Few notes from the Quarterly report before I started work this morning.

Commentary

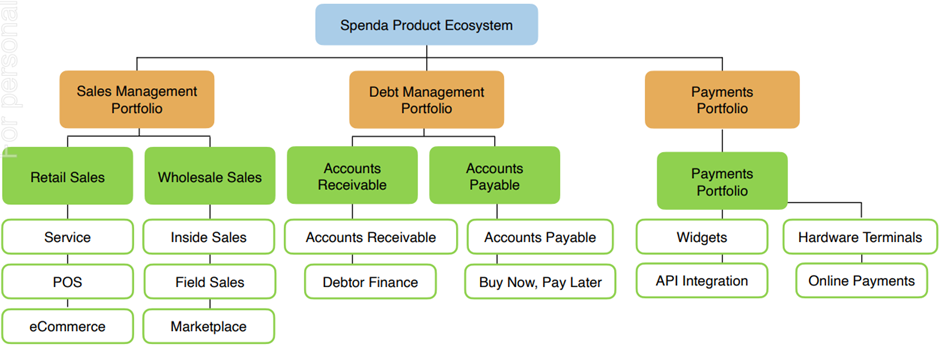

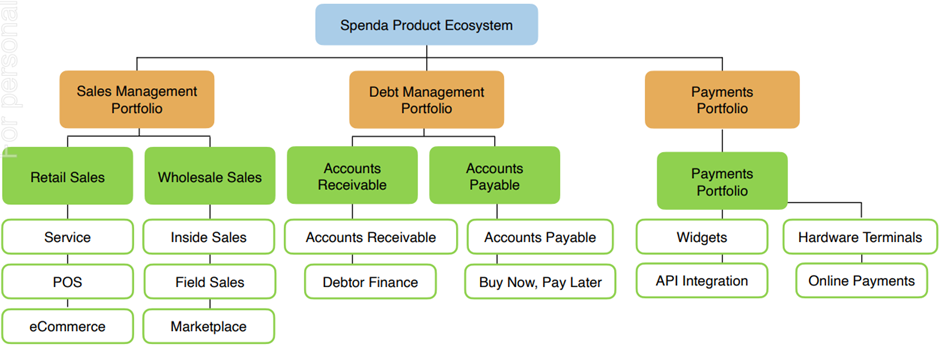

One stop shop for all things payment, invoicing & lending. Streamline process for B2B & B2C transactions. Clip the ticket along the way. Use AI & data to improve lending facilities.

$3m cash burn for the quarter & only $13m cash on hand. 4 quarters of cash left.

Even if they continue to grow at 40%+ QoQ it’s hard to imagine a world where they don’t have to raise capital this calendar year. Even if they continue growing at 50% QoQ that puts Q4 Rev near 1.4M or FY22 Rev of $3.3m at a current $120M market cap. Downside risk in the current market conditions seems more than likely.

The Launch of their debt warehouse could see a significant hockey stick like growth. I’ll continue to hold but may look to lighten my position if we see a run up in news of debt warehouse & if the cash burn position has not changed.

Overview

Cirralto will be changing their name to Spenda after their “flagship” product.

The Spenda Platform is an integrated application which services payments and non-bank lending.

- B2B payment Services

- Digital trading software & integrated solutions

- Manages transaction flow from quote to pay and on demand lending

- Connecting businesses up and down the supply chain targeting “marketplaces”

Quarterly Report

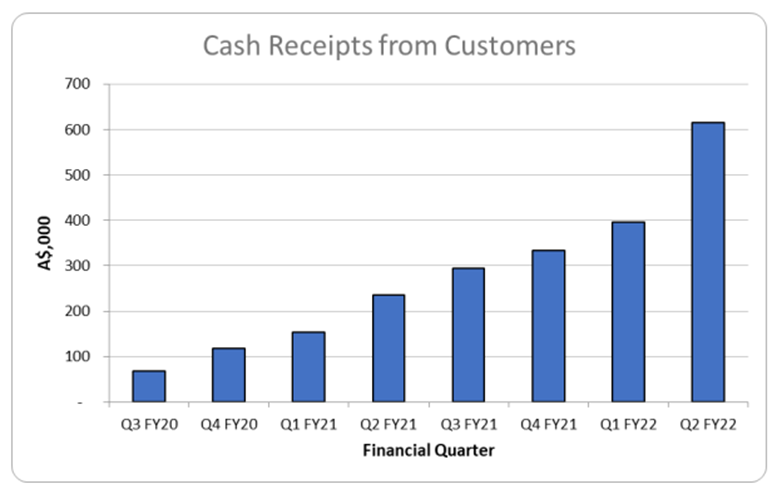

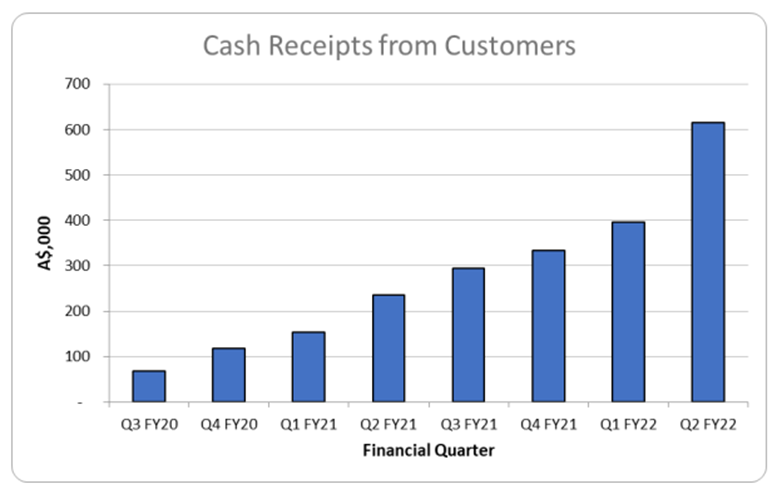

Cash Receipts - 160% YoY - Q2 FY22 $614,637

FY21 Cash Receipts $1.02M - HY FY22 $1.01M

Cash on hand $13M

2022 Outlook

Q1 - Maxmimise use of Spenda AR & AP products – Loan book yiled of 18.8% + Payment yield 8.5% = 26.8%

Q2 – Launch debt warehouse to expand lending & payment volumes

Release Spenda eCommerce to Aus & International markets with integrated payments

Q3 – Expand debt warehouse & payment services

Establish a service integrator channel

Q4 – Focus on marketplace customer acquisition, product internationalisation

Offer AP/AR solution in UK/US markets

International lending

December 2021 – Cirralto funded it’s first global buy now pay later transaction between Aus & China. Evidence based approval matrix, delivers supply chain certainty between Chinese buyers and Australian producers. At the end of the Q James Tyler had drown down $124k from their initial approved $2M facility

App developments

Pay by Link launched for contactless payment added to the Spenda platform without the need for a credit card. Cirralto make between 0.7% and 1% from the total transaction volume for credit card payments and a variable rate for bank transfers.

Pay Statement By Link scheduled for release in Q2/Q3 2022

Launch of payment portal & payment widget with flexible payment options. Both a B2C & B2B tool.

“Being predominantly a B2C tool for collecting payments from retail customers, Pay By Link indroduces mainstream consumers to the Spenda Suite and paves the way for the release of Spenda’s wallet functionality” Trying to get into the “Cash App” space?