Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Market Cap currently $474m

Brett Kelly (appointed on 16 April 2017)

Brett is the Founder and CEO of Kelly+Partners. He has more than 20 years of commercial and professional accountancy experience, specialising in assisting private clients, private business owners and families. He commenced his career as a Chartered Accountant with 5 years at PwC Australia, and then worked at 3 mid-sized accounting firms. In 2006, Brett founded Kelly+Partners with accounting businesses in North Sydney and the Central Coast, before building out the network to 30+ businesses over 30+ locations to date. Brett is also the best-selling author of four books on life, business and wisdom.

Stephen Rouvray (appointed on 2 May 2017)

Stephen has over 50 years’ experience in financial services across many senior leadership roles. He was Chief Financial Officer, Company Secretary and Manager of Investor Relations for AUB Group (formerly Austbrokers) from 2005 until 2015. Prior to this, he was General Manager for ING Australia Holdings from 2002 to 2005 having joined ING’s predecessor company, Mercantile Mutual, in 1985. Over this 20 year period, Stephen held the position of Company Secretary which included its subsidiary companies operating in the life & general insurance, investment management, funds management and banking sectors. At the start of his career, he worked in the accountancy profession from 1971 to 1984. Since retiring as CFO, Stephen continues to represent AUB Group as a director on the board of two of its associates.

Ryan Macnamee (appointed on 2 May 2017)

Ryan is an experienced business technology executive with over 25 years of IT management and cyber security experience. He is currently on the board of Thinkproject Australia & New Zealand, and previously held board positions at the Open Data Institute and Advanced Navigation. Ryan has served in numerous senior IT management roles, including Group Chief Information Officer (CIO) and Group Chief Information Security Officer (CISO), Ryan has also held various senior IT positions at financial, insurance, construction, and retail operations globally. Ryan is co-founder of ECPPro, a Microsoft Azure cloud focused solution provider helping large corporations and MSP (Managed Service Providers) to manage complex cloud environments.

Lawrence Cunningham (appointed on 1 July 2022)

Lawrence is an expert on corporate governance, culture, and structure. Since 2007, he has been the Tucker Research Professor at The George Washington University. Cunningham has written extensively on corporate affairs in university journals and periodicals. He has published many influential books, including The Essays of Warren Buffett: Lessons for Corporate America, in collaboration with Mr. Buffett; The AIG Story, with Hank Greenberg; and Quality Shareholders: How the Best Managers Attract and Keep Them.

Lawrence is Vice Chairman of the Board of Constellation Software Inc., a Toronto Stock Exchange company, and Director and former Treasurer of Ocean Colony LLC, a private resort in East Hampton, New York. Cunningham is a Trustee of the Museum of American Finance; a Member of the Dean's Council of Lerner College of Business at the University of Delaware; and a Member of the Editorial Board of Financial History.

Lawrence has served on the Boards of Directors of Ashford Hospitality Prime, an NYSE investor in luxury hotels; Pearl West Group, a private investment company in Vancouver, and Strata, a private technology company in Silicon Valley.

A former Corporate Associate of Cravath, Swaine & Moore, Lawrence consults for public and private corporations and advises management and boards of directors. He has received numerous awards, including the 2018 B. Kenneth West Lifetime Achievement Award from the National Association of Corporate Directors (NACD).

Paul Kuchta (appointed on 2 May 2017)

Paul is a Chartered Accountant with over 20 years' accounting experience specialising in the provision of compliance, tax and advisory services to private SME’s and their owners. He commenced his career with Farrar & Company Chartered Accountants in 1998, where he worked for 10 years. Paul then joined Crowe Horwath in 2008 for a further 4 years. He was a founding partner of Kelly+Partners Norwest when the practice was launched in 2012. Paul is the managing director of Kelly+Partners Sydney.

Ada Poon (appointed on 6 September 2019)

Ada has more than 20 years' professional accountancy experience and has specialised in accounting and taxation services to Private Business Owners based in Sydney, business and personal taxation compliance self-managed super funds and outsourced finance department services.

Assumed 3 Scenarios growth ranging from 30% - 10% over 5 years. Net Margins 15%. Share Count staying same at 45m. PE45 for high growth and PE15 for low growth. Discounted values back to present day. Blended together each with different weighting on probability I guess on the most likely outcome. Come up with a Valuation of $15.53

KPG Acquisitions/Partnerships

· November 2024 announces executed agreements to partner with an accounting business located in the Sydney CBD. https://announcements.asx.com.au/asxpdf/20241108/pdf/06b5k5fbj8g8hn.pdf

· August 2024 executed agreements to partner with FRSCPA, a CPA firm located in Florida, United States. https://announcements.asx.com.au/asxpdf/20240819/pdf/066r9thwwcsrqz.pdf

· May 2024 Growth Partnership platform Kelly Partners Texas, Kelly Partners Group Holdings Limited is pleased to announce that a senior management team of Michael Hoyle, Jeromy Dixson and Ian McNickle (Texas Senior Management Team), who had considered building their own CPA group, have chosen to join the Company to build Kelly Part- ners’ first Growth Partnership Platform – Kelly Partners Texas. https://announcements.asx.com.au/asxpdf/20240503/pdf/0636rt5nbpx9m5.pdf

· April 2024 announce that Kudos International, a network of 60+ accounting firms located in 45 countries has chosen to partner with Kelly+Partners. https://announcements.asx.com.au/asxpdf/20240422/pdf/062qn3j35n3lv0.pdfhttps://announcements.asx.com.au/asxpdf/20240916/pdf/067x1w36k2vq8h.pdf

· January 2024 announces agreement to partner with an accounting business located in the Lower North Shore, NSW https://announcements.asx.com.au/asxpdf/20240129/pdf/05ztd795cgyv00.pdf

· January 2024 announces the completion of its partnership with a 2nd accounting business located in California, USA. https://announcements.asx.com.au/asxpdf/20240102/pdf/05z2pjfm35yk77.pdf

· December 2023 executed agreements to partner with an accounting business located in Brookvale NSW. https://announcements.asx.com.au/asxpdf/20231227/pdf/05yysj7dnkfngz.pdf

· May 2023 accounces that it has signed a binding heads of agreement to partner with an accounting business located in California, USA. https://announcements.asx.com.au/asxpdf/20230516/pdf/05pqxl3k9b6kq0.pdf https://announcements.asx.com.au/asxpdf/20231204/pdf/05y4hy3b19r1tv.pdf

· May 2023 executed agreements to partner with an accounting business located in Gold Coast, QLD https://announcements.asx.com.au/asxpdf/20230502/pdf/05p9dmzybn6w4b.pdf

· April 2023 acquired an accounting business located in Brisbane CBD, QLD https://announcements.asx.com.au/asxpdf/20230427/pdf/45p199zp66fqv5.pdf

· March 2023 announces it has executed agreements in escrow to partner with a top 100 accounting business. https://announcements.asx.com.au/asxpdf/20230323/pdf/45myk7z198lz6m.pdf https://announcements.asx.com.au/asxpdf/20230712/pdf/05rkk9qswfv78d.pdf

· November 2022 signed agreement to acquire an accounting business located in South West Brisbane, QLD https://announcements.asx.com.au/asxpdf/20221101/pdf/45h2ytcld30d9g.pdf

· October 2022 signed agreement to acquire an accounting business located in St Kilda, VIC. https://announcements.asx.com.au/asxpdf/20221028/pdf/45gwffzfk93zds.pdf

· September 2022 signed agreement to acquire accounting business located in Regional NSW. https://announcements.asx.com.au/asxpdf/20220914/pdf/45f2639p9m1zd2.pdf

· September 2022 signed agreement to acquire an accounting business located in Palm Beach, QLD https://announcements.asx.com.au/asxpdf/20220901/pdf/45dn6gz68ld687.pdf

· July 2022 announces signed agreement to acquire an accounting business located in Leeton NSW. https://announcements.asx.com.au/asxpdf/20220721/pdf/45c1g5wtbfp0ws.pdf

· April 2022 announces it has signed agreement to partner with a leading accounting business located in regional NSW. https://announcements.asx.com.au/asxpdf/20220414/pdf/4580gyh6yt8xr2.pdf https://announcements.asx.com.au/asxpdf/20220701/pdf/45bg4kmd8x3bn0.pdf

· March 2022 announces today that it has signed agreement to partner with a leading accounting business located in Regional Victoria. https://announcements.asx.com.au/asxpdf/20220307/pdf/456rh7jb60kp1r.pdf

· December 2021 acquire an accounting business located in Canberra ACT. https://announcements.asx.com.au/asxpdf/20211216/pdf/4546yz1rbrjt7c.pdf

· December 2021 acquire an accounting business located in Central Coast NSW. https://announcements.asx.com.au/asxpdf/20211215/pdf/4545l4dz6pf0gr.pdf

· December 2021 acquire an accounting and financial planning business located in Northern Beaches NSW https://announcements.asx.com.au/asxpdf/20211206/pdf/453tmp96vl8ct9.pdf

· November 2021 acquire an accounting firm located in Carlton, VIC https://announcements.asx.com.au/asxpdf/20211122/pdf/4537s8m6fwqlkr.pdf

· November 2021 acquire an accounting firm located in Penrith https://announcements.asx.com.au/asxpdf/20211109/pdf/452qvp8tr1pbbq.pdf https://announcements.asx.com.au/asxpdf/20211112/pdf/452wmc32wlgq39.pdf

· October 2021 acquire an accounting firm located in Canberra, ACT. https://announcements.asx.com.au/asxpdf/20211028/pdf/4528k53n1qdq3z.pdf

· May 2021 acquire an accounting firm located in Norwest, NSW https://announcements.asx.com.au/asxpdf/20210527/pdf/44ww3btrd6wj0n.pdf

· April 2021 acquires an accounting firm located in the Sydney CBD. https://announcements.asx.com.au/asxpdf/20210427/pdf/44vx3qfcyt9p4w.pdf

· April 2021 acquired an accounting firm located in Newcastle, NSW. As part of the acquisition, a new partnership will be formed in the name of Kelly Partners Hunter Region. https://announcements.asx.com.au/asxpdf/20210421/pdf/44vr486wz5t9w5.pdf

· February 2021 acquire a financial services and accounting group located in Gosford, NSW. A subsidiary of Kelly Partners will acquire 51% interest in the financial services businesses (ie private wealth management, life insurance broking, finance broking) with the existing vendor owning the remaining 49%. https://announcements.asx.com.au/asxpdf/20210222/pdf/44swggrwlhcrgv.pdf

· February 2021 acquired an accounting firm located in the Inner West, NSW https://announcements.asx.com.au/asxpdf/20210215/pdf/44sncdgsttydfh.pdf

· December 2020 AUB Group announces partnership with Kelly+Partners Group

AUB Group Limited (ASX: AUB), Australasia’s largest equity-based insurance broker network, today announced it has entered into a new partnership with Kelly+Partners Group (ASX: KPG). The new partnership service offerings will include the following: the provision of general and life insurance broking services to Kelly+Partners clients and members; general insurance advice and services to Kelly+Partners Group Holdings Ltd; accounting and tax services to Austbrokers clients and members; design and delivery of tailored solutions for Kelly+Partners clients including a tax and government, audit insurance product as well as specialty HR technical advisory services; and the development of insurance, tax and accounting advisory services for the strata industry. https://announcements.asx.com.au/asxpdf/20201203/pdf/44ql1p6kg5gnx0.pdf

· June 2020 acquired an accounting firm located in Bathurst NSW. https://announcements.asx.com.au/asxpdf/20200617/pdf/44jqr8w0kmx6zj.pdf

· October 2019 acquire an accounting firm located in the Melbourne CBD. https://announcements.asx.com.au/asxpdf/20191002/pdf/4493t356v65hpd.pdf

· September 2019 acquire an accounting firm in the Blue Mountains region of Sydney with the structure following KPG’s standard Partner-Owner Driver Model. https://announcements.asx.com.au/asxpdf/20190925/pdf/448v09fbv0hn0n.pdfhttps://announcements.asx.com.au/asxpdf/20191104/pdf/44b7jr95l169s8.pdf

· December 2018 acquire a 100% interest in an accounting firm in Warriewood to assist in the succession of the senior practitioner. The business will be tucked into the existing Kelly+Partners Northern Beaches business to create synergies and operating leverage. The acquisition, together with the acquisitions announced in August in the Inner West of Sydney and North Sydney in total represent approximately $4m of recurring tax, accounting billings. https://announcements.asx.com.au/asxpdf/20181203/pdf/440xd4cz8td4vv.pdf

· August 2018 aquires an accounting firm in the inner west of Sydney with the structure following KPG’s standard 51% Owner Driver Model https://announcements.asx.com.au/asxpdf/20180816/pdf/43xcz56fthsq7j.pdf

Seems like a decent result from Kelly Partners last week:

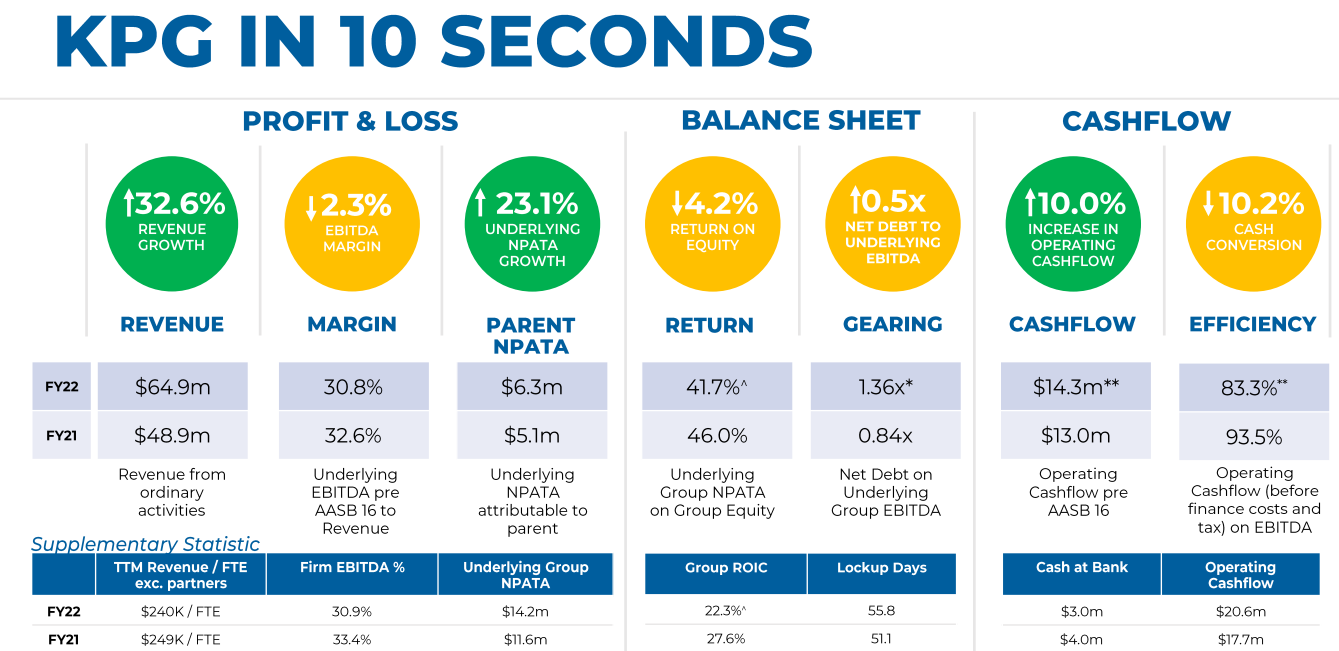

The disconnect between revenue and profit growth are largely attributable to the impact of new acquisitions and added investment. They reckon they can lift operating margins back to 35%, and have some good form on this front -- in fact adding operational efficiency is pretty much what they try to be all about.

Thumb sucking the next 12m of dividends, i reckon shares are on about 2% or so. The forward PE is probably around 25. While I think they can probably sustain a respectable average long-term growth rate (7-9% or so), it feels like shares are roughly around their fair value.

Like a few people here Kelly Partners is one that I have been interested in for a while but never took the plunge as it was expensive, I also thought it was just another roll up that would implode at some stage and I wasn't confident that Brett Kelly wasn't a con, claiming to be the next coming of Buffett. I am now pretty confident that none of those things are true. This is clearly a Brett Kelly story and hats off to him as he has delivered on what he said he would do. Definately worth watching the strawman interview and the 2022 AGM presentation.

I am coming around to his viewpoint that this isn't really a roll up as he is just aquiring little engines that he makes more efficient and then they keep pumping away semi-independently from the larger group. I am seeing how he structures the debt deals so while the gearing ratio is high (1.36x currently), each office pays it off over time, and in a lot of ways this is a really efficent use of debt - buying productive assets. I trust them to buy the right buisnesses and they seem to have a good filter on how they do this, so I think the risk of poor buying is low. Their ROE ranges between high 30's low 40's and ROIC ranges between 20-25%.

I really like the way they present their financials and plans, everything is very transparent. Management quality is high, they are claerly aligned with shareholders, they focus on EPS as a measure of success and don't issue shares during acquisitions or as performance bonus's. The crazyness of how much shareholders give away to poor management teams, with low performance hurdles is only highlighted when you start to examine the group outliers like KPG.

I think KPG is part of that small group of buisnesses that are worth a premium and I don't think a PE ratio of 30-35 is unjustified, if planning on holding for several years, given their execution to date and expansions plans. They did get up around 45 earlier this year, which I thought was a bit steep, but I do think if we come back in another 10 years they will have probably doubled all of their key metrics at least once and probably twice. They have talked about expanding into the US (california) which I thought was crazy when I first heard it, but if you look through how they plan to do this and why California then it is easy to see the attractiveness to their approach and why they should be successful or at worst not a catastrophic failuire..

I am expecting that they will achieve or come very close $80M revenue this year, which will be 1-2 years ahead of their existing 5 yr plan. This is based on $65M made last year and the full year contribution of last years acquisitions which will add another $7-10.5M, and they will get another $3.8M from the acquisitions made this year and I expect a few more will be made over the enxt 3-4 months. They have been growing organically at around 3-5% once they acquire the buisness. I am expecting a EPS of between 17-18c. They have a 2-3% dividend yield. Its not a bargain but I think it is fair valued at its current price and I can't really see this getting cheap unless there is a major problem inside the buisness, in which case we should get an early indication from the reported numbers. I see this as a relatively low risk way to play an uncertain 2023 and potential recession effects.

Brett Kelly's salary has been increased from $360K to $800K from this year, but given how integral he is to this buisness I think this is ok, given that he doesn't have any share performance bonuses.

I think they should make $80M revenue and do around 17-18c EPS in FY2023. I am using a multiple of 30 as I think this is a high quality buisness that has proven its capabilities. This gives me a fair value range of $5.10-5.40 for end of FY23.

Noddy well summarised and respect the risk in terms of the debt accrued in FY22. Something to watch heading into FY23 in meeting long term goals.

Having looked into the Kelly Group after Andrew interview it was very interesting to hear the focus and clarity Brett displayed in respect to the process the group had built up and executed as they made acquisitions.

This is no doubt a driver of getting the PE up and investors willingness to pay for quality.

You simply know what your getting.

The strategy page in the presentation today caught my eye. Specifically in terms of meeting the 5yr plan.

Many corporations are ambitious in plans but to be at the end of the 3rd year of the 5 yr plan and within reach across the revenue , EBITDA and NPAT lines provides confirmation on the effectiveness of the discipline and process focus.

Fair to expect the EBITDA and NPAT margins to improve in FY23 as the acquisitions are bedded in.

Disc Holder RL

Kelly Partners came out with a very early full year results and Annual Report today and it was quite strong. Revenue growth accelerated in the second half to end the year up 32.6% vs FY21. EBITDA and NPAT were also up (although down as a % of revenue).

For those that don't know Kelly Partners is a accountancy practice roll-up focusing on servicing SMEs and high worth individuals. It is very prominent in NSW, particularly western Sydney, but has branched out to other regions and has aspirations to take its model overseas. So far sounds pretty dull but there are a few things that make it more interesting. Firstly the founder and Managing Director Brett Kelly is a devotee of Charlie Munger and Warren Buffett and has done the rite of passage to the Berkshire Hathaway conference in Omaha. He is also a fanatical reader and indeed has some investment books that any new employees/partners are required to read during their induction (or face termination). Surprisingly for an acquisition model company they have not issued a share since IPOing in 2017 and Brett Kelly has stated he has no intention on that changing. They also are one of the few companies to pay a monthly dividend.

Brett appeared on a recent Australian Investors podcast with Owen Rask and it's worth a listen whether you're interested in the company or not. It was also discussed on a recent Baby Giants podcast and is a bit of a favorite on FinTwit. I've looked at it a few times and just never gotten the conviction to buy it (to my detriment). I'm ok with the rollup model but the minority interest that generates makes it hard to analyse this company and get comfortable with the financials. Also, although it's great they haven't been issuing script, the consequence is they have a high level of debt. In fact net debt plus contingent consideration is greater than the entire equity of the company. Also as a result of all the acquisitions intangibles are very high, mainly goodwill and customer lists, which have arguable intrinsic value and no tangible value.

I suspect my biases will prevent me from owning it any time soon but a really interesting company whose journey is worth tracking.

Executive Director, Ada Wig Poon (with a Board retainer of $12,000) bought on the market 37,623 shares averaging $3.65/share and totalling $137,650 between 9th and 11th August. During the same period of time they also sold 9549 shares at $3.53 per share totalling $33,708 in their SMSF. The net result was an accumulation of 28,074 shares totalling $103,942. The Director has approximately an 0.8% stake in the company.

What makes these trades interesting is the timing. The purchases were made over 3 days following the FY21 results announcement on 9/08/21. The Director obviously has a different point of view about the future of the company than the rest of the market. KPG shares have fallen sharply from an all time high of $4.14 to yesterday's close at $3.40, down 18%.

Disc: Held IRL

Brett Kelly’s eponymous business in which he owns 51%.

The alignment of management (especially Brett Kelly, CEO & Chair) is so strong that this is really a bet on Brett.

In reading his writing, listening to him speak and in my interactions with him he seems like a very driven, earnest, focussed, long term thinker – mimics Buffett, et al.

Revenue CAGR 15% p.a. since IPO and projected to continue until 2024 at least.

Pays 50% of NPAT in Dividends which have been growing 10% p.a. since IPO and set to continue for the foreseeable future.

Clever use of debt to fund acquisitions – capital raises unlikely.

Very thoughtful strategy with good track record of execution (from scratch) and long runway ahead.

Reputation growing in target market as an acquirer of choice.

‘Death and Taxes’ thematic

Disc: Held

(Reactivating some initial notes i posted here a while ago.)

A roll-up play for SME sized accountancy practices. Generally not interested in services business OR roll-ups, BUT...

- Still at an early stage. This is when roll-ups work best, when incremental gains from a low base really help move the dial, and the acquirer has a lot of low-hanging fruit.

- Appear to be getting good organic growth, so revenue growth not just purely a function of acquisitions

- Genuine partnership model with acquired partners retaining 49% interest

- Average age of acquired partners is just 42

- Well practiced at acquisition with around 30 completed since inception

- Business is profitable with +'ve operating cash flow. Pays a quarterly dividend

- High target ROI for acquisition ~35%

- Large target market -- 10,000 firms or $12b in revenue

Was impressed by management at a recent conference I saw them present at.

As a roll up play of services businesses, KPG is usually something I stay a mile away from. But i bought a small parcel in 2019 and 2020 at 75c because it was just so cheap.

I was happy to exit at around $1, but now wish I had held on!

Revenue was up 5.8% for the first half of 2021, but improving margins saw net profit per share up 55% (excluding acquisition amortisation).

I think management are smart operators, and this is a growth model that works well in the early years (if done right). The company appears to be effectively capturing its niche and is approaching scale.

There's still a decent growth opportunity ahead.

On an annualised basis, the PE is just under 17 -- not too demanding, all else being equal.

There could be more upside here, but for this kind of business i usually want a pretty attractive discount. The low hanging fruit is picked early, quality acquisitions become harder to find, and less impactful when purchased.

That being said, the higher the earnings multiple, the more attractve the "multiple arbitrage" becomes (eg buying a business on 4x earnings using shares trading at 16x earnings).

I'll continue to watch, but not inclined to dip my toe back into the water just yet.

Results presentation here