Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Few notes from the Quarterly report before I started work this morning.

Commentary

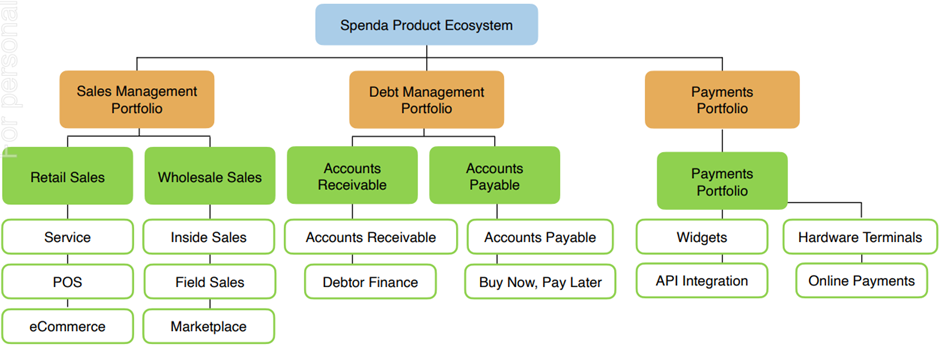

One stop shop for all things payment, invoicing & lending. Streamline process for B2B & B2C transactions. Clip the ticket along the way. Use AI & data to improve lending facilities.

$3m cash burn for the quarter & only $13m cash on hand. 4 quarters of cash left.

Even if they continue to grow at 40%+ QoQ it’s hard to imagine a world where they don’t have to raise capital this calendar year. Even if they continue growing at 50% QoQ that puts Q4 Rev near 1.4M or FY22 Rev of $3.3m at a current $120M market cap. Downside risk in the current market conditions seems more than likely.

The Launch of their debt warehouse could see a significant hockey stick like growth. I’ll continue to hold but may look to lighten my position if we see a run up in news of debt warehouse & if the cash burn position has not changed.

Overview

Cirralto will be changing their name to Spenda after their “flagship” product.

The Spenda Platform is an integrated application which services payments and non-bank lending.

- B2B payment Services

- Digital trading software & integrated solutions

- Manages transaction flow from quote to pay and on demand lending

- Connecting businesses up and down the supply chain targeting “marketplaces”

Quarterly Report

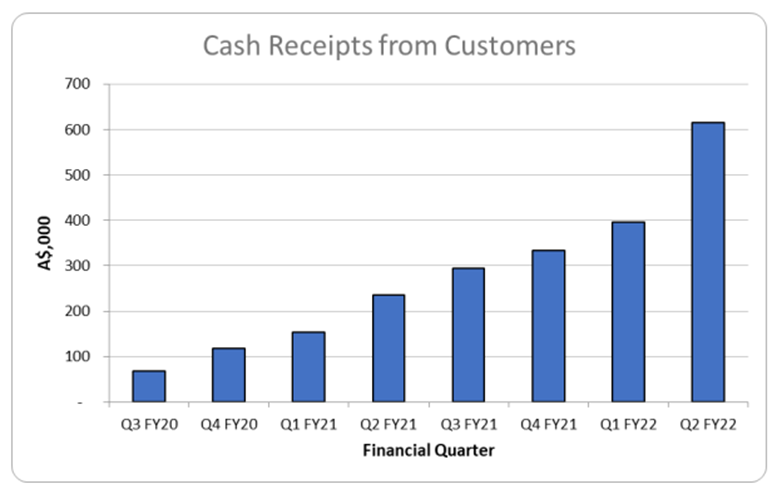

Cash Receipts - 160% YoY - Q2 FY22 $614,637

FY21 Cash Receipts $1.02M - HY FY22 $1.01M

Cash on hand $13M

2022 Outlook

Q1 - Maxmimise use of Spenda AR & AP products – Loan book yiled of 18.8% + Payment yield 8.5% = 26.8%

Q2 – Launch debt warehouse to expand lending & payment volumes

Release Spenda eCommerce to Aus & International markets with integrated payments

Q3 – Expand debt warehouse & payment services

Establish a service integrator channel

Q4 – Focus on marketplace customer acquisition, product internationalisation

Offer AP/AR solution in UK/US markets

International lending

December 2021 – Cirralto funded it’s first global buy now pay later transaction between Aus & China. Evidence based approval matrix, delivers supply chain certainty between Chinese buyers and Australian producers. At the end of the Q James Tyler had drown down $124k from their initial approved $2M facility

App developments

Pay by Link launched for contactless payment added to the Spenda platform without the need for a credit card. Cirralto make between 0.7% and 1% from the total transaction volume for credit card payments and a variable rate for bank transfers.

Pay Statement By Link scheduled for release in Q2/Q3 2022

Launch of payment portal & payment widget with flexible payment options. Both a B2C & B2B tool.

“Being predominantly a B2C tool for collecting payments from retail customers, Pay By Link indroduces mainstream consumers to the Spenda Suite and paves the way for the release of Spenda’s wallet functionality” Trying to get into the “Cash App” space?

Another partnership signed...slowly moving in the right direction. Debt warehouse next milestone, may not make pre Christmas as expected but these things take time. After DW, Revenue growth this qrt and next should be interesting.

https://www.cirralto.com.au/news/2021/12/22/cirralto-signs-strategic-partnership-with-australian-agri-finance-to-grow-farm-lending-services#

Another great announcement today.

Another webinar AF is also taking part in today at 2pm today.

CIRRALTO SIGNS BINDING AGREEMENT TO PROVIDE FUNDING SERVICES TO BEVERAGE TRADING PLATFORM, EBEV

Key Highlights

? Cirralto has signed a binding agreement with eBev to roll out funding services to eBev’s trading network.

? eBev is Australia’s largest online wholesale beverage ordering platform, connecting more than 350 venues, 700 suppliers and 12,000 licensed premises to facilitate more efficient trade between buyers and sellers within the beverage industry.

? eBev has 12,000 buyers in its network, initially services will be rolled out with a A$1m limit being 10% of expected full facility limit of $10m. The initial funding limit of A$1m is intended to be expanded to a A$3m funding limit at least 3 months after initial drawdown and subject to review, and subsequently up to a A$10m funding limit subject to review.

? The eBev platform is synergistic to Cirralto’s Spenda ecosystem in its ability to connect buyers and sellers, we see this as the first step in an ongoing relationship to provide lending and payments services to eBev’s network.

About eBev Founded in 2015, eBev is Australia’s largest independent online ordering and financing platform for the Beverage Trade. With over 65,000 products from 700 suppliers, eBev's is a 'one-stop-shop' for everything from beer, wine, and spirits to the burgeoning non-alcoholic category. Simplifying the ordering process for thousands of hospitality venues whilst reducing business administration for both venues and suppliers sees over $150 Million’s worth of orders go through the platform a year. eBev Trade now further empowers our suppliers with simplified credit functions and guaranteed payment within 3 days. https://www.ebev.com/

Cirralto (CRO) are my highest conviction small cap currently trading on the ASX. It is very early stage but I see them as solving a huge problem in the business to business payment space not just in Australia but globally. 2022 will be pivotal in proving whether my conviction is correctly placed or I’ve been sold a bag by a well spoken CEO.

Adrian Floate (CEO) has done a few presentations lately after their recent quarterly update so just wanted to summarise a few of these here.

Cirralto have just launched their business to business BNPL service (don’t stop reading because I said BNPL please ???? this isn’t a consumer facing Z1P or SZL). B2B BNPL provides payment certainty to the supplier and in my opinion provides huge value to the customer. No longer waiting 30 days for payment or even worse, overdue invoices. I work for a small company who turns over around $150m in revenue each year and cash flow is always front of mind. Late invoices often have flow on effects potentially delaying purchases of inventory or plant/equipment which translates to delayed projects etc.

Adrian outlined how much he take from each transaction flow (ticket clipping)

Payment Service (eInvoicing/PoS) – 0.7% on transaction value

BNPL Service – 2% on transaction value

Meaning a client could be worth 2.7% depending on the services utilised.

Cirralto are targeting marketplaces (buyers and sellers), I think this is incredibly smart as they can potentially capture both the suppliers to the marketplace as well as the sellers of the marketplace (demand & supply aggregation).

In the past quarter they have committed funds on the balance sheet to their debt warehouse facility along with the launch of their BNPL service. None of the revenue from their BNPL service has been recognised in their most recent quarter as it was within 30 days from the end of the quarter.

In the upcoming quarter we can expect revenue from cross border B2B BNPL which I think could provide a huge opportunity. Adrian has said in a number of interviews that he would be disappointed with a 40% QoQ revenue growth.

Cirralto’s current market cap is $150m which if you annualise their current quarter revenue of $396,000 puts it’s on a price/rev of 100x (PME anyone?). Given their CEO has said he would be disappointed with 40% QoQ growth it doesn’t take much extrapolation to get to a reasonable valuation in FY23.

Cirralto doesn’t seem to get a lot of love on Strawman, maybe it’s a little too early to really dig into the company and extrapolate the future profitability but I think they are solving a huge problem in the business to business payment space.

I see Ciralto as having sticky customers who become embedded into their eInvoicing platform & cash flow certainty. By targeting marketplaces there are potential network affects as more suppliers join sellers follow suit.

2021 has been transformative for the company with a number of deals, acquisitions and product launches. The company has gone from crawling to walking and I believe in coming years Ciralto will begin to run.

Disc Held.

I've been following CRO for just on 12 months now.

My initial interest was sparked by the automated reconciliation functionality and thinking about the many hours this could save finance staff.

Their product offerings have grown significantly and although completely over valued ATM, they are a start up transitioning into gaining real customers and real revenue.

It's early days for the CRO team and the next quarterly will be interesting and the next 12months either providing reassurance or to run for the hills. They have rewarded themselves along the way with many shares with some large amounts due out of escrow within the 12 months. Although still an extremely risky investment, todays announcement is a small step in the right direction.

Key Highlights

? Whola and Cirralto have entered into a standard rolling contract with no fixed term to deliver services to Whola’s marketplace buyers.

? Successful roll-out of the Spenda Buy-Now-Pay-Later widget into Whola’s online marketplace, utilising Mastercard Track Business Payment Services.

? The first seven days of the initial rollout period highlighted a 60% take-up of the Pay-Later services by Whola’s marketplace customers.

? Whola has 3,000 buyers in its network, this is expected to create a payment and lend flow of $5,000,000 per month over a 12 month period assuming a 30% adoption rate.

? Cirralto receives a minimum gross fee of 2% from all transactions passed through the Whola network.

? Based on a 30% adoption rate Cirralto will receive minimum gross revenues of approximately $1.2m per annum from the Whola network.

Rather conservative figures above given the sample from the first week detailed below.

Although, there are no guarantees of adoption rate, at present adoption rates from a 10% sample of the base determined from the first week of initial use suggests a 60% adoption and utilisation rate.

A copy of todays full announcement in the link

Spenda-BNPL-Launched-into-Whola's-Marketplace.PDF

When we talk about life changing stocks CRO is the pick for me

DISC This is my equal largest holding in IRL