Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Sat down today and this popped up. Given last year's admission of overstating ARR, no CFO, plus other things, and the steady decline in SP a change was deemed necessary, so here it is! For better or for worse, we shall see.

I quickly skimmed through the presentation and am not holding my breath. It'll be a while I reckon for any change to regain market trust/attention.

Held IRL and on SM.

It's good that PRO has one very supportive institutional shareholder.

It's also why my conviction in AEF is not that strong although the technicals last month of potentially pushing past the 200 MA was too good to pass up (which has now happened), plus the payday super changes which would benefit Christian Super.

Now an indirect holder of PRO. And a few other notable underperformers including M7T and JAN.

So it seems like they've been overstating emite contracted ARR by 15-30%. A few things:

- It shouldn't read as a benign "Changes to...", it's really "Restatement of Errors..."

- Another reminder that you need to put a significant discount on unaudited figures

- While I don't think there's anything nefarious going on, it is at best clumsy (and some less generous adjectives come to mind). Just because it's unaudited doesn't give them a leave pass. It's a key metric and they're not so big that it's a huge job to scan the list by customer and work out what shouldn't be there.

- Understandably the SP is down over 20% at time of writing, though my thesis is based less on the absolute ARR numbers and more on the direction and rate of change, combined with their ability to generate cash ahead of earnings. An opportunity? Maybe, but I think I'll wait to see H1 results - I've been wanting to see higher Snare ARR (not impacted by this announcement) convert to revenue.

- Management has a job to win back trust. As part of that it might have been helpful to bring forward a broader YTD update, which they usually do at their AGM anyway.

- It's worth noting Prophecy are using contracted ARR rather than ARR. This is well explained by Nick Maxwell here.

[Held]

I still don't like ARR multiples, but as per my recent Straw PRO remains a couple of years away from the operating leverage when traditional profitability metrics are appropriate.

4x SaaS ARR of $26m (removing legacy maintenance revenue) gives a price target of $1.40.

“Being extremely early is tantamount to being wrong.”

This quote is attributed to Seth Klarman however it's been paraphrased by many others over the years. I'm not sure I completely agree with the quote, but I do acknowledge the fact that until you are able to look back with the certainty of hindsight, the difference between early and wrong is indistinguishable.

With that in mind, analysis of the PRO FY24 result is whether I am early while the thesis continues playing out or I am wrong and the thesis is busted. In a nutshell, the PRO thesis is that like most other enterprise cloud SaaS businesses it can demonstrate the operating leverage inherent to the business model as revenue grows. The accepting of being early part stemmed from the fact the while PRO was going through a transition from perpetual licence to recurring subscription revenue, that operating leverage would not show up in the headline numbers even as the earnings power of the business was growing in the background.

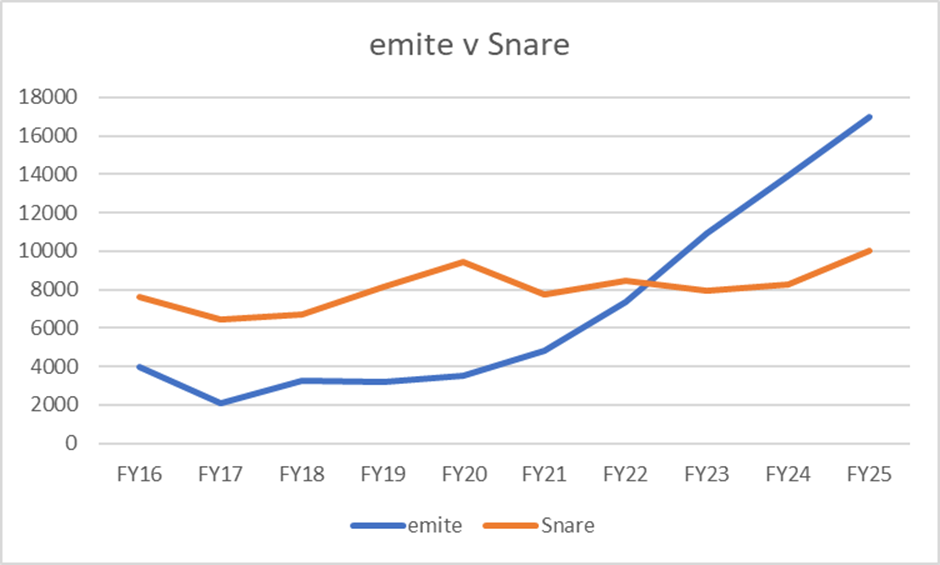

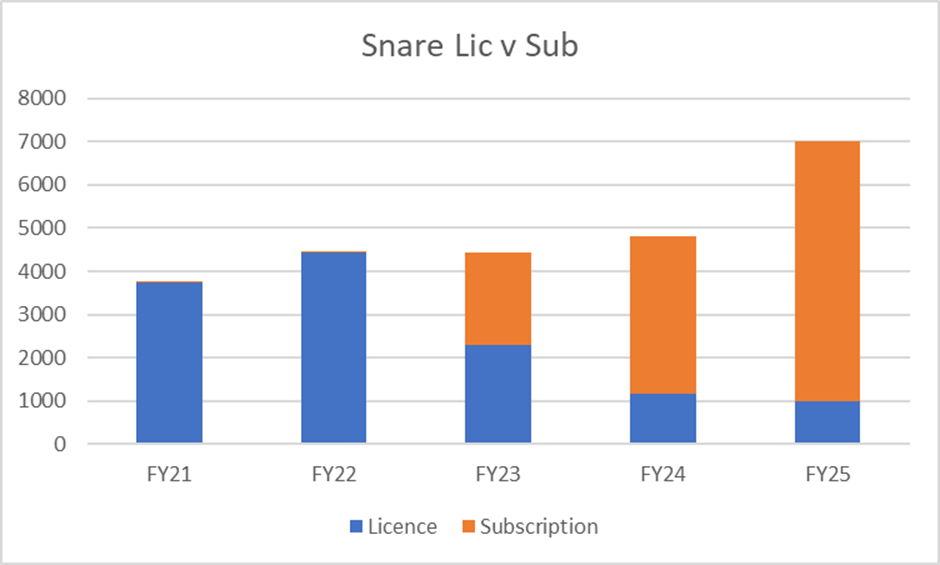

The chart above best highlights the two segments within PRO and is a testament to the quality of the recurring subscription business model compared to its perpetual licence counterpart. emite began the transition in FY17 and it wasn't until FY21 before the benefits were tangibly seen in the reported numbers. Since then however, the beauty of compounding recurring revenue growth can easily be seen. Snare began the transition FY23, and the last two years have been the muddy period where the business growth is not seen in the numbers. However, the chart below shows FY24 is likely the trough of the transition impact with subscription revenue taking over in FY25:

Note: I am looking ahead to FY25 using PRO’s reported contracted ARR and making a conservative assessment of what I think can be implemented and recognised.

So, the revenue side of the PRO investment thesis is playing out. Group revenue has nearly doubled over the last three years driven by emite and with Snare completing its revenue model transition I expect that trend to continue strongly.

The other side of operating leverage is of course the cost base. Given the marginal cost of distribution can be exceptionally low, we know that software businesses run efficiently at scale are very high margin. But many aren't run efficiently, and despite reporting strong growth they never truly scale as they run to stand still or embed a culture of profligate spending.

This has been the main criticism levelled at PRO over the last few years as we have seen a steady swelling of the cost base. To some degree I'm forgiving of this as there is an investment that is required to put in place the infrastructure to shift from on premise licencing to cloud based subscription.

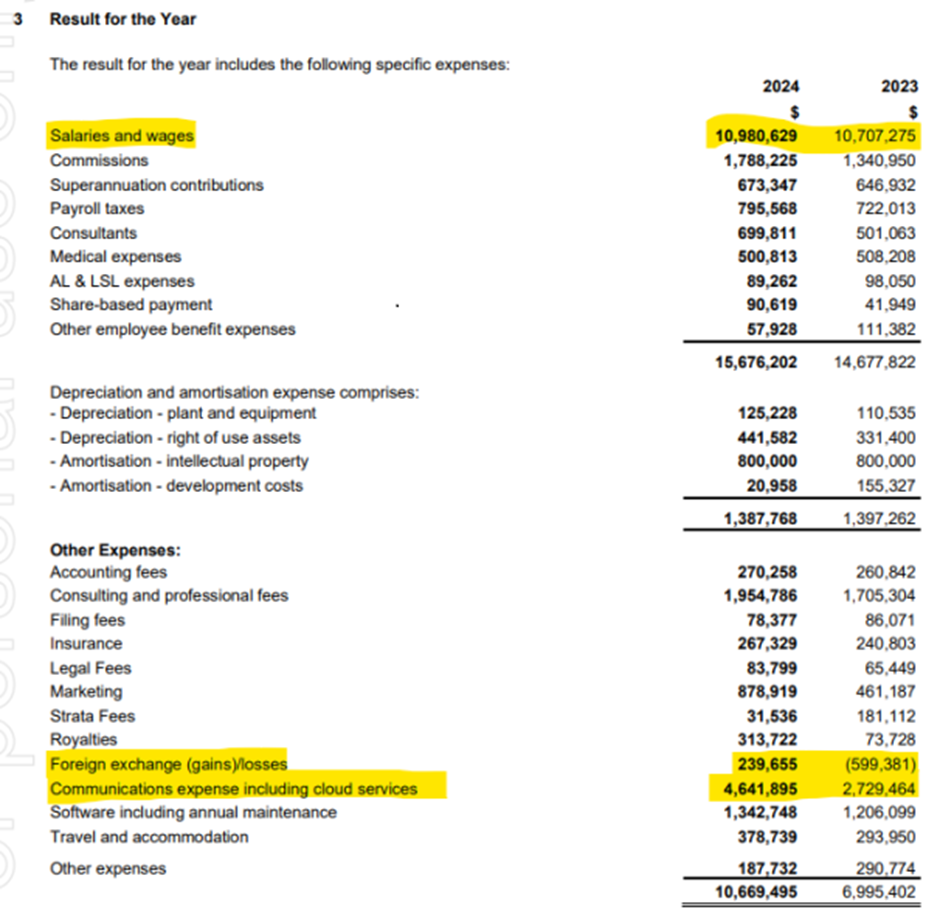

With that investment largely behind PRO now, you should expect to see a normalisation of cost growth. However, from FY23 to FY24 we saw roughly a $4m increase in the operating cost base. Digging into the notes of the report we can see where the biggest impacts came from:

Pleasingly, employee costs only rose modestly, by about $1m with most of that coming from employment benefits rather than direct salaries and wages. The two biggest impacts came from a swing in foreign exchange from a gain of $600k to a $240k loss, as well as nearly a $2m rise in hosting costs.

The foreign exchange swing should be ignored when assessing the operating business, so for PRO the key to answering the question about whether the cost base side of the operating leverage thesis is intact comes down to whether the sharp increase in hosting costs is a structural issue. We can expect there will be modest increases in hosting costs as revenue grows given PRO hosts their customer environments in the cloud, but the bulk of the hosting costs comes from PRO hosting their own internal product development in the cloud as well. In the past they have spoken about the efficiency gains that comes from this arrangement however based on commentary in the report the higher than expected costs will see a re-architecture for emite to save around $700k per year and over time shift to a shared infrastructure to reduce costs further.

If these measures are successful, then the discipline being shown across the rest of the cost base should allow for operating leverage to emerge and the investment thesis to remain well and truly on track.

To wrap it up, the market (the final arbiter of these questions) has decided that I was definitely too early with an investment in PRO. Am I wrong though? While the headline numbers suggest the answer to that question is also yes, I think teasing apart the numbers shows the thesis is still intact (for now!).

I thought I'd start a new thread and put down my thoughts on Oracle Support who also supports Oracle Cloud Infrastructure

It may be relevant to Prophecy being a "preferred partner". Then again it may be not.

Firstly I've been given the runaround on a ticket with Oracle Support after the duty manager confirmed the support engineer is no longer available to look at my last updates regarding why my cloned db system failed in Oracle Cloud

After escalating to Sev 2, the ticket has been "reassigned" to another engineer in my timezone.

Secondly my ticket has been opened for more than 2 weeks. It seems the duty managers don't have visibility on support resources.

Or maybe getting the engineer to update me asap is the wrong question to ask?

But then we would expect to work with the same engineer as they know the issue intimately.

Now it looks like we need to start from square one and I need to explain the issue back to the new engineer.

At the same time, I don't have justification to escalate to Sev 1 yet which turns into a 24x7 ticket by default (and I won't get sleep) but I fear it will still take time.

Also it looks like I'm not the only one

https://blog.edhayes.us/2015/03/25/oracle-support-quality/

I don't want to try and debate the business implications of a technical support tickets being passed off to another resource other than that "time is money".

Maybe this also explains the cost line increase against the revenue line? It is hard to say as I'm an unrelated Oracle customer trying to look in And maybe Prophecy is more fortunate than me hopefully.

On the flipside, could Oracle be working on a Generative AI version of Oracle Cloud support where we have virtual engineers sitting in while the real engineer is unavailable? That would be something

Update: toned down the post and added the link

Sneak peak on how Emite works

Don't worry as I know how it feels.

I had to clone a system on OCI and it failed. I'm still chasing up via the cumbersome OSS if we will still be billed as the VM was still up for 5 days for purpose of troubleshooting even though it showed failed, was "flaky" and running nothing.

But back to this, if using MS licensing then I'm not sure how you can rearchitect to reduce license fees without reducing your compute footprint.

I wrote the following about Prphecy in my spotlight series ( Interestingly enough - Brad mentioned that there is a possibility of merging two products under iPAAS architecture - there may be an interesting development in the future.

Expanding Market Potential

Both Emite and Snare are significantly broadening their Total Addressable Market (TAM). Initially, Emite was limited to integrating with Genesys and Amazon Connect contact center software. However, with their new integration Platform as a Service (iPaaS), they can now connect with multiple sources. For instance, Service Australia has chosen NICE contact center software to replace their legacy Genesys system, and Emite will continue to be used with NICE CXOne contact center.

One challenge for Prophecy is that Emite and Snare might seem like unrelated software products with no clear strategy. However, both are data analytics tools: Emite focuses on contact center data, while Snare focuses on security data. Looking ahead, there's potential for Emite and Snare to merge into a single analytics and data visualization platform. This combined platform could offer customers the flexibility to choose licenses based on the specific data they want to capture, providing a comprehensive analytics dashboard for various parts of their business. (I'm just thinking out loud here—not sure if the company has such a strategy or if it's even possible.)

https://www.growthgauge.com.au/p/spotlight-what-peeked-my-interest

I got a notification that my access to my Oracle cloud OCI account from my company will be removed unless I get recertified

It's an additional cost to me more in terms of time and money second as I use it to test out ideas.

It's like being asked to prove you have a qualification in finance otherwise you will be denied access to your funds.

Wondering if Prophecy is going to get that same treatment from Oracle that their users need to be certified or denied access.

https://finance.yahoo.com/news/prophecy-international-partners-carahsoft-bring-130000423.html

Prophecy International partners with Carahsoft to bring innovative software solutions for securing enterprise to the public sector

Prophecy International Group Pty Ltd (ASX:PRO)

Tue, May 14, 2024 at 10:00 PM GMT+94 min read

Prophecy International Group Pty Ltd (ASX:PRO)

Government agencies are now able to easily procure Snare’s suite of security and compliance solutions through Carahsoft’s reseller ecosystem and contract vehicles

SYDNEY, Australia, May 14, 2024 (GLOBE NEWSWIRE) -- Prophecy International (ASX:PRO), a global software solutions company, has announced a strategic partnership with Carahsoft Technology Corp., The Trusted Government IT Solutions Provider®. Under the agreement, Carahsoft will serve as Prophecy’s primary public sector distributor, making its products available to the public sector through Carahsoft’s reseller partners and NASA Solutions for Enterprise-Wide Procurement (SEWP) V, Information Technology Enterprise Solutions – Software 2 (ITES-SW2) and OMNIA Partners contracts.

Warren Alexander, Director, Partner Alliances (Snare), Prophecy International, said, “We are thrilled to join forces with Carahsoft to provide public sector agencies with Snare’s security data engine solutions, which help our customers stay ahead of increasingly sophisticated cybercriminals. This partnership ensures state and federal government agencies have access to a sophisticated approach to threat detection and response. This strategic move demonstrates our dedication to providing a tailored solution that meets the real-world needs of government, leveraging Snare’s unparalleled data collection, orchestration and management, and storage capabilities.”

As cybercriminals find new ways to evade protective software, public sector organizations must have streamlined access and versatile procurement avenues for premium cybersecurity solutions. The accessibility of Snare through Carahsoft’s robust reseller ecosystem and wide range of contract vehicles empowers government agencies to fortify their systems against cyber-attacks, meet their organization’s audit requirements, and adhere to security standards.

Snare, the company’s flagship cybersecurity product, is a security information and event management (SIEM) agnostic solution that prioritizes flexibility and cost effectiveness while tackling cybersecurity challenges through tailored use cases. By collecting and refining IT event data for rigorous security monitoring, analysis, auditing and archiving, Snare empowers agencies to enhance information protection and optimize digital business operations.

Alex Whitworth, Supply Chain Risk Management Vertical Executive, Carahsoft, said, “We are excited to partner with Prophecy and for our resellers to introduce its cutting-edge cybersecurity solutions to the public sector. Given the escalation of cyber threats and rapid technological advancements, there is a critical need for government agencies to monitor, prioritize, and respond to threats in real time. This partnership allows us to equip more agencies with the reliable, protective software required to address modern cybersecurity challenges.”

Prophecy International’s solutions are available through Carahsoft’s SEWP V contracts NNG15SC03B and NNG15SC27B, ITES-SW2 Contract W52P1J-20-D-0042 and OMNIA Partners Contract #R191902. For more information, contact the Carahsoft team at (844) 445-5688 or [email protected].

About Prophecy International Holdings Limited

Prophecy International Holdings Limited (ASX: PRO) is a leading Australian designer and developer of innovative business software. Through its two products, Snare and emite, Prophecy serves the large and growing global markets of cloud data management, contact center analytics, and cybersecurity.

emite provides a Software-as-a-Service (SaaS)-based real-time and historical analytics platform for customer experience in contact center environments. It provides fast, accurate visibility into operational metrics that drive contact center performance outcomes and superior customer service without adding pressure to busy business intelligence (BI) and management information (MI) teams.

The Snare product suite is a highly scalable platform of centralized log management and security analytics products designed to enable customers to detect and manage cyber threats in real-time and maintain regulatory compliance. It empowers customers to seamlessly detect threats as they emerge and review past events that may have led to system misuse.

Prophecy operates globally with key locations in Adelaide and Sydney, Australia; London, United Kingdom; and Denver, United States.

About Carahsoft’s Cybersecurity Solutions Portfolio

Carahsoft’s Cybersecurity solutions portfolio includes leading and emerging technology vendors that enable organizations to defend against cyber threats, manage risk and achieve compliance. Supported by dedicated Cybersecurity product specialists and an extensive ecosystem of resellers, integrators and service providers, we help organizations identify the right technology for unique environments and provide access to technology solutions through our broad portfolio of contract vehicles. Our cybersecurity portfolio includes solutions for Supply Chain Risk Management, Cloud Security, Network & Infrastructure, Identity & Access Management, Risk & Compliance and more, ensuring comprehensive protection for organizations' cyber ecosystems. Explore Carahsoft’s Cybersecurity Solutions for Government here.

About Carahsoft

Carahsoft Technology Corp. is The Trusted Government IT Solutions Provider, supporting Public Sector organizations across Federal, State and Local Government agencies and Education and Healthcare markets. As the Master Government Aggregator® for our vendor partners, we deliver solutions for Cybersecurity, MultiCloud, DevSecOps, Records Management, Artificial Intelligence and Machine Learning, Open Source, Customer Experience and Engagement and more. Working with resellers, systems integrators and consultants, our sales and marketing teams provide industry leading IT products, services and training through hundreds of contract vehicles. Visit us at www.carahsoft.com.

Q3 FY24 update out today: https://announcements.asx.com.au/asxpdf/20240501/pdf/0633gd1b1ddhy2.pdf

- ARR up 11% on the previous quarter. (more on this later)

- Reiterated cashflow positive for the financial year. There might be a slight upgrade here as the previously guidance was "operating cashflow" positive. The difference is ~$400k of rent.

- Pipeline meaningfully higher than the numbers mentioned in the previous quarter.

The partnership with Devo announced in late January, has expanded the recurring revenue for Snare by 20% in the space of a few months, and has the potential to add to this significantly. Prophecy has clearly found a great fit here. There is clear upside if the company can establish similar partnerships in the future.

A blemish on this update, is the injection of the word "Contracted" in front "ARR". Sounds like the Devo customers are still in the process of being migrated, but management wanted to pump the ARR metric. I don't know why they wanted to bring forward good news by one quarter at the expense of eroding the trust of investors (however small).

Update 18/11/2023

Slight downgrade from $0.81 due to costs in moving to Oracle Cloud and possible increased maintenance and being part of the OPN

See my straw from 18 Nov 23.

10 months ago

Taking the capital raising price completed in Oct-21 as resistance level for share price.

Updating to let everyone know as many may not be aware.

I'm on the fence with Prophecy as in my mind their main product eMite appears to be another business intelligence app that could be developed by other companies in the analytics space (ie: Oracle, Qlik etc)

I wanted to avoid posting on Prophecy and I know this will be a very unpopular low vote post and damage my ranking.

But I can't help myself again!

These slides just screams "Buy Oracle" even if it is $100+ USD and you need to fill in that WB form to receive the quarterly dividends to ensure you are not taxed too much.

There is also a partnership fee when joining the Oracle Partner Network. I know as the company I work for is part of the OPN.

On top of that, there are ongoing certification fees and certification expires after 2 years. - but of course you have a choice to do it once and not do it again.

Then of course there's commissions etc... to Oracle for being a partner which cuts into the margins.

On the move to Oracle Cloud I have a feel this will cost quite a bit and need new hires to maintain emite and Snare on Oracle Clloud Infrastructure. Hence the mention about the hosting cost. Hopefully for shareholders the containers before the move were running latest versions so it would be less labour intensive. Prophecy had no choice because it is obvious that some of their government and NGO clients are making the move to Oracle Cloud. This is why it makes more sense to buy Oracle shares instead.

I could get into more detail on Virtual container image maintenance etc.. on OCI but that will be beyond the scope of this post and will just confuse everyone more. You can do a google search on Patch Hypervisor or Host and Virtualbox for a basic primer of what this could involve but I can assure it is a pain when you patch your Linux system only to find your little Virtual machines and docker stuff suddenly don't work.

Having said that, I think the cycle of moving off deprecated systems in OCI on average is about about 2-3 years.

You are probably aware from the last Sydney meetup about my background in Oracle Cloud so feel free to probe me a bit more on this.

I actually tried to attend the PRO AGM virtually this morning (10:30am Adelaide time) but could not get on.

I got close but nothing came through the registry portal (even after switching browsers, doubles checking time differences, etc) so I think they must have had difficulties broadcasting?

From their IR site, they don't seem to put recordings up, so unless you were in Adelaide this morning it looks like a closed shop.

Did anyone else manage to get on?

Disc: Not held.

FY23 updates highlight

In first half, operationally they were outflow of $2.8m ( which means for full year operational cash outflow will be ~$0.8m)

I think management set expectations of full year cash flow neutral or positive in past few presentations.

Although, the thesis is working nicely ( However, I like management not to set high expectation). Since last five years, ARR has grown significantly and now it is at inflection point of achieving cashflow positive in near future.

ARR Growth:

FY18 : $4m

FY19 : $5.9m

FY20 : $7.8m

FY21: $10.7m

FY22: $18.3m

FY23 : $23.1m

For those intersted and maybe missed it, PRO has a show and tell next wednesday 26/7 4.15pm on Snare and emite. i dont hold this one but they are making progress. obviously critical that these prodcuts have strong posioting in their markets.

have we hosted the CEO on sm? worth a chat i think @Strawman

Prophecy has delivered a substantial turn around in cashflow in Q3, with a $3.0m increase in its cash position since the end of 2022. That compares to a $3.2m outflow in the first half. Larger subscriptions were flagged as being weighted to H2 and management had indicated that cashflow would be positive for the full year. This was evidenced by invoicing, which was almost as high in Q3 as it was for all of 1H.

Annual Recurring Revenue continues to grind higher, up $0.7m to $21.3 since they last reported, although government agencies are continuing to opt for perpetual licenses. The combined sales pipeline for eMite and Snare is roughly equivalent to their last report. Management expect cashflow to remain positive for the remainder of FY23.

At an EV of about $28 million the valuation doesn't look stretched for a company that is growing at the rate it is and can pay it's own way. However the market reaction has been 'meh'. Like many of the companies I own the buy/sell spread is daunting.

[Holding]

PRO is a software provider with two key products: eMite, a cloud based call centre analytics product and Snare, a cyber security monitoring software. @Noddy74 and @Valueinvestor0909 have covered the software in previous Straws so I won't go in-depth here.

FY22 was a foundational year for PRO, winning their largest contracts for both of their products, Humana (US insurer) for eMite and the UK Government for Snare. While the company will likely not be able to match the 70% growth in ARR in FY23, the platform has been set with the business now sustainably established giving management flexibility to further invest in organic growth or perhaps M&A.

2022 was a tough year for tech stocks and the market finally woke up to the various tricks companies can use to make things appear rosier than reality, particularly when the focus was so heavily on ARR and not what was happening beneath that unaudited metric. PRO has been lumped in with these tech peers, but I think it is worth taking a step back and looking at the business and realise that not all software is created equal and the same goes for revenue and cash.

I will focus on eMite with this analysis but most of the points also apply to Snare. eMite is a pure SaaS solution, primarily delivered through channel partner cloud marketplaces Genesys and Amazon Connect. As investors, one of the main reasons software businesses can be so attractive is the fantastic incremental unit economics. However some software products lose a large chunk of this benefit if the software must be heavily customised to individual customers which also comes with long implementation periods. Most companies who suffer from this problem usually disclose contracted ARR to try and show the pipeline of ARR that will come online over time. Further, when software is heavily customised to customers it makes the roll-out of updates and improvements difficult and usually comes with more implementation time.

eMite avoids this problem with an out of the box solution (which can then be highly customisable by the customer themselves) that can be deployed in hours over a customers cloud call centre infrastructure. The lack of a long implementation phase means PRO's ARR is extremely clean. Because the software can be turned on and off so easily, management have also established a disciplined negative working capital model. Management clearly break this out in the annual report (a virtue I wish other software peers would emulate!):

Again, this negative working capital model is another reason why software businesses can be so attractive. However, many software peers have cash collection issues and in 2022 most have been exposed by the market which has focused more closely on cash. The strength of PRO's model can most clearly be seen by FY22 revenue of $16.4m vs $21.5m in cash receipts.

On top of this, management also don't capitalise any R&D so operating cash flow is very clean and the P&L isn't artificially boosted (actually the opposite because some legacy D&A is still rolling off).

The business model gives us clear visibility for FY23, with $18.4m ARR entering the year, another $2-3m in Snare license sales as the business model continues to shift to a subscription service plus further growth through the year. I expect reported revenue to be in the range of $23-24m. Management have flagged a ramp up in costs to chase further growth with the strong tailwinds they have with the shift to cloud based call centre infrastructure and cyber security solutions. I'm not exactly sure how much will be tacked onto the cost base, but given the revenue growth I'd expect the business to be profitable (but definitely cashflow positive given the negative working capital model).

Prophecy International has been absolutely smashing it of late - up almost 3x in the past couple of months, which is pretty extraordinary for a business that was established in 1979 and listed in 1997.

They are a B2B software solutions provider in two major verticals. They have three products but you can pretty much discount eFoundation, which they are not developing and running down. The other two are:

eMite

Which is an analytics solution for contact centres (on premise or cloud). It does number crunching, visualisations, KPI management and reporting. As at mid-Oct it was generating $10.5m in ARR, up almost 40% since Jun 21. This was partly on the back of their largest ever signing (Humana in the U.S) but it has grown steadily and strongly over the past few years.

SNARE

This is Cybersecurity and compliance tool. Up until now I believe this has been offered on a perpetual license basis but was recently rolled out as a subscription offering. This has been a little slower to get going but is growing and has been growing faster of late.

Clearly there's no shortage of competition in the space but they must be doing something right given the growth they're experiencing. Having said that they've been investing to get the growth and haven't been profitable since FY17. Despite the top line growth I'm not sure they will be in FY22 either but we'll see.

Insider ownership is healthy with the non-exec Chairman (joined as GM in 1987) being the largest holder with 12.2%.

Congratulations to ValueInvestor who is its only Strawman investor. You must of been turning over a lot of rocks to find it as it hasn't looked like much on many measures until very recently. Wini has been spruking it of late also so props to him too.

One cautionary note - it's worth reading ValueInvestor's ##Not so honest communication post here.

Psychologically it's hard to look at a company that has recently gone 3x and not think that you've missed it. Having said that the market cap is still only just above $100m and it's not unreasonable to think ARR could end FY22 at $20m. An ARR multiple of 5x? Pro-Medicus holders might like to have Prophecy's ticker symbol but I'm pretty sure they're content with PME's multiple...

[Not held]

So Prophecy announced today, that it has increased ARR to 13.6m ( at the back of the new eMite SaaS deal).

However, they changed the ARR figure for FY21 in this announcement to hide that Snare's ARR has reduced ( which I knew anyway because Snare's main Managed Services partner stop selling it last year - Although, new Managed Services partner has been onboarded later in FY21). It may take little time to ramp up Snare's sales.

The thesis is active -- both products have significant momentum. However, Management tried to change the figure to show more growth.

Look at the following twitter thread, Company did respond to my initial tweet - I am waiting for their further response.

But my confidence in the integrity of Management is somewhat shaken and I will reduce my holding on share price strength.

Update: 15th Oct 2021

Attended webinar hosted by CEO. Products definitely have momentum and CEO also sounded very driven and focused on growing the business.

I will keep this on the watch for ongoing announcements.

Prophecy agrees to provide eMite to Humana Inc. (NYSE: HUM) for an initial term of 3 years, with a minimum commitment of AUD$1.784M million in annualised recurring revenue (ARR) and total contract value of AUD$5.518 million over the initial term. eMite ARR now exceeds $10 million.