This video was recorded and posted on YouTube on 25-Nov-2021. It discusses the value proposition that Envirosuite provides for Airports globally:

Our software is increasing airspace tolerance everywhere I EVS Aviation - YouTube

"We've been committed to improving community relations through better airport environmental management for over 30 years. As the world’s leading supplier of solutions and services for airport noise management, we understand that accurate data integrity and noise measurement is essential for airports to demonstrate compliance with local regulations and provide precise information to maintaining trust within the community."

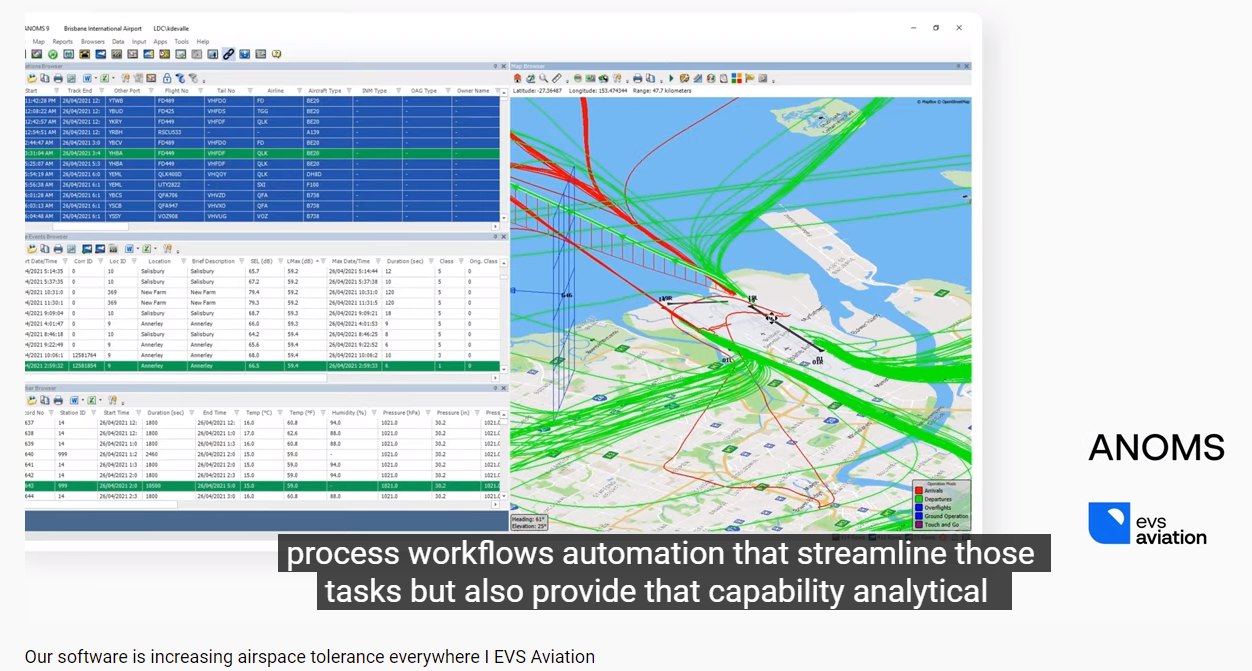

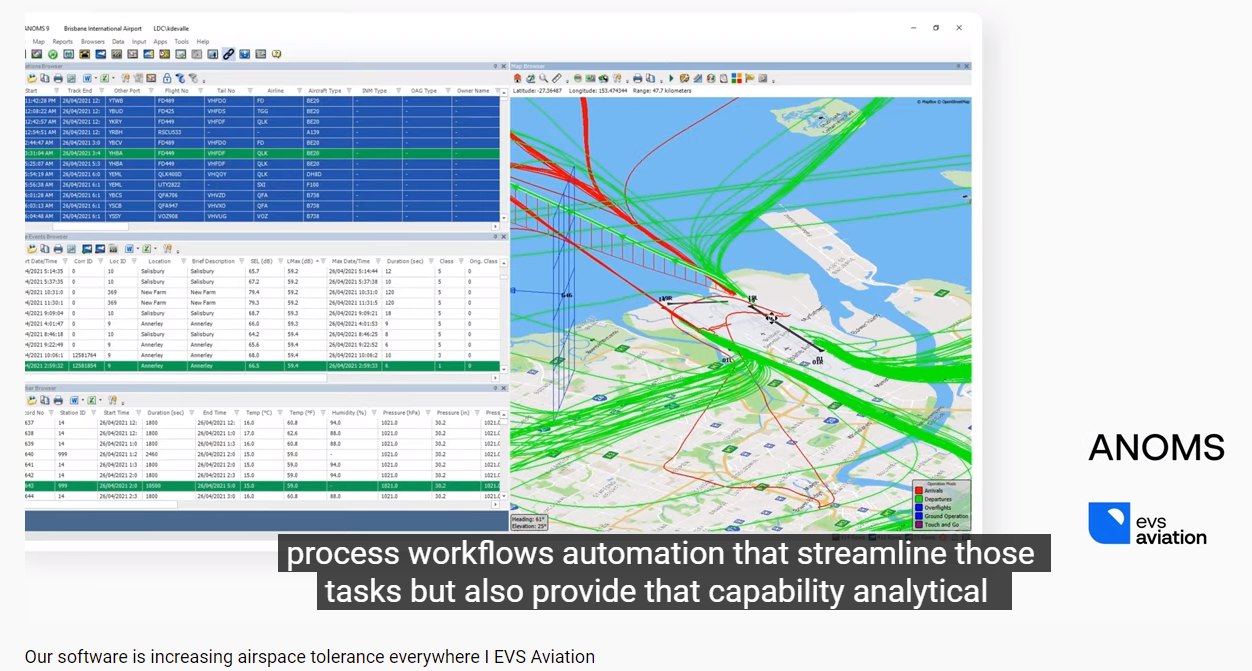

"EVS Aviation offers world leading, comprehensive airport environmental management software. Our flagship ANOMS software provides deep analytics on top of rich datasets, deliver insights that reduce environmental impact, while improving operational efficiency."

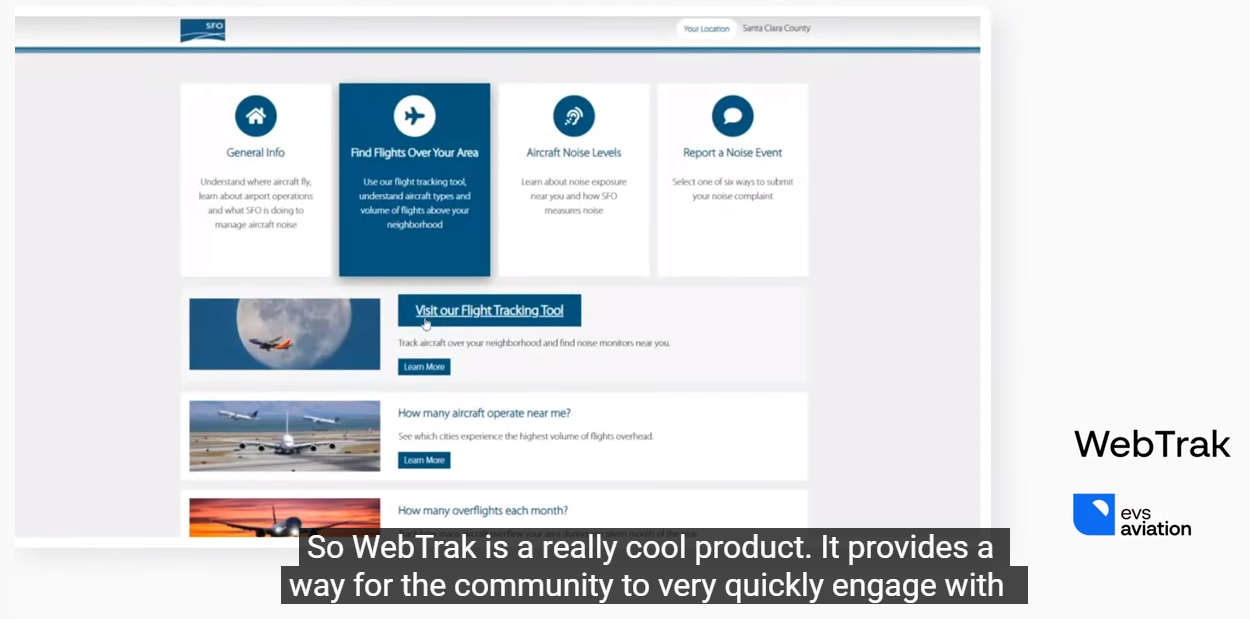

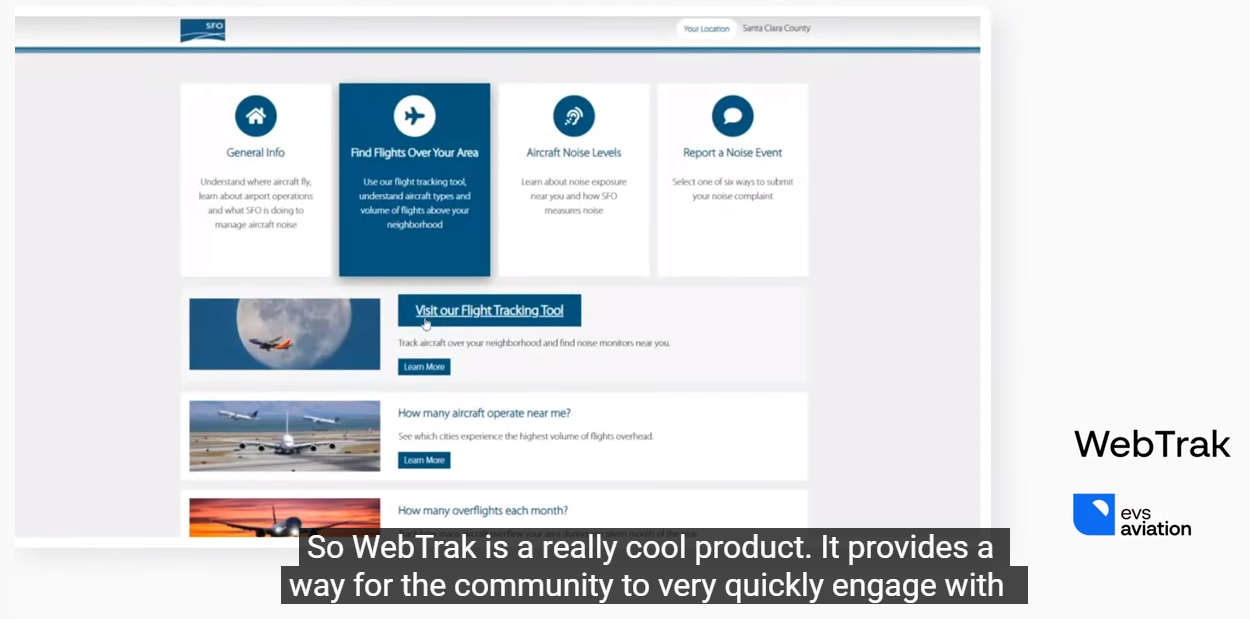

"EVS Aviation provides solutions for airports to transparently communicate environmental exposures and management activities to communities. Our software enables airport teams to work directly with all stakeholders to build trust and airspace tolerance."

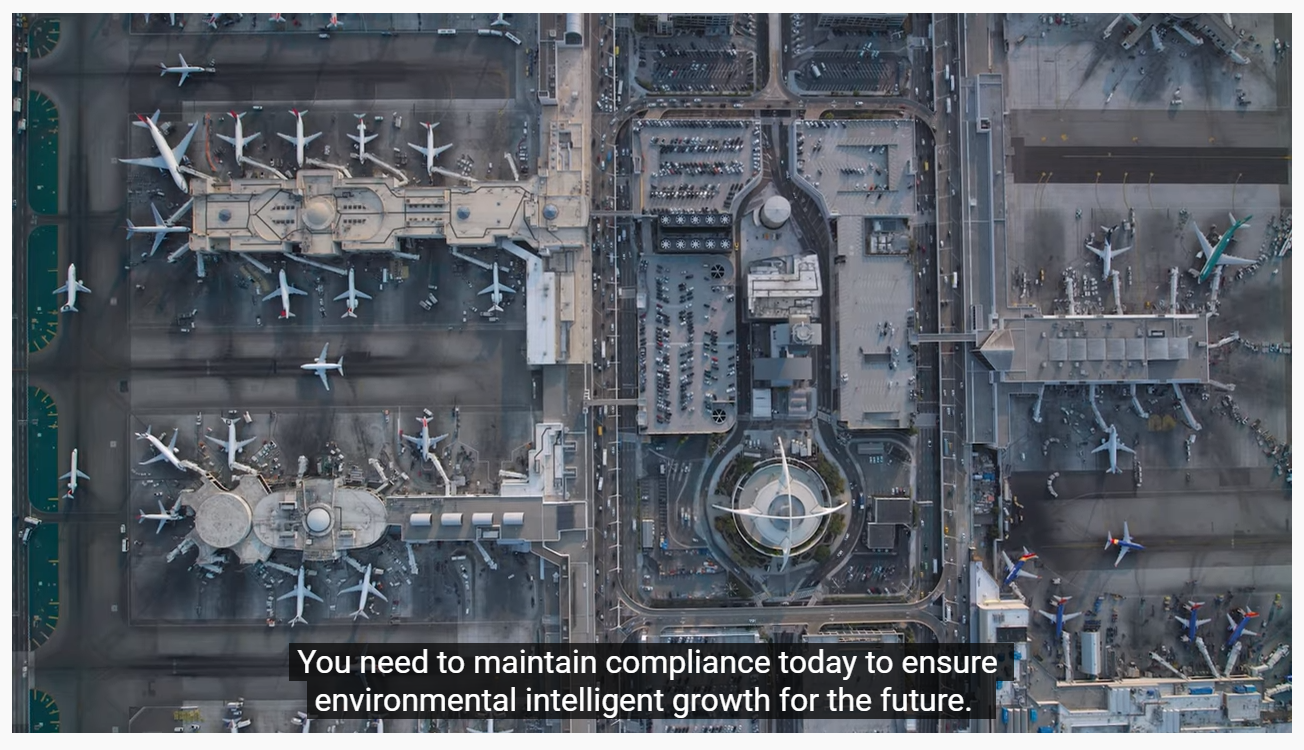

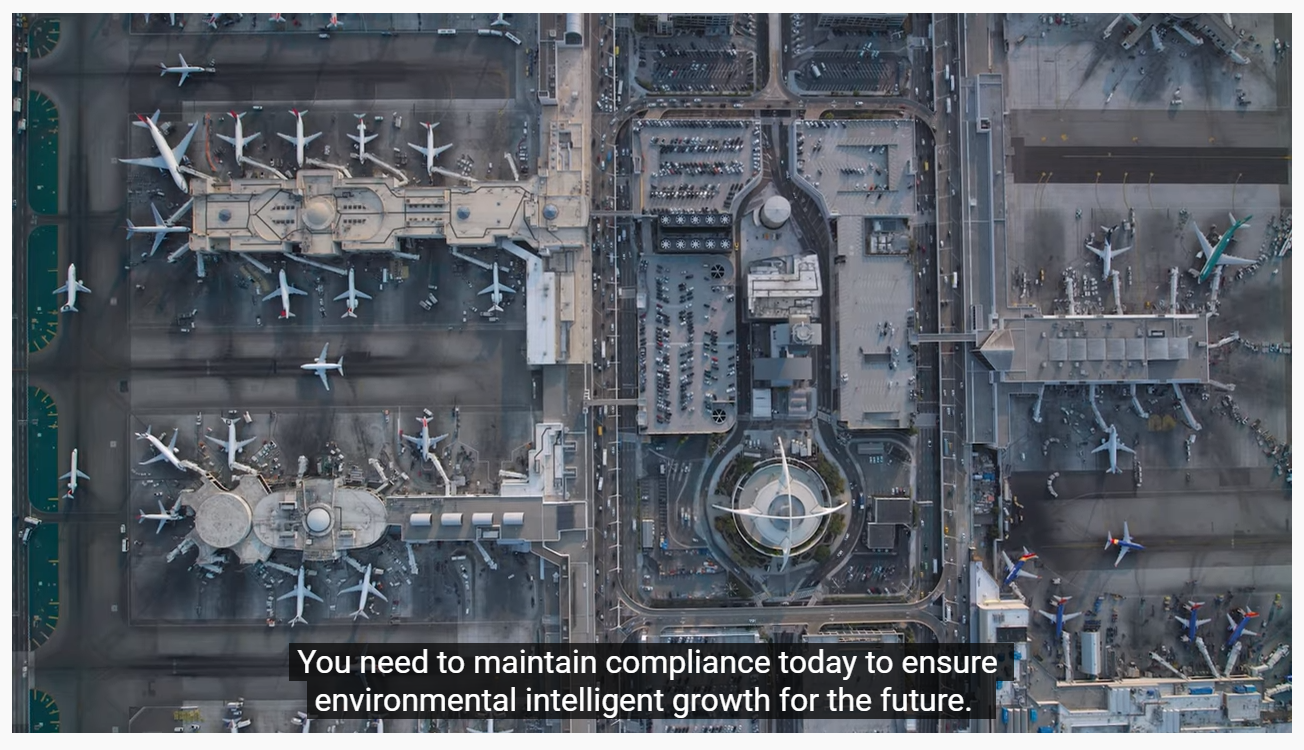

"Harness powerful insights to help you maximise capacity utilisation of your airport infrastructure and reduce operational costs such as decreasing runway occupancy or optimising pavement maintenance and de-icing procedures."

Learn more:

➤https://envirosuite.com/platforms/avi...

Connect with us:

➤LinkedIn: https://www.linkedin.com/company/envi...

➤Twitter: https://twitter.com/envirosuite_ltd?s=21

➤Facebook: https://www.facebook.com/envirosuite/

About Envirosuite:

Envirosuite (ASX:EVS) is a global leader in environmental intelligence spanning more than 15 countries and is a trusted partner to the world’s leading industry operators in aviation, mining & industrial, waste and water. Our proprietary software combines leading-edge science and innovative predictive technology with industry expertise to produce actionable insights, allowing customers to optimize their operations, whilst remaining compliant and managing their environmental impact.

Click here or on the link near the top of this straw to watch the video.

Disclosure: I hold EVS shares both here and IRL. My thoughts are that airports should be getting on with implementing software suites like this now, while things are quieter due to the pandemic and travel/border restrictions, rather than wait until they are super-busy when all restrictions are removed. It's a similar situation to the one that Catapult (CAT) have described where sports teams globally are using the downtime (suspension/deferral of leagues and matches) to use Catapult's gear and analytics to make changes to training schedules and support individual players more to enable them to outperform when things get back to normal and matches/games are back on.

Of course, this video only describes one division of Envirosuite, their Aviation division, and EVS are so much more than that, however it's good, as a shareholder, to get some perspective on what they offer and what their selling points are.

Click here or on the link near the top of this straw to watch the video.