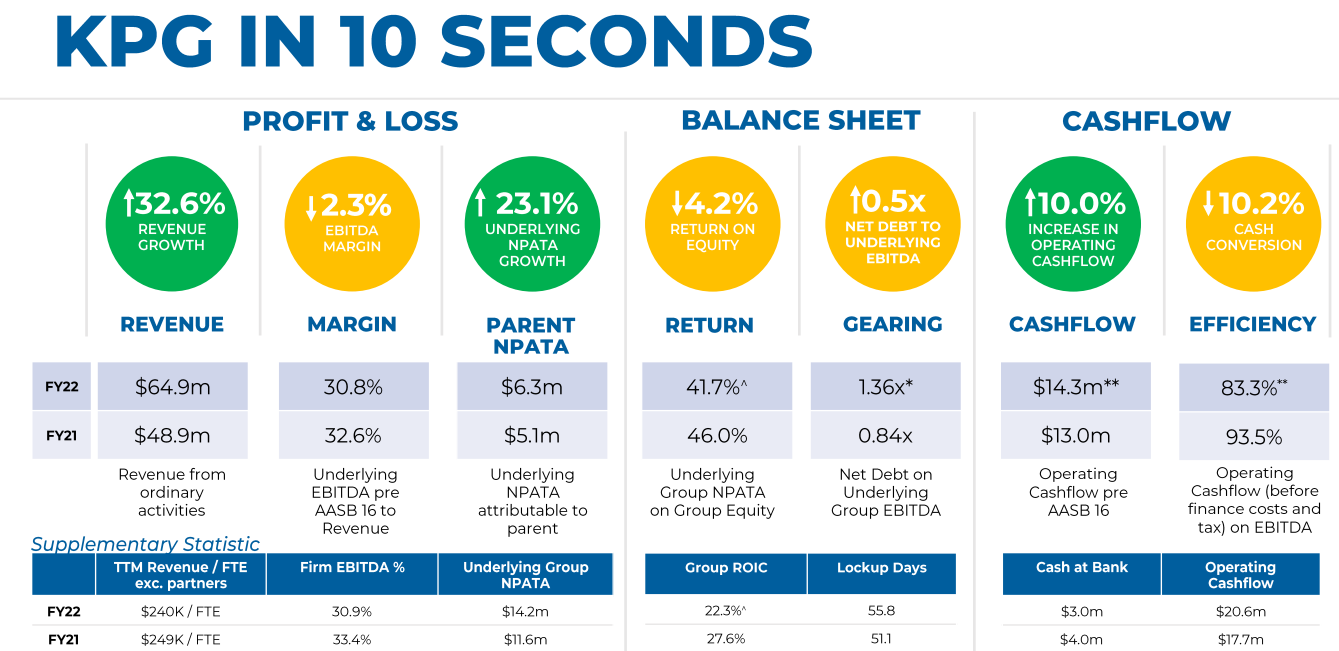

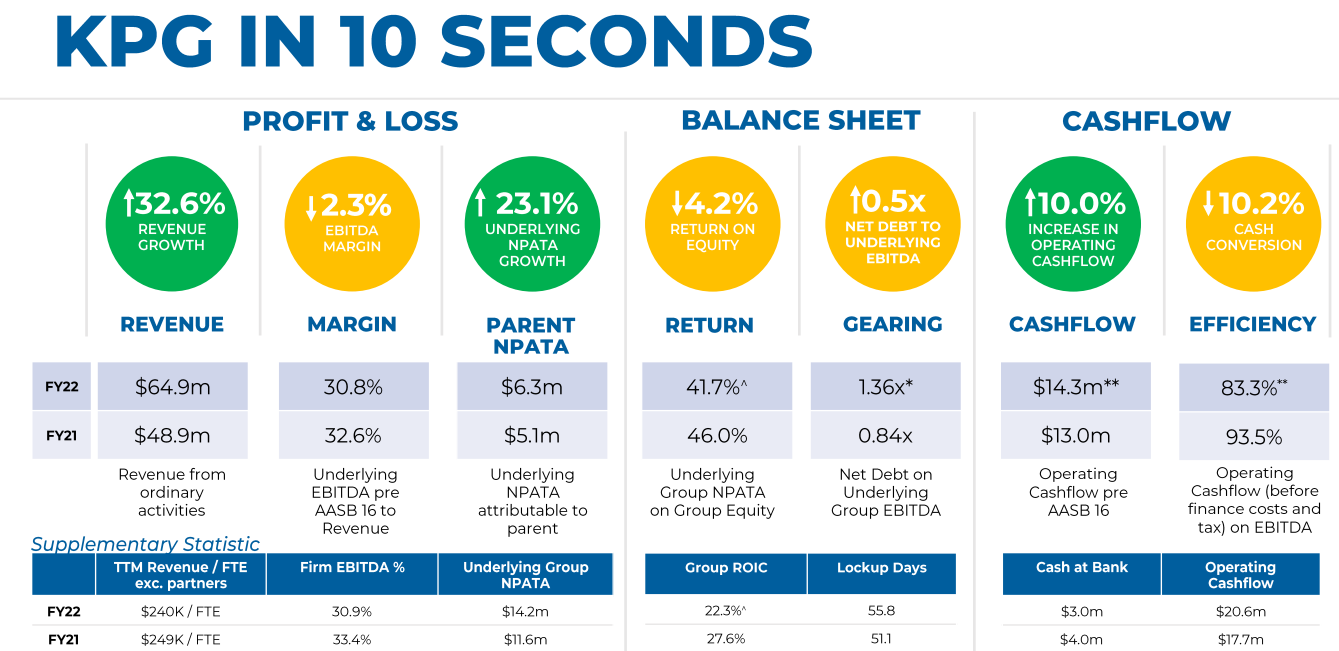

Kelly Partners came out with a very early full year results and Annual Report today and it was quite strong. Revenue growth accelerated in the second half to end the year up 32.6% vs FY21. EBITDA and NPAT were also up (although down as a % of revenue).

For those that don't know Kelly Partners is a accountancy practice roll-up focusing on servicing SMEs and high worth individuals. It is very prominent in NSW, particularly western Sydney, but has branched out to other regions and has aspirations to take its model overseas. So far sounds pretty dull but there are a few things that make it more interesting. Firstly the founder and Managing Director Brett Kelly is a devotee of Charlie Munger and Warren Buffett and has done the rite of passage to the Berkshire Hathaway conference in Omaha. He is also a fanatical reader and indeed has some investment books that any new employees/partners are required to read during their induction (or face termination). Surprisingly for an acquisition model company they have not issued a share since IPOing in 2017 and Brett Kelly has stated he has no intention on that changing. They also are one of the few companies to pay a monthly dividend.

Brett appeared on a recent Australian Investors podcast with Owen Rask and it's worth a listen whether you're interested in the company or not. It was also discussed on a recent Baby Giants podcast and is a bit of a favorite on FinTwit. I've looked at it a few times and just never gotten the conviction to buy it (to my detriment). I'm ok with the rollup model but the minority interest that generates makes it hard to analyse this company and get comfortable with the financials. Also, although it's great they haven't been issuing script, the consequence is they have a high level of debt. In fact net debt plus contingent consideration is greater than the entire equity of the company. Also as a result of all the acquisitions intangibles are very high, mainly goodwill and customer lists, which have arguable intrinsic value and no tangible value.

I suspect my biases will prevent me from owning it any time soon but a really interesting company whose journey is worth tracking.