@TEP, thanks for the great write up, and making me take a better look at this company. I don't have much to add to your analysis but I wanted to look into the history of Halo myself before I bought in as I am always a bit wary when the insiders are selling out but then found your other straw that gives a good explanation of how this has occurred and why the insiders are really disgruntled outsiders now. Without that I would have been pretty wary still.

Anyway I thought I would look into how they were going to turn around a loss making enterprise and just went back through the last 2 years of announcements to see what they have been doing and management have been pretty busy getting this going, expanding production facilities and distribution channels, winning contracts, and the turnaround while early looks pretty evident to me. They give a lot of good information are are transparent in their quarterlies so tick for a management on this. Also the name change from Keystone to Halo and the associated branding is also on point I think.

Not much new insight from me but thought this might be of interest to someone. Of note is that they haven't made a bad announcement in this whole period.

Timeline of what they have announced to the market since Nov 2020-

9-11-2020- Milk powder supply agreement 2yr term, then ongoing option – NZ$7.1

18-11-2020- Expanded distribution network for Tonic products

24-11-2020 – Increased sales order from Nouriz China NZ$3.1M forecast upgraded from 2.5M

7-12-2020 – Awarded Coles private label tender - $5.2M

29-1-2021 December quarterly (Q3)- 12.6M sales – $90K cashburn

5-3-21 – 16.5M performance shares issued to Keystone owners (who are selling out)

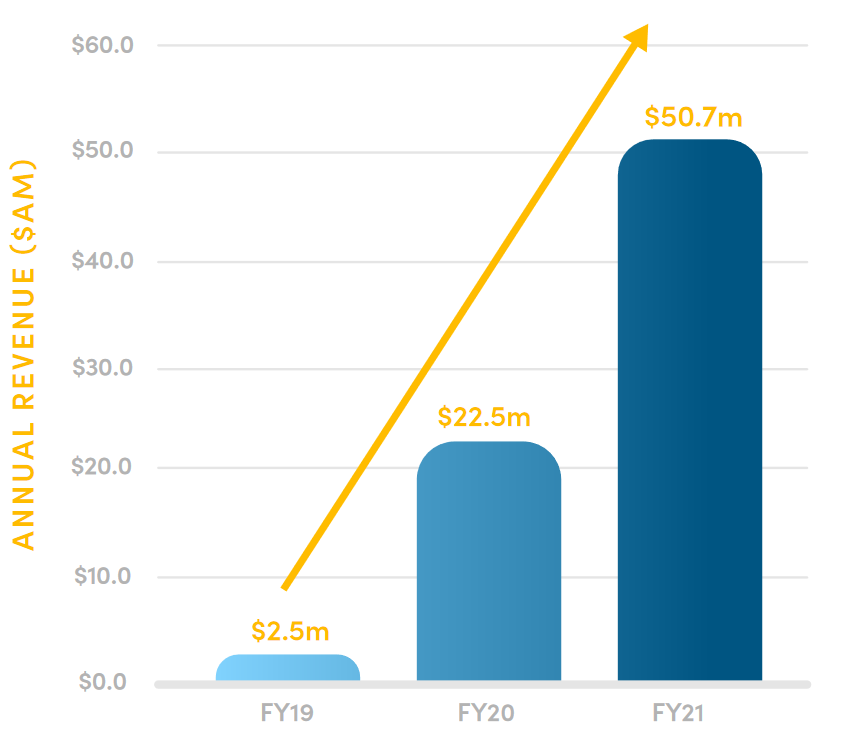

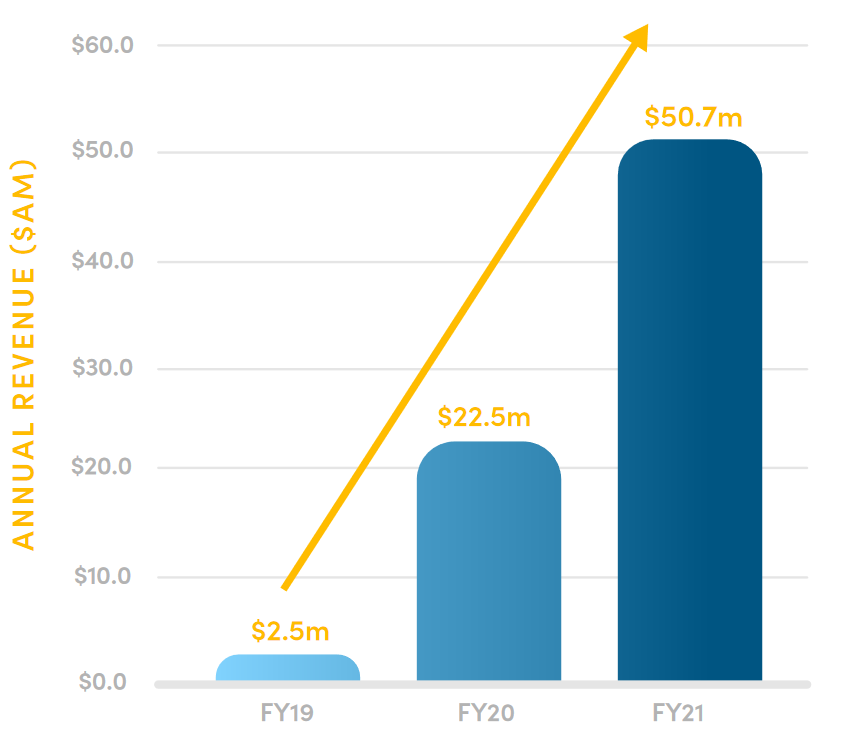

20-4-21 FY21 revenue results – 50.7M revenue (up 125%)

30-4-21- Quarterly – cash burn $3.065M

24-5-21 – triple sales to Walmart China for 5 months to May vs pcp (3.3M vs 1.2M NZ$) + a further 1.4M in next quarter.

26-5-21 Launched Tonik energy

16-7-21 Debt financing in place – NZ $1M, $7M Aus 9.8M available to drawdown on.

26-7-21 Coles contract execution - $800K first 2 months

30-7-21- June Quarterly cash burn $1.036M

19-8-21 Supercubes plant based bars stocked nationally by Woolworths

30-8-21 New milk powder supply into China – through Theland- $1.8M for Dec quarter

2-9-21 Strong order growth for their upgraded and expanded snack and bar manufacturing plant. >2M initial orders

29-10-21 – September Quarterly 15M sales and 13.3 cash receipts (5.7M of sales in September alone) cash burn 2.27M

9-11-21 Change name from Keytone to Halo

10-11-21 $40M (US$) partnership with Theland to sell powdered milk products into China, 2 yr term. Initial US$1.5M manufactured by end of Nov 21

12-11-21- Awarded 2nd Coles private label tender start 1st quarter 2022 - $3.3M/yr

30-11-21 – H1 results 27.8M revenue – net loss of 2.8M (3M in 2020)

31-1-22- December quarterly (Q3) 17.5M revenue and positive cashflow of $2.6M

I also liked this chart from their annual report, I would rather profit but revenue is a good starting point. This year (FY22, they end in March) they are currently at 44.8M revenue for FY22 (Q1- $12.3, Q2- $15 Q3-$17.5) and based on the way they are reporting their contracts and Monthly records - September was a record -$5.7M, then November -$8M. its not too much of a stretch to think Q4 might see 20M and they should comfortably exceed 60M revenue for the year.