Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Refer to yesterday's Straw for my thesis.

Within my DCF, I forecast KNO will make 500k free cash flow in FY23, and then increase to 1m the year after -- followed by yearly increases of 500k. I think this is quite conservative -- it will only take a few significant contract wins to achieve this, but I would prefer to provide myself with a nice margin of safety.

Using my standard discount rate of 8.4%, I reach a company valuation of 31m -- divide this by shares outstanding (216m) and I reach a valuation of 0.15c.

I think the current share price, just under 9c, is an attractive entry point.

Knosys (KNO) provides a range of SaaS solutions that aim to boost productivity, collaboration, and information connectivity in the digital workplace. The business has three main brands:

- KnowledgeIQ: Knowledge software geared towards enterprise

- GreenOrbit (GO): Intranet software (acquired 2020)

- Libero: Library management software (acquired 2021)

Investment thesis: the acquisitions of GO and Libero – conducted in 2020 and 2021 – genuinely add value and should help KNO scale as they close in on cash flow breakeven. They are also well placed to reinvest future profits back into the business.

There were many positives associated with KNO’s recent (4Q) quarterly update:

- Steady and growing revenue base

- Organic growth, complemented by acquisition growth

- Positive cash flow from operating activities

- Strong cash position – 4.6m

Perhaps most importantly, we could be seeing early signs that the business is starting to demonstrate operating leverage.

What I like

- Global brand – 6 global offices, with their customer base spanning 10 countries

- Their recent acquisitions – GO and Libero – have expanded their businesses offering. They are a more attractive proposition for customers as a result. This should enable scaling benefits, with strong on sell capabilities.

- The business has achieved both organic and acquisition growth dating back a number of years

- KNO provide a range of software solutions to benefit a digital workplace. In short, I like the space they operate in, with obvious tailwinds in a post-pandemic society which is increasingly embracing digital and more flexible work arrangements. KNO stand to benefit from this.

- Sound financials. Approaching cash flow breakeven, 4.6m in the bank and no meaningful debt.

- The price is right. Trading on a P/S ratio of 2x, compared with the industry average of 4-5x.

- We are seeing signs that KNO is starting to shift into government, as opposed to only servicing enterprise. They have recently had several contract wins in government, which are typically more sticky than enterprise and come with opportunities to land and expand.

As with any investment, there are some risks. I will include these in a separate straw, but the main one that comes to mind is their lack of insider ownership by executive staff.

I will aim to post my valuation in the coming days.

Disc: bought

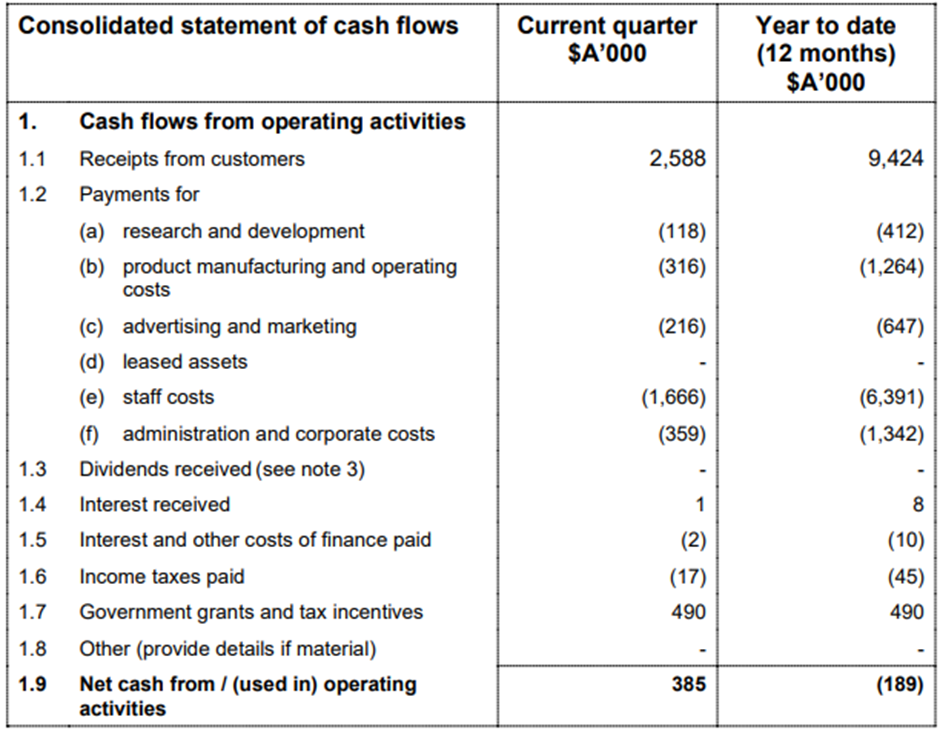

29/7/21 Quarterly Activities/Appendix 4C Cash Flow Report

Wow, first Straw as a Premium member. She needs premium dude, premium!

A solid quarter/year for KNO with the company continuing to run about cash flow breakeven (admittedly factoring in R&D grant).

ARR at the end of July was $6.1m, a nice bump from the $5.8m last disclosed by the company in the presentation for the acquisition of Libero in early July. Adjusting for the Green Orbit acquisition shows a bit of organic growth in the KnowledgeIQ business. Management called out some expansion within the enterprise customers, and five new mid-market customers driving that growth. When Libero closes, ARR will be $8.3m.

Cash at report date was $7.8m as large receipts from an enterprise client was received in July. This leaves a healthy cash balance even after the expected $2.5-3.5m outflow for the Libero acquisition.

It is worth taking a second to discuss the KNO investment thesis as it has now changed somewhat. Originally I viewed KNO as a classic "heads I win, tails I don't lose much" scenario as the business was essentially breakeven with it's two key enterprise clients of ANZ and Optus. I figured the company had a couple of years of cash runway to try and close one more large enterprise deal which may have been the escape velocity into either profitability or the generation of excess cash to plough back into R&D or sales to drive further growth.

To a degree this thesis is still alive. In this quarterly, management called out two major enterprise opportunities they are hoping to progress in the current quarter. If either of these were to land it would drive substantial growth and I am sure the share price would react accordingly.

However, it is worth noting that management has also embarked on an acquisition strategy which is a variation to the thesis. While I would no doubt prefer organic growth in the core business, I appreciate why management have moved down this this path to try and reach scale quicker and I must admit I have been impressed with their acquisitions so far, in particular the use of scrip to incentivise vendors to stay committed to KNO and grow into the future.

So for now I am happy to continue to own KNO, on the current trajectory of modest growth and small acquisitions (especially if they can be funded out of operating cash) the stock should do well, but the chance of explosive growth remains if management can pull off a few more enterprise deals.

25/2/21 Half Yearly Report and Accounts

A great result from KNO recording their maiden profit and very strong operating cash flows.

The result was assisted by the one off service revenue from the implementation of a standalone NZ product for ANZ to comply with banking regulations. Nonetheless, management did a great job of controlling costs over the period, particularly winding back marketing and travel costs as potential customers deferred discrectionary spending during Covid.

Recurring licence revenue was flat on last year as expected with no major customers added and some customers churning seats during Covid. Total revenue increased 26% assisted by the service revenue outlined above.

Operating cash flow of $864k was fantastic, and bolstered cash reserves to $5.9m (with a further $831k R&D refund receivable).

Looking forward, KNO management gave their strongest outlook on the future so far, stating they have signed up multiple pilot programs and have been shortlisted on three enterprise projects.

Knosys saw a 19% lift in license and support fee revenues for the year, and now has an annual run rate of $3m in recurring revenues.

The buisness was cash flow positive for the 4th quarter, up $0.4m. It now has $3.7m in cash.

The company said it was well placed to capitalise on the increasing trend of working from home, and is on the hunt for potential bolt-on acquisitions (which would almost certainly require a capital raise).

You can read the full quarterly results here

Knosys has signed a deal with ANZ New Zealand to migrate its data to a standalone Knowledge IQ system -- a decision driven by a regulatory requirement not to have technology systems dependant on any foreign parent entity.

The deal is expected to generate $840k in service fees over 9 months. For context, KNO generated $396k in customer cash receipts in the March quarter -- so this is a significant deal.

I quite like the business, but am wary of the customer concentration. I do not hold at present.

ASX announcement is here