Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Macquarie Group Limited ('MQG')

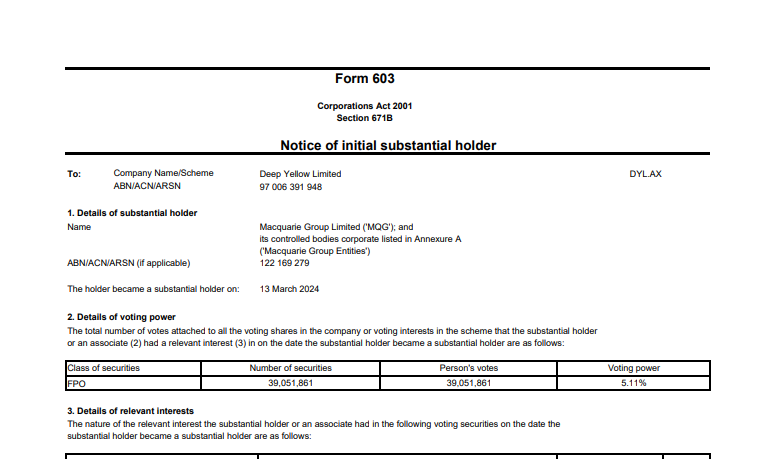

What is Macquarie doing buying into DYL Uranium? - Are they shorting this DYL?

Some people might be surprised to find out that Australia's highest paid boss (CEO/MD) of all listed Aussie companies is actually a Woman, the CEO & MD of MQG, Shemara Wikramanayake.

That's the Good news. The Bad news is that the other 9 on that list above are all men, and that she wasn't even the highest paid executive at Macquarie last year, just the highest paid MD/CEO, as explained below.

Her large payout is in part in thanks to the Macquarie Group’s profit share arrangement, which richly rewards executives when the company does well.

And the listed financial group did do well in 2022, securing net profit of A$4,706 million, 56% up on the year before.

Founded in 1969, Macquarie provides clients with asset management, banking, leasing, advisory and risk and capital solutions. The Sydney-headquartered firm employs more than 18,000 people and has offices in 33 markets globally and A$871 billion assets under management.

Driving the financial group’s success since 2018, Shemara has a three-decade-long career at Macquarie Group, most recently serving as Head of Macquarie Asset Management before taking the CEO role in 2018.

Since joining Macquarie Capital in Sydney in 1987, aged 25, she has worked in six countries and across various business lines, establishing and leading Macquarie’s corporate advisory offices in New Zealand, Hong Kong and Malaysia, and pushing the emerging asset management division of the business to become the bank’s most profitable venture.

Shemara, who is UK-born and of Sri Lankan descent, is the first Asian-Australian woman to head an ASX 200 company and has been instrumental in driving diversity at Macquarie, where at least half of female employees identify as coming from a culturally diverse background, while globally, more than a third of Macquarie female directors identified as ethnically diverse.

Despite this, the firm remains male-dominated, with less than 30% of the senior management ranks female.

--- ends ---

Source: https://businesschief.asia/corporate-finance/these-six-ceos-are-australias-highest-earning-heres-why [27-July-2023]

That top 10 list (of highest paid CEOs/MDs from 2022) above is based on the ASX100 Index, so Australia's largest 100 companies, generally speaking. If you expand that out to the full ASX300 Index, and look at the top 50, Shemara is still at #1, but the Bad news is she is still the only woman on the following list. Well there are two others, Liz Gaines (FMG) who quit that role late last year, and Jeanne Johns from Incitec Pivot (IPL) who left in June this year.

Jeanne Johns was replaced by Paul Victor as an interim CEO at IPL (and he's still in that role today), while the changes at FMG were a little more complicated. Liz was offered a new role as an executive director and global ambassador for Fortescue, and is paid around $1.3 million p.a. for that, and her old CEO job was split into two - Metals and FFI - with the CEO of Fortescue Metals job going to Fiona Hick who left after only 6 months and was replaced by Dino Otranto who had been their head of operations. The other CEO role at FMG was called CEO of FFI (Fortescue Future Industries) and is now called CEO of Fortescue Energy - which includes:

- Fortescue Future Industries (FFI) - Green energy technology and production;

- Fortescue WAE (Williams Advanced Engineering) - Battery and fleet technology development and manufacturing; and

- Fortescue Hydrogen Systems - Electrolyser and hydrogen production systems development and manufacturing.

...and that role was given to Mark Hutchinson.

So while there are three women on the following list of the 50 highest paid CEOs from Australia's largest 300 listed companies (i.e. from the ASX300 Index), only one of those three, Shamara Wikramanayake, is still a CEO or MD today (Shamara is both).

Source: https://www.afr.com/work-and-careers/workplace/revealed-australia-s-50-highest-paid-ceos-in-2022-20221205-p5c3o6 [9-Dec-2022]

Well done to Shemara obviously - she has done very well - however - while it's great that she tops these lists, it's not too great that all the other CEOs and MDs are men. At least the well paid ones seem to be dominating these lists, and despite a fair amount of progress getting better representation on company Boards, women are not getting anywhere near equal representation in very senior roles within Australian listed companies. I'm am seeing more women CFOs these days and heaps of women are in senior HR, "People" and "Safety" roles, but we do need to see more women CEOs and MDs. I find that many women tend to have superior multi-tasking skills, they are more willing to listen and take other ideas on board and work collaboratively (maybe that's a testosterone and/or ego issue with many men), they tend to have less anger management issues, and from my limited experience with middle-management, they tend to deal with stress more appropriately and effectively. And the good ones also know bullsh!t when they hear or see it and don't accept it. Being a strong, decisive and effective leader doesn't mean you automatically have to be a dick - or have one.

Macquarie chief Shemara Wikramanayake topped the ranks of CEO pay again in 2022. Bloomberg

Further Reading: https://www.smh.com.au/business/small-business/it-s-despicable-kim-jackson-calls-out-lack-of-funding-for-women-led-companies-20190701-p52333.html

Venture capitalist Kim Jackson wins business award (afr.com)

How I made it podcast: Carolyn Creswell and Carman’s, from checkout chick to $170m empire (afr.com)

Manning Cartell co-founder Gabrielle Manning on how to create a successful fashion brand (afr.com)

Topic | Female Founders | Australian Financial Review (afr.com)

Another MQG Director buy of $50k at $176. Read into it what you will

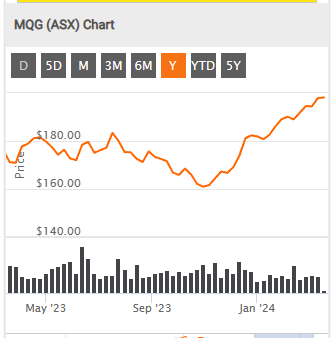

- A look back at 27/07/23:

*Difficult for the 'Millionaires Factory " the increasing high interests is the wrong environment for MQG the strategy.

Return (inc div) 1yr: 2.99% 3yr: 16.67% pa 5yr: 11.59% pa

Return (inc div) 1yr: 2.99% 3yr: 16.67% pa 5yr: 11.59% pa

Glenny's report a bit here:

Mr Stevens said “The Group delivered a record profit of $A5.2 billion, for a return on shareholders’ equity of 16.9 per cent. This was an exceptional outcome, achieved by a high-performing management team who deliver for shareholders by delivering for clients.

Macquarie’s diversification was again evident – even as some business lines faced difficult trading conditions, others were able to expand profitably by servicing a growing client base

MQG Director Mike Roche buy - 700 shares at $120k

another MQG Director buy at $171 for $70k

For those that want some Australian history and a look into the history of Macquarie I'd recommend the new book Millionaires' Factory: The inside story of how Macquarie Bank became a global giant. Only half-way through but finding it very interesting.

Another deal being negotiated by MQG

--National Grid PLC's disposal of a 60% stake in its U.K. gas transmission business will be reviewed by the U.K. government amid increased concerns about energy security, the Financial Times reports.

--The sale to an international consortium led by Australia's Macquarie Group Ltd. is to be reviewed under the National Security and Investment Act, the FT says.

Aug 7 (Reuters) - French waste and water management company Veolia Environnement SA is nearing a deal to sell Suez SA's UK waste business to Australia's Macquarie Group Ltd (MQG) for about 2.5 billion euros ($2.5 billion), Bloomberg News reported on Sunday.

The deal, aimed at resolving antitrust concerns, could be announced as soon as Monday, the report added, citing people familiar with the matter. ()

An investor group led by Meridiam SAS and Global Infrastructure Partners, which bought Suez's business in France and several other countries, has the right to make an offer for the Suez UK assets by matching the price Macquarie is offering, Bloomberg said.

Veolia said in June this year it was proposing to sell off its former rival, Suez's UK waste business, after Britain's Competition and Markets Authority (CMA) raised objections to the Veolia/Suez combination.

NPAT of $4.7 Billion up 56% on FY21

Assets under management $774.8 Billion up 37% on FY21.

Return on Equity 18.7%

CET1 Level 2 Ratio: 11.5%

$3.50 AUD final dividend (40% franked)

34% home loan growth to $89 Billion and 4.4% marketshare.

Hi Barney,

The fall is driven by sentiment, business hasn’t changed. The price got way ahead of itself imo so was probably due for a pullback sooner rather than later.

I wouldn’t compare it so much to the majors, very different business. Apart from being an investment bank compared to a retail one, they’ve altered their business dramatically in the last decade. Around 63% of net profit now comes from their annuity style businesses including their infrastructure unit. With less of their revenue from market facing activities they’re not as leveraged to market conditions as they once were but in a pullback like we’re experiencing most things get hit! The silver donut is still humming along nicely.

Disc: Held IRL

As I have previously indicated, Macquarie Group was a recovery play for me. This has played out nicely until a week or so ago with shares having declined around 15% So what is going on and it is just general market sentiment?

Its banking cousins, the big 4 have all fallen in a similar timeframe. These banks though have fared a little better with the slide around half that Macquarie has suffered.

The US Fed announced today plans to raise interest rates in March and reaffirmed plans to end its bond purchases also in March in what the central bank chief Jerome Powell pledged will be a sustained battle to tame inflation.

Powell said policymakers at this point feel they have quite a bit of room to raise interest rates without threatening progress on jobs or slowing economic recovery.

Half results to 30 September 2021 were released mid January and showed:

- Net profit after tax of $2,043M

- Revenue was up over 40% year-on-year

- Net operating cash flow was $17,937 compared to an outflow of $5,000M in the previous corresponding period

For now, I’ll continue to hold.

Hi All,

Just wanted to share my thoughts on Macquarie Group - certainly a less 'sexy' stock than the average stock held on Strawman. Disclosure: I hold in Strawman and in RL portfolio (3rd largest holding in RL portfolio).

On many metrics, MQG looks expensive today - at least relative to peers locally and globally (eg trailing PE of ~24). And on this basis, I'm currently reluctant to accumulate more MQG shares.

However, I'm not selling either, which is due to MQG's exposure to the green economy / climate change. It currently has 30 GW of renewable energy assets under development. However, more importantly - MGQ has created the capability (or muscle) to manage green energy projects end to end - from design to financing to operationalisation. Similar to Google or Apple's technology ecosystem, MQG has developed a system to play the green energy theme across its businesses - even within its retail banking business via the offering of loans for EVs to consumers.

I'm confident that going forward, MQG's earnings contribution from its businesses with exposure to climate change abatement will only increase. This should translate into a very healthy tailwind for total group earnings. This is a view shared by analysts from Jefferies and Morgan Stanley, with price targets of $211 and $240 respectively.

Blockchain firm Blockstream Mining said it would partner with Australian financial conglomerate Macquarie Group (MQG.AX) to develop bitcoin mining facilities that use renewable energy. Partnership would initially include mining hardware hosting, with the potential to scale in stages as green power infrastructure is deployed. The first project will be based in North America.

Is this why the shareprice has increased recently? Setting up a crypto hosting/trading platform?

Should I Buy Macquarie Bank Shares? Highlights

MQG Share Price

Much like the rest of the market MQG shares have now fully recovered from the COVID Crash, and are now pushing all-time highs. At the time of writing MQG is priced at $153.71. Their share price is up 10.72% over the last 6-months and up 22.79% over the last 12 months. These results are largely in line with the market average being up 21.73% in the last year.

MQG has dropped off slightly from its all-time high in May, their 52-week range is 118.36-162.06. Its current market capitalization is $56.6 Billion.

Over the past 10-years, MQG has made excellent returns for investors with their share price increasing 466.92%. Each year the share price has made an average gain of 41.66%, while also averaging a dividend yield of 15.04% over a ten-year period. Investors have enjoyed a 56.70% return averaged over the long term.

About

Macquarie Group is an international company in the financial services space. They operate in 32 markets in asset management, retail and business banking, wealth management, leasing and asset financing, market access, commodity trading, renewables development, specialist advisory, capital raising, and principal investment.

Macquaries Businesses:

Macquarie Asset Management – A top 50 global asset manager, managing over $495 billion of assets on behalf of superannuation funds and other institutional investors Macquarie Asset Management oversees three stand-alone businesses:

- Macquarie Infrastructure and Real Assets (MIRA)

- Macquarie Investment Management (MIM)

- Macquarie Specialised Investment Solutions (MSIS)

Banking and Financial Services – This is Macquarie’s retail banking business that provides personal banking, wealth management, and business banking products.

There are two capital markets facing businesses:

Commodities and Global Markets – Conducts market research on behalf of clients covering equities, derivatives, fixed income, foreign exchange, and commodities.

Macquarie Capital – Advisers and facilitates the listing of companies on the share market, and provides other Investment banking services.

Macquarie Asset Management (MAM) and Commodities and Global Markets (CGM) are by far the most profitable ventures for Macquarie, each generating over $2 Billion in profits over the FY21.

Dividend History

MQG shares typically announce a dividend with the release of its half-yearly results in November and full-year results in May as seen in their financial calendar. Dividends are typically paid twice a year, in July (Final Dividend) and December (Interim Dividend).

The current average yearly dividend for MQG shares is $4.70 giving them a solid net yield of 3.07% or a gross yield of 3.59% at the current share price.

Financials

In May MQG released its Full Year FY21 report. The group lists the following highlights:

- FY21 net profit of $A3,015 million, up 10% on FY20; 2H21 net profit of $A2,030 million, up 106% on 1H21, up 59% on 2H20

- International income representing 68% of total income

- AUM of $A563.5 billion, down 6%

- Financial position comfortably exceeds regulatory minimum requirements

- Group capital surplus of $A8.8 billion

- Bank CET1 Level 2 ratio 12.6% (Harmonised: 16.2%)

- Annualised return on equity of 14.3%, compared with 14.5% in FY20

Macquarie Group’s profit of $3 Billion, represents their largest profit to date.

Current Broker Views

Citi: Sell, Target Price: $140

Macquarie’s acquisition of AMP Capital’s global equities and fixed income business (GEFI) adds a further $60bn of funds under management (FUM), lifting Macquarie Asset Management’s (MAM) total FUM to $720bn.

Citi expects no earnings contribution in FY22 with a minor benefit in FY23/24.

Forecast:

- Citi forecasts a full year FY22 dividend of 520.00 cents and EPS of 797.40 cents.

- Citi forecasts a full year FY23 dividend of 540.00 cents and EPS of 808.60 cents.

Morgan Stanley: Overweight, Target Price: $175

The acquisition of GEFI will add further diversity, scale, and relationships in the A&NZ market.

Forecast:

- Morgan Stanley forecasts a full year FY22 dividend of 550.00 cents and EPS of 845.00 cents.

- Morgan Stanley forecasts a full year FY23 dividend of 605.00 cents and EPS of 908.00 cents.

Morgans: Add, Target Price: $171

MQG’s full-year profit beat Morgans estimates. Morgans are expecting a flattish result for FY22, with positive results from the Macquarie Capital (MC) and bank.

Forecast:

- Morgans forecasts a full year FY22 dividend of 526.00 cents and EPS of 832.40 cents.

- Morgans forecasts a full year FY23 dividend of 590.00 cents and EPS of 918.00 cents.

Prophet’s Take

Macquarie Group has performed very strongly during the economic downturn. Their strong balance sheet has allowed them to act in this time and grow their portfolio by acquiring AMP Capital’s global equities and fixed income business (GEFI), this has added $60 Billion of funds under management (FUM).

Their ability to respond and grow profits to all-time highs has proven the long-term ability of MQG. We are bullish on MQG.

Full Analysis: https://prophet-invest.com/should-i-buy-macquarie-bank-shares

This was one of my COVID plays, not that I think Australia, or the world indeed is out of the proverbial woods yet. Last year I read Adam Kucharski fortuitously timed book, The Rules of Contagion. The ‘rona is nasty as it is just so easily spread.

Why Macquarie Group you may ask. My thinking extends beyond being a COVID recovery play, with this idea part of a longer term holding, albeit on that I made a much larger play for during COVID.

The business comprised of four buckets:

· Asset Management

· Bank and Financial Services

· Commodities and Global Markets

· Capital

Each of the four have over time been on upswings or downtrends which overall seems to balance things out positively.

As they are tied to large infrastructure investments. You kind of need to take a bet the global economy (or the economy in which Macquarie invests) will not implode.

Macquarie also has pulling power. They attract and retain some of the best and brightest. Maybe the Millionaire Factory reputation is part of it.

21-Mar-2021: Most of the companies that are popular here on Strawman.com do not have a lot of major broker coverage, so I don't look at this too often, but I was having a look at Macquarie today and I was surprised by how varied the broker opinions and targets are. Obviously MQG is a leveraged play on the stockmarket, in that they tend to outperform in a bull market and are absolutely smashed in a bear market, i.e. they tend to overshoot the general market in both directions when the markets are moving. Broker views on MQG are therefore based on their outlooks for markets globally, as well as whether or not they think MQG has already run too hard. Here's what they most recently had to say, as summarised by Rudi Filapek-Vandyck at FNArena.com:

Morgans - 23/02/2021 - Add - Target: $162.30 - Gain to target $13.93

Macquarie Group has upgraded recent guidance for profit (NPAT) to be “up around 5%-10%” on pcp from "slightly down on FY20”. This was driven by increased demand for gas and power as a result of severe weather conditions across North America, explains Morgans.

After upgrading forecasts, the analyst notes the diversification of the Macquarie business has come to the fore and will help deliver an impressive profit growth outcome. It's considered the group remains well positioned to seize opportunities on the other side of covid-19.

The Add rating is unchanged and the target price increased to $162.3 from $147.

Target price : $162.30 Price : $148.37 (23/02/2021) Gain to target $13.93 9.39%

Credit Suisse - 23/02/2021 - Neutral - Target: $145.00 - Loss to target $-3.37

Macquarie Group has upgraded guidance for FY21 earnings to be up around 5-10%, having previously guided to "slightly down" on FY20. Accordingly, Credit Suisse upgrades estimates, anticipating an improved performance from the commodity markets.

Macquarie Group has indicated extreme winter conditions in North America have increased demand from clients for its services in relation to gas and power. Neutral rating retained. Target rises to $145 from $141.

Target price : $145.00 Price : $148.37 (23/02/2021) Loss to target $-3.37 -2.27%

Morgan Stanley - 23/02/2021 - Overweight - Target: $160.00 - Gain to target $11.63

Macquarie Group now expects FY21 profit to be up 5-10% compared with the prior guidance of "slightly down". Morgan Stanley expects a mildly positive reaction in the share price.

Winter weather in North America has driven stronger commodity trading conditions and the broker calculates new guidance implies an extra $500-600m in revenue in the commodity market segment.

This will be a one-off trading gain, with no flow to FY22. Overweight rating, $160 target and In-Line industry view maintained.

Target price : $160.00 Price : $148.37 (23/02/2021) Gain to target $11.63 7.84%

Ord Minnett - 23/02/2021 - Accumulate - Target: $158.00 - Gain to target $9.63

Macquarie Group has upgraded first half guidance, now expecting net profit to rise 5-10%. Extreme weather in North America has increased demand for the company's capabilities in the gas and power business.

Ord Minnett increases assumptions regarding multiples, to better reflect the value of the long volatility position that pays off sometimes when conditions are supportive. This leads to an increase in the target to $158 from $155. Accumulate retained.

Target price : $158.00 Price : $148.37 (23/02/2021) Gain to target $9.63 6.49%

Citi - 23/02/2021 - Sell - Target: $125.00 - Loss to target $-23.37

Macquarie Group has upgraded its FY21 net profit guidance by 5-10% implying a profit of $2.85-$3bn. – The upgrade was led by severe cold weather in Texas that has caused prices in the pipeline to spike.

Citi believes the upgrade suggests the group's commodities and global markets' division earned $600m in revenue in just 2 weeks. The broker upgrades its FY21 profit to $2,934m or 7.5% higher than FY20 while leaving the outer years unchanged.

Sell rating is maintained with a target of $125.

Target price : $125.00 Price : $148.37 (23/02/2021) Loss to target $-23.37 -15.75%

UBS - 10/02/2021 - Neutral - Target: $145.00 - Loss to target $-2.37

UBS observes Macquarie Group's update on December quarter shows a strong cyclical recovery in revenue with market conditions improving significantly. Even so, the group expects FY21 earnings to be slightly down on FY20.

The broker has a positive medium-term view on Macquarie Group as hard asset deal-flow improves and asset recycling accelerates.

Looking at the recovery in trading and markets revenue and the significant operating leverage, UBS upgrades the group's FY21 earnings forecast by 15%.

Neutral rating with the target price rising to $145 from $135.

Target price : $145.00 Price : $147.37 (10/02/2021) Loss to target $-2.37 -1.61%

Note: Excludes dividends, fees and charges - and negative figures indicate an expected loss.

MQG closed at $148.80 on Friday (19-Mar-2021). [I do not currently hold MQG shares.]

MQG is currently at the top of its historical trading range. It's a high-quality business that has benefited from the macro-trend that is benefiting the banks. However, it's a bit too hot for me, right now.

Note: Deciding on a good entry price has always been difficult. So, I have started looking at the historical trading behaviour (based on Forward-PE Ratios) of a number of high-quality companies.

10-Feb-2021: 5 of the 6 brokers who cover Macquarie Group (MQG) - according to FNarena.com - have upgraded their guidance this morning after MQG's results announcement yesterday.

Broker (date of last update), Call, Target Price (TP), gain/(loss) to reach TP from current SP (share price):

- Citi (10/02/2021), Sell, $125.00, (-15.04%)

- UBS (10/02/2021), Neutral, $145.00, (-1.44%)

- Credit Suisse (10/02/2021), Neutral, $141.00, (-4.16%)

- Morgan Stanley (10/02/2021), Overweight, $160.00, +8.75%

- Ord Minnett (10/02/2021), Accumulate, $155.00, +5.36%

- Morgans (04/12/2020), Add, $147.00, (-0.08%).

The average across all 6 brokers is slightly positive, and an average TP of $145.50. MQG closed at $143.14 yesterday and is trading at around $147 to $148/share now (today), suggesting there is not a lot of near-term upside in the SP, and plenty of near-term downside if the market tanks for any reason, because MQG are very leveraged to the market, so do well in a bull market but are usually hit pretty hard in a correction or crash (or a bear market).

While it looks like it might be "as good as it gets" for Macquarie right now, things could actually get even better if there is some serious new infrastrusture spending around the globe, particularly in Australia, the USA, and Europe, and particularly transport infrastructure. Even more so if done via public/private partnerships (PPPs) and MQG are involved. But they do look fairly fully priced to me up here. I would only be interested in buying MQG at much lower levels when they've been sold down, not when they're flying (like they currently are). The risk/reward equation doesn't look attractive to me at current levels, despite their excellent report yesterday. They are solid enough, and a very high quality and well managed company, but there are better opportunities out there in companies who have more upside and less downside in my opinion. It would appear that around half of those brokers have similar views to mine.

09-Feb-2021: Macquarie Group 2021 Operational Briefing Media Release

plus: Macquarie Group 2021 Operational Briefing Presentation

MQG is not so much a Bank these days as a global asset manager, and they are particularly active in global infrastructure assets. This Operational Briefing has caused the pre-market indicative opening price of MQG shares to be well in the green - it looks like they are set to open between 2% and 3% higher than where they closed yesterday. While I do not currently hold Macquarie, they are the only Australian bank that I WOULD be interested in owning at this point. They tend to underpromise and overdeliver and they are very well positioned within their main sector of global infrastructure asset management. MQG tend to morph themselves into whatever they need to be to make money in any environment, and I believe they will continue to do so. They have a winning culture within the organisation as well. They don't call it the "Millionaires Factory" for nothing.

14-Sep-2020: Macquarie Group Investor Presentation and 1H21 Update

Macquarie is down by around 5% in the first 40 minutes of trading today on this first half update and investor presentation.

I like MQG a lot, but I don't currently hold them directly (only via LIC exposure). I would like to buy them directly at lower levels.

26-Jul-2018:

Nicholas Moore will retire as MD & CEO after a decade at the helm and be replaced by Shemara Wikramanayake, the current group head of Macquarie Asset Management.

Mr Moore will step down from the boards of Macquarie Group and Macquarie Bank effective November 30. Ms Wikramanayake, who was born in the UK before her family moved to Australia, becomes the only female CEO among Australia's 20 biggest companies by market value.

Shemara Wikramanayake will be the new boss of Macquarie.

Ms Wikramanayake will inherit a company that's transformed itself under Moore's stewardship from an Australian investment bank into a global asset manager that now earns more than two-thirds of its income overseas. Its asset management, financial services and corporate finance businesses now account for 70 per cent of earnings. Macquarie's share price has more than doubled under Mr Moore's tenure.

Shemara has worked at "the Millionaires' Factory" for over 30 years and most recently has been the head of their largest business unit, Asset Management. Macquarie are now one of the world's largest infrastructure management companies.

Keeping the legacy

Ms Wikramanayake said she wanted to "perpetuate the legacy Nicholas leaves behind" and would be spending a lot of time working with him during the handover, and travelling to different parts of the business.

“I don’t feel any urgency to change, it’s not like when I stepped into asset management after the GFC," she said.

Ms Wikramanayake acknowledged she was a rarity as a senior woman in the finance sector and said more should be done to attract and retain women to the industry, including providing workplace flexibility to both men and women, and examining unconscious bias. However, she said Macquarie had a "wonderful culture".

“Macquarie in the 30 years I’ve been here has always been a meritocracy, I've never felt barriers," Ms Wikramanayake said. "I’ve never found inside Macquarie the quality of my ideas is judged on my gender, my ethnicity, my size, it's really about the quality of my ideas."

I expect that Macquarie's history of under-promising and over-delivering will most likely continue under Shemara's watch.

Glen Stevens, the ex-Governor of the Reserve Bank of Australia, is now officially a board member at MQG, having had his appointment ratified at today's AGM.

[July 2018]

Longer term investment - better case over Big 4 banks a 16.4% return on equity that remains well ahead the pack.

Strong case for both growth and yeild play

Market focused (performance liked to commodities + overall equity markets)

MQG has benefited from strong market conditions

Further AUD depreciation will continue to benefit

Known as the millionaires factory with an employee share plan hopefully aiming to align shareholder and employee interests.

If they make their employees millionaires they will need to also benefit shareholders.

furthermore, their change to a more infrastructure focused and ho focused ldings focused bank seems to provide them some defensive earnings cover

buying a green bank in the uk seems a good move for the future, particularly with the uk and europe far ahead on climate policy than us in Australia

MS raised target price to $130

Post a valuation or endorse another member's valuation.