“Being extremely early is tantamount to being wrong.”

This quote is attributed to Seth Klarman however it's been paraphrased by many others over the years. I'm not sure I completely agree with the quote, but I do acknowledge the fact that until you are able to look back with the certainty of hindsight, the difference between early and wrong is indistinguishable.

With that in mind, analysis of the PRO FY24 result is whether I am early while the thesis continues playing out or I am wrong and the thesis is busted. In a nutshell, the PRO thesis is that like most other enterprise cloud SaaS businesses it can demonstrate the operating leverage inherent to the business model as revenue grows. The accepting of being early part stemmed from the fact the while PRO was going through a transition from perpetual licence to recurring subscription revenue, that operating leverage would not show up in the headline numbers even as the earnings power of the business was growing in the background.

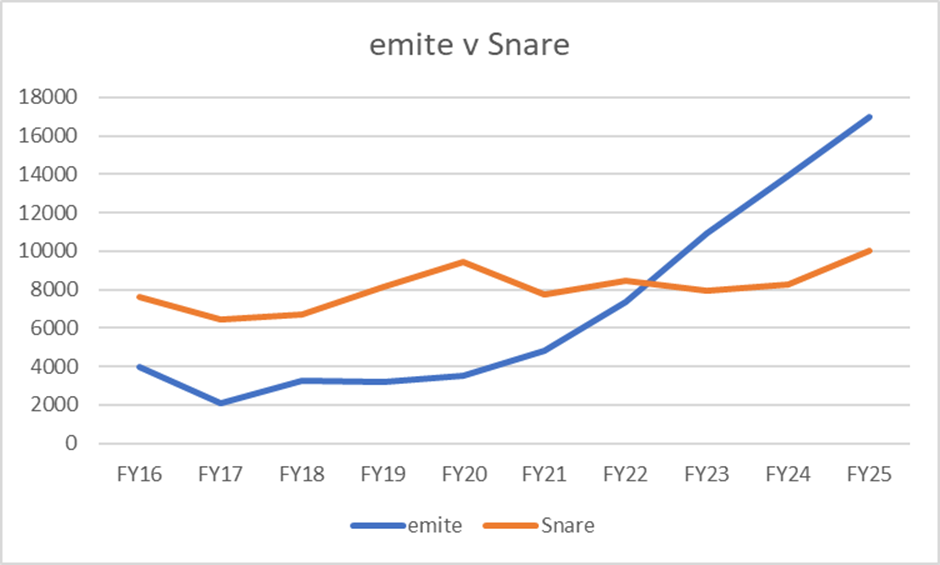

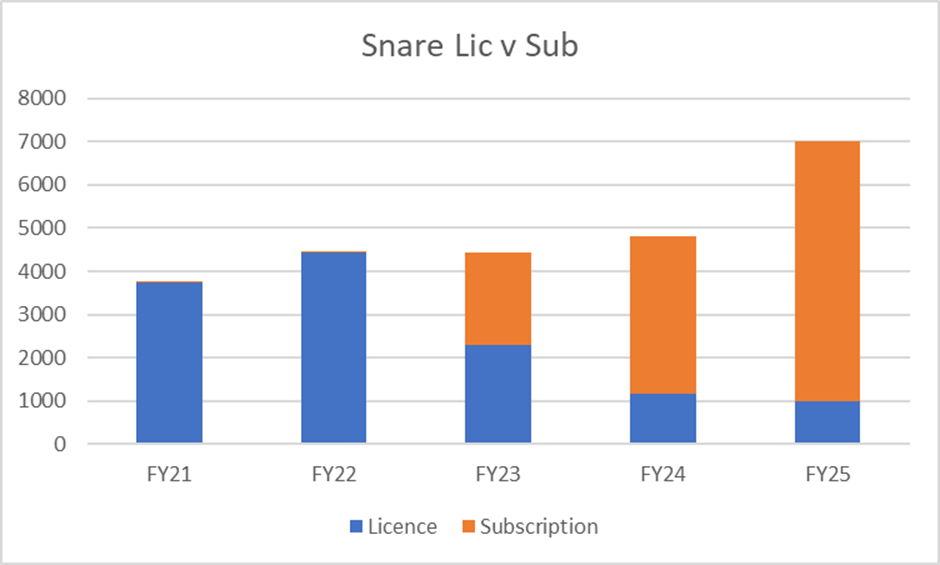

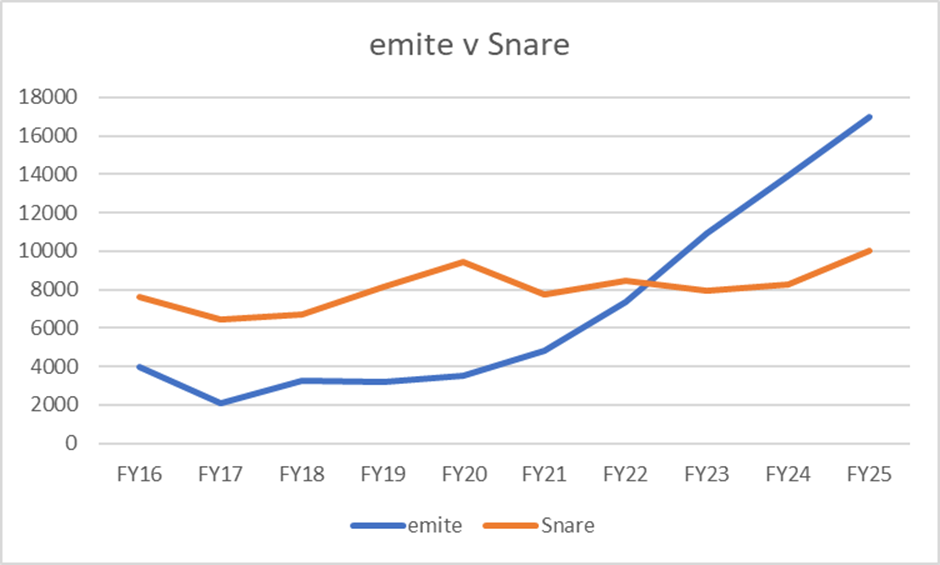

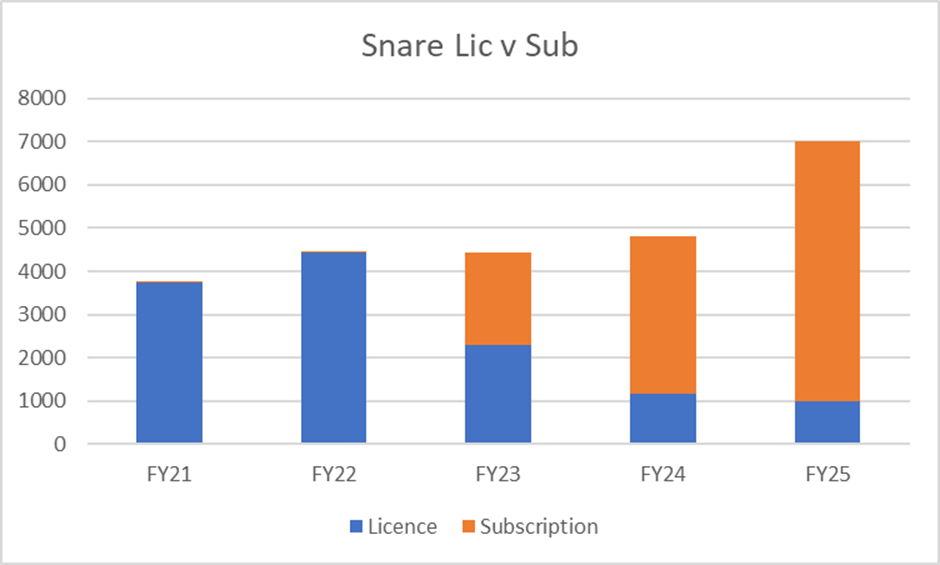

The chart above best highlights the two segments within PRO and is a testament to the quality of the recurring subscription business model compared to its perpetual licence counterpart. emite began the transition in FY17 and it wasn't until FY21 before the benefits were tangibly seen in the reported numbers. Since then however, the beauty of compounding recurring revenue growth can easily be seen. Snare began the transition FY23, and the last two years have been the muddy period where the business growth is not seen in the numbers. However, the chart below shows FY24 is likely the trough of the transition impact with subscription revenue taking over in FY25:

Note: I am looking ahead to FY25 using PRO’s reported contracted ARR and making a conservative assessment of what I think can be implemented and recognised.

So, the revenue side of the PRO investment thesis is playing out. Group revenue has nearly doubled over the last three years driven by emite and with Snare completing its revenue model transition I expect that trend to continue strongly.

The other side of operating leverage is of course the cost base. Given the marginal cost of distribution can be exceptionally low, we know that software businesses run efficiently at scale are very high margin. But many aren't run efficiently, and despite reporting strong growth they never truly scale as they run to stand still or embed a culture of profligate spending.

This has been the main criticism levelled at PRO over the last few years as we have seen a steady swelling of the cost base. To some degree I'm forgiving of this as there is an investment that is required to put in place the infrastructure to shift from on premise licencing to cloud based subscription.

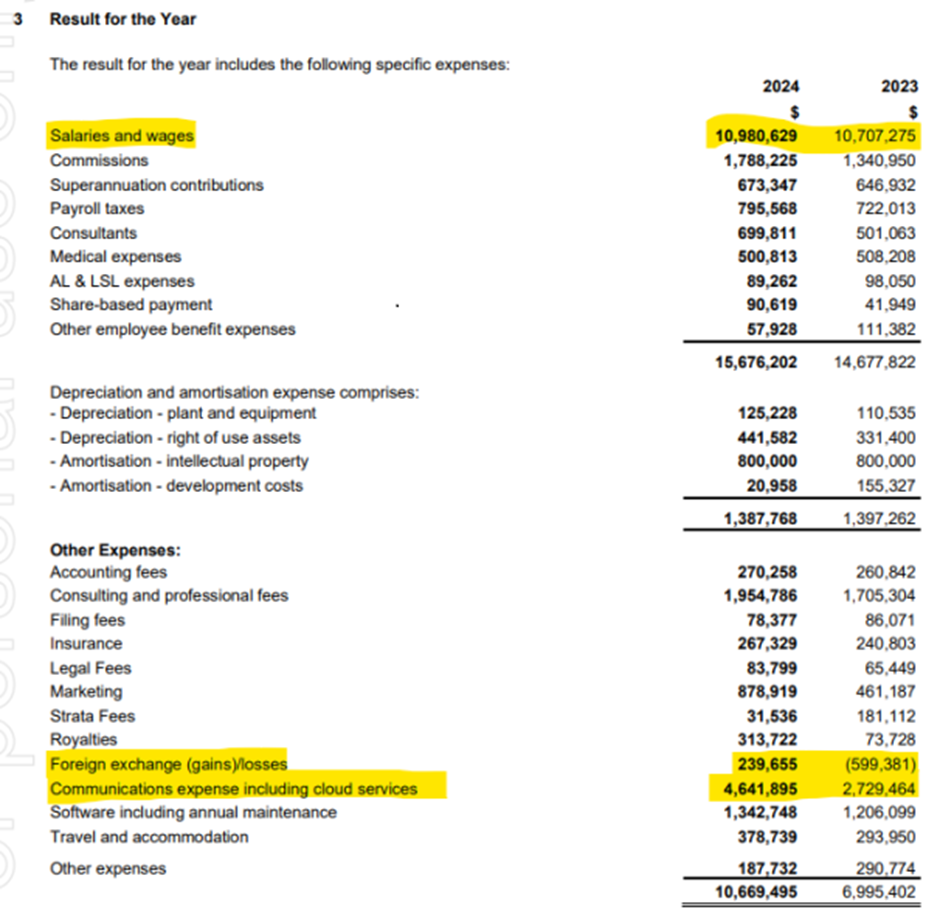

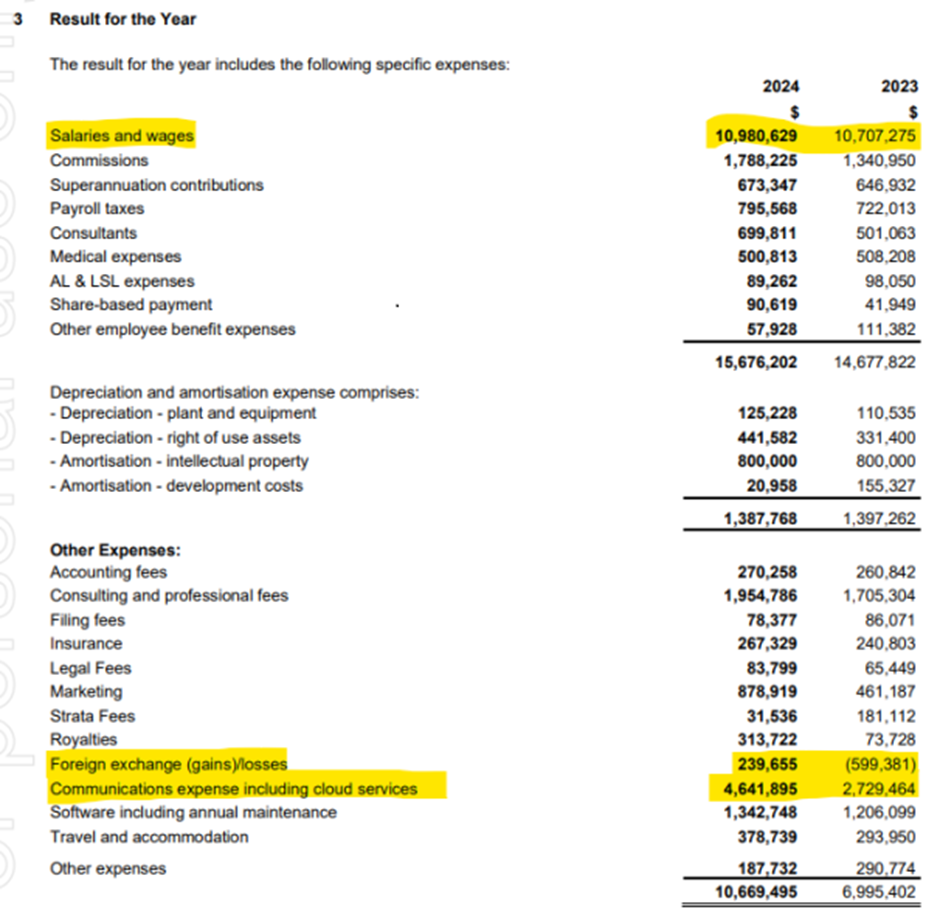

With that investment largely behind PRO now, you should expect to see a normalisation of cost growth. However, from FY23 to FY24 we saw roughly a $4m increase in the operating cost base. Digging into the notes of the report we can see where the biggest impacts came from:

Pleasingly, employee costs only rose modestly, by about $1m with most of that coming from employment benefits rather than direct salaries and wages. The two biggest impacts came from a swing in foreign exchange from a gain of $600k to a $240k loss, as well as nearly a $2m rise in hosting costs.

The foreign exchange swing should be ignored when assessing the operating business, so for PRO the key to answering the question about whether the cost base side of the operating leverage thesis is intact comes down to whether the sharp increase in hosting costs is a structural issue. We can expect there will be modest increases in hosting costs as revenue grows given PRO hosts their customer environments in the cloud, but the bulk of the hosting costs comes from PRO hosting their own internal product development in the cloud as well. In the past they have spoken about the efficiency gains that comes from this arrangement however based on commentary in the report the higher than expected costs will see a re-architecture for emite to save around $700k per year and over time shift to a shared infrastructure to reduce costs further.

If these measures are successful, then the discipline being shown across the rest of the cost base should allow for operating leverage to emerge and the investment thesis to remain well and truly on track.

To wrap it up, the market (the final arbiter of these questions) has decided that I was definitely too early with an investment in PRO. Am I wrong though? While the headline numbers suggest the answer to that question is also yes, I think teasing apart the numbers shows the thesis is still intact (for now!).