Just went down a rabbit hole on the latest annual report ... (trying to work out my latest valuation)

Trying to work out the negative cashflow -8.052M and get a feel for when these guys are going to run out of money and need to raise more capital. They've only got 8.22M cash so look to have less than a year or runway left. Based on their last raise and burn I'm guessing they are going to be looking for another $10m or so which would be a further 10ish% dilution.

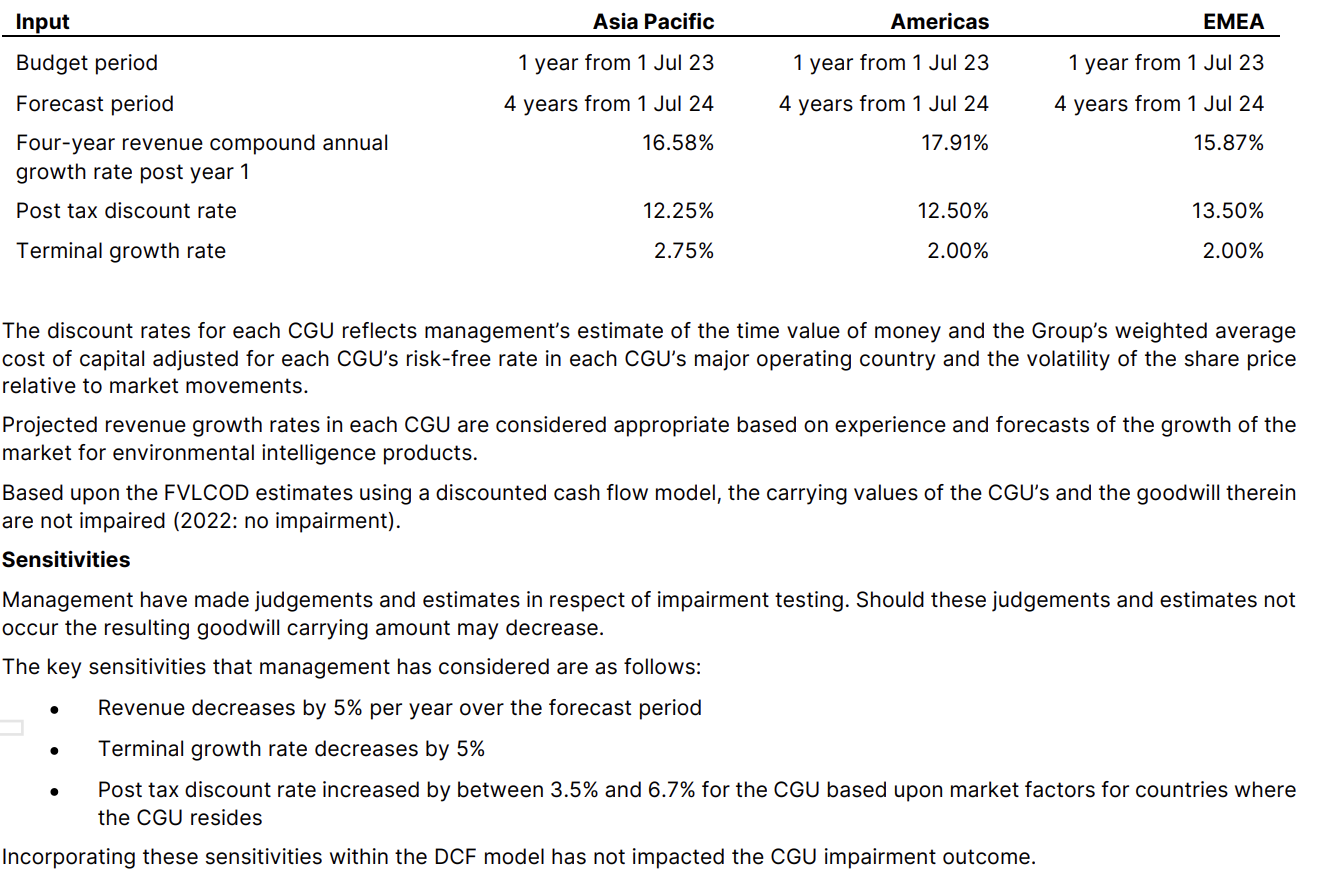

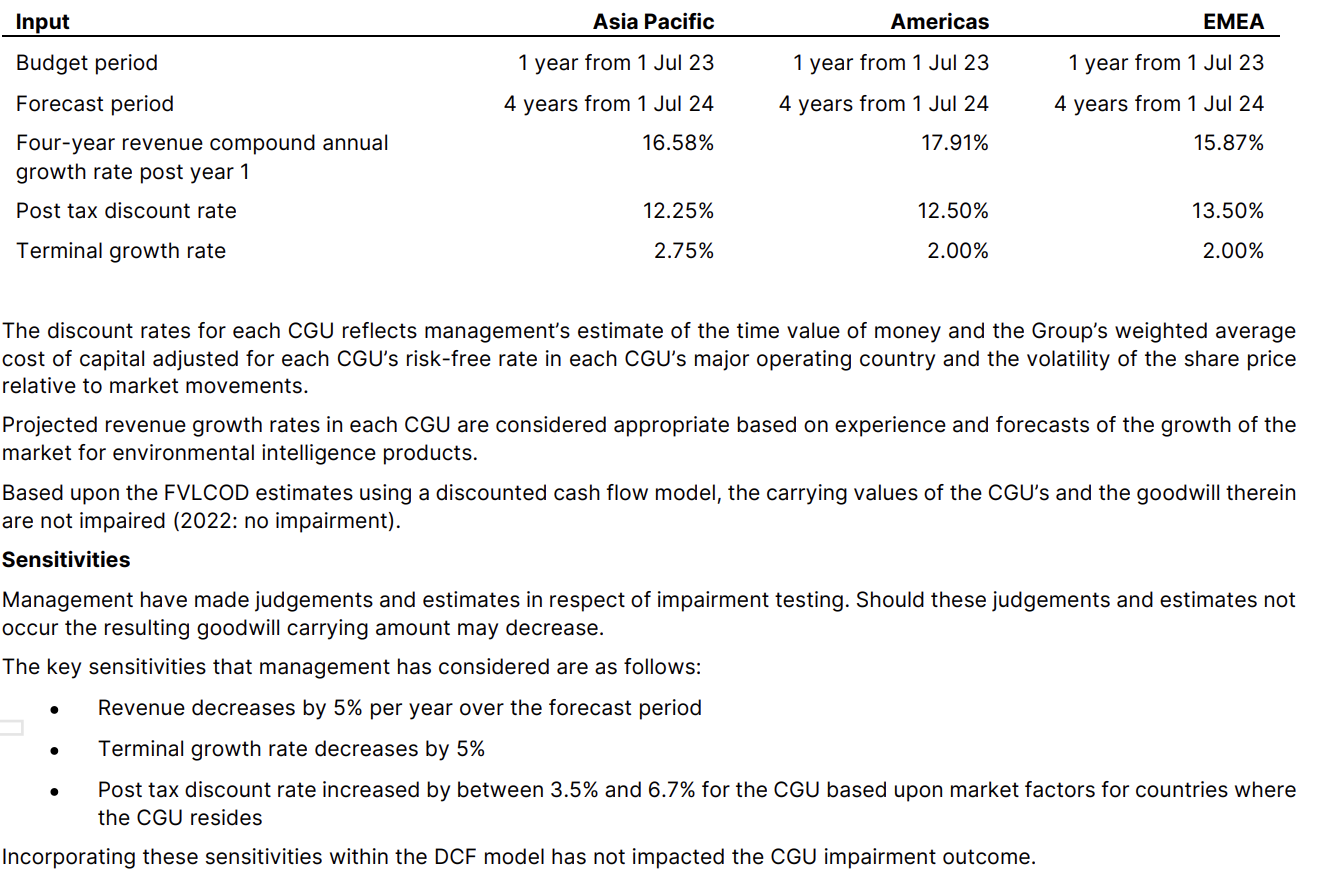

In doing this digging I realised how large an amount of goodwill they have on their balance sheet. In viewing this, they have racked up 66m of retained losses to generate 107m of intangible assets. This seems to be backed up by a DCF model from management.

My key question here is how do these figures compare with those in your DCFs or estimates of value (mid teens revenue growth rate with 12.5% discount rate) that seem to have lead to a consensus valuation of 15c per share?