Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

10th June 2025: Corporate Presentation - Focused

Raleigh likes the odd pun. They've just bought all of the Laverton assets from Focus Minerals (FML). And GMD are "Focused".

Yeah, I see what he did there.

So this presso is all about how the Focus Minerals Laverton assets feed into the Genesis Minerals growth narrative, and before I get into the most interesting slides, I want to point out something that this presentation does NOT touch on, which is that one of the tenements that came with these Focus assets is the one directly to the North of Magnetic Resources' (MAU's) Lady Julie North gold project, the one that contains most of their gold, which is planned to be an open pit operation.

The following image is a snapshot from a virtual project flyover video on the Magnetic Resources' website (link below image) which shows how the pit should look eventually:

Source: https://youtu.be/5cd4FW7P-Lc

From: https://magres.com.au/

Time Stamp Link: https://youtu.be/5cd4FW7P-Lc?t=33

That image is looking basically east with the yellow line on the left side being MAU's northern boundary. The Lady Julie North gold deposit is open to the north but MAU have been unable to buy that adjoining tenement (left side of the yellow line) because FML wouldn't sell it by itself. Focus Minerals did however just sell it to Raleigh Finlayson's Genesis Minerals as part of their entire Laverton tenement package, so, as the MoM lads pointed out last week, this is also a strategic move by Ral at GMD to lock up MAU if and when he wants to move on them, as the reality is that whoever buys Magnetic to get Lady Julie Central and Lady Julie North (and Magnetic is definitely for sale!) can NOT mine all of that Lady Julie North gold deposit without encroaching on that tenement to the north that is now owned by Genesis (GMD).

The short version is that the most likely buyer of MAU at some point in the future is now GMD because GMD now own the tenement directly North of Lady Julie North that MAU need to fully mine that Lady Julie North gold.

This is one of the reasons why George Sakalidis at MAU keeps telling everybody that he has heaps of people interested in buying his company (7 different companies were currently showing interest he said two weeks ago) - something he was doing back at D&D (Diggers and Dealers) in Kalgoorlie last year - BUT nobody has lobbed in an offer yet. Nobody wants to buy MAU without that adjoining tenement that has now just been acquired from FML by GMD.

Which probably means that Ral at GMD can bide his time now and wait for MAU's share price to go back down to more sensible levels - MAU's SP has an M&A premium in it, which is a direct result of George talking up the M&A interest at every opportunity, but it won't stay elevated if nobody makes a bid, and now that GMD own that adjoining tenement, it's quite possible (not 100% locked in, but still quite possible) that nobody will make a bid, until Genesis Minerals make one when they're good and ready, which could be a year or two away. It could also be tomorrow, but I would imagine Ral can afford to wait for a better price level. Genesis is now the natural owner of those Lady Julie gold deposits that MAU own, IMO, but there is no rush.

Similarly, Genesis is also the natural owner of Vault Minerals' (VAU's) KOTH (King Of The Hills) gold mill and mine, but, again, Ral has shown plenty of patience with that asset also, having not made a move yet, or not one that has been disclosed by either VAU or GMD anyway.

But back to today's presso, which is all about why Ral has bought those Focus tenements:

Here is a selection of the most interesting slides (IMO) from the 28 slides in the deck:

Wow - that came out small - here's that map again, hopefully larger:

That map a little larger:

You can see Magnetic's (MAU's) "Laverton" project (which includes Lady Julie Central and Lady Julie North) as the black dot with the gold centre immediately below the FML Tenement containing the Apollo and Beasley gold deposits/prospects in the "Chatterbox" tenements which are marked with a red "3" on the map above.

That last one is super interesting to me because it is highlighting all of the Refrac ore in the area (both refractory and semi-refractory) ore that GMD now own, which requires more than a basic CIL mill to extract the gold; They also mention that the Hemi deposit that came with De Grey (which NST just paid $5 Billion worth of NST shares for) includes refrac mineralisation.

NST's largest existing mine, the Kalgoorlie Super pit, also known as KCGM (Kalgoorlie Consolidated Gold Mines) and/or the Fimiston Mill, already processes refrac ore, so NST are no strangers to it and that's why they weren't afraid to shell out the big bucks for De Grey to get Hemi.

Here's that map a little larger:

Always big on the investor relations and explaining what they are doing, their targets, their timelines, and their progress to date, Raleigh Finlayson, GMD's MD, is doing exactly what I expect him to do, and I'm very happy to be along for the ride once again (I rode his Saracen Minerals up also through to the merger with NST).

There is a reason why this company is so loved by insto's and brokers, and can borrow any amount of money they want, if and when they want money. Or raise fresh capital through placements of additional shares.

It's as close to the perfect Aussie gold growth story as you can get on our market - it's pretty damn close to perfect actually. There's a management and growth premium in the SP, but you get that with a company like this, and if you wait for a big pullback before jumping on, you may never get to enjoy the ride at all.

Disclosure: I hold GMD shares both here and in my SMSF.

26th May 2025: Acquisition of Laverton Gold Project.PDF [GMD]

plus Sale-of-the-Laverton-Gold-Project.PDF [FML]

Makes sense !

We knew that GMD were going to buy something around Laverton to fill up their existing 3Mtpa Laverton Mill (the mill that came with the Dacian Gold acquisition a couple of years ago) which is just 30km away from this gold deposit they have just acquired, and we knew they couldn't buy all of Focus (FML) because Focus are 63.19% owned by Shandong Gold International Mining Corporation of China ("Shandong"), so are considered to be a wholly controlled subsidiary of Shandong, despite FML being ASX-listed, and Shandong are China's second largest gold mining company (after Zijin) and also one of the largest gold mining companies in the world, and they rarely sell off their prospective land tenement packages, and they aren't doing that on this occasion either - as the FML announcement (link above) makes clear:

Focus’ Executive Chairman, Mr Wanghong Yang said: “We are extremely pleased with the outcome achieved in the sale of Laverton and believe the consideration payable represents compelling value to our shareholders. Proceeds from the sale of Laverton will strengthen the financial position of the Company as it continues with development at the Bonnie Vale Underground Mine and open pit mining operations at the Coolgardie Gold Project.”

Importantly, FML retains a good percentage of their over 1,650 square kilometers of land tenements in Western Australia across multiple regions including the Coolgardie and Laverton areas within the eastern goldfields. My understanding is that the Laverton tenements are included in this sale to GMD, but none of the other tenements.

So Focus retain plenty of optionality while monetising one asset.

From Genesis' POV, through paying just $250 million (cash), they are buying relatively cheap ounces of gold that they need for their own Laverton mill. The Laverton Gold Project (LGP) that they are acquiring has a global Mineral Resource of ~4Moz at 1.7g/t so their $250m purchase price equates to ~A$63 per Resource ounce. The LGP Reserves stand at 546koz at 1.3g/t.

The GMD announcement (link above) also says that in Raleigh Finlayson's opinion there is substantial scope for Resource growth from this acquisition through the large tenement package comprising highly prospective gold tenure.

Makes sense !

GMD is up today on this announcement, so it makes sense to the market also.

And on good volume too (over $11m worth of GMD shares have changed hands already today).

And FML's SP has doubled. In fact, it was up as much as +166.67% this morning - @ 60 cps, but is back at 45 cps now (or was one minute ago when I took that screenshot below). Not bad, considering they closed at 22.5 cps on Friday.

Mind you, FML is not widely held because of the controlling interest by Shandong (63.19%), so you can get some mighty big moves in lightly traded companies like FML when something significant actually happens, like this. I haven't held FML since before Shandong became their controlling shareholder, so not for a few years now.

While this is good news for GMD shareholders (like me) and great news for anybody lucky enough to be holding FML (not me), it's not AS great for some of those other names around Laverton who were also possibly on GMD's radar, such as Brightstar (BTR) and Magnetic Resources (MAU), because it seems less likely now that GMD need to acquire those companies in addition to today's acquisition of FML's LGP.

However MAU still made a new 12 month high of $1.705 this morning, and is currently trading just 1.5 cps higher (or +0.9% higher @ $1.675) than Friday's $1.66 close.

My personal thoughts are that MAU's colourful MD George Sakalidis cooked the company's chances of being taken over any time soon when he blurted out at last year's D&D in Kal that they had several companies in their data room and actually named some of them. He then doubled down on that mistake by telling the West Australian newspaper this month (May 2025) that Magnetic had SEVEN gold producing companies showing interest: https://thewest.com.au/business/mining/seven-gold-producers-attracted-to-magnetic-resources-lady-julie-project-near-laverton-c-18635991 [Fri, 9 May 2025].

Potential acquirers generally do NOT like being outed by the MD of their prospective target company while they are still at the DD stage, and while Sakalidis' behaviour is likely designed to both elevate the MAU share price and increase competitive tension for Lady Julie (MAU's flagship and most advanced gold project), it backfired on him last year, and it could backfire again now.

I am fairly certain that Raleigh Finlayson at Genesis prefers to surprise the market with his acquisition announcements, like he has today, rather than have his intentions broadcast in advance by whoever is running the company he is looking at possibly acquiring.

So while GMD may still acquire MAU at some stage, I doubt it's going to happen while MAU's George Sakalidis keeps running his mouth off and driving up the MAU SP.

Just my opinion, FWIW.

For the record, I like today's announcement, as a GMD shareholder.

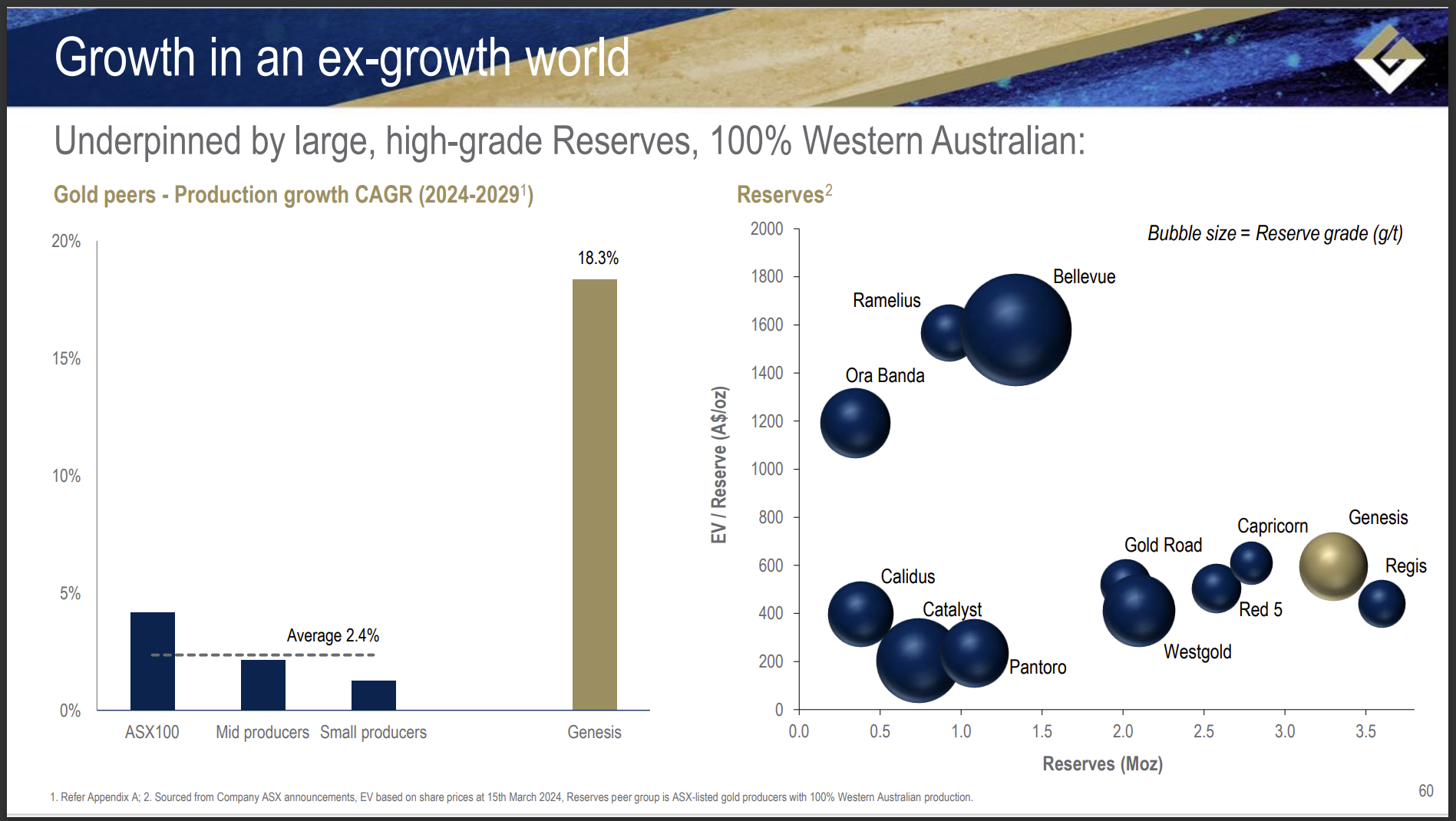

07/05/2025: 3:26 pm AEST: May Corporate Presentation - Long Ore

A couple of slides from today's presentation that sum up why I hold Genesis (GMD):

That Map a little larger (hopefully):

Source: https://gmd.live.irmau.com/showdownloaddoc.aspx?AnnounceGuid=3599bce9-f168-46c5-9f17-a798b207e01c

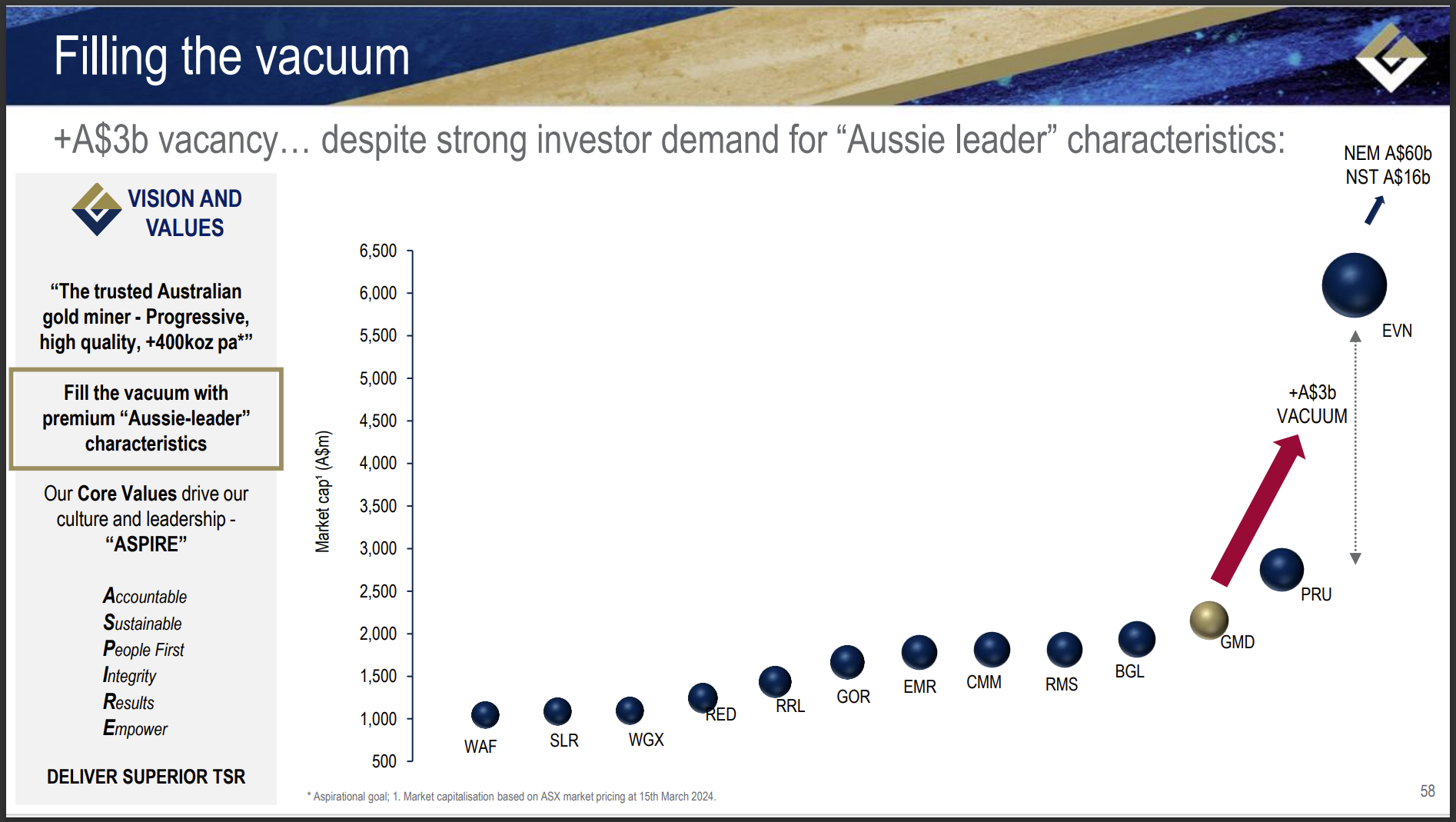

The market likes them - this opportunity is NOT a secret:

Yes, there's some growth priced in already, but all of it? Not likely. If the gold price stays up around current levels or goes higher, there's no reason to expect GMD to be trading at lower levels if Ral keeps delivering on his promises as he has so far.

Disclosure: I do hold this one both here and in my SMSF. One of the best growth stories in the Australian Gold Sector and also one of the best management teams. People that made money out of Saracen (was SAR.asx until they were acquired by NST) have followed Ral into GMD hoping for more of the same, and he's certainly been delivering so far. I was one of those people - I made money out of Saracen, and I've made even more from GMD so far, with more to come (IMO). Not advice. Just my thoughts based on my experience.

16th April 2025: Genesis Minerals (GMD) Quarterly Activities Report - March 2025

Another cracking quarterly from Genesis, who are, IMO, the best growth story in the Australian Gold Sector in terms of decent sized multi-mine producers, and all of their assets are concentrated around Leonora and Laverton in the WA Goldfields.

Excerpts from the first three pages:

Importantly, they are still finding more gold across their tenements:

Which will also be added shortly here: https://genesisminerals.com.au/investor-centre/company-reports/quarterly-reports/

See also: https://genesisminerals.com.au/about-us/

The market clearly liked this latest quarterly report from GMD:

GMD made another new all-time high share price this morning - this time it was $4.31/share. Their 12 month low, almost a year ago, was $1.67. It's a good looking chart! They're not Robinson Crusoe - they DO have company - but Genesis (GMD) are certainly one of the better performers in the past year!

And they weren't even the best performing Aussie gold company this morning, although they are certainly in the mix.

[Only the top performers - with over +3% SP gains today so far - are shown above - that snapshot was taken at 10:52am today]

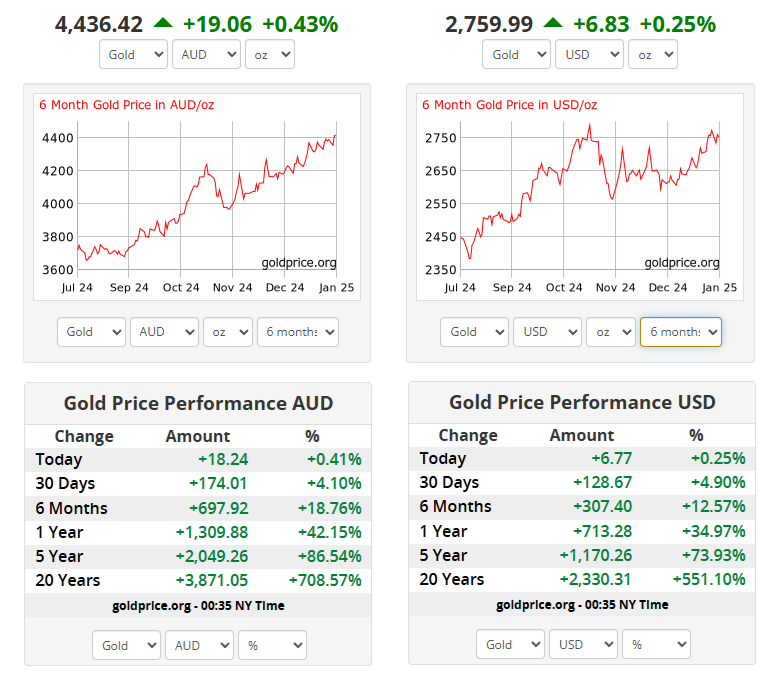

The gold price is providing a continuing strong tailwind to the sector:

Note: It's interesting that A$ gold has now outperformed US$ gold in terms of percentage returns for every time frame from 30 days up to 20 years, as shown in the side-by-side comparison tables above.

Disc: I hold GMD shares. In the Aussie Gold Sector I also currently hold NST, RMS, EVN, CMM, SPR, BGL, BC8, NMG, PLC, MEK and CYL. Some of those are held for shorter-term trades, others as longer term investments.

30-Jan-2024: One of my largest real life positions - my second largest across my largest two real money portfolios, Genesis Minerals (GMD) - which is held in both of them - made another 12-month (52 Week) high (share price) today. It could be considered an all-time high also, as while the share price chart does show a spike up above these levels briefly back in 2011 and again even further back in 2008, they were a very different company back then with different management and those spikes were immediately followed by drops to below $1/share in both 2008 and 2011. Now, with Raleigh Finlayson running the company, we don't see that sort of volatility in the share price, just a nice uptrend:

And what an uptrend it's been. I trimmed another 2,000 GMD shares this morning from my largest portfolio - to free up another $6 K - but still hold 10,000 GMD in that one and another 20,000 GMD in my super (SMSF) which is limited to ASX300 companies and is currently heavily skewed to Aussie gold producers.

Here's a snapshot of the shares portion of my SMSF portfolio as of last night:

My ex-300 companies plus more GMD and RMS and AEL are held within my other larger portfolio outside of super.

The market certainly views Genesis (GMD) as a growth company now - here is their latest quarterly report:

16/01/2025 8:17 am AEDT : Quarterly Activities Report - December 2024

Some highlights:

- December quarter production of 57,055oz at an all-in sustaining cost (AISC) of A$2,202/oz. With costs reducing over the next 4 years to closer to A$1,600/oz. The A$ gold price is now over $4,400/oz (see chart below).

- Cash generation was robust. Gold sales of 49,643oz underpinned revenues of A$200.9 million, allowing Genesis to grow its cash and equivalents to A$237.5 million at quarter-end. This was up $59.9 million from last quarter (A$177.6 million).

- During the quarter, Genesis brought forward the re-start of the Laverton mill to October 2024, six months earlier than flagged in the March 2024 Five-year Plan. This resulted in an increase in the FY25 production outlook to 190 - 210,000oz (from 162 - 188,000oz) at an AISC of A$2,200 - 2,400/oz (from A$2,250 - 2,450/oz).

- With the Laverton mill already running at 3.0Mtpa nameplate, Genesis has 4.4Mtpa processing capacity from two mills at the one production centre. With record December half production of 93,075oz at an AISC of A$2,383/oz Genesis is on track to meet upgraded guidance.

- As planned, Gwalia stoping progresses through a selective, lower grade portion of the mine schedule in the current March quarter, before the next lower cost bulk stope comes online in the June quarter. So we can expect grades to drop in the current quarter after rising in the December quarter, but Gwalia will return to higher gold grades in the June quarter this year. Gold mined at Gwalia underground for the December quarter was 35.3koz at 6.0g/t vs. the September quarter which produced 29.9koz at 5.0g/t. Remember that Gwalia underground is now 2km deep (vertical depth), so one of the deepest producing gold mines in the world, and by far the deepest in Australia, so it takes some time to get that ore to surface for milling, however Gwalia underground is not where Genesis' main growth is going to come from.

- At Ulysses underground, stoping successfully commenced late in the December quarter following the completion of escapeway installations, ahead of schedule. Ore production totalled 3.5koz mined at 3.4g/t (September quarter 2.7koz at 3.2g/t). Ulysses is ramping up, and will be significant for them in the future.

- The Leonora mill processed 349kt at 4.1g/t (September quarter 345kt at 3.5g/t) with a metallurgical recovery of 93.8% (September quarter 93.1%). Building on the processing rates accomplished in August and September 2024, the Leonora mill achieved a full half year of delivery at nameplate capacity of 1.4Mtpa being the first time since 2015 that the mill has been fully utilised. Importantly, grades increased and recoveries did also (vs the previous quarter).

I won't go on - it's all in their quarterly report. Point is, Raleigh is delivering on his promises, as he did with Saracen previously.

And they have a nice tailwind with the Aussie gold price STILL being on a tear:

Aussie gold prices on the left, US$ gold prices on the right.

Source: https://goldprice.org/

Yep, investment thesis is still on track.

Disc: Holding.

Further Info: Excerpts from quarterly report:

Ulysses Underground:

Leonora Mill (formerly known as the Gwalia Mill when it was owned by St Barbara - SBM):

The following is just one example of future growth with Genesis:

And their current Hedging situation:

Plenty of flexibility through the use of collars and put options, with minimal forward sales of just 13,500 ounces of gold in total.

Lots to like about GMD!

14-Nov-2024: Genesis Minerals (GMD) held their AGM today, and I've attached links to their Chairman's Address and AGM Presentation below:

Highlights and interesting stuff:

Skin in the game: They have 7 people on their Board, of which 5 hold GMD shares, and those shares represent 3.1% of the SOI (shares on issue). The vast majority of those shares (the 3.1%) are held by their Managing Director, Raleigh Finlayson, who holds 26,213,858 GMD shares plus another 12,250,000 options.

Data in that table above was sourced from Commsec.

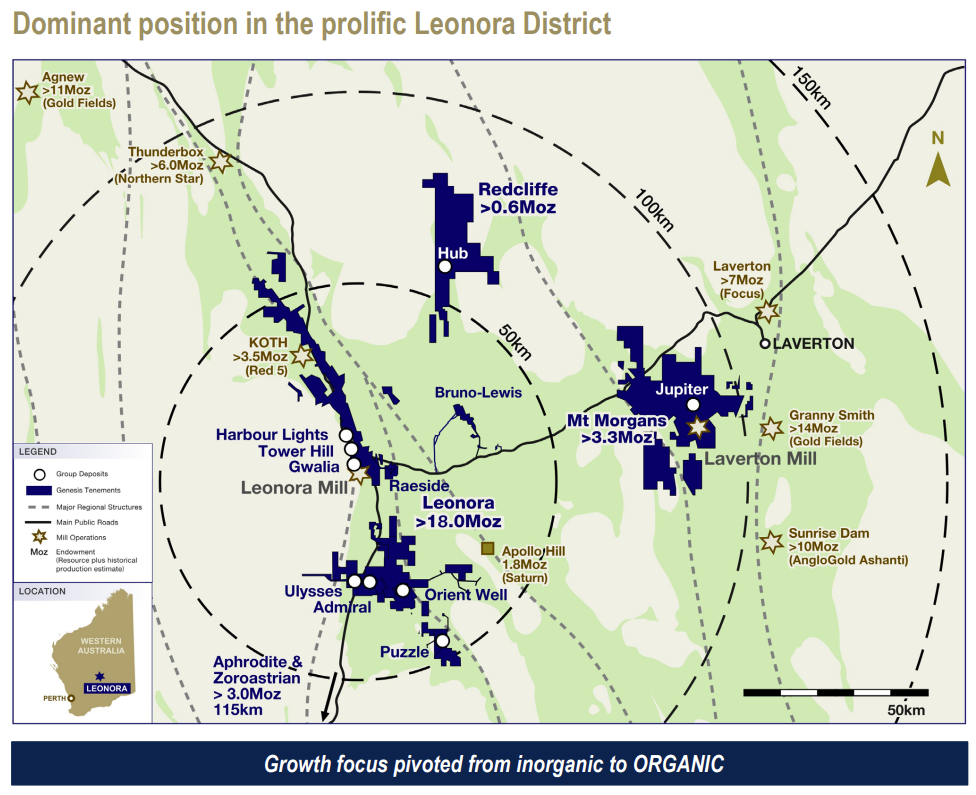

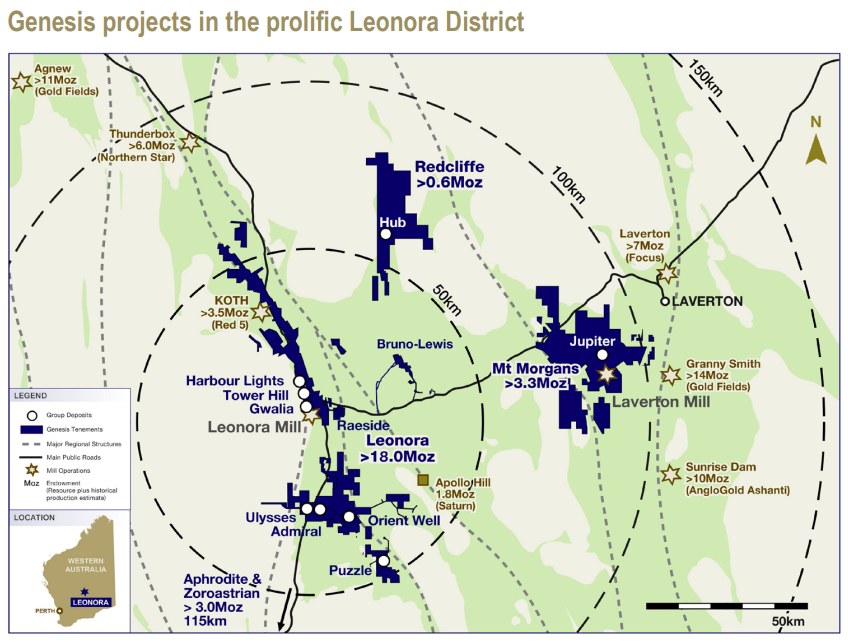

We have an updated map that also includes Aphrodite and Zoroastrian between Menzies and Kalgoorlie, which are future growth options, however the focus is still clearly on that area between Leonora and Laverton in WA, and Raleigh loves Leonora as a town, and supports the local community through GMD:

Here's that map again, by itself, hopefully larger:

They've come a long way in a couple of years since the Saracen merger with Northern Star and Raleigh subsequently leaving Northern Star to build up Genesis from bugger-all to now a $2.6 Billion company.

While gold stocks have been sold down since Trump won the US election, which includes the Aussie gold sector being the worst performing sector both Tuesday (12th Nov) and today (14th Nov), on the back of a moderating (falling) gold price, GMD remains within their uptrend channel:

Right in the middle of it actually, at $2.25.

The company is well positioned for continued growth also:

Source of Slides: GMD AGM Presentation [14-Nov-2024]

They also released this on Tuesday: Updated - Strong drill results support growth [12-Nov-2024]

And this on Monday: Presentation - Accelerate, UBS Australasia Conference [11-Nov-2024]

All good. Holding. Smaller position here. Larger position in my SMSF.

11-Sep-2024: Genesis Minerals: ACCELERATE: DENVER GOLD FORUM, COLORADO SPRINGS, SEPTEMBER 2024 (Presentation)

On a day when most of the Aussie Gold Sector finished up, GMD finished flat, so I imagine the market didn't find anything new in this presso, but it's certainly on-brand for Ral to be spruiking Genesis in North America. He's always been good at selling his companies to the world, as well as laying out a clear strategy and then exceeding expectations in terms of achieving that strategy within the desired timeframe, often years ahead of schedule.

[I hold GMD].

02-Sep-2024: On a day when the majority of Aussie gold companies are being sold down, Genesis (GMD) have released this: Genesis increases FY25 production outlook on earlier re-start at Laverton mill (.PDF)

HIGHLIGHTS excerpt:

FY25 outlook

- Laverton mill to re-start in October 2024, six months earlier than flagged in the March 2024 Five-year Plan;

- FY25 production outlook increased to 190 - 210,000oz (from 162 - 188,000oz);

- FY25 all-in sustaining cost (AISC) outlook falls to A$2,200 - 2,400/oz (from A$2,250 - 2,450/oz);

- Production to progressively increase over FY25 culminating in lower AISC; September quarter production and AISC outlook in-line with June quarter 2024; and

- Early re-start of the Laverton mill marks the first step in accelerated growth strategy aimed at achieving the 325koz pa target and reducing AISC ahead of the Five-year Plan.

Click on link above for the full announcement.

Positive, as I expect from Raleigh Finlayson at Genesis, however it might not save them from the tsunami of selling across the gold sector this morning.

[Disc: I hold GMD shares]

09-August-2024: Ord Minnett: GMD-update-ordminnett-09Aug2024.pdf [23-July-2024: Target Price: A$2.00 (Previously A$1.90), Recommendation: Hold (Previously Accumulate), Risk: Higher]

GMD closed at $2.06 today, hence OM moving from Accumulate to Hold on GMD. Disc: I do hold GMD shares.

OM wrote the report on July 23rd (when GMD were @ $2.12/share), but their update was moved into the public domain today (Friday 9th August) when it was included in the weekly ASX broker reports email - sign up for that free email every Friday here: https://www.asx.com.au/investors/investment-tools-and-resources/broker-reports

05-Aug-2024: GMD D&D Presso: https://gmd.live.irmau.com/pdf/8f1e27d6-e139-474d-ae74-3aecd578eec1/Corporate-Presentation-Accelerate-Diggers-and-Dealers.pdf

Also, back on 19th July: Gold explorer Ordell Minerals debuts on ASX after raising $6m.PDF

GMD own 8% of ORD (Ordell Minerals) with another 8% of ORD owned by ORD's CEO and Managing Director, Michael Fowler, who was also the CEO and MD of Genesis Minerals (GMD) up until 23-Feb-2022, the day that Raleigh Finlayson took over those positions at GMD. So Genesis and Mick Fowler are the two equal largest shareholders in ORD.

ORD might be another one to keep an eye on - I don't think Genesis will want to take them over, because ORD's main asset - their Barimaia JV Project - is up near Mt Magnet, not down near Leonora or Laverton, but what about Ramelius Resources (RMS) - who are already all over that Mt Magnet area.

Ramelius have already taken a 17.94% strategic stake in Spartan (SPR) who own the Dalgaranga Mill there - to the NW of RMS' Mt Magnet mill. Barimaia is right next to RMS' Mt Magnet Mill (immediately SE of it).

About the Barimaia JV:

- Strategic location in the Murchison Gold District of WA

- Immediately SE of Ramelius’ Mt Magnet Gold Mine

- Opportunity to assess a drill ready ground package in close proximity to several producing gold mines

- Extensive gold system defined with limited drill testing

- Ordell has acquired Genesis Minerals Limited’s (ASX: GMD) 80.2% interest in the Barimaia Project by acquisition of 100% of Metallo Minerals Pty Ltd

- Genesis commenced the JV in 2017 following the acquisition of Metallo

- Exploration by Genesis during time of Barimaia JV was limited as a result of the focus on the Ulysses Project near Leonora

- Ordell’s objective is to define significant shallow (<100m) gold resources

- Extensive gold system defined associated with felsic intrusion host rocks within mafic-ultramafic stratigraphy

- East-west orientation of the stratigraphy confirmed by Genesis drilling and interpretation in 2018

- No modern exploration until post 2010

- The McNabs Prospects are under up to 10m of transported cover

- 2021 AC drilling extended the ENE trending Au anomalous corridor a further ~900m to the east

- 2024 drill testing over 3.5km of strike

Source: https://www.ordellminerals.com.au/barimaia

So, this is a non-core asset of GMD that they have spun out effectively, but retain an 8% stake in, and the natural owners are definitely Ramelius (RMS).

And RMS have half a billion in cash and liquid shares (in other goldies), plus are producing gold from multiple locations at low costs and high margins.

Further Reading: Maiden drill program underway at the Barimaia Gold Project, WA 2,600m: Phase 1 RC drill program to target Eridanus-style discoveries.PDF (31-July-2024)

Disc: I hold GMD and RMS shares, but not any ORD directly. ORD's entire market cap is only about $13m according to the ASX website, so they would be a small bolt-on acquisition for RMS, however RMS may elect to wait and see if ORD find anything decent with their drilling before having a sniff. RMS' and GMD's m/caps are both over $2 Billion.

06-May-2024: Genesis-Minerals-Corporate-Presentation---ASPIRE-400.PDF

Compelling! [I hold GMD shares]

21-Mar-2024: Five-year Strategic Plan plus Growth strategy underpinned by robust Reserves

Below are a selection of slides from that 68 page/slide presso [the "Reserves" one was 370 pages long - links above] which was released after the market had already closed this arvo, so we'll see the market's reaction tomorrow morning.

Some of the areas covered:

And here are some of the maps that they included:

Below is how they anticipate those assets feeding their Leonora Mill (shown in Blue) and their Laverton Mill (shown in grey):

Below is a wider view that shows where their Aphrodite and Zoroastrian projects sit in relation to that lot above:

And here's that map a little larger:

That map is of their main exploration targets where they hope or expect to find more gold, below is the Bardoc Gold Project back when Bardoc Gold was a listed company in March 2020. It was from their PFS:

Aphrodite is at the top, and would be just below the Chameleon Trend target in the Genesis map. St Barbara acquired Bardoc Gold in April 2022 after announcing the acquisition back in December 2021, and Genesis acquired all of St Barbara's WA Goldfields (Leonora) assets (including the Bardoc Gold assets) in the middle of calendar 2023. There are over 3 million ounces of gold there already that they know about - mostly in Aphrodite and Zoroastrian - however Genesis don't even talk about that, as they much more focused on their assets between Leonora and Laverton, those assets within that 100km radius of Leonora, but we shouldn't forget about the Bardoc Gold assets, which are around 150km south of Leonora. They are also significant!

There's a lot going on at Genesis Minerals.

Yep, I hold GMD shares.

23-Feb-2023: "READY, SET, GROW; Assets and people in place for +300,000 ounces per annum"

Corporate-Presentation---Ready,-set,-grow---BMO.PDF

BMO GLOBAL METALS, MINING & CRITICAL MINERALS CONFERENCE - FLORIDA - USA - on 23rd FEBRUARY 2024

Disc: I hold GMD shares, here, there (everywhere).

05-Feb-2024:

Red5 Dangles the Carrot for Genesis in $2.2Bn Merger with Silver Lake | Daily Mining Show - YouTube [Money of Mine podcast, 05-Feb-2024]

Chapters:

0:00:00 Preview

0:00:00 Introduction

0:01:08 Silver Lake's alternative marketing strategies

0:07:02 Red 5 MERGING with Silver Lake Resources

0:43:00 Potential Lynas and MP Materials merger

0:44:29 Centaurus get Environmental approvals

0:45:09 Silvercorp/Orecorp update

0:45:36 New Copper producer on the ASX

The short version:

The best thing about SLR is their large cash balance. The worst thing about RED is their debt and lack of cash, and to a lesser extent their out-of-the-money hedgebook. Putting the two companies together certainly makes sense for RED, as they need SLR's cash, and SLR will have better prospects to spend their cash on than they appear to have currently - in terms of exploration spending in highly prospective areas. And it will frustrate the hell out of Raleigh Finlayson at Genesis (GMD) who wants Leonora all to himself (or within his company, Genesis Minerals). Luke Tonkin might not have stopped the Gwalia sale from going through (from SBM to GMD), but he might just end up with RED, unless this deal gets trumped by Raleigh/GMD with a better deal.

The best thing about RED is their KOTH gold mill which is close to one of GMD's big gold deposits that they intend to develop. But does Raleigh Finlayson think Genesis Minerals (GMD) needs KOTH yet, or ever? The MoM boys have a long and detailed discussion about these and many other questions in today's poddy - links above - and for my thoughts see here.

Genesis-Minerals-Limited-cr-101223-ordminnett-initiate-coverage-Hold.pdf [10-Dec-2023: Ord Minnett initiate coverage of GMD with a "Hold" call and a TP of $1.70, which is below GMD's current share price - GMD closed at $1.795 today - Friday 15-Dec-2023.]

That report from OM is dated December 10th, and GMD did announce on the 14th (yesterday) that they had agreed to buy an additional two gold projects, this time from Kin Mining (KIN) - for cash and GMD shares - see here for more details - and those projects are both within trucking distance of GMD's two gold mills (@ Leonora and Laverton) - so I don't know if that changes Ord Minnett's valuation for Genesis Minerals at all, but the market appears to like Genesis better now than they did before that announcement. The GMD share price got as high as $1.90 yesterday before closing at $1.75, so they were "only" up +5.1% for the day in the end, but they were up again today, closing near their $1.80 day-high price, at $1.795, so they finished the week with a little positive momentum.

Ords said on the 10th (link to broker report above) that Genesis looked fully priced to them (hence the "Hold" call instead of a "Buy" call) but I don't reckon they're factoring in too much of the upside potential from here - you only have to look at what Raleigh did with Saracen to get a fair idea of what he will probably achieve with Genesis.

Raleigh Finlayson of Saracen (left) and Bill Beament of Northern Star (right) at the announcement of merger of Saracen Mineral Holdings and Northern Star Resources.

Source: https://www.kalminer.com.au/news/kalgoorlie-miner/kalgoorlie-super-pit-partners-saracen-and-northern-star-hailed-record-half-year-results-ahead-of-16bn-merger-ng-b881792384z [Kalgoorlie Miner, 11-Feb-2021]

Disclosure: I hold GMD shares here, and in my two largest real money portfolios as well.

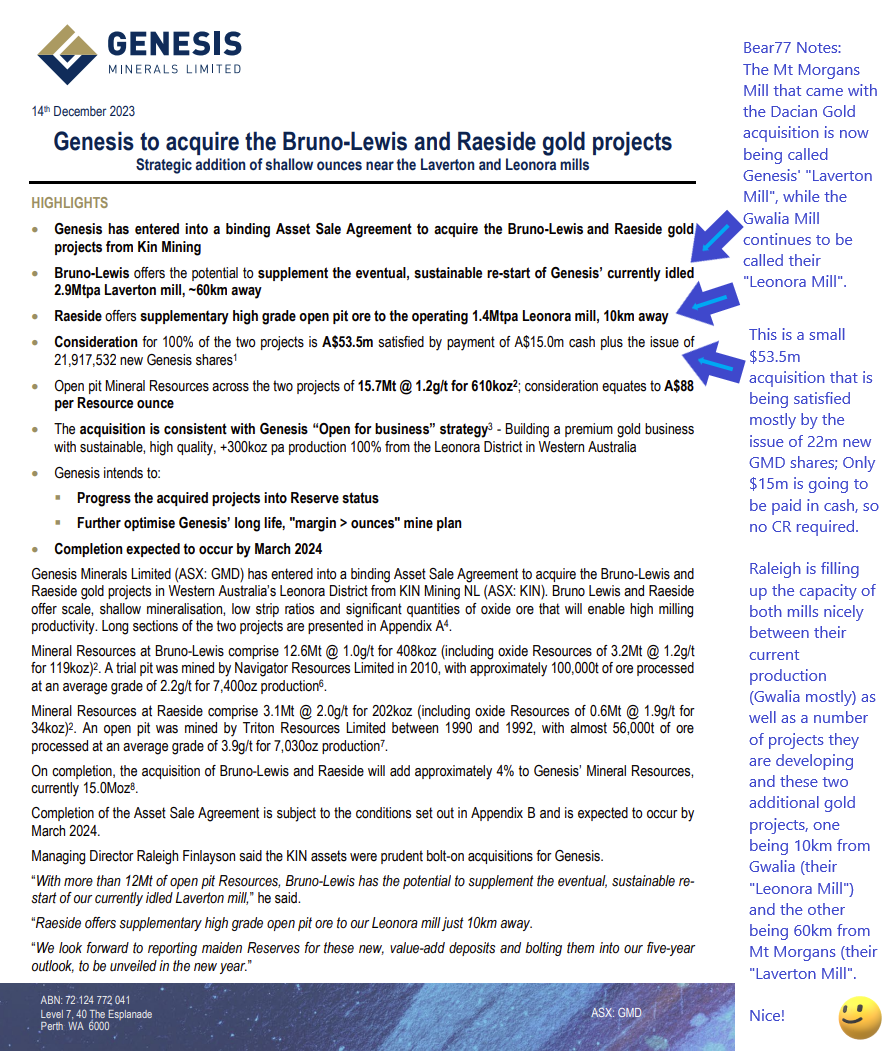

14-Dec-2023: Genesis (GMD.asx) has just agreed to buy a couple more gold projects, this time from Kin Mining (KIN.asx).

GMD-to-acquire-the-Bruno-Lewis-and-Raeside-gold-projects.PDF

GMD-Reporting-on-select-Kin-Mining-gold-projects.PDF

Kin-Receives-$535m-from-Sale-of-Gold-Deposits-to-Genesis.PDF

That's $53.5m, not $535m as the KIN announcement file name suggests - can't have dots in the middle of file names - I wish companies would stop doing that, as it can give an entirely wrong impression until people open the announcement and read it properly.

Below is the first Page of GMD's first announcement, with some notes from me on the right:

Map from page 2 of that same announcement:

As I write this, GMD's SP is up +8% at $1.80 (closed at $1.665 yesterday), however they spiked up to as high as $1.90 this morning which was +14.1% above yesterday's close. They got down to below $1/share in mid March, so they're up over +80% from there.

KIN is up +10%, but were up +16.7% earlier at 7 cps (closed at 6 cps yesterday, currently trading at 6.6 cps).

The rise in the GMD share price today might seem a bit overdone for such a small acquisition, but it's more about the fact that the market may be coming around to my way of thinking in terms of Raleigh being less likely to be bidding for RED (Red 5) now. My argument is that RED has now become too expensive, and their mill is no longer needed by GMD now or in the near term, AND that SLR have a blocking stake in RED that they would almost certainly use to frustrate any takeover of RED that GMD might attempt. It would be a negative if Raleigh tried to go after RED at current levels because he would almost certainly be overpaying, however with every small acquisition like this the likelihood of GMD making a near-term bid for RED reduces in the eyes of the market.

In short - the roll-up (growth via acquisition) model remains intact without Genesis clearly overpaying for any assets that they are acquiring - so all good, thesis remains on track. The market is liking the progress to date.

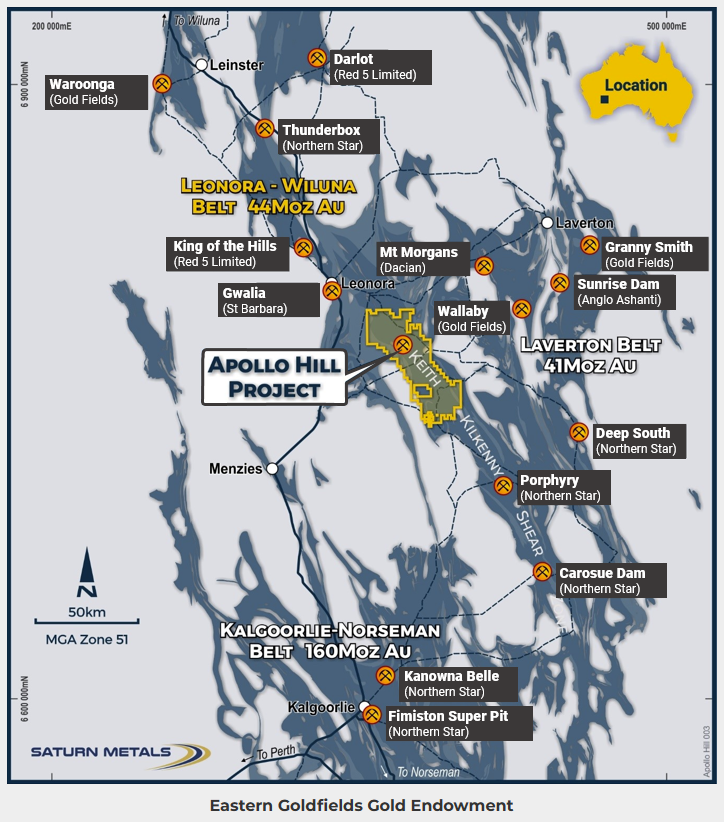

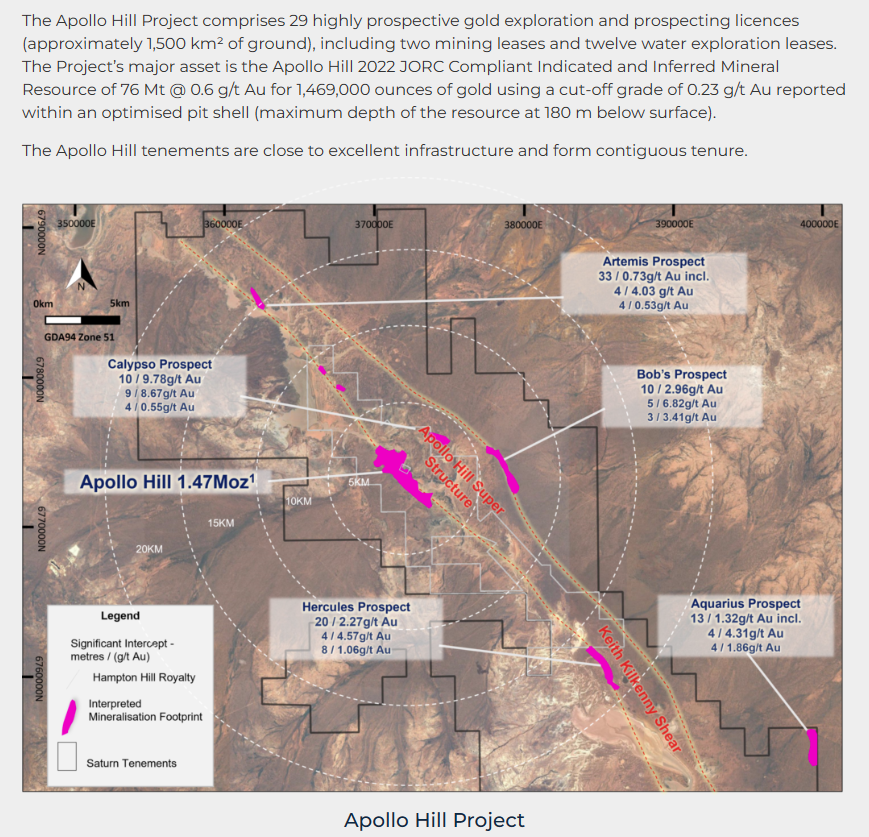

Sidenote: Saturn Metals' (STN's) Apollo Hill gold project is absolutely in the firing line for Genesis Minerals. Apollo Hill is around 40km south east of the Gwalia (Leonora) Mill. RED's KOTH (King of the Hills) mine and mill are around the same distance north west of Gwalia/Leonora (see map above). RED's market cap is $1.17 Billion. STN's m/cap is less than $40 million - currently $33.46m according to the ASX website. Genesis could buy all of Saturn (STN) for less than $100m, or just Apollo Hill, although the price difference wouldn't be much considering Apollo Hill is STN's main asset. They bought it off Peel Mining (PEX) in mid-2017.

That's from the Saturn Metals website: https://saturnmetals.com.au/projects/apollo-hill/

...which needs to be updated - as it shows Gwalia as still being owned by SBM and Mt Morgans still being owned by Dacian (which is now 100% owned by Genesis) - plus it shows Apollo Hill as having 1.47 Moz (million ounces of gold) in the ground (see below) but the up-to-date map from today's GMD announcement (scroll up for that - towards the top of this straw) shows Apollo Hill as having 1.8Moz. Not particularly high grade, but close to Leonora. Raleigh would have an eye on that one for sure.

Disclosure: I hold GMD shares, and I have STN on a watchlist now.

That's a better buy than RED is at current levels - for sure. The major differences are that RED are in production, have WAY more gold, at higher grades, and a very decent mill as well, but they're priced for all that at over $1 billion. So STN is high risk for sure, and RED is expensive but de-risked. If I was to invest in STN, it would be an appropriately small punt rather than an investment, because they don't make any money, and they could go broke if they're not taken over by somebody like Genesis. High risk means I would put way less money at risk, but I'm not pulling the trigger on them yet - just on a watchlist for now.

07-Dec-2023: Genesis-now-owns-100-per-cent-of-Dacian.PDF

Dacian Gold (DCN) has now been removed from the ASX list. As I have said elsewhere (here), with full control of the Mt Morgans Mill (that DCN owned), as well as full control of the Gwalia Mill (that Genesis bought from SBM at the end of June), Genesis now have sufficient ore processing capacity in the Leonora (WA) area to satisfy their immediate and near-term requirements, so there is no pressing need for Raleigh Finlayson to go after Red 5 (RED) and their KOTH (King of the Hills) Mill, which has been widely expected by the market, and is one of the reasons why the RED share price has been on a tear over recent months.

I'm fairly certain that Raleigh won't make any moves on RED in the next few months, certainly not while their share price is so high, and with SLR (Silver Lake Resources) owning 11.08% of RED (a blocking stake) and SLR's Luke Tonkin having form for going out of his way to frustrate Raleigh when he was purchasing SBM's Leonora assets for Genesis (GMD) earlier this year. I hold GMD shares by the way, and I'm very happy with their progress so far.

And I'm also very happy to be OUT of SBM.

27-Nov-2023: Just noting (1) that GMD hit a new 12 month high closing price of $1.76 today and also reached an intra-day high of $1.785, another record, and (2) that despite holding them both here and IRL, I haven't posted any straws on the company.

That ends now!

Firstly, the company is in a sector with some tailwinds - gold was one of only two sectors in the green today (see below) and secondly, it's a growth story via both organic and acquisitive growth - in fact Raleigh Finlayson has been very upfront about his intentions to roll up all of the good gold around Leonora into Genesis Minerals (GMD), and he's already bought all of SBM's Leonora gold and gold producing assets, including Gwalia, Australia's deepest operating gold mine, the 1.4 Mtpa Gwalia Mill, and some advanced gold projects around the same area (Tower Hill open pit, Zoroastrian high grade underground mine, and others) to add to the ones GMD already had, plus Dacian Gold is also now 100% owned by GMD, which comes with their Mt Morgans 2.9 Mtpa Mill, with more than twice the current annual ore processing capacity of the Gwalia Mill.

If a picture is worth 1,000 words, the following should be worth around 20,000 words...

Above: Gwalia Gold Mine, circa 1921. Below: Gwalia today (or recently).

And Below - the Mt Morgans Gold Mill:

d

Zenith Energy's BOO (Build-Own-Operate) Power Plant at Mt Morgans (above) and Mt Morgans Mill by night (below) during commissioning by GR Engineering (GNG).

They are also the 4th most shorted company on the ASX according to Shortman.com today. They were the third most shorted company last week:

But Core Lithium have leapfrogged them since I took that screenshot, so GMD are now the 4th most shorted.

The GMD shorting may have peaked however, and we may have seen a little short squeeze today (GMD +6.5 cps or +3.83% to $1.76).

The screenshot below is from this evening:

Source: https://www.shortman.com.au/stock?q=GMD

That data does not include today as there is 4 day lag, as explained above.

In terms of WHY people are shorting Genesis, the prevailing theory seems to be all about Red 5 (RED) and that either (a) that Raleigh's Leonora Consolidation Plan is going to turn pear-shaped now that Silver Lake Resources (SLR) own 11.08% of RED (bought as a "strategic investment" according to SLR's MD, Luke Tonkin) and have proven to be adversarial towards Raleigh and Genesis by putting in multiple rival bids to try to prevent Genesis from acquiring St Barbara's Leonora assets earlier this year despite SLR having zero assets in the Leonora area themselves (so zero obvious synergies for SLR), or (b) that Raleigh is going to end up overpaying for all of RED - based on Genesis paying over-the-odds to mop up the final 20-odd-per-cent of DCN - and that will cause a negative re-rate of Genesis by the market at that time.

In reality, Genesis don't actually need RED and their KOTH (King of the Hills) gold mill now that they (Genesis) have full control of both the 1.4 Mtpa Gwalia mill and the 2.9 Mtpa Mt Morgans mill. I'm sure Raleigh is still interested in acquiring RED, purely as part of his Leonora gold asset consolidation plan, but he doesn't have any pressing need to do it soon now that he has all the milling capacity he wants for the time being. He can afford to bide his time - so the ball is now in Red 5's court - and their management - to prove that they deserve the positive market re-rating that they've received - RED's market cap has grown to $1.12 Billion now (yes, with a "B", not an "M") and they really don't look THAT good to be honest. They were trading at 13 cps in February and they closed at 33.5 cps today. The market is now valuing RED ($1.12B) as being worth more than SLR ($963m) and SLR have a much stronger balance sheet, a pile of cash, more mines, more mills, better quality assets, and they're producing a lot more gold at much lower costs than RED are. And I don't want to own SLR, due to their management, so I definitely am not buying RED at current levels!! My best guess is that the Red 5 (RED) share price comes down from here as the M&A premium comes out of it. Either way, Raleigh is probably going to ignore RED for a while. He's got plenty to be going on with currently. I'm sure RED will remain on his longer-term radar, but there's certainly no reason for him to move on them while their share price is this high.

About Raleigh Finlayson: The driving force behind Genesis Minerals is Raleigh Finlayson, who built up Saracen Minerals from nothing to be the 4th largest Australian gold producing company on the ASX. Saracen and Northern Star merged, which was effectively an acquisition of Saracen (#4) by NST (#2) at the time. Soon after the merger, Raleigh left NST to build out Genesis Minerals.

Have a look at this presentation that he put together back in August last year (2022) titled "THE FIRST STEP: Merger with Dacian Gold". It didn't end being a straightforward merger, but he got there in the end. The thing to note however is his vision, and how he plans to get there with Genesis. Remembering that he's already done something very similar with Saracen, which was a good ride that ended very well for Saracen shareholders, some of whom were Insto's who have now jumped onboard GMD.

The following article about Raleigh and his sister Marnie - who works for Rio Tinto and is also on the NST Board - is worth a read to get a good understanding about what drives Raleigh - where he has come from, and a little insight into why he does what he does, and where he is doing it (Leonora).

Raleigh Finlayson (GMD) with sister Marnie Finlayson (RIO, NST) near the WA School of Mines in Kalgoorlie. Chuck Thomas

Source: Marnie and Raleigh Finlayson: Rio’s lithium star and her Genesis CEO brother (afr.com) [25 Aug 2023]

Excerpt:

Marnie Finlayson is the battery minerals boss leading Rio Tinto into the decarbonisation era. Raleigh Finlayson is a precious metal stayer chasing more success in gold, where his sights are set on a 126-year-old mine.

The sister and brother grew up tormenting one another on a dusty sheep station in Western Australia. They embody the old-meets-new reshaping of WA’s resources industry in their vast childhood backyard, the Goldfields.

Marnie and Raleigh were raised in the Goldfields, a region as rich in the precious metal as anywhere in the world, a major source of nickel for more than 50 years, and now, a lithium hot spot.

Their entrepreneurial uncles – Peter and Chris Lalor – once controlled a string of gold mines and produced tantalum from assets that are now regarded as world-class lithium discoveries.

Those mines – including Greenbushes in WA’s south-west and Wodgina in the Pilbara – are valued at tens of billions of dollars. The Lalor brothers were about 30 years too early to capture any of that value.

There is mutual respect between Marnie and Raleigh, who are graduates of the WA School of Mines in Kalgoorlie. There is also plenty of sledging and stirring. Raleigh, who is younger, took years to grow into his oversized ears and was “spoiled rotten” as the baby of the family.

Marnie hates being reminded that he taught her to drive.

If you believe Raleigh, their jaunts in an old ute sometimes took them onto the highway – aged four and seven. Marnie declares he’s a notorious teller of tall tales.

Marnie, Rio’s managing director of battery minerals, is keeping a close eye on the lithium projects springing up in the wider Goldfields region. Raleigh, as boss of Genesis Minerals, is digging into family history after Genesis’ $628 million acquisition of the Gwalia gold mine once controlled by their maternal uncles.

The familial ties go further: Genesis also has gold projects, including Ulysses, on land once part of their paternal grandfather’s Melita sheep station.

Marnie and Raleigh are both excited by the emergence of lithium in the Goldfields, where Lynas Rare Earths is building a downstream processing plant at Kalgoorlie.

“I think it’s brilliant,” Raleigh says.

“When gold has had its really low days, nickel has supported it and vice versa. All of a sudden we’ve got another commodity [lithium] or commodities when you think about rare earths, that help support the region. You don’t have that sort of feast or famine, and it’s more sustainable.

“I remember not that long ago you couldn’t sell a house in Kalgoorlie and now suddenly, you can’t get one.”

Marnie, Raleigh and their older brother, Daniel, grew up on Jeedamya Station near Leonora.

All three spent school holidays working at the Gwalia gold mine, about 40 kilometres from their home, when their uncles were directors of Sons Of Gwalia. The mine’s long history includes a chapter late in the 19th century when it was run by Herbert Hoover, later the 31st president of the United States.

The 46th president, Joe Biden, has fired up lithium interest in the wider Goldfields region through his Inflation Reduction Act.

Marnie was hooked on mining from the start. Raleigh grew to love it. Daniel has his own successful business on the WA coast making cray pots, the traps used to catch lobster that fetched huge prices on the Chinese market before Beijing’s trade war in 2020.

No childhood on the Goldfields where sheep eventually gave way to cattle can be described as idyllic.

“We grew up in quite a difficult environment. We loved it and hated it at the same time, growing up on the station and working hard,” Marnie says.

Raleigh says: “It was tough just about every year, but a drought would make it even harder. But every year was a good year as far as how tight the family was and continues to be. So for us, there was no better childhood to be blunt, as hard as it was.”

Pocket money

Even shovelling rocks at Gwalia for $5 an hour could not dissuade Marnie from mining.

“I shovelled rock for 12 hours a day. It was my first experience in the industry and I absolutely loved it. From the first moment I started, I knew that the mining industry was absolutely the one for me,” she says.

Marnie presented a battery minerals strategy she developed to the Rio board at the end of 2021. She has lived in Serbia, where she was in charge of Rio’s Jadar lithium project and also ran Rio’s borates operations in California.

The Rio board was sufficiently impressed to back it and make her head of battery minerals.

Why a passion for battery minerals for someone who grew up in the Goldfields, and agreed to join the board of another gold miner, Northern Star, last year?

“I’m passionate about ensuring that mining delivers the materials that are required for the energy transition because I believe that’s critical for ensuring there’s a good future for my children and their children,” she says.

“I see myself in a perfect position to be able to mobilise that, not just through the materials that are produced through the battery materials strategy, but more importantly – and this is Rio’s objective – how they are produced. We’ve got an overall societal challenge about ensuring that mining is done in a sustainable manner.”

Marnie joined Northern Star’s board after Raleigh’s departure as its managing director.

Will they ever work together? “You never say never,” Marnie says. Chuck Thomas

Superpit

It was around August 2021 when Raleigh started to think about his next big challenge after deals that included Saracen’s $1.1 billion acquisition of a half share in the Superpit mine on Kalgoorlie’s doorstep, and a $16 billion merger with Northern Star. His gold industry contemporaries Bill Beament and Jake Klein were lamenting the investor focus on decarbonisation and related minerals.

Asked by The Australian Financial Review in March last year about why he stuck with gold and set about consolidating Leonora, Raleigh replied: “It would have been the easy and obvious option to flip out of gold and into the new fancy metals.”

Today, his response is more even-handed.

“It’s what I know,” he says.

“I could very comfortably go to those [Genesis] shareholders and articulate the strategy and articulate that we’ve got good knowledge of the area and that we have operated lots of mines to be able to get that type of equity over the line at zero premium or zero discount.

“If it had been a green metal and I’m sitting there trying to convince myself – let alone my shareholders – that I’ve got experience and knowledge in that space, it is probably a different conversation.”

Raleigh acknowledges that lithium has “gone beautifully” since he opted to stick with gold. He also points out the gold price is hovering at about $3000 an ounce compared to about $900 an ounce when he started out at Saracen.

Peter and Chris Lalor founded the third and final iteration of Sons of Gwalia in the early 1980s, and turned the listed company into one of Australia’s biggest gold producers at its peak. Things went badly in the mid-2000s.

Early bets

In its heyday, Sons of Gwalia was the world’s biggest supplier of tantalum to the electronics industry. Most of it came from Greenbushes, whose abundant lithium was largely ignored.

Greenbushes is now considered the world’s best hard rock lithium mine and is owned by New York-listed battery chemical giant Albemarle, China’s Tianqi and its partner, IGO Limited.

In 2002, the late Peter Lalor said there was no magic in “new metals” after having his fingers burnt on a mistimed lithium venture once.

Hype around lithium and its use in ceramics, glass, speciality steels and even treating bipolar disorder in the 1990s had compelled Sons of Gwalia to build a lithium plant next to the Greenbushes tantalum plant.

Lalor described how a rival producer out of Chile ruined his plans to dominate what was then a small global market in lithium.

“They had a much lower cost of production and, basically, we were not competitive,” he recalled. “It was essentially a better ore body in the form of a brine deposit, which meant the lithium was recovered in an evaporative process. A hard-rock ore body can never compete with that.”

The brine versus hard rock debate rages today, but these days the big players Albemarle, SQM, and future partners Livent and Allkem, keep a foot in both camps.

Rio too; it acquired the Rincon brine project in Argentina for $US825 million last year and hasn’t given up hope on the Jadar lithium-borates project despite Serbia revoking its licences and approvals in January last year.

Living in Serbia opened Marnie’s eyes to the pace of electrification in Europe. “I really got to understand the importance of batteries for the energy transition and became very passionate about it,” she says.

“We as an industry have a role to play to show how mining can be done well, and how we minimise the impacts and how important it is to the future.”

Small world

Raleigh bumped into old mate and Northern Star chief executive Stuart Tonkin, another WA School of Mines alum, on the streets of Kalgoorlie.

“Stu goes, ‘I always suspected Marnie was better and smarter than you, and now it’s been confirmed’,” he recalls. “I said, ‘Mate, I didn’t have to suspect it. I’ve always known it’.”

Raleigh, who turns 45 in November, says their professional paths are likely to cross in either an executive or non-executive capacity somewhere down the track after the near-miss at Northern Star.

“We do talk a lot about what she is seeing and thinking and ditto for me. We sort of mentor each other in lots of ways, provide support and spitball different ideas,” he says.

Marnie says Raleigh didn’t apply himself in the classroom but had a lot of fun. His boarding school encouraged him to get an apprenticeship, and their father suggested the army.

His second job, after Gwalia, was working part-time at the Superpit.

“One thing Ral and I absolutely share is a passion for people, and we’ve got very similar leadership styles. We just apply them in different types of companies,” Marnie says. “We do talk a lot about leadership.”

Will they ever work together? “You never say never,” Marnie says. “If you’d told me five years ago, ‘You’ll be managing director of battery minerals for Rio Tinto and sitting on the Northern Star board’, I would have laughed.”

--- end of excerpt ---

See Also: https://ceoworld.biz/directory/exec/raleigh-finlayson#

And: (25) Raleigh Finlayson | LinkedIn

And: Raleigh Finlayson Excellence Redefined_Ep11_WASM Alumni Podcast | WASMA Mining & Resources Podcast (podbean.com) [14-Nov-2018]

And: Finlayson starts from the beginning with Genesis | The West Australian [22-Sep-2021]

And: Finlayson to spearhead Genesis Minerals - Australian Resources & Investment (australianresourcesandinvestment.com.au) [23-Sep-2021]

And: Five or so questions for Genesis Minerals MD Raleigh Finlayson - Stockhead [4-April-2022]

And: Diggers & Dealers 2023: Genesis boss Raleigh Finlayson sees heritage backflip as opportunity for approvals | The West Australian [9-Aug-2023]

Genesis Minerals Managing Director Raleigh Finlayson during the 2023 Diggers & Dealers Mining Forum on Wednesday August 9, 2023. Photo Credit: Carwyn Monck/Kalgoorlie Miner.

Disclosure: Yeah, I do hold GMD shares, both here and in my larger real money portfolios, including my SMSF. I wouldn't be betting against Raleigh. He's got the form, and the backing, and the determination, and he's not half bad at what he does either. Really top-notch calibre and highly-driven Management is often the key to success in industries with a heap of different players, like the gold industry, and Raleigh ticks all of the boxes.

Post a valuation or endorse another member's valuation.