Hansen has proven to be very reslient in the face of covid, as you would hope given the core role it plays for utility customers.

Revenue rose 30%, while EBITDA and NPATA were up 34% and 41% respectively. On a per share basis, earnings were 40% higher at 23.9c (on a NPATA basis, which excludes non-cash amortisation of acquired customer lists).

Hansen paid out 10c in dividends (including a 2c special dividend) in FY20. That represents a 46% payout ratio and puts it on a trailing 2.5% yield (exc. Special div).

The company also managed to pay down a chunk of debt, reducing the total by 23%. (Sigma was entirely debt funded)

Free cash flow was really strong at $44m, only just behind the reported NPATA of $47.4m, and almost 50% above FY19.

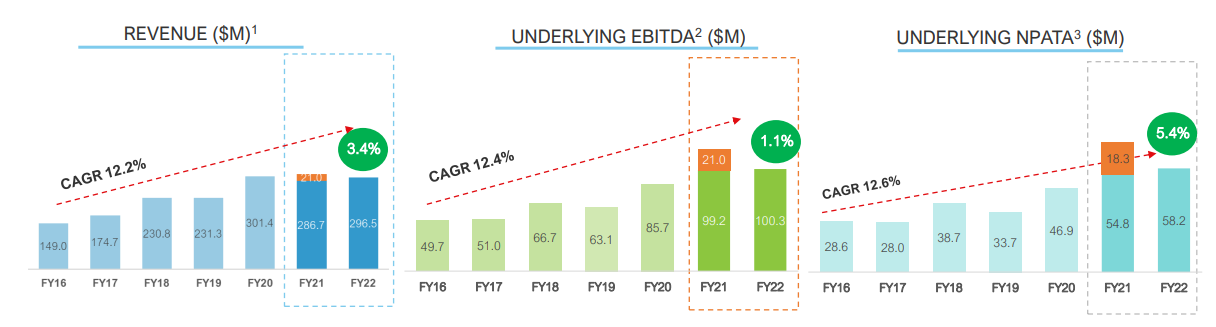

This big jump in profits was due to the acquisition of Sigma last year -- the biggest purchase in the company's history (being debt funded, there was no material increase in the share count). Organic revenue growth was only 2.9%.

Overall, these results came in slightly better than I expected (see previous Straws), and have underscored the quality of the business and management.

This is a company that is all about growth by acquisitions -- something that should normally make you nervous. But Hansen have been doing this for 20 years, creating significnat wealth for shareholders over that time and reinforcing a strong competitive position.

They are good at what they do.

Although organic growth is usually around single digit levels, the revenue generated is very reliable and high margin (16% net margin).

Over the past 5 years, per share earnings have compounded at an average annual rate of growth of 16% and i think low double digit growth is likely for the next 5 years.

Happy to continue holding this for many more years, with a view to accumulate more whenever the market worries over short term factors.

Results presentation is here