Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

SKS has gone back-to-back with a couple of welcome announcements in the last couple of days.

Yesterday it was my lone soldier in green, among a sea of red, after announcing an intent to proceed with a modest acquisition. On paper it looks like a good solid line and length acquisition, smack bang in their existing data centre (DC) fitout vertical, but giving them extra exposure in the state that dominates the DC space. Presumably it was this and the modest multiple they have agreed that the market applauded. The $13.75-15 million, depending on earnout, price represents 5 times earnings averaged over the past 3-years. That would be a reasonable EBITDA multiple, but they're one of the rare companies that have calculated the multiple on earnings, so it actually looks relatively cheap. Whilst not yet binding and non-conditional, it has been agreed so would seem highly likely to proceed. The consideration is a mix of cash and scrip, with the scrip locked up in two tranches, at 12- and 24-months respectively.

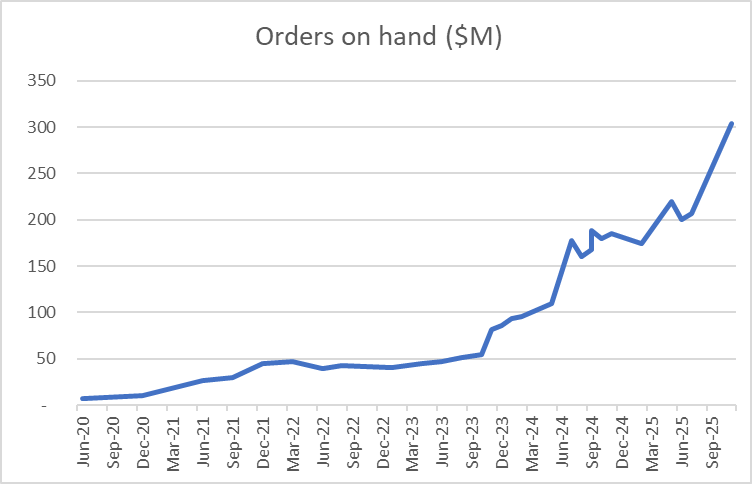

Today they've followed that up with a new $130 million DC project in the great state of Victoria, their largest single win to date. This project is expected to deliver them revenues all the way through to FY27 and has led them to upgrade FY26 guidance to $320 million, which would represent well over 20% YoY growth. The win has increased their order book to a new all-time high of $304 million.

SKS has been my biggest winner by far in the last few years. I started buying in December 2023 at 24 cents and have watched it travel all the way up to $4.48 recently. I've bought some and sold more along the way (including 3 tranches in the last 2 months), but it's one that always seems to punish me for not just leaving it alone. Still, it is or is close to, my biggest position so I'm not lamenting too much. It has had a big run up in recent months though, so does the air need to come out of it a bit? If they achieve revenue guidance and get a similar PBT margin to last year, they'll deliver PBT north of $25 million. Based on the significant cash balance they disclosed yesterday, that represents a PBT/EV multiple just over 13. They do need to keep filling up the funnel, but so far they clearly are and have been a big beneficiary of the cloud migration. I dunno, I'm tempted to take at least some of the proceeds of recent sales and top up again at a significantly lower price today.

[Held]

August, FY25 update:

So 92% revenue growth yoy with guidance of more than 15% for FY26. Given 72% work on hand is datacentres you would think some reversion is inevitable (work on hand reduced from 220m in May to 200m in June), but there still 358m in open datacentre tenders. Check out their customers, impressive list (microsoft, amazon, defence, alibaba, etc).

Sure price has 10x since start of 2024 (and up lots since I looked at it), but revenue has grown with that and these guys have executed wonderfully,

NPAT Margin only slightly improved to 5.3% from 4.9% yoy but they did pay themselves an extra 3m (not complaining and there hasn't been much dilution) and they say their cost base can support 350m of revenue. Overall, base case seems relatively conservative for FY26. It's still a cyclical business, H1FY26 may present as high margin and good exit point.

Note, I really should look into working capital and inventory - it's important for this kind of business.

bear case, 10% revenue growth, 5% NPAT margin, pe of 12 => $1.58

base case, 15% revenue growth, 5.5% NPAT margin, pe of 20 => $2.78

bull case, 20% revenue growth, 6% NPAT margin, pe of 30 => $5.63

weighing equally gives $3.22.

Feb, H1FY25 update:

This is a tough one, >100% revenue growth from H1FY24 to H1FY25 - this can't continue, but what could it be? Highly uncertain, but there lies the opportunity!

Assuming 20% revenue growth to FY29, 7% PBT margin, PE 15x gives EPS of 15 cps and $3.66, discounting back 5% gives 3.01.

Forward PE if 260m FY25 achieves @ 2.09 is 18, assume you would get multiple expansion if achieved but shouldn't rely on this. cf. IPG @ PE ~17 which has stagnant growth, similar revenue but higher margins.

Downside risk, I worry margins won't be stable, e.g. 5% PBT gives $2.10 ~ pretty much current price.

SKS released more good news today.

- They spot on with their FY revenue projection of $260M

- Beat their PBT $20.8M vs $18M

- Have $32M cash on hand - that's 13% of their market cap

- Order book for this FY is $200M

This isn't on my SM card, but held IRL.

SKS had a welcome boost today after securing another $100M data centre contract, this time in western Melbourne. The award sent orders on hand to a record $220M. With the build expected to complete in September 2026, it sets the company up for a healthy FY26, after reiterating guidance for FY25. The project is for fitout of building C and follows SKS's successful completion of buildings A and B on the same site.

Up until today it had been a quiet few months for SKS and the SP had drifted, as it is prone to do. Today's announcement has put some attention back on them and we'll see how it lasts, although it does seem to be a stock that overextends at both the bullish and bearish ends of the barbell so here's hoping it goes on to test new highs.

Interestingly the order book is now exactly twice what it was 12 months ago when it was about to start a tear from circa 70 cents to a 12-month high of $2.45. Apart from the order book, the number of open tenders is also at a new high and the value of those tenders is similarly elevated (although not a record after the awarding of todays $100M contract).

[Held]

Anyone want to guess the time in SKS's results call that the CEO mooted a capital raise because "various organisations are encouraging us to do so"?

[Held]

SKS Technologies was up by around $1.20 at one point today. This could have been my very first real-life "spiffy-pop" (I hope I'm using that correctly - haha). I'll give myself a small pat on the back but not without first reflecting on a recurring theme with any of my winners, in terms of cognitive bias. It occurred to me today while driving home, that whenever I make an initial entry with the intention of buying more, and the stock shoots up by more than 5-10% from my buy price, I almost always fail to buy more on the way up. Definitely something to work on!

I'm sharing this with the group mainly for accountability. Putting this out there helps me stay focused on my growth areas. Sticking to the basics is key: if the thesis is on track and the valuation looks appealing, pull the trigger and buy more. Don’t just get sucked into buying more of stocks that have fallen just to average down.

Hopefully, sharing these experiences will be useful to others too.

It seems the ASX isn't happy with SKS Technologies (~$30M contract & increase to CBA Banking facilities) announcement yesterday. They were suspended from quotation until further detail are provided.

Today the chairman accouned at the AGM: "At this point, we are unable to disclose the counterparty to this contract and as such, in line with ASX listing rule 17.3, until such time as this is possible, the ASX requires the Company to halt trading. Our expectation is that this information will be disclosed over the coming week when we are able to do so."

In the big scheme of things, this seems reasonable and a minior inconvenance.