that revenue growth is pretty much locked in for FY26 and FY27 as the current baseline scenario, with all the upside still to come from increased global spending on counter-drone defence.

It is never easy to watch the share price halve as it has with EOS, but I would hope that all the froth has been shaken out and we are now down to pure fundamentals of EOS as a company. And gee, I absolutely like what I am seeing.

Discl: Held IRL 8.99%

Had a read of the much anticipated European Commission’s “Preserving Peace - Defence Readiness Roadmap 2030” which was released on 16 Oct 2025 and which defence industry companies have been waiting for. Not a difficult read.

A summary of the key points of the roadmap

From an EOS standpoint, this was really exciting to see as:

1. The horizon is a very short 5 years

2. The milestones against each of the 4 Defence Flagships looks mighty aggressive for any nation, never mind the EU as a whole, but it reflects the huge sense of urgency that the EU feels to get their defences ready, both country and as a region, against primarily Russian aggression

3. The plan calls for projects to all be launched by 1HCY2026

4. This will not be a one-size fits all scenario - the phrase “multi-layered” pops up everywhere

5. It almost feels like EOS not only saw all this coming, but actually cleared the EOS decks by selling EM Solutions to enable the organisation to fully focus on riding this Roadmap - both EOS Divisions, Defence Systems and Space Systems look to have offerings that could play a part in each of the 4 Defence Flagships

6. There is a big focus on in-country/in-region production - this augurs well for EOS as one of the major advantages of the High Energy Laser Weapon offering is that EOS owns the IP and has made “in-country production” one of the key selling points of the HELW

7. One of the best moves that EOS did during the turnaround was hiring Andres Schwer as CEO - he has brought deep industry and engineering knowledge and experience and the European network and connections to enable EOS to be in the heart of this wave.

Lots to look forward to in the coming 1-2 years, I think.

Discl: Held IRL 9.38%

Not too much new in EOS’ Trading Update today. EOS has been very transparent about where things are, so most of the new deals have been previously announced.

CONTRACT BACKLOG

This was a good perspective of the changing EOS order book, which currently stands at $415m, a $279m or 206% increase from 31 Dec 2024. This will underpin revenue for the next 2+ years.

NEW DEVELOPMENTS

A few new developments not previously announced:

1. EOS USA is developing enhanced capabilities for the Slinger Counter-Drone RWS, incorporating capabilities to meet the growing challenge of drone attack, such as aided target recognition and selectable autonomy. Customer funded, and is linked to the US8.5m order for Slinger counter-drone development work and an inaugural order for 1 x R800 heavy-calibre RWS - EOS is optimistic that this could lead to increased order intake in the future

2. Several Ukranian donation opportunities continue to mature

3. Demonstrable increase in enquiry from new potential customers interested in the 100kW High Energy Laser Weapon

4. EOS and Diehl Defence (Germany) signed an additional Teaming Agreement for a new opportunity an jointly submit a bid in response to a German request for approximately 3,000 light RWS. Next stage of proposal down-selection is expected to occur in late 2025 or early 2026

5. In mid-Oct, the European Commission released its “Preserving Peace Defence Readiness Roadmap 2030” - need to peel this to understand the potential impacts to EOS and the broader Defence industry

CASHFLOW

- Cash holdings was $71.5m, down $38.8m from 30 June 25, no debt - there is a further $20m of Term Deposits, and $52.0m of Security Deposits for Performance Bonds, Guarantees

- Net Operating cash outflow was $34.3m - timing differences from customer receipts vs cash payments of $50.8m

- No concerns given order book and full-on manufacturing that is ongoing to fulfill order deliveries

TRADING UPDATE

No change to FY2025 guidance - full year revenue expected to be $115-125m, with the potential to add $25m if new orders can be signed before 31 Dec 2025.

Disc: Held IRL

EOS announced the signing of a A$108m Remote Weapon System for the ADF’s LAND 400-3 project today.

This is the 2nd and final of the 2 x $100m+ contracts it announced in July 2025.

This should now increase the contract backlog from $299m, announced on 30 Sep 2025, to ~$407m, very healthy indeed.

With both these $100m contracts now locked in, any new contracts from hereon through to the end of CY2025 should be new wins. These wins will not move the dial on the FY2025 revenue as there will be no time to deliver and recognise the revenue, but will add to the significant growing backlog.

Market response was muted, given the size of the contract, Quite possibly, news of the win could have prematurely leaked out last week, which caused the pop past $10. This announcement is perhaps reality catching up.

Discl: Held IRL

Scratching my head at the catalyst for today’s EOS 13+% pop with fairly decent volume. Can’t say I was overly enthused in reading the Announcement this morning on the FY2025 revenue outlook and Contract Backlog. I was actually concerned that the market might actually be disappointed with (1) where FY25 revenue would land and (2) the nothing terribly new contract backlog numbers.

What might have prompted excitement is the drone attack on Ukraine overnight as well as the recent drone attacks in Copenhagen and Aalborg, Denmark, which again highlights the increasingly brazen-in-your-face drone attacks and the criticality of anti-drone capabilities in warding off these attacks.

Full Year 2025 Outlook

This was new news. Revenue in recent years has been lumpy, but the current FY2025 guidance does not quite stack up with revenue in recent years, even if the stretch $25m revenue, is achieved.

Contract Backlog

The contract backlog seems to have generated some market excitement, although I am struggling to see the fuss. EOS has announce $189m of additional contracts per below, and the $136m contract backlog at 31 Dec 2024 is public news.

That the contract backlog now is ~$299m should not be new news either as EOS has been very transparent with new contract announcements.

Chart Review

Price-wise, EOS is not too far away from its all-time high of $10.80 of January 2020. With strong market momentum clearly behind it, and the ongoing drone-drive wars fuelling demand for anti-drone products, it does feel like the all-time-high could be taken out soon.

Will continue to let EOS run ...

Very nice EOS move, which probably explains the sharp pop these past 2 days. Another smart-no risk-no-big-change-high-impact move from management which enhances the EOS flywheel currently in play.

Discl: Held IRL and in SM

Reading the horribly depressing news lately, this WSJ article and diagram of the drone which Russia flew into Poland caught my eye.

This really looks like a larger and souped up Remote Control (RC) plane, the ones that would grab attention in a RC weekend flying event at the local RC airstrip due its larger than normal size.

But the NATO response to shooting down 19 of these was interesting:

- Dutch F35's

- Polish F-16's

- Black Hawk helicopters (no mention how many of each, but it was plural, not singular)

- 1 x Italian AWACS plane.

And the latest is that the following hardware will now be deployed to Poland's eastern flank:

- 3 x Czech Mi-171Sh helicopters

- 3 x French Rafale jet fighters

- 2 x German Euro fighters

This puts in perspective the EOS 100kw HELW system recently sold.

- The drone looks to be of the type that the HELW was intended for

- It can take out 20 drones per minute

- No need for ammunitions - all they need is power

- $1-$10 per shot

- But the 100kw Range is 1 to 8km only ... and the EOS 100kw is the first of its kind for 100kW

- The higher the power, the longer the range - EOS looks to have the ability to scale to 150kW

- Each country will need a heck of lot of these systems if it to make any dent in the counter-drone capability, not just 1 or 2 units ...

A lot to look forward to with EOS in terms of (1) increasing HELW demand (2) increasing pressure to deploy the HELW faster - the countries needed it yesterday, literally (3) increased pressure to scale to 150kW and beyond to get longer range, and (4) a ready real-life battlefield when the system will actually be needed, to prove its capability ...

Discl: Held IRL and in SM

Discl: Held IRL

More information on the Land 156 bid.

- This is an Integrated approach vs a technology-based piecemeal approach, which makes intuitive sense, given how counter drone technology is now significantly more technology systems-centric - the integration between different pieces of technology is more key than ever

- It feels like this is in EOS' sweet spot for both its kinetic counter drone (Slinger) and High Energy Laser Weapon (HELW) offerings

- By the time this project takes off in earnest in CY2026/2027, there will have been progress on the HELW project, which the ADF will no doubt be keeping a really close watch on

- Small dollars for what sounds like a "what does minimum counter-drone capability look like" focus through to Dec 2025.

- The possibilities thereafter when capabilities are proven to work in an intergrated-systems envionrment is what is more exciting to look forward to.

You have to be in it, to win it, so big tick to the first step of "granted entry to the tent to play the game" ...

Price reaction to the announcement today is muted thus far, following the massive over reaction to the initial announcement (OMG Major deal, whoo hoo!) , then yesterday's retracement (Ah ... so ....) to today's (Ah OK ,,, chill, only an initial demo deal). A much more sensible reaction to a very-positive-but-very-early-days deal ...

What is more interesting for me is to see the price "behave" within the support/resistance and retracement areas that I have been watching, in these wild swings ...

Discl: Held IRL

While not a done deal and deal size is small, at least at this stage, this can’t possibly hurt ....

This opportunity was flagged in EOS’ list of Notable Opportunities.

Discl: Held IRL

SUMMARY

- As EOS has communicated extensively in the past 2-3 months, nothing terribly new

- 1HFY25 results unimpressive but not the focus - FY25 revenue heavily weighted to 2HFY25, as previously guided

- Building the Contract Order book was the 1HFY25 focus - contract backlog is now $307m, up from $136m in Dec 2024

- Planets are aligning for high-volume HELW orders - the urgency in getting the HELW to counter drone swarms is driving this dynamic, the hard work and long contracting period to lay the contractual ground with the HELW launch customer will likely pay off

- It really is all about the big orders coming through - each order won will turbo charge the contract backlog and revenue in a stepped manner ...

KEY TAKEAWAYS FROM EARNINGS CALL

Financials

- EOS 1HFY25 Financials - unimpressive in absolute YoY terms - Revenue $44.1m (down 61.4%), Underlying EBITDA ($13.3m) (down12.3%), NPAT ($44.8m) (down 34.0%) after large contract completions - but this was flagged including the outlook that “2025 revenue is heavily biased to 2H”, so no cause for any concern

- Very clean balance sheet - $130.3m cash, $51.9 security deposits, zero debt

Order Book

- EOS is really a Contract Order Book story - this was the focus in 1HFY25

- The market was again reminded of the significant opportunities ahead, especially for 100kw High Energy Laser Weapons, but all of the information has already been announced in recent weeks. The reminder was nevertheless, good to hear still ...

- Contract backlog on 20 Aug 2025 is $307m, up from $136m in Dec 2024 - this is the key parameter to focus on

Updates on Key Contracts

A. Middle East UAE Slinger R500 - successor to R400 product contract to UAE, $500m+

- Customer has participated in demonstrations

- Within the UAE, have different client groups - each have different requirements causing contract complexity

- May take longer to close, but good confidence this will close in CY2026

B. High Energy Laser Weapon 100kw

- Build will take ~2.5 years, plans are in place to accelerate this delivery period

- Customer is a very established customer, sole sourced as there are no other competitors, well known for its highly stringent procurement process and financial audits - other countries are likely to rely on this customer’s due process and ride on this initial contract rather than negotiate a contract from zero

- This initial contract allows other NATO countries to easily ride on the contract, paving the way for shorter contract processes in 2026

- EOS has an internal lower powered demonstrator to showcase the HELW - no need for clients to see the 100kW system as they can extrapolate what the 100kW system will do from the lower powered demonstrator

- The criticality of the HELW to country defence strategies to counter the latest drone threats means that there is no time for the typical elongated 5-7 year procurement process ie, buy 1-2 units to prove effectiveness, before placing larger orders - there is significant urgency for countries to rely on the live demonstrations and the initial contract to expedite the delivery large quantities of the HELW - “we want it now”

- EOS is well placed with no competitors in this 100kW space, is the only “Golden Dome” player outside of the US - expecting that contracts with large quantities of the HELW should come through

Improvement of Product Software and AI Capabilities

A current battlefield problem is manned battle stations are intended to defend against single drones, not drone swarms and drones controlled by AI

Need a “robotic” solution, to build intelligence into the battle stations to counter drone swarms - this is all software-driven, but there is currently no software capability - need to focus on building this capability into EOS products

Manufacturing Capacity for HELW

HELW production in Singapore is about to be moved to new facilities which can handle 5 contracts simultaneously

Production capacity is not a concern as most countries are insisting on localised production facilities to retain self-control and eliminate supply chain issues - likely to have local manufacturing partners who will provide the required manufacturing facilities, capex etc

Management thus expect capex requirements to scale HELW production to be small, with no impact expected to the SIN facilities

EOS got belted today, together with DRO and other Defence companies. A possible "explanation" is that Mr Market somehow believes that the war will end soon, time to exit defence.

Can't understand that logic, if that was the rationale - this WSJ article helps crystallise how the path ahead is fraught with so many challenges. Much as I hate Trump, I have to concede that he is at least giving it a crack. He will need to keep smoking the fine stuff he must be smoking if he believes he can actually make this happen.

I hate war, so am wanting the Ukraine war to end as soon as possible.

My EOS thesis is not based on an indefinite Ukraine war at all. So while there will be a short term price impact if the war actually stops, the longer term thesis of mandatory EU defence spending, the need to protect countries against drone swarm attacked, then protecting civil installations from drone attacks, then space control, will still be very much intact for many more years to come.

The EOS chart looks quite good and healthy actually. The current insane leg up was way too steep and way too hot - a correction was not only imminent, but necessary, if it is going to sustain the good momentum. Todays belting takes the retracement past 23.6%, thats a good technical tick in terms of satisfying the Fibonacci retracement minimum.

$4.59 to $4.76 could provide the next level of support, failing which, the next retracement level of 38.2% beckons at $4.35, then likely to be stronger support around $3.70 which not only a decent support area from the late July rally, it is also the 50% Fibonacci retracement.

Discl: Held IRL at overweight allocation

Nice to see another new fundie appear in the EOS Register, FMR LLC.

Per the announcement today, purchases were made on the market between 14 July and 8 Aug 2025, between $3.05 and $5.00, so rough average cost around ~$4.00 perhaps, probably contributing a bit to the pop in the price in early August.

Discl: Held IRL

A really eye-opening presentation by EOS this morning as it updated Investors on High Energy Laser Weapons (HELW), on the back of the $125m HELW deal EOS announced 2 days back. Link is below, and my notes from the call follows.

SUMMARY

- This was a ground-breaking, world-first deal in the 100kW HELW space which addresses many challenges in anti-Drone warfare and is shaping up to be a significant milestone deal for EOS.

- EOS has between 3-5 years headstart over its nearest competitor, owns the full IP of the HELW - a key differentiator, as it allows EOS to work with customers to customise the installation in-country, giving the customer full control over the system, free of dependence on supply chains, US export restrictions etc - these form a significant technological and capability moat.

- Demand is strong - not only for military battlefield purposes, but also for Homeland security to protect critical infrastructure, public venues/installations, from remote drone attacks - Homeland Security is a bigger TAM than military uses.

- Will wake up the market that a 100kW system is now commercially available - this could well spark an “HELW arms race” as other countries now fall behind in having this capability and are thus vulnerable to ongoing drone attack.

- EOS is now in a position of significant strength and leverage as it holds the technology IP keys to strong anti-drone defence in a countries layered-defence strategy which is what is needed in today’s battlefield - this leverage will significantly reduce the risk of commercial stupidity of the past, demonstrated by the diligence in the economics of the deal.

My ESG and patriotic conscience is very clear - war is inevitable and unavoidable as long as mad persons are allowed to roam the world. EOS capabilities are for DEFENCE AGAINST attack, not offence to attack. This is good and necessary for the prevention of loss of human life and destruction of property, with an Aussie company at the world forefront of this.

Fair to say, EOS is firmly out of my portfolio doghouse and in my “likely to continue rocketing” bucket. The market seems to have now taken notice, given the very sharp price pop since the deal was announced.

Discl: Held IRL

PRELIMINARIES

As I joined the call just before the start, there were already 57 participants - a good sign of investor interest in the EOS story

DRONE WARFARE ISSUES

- Drones are now built in backyards for <$1k, some 200k used per year, deployed in swarms - larger and more autonomous

- Can be hardened to resist anti-spoofing/anti-jamming capabilities using simplistic measures eg. Faraday cage shields, fibre optic gyro’s - jamming, spoofing now ineffective

- Use of fibre optics which cannot be defeated by jamming - 50km range

- ~70% of all armoured vehicles in recent times have been taken out by drones

- There is currently no appropriate counter-measure response to these drone threats

SIGNIFICANCE OF THE HELW DEAL

- Historical deal from an industry, military operations,battlefield and EOS perspective - 1st of its kind for a 100kW high power/high energy laser system

- Game changer in anti-drone warfare as it can detect and shoot down class 1 to 3 drones

- Addresses key battlefield issues:

- High economical operational cost - $1 to $10 per shot vs ammunitions and missiles

- High speed, highly agile - 20 drones per minute capability, 5-10x more effective than kinetic counter-drone measures

- Has range between 1-8km, 2-3 seconds engagement time over 2km

- Can scale from 100kW to 150kw - important as the higher the power, the lower the engagement time and the longer the range

- 150kW takes the capability into the air and missile defence space to provide anti-rocket and anti-missiles

- The “ammunition” is electricity, not munitions that require ongoing cost - battery rack can do 300 kills without a power connection, once connected to power, there is no limit to the shots, thus no supply chain and run cost issues

COMPETITIVE MOAT

Slide 11

- EOS is approximately 5 years ahead of its rivals, technologically, in the 100kW space

- Israel’s Rafel/Elbit collaboration is the closest and only real competitor in the 100kW HELW space, but the key issue is that they don’t own the IP across the solution and Israeli technology has limited access to some markets

- UK’s Dragonfire system is only 50kW and will only be ready by 2028, EOS is at least 3 years ahead

- US - focused in same space but will not be able to export the technology and will be US focused - EOS sees itself playing in the “Rest of the World” market with the US focusing on the US

- France - 2-5kW systems only

- Chinese - 50kW systems but inherent security concerns will prevent any expansion into Western/NATO nations

- Germany - 20-30kW focus, no commercial products

IP

Slide 14

- Excluding Power and Amplifiers, which are commercial off-the-shelve components, EOS owns and controls ALL THE IP of the laser system

- IP is based in Singapore

- This is a very crucial asset as it allows EOS to customise the installation for each customer for them to be (1) self sufficient/self managing of the system (2) free of US Content ie. ITAR free, and hence, be the masters of their own defence destiny, free of dependence of any country or any supply chain

MARKET DEMAND

- Demand is strong - not only for military battlefield purposes, but also for Homeland security to protect critical infrastructure, public venues/installations, from remote drone attacks

- Homeland Security is a bigger TAM than military uses

FINANCIAL DETAILS OF THE DEAL

- Contract is for ONE unit of the HELW system + lots of customisation to incorporate the system into a multi-layer air defence battlefield system - this will be the first 100kW battlefield operational system, once deployed

- Deal is profitable and cashflow positive

- Revenue Recognition - (1) FY2025: $5 to $10m, so not an uplift to guided revenue (2) Bulk of revenue will be recognised in FY2026 and FY2027, and a bit in FY2028

- EOS target gross margin on projects is typically between 40-50% and EBITDA project margin is typically ~20% - the expected Gross Margin on materials of this deal is expected to be around 50%, with incremental EBITDA margin expected to be 20% “or higher”

- Expect expenses to rise by $5 to $6m, mostly people cost

- No additional capital required as EOS SIN facility has capacity for 4-5 projects simultaneously

- Expect neutral cash flow in the first half of the project, then profit thereafter

- Singapore will be the hub for laser innovation, with Canberra having a greater space control focus - wide footprint of laser experts within EOS

- Clarification on “Customary Cancellation” contract clause - contract is (1) unconditional (2) allows client to cancel the contract for significant events eg. Change in government, political eruptions (3) Client still has to pay for all expenses incurred. Very rarely occurred and is not a threat to EOS

FOLLOW-ON OPPORTUNITIES

- EOS has the opportunity to be a very embedded supplier if it gets this right

- Have been in advanced negotiations with another client - likely to be signed in 2026 than in 2025

- Following the deal announcement, the market will wake up that 100kW is now available commercially for distribution

- First clients typically order lower quantities, then once proven, mostly procure larger quantities

- Expect future projects to be built in-country, fully funded by customers - this ability to customise and localise is a game changer for the industry given the highly strategic nature of the capability

- SIN facility has capacity for 4-5 projects at a time, which can be expended if required

Very nice Yeah Baby! moment with EOS announcing this EUR71.4m.AUD125m order for a High Energy Laser Weapon (HELW) for drone defence capability.

While this was pre-telegraphed as being "imminent in 2HCY20205" in the Appendix C last week, it is always good to see the deal actually being done!

This deal is significant from several perspectives: (1) revenue boost (2) technologically - a world first for a 100kw laser defence system, converts a R&D development capability to reality (3) clear evidence that the strategic management pivot to focus on HELW as 1 of 2 EOS pillars, was absolutely the right and smart move.

It also puts more distance and separation between EOS and the like of DRO in terms of anti-drone capabilities, such that I do not think they now compete directly as they offer different capabilities for different use cases.

Nice pop in the price today with good volume. The pop is especially nice from a technical chart perspective, as it comes after the ~25% price retracement in the past week.

Discl: Held IRL

Discl: Held IRL

SUMMARY

- A lot of activity - small customer orders that look like paid BD, a strong focus on manufacturing to fulfill sold orders and a good geographic spread of BD activity

- There appears to be solid progress on 2 large deals that could deliver between $180-$200m revenue in 2H2025, one of which is for a High Energy Laser Weapon - management decision to pivot and focus on HELW’s looks to be bearing fruit

- Balance sheet is now extremely clean and rock solid - $130.3m cash, zero debt, Asset Contract Value now down to $5.1m following cash collection of $60m from its Middle East customer - this was problematic for many years.

- Following the full repayment of WHSP debt and the final collection and closure of the ME contract, it does feel like a line in the sand has now been drawn on the EOS of old

- EOS is now significantly stronger, focused and well positioned to capitalise on the imminent upswing in global defence spending in anti-drone capability

Having stomached the very painful turnaround, patience is now needed to let the business do its thing - have very high confidence in Andreas and his management team as they have done an outstanding job cleaning up EOS.

Am now a very happy EOS shareholder!

Some interesting pieces of news in EOS’ June 2025 Appendix 4C.

CUSTOMER ORDER ACTIVITY

There are new small orders which look more like paid Business Development - augurs well for future orders

MANUFACTURING AND DELIVERY ACTIVITY

Focus in the Quarter has been on manufacturing:

ORDER BOOK DEVELOPMENT ACTIVITY

Contract backlog at 30 June 2025 was $170m, a $34m or 25% increase from 31 Dec 2024

These 2 deals look very promising - $80-$100m and $100m, respectively, due to be signed in CY2025

The High Energy Laser Weapon is also exciting as that would be the first big sized deal in that space since EOS started to laser focus (pun absolutely intended!) on it in the past year.

Lots of ongoing Market Development activity - the key takeaway is the geographic spread of the activities which is nice to see - UK, India, US, Japan, Indonesia, Belgium, Greece - a good expansion and pivot away from the heavy Middle-East focus in the past years.

FINANCIALS

Total Cash 30 June 2025 was $130.3m, a $27.2m increase from Mar 2025 - very healthy

Over and above this, $51.9m is held as cash security deposits with banks to support bank guarantees and bonds

Solid $78.1m cash receipts, driven by the finalisation of a Middle East contract where $60.0m was collected - this drove a huge drop in Contract Asset Working Capital Balance to $5.1m. Have been tracking this FY2023 where the Asset Contract Value was $139.0m .... very good to see this brought down and cash collected.

Nothing concerning with operating cash flow burn of $47.8m in 2Q - reflects the focus on manufacturing

Cashflow and Investing Cash flows have normalised following debt repayment and receipt of EM Solutions proceeds in 1QFY25

Following the full repayment of debt to WH Soul Patt, EOS has one heck of a solid balance sheet - strong cash balance, zero debt, minimal working capital after collecting final cash from the problematic Middle East contracts - it is a really, really good place to be

TRADING UPDATE

No change to previous trading update:

- 1HFY25 revenue to be between $40-$45m

- Full year FY25 revenue to be heavily biased to 2HFY25

The updates around the 2 big deals highlighted above and the strong focus on manufacturing provide confidence of the 2HFY25 jump in revenue per the guidance.

The EOS chart is also looking very interesting.

- The very nice and strong bullish run stalled at about $3.72, which is the top of the support resistance zone that goes back to Jul 2019 and Oct 2021.

- Price has since retraced 23.8% to $3.10, to ~$3.02 which looks to be a resistance/support areas, and looks to be consolidating around these levels - this came with low-ish volume, which indicates a nice healthy pullback

- While I would hate for the price to fall back further, a drop to ~$2.75-ish would not only not be bad, it could be healthier for the price in the long run, as it would have retraced 38.2%, with profits been taken and new holders coming into the picture

Will be very interesting to see where the price goes once results are announced.

Discl: Held IRL

2 announcements from EOS today, the first I thought would throw a spanner in the price, the second likely saved it ...

1HFY25 Trading Update

1HFY25 Revenue expected to be $40-45m vs FY2025 guidance of “similar revenue to FY2024 of A$176m”

EOS has consistently stated full year 2025 revenue will be heavily biased to the second half, and repeated this guidance today

Looks like a tall ask, but there is a healthy contract backlog for the rest of 2025 and the prospect of new contracts to be signed before 31 Dec 2025, so I do think it is achievable.

Given the EU’s grovelling commitment to “Daddy” (sorry, reached out for the barf bag) of 5% GDP defence spend, no sign of the end of any of the ongoing wars, my view remains that defence spending is only just beginning and EOS is nicely poised from a product relevance, manufacturing/delivery capability and cash position to capitalise on this macro situation.

Receipt of US$40m

Not sure how coincidental or fortuitous that EOS alluded to this payment which was “previously constrained revenue” relating to the finalisation of a long standing contract with a customer in the Middle East, “in the near future” in the 1st announcement

Regardless, the US$40m was received 2-3 hours after the announcement, bringing the cash balance at 30 June 2025 to A$130m - very nice

The price action appears to have mirrored by reactions to both announcements - a bit of an “Ah, understandable but not great” initially (dipped to 2.57), then a “yeah baby, US$40m, contract done” (now hovering around 2.89).

From being in the doghouse 2-3M ago, EOS is now firmly medium-high conviction for me now.

Disc: Held IRL

A good, concise summary of EOS from Edison: https://www.edisongroup.com/research/positioned-for-drone-defence/BM-1729/

EOS now has a squeaky clean balance sheet with no debt, laser focused (pun intended) management chasing very specific RWS, counter-drone, high-energy laser weapons and space systems. Things are finally looking up (pun again absolutely intended).

Along with other defence companies, more so following the announce of the $53m Slinger counter-drone contract in May, the EOS price has quietly moved from the recent low base of ~$1.05 in mid April to close at $2.45 today, a really nice sharp spike up in 2 months - nothing to complaint about ... With drone warfare being front and centre of each conflict area, and with EU having to spend large amounts of money on defence after Trump flipped the bird on them, this should really be only the start of a nice and steady long run upwards.

The 2.25 to 2.35 resistance/support area, which goes back to the 2017 to 2019 period, looks to be crossed, and if sustained from here, should form a very nice support base for the share price going forward.

Discl: Held IRL

Continuing my catch up of EOS announcements this morning, this one summarises the 1QFY2025 Appendix 4C released on 29 April 2025.

Discl: Held IRL and in SM

SUMMARY

- Quieter period for actual orders but good update on order book development activity - lots is happening on multiple fronts, with clearer focus on RWS and High Energy Laser Weapon systems

- Potential contracts on High Energy Laser Weapons is exciting, given leading technology and contract values

- EOS balance sheet is now essentially fully cleaned up with zero borrowings and cash balance of $103.1m, will placed to focus on future growth

Customer Order Activity

- US$8.4m (A$13.5m) worth of orders, mix of counter-drone, RWS

Manufacturing

- Setup of R800 production line within Huntsville, Alabama

Order Book Development Activity

- A$30m - R800 RWS to a new North American customer, delivery in 2025/2026

- A$90m - Land 400 Phase 3 RWS opportunity in Australia, delivery in 2026/2027

- Continued work on Ukrainian opportunities - Ukrainian budget availability + European donor nations

- Advanced negotiations with 2 potential customers for EOS High Energy Laser Weapon - each opportunity is worth $50-$100m, one targeted for 2025 signing, the other 2025/2026

Market Development Activity

- Formal launch of EOS Next Gen R500 remote weapon system

- Strategic Collaboration agreement with Calidus to explore joint manufacturing of EOS Next Gen R500 RWS

- Signed co-operation agreement with Milrem Robotics to work together to advance unmanned ground systems solutions

Sales of EM Solutions and Repayment of Borrowing

- Divestment proceeds $158.6m received on 31 Jan 2025

- Repaid $61.1m of borrowing to WHSP

Tariff Impact

Impact of announced trade tariffs on EOS is not expected to be material

Financial Summary

- Cash balance 31 Mar 2025 was $103.1m, no borrowings - well placed to focus on future growth

- Gross contract asset $56.7m, $0.7m lower QoQ (excluding EM solutions)

Nice announcement from a few perspectives:

- Largest order to date for the EOS Slinger Counter Drone Remote Weapon System (RWS)

- Largest ever EOS order for naval RWS

- That these “largest order” milestones occurs in a deployment that is a slight adjacent to the usual land-based RWS equipment augurs well for the deployment versatility of the product

- A good new tick for EOS in terms of capitalising on increased EU defence spending

Discl: Held IRL and in SM

FWIW, I got ChatGPT to help pull together a list of EOS' counter-drone competitors ad their products as I wanted to understand how EOS' Slinger Remote Weapon System (RWS) is differentiated. I tried different ways of asking ChatGPT and with each iteration, got a slightly longer list. Thought this was a decent list to achieve my 'differentiation" objective.

Key learnings in this simple exercise:

- There are many "counter-drone" approaches - EOS takes a kinetic (guns) and directed energy (laser) approach (hence the name "Electro-Optic") vs the competition which take a jamming, detection, interception, neutralisation approach, so quite chalk and cheese.

- The products vary significantly - from small arms to uncrewed aircraft. EOS is a vehicle-mounted product

- Did not come across any other product or competitor which resembles what EOS does

A simplistic exercise for sure, but it helped me (1) get a better understanding and (2) have greater confidence in the differentiation of EOS' product range. As to be expected, it is is horses for courses, in terms of what each product is intended for.

Having real-live Ukraine battlefield credential is a huge tick of approval.

Discl: Held IRL

EOS DIFFERENTIATION

Electro Optic Systems (EOS) specializes in counter-drone solutions, notably the Slinger system—a remote-controlled weapon station (RCWS) equipped with a 30mm autocannon designed to neutralize unmanned aerial systems (UAS) effectively.

1. Kinetic and Directed Energy Approach

Unlike many companies that focus on electronic warfare (jamming and signal disruption), EOS integrates kinetic weapons (guns) and directed energy weapons (lasers) into their counter-drone systems.

- The Slinger system uses a 30mm Bushmaster autocannon with radio-frequency proximity-fused rounds, allowing it to destroy drones with precision.

- EOS has also demonstrated laser-based counter-drone weapons, capable of neutralizing threats without relying on traditional ammunition.

- This contrasts with companies like Anduril (which uses interceptor drones) or Raytheon (which relies on jet-powered kamikaze drones like the Coyote).

2. High-Precision Electro-Optical Targeting

EOS specializes in high-precision electro-optical systems, giving their weapons an edge in tracking and targeting:

- The Slinger uses an Echodyne EchoGuard 4D radar, which can detect and track small drones at distances of 1-1.4 km, and can be mounted on various vehicles, including pickup trucks and armored personnel carriers.

- It integrates day and thermal cameras, detecting objects at 12 km (day) and 13.7 km (thermal).

- Once locked onto a target, the system uses automated tracking, reducing operator workload.

- Most counter-drone systems rely either on radar-based tracking (like RADA) or AI-driven visual tracking (like Anduril). EOS combines both for higher accuracy.

3. Modular & Vehicle-Mounted Design

EOS prioritizes high mobility by designing vehicle-mounted counter-drone turrets:

- Slinger can be mounted on pickup trucks, armored vehicles (like M113s), and MRAPs.

- The system is controlled via a joystick inside the vehicle, meaning operators don’t need to be exposed to enemy fire.

- In contrast, many other systems are stationary or require separate deployment platforms (e.g., Anduril’s ‘Anvil’ drone launcher).

4. Proven Combat Deployment (Ukraine)

While many counter-drone systems remain in development or testing phases, EOS has delivered 160 Slinger systems to Ukraine, where they are actively used against enemy drones.

- 110 mounted on M113 armored personnel carriers and 50 on Practika 4x4 light MRAPs, enhancing Ukraine's defense against drone threats.

- Unlike experimental drone-killing lasers or interceptor drones, EOS weapons have combat-proven effectiveness, giving them an advantage in real-world military contracts.

5. Cost-Effectiveness & Scalability

EOS markets the Slinger as a cost-effective counter-drone system, focusing on affordability and ease of deployment:

- Companies like Anduril use expensive AI-driven drones to intercept targets.

- EOS focuses on low-cost, high-volume weapons, making them attractive to militaries needing scalable solutions.

Conclusion

EOS stands out because of its combination of kinetic, laser, and electro-optical tracking technology in highly mobile and combat-tested counter-drone systems. Unlike competitors that focus on jamming, AI-based tracking, or kamikaze drones, EOS emphasizes precision gunfire and scalable vehicle-mounted solutions—making it unique in the counter-drone market.

Amidst all the Trump/NATO/Ukraine noise, took stock of the EOS 1HFY2025 results. Will post separately, some insights my new buddy, ChatGPT, picked up in terms of the competition for EOS' Slinger counter-drone system as I was trying to work out where that product sits from a competitiveness perspective.

Discl: Held IRL and intending to continue to Hold

SUMMARY

With the sale of EM Solutions, the full repayment of the Soul Patt debt, a very strong balance sheet, and strong and focused management, EOS is now a significantly different company, duly turned around.

Markets and demand have been and remained strong - a huge, just started, tailwind in the shift from “conflict-induced” demand for EOS’ Remote Weapons System to the forced increase in Defence spending across Europe from the US’ abandoning of NATO- a seismic change is underway.

Am staying invested to ride this tailwind and reap the benefit of this turnaround - strong market opportunity as global geo-politics undergo seismic changes. EOS is extremely well positioned with products, IP and R&D and balance sheet to capitalise on this, but contract backlog has reduced with the divestment of EM Solutions and needs to be built back up.

The challenge is that the journey will not be a straight line as the sales cycle is a longer 1-3 year one but it does feel like the long-term direction for EOS is up as it can now focus on Sales Growth and contract delivery, now almost completely free of any company-related challenges.

FINANCIALS

- FY2024 was the year where EOS achieved its highest revenue ever

- Not much point comparing the YoY financials after the divestment of EM Solutions, which essentially monetised the ~$171m EM Solutions 31 Dec 2024 orderbook

- All key financial parameters improved YoY - Revenue, Gross Margin, Underlying EBITDA, NPAT, both with Total Operations and with just Continuing Operations

- Revenue has diversified across different regions and customers vs previously very concentrated customers

- Strong balance sheet of $128m in cash + $48m security deposits to support future growth

- The last 2 years have been a period of almost complete calmness where new management is in place and stable, a clear turnaround plan was put forth and executed against, cash flow problems have been completely addressed, all debt incurred to address the cashflow issues has been repaid ahead of time - the company is structurally and financially, now in an extremely good place.

STRATEGY

EOS is now only focused on 2 things - Counter-Drone and Space Control - complete clarity in purpose and mission

MARKET CONDITIONS

Markets and demand have been and remained strong - a huge, just started, tailwind in the shift from “conflict-induced” demand for EOS’ Remote Weapons System to the forced increase in Defence spending across Europe from the US’ abandoning of NATO- a seismic change is underway

- US (1) anti-NATO stance and (2) aggression to drive NATO member country to achieve at least 2% defence spend is well in play, with Germany already taken decisive steps to unlock expenditure ceilings

- NATO member countries Defence expenditure under spend is significant

Drone warfare is front and centre in the Ukraine conflict - this was an in-your-face realtime, real-life battlefield credential for EOS with 190 EOS Remote Weapon Systems sent to, and have been used in Ukraine.

EOS is well placed for counter-drone remote weapon capabilities, high energy laser weapons and space control - not impacted by tariff spate as it has manufacturing capabilities in the US,

EOS’ counter drone product, Slinger, is clearly differentiated from other counter-drone products

- Neutralization Method: The Slinger uses kinetic energy to physically destroy drones using autocannon fire. Systems like Leonidas and THOR employ directed energy to disable drones electronically with varying deployment strategies. DroneShield uses electronic warfare techniques, disrupting drone operations through jamming.

- Mobility and Deployment: The Slinger is vehicle-mounted, suitable for integration into military vehicles for battlefield scenarios. Systems like THOR are designed for base defense and can be rapidly deployed and assembled.

$136m contract backlog, ex-EM Solutions. The challenge and focus is now on growing its Order Book

Herein lies the investment challenge - strong market opportunity as global geo-politics undergo seismic changes, EOS is extremely well positioned with products, R&D and balance sheet to capitalise on this, EOS contract backlog has reduced and needs to be built back up, but the sales cycle is a longer 1-3 year one.

GROWTH STRATEGY

Growth Strategy makes sense. Future Growth Opportunities in High Energy Laser Weapon and Space Control make complete sense but gestation period takes time.

Discl: Held IRL

SUMMARY

Following a better-than-expected EM Solutions divestment, EOS has fully repaid all WHSP 2022 loans, has zero debt and cash balance of $128.0m - a significant turnaround milestone from the rather dire cashflow position prior to 2022

EOS is now on a significantly stronger financial footing and has a good war chest for growth opportunities

Operationally, manufacturing and delivery appear to be in a nice BAU cadence - Gross Asset Contract Value appears to be stabilising from previously high levels as deliveries are invoiced and cash is collected - no obvious concerns

Pipeline feels focused and healthy - there has been steady and periodic announcements of new contract wins

Business performance is continuing to play out as management has planned and clearly articulated in the past 2 or so years - have continued confidence in Andreas’ methodical leadership approach to EOS’ turnaround, and now growth

Patience is now required to let the benefits of the turnaround to fully kick in and growth to accelerate

Completion of EM Solutions Divestment

- Transaction to sell 100% of EM Solutions has completed

- Following various adjustments, amount received on completion was $158.6m, higher than the EV price of $144.0m, mainly due to estimated contract balances at completion.

Manufacturing and Delivery

- Continue to manufacture Remote Weapon Systems (RWS) for longstanding Middle East and a domestic Australian customer

- Delivery of EOS Slinger counter-drone systems to a German customer

Customer Orders, Market Development Activity

$34m new orders in the quarter announced on 23 Dec 2024

Ongoing negotiations on opportunities:

- Land 400 Phase 3 RWS opportunity in Australia, $100m, delivery 2026 & 2027

- New North America customer for R800 RWS, $30m, delivery 2025

- Ukraine opportunities with both Ukraine on RWS and with donor nations on supply of RWS for donation to Ukraine. Counter drone products previously supplied for use in Ukraine were deployed during the quarter in warfare

Market development:

- Existing Middle East customer on development and significant order of a next generation RWS

- Demo of counter-drone RWS capabilities for potential new Middle East Customer

- Advanced negotiations continued with 2 potential customers for High Energy Laser Weapon

- Discussions with potential new customers on Space Control opportunities

FINANCIALS

- ZERO borrowings on its balance sheet

- At 31 Jan 2025, cash balance of $128.0m, and a further $48.0m of security deposits, held as security for bank guarantees

- Net cash used in Operating Activities was ($10.3m) vs Inflow of $10.5m in Q3 CY2024

- Net Cash inflow from Investing Activities was $10.6m, includes release of cash security deposits after successful completion of manufacturing milestones for a domestic Australian customer

- Gross Contract Asset $79.1m, unchanged from 30 Sep 2024 - relate largely to a Defence customer contract in the Middle East and a domestic Australian contract for EM Solutions

- Advanced payments received $36.4m (including $12.3m relating to EM Solutions)

Final Repayment of WHP Debt

- EOS has repaid Washing Soul Pattinson $61.1m - representing full repayment to WHSP of all outstanding amount, including “make whole” payments required under the borrowing agreements.

- Early repayment of debt in full was required with the completion of the divestment of EM Solutions

- All amounts borrowed from WHSP in 2022 have been repaid

- EOS has no borrowings and Directors consider EOS is well placed to focus on future growth

- Continue to hold bond facility agreements with Export Finance Australia, which has ongoing quarterly covenants

- Continue to be in compliance with obligations of Middle East customer’s country “Offset Program” - secured by an offset bond of US16.9m, guaranteed by Export Finance Australia

Lost some with EML, but won some with EOS.

A nice in-the-right-spirit-of-Christmas and welcomed announcement from EOS. Continues the cohererent and consistent strategy trajectory that Andreas has taken EOS on since taking over ...

Discl: Held IRL

EOS enters binding agreement to divest non-core naval SatCom subsidiary - EM Solutions

- Cohort to acquire 100% of EM Solutions for an enterprise value of $144 million

- Net proceeds of the sale to be used to support growth in EOS’ core business, including in the counter-drone market

- Sale demonstrates EOS' strategic and capital allocation discipline

- Subject to satisfaction of certain conditions, including customer and security approvals

- Foreign Investment Review Board (“FIRB”) approval received

EM Solutions, based in Brisbane, Australia was acquired by EOS in 2019 in a scrip-based transaction which valued EM Solutions at approximately $26 million. The 2019 acquisition of EM Solutions was intended to support the EOS SpaceLink venture which EOS terminated in 2022. While an attractive, growing and profitable business, EM Solutions has become non-core to EOS’ current growth strategy, which is focussed on counter-drone systems

Completion of the Proposed Transaction will automatically trigger the repayment of EOS’ outstanding debt facility with Washington H. Soul Pattinson and Company Limited (“WHSP”) in full (which EOS would otherwise have repaid from organic cashflows upon maturity in October 2025). The total amount to be repaid to WHSP (including future monthly interest amounts) is currently $64.4m.

Following this repayment, EOS will have no borrowings and have the balance sheet strength to support future growth.

TAKEAWAYS

- Management continues to execute against a very focused strategy of remote weapon systems, directed energy and space control

- Exits a business that is non-core for what looks like a good price and gain and fully closes out the termination of the EOS SpaceLink venture

- Significantly strengthens the balance sheet - $64.4m debt is fully repaid, no borrowings, funds become available to support future growth

Can't quite see a negative in what seems like a sensible move at a good price, consistent with the strategy that EOS continues to work towards. Will see what else management to say in the call tomorrow morning.

Discl: Held IRL and in SM

SUMMARY

- Steady quarter with no surprises

- Steady manufacturing and delivery progress, reducing the Gross Asset working balance as the deliveries convert to cash

- Orders and BD moving along at a steady cadence

Discl: Held IRL and in SM

KEY ACTIVITIES

Manufacturing & Delivery - steady progress of deliveries to key customers, continued reduction in the Gross Asset working balance

Customer Order Activity

- New strategic RWS Middle East customer purchases a RWS for testing on vehicles, to assist in evaluation for future potential orders

- EOS Space Technologies $9m strategically important work, Australia

- EM Solutions $15m new orders, continuing expansion in Europe

Order Book Development Activity - continued negotiations:

- Land 400 Phase 3 RWS opportunity in Australia, up to $100m for 2026-2027 delivery

- Potential new R800 RWS customer in North America, up to $30m, 2025 delivery

- Continued work on Ukrainian opportunities

- Continued market development activity

FINANCIAL SUMMARY

- Cash balance up $2.8m to $55.0m

- Net Cash from Operating Activities up a significant $18.5m to go from ($8.0m) to $10.5m

- Gross contract asset down $10.6m to $79.1m - good, steady delivery progress to bring this down and convert to cash

- Net contract asset value continues to drop to $43.0m, close to half of 3QFY2023

Small but important win in the Space space (pun intended) as (1) it enables customer funded new capability development work in Space technologies (2) broadens the recent wins in a non-directly-war-related space and (3) continues to demonstrate that the new EOS management HAS a clear strategy and is focused on pursuing that strategy.

Discl: Held IRL and in SM

Catching up on the EOS Trading Update of 16 July.

- Nice pop in the 1HFY24 revenue, growth across all business

- Working capital has gone up HoH, but fallen QoQ - maintaining its view that this investment will be realised in the next 12 months

- Cash balance 30 June 24 $52.2m

Continues flow of positive news! Looking forward to the formal 1HFY2024 results for more detail.

Discl: Held IRL and in SM

-----------

1H 2024 Revenue

- Unaudited 1H 2024 revenue was approximately $142.6m, an increase of 92% on the $74.3m result for 1H 2023. EOS previously announced Q1 2024 revenue of $77.3m, an increase of 127% on the $34.0m result for Q1 2023.

- The increase in unaudited revenue for 1H 2024 includes growth across all of EOS businesses, including the impact of accelerating production and delivery of Remote Weapons Systems (RWS) under an existing contract with a customer in the Middle East; growth in the EM Solutions business and growth in the Space Technologies business.

Contract Asset

- At 30 June 2024, EOS had a working capital investment in a gross contract asset balance of $89.7m. This represents an increase of $21.7m on the 31 December 2023 balance of $68.0m and a decrease of $7.8m on the $97.5m balance at 31 March 2024.

- EOS expects this increased working capital investment made during 1H 2024 to continue to be progressively realised during 2H 2024 and 1H 2025.

Bank Guarantee Collateral Reduction

- EOS made a further scheduled debt repayment of $20.5m during April 2024. This follows the $26.9m repayment of the initial Working Capital Facility in September 2023. A further debt repayment of $52.1m is due in October 2025.

- Following the April 2024 debt repayment, during June 2024 EOS finalised an arrangement with its funding providers to reduce the level of cash security deposits required to support existing bank guarantees by $8.3m. This resulted in an $8.3m cashflow receipt (from investing activities) during June 2024.

Cash Position at 30 June 2024

- EOS’ unaudited cash balance at 30 June 2024 was $52.2m. This compares to a cash balance of $72.4m at 31 March 2024, and follows the previously announced repayment of $20.5m of debt during April 2024.

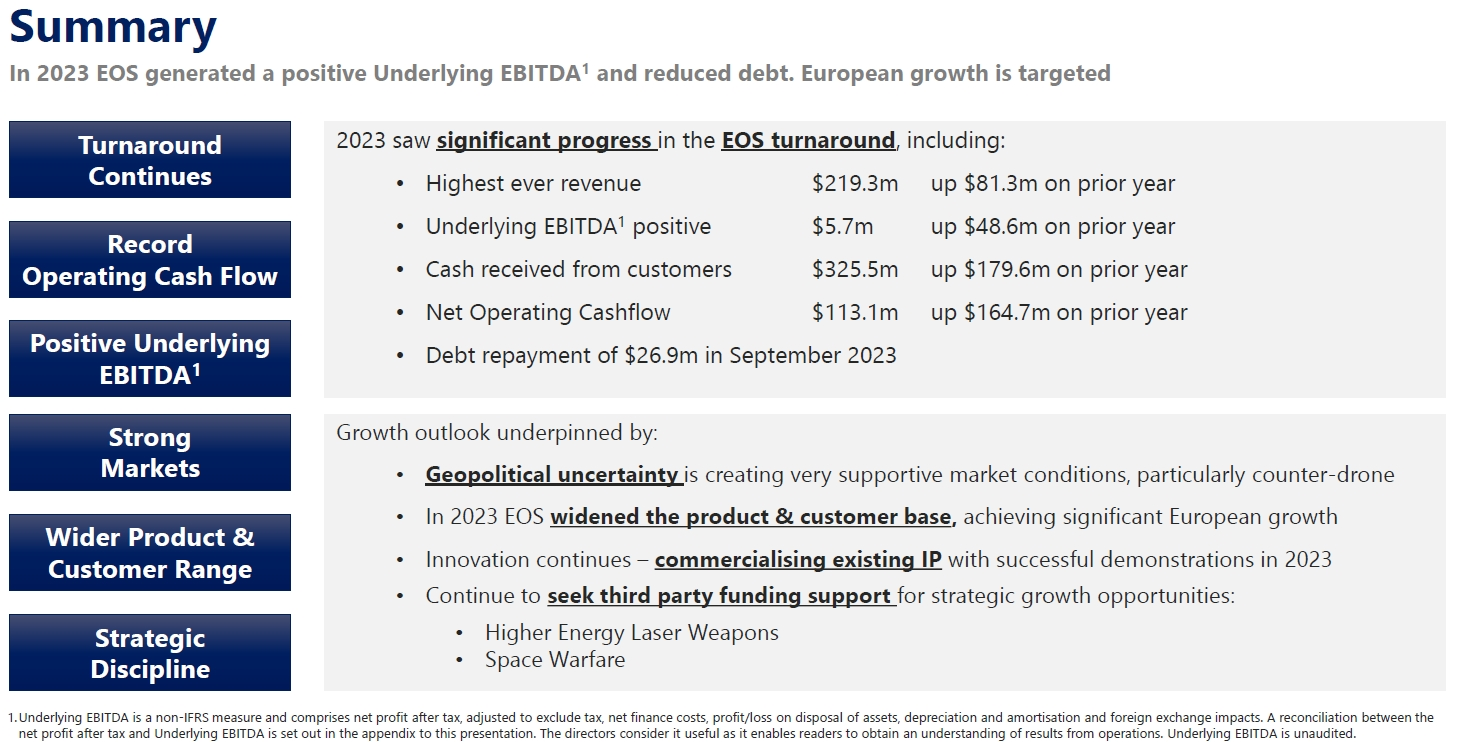

Have done a more detailed review of the EOS FY2023 Annual Report, the 1QFY2024 Appendix 4C and the recent Investor Day Presentation. The slides below is how I have internalised the good turnaround story and the very positive trajectory of the business since new management came onboard in late 2022, amidst of a lot of business/Covid turmoil.

Have been seeing a very steady flow of positive news in the last year and knew that things were going well, but have got a much better appreciation of how well through these slides and the financial summary.

Have remained invested since Mar 2020 when initially opened the position from around ~6.60, after falling from the peak of ~$10, (thinking I got in at a good price ...). Have topped up from about ~1.13 earlier this year as more evidence emerged of the positive turnaround outcomes.

EOS is now on a much firmer footing with clearer direction, amidst buoyant global demand for its products, as governments respond to the changing nature of warfare towards counter-drone, electronic warfare, autonomy/unmanned and space - EOS is very well positioned to meet demands in these areas.

Really liking what management has done to fix the business issues and the evidence of those fixes steadily emerging. Will stay invested and average up as more positive evidence emerges with the expectation that EOS is one best positioned for the medium instead of short term, given the very long selling and product development cycles amidst inherent government/military/was conflict uncertainty.

Discl: Held IRL

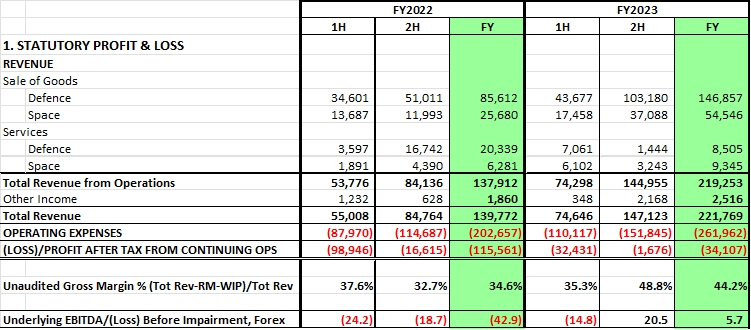

FY2023 Results

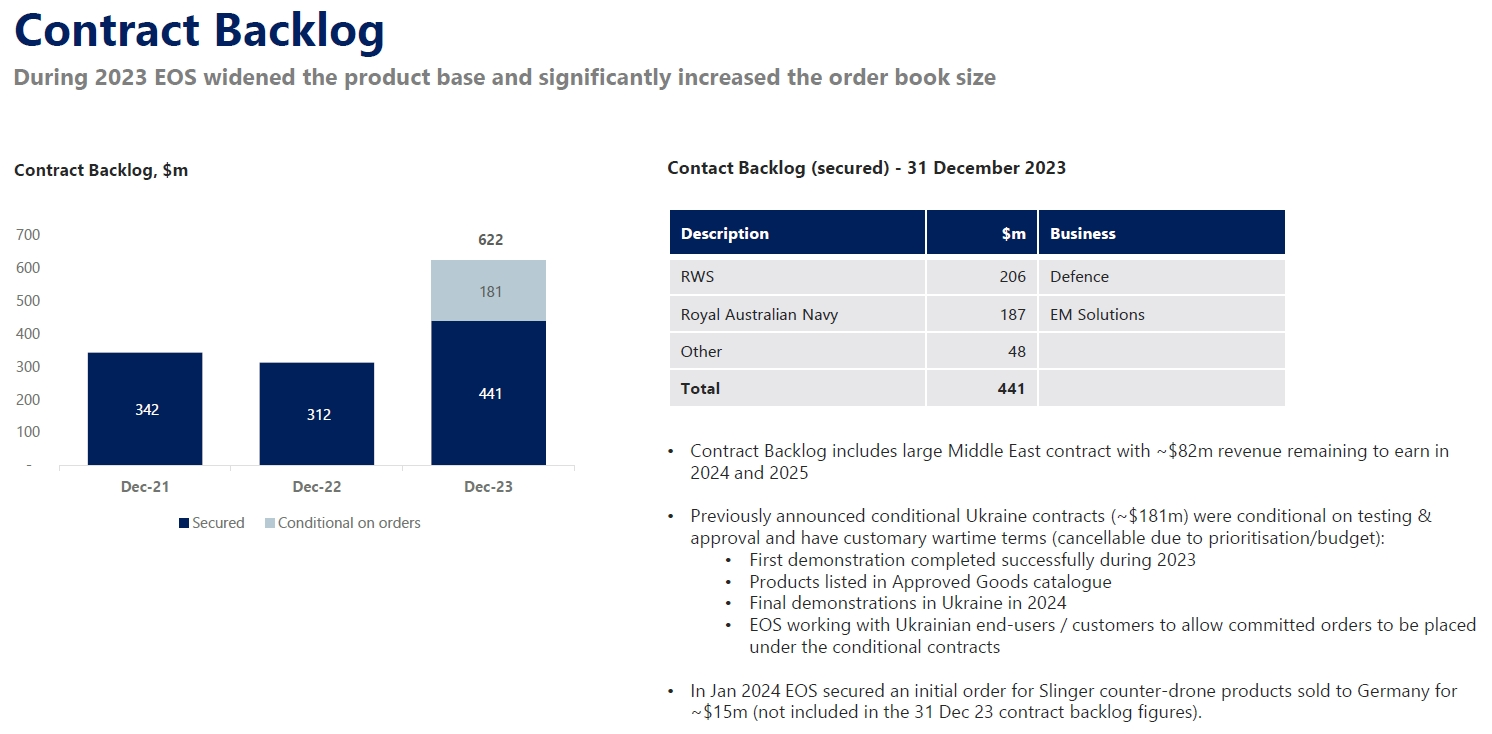

Slides summarises nicely, the FY2023 full year results ending 31 Dec 2023.

Contract backlog of $622m at 31 Dec 2023

While FY2023 results were strong, summary below of the last 4 HY’s shows more clearly, the significant positive moment in (1) revenue (2) rapidly reducing Loss After Tax (3) improving Gross margin and (4) steady march to positive underlying EBITDA

1QFY2024

- 1QFY2024 continues the 1H revenue momentum since FY2022 - appears that 1H has consistently been the weaker half.

- Cash balance of $72.4m as at 31 Mar 2024 with record cash flows at the end of FY2023

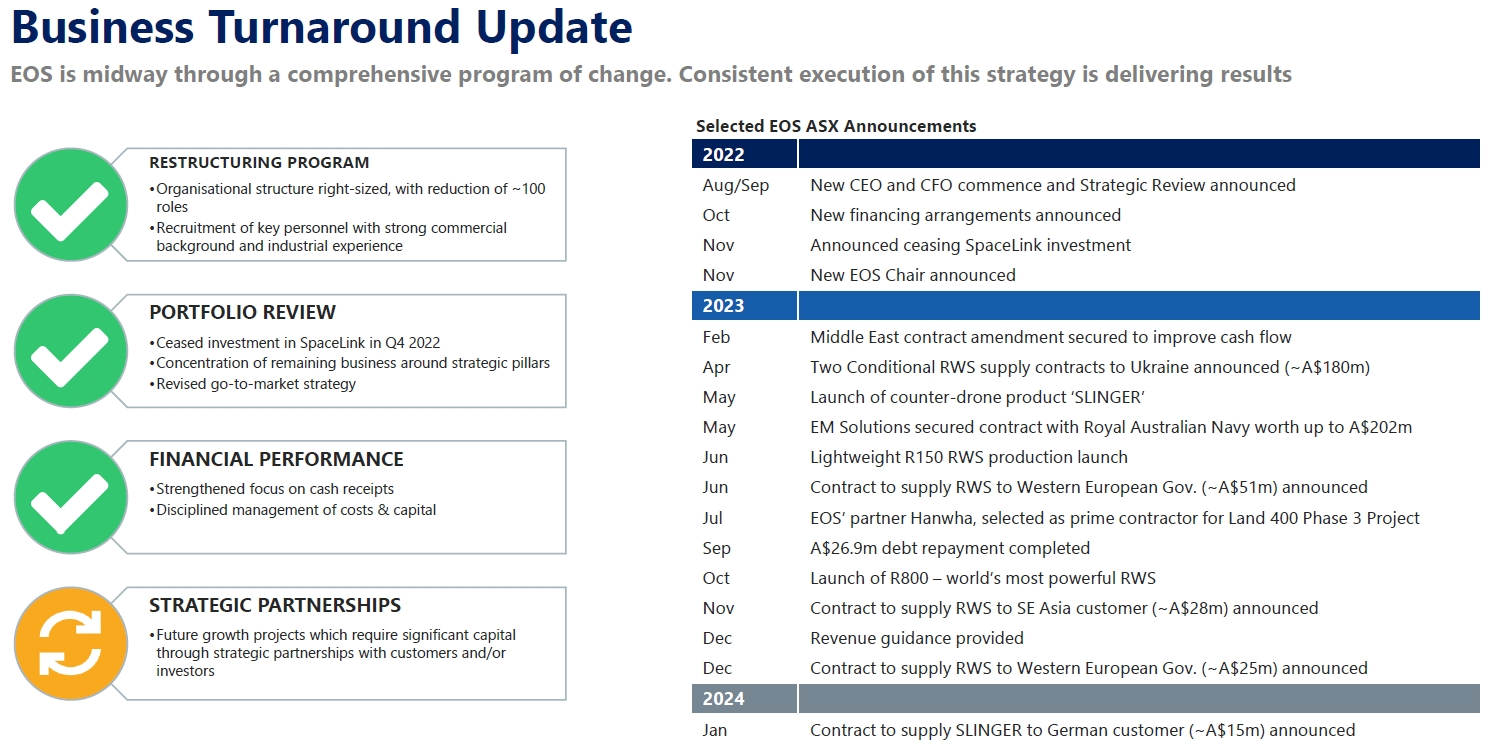

Business Turnaround

- Previous issues with cash collections, liquidity very much under control - significantly improved revenue, revision of contract terms, cash collected + capital raising has allowed the consistent on-time repayment of high-cost working capital loans from Washington SOL Pattison, a major shareholder, and meeting of debt covenants.

- Business Turnaround under new management after the turmoil of 2022 has delivered results and is well advanced - leaner organisation, sale of loss making SpaceLink, disciplined cost and capital management

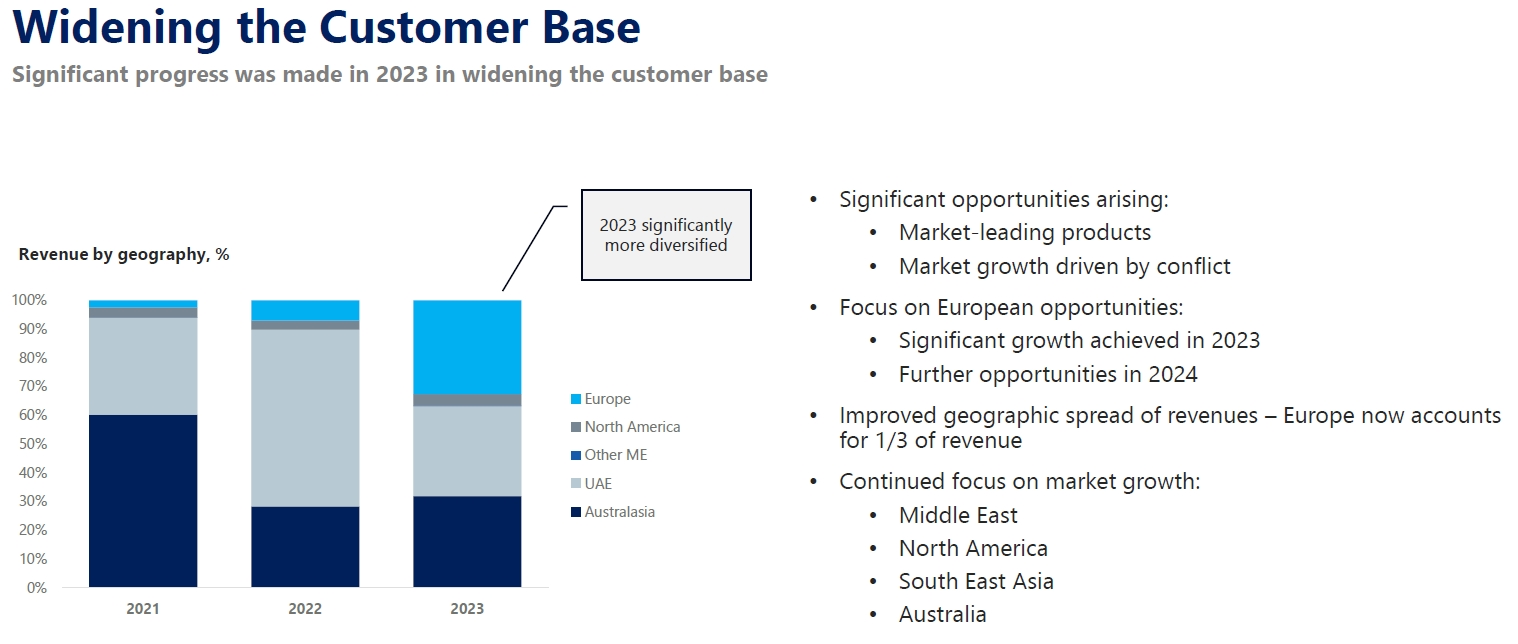

Market Conditions

Market conditions and demand are very favourable - current conflicts have highlighted the changing nature of warfare - EOS has products and IP to directly address this changing nature of warfare and is positioned very nicely to capitalise on this demand with recent product launches in the back end of 2023/early 2024.

Customer base has significantly widened to Europe, reducing previous heavy dependence on the UAE market

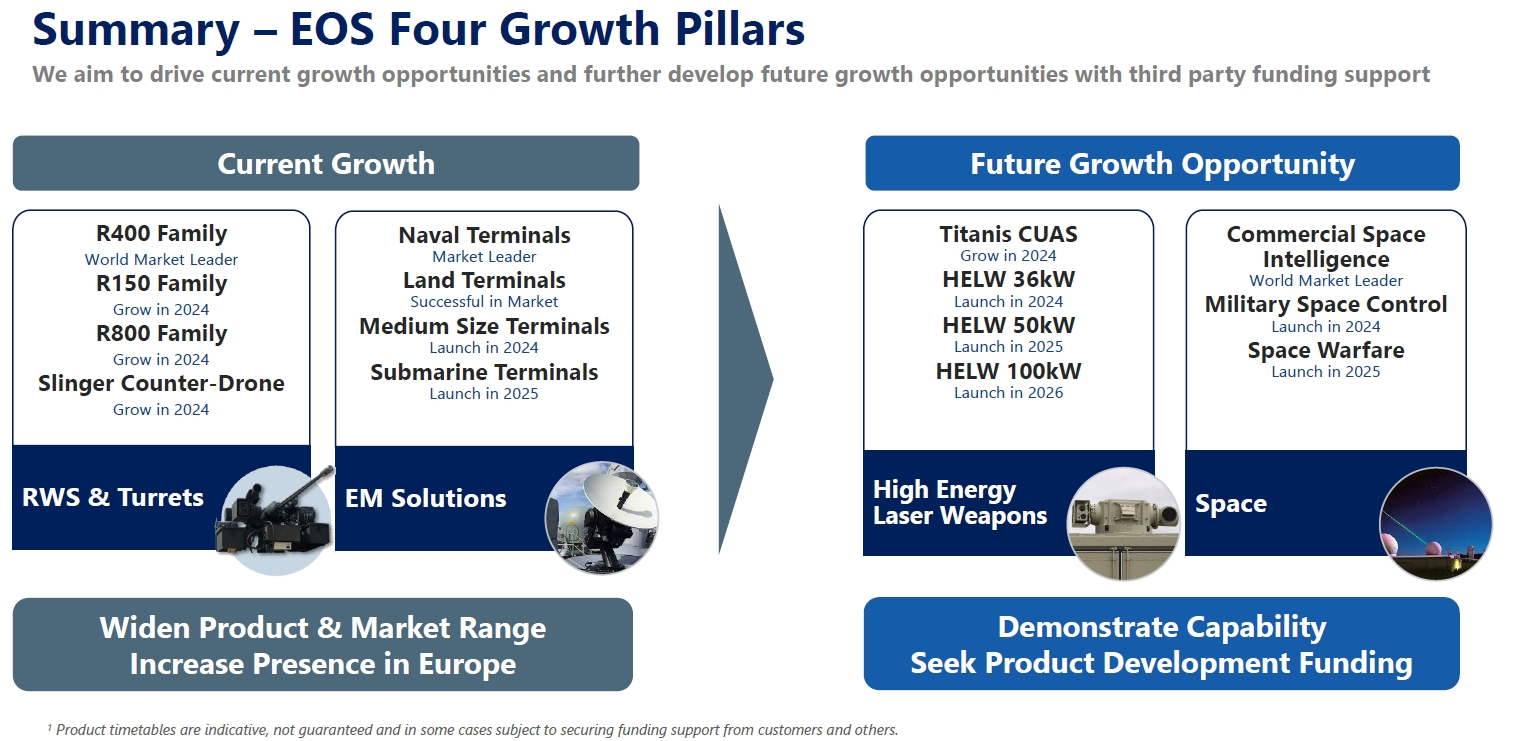

Growth Plans

EOS has IP and innovations in High Energy Laser Weapons and Space Warfare - focus now is on finding customer partners to fund the development of these innovations - this will drive the next wave of EOS growth in 3-5 years and beyond.

Continuing the positive flow of news, this time in the other divisions. Price action seems to be hovering around the SPP price. Glad I topped up when it dipped last week.

Discl: Held IRL and in SM

EOS repaid $20.5m debt on schedule and have now repaid, on schedule:

- 50% of the principal amounts originally due to SOL

- 100% of the Working Capital Facility amounts

This is the continuation of the positive news from EOS and what I feel, has been clear communications from management in terms of the plan, what to expect, then the delivery of that plan. Andreas' German precision and clarity has made a big difference in how EOS has managed shareholder expectations since he came onboard, which I appreciate very much.

Topped up at $1.57, with what I would have purchased via the Retail Share Purchase Plan. The SPP will clearly be a flop given how the share price has moved. I got a call from the EOS broker managing the SPP asking if I was participating ...

I think EOS is very well placed to capture significant demand with conflicts breaking out everywhere. Management is very much on the ball in its response.

Discl: Held IRL and in SM

Details released this morning:

- $35m fully underwritten Institutional Placement of 20.6m at $1.70, 12% of existing issued share capital

- Share Purchase Plan to raise a further $5m, not underwritten, also at $1.70

- 18.3% discount to the last closing price of $2.08

In the last 18 or so months, since Andreas came onboard, it feels that EOS has quite decisively morphed from doghouse -> Turnaround -> steady contract growth and resolution of cash flow issues -> accelerating growth.

This raise thus makes sense to me and I'm in.

Discl: Held IRL and in SM

EOS went in a Trading Halt this morning.

AFR reports EOS ".... is seeking up to $40 million from investors, wall crossing fund managers on Tuesday night. Proceeds would fund working capital needed to fulfil customer orders."

It does make sense to me to do this and reduce reliance on very expensive debt. EOS is in a good position with its Turnaround and has had a very strong 100% run up in share price in the last 6 or so months. The need for funding for working capital lines up with the consistent management commentary of demand going gang-busters.

No mention of whether there is a Retail offer but I would have no hesitation signing up to it, if there was one as I have been looking to top up again.

Discl: Held IRL and in SM.

Wonderful to see EOS having to respond to a ASX speeding ticket today for the price movement from $1.235 on 8 Feb to $1.645 today 12 Feb.

Despite what many swear against, I do believe turnarounds ARE possible, but only IF the right ingredients are in place - CAT, EOS, EML, C79 are standouts for my portfolio .... I need NAN, ALC and maybe JAN to make the not so possible, possible ... !

Notes from the EOS Investor Update call earlier today, following the release of its Appendix 4C yesterday. In summary:

- Cashflow and operational challenges of 2019-2020 seem to now be well under control

- Good bullish sales momentum - the timing of how the Turnaround has been initiated and rapid progress on that journey has positioned EOS very nicely for 2023 and 2024. Steady flow of sales contracts have been announced

- Debt is now under control - good contract, collection and overall cashflow discipline against a backdrop of a bullish market provides strong confidence that debt repayments will be comfortably met

- Low capex requirements ahead, focus is on monetising R&D in recent years

My 3 concerns in July 2023 were: (1) sustainability of the turnaround (2) translation of the turnaround to improved sales, revenue, delivery and cashflow and (3) “top up when the Working Capital debt is mostly repaid”.

Decided to accelerate the top up today as the track record in FY2023 suggests that EOS is on a good, disciplined trajectory with a bullish market ahead, meaning (1) and (2) are mostly met which significantly improves the risk profile.

Discl: Topped up Today IRL and placed Buy order in SM.

- Very bullish market currently, and is expected to remain bullish all of FY2024/CY2024

- At the start of a 2-3 year trend in these areas:

- EOS products are the “weapon of choice” to address the threat of drones in current war conflicts - traditional missile defences are (1) unaffordable (2) suffer from congested airspace issues - key differentiators for EOS is precise positioning, high reliability, high fire power/hit probability

- Robotic unmanned battlefield vehicles is a key demand as operations increasingly move from manned to unmanned operations

- Laser systems - 2024 is the launch year of commercialisation, expecting 1-2 contracts to kickstart sales after completing development investment in 2023

- A unique offering is to have these laser systems used in classic/conventional weapon systems

- 29 Jan 24 deal to sell Slinger Counter-Drone Systems to Diehl Defence was a major breakthrough into the German market - small contract size but a highly strategic win

- Recent deals have significantly broaden EOS’ customer base - addresses the previous issue of high business concentration on a few customers

- Talking to ~20 countries in Europe at the moment - likely to need to open a European office and logistics centre to increase supply reliability to customers

- US manufacturing facility in Huntsville will be increasingly key in the future as US sales will likely need to be manufactured onshore in the US - having to find ways of expediting sales and delivery to customers which minimise red tape

- Sales is focused in the following areas:

- Conflict Driven Ukraine, Middle East - key focus in 2024 is how to support the “immediate demand”-type sales. EOS has good pricing power in these sort of sales.

- Non-Conflict, long-term growth - Large quantity orders over a longer term supply period, strategic in nature, bullish will continue to grow order book in 2024

FINANCIAL UPDATES

- Strong focus on cashflow clearly seen in cashflow results

- Strong continued discipline in ensuring new contracts have a good cash flow positive profile - actions to remediate key Middle East contract completed in Feb 2023

- FY2023 cashflow was the highest ever achieved with $325.4m received

- $71.0m cash balance after paying of $26.2m debt in Sep 2023

- Other than the potential European office, minimal requirements for capex going forward - EOS does not need Capex to scale up and is now mostly focused on monetising prior year investments in development

Debt is in a good place following the resolution of the lender fee dispute with WHSP

No breach of borrowing covenants relating to cash inflows and cash outflows calculated on a rolling 3M basis in the last Quarter

TRANSFORMATION/TURNAROUND

Progress in the last 12-18M against the Turnaround plan has gone exceptionally well, beyond initial expectations

EOS Defence Systems has secured a new contract to supply approximately A$28m of R600 Remote Weapon System (“RWS”) unit spares to a customer in South East Asia.

- Deliveries under the contract are scheduled to commence in late 2024 and continue into 2025 and 2026.

- This sale was secured pursuant to EOS strategic initiatives to widen the product base, customer base and manufacturing base of the Group.

- The products to be supplied under this contract will mainly be manufactured at EOS facilities in the United States.

Really liking the sales momentum and breadth in recent months at EOS. Once they can solve that irritating dispute with WHSP, life will be much better holding on to EOS ....

Discl: Held IRL

The EOS Marketing guys are justifying their high salaries by keeping EOS in the news ...

https://www.abc.net.au/news/2023-10-02/australian-drone-killer-system-ukraine-730/102876242

Notes on the EOS Activity Statement Qtr Ended 30 Jun 23. I liked and followed the headers that @Bradbury uses - it really does help clear my head and crystallise the key points.

Discl: Held IRL

WHAT WAS GOOD

- Cash balance as at 28 July was $84m, double the 30 Jun 23 cash balance of $42.0m - this has really improved

- Cash flow has benefited from contractual changes with significant Middle East customer in Feb 23 allowing earlier invoicing - Q2FY23 receipts from customers $61.1m, total 1HFY23 receipts $123.2m vs pcp $74.5m

- Continued good flow of cash positive new contracts this quarter - approx AUD435m

- Contract Asset Balance continues to fall as payments are received from customers - gross contract asset 30 Jun 23 = $109m, $30m less than gross contract asset at 31 Mar 23

- More cash flow improvements in 2HFY23 are expected from (1) termination of SpaceLink Venture (2) $25m cost reduction program

- Positive global market for EOS products during Q2 from Ukraine conflict and impact on demand from NATO countries

- Continued to deliver products in Defence Systems, Space Technologies, EM Solutions

- Continued to develop and commercialise Anti-Drone Counter Uncrewed Aerial System

- Continued to ensure working capital loan covenants not breached - first $20m principal due 6 Sep 2023 - well placed to repay given $84m cash balance on 28 Jul 2023

- No surprises as all the above has been announced during the Quarter - transparency and detail from the new management in recent months have helped boost confidence of the Turnaround journey

WHAT WAS NOT SO GOOD

Nothing to not like from this report for a change!

WHAT TO LOOK OUT FOR

- Continued sales momentum

- Continued momentum in contract delivery and conversion to cash receipts

- Continued meeting of working capital loan covenants and ability to repay the first $20m due in Sep 2023 - this looks comfortable

- Further progress in EOS 2.0 Turnaround Phase 2 planned for 2023-2024 - Implementation of Strategy

WATCH STATUS:

Very Encouraged, but not yet ready to add to holdings