With reporting season behind us, before prioritising and embarking on the next phase of research on current holdings and watchlist, I do a quick review of holdings on my “Exited Watchlist” (see end of this straw for an explanation.)

Today its Pointsbet ($PBH).

My investment timeline: Entry Thesis and Exit Thesis

Fascinated by the opportunity to follow a new and rapidly developing market, enabled by legislative changes in the USA, I took an initial position in $PBH in Feb 2020. The thesis was: having developed and acquired its own tech, and built a leading position in Australia, it would form key partnerships and leverage them to move quickly in targeted US States as these opened up for online sports betting. The blue sky in the thesis was i-gaming.

Sometimes we just get plain lucky, and later that year, $PBH became a 3-4 bagger off the back of the transformational, strategic partnership deal with NBC, whereupon I sold down, paid the tax, and retained a position equal to my original holding (1.5%). While it is tempting to "let winners run" I considered PBH super high risk, because there was no solid analysis or basis to the investment thesis. Accordingly, my portfolio "rules" required me to reduce my holding.

In addition to the headline metrics of revenue growth, net-win and competitive positioning as new states opened up, there were two key metrics to monitor:

- Marketing spend, as a proportion of cash receipts

- Market share

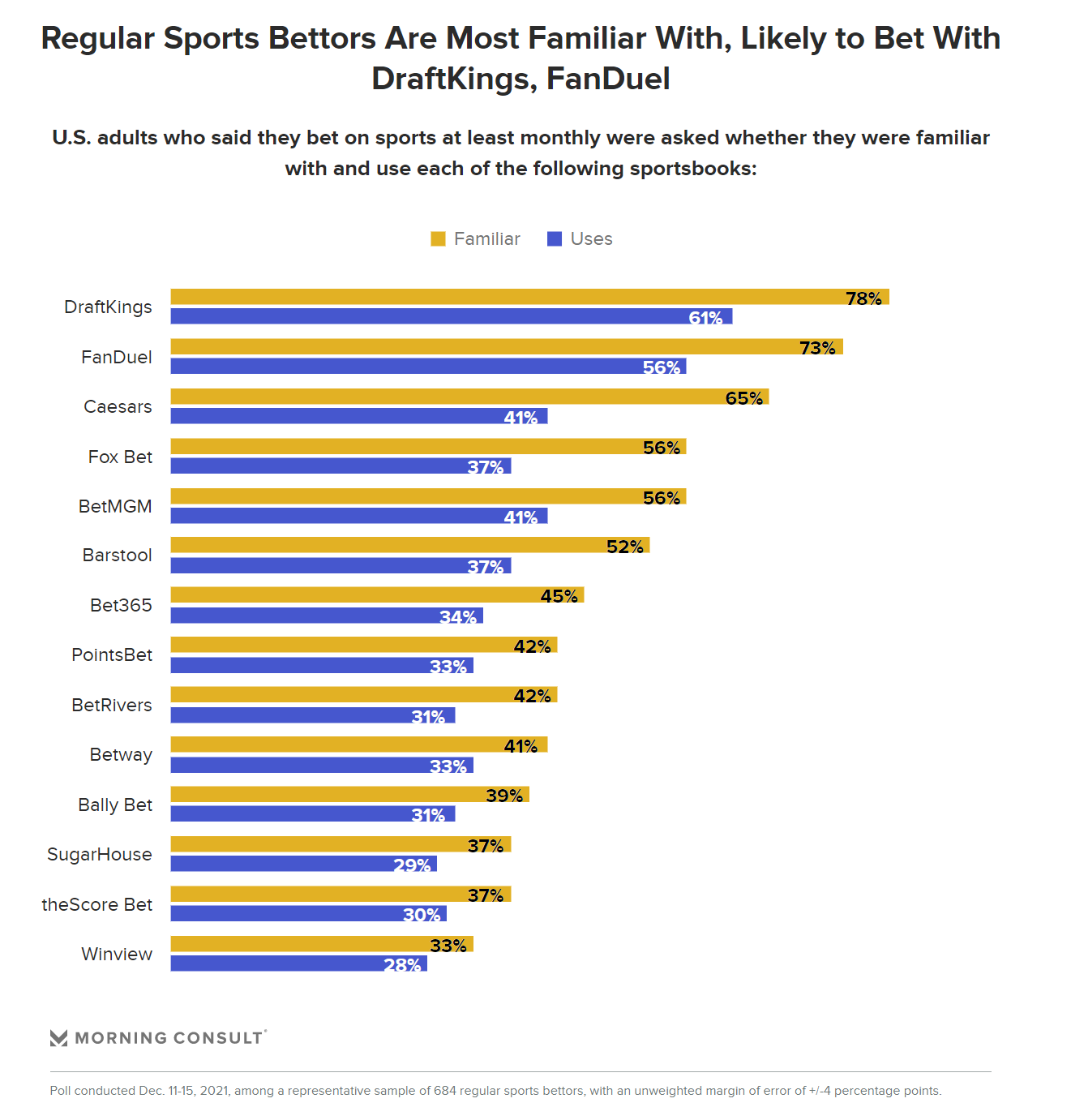

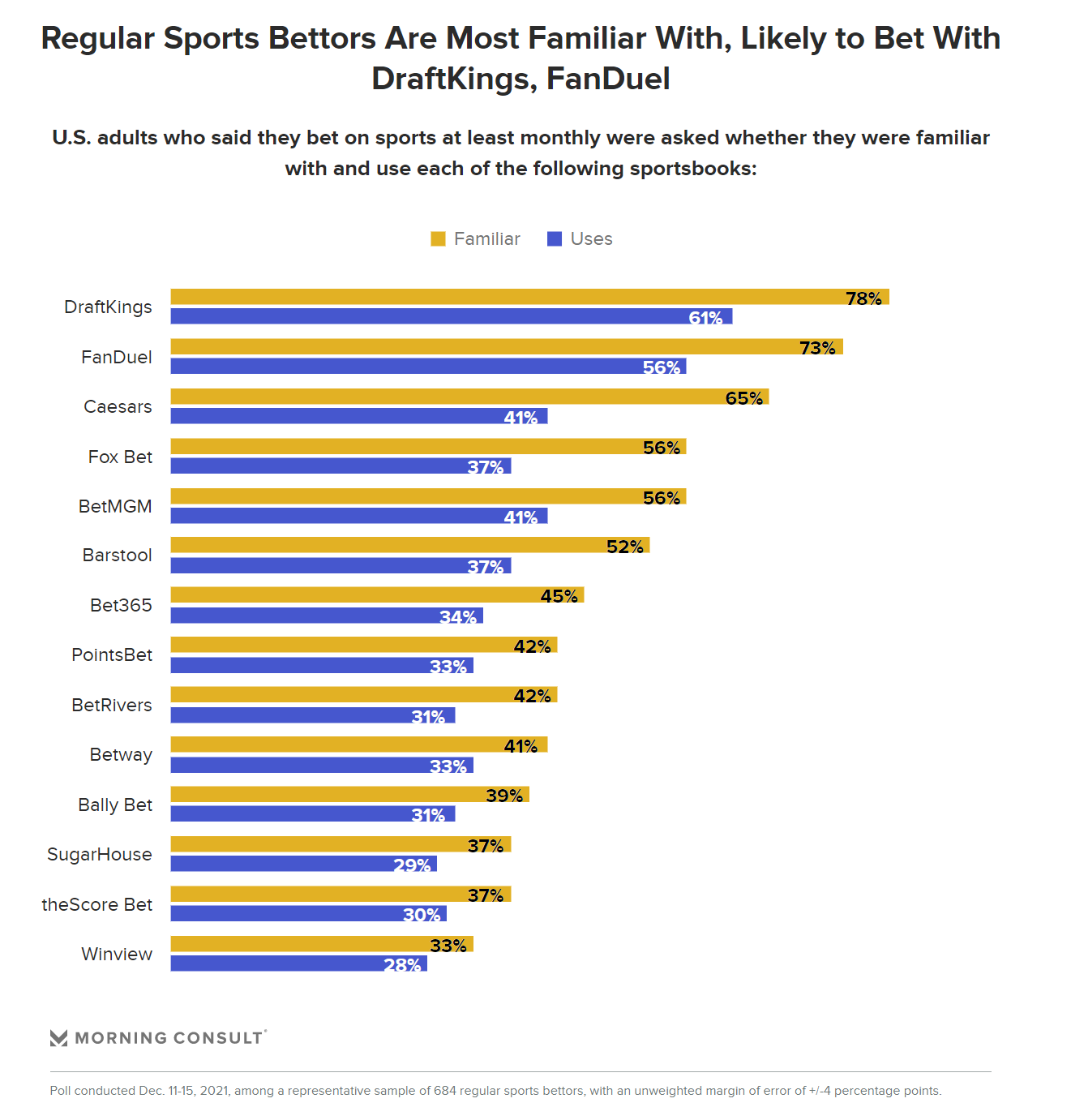

In April 2022, I exited my initial stake (having rode all the way up and all the way back down), having concluded that marketing spend was unsustainable given high competitive intensity in the sports betting industry. This article from January 2022 (and from which I extracted the following indicative market share (awareness/use) analysis was illustrative of the industry analysis I monitored. The hypothesis being that industry returns would be low, eventually leading to rationalisation/consolidation (or players just running out of cash and exiting). Importantly, $PBH was not positioned as one of the top 2 or 3 who might reasonably be expected to survive.

So, reviewing the latest results, what have I learned?

- It was a great year with Net-Win up 48% (Group) and 122% (US)

- EBITDA loss increased to ($243.6m) from ($156.1m)

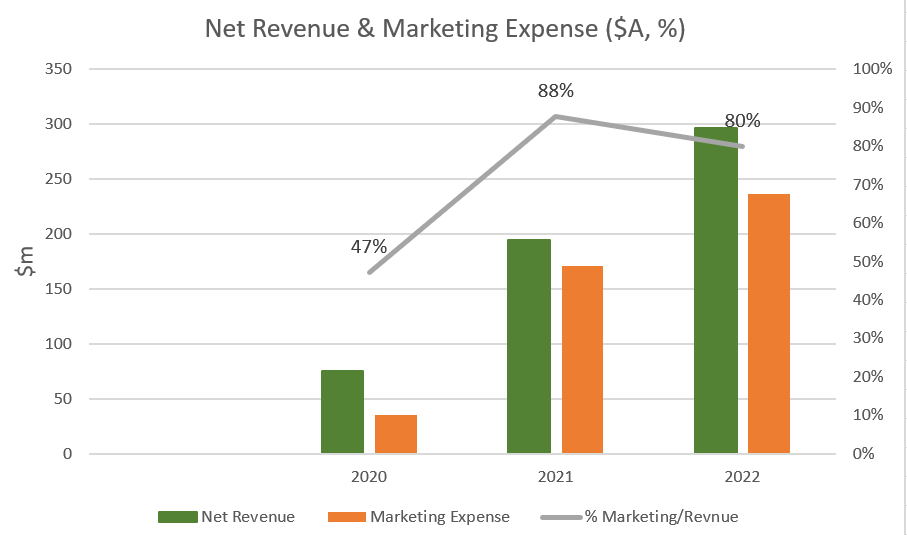

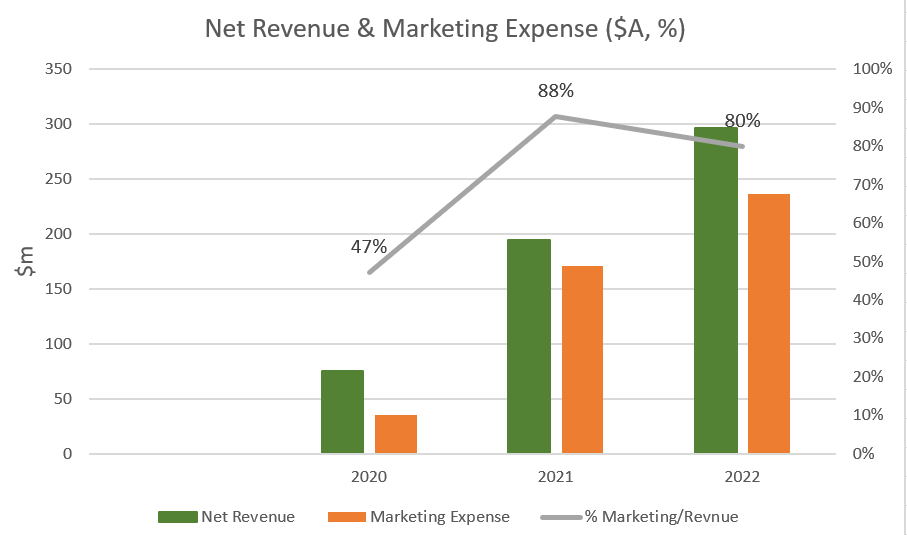

- This was driven by marketing expense increasing to $236.8m from $170.7m

Importantly, the increase in marketing spend of +$66.1m from FY21 to FY22 drove an increase of only $34m in Gross profit (from $87.6m to $121.6m).

The graph below shows the sales and marketing spend compared with revenue. As a proportion of revenue, this fell slightly from 88% to 80%. While this is a positive change, I remain concerned about the sustainability of the spend, in the context that FCF was ($291m) in FY22 from ($197m) in FY21. The closing cash position of $520m means within that a year or two more capital will be required, unless there is a fundamental shift in market dynamics. I can't see what will drive that shift.

Now you might argue that this marketing spend is an investment in market share and brand. However, given the competitive market structure, I can equally argue that the value of that investment will be short-lived and competed away. I might be wrong, as I am not an expert in gaming market competitive dynamics. (It is not clear to me that the state by state market share gains are being sustained, but that's a level of analysis we are not getting into today.)

As for the blue-sky part of the thesis, i-gaming appears to be doing well. Net-Win jumped from $1.5m to $20.4m, contributing almost 7% of the Group Net-Win. I will continue to monitor this progress.

Conclusion

I am happy with my exit decision earlier this year. I don’t see the case to re-enter, as the “exit thesis” is playing out. $PBH and the sports betting industry in USA more generally is not for me because industry structure and conduct is unattractive.

This is not invesment advice. This is a record of my personal investment diary.

What is the "Exited Watch List"?

Just as a decision to invest can be mistaken or changed by events over the passage of time, so too the decision to exit an investment. I maintain a list, built over 5-6 years of investing in ASX stocks that I have previously held, and continue to monitor.

Note: not held in the list are resource stocks - the one class of equities in which I will periodically "trade" over a 3 to 24 months time horizon. That's for another day.

Exited Watchlist:

A2M, AD8, APX, BTH, BVS, BWX, CAT, CGS, DTC, DUB, ELO, EOL, HSN, KGN, LVT, NAN, NOU(FNP), NTO, NWL, PBH, PPH, RBL, RFF, SKO, ST1, VHT, WEB, WSP

Disc: Not held in RL or SM