Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

FY24 eps 11c - assume growth at 6% 4% terminal and 13% discount rate gives a DCF of $1.38. Broker coverage bumped it to $1.45 following the half yearlies (a tad high) McNevin value of $1.18 (at 13% required return) . Company has shown consistency of dividends over the last 8 years so I look at this as a a bond with a coupon attached. The value of the grossed dividend is worth 12.8c and I am happy with 10% return - so I will settle on a conservative $1.28

Speciality retailing is a tough gig & likely to get tougher until we see some relief in the interest rate and an improvement in ‘disposable dollars’ which drive specialty retailing.

Even the stars are down on 52-week highs – LOV down 7.46%, JBH down 9.25% and PMV down 14%. Many have been savaged like KMD, MHJ, CCX all down over 60%

And then you have some ‘under the radar’ champions like Shaver Shop (SSG) who own their niche marketplace & whilst down 10% are likely to weather the continuing tougher times because of their product mix.

A five o’clock shadow quickly becomes six o’clock (and later) whether it be a beard, skull, back or nether regions. Vanity being what it is and the higher prices of barbers in tougher times are good for Shaver Shop.

Today they announced exclusive rights in ANZ to ‘Skull Shaver’ – not a product for me, but it writes good business – to the tune of an additional $750k in NPBT each year – that’s close on an additional 4% improvement in FY results alone.

With a strong Balance Sheet and a decent ROCE of 22%, the fully franked dividend of circa 9c runs rings around the current cash deposit rate. Happy to hold in my SMSF.

SSG is a little champion - unnoticed and unloved - and yet it has a strong moat in a growing area of the retail market - men's beauty (and latterly they are attacking segments of the female part of this market). Bearded ladies NO! But the alpha male has softened and now regards his beauty treatments to be absolutely crucial to success on the dance floor at the night club (any night club).

The AGM today has announced sales up 13% this FY23 (to 6 Nov) and they are confident about the next two months when they will bag heaps of cash over their busiest trading period. Just as importantly their GP is 'resilient' and up on FY22 @ 43.7%.

There's a lot to love about this champion where the SP hasn't reflected its growth over recent years. Its a simple business, not many moving parts, it doesn't require lots of WC and it pumps free cash. With no net debt and a dividend payout ratio of just under 80%, shareholders can look forward to a 10.5c ff dividend this year. That's a gross return of around 14% without any SP movement.

What I do love about management is their concentration on staff excellence represented by an almost unmatchable Net Promoter Score (NPS) score of 88.4 - this is the judgement by the only peopel who matter - customers. By way of reference here the NPS score for the major banks is in minus territory.

SSG has a pretty good runway of growth over the immediate future.

Shaver Shop Group Limited (SSG) is an Australian specialty retailer of personal grooming and beauty appliances in Australia and New Zealand. Through network of more than 120 stores and online sales capability, it delivers customer service excellence across every channel that customers choose to engage in.

With an Average Daily Trade of $116,000 it's a small cap stock**.

- Price/Operating Cash is 4.11

- Share price < Consensus IV

- Price <= Book+30%

- New 3Pt Upturn

- Yield > Bank Debt

- Consistent Financial Health

- Health Stable or Increasing

- High Board Ownership

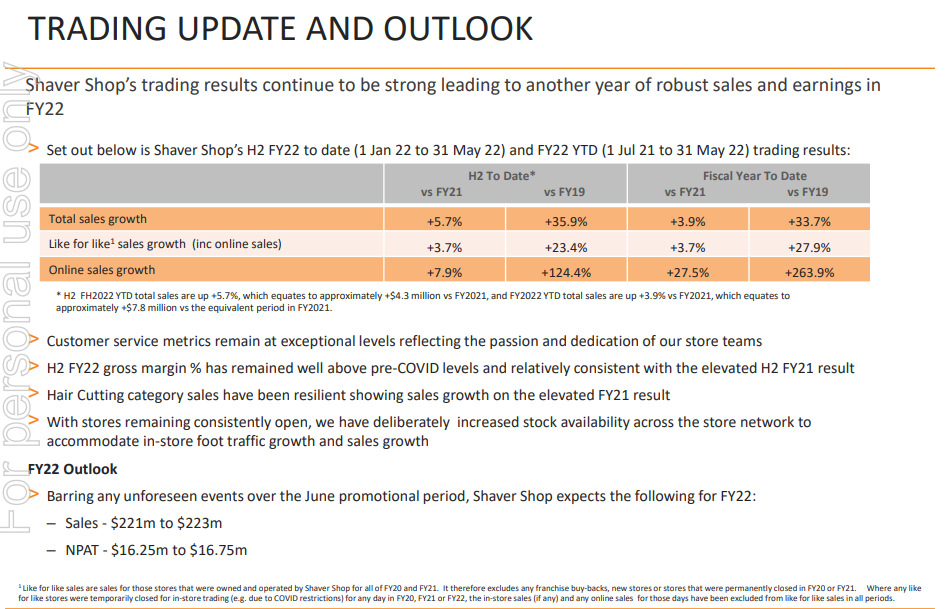

@Noddy74, thanks for highlighting trading update for Shaver Shop. It's an impressively solid little nugget. Current valuation on SM seems fair, maybe even conservative. It won't 10-bag in the foreseeable future, but likewise it's unlikely to crater. Long history of solid growth (11% CAGR over 15 years), net margin bouncing around 7%, and dividend yields (typically 8-10%). And sitting at low PE of 8. Main downer seems to be that FY22 growth has slowed, but not surprising after faster growth through Covid. With conservative future assumptions I can still see a strong case for 15%+ annual returns. Not one if you want to set your stable on fire, but feels like a solid workhorse. I'm wading in.

Good little update from Shaver Shop today. Full year guidance shows revenue up 4%, GM still strong and although NPAT is marginally down it still puts them on PE of 8x. It's going to be interesting to get some updates on how retailers are tracking given all the talk of doom and gloom. The worst is likely still to come but I see Shaver Shop as less discretionary than a lot of the market. I also think that in FY23 they'll be cycling a heavily COVID-impacted comp.

Anecdotally a dentist mate of mine says he permanently has the Shaver Shop website open on browsers in his practice to show patients what electric toothbrush they should be buying. They've no debt, plenty of cash and are paying a 9.5% divi yield (before franking credits are applied). Lots to like - except sentiment.

[Held]

The interims of SSG reflect a top-flight Retailer showing great growth, plenty of free cash flow and a willingness to reward shareholders with improved dividends. The two-year EPS has grown 74.5% and two-year interim dividends are up 114%. Of course, this reflects strongly in ROIC – up 20.1% over the past twelve months.

Plus, they are one of very few retailers to see revenue expansion in a half yearly marked by substantial loss of trading days because of Covid.

This is a well-run company which dominates its specialty niche - has exclusivity over 24 of its top 30 selling products which suggests some semblance of a moat and with substantial public approval via the Net Promoter Score (NPS) rating at an industry leading 88. In short, the public loves them which augers well for the future.

One of the fallacies is that all they sell is ‘hair clipping & shavers’ and it will be all over red rover when we go back to the barbers. Yes, while that is important it makes up just half of how they make their money and they are branching out into women’s products and all round beautification/wellness products.

To an extent it will morph slightly into the orbit of companies like Adore Beauty (ABY) whilst always retaining is specialty core niche. And therein lies one of those unbelievabilities of the market. How can ABY have a market value of $212m v SSG at $115m when SSG pumps out much the same revenue, but has a NPBT of $18.6m v a puny $2.78m for ABY.

One is overvalued or the other undervalued. I suspect both!

I hold as my major retail investment for both the growth and the dividends which on today’s price of $1.14 will yield you a gross return for FY22 of 11%+ (assuming 9c ff)

I thought it was a relatively strong trading update from SSG today. Considering the number of days of store closures in NSW and VIC, the fact their total sales are materially in line with last year seems like a net positive. I had them flat across FY22 so that seems a bit conservative now. Online sales have been really strong and now that stores are open heading into their busiest trading period things are looking up.

The market response was tepid though (up 3%). Maybe they didn't like this slide - I can't say I blame them - what the hell are they trying to convey? "Our share price doesn't do much - unless we're in lockdowns - and even then...not always..."

[Held - here and IRL]

Niche Omni-Channel retailer Shaver Shop (SSG) is absolute leader in its speciality area of personal grooming (much wider than just hair removal) for both males and females. Indeed, contrary to usual opinion, it has developed a moat via its product exclusivity, BOPIS (buy online pickup in store) strategy, and its massive push to upskill all staff on product knowledge, cross selling, upselling etc.

This strategy is working, according to the one source whose judgment is crucial – the customer!

SSG ranks as the best of the specialized retailers in terms of NPS (Net Promoter Score) which is basically a measuring tool to just this one question - On a scale of 1 to 10 how likely are you to share SSG (company name) with your friends and family.

The last time I checked this, the Australian retail industry average is 44, SSG was the highest at 89.1, well ahead of straight online companies like Kogan @ 58.

The usual call by the uninformed is that shavers are shavers and why buy from SSG when you can get a cheaper pair at Target or Big W or whoever.

Note this well: In FY2021, 26 of Shaver Shop’s top 30 products by sales value were exclusive, as are the majority of its top 50 products.

For mine, SSG has a moat in the personal grooming arena, and it will retain its #1 crown because the management is savvy, heavily invested and with a free cash flow which can cater for expansion.

Let’s look at one example of street smarts. SSG is omni channel with a difference. Online sales are now 28.6% of total sales and they have an active database of 800,000. This will grow, obviously. But where the smarts come in is in the delivery – particularly addressing the last mile scenario. Hey, we are all acutely aware that online has delivery issues. Not so SSG where they use the local store network to assist. Not only do they assist in fulfillment (97% picked & packed within 24 hours) but they also get the opportunity for a personal touch and an opportunity to upsell.

FY21 was a cracker. Sales up 9.6%, Margins improved by 5.7%, labour costs were down and best of all, the NPAT margin improved from 5.3% to 8.2%. For the investor, this resulted in a 14.2c eps and a 5.9c ff div. Not bad for an investment today of just over a buck!

SSG have two problems atm – Covid closures and what to do with all that free cash flow. In FY21 they bought back the remaining franchised stores and have 121 at June 30, 2021.

Part of that FCF will go into rolling out present day 121 Aus/NZ stores to 130- 135 within three years and a continuous expansion of the online side of things.

One comforting fact is the continuing macro trend of men having a beauty regimen, as women do. So long as the five o’clock shadow and variants thereof remain popular, SSG will continue to grow organically. Like a number of the Princes of Australian Retail who sit on the SSG board, I’m betting that vanity is enduring.

So, FY22 will show some effects of the prolonged Covid lockdowns, buffeted by expanding omni channel sales. But sales will be down a tad on FY21. That said, I can still see a 12c eps and a 7c ff div. And because hair growth and vanity are not directly impacted by Covid, I am taking a longer-term view.

SSG - The Future

As the #1 retailer in the huge and growing market segment of personal grooming, SSG is well placed. Its FY21 results are expected to be an eps of around 13.5c and with a ff dividend of around 6.7c, that’s a good return on a current investment if just $1.00. FY22 results are expected to be much the same as we return to a normal existence (hopefully) post Covid. Analysts consensus is an IV of $1.50, though an IV of as high as $1.96 is possible based upon a 13.c eps growing at 5% pa for 5 years with a then annual run rate @ 3% and discounted by 11%.

But, there are some grey areas around managements lack of clarity around how they are going to grow the business going forward and this is probably a main reason behind the companies recent share price weakness.

In FY20 and FY21 they have paid down debt and acquired the remaining 6 franchise stores – tick – well done.

Just where do they deploy a free cash flow of around $40m per annum going forward?

Will they invest further to grow their online business, but right now their methodology of ‘click and collect’ with orders fulfilled at the store level and the ability to value add the sale with face-to-face at collect has worked well.

They seem cautious about rolling out more stores in Australia. Yes, NZ is a targeted country, but again, they seem cautiously hesitant – perhaps this is a good thing, but it’s hardly inspiring to those of us wanting a clear growth path.

Nothing has been mentioned about attacking the world market.

Will they look to line extend into the larger pool of health, beauty and personal grooming?

Will they admit to a lack of opportunity and resort to a share buy back or a special dividend?

Right now, this is a company with extreme value which can be incrementally higher once they clarify their forward growth plans.

102% ONLINE SALES GROWTH DRIVES RECORD FIRST HALF SALES AND PROFITS

H1 FY2021 results highlights (vs H1 FY2020)

- Total sales up 15.0% to $123.6 million o Like for like sales up 17.3% (including online sales and Victorian store sales during Q1 shutdown)

~24 months of consecutive LFL sales growth

~ Corporate store online sales up 102.0% to $37.6 million (30.4% of total corporate store sales)

- Gross profit margin up 340bps to 44.7%

- NPAT up 85.5% to $14.2 million (H1 FY2020 - $7.6 million)

- EPS up 85.4% to 11.6 cents per share (H1 FY2020 – 6.3 cents)

- Operating cash flow up 41.7% to $41.5 million

- Strong balance sheet with excellent liquidity; $41.1 million cash, no debt and $30 million debt facility headroom (30 June 2020 – net cash of $12.6 million)

- Interim dividend up 52.4% to 3.2 cents per share, 100% franked (H1 FY2020: 2.1 cps, 80% franked)

PRESENTATION

https://www.asx.com.au/asxpdf/20210219/pdf/44stp5xb2n4tyb.pdf