Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I think the June qtr update goes a long way to showing that inflection thesis is still intact, even if by a few threads lol. The cost side has met the targets given by the Co over the last year. Revenue hit a blip with SA health finally dropping off but 4Q sales were strong and brings full year to $2.4m. Unclear what the split is on implementation and ARR which is the key nuance to work out. Whilst its is probably not smart to be an extrapolatooooooooor, the sales trajectory is more impressive considering the consistent negative commentary around the health sector in Oz as noted by GLH too. Other elements like the use of AI to reduce costs further and improve customer success.

The inflection has been bumpy and may continue to be for the near term but the trajectory of the business is positive and it remains clear that the inflection is possible and coming, albeit a little longer than previously expected. Whilst the balance sheet is still a little tight, GLH is mostly likely a spec buy here.

FY25 guide is $7.0m ARR from ~$5.9m in FY24 (+18%). M&A in micro tech has bottom quartile mark of ~3x with a peer group trading around that level +/- and arguably some lower quality than GLH. Inflecting back to profit and CF even would support a re-rate of some sort anyway. Not ascribing any value to the PS/other revenue as it is the enabler of ARR which is the basis for valuation.

So (($7m x 3x) + $2.4m cash - 1.4m debt) / 58m SoI = $0.36/sh.

The qtr reported dropped and wit hit news that SA health has come to an end. Sizable contract but as the release states, new sales won YtD will more than offset the loss within the next 12 months. Whilst that is positive, particularly against a backdrop of the health sector being tough in general atm, it does add risk to the turnaround thesis, increasing burn short term and creating a gap in the balance sheet that makes the company appear cum-raise.

Interesting dynamic as it likely has to raise but can't at this valuation without destroying value. NFI if there is appetite for more con notes now.

Given the large disconnect that persists between listed and private tech, there is NOW a case that the Board & Matthew should run a process to sell the company and maximise the value for minority shareholders.

As mentioned before in my prior posts, understanding growth is the hardest aspect to work out in GLH and given the weak backdrop in the health sector, it would likely be modest (say hopefully 10% p.a.). With today's news, it may be a bit better than modest but quite likely lumpy. $1m over 3yrs is a large contract and it is hard to see GLH not make the inflection given expectations/guidance on the forward cost base. Its hard to know if or how many other opportunities like Youturn are out there but I'll take them as they come.

https://announcements.asx.com.au/asxpdf/20250317/pdf/06gpr87pwncvvq.pdf

Btw, I had nothing to say on the 1H25 results as it was effectively disclosed via 4Cs. As discussed before, 2H25 is the key period to prove or disprove the inflection thesis and where they guides from GLH are "credible".

Dec qtr report is out and the period was fairly CF+. Whilst one can't take that result and simply run-rate it is indicative of the the company making the turn, given previously discussed ARR and cost targets from presos by Matthew for FY25.

Still need to see the HY report to understand the finer details (i.e. revenue breakdown as 1H25 likely front loaded with PS, tracking to ARR target, etc...). Will look to update my modelling then.

Otherwise, should GLH maintain the all in CF+ trajectory into 2H25, the stock would likely melt up as investor remove the cum-raise tag and can get comfortable valuating the business on profitability and cashflow potential.

Belated update post qtr report, strawman preso and their preso yesterday at the aussie micro conference.

Qtr report - face value 1Q25 looks weak but driven by one-offs, timing and seasonally weak. Does tell one that the inflection is going to be fully reflected in 2H. Ideally one would want to see 2Q25 be close to or above even.

From the recent presos, clear that the success of the inflection can be lucrative as it potentially places the company on a single digit multiple. The Straw and OZ Micros presos had additional "colour" on FY25 with guides of revenue +10% and total costs -10%.

FY24 gross revenue and costs were $8.6m and $10.0m respectively. Based on the guides, they would be $9.4m and $9.0m respectively, which implies a profit of +$0.5m. Given a fully expensed biz model with no D&A, I interpret this is effectively EBITDA/EBIT. It also implies a number higher than the very specific EBITDA of $301k in the sharewise preso so maybe I have the estimated grant or another figure slightly off to get a higher output. I do note that the R&D grant would be the difference between flat and the guided positive profit figure ultimately. But either way, the jaws are opening up and the business is on a trajectory of inflecting.

The current EV is $8.3m and using the above maths, implies an EBITDA/EBIT multiple of ~18x so not cheap at face value atm especially with 1Q25 report giving some concerns.

2H25 will be important as it will show the underlying profitability and an exit run-rate to work with as well a step up of profitability into FY26 could be. As in my prior straws, my graphs show what that run-rate and inflection into FY26 could look like on the current trajectory but to reiterate, there is reasonable scope that EBITDA/EBIT could be $1m+ (ex-grant) implying a multiple of ~8x. To get this in FY26, revenue has to grow 10% again whilst costs are flat as any opex increases are offset by another ~200k+ in reduced R&D spend as flagged in a prior preso.

Looking forward, 2Q25/1H25 results will be a big derisking catalyst for the inflection narrative in GLH as it will confirm (or not).

(Edits for spelling and incorrect EV figure, $8.3m not $7.4m)

Is this the first time Strawman has been mentioned in an official Price Sensitive ASX announcement?

In reference to the CEO interview later today.

Today Matthew held a preso via sharewise and offered some further titbits around FY25 which have helped me firm up FY25 expectations and provide some lead into FY26.

Key financial points were:

- FY25 R&D spend of $2.055m (FY24 was $2.686m)

- With cost reductions in FY24 being fully realised in FY25, coupled with lower R&D spend and revenue growth, leads to FY25 EBITDA guide of $301k.

- FY26 R&D spend to taper to $1.8m which at the target of 20% of expenses implies a total cost base of $9.07m.

Key business initiatives in FY/CY25 were:

- From Jan 2025: Upgrading everyone to SaaS & More aggressive upselling of hothealth and referral net messaging

- From July 25: Push B2C products to get value out of customers customers & Add channel partners to ramp sales

Below are updated charts from my prior inflection post update based on new info today and extending to include a potential scenario for FY26 which I think gives scope to see the company do $1m+ in EBITDA post R&D spend (assuming revenue of $10m+ is possible). This implies an EV/EBITDA of ~6.5x which I think is too low for a sustainably growing tech company with the quality of ARR that it has.

Sharewise do eventually put out replays of the webinar so keep an eye out for it.

This is where I see opportunity in micro tech names such as GLH as the market caps/EVs continue to lag the large/Mid-cap names that are back in vogue as well as underlying fundamentals of specific micro names.

With GLH, the inflection back into profitability as the company continues to execute client implementations and ARR growth (guiding $7m for FY25) hits the revenue line at the same time costs continue to be managed + plus peak R&D spend rolling over to create operating leverage at the bottom line.

With operating metrics improving significantly and the market cap at historical lows, seems like the asymmetry of returns is to the upside. More so post the con note which increases the liquidity on the balance sheet (noting $250k of the $1m was picked up by insiders).

I know the below is very speccy but seems directionally right as long as the fundamentals play out.

Quarterly is out with news of positive operating cashflow.

Although the figures look amazing, it has taken more than a few years for the MD to get to this point as seen below

From market index.

Guessing why the market did not really react to the news.

Either way, I guess it is worth digging in and keeping an open mind - if you can get past the question to the MD of what has been achieved in the last decade??

Plus GLH does have a tiny market cap right now.

I've been kind of vacillating about whether Global Health's recent update was a good one or not. On balance, I've talked myself into believing it was, but it kind of needed to be - and they're not out of the woods yet with Q4 being critical if they are to stay on the narrow goat track that avoids a costly credit raise.

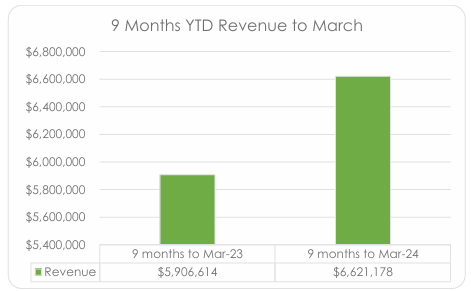

The good news is what appears to be the second highest revenue quarter in the company's recent history. However, they didn't exactly crow about it and that's probably because the highest revenue quarter was Q3 FY23. As a result there wasn't a lot of pcp comparisons, unless they were comparing YTD performance. Free cash flow was frustratingly close to turning positive, but the fact it wasn't meant their dwindling cash balance looks ever more meagre.

The Company's commentary focused on how a government-mandated move to use a single Prescription Delivery Service meant customer-funded delivery and the ongoing SaaS-ing of their products was delayed. DHS has mandated the use of a PDS operated by Fred IT, whose largest shareholder is Telstra. In a way that is also kind of a positive as if they can grow revenues as strongly as they have while having to use resources in an area that doesn't generate revenue, it bodes well once they can get back to the areas that add value.

Stuff I don't like so much:

- they've stopped reporting on ARR the last couple of quarters. It's not such an in-favor metric these days but anything that helps break down the split between services and software revenue would be helpful.

- they haven't been trumpeting major new deals of late. The move around 18 months ago to go from a direct sales model to a greater focus on reseller arrangements, has certainly saved on expenses but risks new growth. If that risk is realised it would take time to take effect as long lead time deals are actioned. Are they about to feel the impact of that and does the commentary that "the focus post-June will be on generating new revenue" suggest they are seeing this in the pipeline?

- borderline chart crime:

The reality is that this is purely a risk versus reward play for me - I suppose they all are but the risk and reward are both heightened in this case. Despite the structural tailwinds this has some hairs on it and that is reflected in the price the market has put on it. But at an Enterprise Value of $6 million, there is a lot of upside if they cross over into sustainable FCF.

A lot rides on this quarter. Q4 is generally a strong quarter for them and the gap between Q3 receipts and revenue suggests that may be repeated once again. However, it really needs to be as Q1 tends not to be with the timing of major licensing invoices skewed to other quarters. Hope is a valid strategy, right?

[Held]

Wolper Jewish Hospital to implement MasterCare for Patient Administration System

Australian Healthcare Software provider Global Health Limited (ASX:GLH) (“Global Health” or “Company”) is pleased to announce that Wolper Jewish Hospital (Wolper) has signed for the implementation of Global Health’s MasterCare Patient Administration System (PAS) for hospitals on a first year value of over $78,000.

Key Highlights:

- Implementation of MasterCare Patient Administration System (PAS)

- Projected $78,000 in revenue over first year of the contract