Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

https://www.bbc.com/news/articles/cd0ynenr1eno

An interesting media piece about the growth of interest in small or micro data centres. It appears logical. Technology goes through phases after all. A move from generic to application focused AI appears obvious and more efficient and effective. The use of data centre heating seems to me to be a marginal gain, useful for specific situations rather than a core benefit for data centre evolution.

How does this effect my investing? Similar to micro or small cap investment I'll be looking now more closely at emergents that focus on more focused AI applications.

NXT held in RL and SM.

NEXTDC sits at the intersection of powerful secular trends: cloud computing, AI infrastructure, and data sovereignty. The company will almost certainly grow. Five years from now, it will likely be a larger business by most conventional metrics. The harder question is whether each share will be worth meaningfully more.

Here's why I'm avoiding the stock.

· Capital Intensity Creates a Structural Headwind

NEXTDC operates one of the most capital-intensive business models in the market. Billions must be deployed years before meaningful returns materialize. Shareholders fund this growth long before cash flows improve, creating a persistent gap between economic activity and shareholder value creation.

This structure makes the company unusually vulnerable to capital market conditions. When credit tightens or equity markets turn, growth either slows or dilution accelerates. Neither outcome favors existing shareholders.

· Dilution Erodes Per-Share Value

The share count continues climbing through both equity raises and employee incentives. Revenue and EBITDA can deliver impressive growth rates while per-share metrics lag behind. This isn't a temporary phase, it's embedded in the business model. As long as growth requires external capital, dilution remains a structural feature rather than a temporary inconvenience.

· Long-Duration Assets in a High-Rate Environment

Most of NEXTDC's value sits in cash flows projected years into the future. This makes the stock acutely sensitive to discount rates, investor sentiment, and capital availability. When rates rise or risk appetite falls, long-duration assets get repriced aggressively. The company's growth story doesn't protect it from this reality.

· Customer Concentration and Bargaining Power

Hyperscalers represent both the opportunity and the risk. These customers are large, sophisticated, and have alternatives. They negotiate aggressively, can build their own infrastructure, and can defer deployments when it suits them. This dynamic puts sustained pressure on margins and makes revenue less certain than it appears.

· Infrastructure

Data centers don't just need customers, they need electricity and water. Grid congestion, rising energy costs, and regulatory uncertainty all create real operational constraints. Strong demand means nothing if the power infrastructure can't support it or if water availability becomes a political issue.

· Execution Risk Is Underappreciated

Delays in construction, regulatory approvals, or grid connections flow directly through to equity value. The market prices in aggressive growth assumptions. Any slippage, whether from permitting issues, contractor delays, or infrastructure bottlenecks, rerates the stock immediately. AI demand is irrelevant if projects can't be delivered on schedule.

· Technology Risk Sits on the Horizon

The assumption underlying every data center investment is that workloads will continue requiring centralized, latency-sensitive infrastructure at scale. But technology evolves. Edge computing, improved compression, more efficient chips, or breakthroughs in distributed architecture could all reduce the need for massive centralized facilities. This risk is distant but not negligible, and the market isn't pricing it in.

After a week from publishing FY24 result, NextDC in the market to raise $750m and then further reports about them raising $2.9b in debt : https://www.bloomberg.com/news/articles/2024-09-12/nextdc-seeks-a-2-9-billion-loan-to-expand-data-centers-in-asia

I have put my full thoughts : https://www.growthgauge.com.au/p/nextdc-asxnxt-fy24-result-review

I reduced my holding today in RL and SM as per this blog -- so wait for it to moon. ( hence I kept some )

NextDC announced contracted utilisaiton,

I have just put it together in context so we see the growth ( Blue is what they announced today) full thoughts: https://www.growthgauge.com.au/p/nextdc-asxnxt

DJ NextDC Raising A$1.32 Billion Amid Record Data-Center Demand -- UpdateNXT$16.71$0.00 (0.0%)$16.71$16.46

11 Apr 2024 08:48:141 ViewBy Stuart Condie

SYDNEY--Australian data-center operator NextDC is raising 1.32 billion Australian dollars (US$860.4 million) of equity to accelerate several developments as the global shift to cloud computing drives record demand for its services.

The ASX-listed company on Thursday said that it would use the proceeds of a fully underwritten entitlement offer to accelerate the development and fit-out of centers in its core Sydney and Melbourne markets. The initiative is part of NextDC's broader planned capital outlay, which includes expansion into Asia-Pacific.

The offer, which includes institutional and retail components, involves the issue of shares on a 1-for-6 pro-rata basis at A$15.40 each. NextDC shares last traded at A$16.71 and are up 22% so far in 2024.

NextDC reaffirmed the FY 2024 revenue, earnings and capital expenditure guidance issued in February and said it is experiencing record demand. It added that it expects forward orders to convert into billings over the five fiscal years through FY 2029, driving growth in revenue and earnings.

"NextDC continues to see significant growth in demand for its data-center services underpinned by powerful structural tailwinds," Chief Executive and Managing Director Craig Scroggie said.

Write to Stuart Condie at [email protected]

(END) Dow Jones Newswires

April 10, 2024 18:48 ET (22:48 GMT)

I have put together my thoughts about NextDC here : https://growthgauge.substack.com/t/asxnxt If you are interested to read through.

Interested to see what the commonalities or not would be.

Data centre owner Equinix latest target of Hindenburg

Bloomberg

Short seller Hindenburg Research targeted data centre owner Equinix, alleging that the company manipulates its accounting and is selling an “AI pipe dream”.

Hindenburg’s disclosure of a short position and its allegations raise questions about the future for Equinix, which has been benefiting from the expectation that artificial intelligence companies will need even more data centres to power the technology.

Equinix shares fell on Wednesday in New York and the company pulled a previously planned bond offering after the report hit.

A representative for Equinix said the firm is investigating the claims.

Hindenburg alleges that the nearly $US80 billion ($122.5 billion) real estate investment trust is manipulating its accounting for a key profitability metric — adjusted funds from operations — and overstated that figure by at least 22 per cent in 2023. The short seller also said Equinix trades at elevated levels even if financials are taken “at face value”.

Bevin Slattery (NEXTDC founder), has written up some thoughts on where the demand cycle goes from here:

Why growth in Digital Infra has only just begun...

His conclusion:

If the effective size of the prize for having the best LLM on the planet is $10T in market capitalisation over the next 5 years, then what’s the right level of investment to get your piece of that pie? 5%? 10%? 20%? Well that’s the arbitrage. Right now, NVIDIA sold US$60B of chipsets last year. That is less than 1% of the AI prize. Let that sink in. If the world needs 50GW of data centres over the next 3-5 years that will cost US$300B to build. That’s about 3% of the prize.

No one is going to complain about GPU or data centre pricing for the next 3 years because the cost of not investing will be a 10-50x destruction of your market capitalisation. If you don’t keep up, you will be left behind. Just ask Intel…

I don't know if his numbers are right, but I put some weight in the broader point. There's a big prize to be claimed and investors will back investment or risk losing it.

NextDC Valuation/Price Target maintained based on FY23 Results

Pleasing increase in contracted utilisation since their announcement in April 2023. Balanced against this are the risks of very high-levels of debt in the possibly higher for longer interest-rate environment and the off-shore expansion strategy execution.

FY2023 Highlights

REVENUE GROWTH

▪ Total revenue up A$71.3m (25%) to A$362.4m

▪ Contracted utilisation increased 39.2MW (47%) to 122.2MW with record sales in key partner, network and enterprise segments

▪ Further increase in contracted utilisation recorded post year end, up 23.2MW (19%) to 145.4MW

▪ Interconnections increased from 1,203 (7%) to 17,816, representing 7.1% of recurring revenue

OPERATING LEVERAGE

▪ Underlying EBITDA up A$24.6m (15%) to A$193.7m

▪ Operating cash flows increased A$9.3m (8%) to A$126.5m

▪ Billing utilisation increased 4.8MW (7%) to 77.7MW

CAPITALISATION

▪ Secured an incremental A$400m senior debt facility with favourably amended covenants and terms across all facilities

▪ Completed an Entitlement Offer of A$618m to support regional expansion and accelerated development

▪ Liquidity (cash and undrawn debt facilities) of A$2.3bn at 30 June 2023

▪ Best-in-class data centres in prime metropolitan locations across major capital cities underpin total assets of A$3.8bn

NETWORK EXPANSION

▪ Capital expenditure increased A$85.6m (14%) to A$690.4m (FY23 Guidance: A$670 – A$720m)

▪ S3 Sydney final building works completed on time and on budget, while M3 Melbourne completed on time and on budget and opened in 1HFY23

▪ Secured additional land for future expansion in Sydney (S5) and Melbourne (M4)

▪ First international development sites secured for KL1 Kuala Lumpur and AK1 Auckland

▪ PH1 Port Hedland opened in early FY24 with NE1 Newman underway, development works for A1 Adelaide and D1 Darwin progressing

Some interesting observations recently.

At 31st December 2022 ---> NextDC contracted Utilisation was 84.2MW ( It took 10 years for NextDC to sell 84.2MW)

From 31st December to 12th April ( NextDC sold another 35.9MW in 4 months, Remember it took 10 years to sell 84.2MW)

From 12th April to 23rd August ( NextDC sold another 25MW in 4.5 months)

What has changed? in just 8 months, NextDC almost sold 61MW capacity.

The following article resonates with me. Have a read

NextDC is raising equity for global expansion into the Asia Pacific.

Not surprisingly the share price has held up quite well despite the discount (10.80)

Thought I'd start the discussion as no one else had discussed it.

So is the share price expensive?

Using the Real option method by Damodaran and assigning a higher prob of success versus failure because of better management and also being a top ASX listed firm.

Think this might be a good raise and maybe better than AMI. Again not advice and my figures could be wrong. Personally I'm waiting till the entitlement raise is over and see how the share price behaves.

For anyone who is interested and has time and love maths and probability, you can read the paper by Damodaran here

NEXTDC Limited (ASX: NXT), Australia’s leading data-centre-as-a-Service provider announces its appointment by the Digital Transformation Agency (DTA) as a panellist on the Data Centre Facilities Supply Panel Contract (DTA-ICT-29247). NEXTDC are among the first category of panellists to be appointed, where panel arrangements have come into effect on 15th May 2023.

NextDC reported it that the company's contracted utilisation has increased by 35.9MW to 120MW since 31 December 2022. That is massive number for half year and explains that they must have been chasing this big customer win since last 2 years.

To compare the scale of this number have a look at this graph

Now, Amazon have said that it plans to invest in its AWS business in Sydney and Melbourne from 2023 and 2027

https://www.manmonthly.com.au/aws-invest-13-2-billion-australian-cloud-infrastructure/

So you can guess who the customer may be. ( its just a speculation on my part )

This is going to be short squeeze in my opinion

Let's see what happens in the next few weeks.

$NXT reported results yesterday that were broadly well-received by the market. Expansions, site acquisitions for new data centres, and expectations of material new contracts supported this long term growth story. Analysts reactions are broadly positive, with no major moves to SP targets based on the updates so far. (Although GS tweaked down their 12m TP from $13.60 to $13.30)

I've had exposure to the data-centre theme IRL for several years ($NXT, $MP1) and continue to see it as a long term growth theme.

However, I have recently switched my RL position from $NXT to $MAQ, and I'll briefly explain here.

$NXT is a more agressive growth play, with 3-year revenue CAGR to end FY22 of 18% vs. 8% for $MAQ, and a 3-yr EBITDA CAGR of 26% vs, 19% at $MAQ. However, this is at the cost of significant debt, with long-term borrowings now reaching $1.26bn and interest for the last 6 months now up to $62m (annualised).

On a comparative basis $NXT is spending 32% of EBITDA on interest, compared with a more conservative 12% at $MAQ.

Furthermore, $NXT have recently signalled an intention to expand internationally, although we are yet to see what this means in practice. This further increases the risk profile.

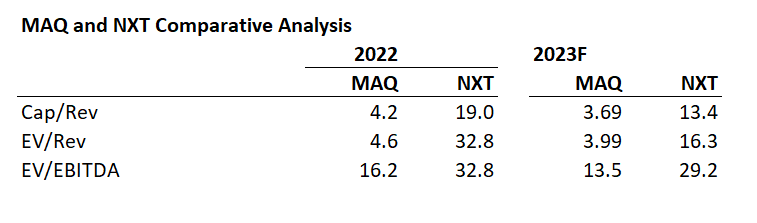

Looking at valuation multiples, $MAQ is looking favourable, and I have initiated my RL position recently at $55.50 (2.75%). (I will follow today in SM, because strictly speaking these companies are "yet to prove themselves", which is my criterion for holding in SM.)

Table 1: Comparative Valuation Multiples

Source: www.marketscreener.com; Company Accounts

Overall, with interest rates still rising (and the real chance that peak forecasts will go up further) and with tech companies reducing investment in new storage, this sector may move from a focus on expansion to a greater focus on utilisation and profitability, with consequence implications for pricing.

Overall, while I like both $NXT and $MAQ, I consider that $MAQ is more defensively positioned given these risks. I have been watching it for several years, and with the SP below $60 I feel now is the time to switch horses.

$MAQ brings some other differences to $NXT as follows:

- It is founder-led, managed and majority owned

- The limited free-float means that it is not as easily accessible to institutions; however, liquidity is fine for a retail investor

- Its capital structure is different with a higher proportion of capital leases vs. owning real estate.

I don't often switch horses within a sector and, while I think BOTH companies will generate long-term shareholder value, I now prefer the risk-reward profile of $MAQ. So, out with $NXT and in with $MAQ.

Disc: $NXT - not held; $MAQ - held IRL (and later today on SM)

P.S. For those who follow Gaurav Sodhi, you'll recognise I have adopted his rationale. I have been aware of his perspective for well over a year, and on this occasion my analysis aligns with that story. You can look it up by watching back issues on "The Call" - just search for $NXT and $MAQ and pick the days when he the "talking head".

Mega trends

Macroeconomics conditions

Move to Cloud has just begun

Data

Microsoft reported yesterday and highlighted in Azure the slowdown in cloud computing demand with the slowing economy - I'd assume this is temporary in nature and the strucutral trend is still up. What was interesting was the increase in electricity prices crimping margins being so massivley power hungry.

Might have some flow on effects to NXT.

I don't follow data centres closely as I was always worried about technologic absolesence (Moore's Law) making it a very capital intensive business with the long term economics unclear especially given the commodity nature of the industrie and the hyperscaler opposition. I am by no means an expert and this is probably a very uninformed viewe, especially with smart investors like Gurav often citing how excellent these businesses are including Macquarie Telecom and Infratil.

I had not thought of privacy also being an issue - but this article is interesting in discussing this. The quote of replacing every 3 - 5 years if true (and I'm not sure on cost) seems like a rather short payback and profit period. - Why Big Tech shreds millions of storage devices it could reuse | Financial Times (ft.com)

Key quotes below:

Data centres usually upgrade their servers every three to five years, meaning most of the 11mn that were produced globally in 2017 will be decommissioned this year.

Although most data centre companies discard their storage devices after a few years, they could last for years — or even decades — longer, according to several industry experts.

“Clients are so worried about disposal of data that they’re insisting on the hard drives being destroyed,” says Michael Winterson of global data centre provider Equinix.

Some of the major cloud computing providers have been taking steps towards reuse. Google says 27 per cent of the components it used in server upgrades in 2021 were refurbished inventory and that it overwrites data on its hard drives for reuse where possible. Microsoft now operates several circular centres” for refurbishing old servers and says more than 80 per cent of its decommissioned assets will be repurposed by 2024. But for hard drives, specifically, shredding is still the norm.

SC1 is live and ready to welcome customers

S3 is open now

M3 is close to complete now

US Hyperscalers have reported mouthwatering growth in Cloud business and the growth forecast for cloud computing isn't slowing anytime soon. that bodes well for NextDC.

Few questions - is NextDC in a position to pass on inflation to these hyperscalers or suffering margin squeezed? Is there any signed contract NextDC holds for all these new capacities it is about to open for customers? Has overseas expansion on the card? What's the plan for going free cash flow and future investment?

Bull Case 9.79

Base Case 6.57

Quick Valuation

Work on achieve a Bullish $765 Million Revenue year 2026. (Growth 25% a year)

Share Count over past 5 years have growth 15% a year. I apply again a generous 5% percent increase giving share count of  (FY26).

(FY26).

Love the idea of the business and tailwinds just can't make the number work to justify the price or risk. Open to be corrected.

NextDC is a data center services company. There is definitely a tailwind for its services. All Cloud migration, business digital transformation, and abundant data that everyone generates need home.

There is a number of players already exist in the market e.g. Equinix, Airtrunk, Rackspace, MAcquire Telecom etc

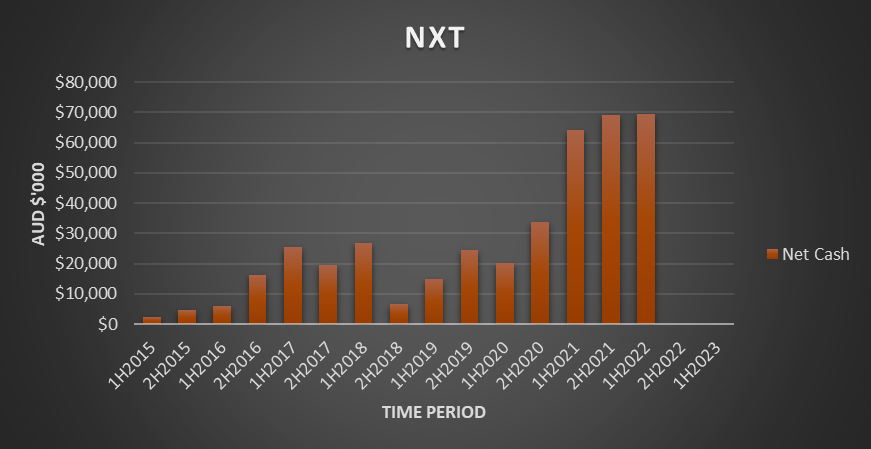

NextDC is well placed and ahead in the Australian market compare to other providers - It's financial is sorted - last November it renewed its debt facility.

If you ignore new investments, NextDC is already cash-flow positive at the operation level. The following graph illustrates how much operating cash it generated from FY2015.

Currently, NextDC has 98 MW capacity and current investment is to increase its capacity 4 times i.e 400 MW

Each 1 MW currently generates 4m in revenue.

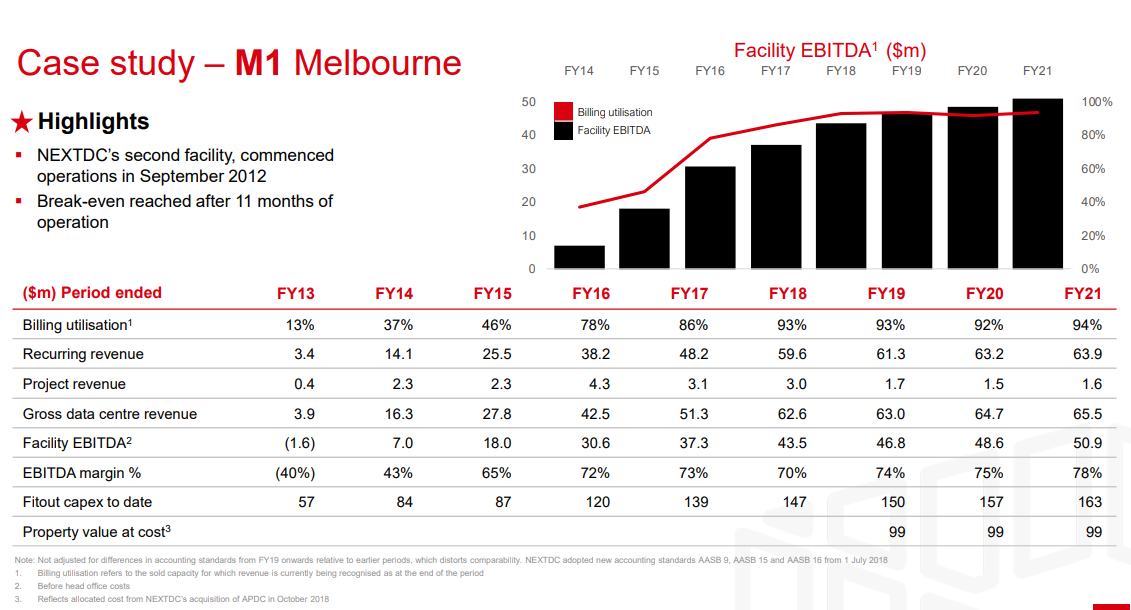

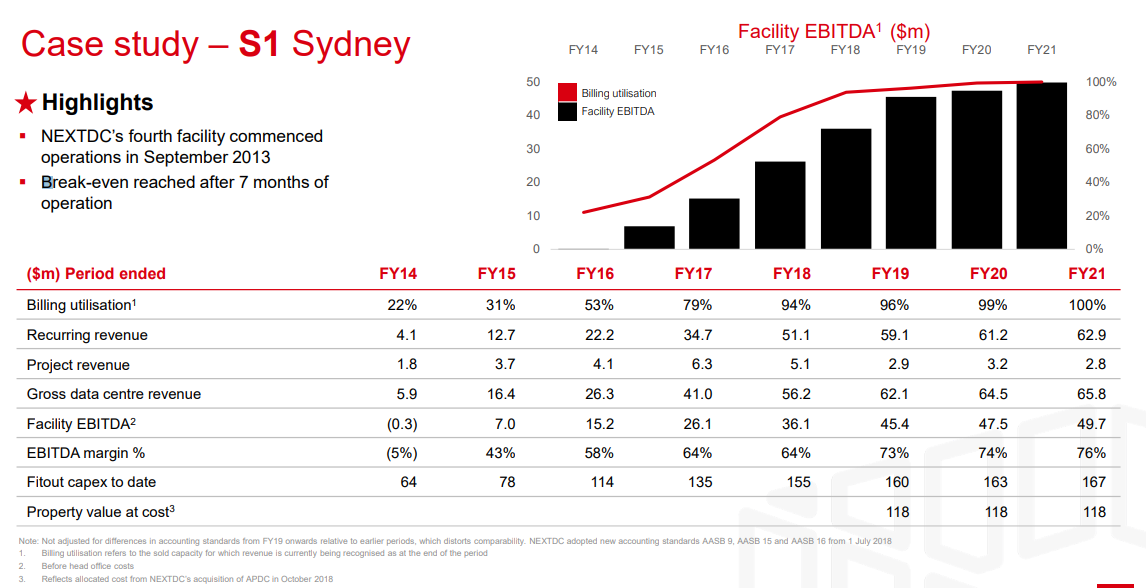

The following two case studies were done during the FY21 presentation, which illustrates How a single DC generates ~75% EBITDA at a mature stage.

Now Do you think that there will be enough demand for data centers in the next 5 to 10 years? Wou7ld NextDC be able to capture that demand? Would NextDC will be able to fully utilize it's 400 MW capacity in the future? If answers to these questions are yes or highly likely then NextDC is too cheap currently - as at that stage it will be gushing cash like a machine.

NXT is a big ol' green house gas maker! A polluter!

This itnews article talks to another DC operator whom won't release their greenhouse gas emissions data as if it will help their cause.

Extract:

NEXTDC was the next largest producer, emitting 294,460 tonnes (293,797 tonnes of scope two) in 2020-21, significantly higher than 2019-20 (219,038 tonnes) and 2018-19 (198,418 tonnes).

The other big DC operators release theirs. They own the reality of their business.

In fact one could argue, the emissions are not even the DC's, they belong to the business that owns the servers, and by virtue of the rent they NextDC, cause and own the greenhouse gases for the electricity, cooling, water, fire suppression generator fuel etc etc involved in operating a DC. But perhaps that is an unnecessary rabbit-hole to scurry down, as either way the emissions are occurring.

Overall it is of no impact to my thesis - but noise may be made about it every now and then. IMHO, no one is shutting down DCs anytime soon. And like all big polluters, they will change with the tide and go green eventually.

Hi Llati.

Thanks for the post, I think you’ve raised some really good points there. I have a counter view on the business with regards to network effects. I think the network effects come from the cross connections (both physical and elastic) side of the business which currently has nearly 16000 interconnections across their network. This makes up 7.3% of their recurring revenue, some of the overseas competitors this number is a lot higher so there’s potentially a lot of upside there too.

Here’s a link of Gourav Sodhi from about 22:30-24min giving a good explanation of the business model and articulating how the interconnections fit in as part of that. I don’t think the network effects are as cut and dry as they are in some other businesses but I still see them at play here.

Disc: Held

https://www.ausbiz.com.au/media/the-call-monday-31-january-?videoId=18920

1H22 financial highlights

- Data centre services revenue increased $22.9 million (19%) to $144.5 million (1H21: $121.6 million)〉

- Underlying EBITDA increased $19.3 million (29%) to $85.0 million (1H21: $65.7 million)

- Operating cash flow increased $5.9 million (9%) to $69.5 million

- Liquidity (cash and undrawn debt facilities) of $2.1 billion at 31 December 2021〉

FY22 upgraded guidance

- Data centre services revenue in the range of $290 million to $295 million (upgraded from $285 million to $295〉 million)

- Underlying EBITDA8〉 in the range of $163 million to $167 million (upgraded from $160 million to $165 million)

- Capital expenditure in the range of $530 million to $580 million (upgraded from $480 million to $540 million)〉

Are we finally starting to see NextDC demonstrate operating leverage after years of heavy capital investment?

Data centres are still misunderstood in my opinion and herein lies the opportunity. They aren’t property or infrastructure businesses; they are network opportunities. Attracting the likes of Amazon, Microsoft and co will in turn attract the smaller end of town to their data centres. It provides opportunities for the smaller guys to connect and utilise this same network, and brush shoulders with the big 6 tech -- amongst others. The larger and more interconnected the network becomes, we start to see a ‘network effect’ take place. NextDC wont make its big bucks out of the big 6, but it becomes far more attractive and appealing to other customers by merely having their presence within its network.

NextDC, or more broadly its network, should continue to tick along nicely at 10-15% growth each year. This might not mean too much now, in fact to many they appear bloody expensive - but there is a good case to be made that we are slowly witnessing the creation of a giant that, in 5-10 years time, will have incredibly high margins, attractive pricing power, low churn and a sizeable moat (the NextDC network).

My strategy remains as it did 6-12 months ago -- continue to take nibbles at NextDC as they continue to progress as a business. My hesitancy exists (if that’s what you want to call it) due to the fact the business still remains at a bit of a crossroads -- it is unpopular in the current macro environment given its multiples; they are moving into wholesale data centres to get even larger (risk and lower margins); and lastly, they are expanding overseas (more risk, and the chance that management throw money down the drain to accomplish expansion).

That said, I have no complaints with H1 FY22 - quite the opposite. This was a great reporting period for NextDC and the thesis remains well and truly in tact.

Disc - held in Super account