Knosys (KNO) provides a range of SaaS solutions that aim to boost productivity, collaboration, and information connectivity in the digital workplace. The business has three main brands:

- KnowledgeIQ: Knowledge software geared towards enterprise

- GreenOrbit (GO): Intranet software (acquired 2020)

- Libero: Library management software (acquired 2021)

Investment thesis: the acquisitions of GO and Libero – conducted in 2020 and 2021 – genuinely add value and should help KNO scale as they close in on cash flow breakeven. They are also well placed to reinvest future profits back into the business.

There were many positives associated with KNO’s recent (4Q) quarterly update:

- Steady and growing revenue base

- Organic growth, complemented by acquisition growth

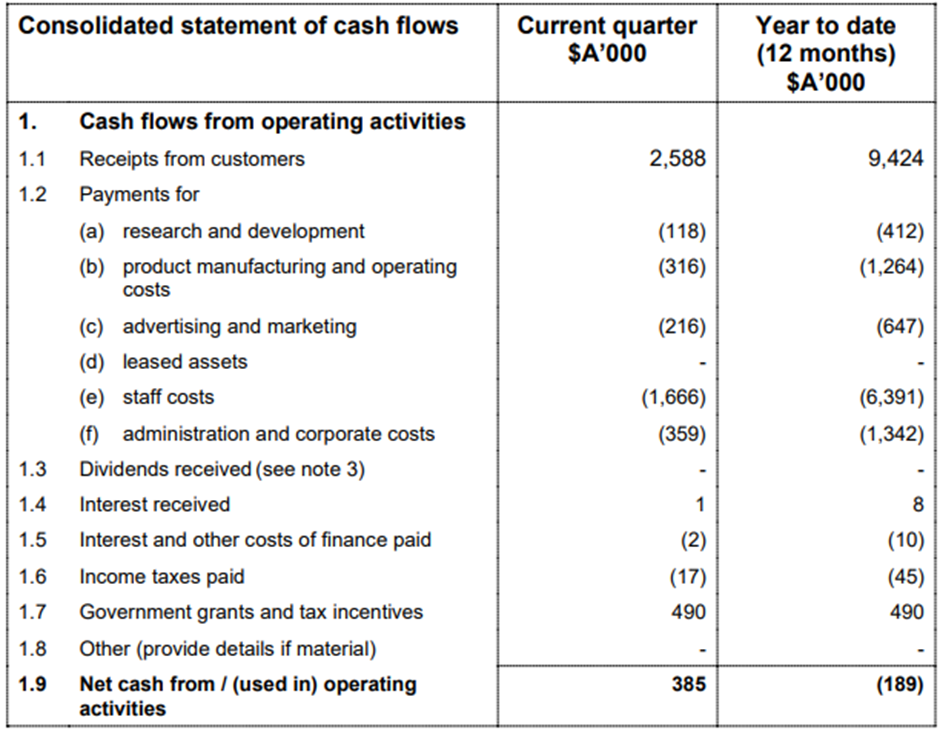

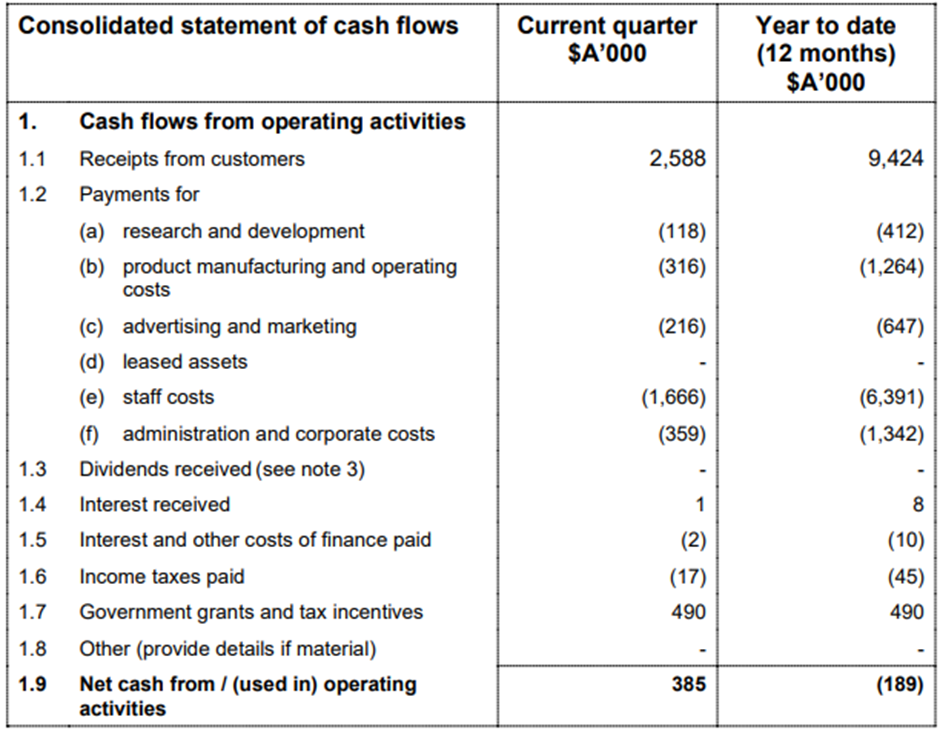

- Positive cash flow from operating activities

- Strong cash position – 4.6m

Perhaps most importantly, we could be seeing early signs that the business is starting to demonstrate operating leverage.

What I like

- Global brand – 6 global offices, with their customer base spanning 10 countries

- Their recent acquisitions – GO and Libero – have expanded their businesses offering. They are a more attractive proposition for customers as a result. This should enable scaling benefits, with strong on sell capabilities.

- The business has achieved both organic and acquisition growth dating back a number of years

- KNO provide a range of software solutions to benefit a digital workplace. In short, I like the space they operate in, with obvious tailwinds in a post-pandemic society which is increasingly embracing digital and more flexible work arrangements. KNO stand to benefit from this.

- Sound financials. Approaching cash flow breakeven, 4.6m in the bank and no meaningful debt.

- The price is right. Trading on a P/S ratio of 2x, compared with the industry average of 4-5x.

- We are seeing signs that KNO is starting to shift into government, as opposed to only servicing enterprise. They have recently had several contract wins in government, which are typically more sticky than enterprise and come with opportunities to land and expand.

As with any investment, there are some risks. I will include these in a separate straw, but the main one that comes to mind is their lack of insider ownership by executive staff.

I will aim to post my valuation in the coming days.

Disc: bought