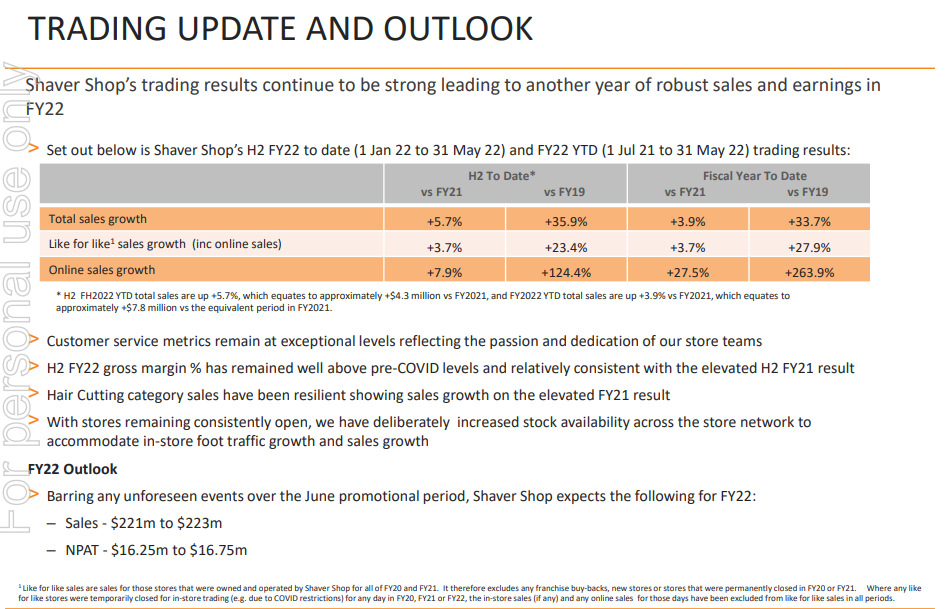

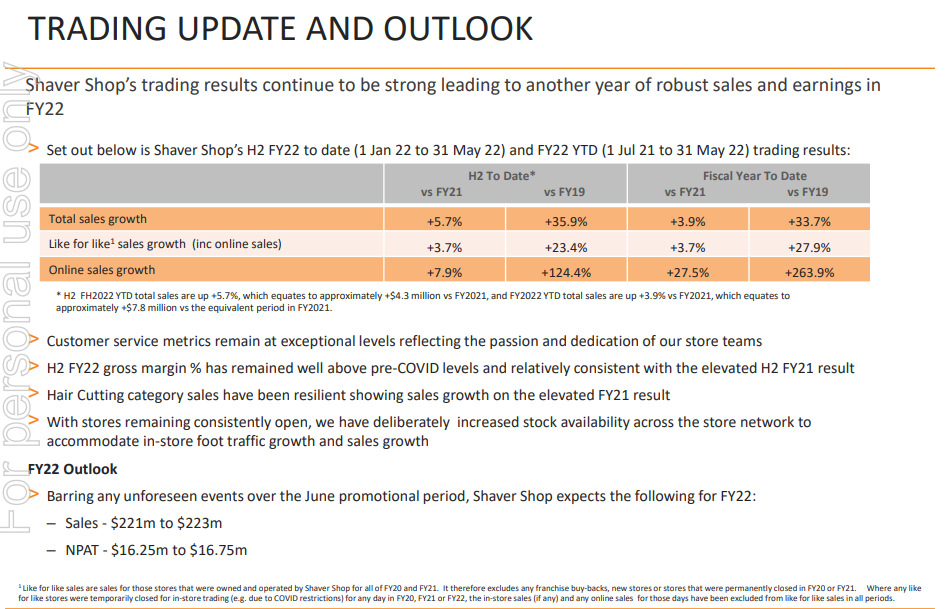

Good little update from Shaver Shop today. Full year guidance shows revenue up 4%, GM still strong and although NPAT is marginally down it still puts them on PE of 8x. It's going to be interesting to get some updates on how retailers are tracking given all the talk of doom and gloom. The worst is likely still to come but I see Shaver Shop as less discretionary than a lot of the market. I also think that in FY23 they'll be cycling a heavily COVID-impacted comp.

Anecdotally a dentist mate of mine says he permanently has the Shaver Shop website open on browsers in his practice to show patients what electric toothbrush they should be buying. They've no debt, plenty of cash and are paying a 9.5% divi yield (before franking credits are applied). Lots to like - except sentiment.

[Held]