Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Finally,

Can anyone provide any Info regarding my Sharesight Portfolio, will this eventually just be removed?

Not a surprise given the past few years performance

Halo Food Co. Limited (Liquidators Appointed) (Receivers and Managers Appointed)

ASX code: HLF

ACN 621 970 652 (‘the Company’)

Appointment of Liquidators ASX code: HLF

Notice is hereby given that Michael Korda and Robert Hutson of KordaMentha were appointed Liquidators of the Company and the companies in the attached schedule (together ‘the Companies’) on 30 January 2024.

Pursuant to Section 436A of the Corporations Act (‘the Act’) at the Second Meetings of Creditors of the Companies held on 30 January 2024, the creditors of the Companies resolved that the Companies be wound up under Section 439C(c) of the Act and that Michael Korda and Robert Hutson be appointed Liquidators.

As per our previous announcement David Hardy, Ryan Eagle and Emily Seeckts of KPMG were appointed as Receivers and Managers of the Companies on Friday, 25 August 2023. The Receivers and Managers continue to have day to day control of the assets and trading operations of the Companies.

We confirm that the Liquidators have put in place arrangements to respond, free of charge, to members’ and creditors’ queries in relation to the consequences and progress of the external administration.

The contact details of the Liquidators are:

And it keeps getting worse. How can an acquisition in Feb 22 for $17M then be impaired by $11.3M in May23 and sold in Aug 23 for $588,540? Divestment of THM

Halo retains the manufacturing of THM products for 18 months

At the time of purchase this is what we were told.

- A fast growing, profitable and cash generative business, in FY21, THM recorded revenue of ~$21 million and normalised EBITDA of $4 million

- Acquisition price of $17.0 million and a $5.0 million earn-out, subject to revenue and EBITDA performance milestones

Have things really changed by that much? If things are that bad is the company not trading insolvent?

My timing on this one was spectacularly wrong and a lesson hard learnt. Do not take announcements as being accurate and beware change in management which looks to only serve itself.

Held in SM and RL as so little left it is not worth selling.

Words to make me feel nervous "Strategic Review"

Looks like Halo are looking for a buyer after employing Modus Partners to undertake a strategic review of the company.

Hold in SM and a small holding IRL

Slightly higher shelf in a different Woolworths but already at 1/2 price!

Oh dear!

it seems someone has noticed that HLF have advertised their manufacturing premises for auction on the 2nd of March. They’ve been issued a “please explain” by the ASX and the answer is a bit of time-saving fluff

Not sure what this does for the credibility of management/board and investment thesis.

The Healthy Mummy products at Woolworths. Not exactly premium position on the bottom shelf compared to man/lady shake.

Sales for the 4th quarter (FY end is 31 March) were $14.7m --12% higher than the previous 4th quarter, but 15% lower than Q3 (this was due to unusually high absenteeism due to Omicron which delayed manufacture and dispatch).

That being said, the final month of the quarter was a record for the company, and represented almost half of the total sales for the entire quarter. The company says this shows good momentum going into FY23, but it maybe also represents some catch up from the covid delays described above.

For the full year, FY22 delivered $59.9m in revenue, which is an 18% lift on the FY22. This does not include any contribution from the Healthy Mummy (THM) Acquisition which was consolidated into the company on April 1st.

That's a strong lift, but it's also worth noting that on a per share basis, sales went from 18.6cps in FY21, to 14.9cps in this latest year. Of course, the lift in shares is associated with the acquisition of THM, which last year delivered around $21m in sales -- so if you account for that sales per share come in around 20.2c -- around 9% higher. Not bad, but half the growth that management highlight (remember, our ownership currency is on a per share basis).

One area of concern was a 40% lift in raw materials cost (hello inflation!) and a rise in staff costs as casual labour was employed and overtime incurred to mitigate the covid related absenteeism, but these employee costs should normalise going forward.

The company did improve its cash burn despite these challenges -- with the business down $3.9m compared to $8.2m in the prior year. It still has $8.9m in the bank.

THM, though not captured in this reported period, did see a 13% uplift in revenue for March compared with a year ago. Digital subscriptions were up 22% and app downloads were 40%.

There's a lot more detail that you can dive into in the actual ASX announcement (here)

But all told, you have a business on something like $80m in forward annual revenue, currently trading at around $24m market cap. Of course, it's still sub-scale and is very much a low margin, volume dependent business -- and one facing cost pressures and that operates in a cyclical and discretionary sector. Still, @TEPCapital has laid out a good case and there certainly seems to be a good margin of safety in the price.

I hold a small parcel on SM and in real life.

Article in today's Australian "Cash ban for online health spruikers"

https://www.theaustralian.com.au/nation/cash-ban-for-online-health-spruikers/news-story/5c02b45e705e7e76ab1cc1f2c70c0401

I wonder what the impact will be for advertising for HLF and costs for THM marketing.

The New Code clarifies the position.

- Paid or incentivised testimonials, regardless of whether any payment is disclosed, or the testimonial is genuine, are prohibited.

- While genuine unpaid testimonials are permitted, under the New Code, influencers, direct sellers and anyone else who receives “valuable consideration” for their testimonial are taken to be persons “involved with the production, sale, supply or marketing of the goods” (and therefore prohibited from providing testimonials).

- “Valuable consideration” is broad and would include non-monetary items such as services, gifts, opportunities, or any other incentive. During a webinar on 17 February 2022, the TGA indicated that all advertising that includes paid or incentivised testimonials that is currently live and accessible (including on social media) will need to be taken down by 1 July 2022, even if uploaded prior to that date.

- Brand ambassadors can endorse a therapeutic good (that is, provide an expression of support for a product or brand) provided the endorsement does not refer to the person’s personal experience using the good (which would amount to a testimonial). Endorsements must also meet specific requirements under the New Code. For example, if the endorsement refers to health benefits, the endorsement must be typical of the benefit that can be expected from the goods when used in accordance with the label and the approved indication and use.

- The New Code also prohibits endorsements by particular people and organisations, including brand ambassadors who represent themselves as having expertise or qualifications in a health-related field, current and former health practitioners, and medical researchers.

https://www.kwm.com/au/en/insights/latest-thinking/major-changes-to-the-therapeutic-goods-advertising-code.html

@TEP, thanks for the great write up, and making me take a better look at this company. I don't have much to add to your analysis but I wanted to look into the history of Halo myself before I bought in as I am always a bit wary when the insiders are selling out but then found your other straw that gives a good explanation of how this has occurred and why the insiders are really disgruntled outsiders now. Without that I would have been pretty wary still.

Anyway I thought I would look into how they were going to turn around a loss making enterprise and just went back through the last 2 years of announcements to see what they have been doing and management have been pretty busy getting this going, expanding production facilities and distribution channels, winning contracts, and the turnaround while early looks pretty evident to me. They give a lot of good information are are transparent in their quarterlies so tick for a management on this. Also the name change from Keystone to Halo and the associated branding is also on point I think.

Not much new insight from me but thought this might be of interest to someone. Of note is that they haven't made a bad announcement in this whole period.

Timeline of what they have announced to the market since Nov 2020-

9-11-2020- Milk powder supply agreement 2yr term, then ongoing option – NZ$7.1

18-11-2020- Expanded distribution network for Tonic products

24-11-2020 – Increased sales order from Nouriz China NZ$3.1M forecast upgraded from 2.5M

7-12-2020 – Awarded Coles private label tender - $5.2M

29-1-2021 December quarterly (Q3)- 12.6M sales – $90K cashburn

5-3-21 – 16.5M performance shares issued to Keystone owners (who are selling out)

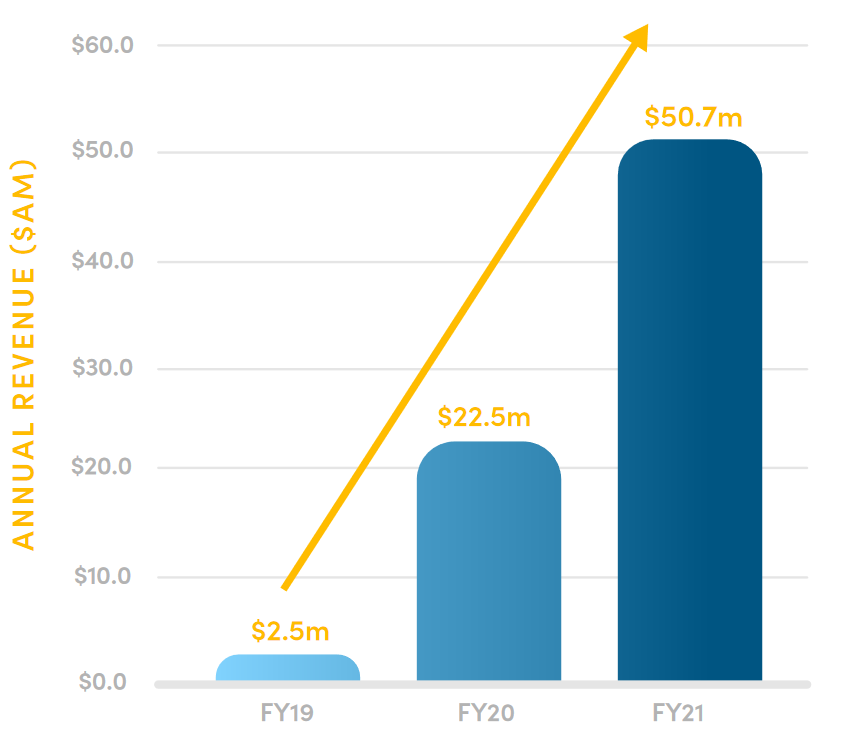

20-4-21 FY21 revenue results – 50.7M revenue (up 125%)

30-4-21- Quarterly – cash burn $3.065M

24-5-21 – triple sales to Walmart China for 5 months to May vs pcp (3.3M vs 1.2M NZ$) + a further 1.4M in next quarter.

26-5-21 Launched Tonik energy

16-7-21 Debt financing in place – NZ $1M, $7M Aus 9.8M available to drawdown on.

26-7-21 Coles contract execution - $800K first 2 months

30-7-21- June Quarterly cash burn $1.036M

19-8-21 Supercubes plant based bars stocked nationally by Woolworths

30-8-21 New milk powder supply into China – through Theland- $1.8M for Dec quarter

2-9-21 Strong order growth for their upgraded and expanded snack and bar manufacturing plant. >2M initial orders

29-10-21 – September Quarterly 15M sales and 13.3 cash receipts (5.7M of sales in September alone) cash burn 2.27M

9-11-21 Change name from Keytone to Halo

10-11-21 $40M (US$) partnership with Theland to sell powdered milk products into China, 2 yr term. Initial US$1.5M manufactured by end of Nov 21

12-11-21- Awarded 2nd Coles private label tender start 1st quarter 2022 - $3.3M/yr

30-11-21 – H1 results 27.8M revenue – net loss of 2.8M (3M in 2020)

31-1-22- December quarterly (Q3) 17.5M revenue and positive cashflow of $2.6M

I also liked this chart from their annual report, I would rather profit but revenue is a good starting point. This year (FY22, they end in March) they are currently at 44.8M revenue for FY22 (Q1- $12.3, Q2- $15 Q3-$17.5) and based on the way they are reporting their contracts and Monthly records - September was a record -$5.7M, then November -$8M. its not too much of a stretch to think Q4 might see 20M and they should comfortably exceed 60M revenue for the year.

Thanks @TEP.

Always look forward to your highly knowledgable input.

I have never got into TA, but realise it must have a place in investing.

Regarding the SP graph and the various points your draw:

- would it be fair to say the there would have to be compression of these ribbons? The only way they could not compress would be if the SP somehow became negative - otherwise the downward slope is going to have to level off?

- This is in no way meant to subtract from your otherwise excellent thesis on HLF!

Thx @TEP. It was so far away I missed it!

Hi TEP

which bubble is Halo? Or am I being dim?