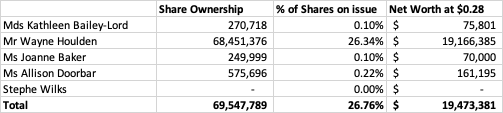

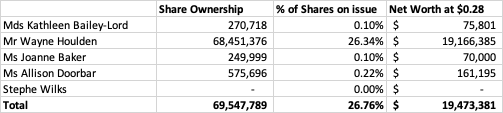

Market Cap $72.77m at $0.28 per share

Board Bio's

Kathleen Bailey-Lord - Chair

Kathleen is an experienced independent company director and business advisor. She is passionate about the opportunities for business and society to “build back better”. She believes that together, people and technology can make the world a better place – with conscious decision-making and effective governance.

As a senior executive Kathleen has enjoyed a career at the forefront of transformational change within a wide range of industries across Australasia and Asia. This includes leading businesses in technology (IBM), professional services (Law and Accounting) and Financial Services (ANZ Bank, Fordham Group). Blending strategy and pragmatism, Kathleen is known for her curiosity, optimism and eye to the future. Kathleen enjoys nudging enterprises forward to embrace the opportunities of today to build value for all stakeholders.

Kathleen is a Fellow of the Australian Institute of Company Directors (AICD), as well as a member of the AICD Victorian Council and the AICD Governance of Innovation and Technology Panel. She is an active member of Chief Executive Women and currently serves on the boards of Alinta Energy, QBE Insurance (Auspac), Melbourne Water Corporation and Monash College. Her past boards include Bank of Queensland (BOQ), Trinity College at the University of Melbourne and Australian Government Solicitor (AGS).

Wayne Houlden - Director of AI Research & Vice Chair

Wayne Houlden founded Janison Education Group Ltd in 1998 and is regarded as a market shaper and thought leader internationally in education technology. Since the earliest days of the World Wide Web, he created solutions that continue to transform how education is delivered in Australia and beyond.

His award-winning national education portals, learning management systems and digital assessment platforms are now used in more than 100 countries and have been repeatedly recognised by tech giants including Google and Microsoft.

Wayne was instrumental in winning and delivering world-first national schools assessment projects in Australia, national exams for the Singapore Examinations Assessment Board (SEAB) and, more recently, partnership with the OECD to deliver its PISA-Based Test for Schools internationally.

Wayne has a global vision for Janison and has strong relationships in the education technology industry and edtech investment community around the world. His focus is now on developing Janison’s AI capabilities, as well as building our brand’s strategic partnerships, and mentoring and supporting the Janison executive team.

He is also a fund advisor for Europe’s leading edtech investment group, Emerge Education.

Allison Doorbar - Non-Executive Director

Allison is Managing Partner at EduWorld, a company that provides market research and strategic consulting services to the education sector. She has spent most of her career working with education providers globally helping them to develop and implement their marketing strategies. This includes working with many of the World’s leading universities, major global providers as well as many government departments and agencies.

Jodie Baker - Non-Executive Director

Jodie is a Non-Executive Director with 30+ years’ experience banking, funds management and stockbroking. She is currently on the board of Beyond Bank, where she chairs the Risk Committee and CareFlight, where she chairs the Audit and Risk Committee. She was formerly on the boards of Export Finance Australia, Percussion Australia, and Disability Sports Australia where she chaired the Audit and Risk Committees, as well as Spaceship Superannuation and Financial Executives Institute.

During her executive career, Jodie’s roles included Managing Partner of Blackhall & Pearl, a board, risk, and governance advisory firm; CEO and Managing Director of a fintech business Morgij Analytics; and senior executive credit and risk roles at ANZ, Société Générale and BT Financial Group. Earlier in her career, Jodie worked in front line and credit roles at Westpac, Macquarie Bank and Bankers Trust Australia.

She holds a Bachelor of Commerce from University of Western Australia and is Trustee Fellow of the Association of Superannuation Funds Australia and a Graduate of the Australian Institute of Company Directors.

Stephe Wilks - Non-Executive Director

Stephe Wilks is a lawyer, technologist, and an experienced company director with a long record of leading successful global technology companies in high growth and disruptive industries. He has guided several Australian and international telecommunications and technology companies, including as Regional Director (Asia and Japan) Regulatory Affairs for BT Asia Pacific, Managing Director of XYZed Pty Ltd (an Optus company where Stephe developed and managed Australia’s first competitive broadband wholesaler), Chief Operating Officer of both Nextgen Networks and Personal Broadband Australia, and as Consulting Director of NM Rothschild and Sons. He has held numerous non-executive director and non-executive chair roles in both ASX Listed and private companies.