Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 3.48% and in SM

HSN’s long-standing Chairman, David Trude, sold a bit under 50% of his HSN holdings.

Not a good look at first glance, but on poking around:

- Bought with his own coin, 40,000 shares on 2 May 2011

- Bought with his own coin, 60,000 shares on 5 Mar 2014

- Thereafter up to today, he has been acquiring shares via the HSN Dividend Reinvestment Plan and any sales have been in and around these DRP shares, so very small ins and outs

After 14 and 11 years of holding, fair enough, won’t hold this sale against him ...!

Discl: Held IRL 3.39% and in SM

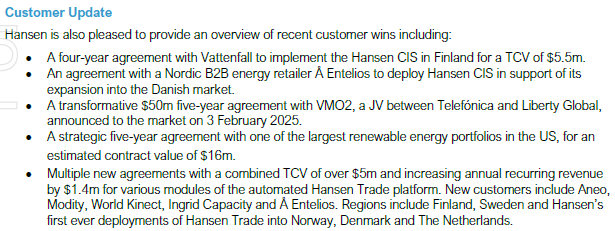

No change to the FY26 outlook in today’s FY25 AGM, but the Customer Wins slide provide good confidence of a good year ahead.

Discl: Held 2.90% IRL and in SM

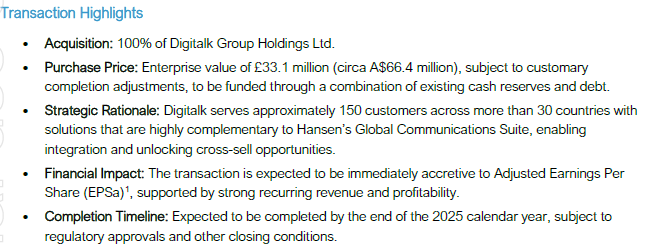

Just finished listening to the recording of the HSN call on the announcement to acquire 100% of Digital.

SUMMARY

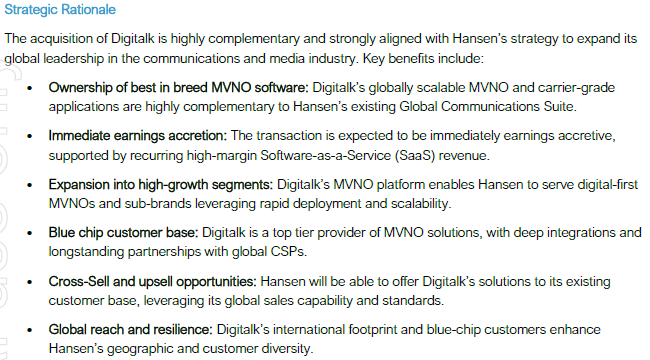

1. Another good, sensible acquisition which ticks all the usual HSN boxes for acquisitions - complementary product, cloud offerrings, SAAS product with ~90% recurring revenue, immediately earnings accretive, good culture fit as the business is 30 years old and founder led

2. Cost of $66.4m is no biggie with HSN’s $48.2m cash on hand 30 June 2025 - they will take on $30m debt which is completely fine as HSN has excellent discipline and track record of regularly paying down debt early.

3. Adds a good chunk of 150 customers and global reach to 30 countries and opens up opportunities in the telco wholesale market

4. Management was very upbeat and analysts were very complimentary of the deal unlike the powercloud acquisition call which was dominated by all round concern (which was eventually misplaced ...)

OVERVIEW OF ACQUISITION

- Flagship offering is a full-stack Mobile Virtual Network Operator (MVNO) MVNO-in-a-box platform comprising Billing, CRM, Online Charging System, Provisioning, Interactive Voice Reponse that enables communication service providers to launch, operate, scale and monetise MVNO and sub-brand services rapidly and efficiently.

- Also offers a cloud-based wholesale voice trading platform, including routing, billing, fraud prevention and monitoring, for international mobile carriers and wholesale service providers.

- Opens up the wholesale/reseller market space for voice for telco’s looking to resell their product, particularly 6G where telco’s are looking for other companies to ride of their infrastructure backbone - Digitalk is a full out-of-the-box, global solution for the resellers - all about gaining market share, not to migrate existing customers.

- Digitalk owns the IP.

- Product is very complementary to HSN’s Communications Suite.

- Mission critical software - very long term 10+ year customer relationships, implementation cost + subscriber growth-revenue model - revenue grows as subscriber count grows .

FINANCIALLY

- 30 year-old business, historically profitable, cash generative business - last 3 years have grown 8-10% YoY, successfully expanding into more countries

- Buying from the founder - will remain as advisor to HSN

- 60 UK staff to support 150 customers across more than 30 countries

- FY25 revenue of STG10.5m (over 90% recurring), Cash EBITDA of STG3.3m - acquisition multiple 10x EV to Cash EBITDA, HSN currently trading at 12x

- FY26 impact to HSN is A$11-12m, expect Digitalk to grow the top end of HSN’s 5-7% growth targets

- Not expecting to make any significant changes to the cost base of the business, no mention of any investment - this is a “quality business” was constantly repeated

FUNDING

- $66.4m cost, funded through combination of Cash and Debt, to close before end CY2025, no earn outs

- Increased debt facility by $30m, debt ratio will remain ~0.5 or below, expect to pay that debt down quickly over the next 24 months

- HSN had $48.2m cash at 30 June 2025

Discl: Held IRL and in SM

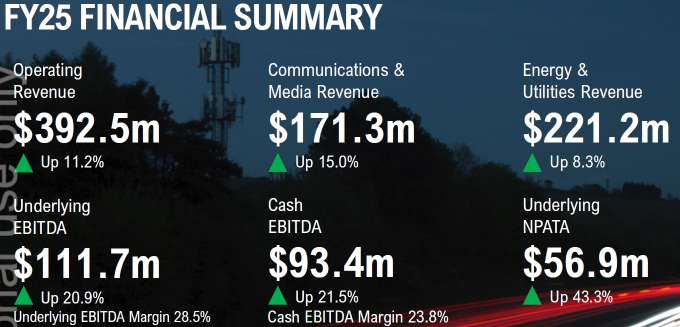

SUMMARY VIEW

- 2H recovered as was guided for FY25 to finish on a very positive note

- Steady-as-she-grows, both verticals doing well - no concerns

- Andrew reiterated that the business outlook is very bright, the business and margins are growing, no fundamental change to business - business continues to execute well and is well poised to capitalise on opportunities

- Not concerned with the broader analyst angst over Licensing Revenue - that is BAU, it will be what it will be

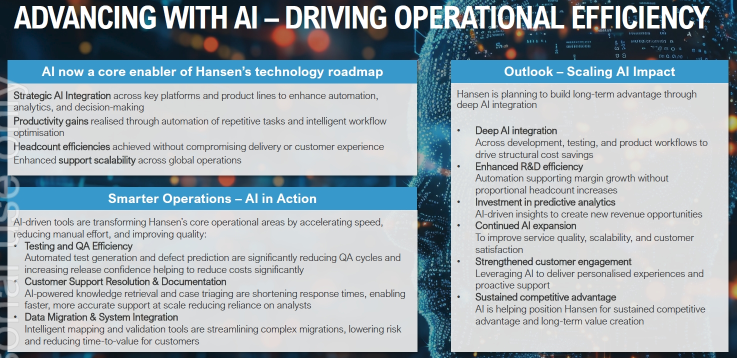

- "AI" has arrived at HSN - sensible use cases, no outlandish promises that it is the mesiah to the promised land, a good thing

KEY TAKEAWAYS

- 2H ended up being stronger as guided - ended the year with ongoing momentum, business in great position

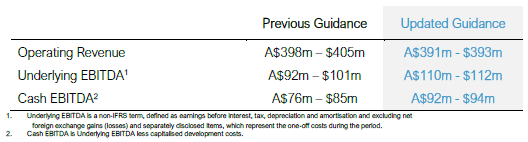

- Operating Revenue - $392.5m, upper end of revised guidance $391m to $393m

- Underlying EBITDA - $111.7m, upper end of revised guidance $110m to $112m

- Cash EBITDA - $93.4m, mid of revised guidance $92m to $94m

- Strong cash generation and conversion - $48.2m cash at 30 June 25, to pay down more debt

- Disclosed R&D Spend Allocation for the first time - Capitalised vs Expensed - $34.5m in FY25 in total, circa 9% of revenue and will stay at these levels

- Big continued focus on Sustainability - good progress on ESG initiatives which are bring externally recognised - important for EU credentials

- No change to the M&A focus and highly disciplined approach, as a vehicle to enter new markets and new verticals - Insurance is emerging as a likely 3rd industry vertical - every deal done has delivered at or above expectation

4 Key Themes

A. Germany, Germany, Germany - that's the immediate focus as Germany moves towards the 2030 Smart Meter timeline

- Powercloud going better than expected - cash generative and positive underlying EBITDA for FY25, customer churn from customers who exited the German market, major release completed in FY25

- Conuti acquisition helps add to German presence

B. AI - AI appears to have “take off” this 2H as there was no mention of AI prior to this update - now a core enabler of HSN’s Technology Roadmap

- Driving automation to automate repetitive tasks, Predictive analytics - improve speed and accuracy, some dabbling into agentic AI - all sensible early and safe use cases

- Not threatened by AI but see it as an enabler, customers are embracing HSN’s view of AI

- Expecting to sustain some headcount reductions via greater use of AI, no outlandish promises

C. License Revenue Angst - this seems to cause a disproportionate amount of angst among the analysts on the call

- Lots of analyst angst at FY25 Licensing revenue was $49m, vs prior years of between $29m and $36m as it is clear that the sharp spike in pure licensing revenue will not recur in FY26

- CFO guided that FY25’s licensing revenue was 12.7%, it typically bounces between 9-12%

- FY26 license revenue expected to be lower, but this is just part of the core business

- Am not concerned with this at all as licensing is typically a small part of an overall software and/or outsourcing deal AND the licensing costing is dictated by, and varies, by customer - it was interesting that the analysts seem totally fixated with this - Andrew mentioned at the back end of the call, that he was very surprised with the focus on this vs the bigger picture - I agree with Andrew

- This might have contributed to today’s price reaction - huge drop to $5.00 before recovering to the close at $5.60 as analysts tried to make sense of what FY26’s numbers might look like

D. Change to Medium Term Outlook vs 12M Guidance - Board decision to focus on the 2-3 year horizon instead of the next 12M, which lines up to how HSN management operates. May have also contributed to the price reaction as well

Overall Outlook

- Management very bullish with opportunities

- Guidance is for (1) organic revenue growth of 5-7% over the medium term and (2) target medium-term Underlying EBITDA margin of 30% or above - seems that Andrew has been reading or talking to SiteMinder’s Sankar Narayan as this HSN guidance feels like it was lifted from SDR’s guidance ...

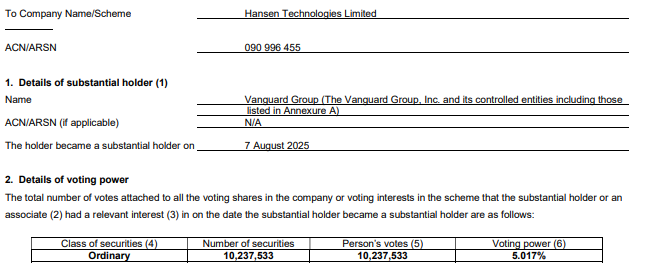

Nice to see Vanguard come onboard HSN between 10 April and 7 Aug 2025, between ~$4.84 and ~$6.15, before the FY25 results. Looks to be quite determined positioning given the buying into the sharp rally to 6.00-ish.

The HSN price has sustained nicely and "decisively" above the ~$6.03 resistance line for the past 1-2 weeks. Given that most of the positive HSN news around FY25 is already out, it does look like a base for the next leg up is forming around these levels.

Discl: Held IRL and in SM

Nice FY25 update from HSN earlier this week:

Revenue looks to be falling $5-6m short of the lower end of the previous guidance - “project timing and customer-drive factors” will shift to FY26, with FY25 YoY growth expected to coming in 11%, 5% excluding powercloud - looks like the shortfall in 1HFY25 revenue could not be fully recovered in 2HFY25.

But this weaker revenue has been more than compensated for by very decent improvements in Underlying EBITDA and Cash EBITDA, showing good operating leverage.

powercloud looks to have performed well, with positive earnings contribution flagged - it has “returned to profitability ahead of expectations at the time of acquisition”.

Not concerned with the revenue shortfall as (1) it feels that this is mostly a timing, rather than permanent, difference and (2) the update on recent customer wins provides good confidence of continued momentum and (3) powercloud has begun positively contributing.

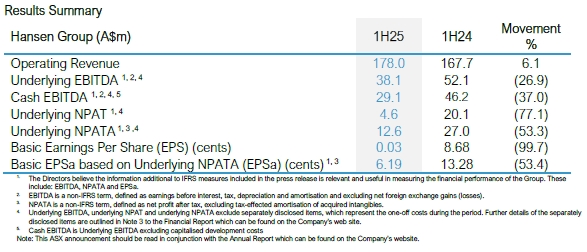

Recap of Notes from 1HFY25 Results

Comparing back at my notes from the 1HFY25 results, this is a good positive outcome:

- Weak result is not great, but signs are that this is temporary and will recover in 2HFY25 - no thesis breaking concerns - TICK

- 2HFY25 revenue and margins looking to be significantly stronger to compensate - TICK, improved Underlying and Cash EBITDA more than compensates for revenue shortfall

- FY25 guidance reaffirmed, Jan 2025 YTD results provide reasonable confidence that this can be met, TICK per comment above

- Powercloud integration and turnaround going well, Cash generative, expected to deliver positive Underlying EBITDA for FY25, as was guided during acquisition - TICK

Chart Update

Market has received the update positively with a nice run up since, breaking above the 200 SMA line. Still range-bound, but expect it to test the upper resistance of ~6.03 soon.

Discl: Held IRL and in SM

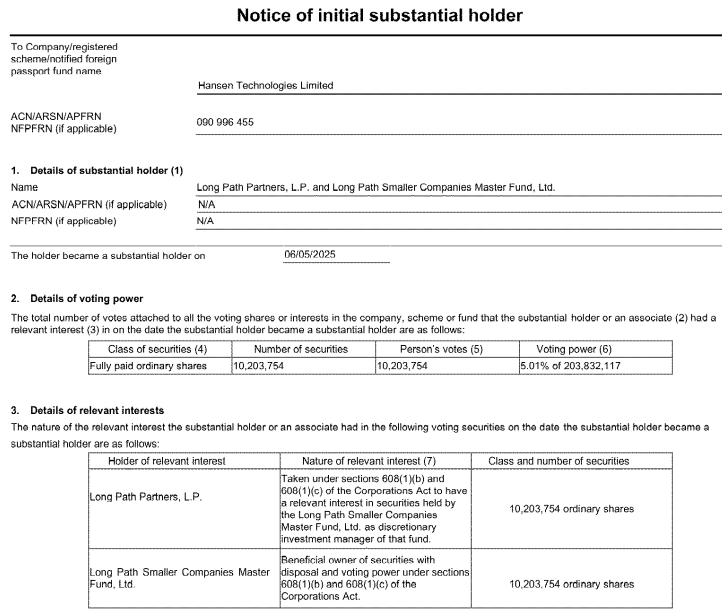

Long Path Partners and Long Path Smaller Companies Master Fund from Stamford, Connecticut, looks to have bought 5.01% of HSN between 19 Feb and 6 May 2025, buying almost daily from the market with average cost around ~$5.20 based on the price action in this window.

Looking at the exact number of shares purchased by both entities to get to 5.01%, this looks like a deliberate buy by the fund - can't be bad for HSN if that is indeed the case ..

Discl: Held IRL and in SM

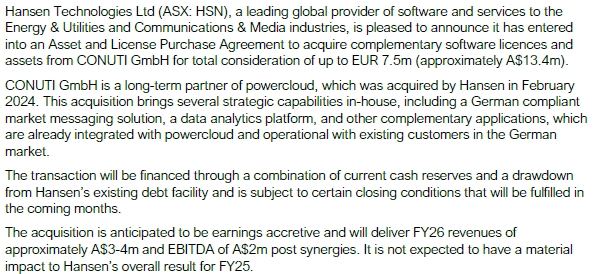

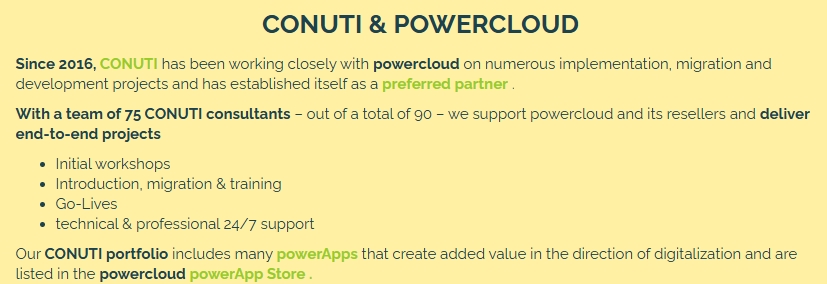

From their website, CONUTI appears to be a powercloud reseller/systems implementer/support/developer/partner - 75 of its 90 (~83%) consultants seem to be supporting powercloud in some shape or form.

The deal appears to be only for the Asset and licenses of several applications which Conuti appears to have developed, which is integrated into powercloud and used by existing powercloud German customers.

At ~3.8x earnings, it will be earnings accretive, cost seems reasonable - would likely have been a good opportunity for Conuti to sell off the software it would have developed "along the way" and allow them to focus back on services.

Cash will not be an issue as HSN was expecting a significant inflow of cash in 2HFY25.

With no detail other than the module names, hard to tell what impact these applications will have on powercloud overall, but it HSN looks like it is doubling down on the German market by adding new Germany-ready software capability into the HSN platform. It follows the small Dial AI, Canadian acquisition a few months back for specific targeted software products that can be easily bolted on to the existing HSN platform. But it makes sense against the “enter Germany/DAC market” strategy.

Discl Held IRL and in SM

Discl: Held IRL and in SM

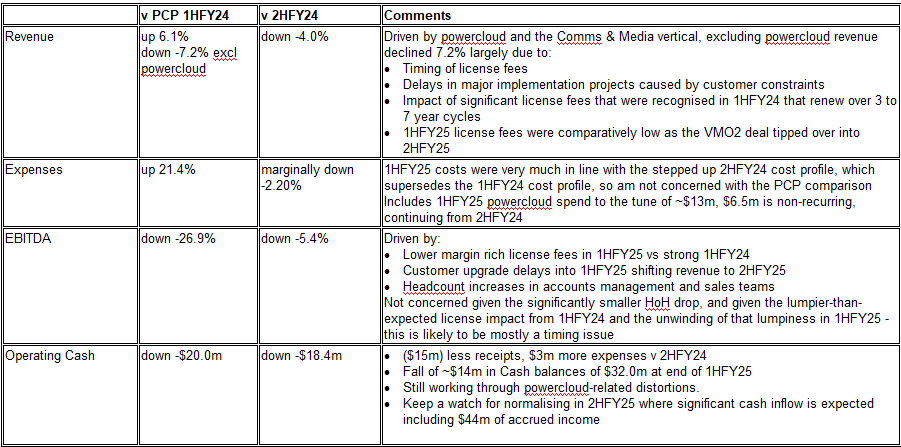

SUMMARY

Weak result is not great, BUT signs are that this is temporary and will recover in 2HFY25. No thesis breaking concerns.

NOTES

Weak 1H result, driven primarily by (1) lower license fees v strong 1HFY24 license renewals which only renew in 3-7 year cycles (2) upgrade delays which shift revenue into 2HFY25 (3) continued powercloud investment.

New wins in 1HFY25 include City of Kingsport water billing modernisation, A Entelios expansion into Denmark, expansion of relationship with Vattenfall and Stockholm Energi.

2HFY25 revenue and margins looking to be significantly stronger to compensate, due to:

- New logo implementations

- Customer upgrades deferred from 1HFY25

- Deals done in 1HFY25 above

- Impact of VMO2 deal signed in Feb - VMO2 wanted term licenses to capitalise, not SAAS, expect to recognise $10m/yr less 5year license fee

FY25 guidance reaffirmed, Jan 2025 YTD results provide reasonable confidence that this can be met:

- Operating Revenue increased $52.0m in Jan to $230.0m

- Underlying EBITDA increased $29.1m in Jan to $67.2m

- Fx impact YTD immaterial and primarily incurs costs in the same countries where it generates revenue

Customer churn continue to be consistently low

Both Energy & Utilities verticals are well positioned for currently ongoing rapid industry transformation

Powercloud integration and turnaround going well:

- Continued significant investment in core product Retail Core Service system, due to be released in June

- $13m invested to restructure business a ‘wholesale change to business’, reduce its fixed cost base and implement Hansen systems and Processes - powercloud is back to prospecting

- Rationalised workforce from 390 to 140, hired new local management, reduced fixed costs by $31m annually

- Cash generative, expected to deliver positive Underlying EBITDA for FY25, as was guided during acquisition

- Revenue growth anticipated from FY26 from German roll-out of smart meters, only recently commencing

- Updates on powercloud will scale back from hereon, in line with practice from previous acquisitions

Small acquisition of a $2.2m 30% stake in Dial AI, based in Canada - AI-powered tool designed to enhance automated customer interactions (sounds like a Whispir-like solution) - this makes sense to add into the Customer Care suite. Focused on energy & utilities, but can be applied to Telco’s

5c interim dividend, partially franked to 3.3c

Following recent posts on powercloud, I realised that I did not have a sufficiently robust understanding of HSN’s software solutions, how it has evolved and how each integration is integrated into HSN’s overall solution suite.

I went through the ASX announcements for each of the HSN acquisitions since 2018, using this FY2024 AGM slide as a reference. I then grouped and summarised the various solutions acquired based on industry group/functionality/offering which has enabled me to get a clearer view of how these solutions overlap/differentiate - see below for detail.

I found the exercise very worthwhile in increasing my understanding of HSN's solution offerings, extrapolating how they might go to market, the level of disclosures that can be expected post acquisition etc.

If there is one clear finding, it is that HSN's approach to acquisitions from start to end have been highly consistent.

This does not change my overall view of HSN, the sustainability of its revenue and how I am thinking of the powercloud acquisition outlined in my earlier posts, but I suspect having this greater baseline understanding will enable me to make better sense of HSN announcements going forward.

Discl: Held IRL and in SM

SUMMARY

HSN does not appear to offer a SAP/Oracle-like single, all encompassing billing & customer care software solution and I cannot quite find evidence to suggest it will go into that scenario as a long-term goal.

HSN instead has acquired and offers, “best-of-breed” solutions to new customers which appear to be based on previously acquired solutions - factors like industry, type of customer, geography will likely be the drivers to select the most appropriate solution to deploy to a new customer. Coming from my integrated ERP background, this does take a bit of effort to wrap my head around, but if I look at it from a pure financial and investment perspective, makes good sense given the completely prohibitive cost and effort to (1) develop a single platform and then (2) migrate all of HSN’s customers from their current platform to a single suite.

From the announcements, sometime around 2020, HSN appears to have done a rebranding exercise and has progressively referred to the acquired solutions in terms of “Hansen [Module]” or “Hansen CIS Suite” or similar - this has caused almost total blurring of the acquired solutions eg. Sigma System Order Management is now “Hansen Order Management”. It is now not entirely clear which solution is actually being implemented in a new customer contract as they all seemed to now be branded as “Hansen CIS Suite”.

HSN management has been very consistent in how it has approached and disclosed each of its acquisitions since 2018, including powercloud - it has used acquisitions to add a combination of scale, geography, customers and software solution capability rather than from a pure software solution capability perspective.

Management has not provided running commentary on how each of the acquired solutions perform post acquisition. The disclosures around powercloud progress has in fact, been an anomaly in terms of the greater level of detail that has been provided.

At A$49m, the powercloud acquisition is only the 3rd largest HSN acquisition in the 4 acquisitions where the cost was disclosed, and is roughly only 1/3 the cost of the largest acquisition, Sigma Systems, which was acquired at A$166.2m in 2019 - relative to the Sigma acquisition, powercloud appears to only be a medium-sized acquisition and thus, a medium financial and operational risk to HSN overall. This was an important data point to put the powercloud acquisition in proper context relative to ALL prior HSN acquisitions.

With this perspective, it is now clear to me that (1) HSN is a multi-solution best-of-breed provider of billing and customer care solutions (2) is is unlikely that there will any further detail on powercloud’s specific performance from hereon, similar to the approach taken by HSN in all of its 10 acquisitions prior to powercloud and (3) instead of focusing on the performance of each individual acquisition like powercloud, which will be challenging to do with the lack of detailed information, the approach will be to focus on HSN’s broader/overall revenue sustainability, growth trajectory, churn rate etc across all the billing solutions it offers.

OVERVIEW OF HSN’s SOLUTION OFFERINGS - MORE DETAIL

HSN’s baseline customer care and utilities billing solution used to be known as “HUB” - this appears to be for Telco, Electricity, Gas and Water industries.

HSN’s acquisition approach since 2008, has been highly consistent, meeting the following acquisition criteria:

- Are within and adjacent to its core business of billing and customer care

- Increases revenue base

- Expands suite of global products

- Expands existing geographic footprint, market presence

- Expands customer base

- Is immediately EPS/EBITDA accretive on acquisition

Each acquisition appears to directly add to HSN’s overall product suite despite what appears to be direct functionality overlaps to previously acquired solutions.

There does not appear to any focus to merge/integrate/collapse/rationalise newly acquired overlapping solutions into a single all-encompassing HSN billing and customer care solution suite - each solution continues to operate as is, and is offered to new customers, “as-is” eg. PeacePlus was the solution for Ergon Energy (Dec 2014), eRex Corporation (Sep 2015) and the ICC Solution was the solution for Hinduja Group (Jul 2015), DishHome (Feb 2016).

However, it does appear that a rebranding of acquired solutions into “Hansen XX” occurred around 2020 as contract announcements stopped using the names of the acquired solutions - Jan 2020 Simple Energy announcement referred to “Sigma Catalog” and “Sigma CPQ” but in the Jun 2020 announcement on Hansen Provision Release 7.0, there was reference to Hansen Catalog, Hansen Order Management etc - these were Sigma products.

The employee base of each solution acquisition is likely to be resource base to implement, support, enhance each of the acquired solutions.

This approach may be required as each acquired solution is likely to be mission critical to the customer base of that solution and is hence, highly “sticky”, meaning that migrating customers from each acquired solution to a single, all-encompassing HSN solution suite may simply not be possible without significant effort and cost.

This then means that HSN’s solution offering approach is one “best-of-breed” - new customers will be matched with the best fit solution based on industry, scope, geographic location etc.

This also means that “Hasenisation” is really around optimising business processes, resourcing, software development methodologies and tools etc, and not technical integration/rationalisation/merging of acquire software solutions into a single suite.

Disclosures around each acquisition has also been highly consistent:

- Single announcement of the acquisition - cost, impact on HSN revenues, strategic rationale, funding, employee additions, customer additions etc.

- Follow-up commentary post an acquisition is usually included in HSN’s half-year and full-year results, mostly focused on impact on earnings, completion of integration etc

1HFY18 results announcement following large Enoro acquisition,

FY19 Results Announcement following the largest acquisition to date, Sigma Systems

Post acquisition, there has been no detailed commentary on how each acquisition has progressed from an operational, competitive position/progress of each solution. The only reference to previous acquisitions appear to be when an acquired solution is used as the basis of a new customer contract eg. Use of ICC Solution for the Nepal DishHome contract (Feb 2016) or if there is a major upgrade to an acquired solution eg. Solution Upgrade for Banner CIS to v5 (Apr 2015).

HSN SOLUTIONS, GROUPED BY INDUSTRY/SCOPE

Utilities - Billing, Customer Care, Customer Information System (CIS)

Utilities - Integration/Add-On Solutions

Utilities - Water Billing

Utilities - Business Process Outsourcing, IT Services

Media, Entertainment, Telecommunications

Some positive news amidst the bloodbath today - new $50m-ish deal and reaffirming of FY25 guidance.

Market clearly liked it, as did I!

Discl: Held IRL and in SM

Virgin Media Limited Deal

- License HSN’s cloud-native Suite for Communications,Technology & Media to VMO2 for an initial 5-year term

- VMO2 is joint owned by Liberty Global and Telefonica, with 45.6m connections in the UK across broadband, TV and home phone

- Hansen Suite will deliver 3 platforms for VMO2 expanding wholesale and retail markets as part of VMO2’s digital transformation

- “With associated revenue of approximately A$50m” - unclear if this is THE total deal size or over and above the subscription as A$15m of VMO2 license revenue will be recognised upfront in 2HFY2025

FY2025 Guidance

I am starting to fully appreciate the benefit of spending a few minutes working through AGM material of the companies I own. 90% of the material is a repeat from the results announcement, but there are just these few additional insights and/or reinforcement of previous points that seem to make things that much clearer for me. I also look out for new or updated slides. And so it is with the HSN AGM material.

Very pleased with how HSN has been travelling.

My shit-hits-fan top-up zone remains between ~$4.21 and ~$4.42. There is Long-Term resistance ahead at $6.03 which will cap prices during FY25, but a good FY25 result with realised powerCloud post-restructure EBITDA , looking to be better than initially flagged, should see an assault through this in early FY2026. I much prefer these sorts of paced earnings-driven price moves rather than straight line hot stock-like moves, as they are much more sustainable.

Discl: Held IRL and in SM

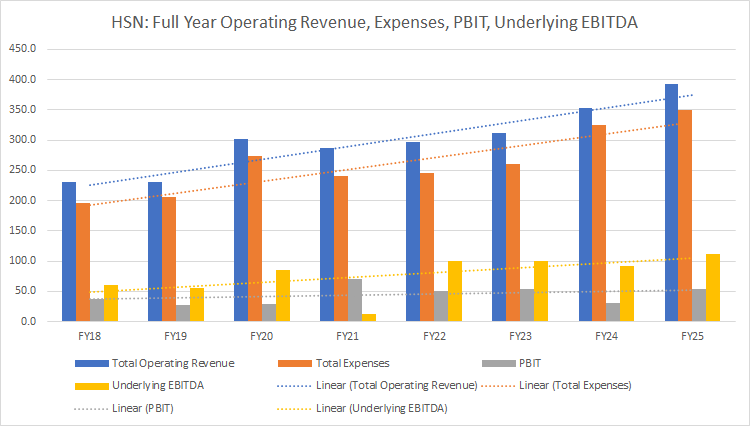

Overview of Industry Verticals

We support two industry sectors – Energy & Utilities and Communications & Media and each of our verticals has a strong presence. Both verticals are well diversified across the globe

Both of these sectors are incredibly dynamic and in exciting transition phases. As a Group we are uniquely positioned to help accelerate our customers’ transition and transformation.

These dynamic changes are helping to drive solid growth prospects for Hansen and it was very pleasing to note the Energy & Utilities vertical delivered nearly 15% organic growth in FY24. Energy & Utilities growth is driven by their need to manage regulatory compliance and the transition to Distributed Energy Resources.

The Communications & Media segment is a little different to the Energy & Utilities segment. The Communications & Media operators are essentially technologists. During Covid and the years immediately following, the sector has been cautious to invest in large scale transformational technology programs. This is changing and we anticipate a stronger performance in FY25 with several late-stage new logo discussions in the communications space across the main regions we operate in.

Re-Iteration of Strong M&A Track Record

Since 2008 we have acquired and successfully integrated 11 businesses and have achieved a 14.7% Operating revenue CAGR and a 14.3% EBITDA CAGR since then.

We take a very careful approach to M&A and have a defined playbook to both acquire and integrate business.

Ultimately, we are a business that spends the money like it’s our own and we don’t do a deal unless it makes complete commercial sense.

powercloud Update

Turnaround of powercloud is on track, nearing completion, and will be EBITDA positive during 2H25.

Since acquiring and updating the powercloud strategy we have rationalised the structure from approximately 390 staff to 140 staff - thats an impressive 64% reduction in headcount.

We have been carefully listening to the powercloud customers to deliver mutually beneficial outcomes - we have refocused our R&D efforts on the core system, RCS which is what our clients have been wanting.

We have reviewed and adjusted the fixed cost base and there are more potential medium-term savings available. Since acquiring, we have reduced the cost base by approximately $27m AUD on an annualised basis - this was flagged as $13m during the August results announcement, so annualised savings appears to have now doubled

The strategic rationale for acquiring powercloud remains, with significant potential upside as the German energy market transforms over the medium term.

FY25 Guidance

The Group’s guidance for revenue remains unchanged.

We are experiencing current FX headwinds but the global FX rates in November are moderating and it's still early in the year. Due to the natural currency hedge Hansen has by region, driven by the localised cost base, we don’t see the current FX headwinds materially impacting bottom line.

Most importantly, we expect that the industry tailwinds the business is experiencing should persist beyond FY25.

SUMMARY

No surprises on Core Hansen business, German PowerCloud acquisition short-term financial drag was flagged and thus expected.

Pleased with progress on Hansenisation of powercloud in the short time since acquisition - it will be a good launch pad into the DACH region, once completely integrated into HSN.

powercloud expected to be Underlying EBITDA positive in Q4FY25, with Underlying EBITDA loss capped at (A$5m) and capitalised R&D capped at $A5m - expect this to be achievable given current progress and HSN’s strong record of integrating acquired businesses.

Thesis of steady, dependable growth very much intact. HSN provides my portfolio with a stable growth ballast and dividends.

Discl: Held IRL and in SM

Core Hansen, Excluding powercloud

Chugging along nicely (1) $334.7m revenue, 7.3% increase (2) Underlying EBITDA flat at $99.7m (3) Underlying EBITDA margin 26%

11 Tier 1 & 2 wins in FY24

No one customer contributes >8% revenue, customer church remains extremely low at ~1%

No surprises, both Energy & Utilities and Communications & Media verticals are travelling nicely

German powercloud Acquisition

The German powercloud acquisition has, as expected, dragged the FY24 results down (1) Revenue $18.4m (2) Underlying EBITDA ($7.4m) (3) Underlying NPAT ($10.4m) - this was previously flagged, so no surprises.

“Hansenisation” of powercloud have gone well, powercloud financials have been better than originally anticipated.

Re-signed EWE, a major powercloud customer, for another 5 years.

Initial restructuring completed with estimated annualised savings of ~$13m.

powercloud has offered a cheaper, faster more effective way to enter the German market vs the alternative option of building HSN’s billing software from scratch.

Balance Sheet

- $59.1m Operating Cash flow, down 25%

- Free Cash flow ($5.7m) to $46.7m

- $70.2m debt, net debt position $23.5m

- Already paid down $12.0m of initial borrowing of $55.3m to acquire powercloud

- No change to dividend payments - $51.1% of NPATA

M&A

Continue to be on the lookout for M&A opportunities with the usual HSN M&A diligence

FY25 Guidance

Back to “normal” HSN trajectory

Pleased to see some “precision” in powercloud financials - EBITDA positive Q4FY25, subsiding of Underlying EBITDA losses and capped to ~A$5m, capitalised R&D capped at ~A$5m

Hansen Signs 7 Year Renewal & Upgrade Contract with a Leading European Utility

- Hansen signs 7-year renewal contract with a leading European utility

- SSE, a long-term Hansen customer since 2005, is a leading supplier of electricity and gas to the United Kingdom and Republic of Ireland

- The agreement will facilitate an upgrade to Hansen’s cloud-enabled, event driven CIS platform

- The contract renewal and upgrade represents a significant enhancement to the existing contract and includes implementation commencing in FY25 and an additional incremental recurring revenue uplift of approximately A$2.8m per annum post implementation completion.

A nice win to end FY24 from the perspective of (1) a continuing long-time customer (2) a strong vote of confidence in HSN's Customer Information System (CIS) platform!

Discl: Held IRL & SM

Finally got round to reviewing the position with HSN and determining what action to take.

Discl: Held IRL and in SM

1HFY24 Summary

- Robust 1HFY24 results with growth in revenue, underlying EBITDA margin, strong cash generation, debt repayment and returning of cash to shareholders, underpinned by stable and predictable revenue, very low customer churn

- Net cash positive for the first time since 2017, $8m, pre-powercloud acquisition where cash reserves of ~$45.1m exceed debt of $36.9m

powercloud Acquisition Feb 2024

Market has been spooked by the powercloud acquisition in Feb 2024

The strategic rationale for the acquisition makes sense (1) buying a robust, modern and entrenched suite of complementary billing software (2) opens access to the broader DACH region markets (3) at a stage in powercloud’s maturity that will benefit from the more robust Hansen discipline and processes to become more efficient and hence more profitable

Downside:

- Requires ~$20m more investment over and above the upfront acquisition price of EUR30m

- Will adversely dilute short term FY24 underlying EBITDA by ~$7-8m, bringing FY24 underlying EBITDA margin to +26% from the normal pre-acquisition underlying EBITDA margin of ~+30%

HSN has a strong proven record of successfully integrating acquisitions into the broader HSN business - this acquisition should be no different. Must however, sit through the risk of margin dilution in the next 12-18M before powercloud can be fully earnings accretive.

Current Position and Action

- Price has been drifting towards a ~3-years old well-supported zone between ~$4.21 and ~$4.42

- this zone was a strong resistance zone for a good 18M prior to mid-Mar 2021 when the resistance was penetrated

- Since Mar 2021, this has been a strong support zone, successfully defended in Oct 2023, then April 2023

- If price falls into, or in the vicinity of the top up zone, increase position from current ~1.8% to 2.5%

Discl: Held IRL

THE GOOD

Revenue

- 5.2% increase in operating revenue, 2.1% in NPAT, 1.0% increase in EPS - organic growth, highest ever operating revenue result vs FY2023 guidance was 3-5% increase in revenue

- Services, Support & Maintenance revenue grew organically 7.3% YoY, well above historical average of the business

- No customer makes up more than 7% of revenue - diverse across geography, currency, product, and industry

- Continued generating significant cash-flows and the paying down of debt - effectively net debt zero outcome

- Several new logos and renewals won during FY23, no material loss of customers in FY23

Cash Flow and Debt

- $78.8m of operating cashflows in FY23, used to (1) retire $33.6m of debt (2) pay dividends of $18.4m (3) fund the capitalised portion of ongoing product development program of $21.1m.

- At the end of FY23, total borrowing's is $54.3m, net debt is effectively zero

- Strong balance sheet with headroom for future borrowing capacity when the right acquisition opportunity is secured

- Final Dividend of 5.0c, partially franked to 1.5c

FY24 Outlook

- Organic revenue growth rate in FY24 is 5-7%, higher than FY23 5.2% growth

- EBITDA expected to remain above 30%, and above pre-pandemic historical run rate of 25-30%

- FY24 capitalised R&D spend of 5-7% of revenue

Acquisition Pipeline

- Macro-economic factors increasingly favourable for acquisitions

- Having effectively zero debt, HSN has significant financial resources for acquisitions

NOT SO GOOD

- Underlying EBITDA FY23 was $99.5m, Labour costs and staff churn has stabilised

- EBITDA margin at 31.9% reflects careful cost control - 2HFY23 EBITDA margin was 33.5%, indicating HoH margin improvements

- Licencing revenue bounces around from half-to-half - driven by revenue recognition standards, does not appear to be a concern

WATCH & RISKS

FY24 seems set up to be a year of acquisition as (1) opportunities increase with the current macro challenges globally and in EMEA where HSN has a big footprint (2) decks have been cleared from a debt perspective to build the war chest to fund acquisitions - need to watch that the acquisitions make sense - excellent track record in this respect, so risks are very low

SUMMARY

- Good solid results, exceeding FY23 guidance, steady as she goes - as “defensive” as technology companies can go

- FY24 guidance is bullish

- Expecting M&A activity in FY24

Positives

- Stable, steady-as-she-goes result - boring really

- No loss of customers, significant project go-lives, stable margin - signs of continued operational excellence amidst staff, wage and inflationary pressures and a highly sticky customer base

- Guidance for FY2023 maintained - 2HFY23 should see a better result than 1HFY23 due to (1) license renewal revenue - a timing difference in 1HFY23 (2) benefits flowing through stabilisation of workforce churn (seen in higher costs, reducing EPS)

- Continue to be robustly cash generating, enabling rapid payment of debt (net debt $28.7m, 0.32x leverage ratio, but no debt actually paid this half), war chest in in place to take advantage of M&A opportunities as businesses globally face increasing pressures to shed cost as interest rate rises and other business inflationary pressures kick in - IT is always a good candidate for cost shedding, HSN is well placed to pounce

- HSN is well placed with operational excellence/improvement and cash generation continuing in one stream, which then directly feeds its ability to find and execute M&A opportunities

- Recent history has suggested that patience in M&A opportunities will likely be well rewarded as financial screws tighten further globally in CY23 and CY24 - next 12-18M could be very interesting

Minuses

- Growth is significantly more “steady-to-flat” and boring - out performance will occur in distinct steps, tagged to M&A activities

- Flat pcp revenue

Things to Watch Out for for 2HFY23

- No improvement in license revenue in 2HFY23 - this would be a cause for concern

- Costs continue to rise rather than flatten

- Progress on any M&A opportunities

- Continued traction on deployment implementation

Other Observations

- The lack of M&A in recent periods has probably allowed for a period of technical stability to enable digesting/integrating/embedding of the acquired technology into the broader solution suite and customer - a good thing

- Recent announcements appear to be contract extensions or new deployments of the HSN Solution Suite

Red Flag Risks

- Loss of customers - a big red flag given historical trend of retention

- Hint of challenges in technology deployment

Portfolio Positioning

- Current portfolio has too much cash from forced divestments of high growth/high gain companies in the portfolio due to being acquired

- HSN provides (1) a better position to deploy that scarce cash while looking for new opportunities to invest in (2) a ballast to a tech and growth-skewed portfolio (3) a steady dividend stream

- Is not the best place to deploy scarce capital as there are more exciting opportunities for growth, but it is prudent to inject a bit of strong stability and strong cash flow generation into the portfolio, with the potential for decent price upside

- Added 0.5% today at $4.71 to the existing 0.62% position, bought at $4.47

- Ultimate position size could be 2.5-3.0% over time.

- Has not tested 52-week lows of $4.32 for some time and is nowhere near the 52-week highs of $6.10 - have funds availability to top up if the market tanks and 52 week lows are re-tested

Discl: Hold 1.1% IRL

Post a valuation or endorse another member's valuation.