SKS has gone back-to-back with a couple of welcome announcements in the last couple of days.

Yesterday it was my lone soldier in green, among a sea of red, after announcing an intent to proceed with a modest acquisition. On paper it looks like a good solid line and length acquisition, smack bang in their existing data centre (DC) fitout vertical, but giving them extra exposure in the state that dominates the DC space. Presumably it was this and the modest multiple they have agreed that the market applauded. The $13.75-15 million, depending on earnout, price represents 5 times earnings averaged over the past 3-years. That would be a reasonable EBITDA multiple, but they're one of the rare companies that have calculated the multiple on earnings, so it actually looks relatively cheap. Whilst not yet binding and non-conditional, it has been agreed so would seem highly likely to proceed. The consideration is a mix of cash and scrip, with the scrip locked up in two tranches, at 12- and 24-months respectively.

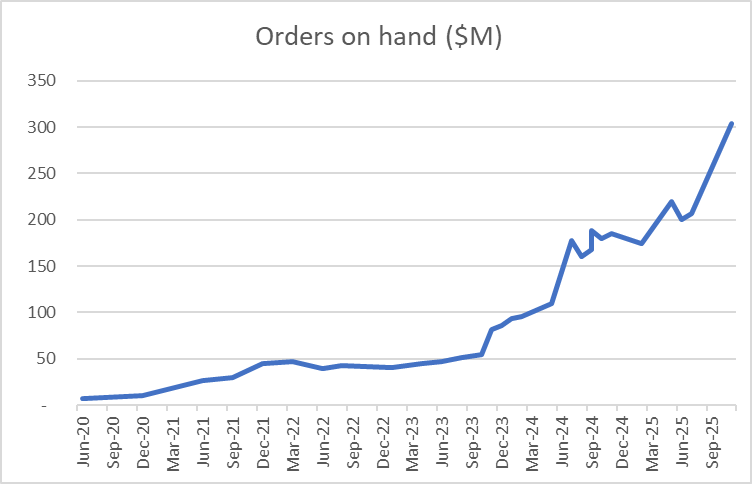

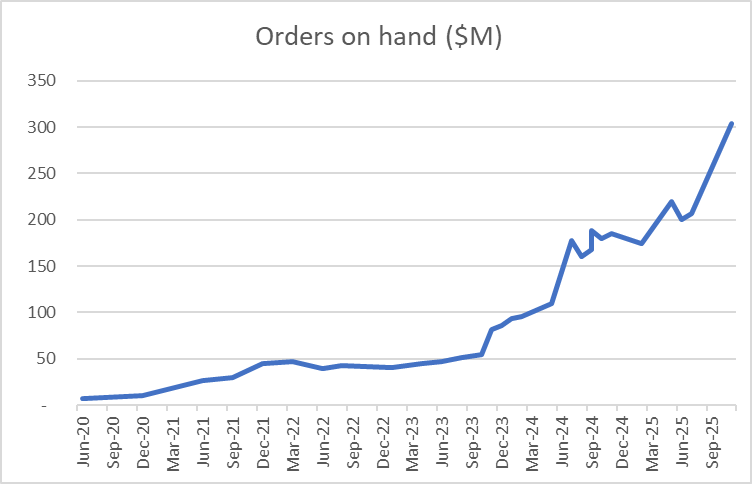

Today they've followed that up with a new $130 million DC project in the great state of Victoria, their largest single win to date. This project is expected to deliver them revenues all the way through to FY27 and has led them to upgrade FY26 guidance to $320 million, which would represent well over 20% YoY growth. The win has increased their order book to a new all-time high of $304 million.

SKS has been my biggest winner by far in the last few years. I started buying in December 2023 at 24 cents and have watched it travel all the way up to $4.48 recently. I've bought some and sold more along the way (including 3 tranches in the last 2 months), but it's one that always seems to punish me for not just leaving it alone. Still, it is or is close to, my biggest position so I'm not lamenting too much. It has had a big run up in recent months though, so does the air need to come out of it a bit? If they achieve revenue guidance and get a similar PBT margin to last year, they'll deliver PBT north of $25 million. Based on the significant cash balance they disclosed yesterday, that represents a PBT/EV multiple just over 13. They do need to keep filling up the funnel, but so far they clearly are and have been a big beneficiary of the cloud migration. I dunno, I'm tempted to take at least some of the proceeds of recent sales and top up again at a significantly lower price today.

[Held]