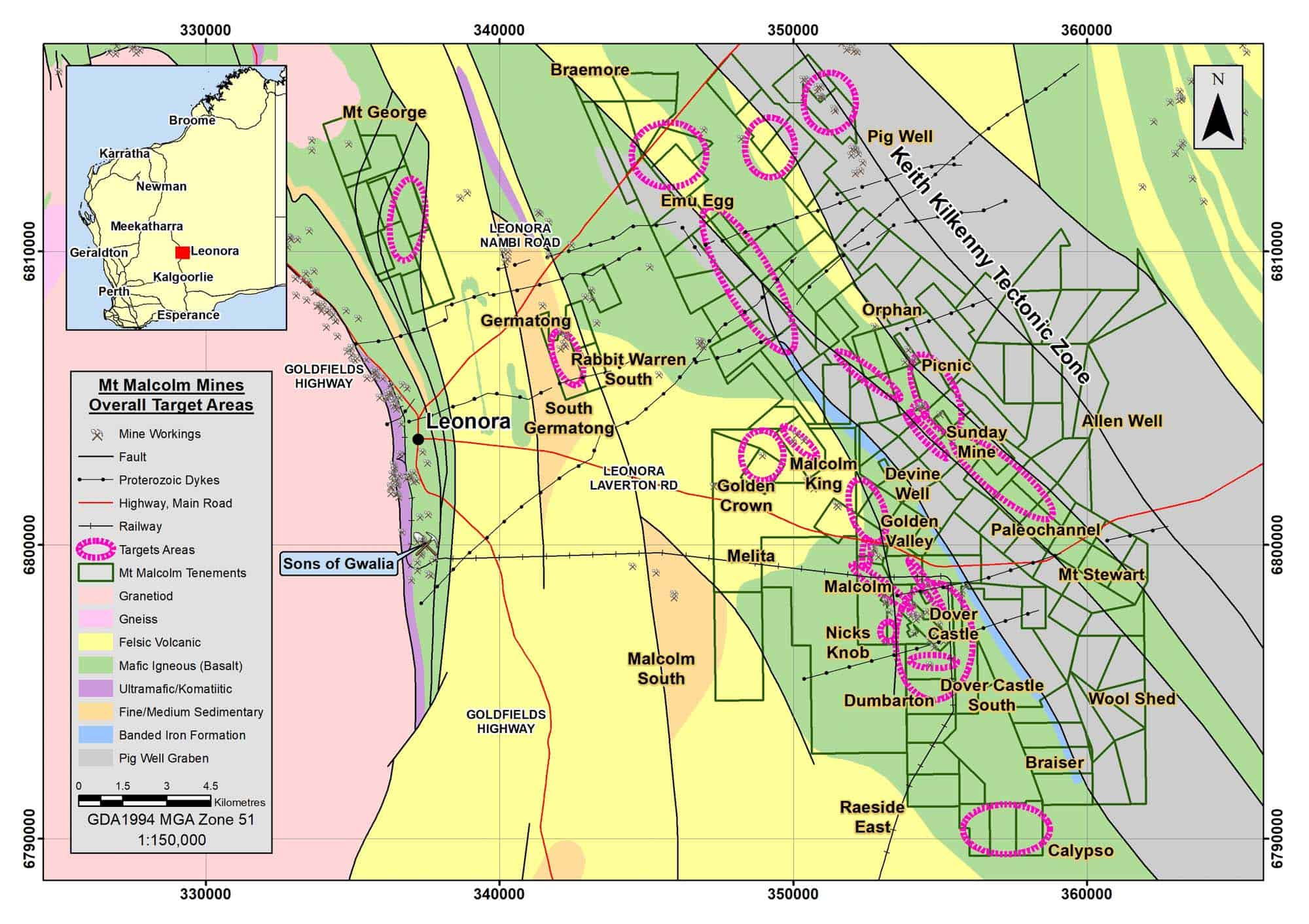

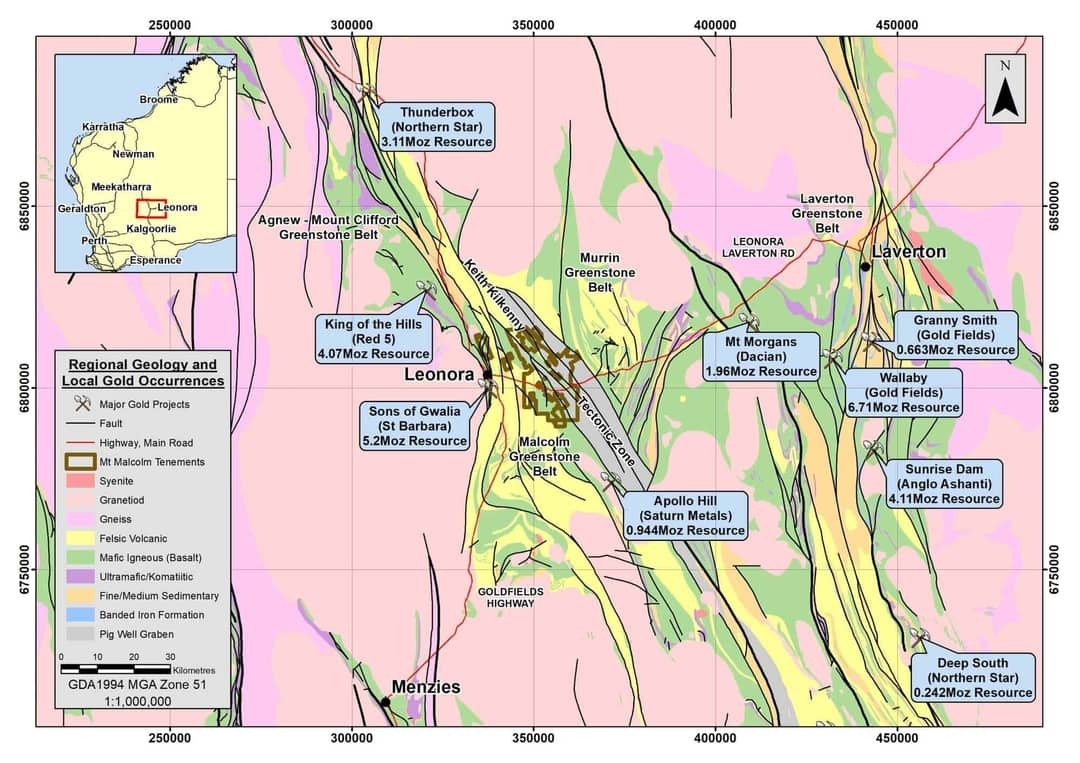

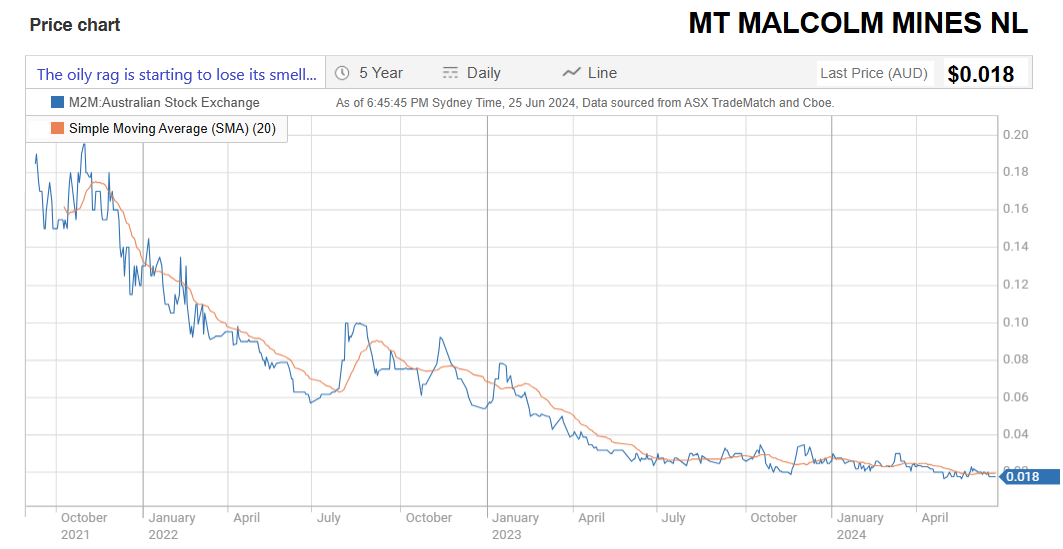

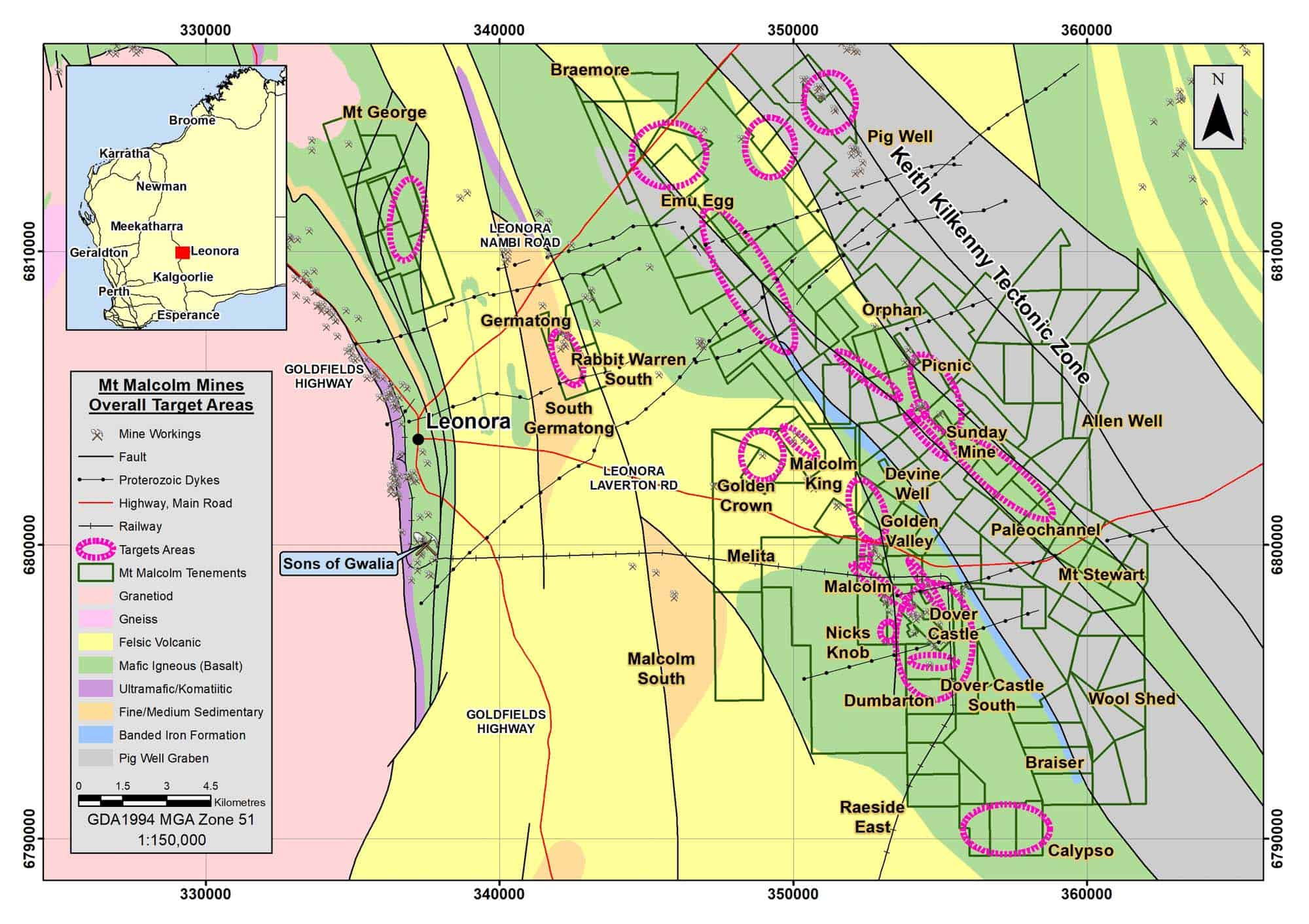

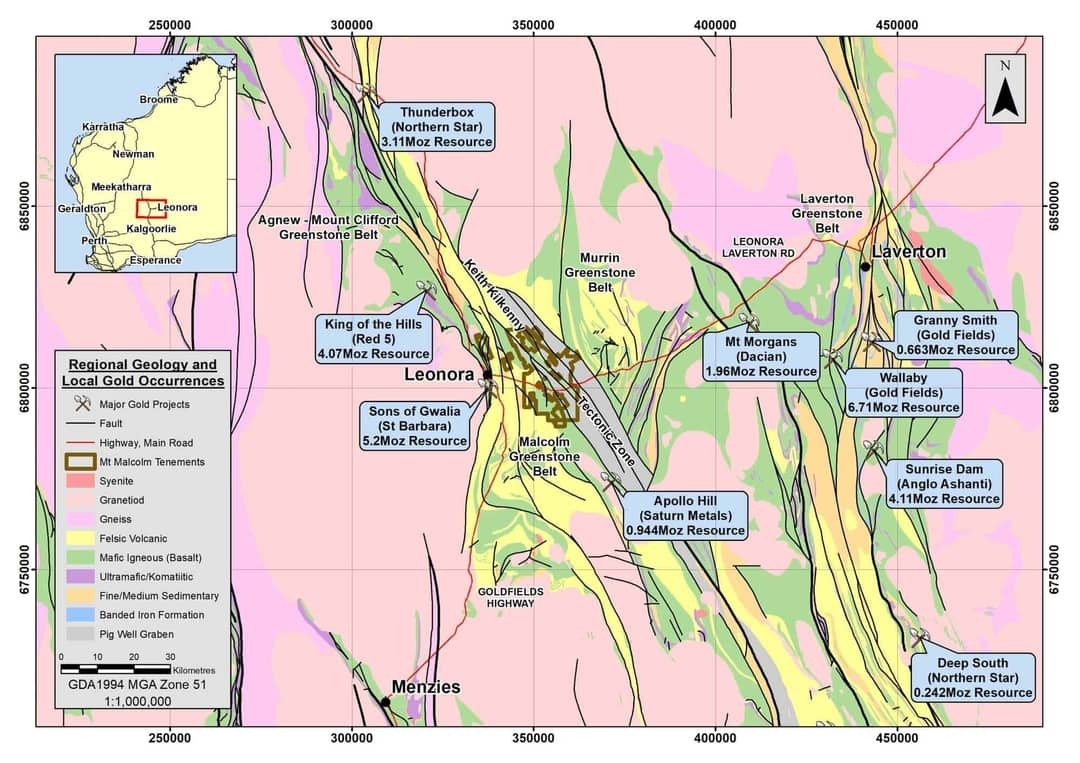

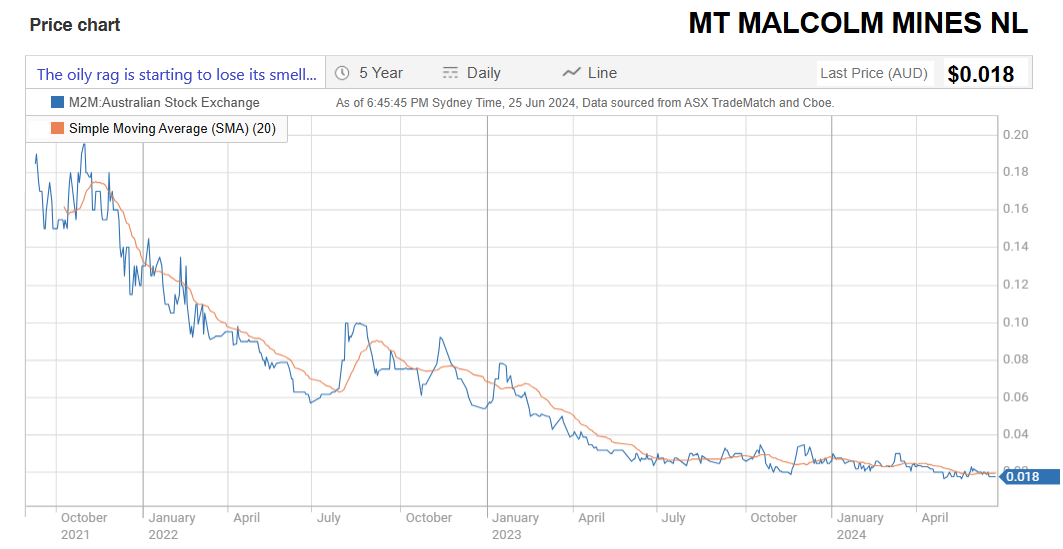

25-June-2024: M2M just keeps scraping through every quarter, on next to nothing. They are either going broke (into VA) or they're going to get bought out for peanuts by somebody like GMD who own good gold deposits all around M2M's tenements.

Current market cap: $3.3 million (no, not 33, 3.3)

Latest CR: Have a gander at this: M2M-Share-Purchase-Plan-Results-05-June-2024.PDF

Yeah, they did an SPP and got 17 applications for 9,250,000 new fully paid ordinary shares (New Shares), at an issue price of 2 cps, raising a total of $185,000 BEFORE COSTS.

This includes applications from directors for a total of $75,000.

They were targeting just $1m from the SPP - see here: Share-Purchase-Plan-1-May-2024.PDF

They then announced (see here: Funding-Update-27-May-2024.PDF) that subsequent to positive investor enquiries at the recent Sydney RIU Resources Roundup Conference, the Company has received firm commitments from sophisticated investors (non-related parties of the Company) to subscribe for up to $575K (being for up to 28,750,000 new ordinary shares) at the same price as offered under the SPP, i.e. 2 cents/share (cps).

So they tried to raise $1m, BEFORE COSTS, and got $75 K from their Directors, another $110 K from other investors, and another $575 K from new Soph's for a total of $760K BEFORE COSTS (all at 2 cps).

And that was probably because they couldn't get any support for another placement, which would obviously have had lower costs.

They closed today -10% lower than that raising price, at 1.8 cps. So, even though you might be chomping at the bit to buy a sh!tload of this fine company's shares here on SM, you can't, not while they're under 2 cps anyway, which could be for a while if their current share price trajectory continues. And that's probably for the best.

Pages 4 and 5 of their Cashflow Report, which is after their 19 page Activities Report here: Quarterly-Activities-and-Cashflow-Report-for-the-March-2024-Quarter.PDF says that they had 0.56 quarters (i.e. 7 weeks' worth) of funding available to them at March 31st based on their March Quarter cash burn rate.

In terms of how they expected to remain operating as a going concern they said the following:

8.8 If item 8.7 is less than 2 quarters, please provide answers to the following questions:

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not?

Answer:

The Company commenced and completed a 60 hole RC drilling campaign during the March 2024 quarter. Following this, the Company expects to have slightly reduced expenditures in the June 2024 quarter, but overall expects to have similar net operating cash out flows for the foreseeable future as it continues to execute on its planned work program.

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful?

Answer:

The Company obtained pre-approval from shareholders at its 31 January 2024 EGM to raise up to $3m in new equity (with such approvals set to expire on 30 April 2024). At the date of this announcement, the Company has not entered into any fundraising agreement to utilise this approval.

The Company has also entered and previously announced a drill offset deed (refer ASX announcement dated 9 February 2024). Under the deed that Company can offset 30% of drilling costs by issuing shares (up to $300,000 excluding GST). The Company previously settled $74k in costs via the issue of shares.

The Company also entered into a short term, unsecured loan facility arrangement with Mr Trevor Dixon, the Managing Director of the Company (refer ASX announcement of 31 October 2023 and item 7 above). Under the facility the Company have a further ~$490k in available funds it can drawdown, should it so choose.

The Company continues to monitor and consider its capital requirements and retains the ability to raise capital, as required.

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis?

Answer:

The Company will be able to continue normal business operations. The Company has the ability to reduce its discretionary expenditure to reserve cash, including until such time as it finalises any future capital raising options.

--- end of excerpt ---

Well that's a relief!! For a minute there they looked to me like a company on the bones of its arse searching desperately for a rag that might have a trace of oil on it that they could sniff.

That's from their website today. Money is tight and updating websites obviously remains a low priority. Dacian was acquired by Genesis (GMD) a couple of years ago and Sons of Gwalia was purchase by Genesis from St Barbara at the end of last June (2023).

Trouble is... it takes money to keep drilling, and without positive drilling results, the SP is only going to keep heading south east...

Disclosure: Yeah, nah. Not holding. Not planning to.