I've been kind of vacillating about whether Global Health's recent update was a good one or not. On balance, I've talked myself into believing it was, but it kind of needed to be - and they're not out of the woods yet with Q4 being critical if they are to stay on the narrow goat track that avoids a costly credit raise.

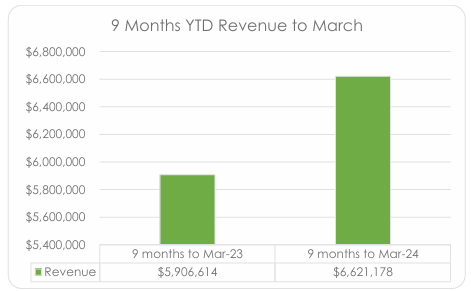

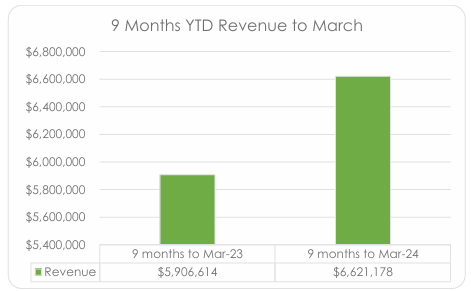

The good news is what appears to be the second highest revenue quarter in the company's recent history. However, they didn't exactly crow about it and that's probably because the highest revenue quarter was Q3 FY23. As a result there wasn't a lot of pcp comparisons, unless they were comparing YTD performance. Free cash flow was frustratingly close to turning positive, but the fact it wasn't meant their dwindling cash balance looks ever more meagre.

The Company's commentary focused on how a government-mandated move to use a single Prescription Delivery Service meant customer-funded delivery and the ongoing SaaS-ing of their products was delayed. DHS has mandated the use of a PDS operated by Fred IT, whose largest shareholder is Telstra. In a way that is also kind of a positive as if they can grow revenues as strongly as they have while having to use resources in an area that doesn't generate revenue, it bodes well once they can get back to the areas that add value.

Stuff I don't like so much:

- they've stopped reporting on ARR the last couple of quarters. It's not such an in-favor metric these days but anything that helps break down the split between services and software revenue would be helpful.

- they haven't been trumpeting major new deals of late. The move around 18 months ago to go from a direct sales model to a greater focus on reseller arrangements, has certainly saved on expenses but risks new growth. If that risk is realised it would take time to take effect as long lead time deals are actioned. Are they about to feel the impact of that and does the commentary that "the focus post-June will be on generating new revenue" suggest they are seeing this in the pipeline?

- borderline chart crime:

The reality is that this is purely a risk versus reward play for me - I suppose they all are but the risk and reward are both heightened in this case. Despite the structural tailwinds this has some hairs on it and that is reflected in the price the market has put on it. But at an Enterprise Value of $6 million, there is a lot of upside if they cross over into sustainable FCF.

A lot rides on this quarter. Q4 is generally a strong quarter for them and the gap between Q3 receipts and revenue suggests that may be repeated once again. However, it really needs to be as Q1 tends not to be with the timing of major licensing invoices skewed to other quarters. Hope is a valid strategy, right?

[Held]