NextDC is a data center services company. There is definitely a tailwind for its services. All Cloud migration, business digital transformation, and abundant data that everyone generates need home.

There is a number of players already exist in the market e.g. Equinix, Airtrunk, Rackspace, MAcquire Telecom etc

NextDC is well placed and ahead in the Australian market compare to other providers - It's financial is sorted - last November it renewed its debt facility.

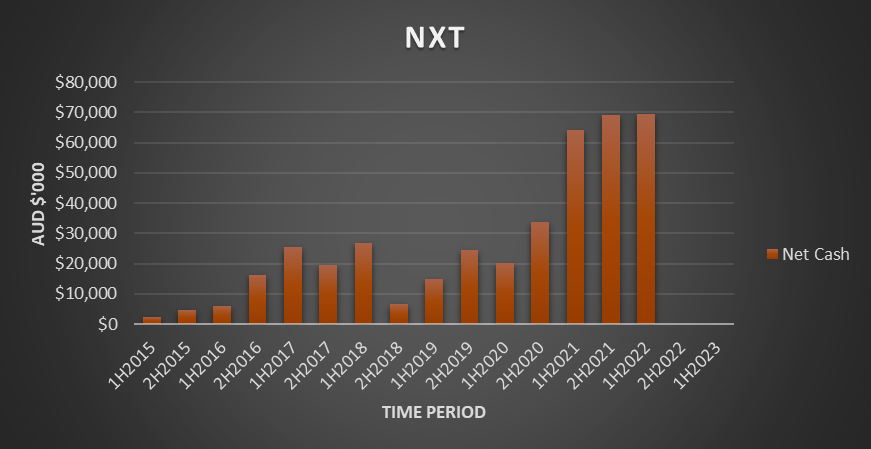

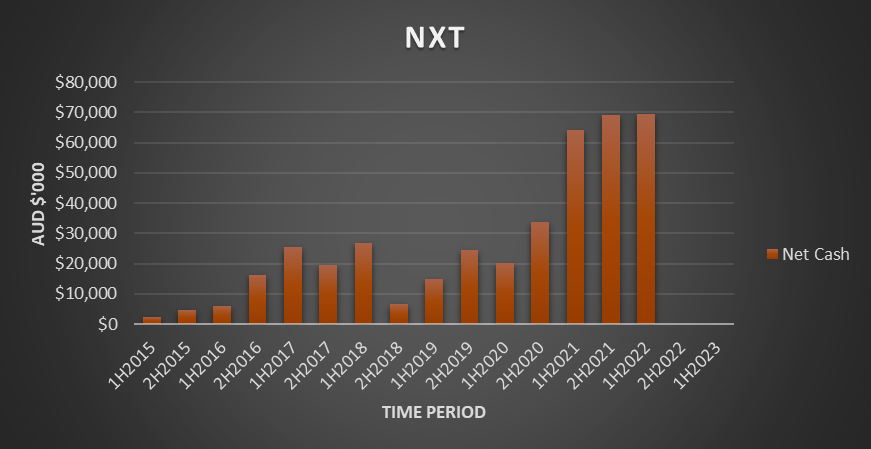

If you ignore new investments, NextDC is already cash-flow positive at the operation level. The following graph illustrates how much operating cash it generated from FY2015.

Currently, NextDC has 98 MW capacity and current investment is to increase its capacity 4 times i.e 400 MW

Each 1 MW currently generates 4m in revenue.

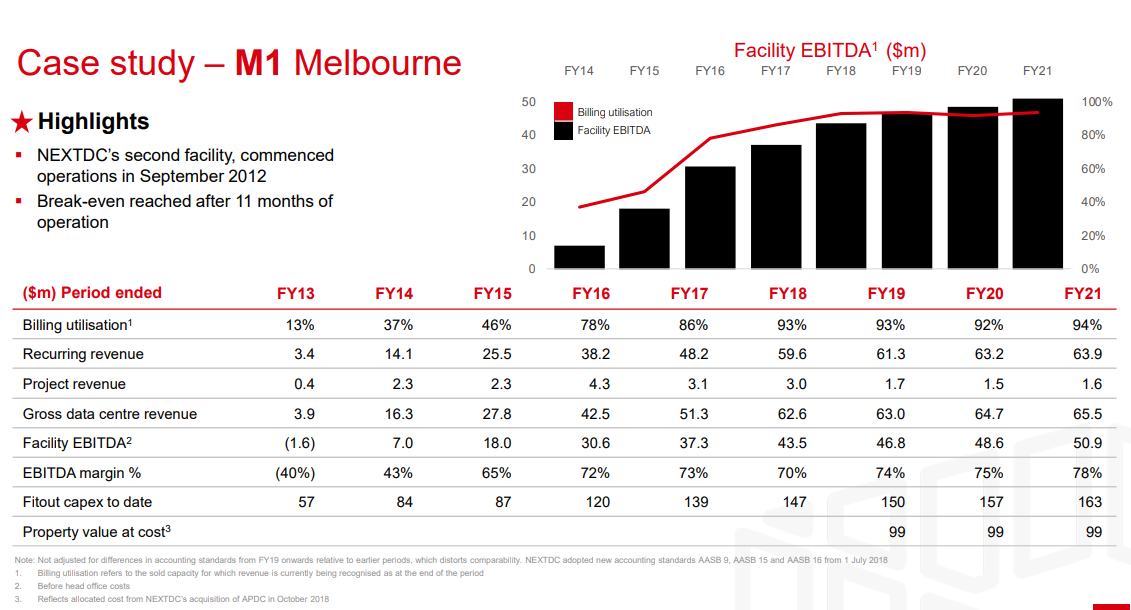

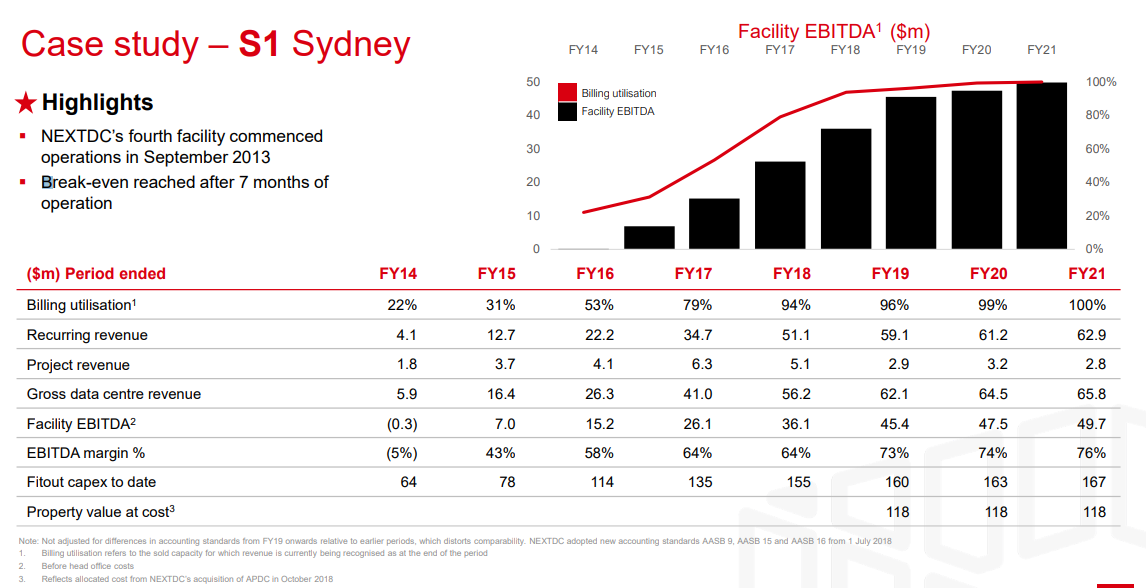

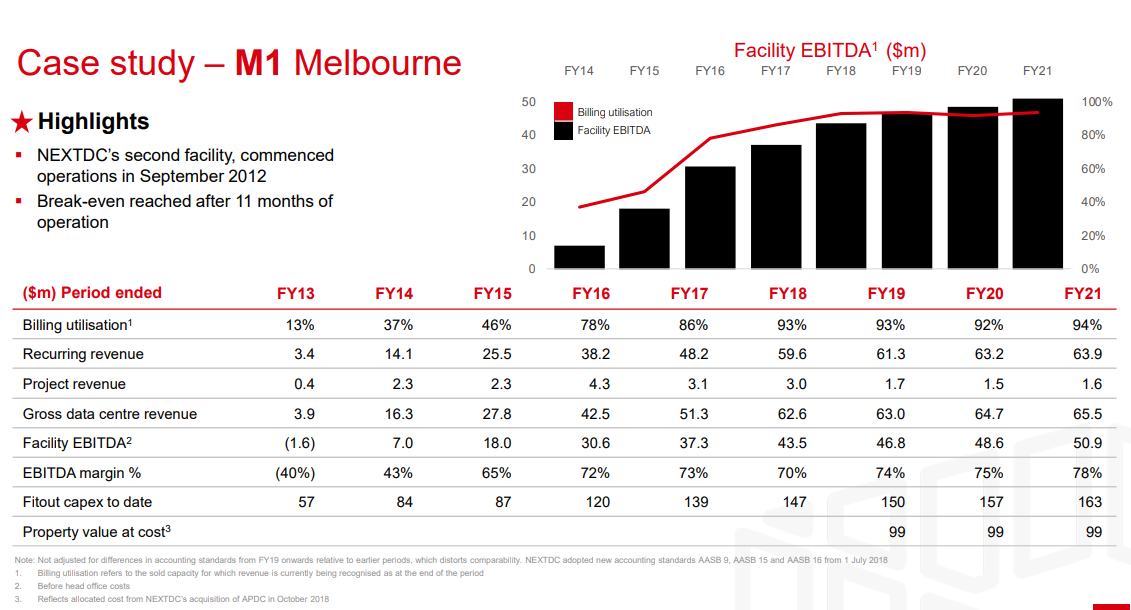

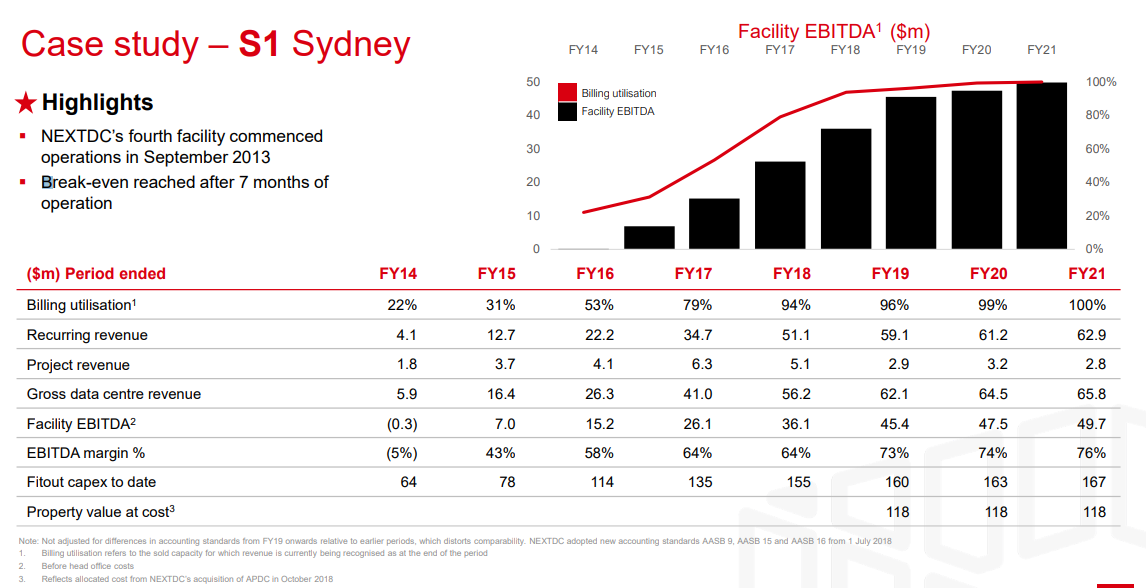

The following two case studies were done during the FY21 presentation, which illustrates How a single DC generates ~75% EBITDA at a mature stage.

Now Do you think that there will be enough demand for data centers in the next 5 to 10 years? Wou7ld NextDC be able to capture that demand? Would NextDC will be able to fully utilize it's 400 MW capacity in the future? If answers to these questions are yes or highly likely then NextDC is too cheap currently - as at that stage it will be gushing cash like a machine.