Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I dont really follow Super Retail Group, but it's noteworthy when a $3.5 billion company sees its shares dump >5% after guiding for another record first half sales result.

Of course, the devil is in the detail, and the thing to note here is that despite higher sales ($2.2 billion in the last 26 weeks), profit is expected to drop from the $184.4 million reported in the first half of last year to between $172 million and $175 million this time around. This is mainly because of sales promotions and heavy discounting at Rebel Sport, which meant profit fell around 7% below what analysts were expecting.

My first thought was, "well, that's what happens when a high multiple stock misses expectations", but the PE is only on a forward multiple of 15x.

Perhaps that's not unwarranted given their EPS performance since COVID. They got a huge spike in 2021, but ever since then per share profits have been in decline. It looks like a consequence of a higher cost of doing business, with inflation pushing up wages, rent, and overheads. It's not all just general inflation, though. The group is also working through $26 million to $28 million in duplication costs for its new Victorian distribution centre and a new payroll platform implementation. And, it seems, more theft at Rebel. A sign of the times perhaps.

I'm quite gun shy towards retail these days, so am not tempted by the price fall. But interesting to watch from the sidelines.

Any thoughts on SUL results today? Looks like improvements not just financially but across the business.

Super Retail Group have released their results for 2023/24 as follows:

•Group sales up 2 per cent to $3.9 billion

•Group gross margin up 10 bps to 46.3 per cent

•Segment EBIT down 9 per cent to $400 million

•Segment PBT down 12 per cent to $343 million

•Statutory NPAT down 9 per cent to $240 million and normalised NPAT down 11 per cent to $242 million

•Statutory EPS of 106 cents and normalised EPS of 107 cents

•Fully franked final ordinary dividend of 37 cents per share and fully franked special dividend of 50 cents per share

•Expanded store network – opened 28 new stores

•Effective omni retail execution – online sales up 9 per cent to $485 million

•Growing loyalty base – successfully launched rebel Active loyalty program and increased total active club members by 12 per cent to 11.5 million1

•Highly engaged team – engagement score of 812

•Decline in safety performance – TRIFR increased to 14.5 due to higher incidence of manual handing injuries3

•Conservative balance sheet - no drawn bank debt and $218 million cash balance

In regards to a valuation,

This is not a growth stock anymore as although sales are up 2% NPAT is down 9%,

The board have increased the payout with a special dividend of 50 cents per share and I guess that is one way of boosting the SP,

With 225.8 SOI and a Normalised EPS of $1.07,

Assuming a PE of 12 gives a valuation of $2.90 Billion or $12.84 per share

My revised valuation is $12.84 per share,

With the current SP being around $17.87 SUL is quite overvalued even though SUL is an extremely well-run company, as we go into a period of reduced consumer spending I believe that SUL will come back to around $12.00 in the next 12 – 18 months,

I hold a few SUL in my actual portfolio but not in my Strawman one and will be looking to offload these over the next month or so and then waiting for it to come back to more realistic levels before getting back in.

Retailer $SUL reported their FY24 results today,

Their Highlights

- Group sales of $288.5 million, +9.7% versus prior corresponding period (“pcp”), reflecting strong trading performance, with increasing momentum throughout the financial year

- Gross profit margins +110 basis points versus pcp, to 60.1%

- Underlying EBIT of $47.1 million, +16.6% versus pcp

- Statutory net profit after tax (“NPAT”) of $34.3 million (+45.3% vs pcp)

- Underlying earnings per share (“EPS”) of 39.6 cents per share (“cps”)2

- 35.5 cps fully franked dividend determined (final dividend of 19.0 cps)

- Net cash of $14.3 million as at 30 June 20243

- 102 physical store locations as at 30 June 2024, comprising 80 Universal Store sites, 14 Perfect Stranger sites, and 8 THRILLS stores

My Analysis

I've previously held $SUL, and only sold in early 2023 when I got a good price and decided to consolidate my retails bets with $BRG and $NCK (with which I remain very happy).

That said, in the current environment, the $SUL results are strong, and despite the SP being some +9% ahead of consensus already, the positive result and positive trading update have pushed the shares up another +6%. We'll no doubt see some valuation upgrades when the analyst notes come through.

Even though NPAT was down -9%, this is inevitable in retail given the relatively flat sales and a cost based which advances relentlessly in an inflationary environment. (Much, much larger profit declines are very commonplace with retailers through the negative part of the cycle.)

The proof of all this can be seen in the FY24 dividend of $1.19, a yield of 6.7% or almost 10% grossed up,... if I've done my sum correctly.

The result clearly shows that Australia's well-managed retailers (the category leaders) are performing well ( ... adding to $JBH, $UNI - another standout result this morning, $TPW, $AX1,.... just rattling off a few that I follow).

The two tables from the ASX release on financials and LFL performance paints the picture. $SUL is no doubt a beneficiary of the fact that while Australia is in a per capita recession, immigration and the positive impact of high interest rates on those with savings (particularly the >55 years segment), continue to drive aggregate demand. No doubt, the RBA is taking notice ... strong aggregate demand versus capacity in the economy does not bode well for interest rate reductions.

Disc: Not held

Chart Udpdate Mon 15th July 24

The weekly and daily are both topping out so looking for C wave down

$SUL reported this morning. I'll list their highlights and give my quick comparison the P&L. This is an example of a really well-managed retailer, with some aspiring categroy killers (SCA, Rebel, BCF).

Contrast this to my $BAP quick-take yesterday. (Interestingly, SCA topline growth was also 10%) showing this is an industry trend.

But what is most interesting about the $SUL result is that, while revenue growth was modest, at +7.1%, strong cost discipline across spend categories, led to NPAT growth of 9.7%. This is, in my view, an outstanding result in the current environment.

Their Highlights

- Group sales up 7 per cent to $3.8 billion (up 9 per cent adjusted for 53rd week in FY22)

- Group like-for-like sales growth of 8 per cent

- Group gross margin of 46.2 per cent

- Segment PBT up 12 per cent to $391 million

- Segment PBT margin up 50 bps to 10.3 per cent

- Statutory NPAT up 9 per cent to $263 million and normalised NPAT up 12 per cent to $274 million

- Statutory EPS of 117 cents and normalised EPS of 121 cents

- Fully franked final ordinary dividend of 44 cents per share and fully franked special dividend of 25 cents per share

- Strong cashflow generation – EBITDA cash conversion of 88 per cent

- Growing loyalty base – active club members up 12 per cent to 10.3 million

- Highly engaged team – engagement scores of 80 and 81 in the period

- Expanded store network – 24 new stores opened and successfully launched BCF superstore format in Townsville and Kawana

- Conservative balance sheet - no drawn bank debt and $192 million cash balance

My Quick Analysis of the P&L

While there was some %GM compression, indicating pressure in passing on full cost increases via pricing, good expense management and a strong balance sheet means that strong growth in PBIT and NPAT was achieved.

$SUL continue their strong network expansion and upgrade program, although capex down to c. $110m from $125m in FY22 indicates a prudent approach to expansion through an uncertain environment.

On Outlook, at a group level $SUL are flat on a LFL basis, but growing sales at 2% given investments. (The result being driven by SCA and BCF). That's 6 weeks into FY24, so it is early days. But this is a strong performance given how retail is tracking generally.

My Key Takeaways

A great result. Today's result demonstrates the quality of the portfolio, categoies that are perhaps being less harder hit by the economics downturn, and excellent management. With no long term debt, interest costs are flat!

I exited $SUL in RL earlier this year (at around today's open SP) as part of managing my retail exposure given macro uncertainty.

$SUL SP has run up quite significantly over the last few months, and with a p/e of 12, it is well-priced in the retail sector. I'll sit on the sidelines for now, but continue to monitor this well-run, mid-cap retailer.

Disc: Not Held (but on watch list for any pull back)

I wont go through the results as previous members have done an excellent job but wanted to revise my valuation

Normalised NPAT 1H23 of $153.5M which is a 36% increase on PCP

Normalised NPAT 2H22 of $132M and allow for 25% increase = $165m

$153.5M plus $165M = $318.50 FY Normalised NPAT

This is a growth stock and is growing strongly after the Covid period that has affected all retail stocks,

A PE of 8 here is too low but I think a PE of something like 12 is a bit high giving that we are going into a period of higher interest rates that will affect spending so a PE of 10 seems reasonable

Assuming a PE of 10 gives a valuation of $3.185 Billion or $14.10 per share

My revised valuation is $14.10 per share

$SUL released their 1H results this morning. Below are their highlights and some takeaways from the conference call, just concluded:

Their First Half Highlights:

• Sales up 15 per cent to $1.96 billion - driven by strong Black Friday and peak Christmas trading performance

• Group like-for-like sales growth of 11 per cent

• Group gross margin 46.2 per cent – reflecting price discipline and promotional effectiveness

• Segment PBT up 36 per cent to $218 million, at the top of previously announced guidance range

• Statutory NPAT up 30 per cent to $144 million and normalised NPAT up 36 per cent to $154 million

• Statutory EPS of 63.9 cents and normalised EPS of 68.0 cents • Fully franked interim dividend of 34.0 cents per share

• The Group has increased its provision to recognise amounts potentially payable as a consequence of proceedings filed by the Fair Work Ombudsman in January 2023

• Strong cashflow generation – EBITDA cash conversion of 108 per cent

• Continued growth in active club members – up 11 per cent to 9.7 million

• Store network expansion – eight new store openings plus successful launch of BCF superstore format in Townsville

• Conservative balance sheet - no drawn bank debt and $212 million cash balance

Group Managing Director and Chief Executive Officer Anthony Heraghty said “We are pleased to report a net profit before tax at the top end of the previously announced guidance range, following record first half sales. Once again, I would like to thank our team members whose tireless efforts and passion in serving our loyal customers have been instrumental in achieving this outcome."

“This result is a testimony to the strength of our four core brands, all of which delivered record first half sales off the back of strong peak period trading. The success of our new store formats (including rebel rCX and the new BCF superstore) and our club member programs, which have added one million members in the past 12 months, have helped to deliver a strong first half performance.”

My Takeaways

There was strong performance across all brands (Supercheap Auto, Rebel Sports, BCF, Macpac with BCF flat due to a strong competitive environment.)

Most of the 11% like-for-for like sales growth is driven by price in the PCP comparison.

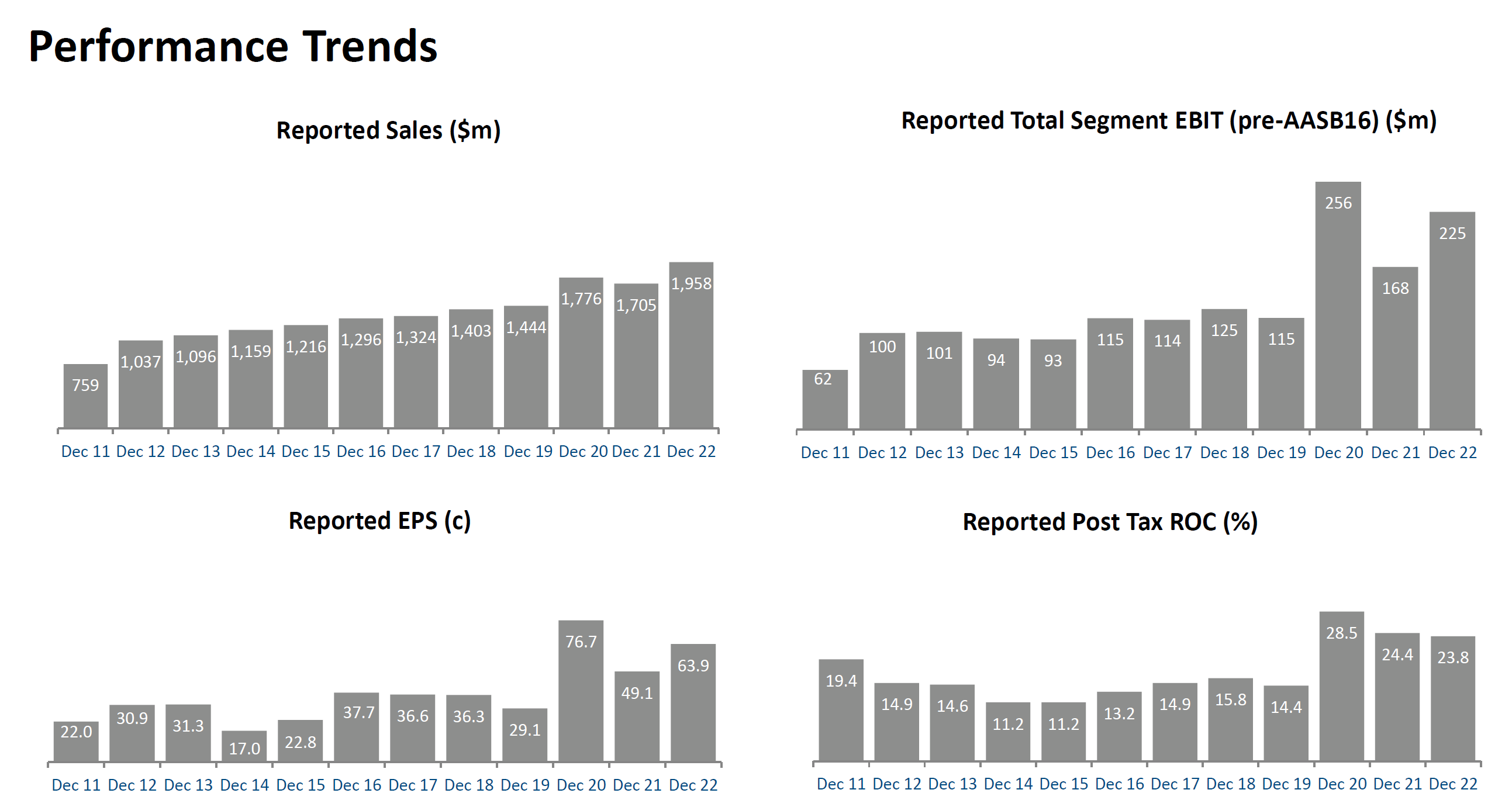

With retailers, it is really important to look through the COVID period. Figure 1 below shows that $SUL has emerged through COVID-as a more material and stronger retailer, focused on execution in its 3 category killers, with more recent addition Macpac now growing strongly.

Figure 1

Source: Slide 39 of Results Presentation

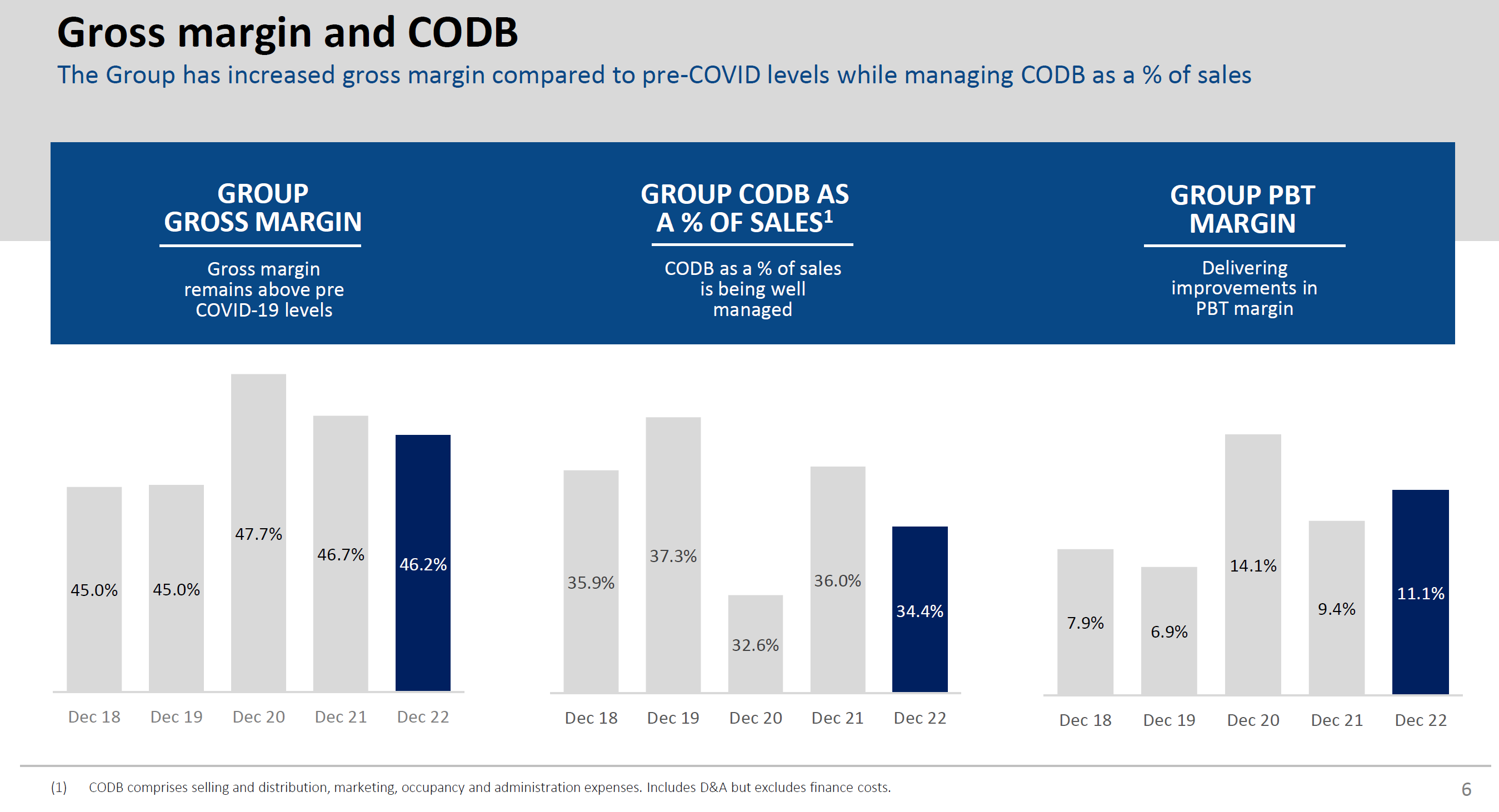

In terms of margin progression (Figure 2), management previously indicated a goal of holding onto half the COVID margin uplift, and today's result indicate that to be on track. There were repeated references to the business having achieved a new normal, with customers returning to instore shopping and supply chain pressures eased and largely on track towards pre-COVID conditions.

More specifically on supply chain, CEO Anthony Heraghty reported that there is now good availability of goods from all suppliers and freight arrangements are being renegotiated now that global freight has largely returned to pre-pandemic norms. There are still some local challenges in NZ and Aus due to pallet shortages, staff shortages with some supply chain partners and impacts of floods, but these were cast very much in the context of business as usual.

Figure 2

In terms of the outlook, Anthony is very confident about $SUL continuing to execute their strategy, with a strong program of store upgrades and new openings for this year.

Regarding the macro-environment, he was clear that "We don't see any reason why we would be immune to the macro-economic environment than any other retailer". He went on to say that the the supply chain re-normalising is a big prize that goes some way to offsetting inflation in the cost of doing business. So the margin outlook remains positive.

Given the economic uncertainty, $SUL are adopting a "prepare for the worst" strategy. With no debt and $212m in net cash, Anthony commented that they are holding "excess capital", which will be returned to shareholders. It is a question on when and not if.

Given the cash and debt capacity, there was a question about M&A. Anthony was clear that they wish to avoid distraction, being part way through delivering the current strategy. He said the right opportunity wouldn't be ruled out in the longer term.

It seem that progress is being made in developing their customer loyalty platform, with $10m spent in the half and more to come. On loyalty, they have laready achieved 9.7m active customers, and there was reference to revisting the 10m goal which is only due by end of FY24.

In terms of outlook, they gave no guidance, but indicated that LFL sales in the first 32 weeks of the year were up 10% over PCP. This is in line with macro-data indicating that inflation is offsetting any volume effects on spending, with interest rates yet to take full effect on discretionary spending, helped up strong employment

There was no discussion regarding the action by the Fair Work Ombudsman beyond the provision made, which account for most of the difference between statutory NPAT and underlying.

Conclusion

Another strong result from $SUL, which is executing well against its strategy and appears well-positioned to take on the head-winds that are widely expect in the second half of (calendar) 2023, as interest rate hike starts to bite into consumer discretionary spending.

This is a well-run company. I have recently reduced my RL holding to 1.5% taking advantage of recent SP gains, and wanting to manage my overall exposure to the concusmer cyclical sector to 10-15% of my portfolio. As the macro outlook clarifies, $SUL is certainly on my list of holdings I'd be happy to add to.

For now, a HOLD.

Disc: Held in RL

But I just don't see continued retail sales growth.

SOLD IRL.

Citigroup has set a price target of $13.30

Sales of $1.7 billion (excluding Boxing Day) – reflects strong rebound in second quarter sales across all four core brands1

• 46.7 per cent Group gross margin – maintained margin uplift above pre COVID-19 levels despite higher supply chain costs

• Record online sales – digital sales up 64 per cent to $389 million

• Acceleration of growth in active club members – up 22 per cent to 8.7 million2

• Fortified inventory position – mitigated the impact of supply chain disruption, enabling the Group to capture strong consumer demand

• Investment in stores, digital and team to support future growth – resulting in normalisation of operating costs

• Successfully navigated extended period of store lockdowns via omni-retail execution – Click & Collect sales up 109 per cent

• Store network expansion – completed 15 new store openings and 28 refurbishments and relocations

• Conservative balance sheet – no bank debt and $94 million cash balance

• Normalised EPS of 49.9 cents and fully franked interim dividend of 27.0 cents per share

Chief Executive Officer and Group Managing Director Anthony Heraghty said “We are pleased to have delivered a strong top line sales performance in the first half, despite the challenges of Omicron and a disrupted global supply chain. I would like to thank our team members, who have all contributed to this result, for their dedication and passion in what has been an extremely challenging period.”

“After COVID-19 lockdowns disrupted trade in the first quarter, we delivered a fast finish to the half, achieving a record second quarter sales result. Our omni-retail capability and execution has been key to meeting consumer demand, underpinning a record digital sales performance driven by uptake in Click & Collect.”

“We entered the second half with strong sales momentum, which has continued in the new calendar year. Looking forward, the Group will continue to reinvest in the business, including digital, loyalty and network to execute our strategic priorities and grow our four core brands.”

Disc: Not held

Today Super Retail Group announced a net profit after tax attributable to owners for the 52-week period ended 26 June 2021 of $301.0 million.

EPS was 133.4c up 139% YoY. This is expected by the market and in line with analyst forecasts. Commsec analyst consensus forecast was 139c per share, slightly higher than reported.

Group sales were $3.45 billion up 22% like-for-like (LFL), but slightly behind the LFL sales growth reported in the Trading Update for the first 44 weeks announced on 4 May 2021.

Online sales have grown by 43% to $425.6 million, likely driven by COVID 19 lifestyle changes.

The standout performance was from BCF. Total sales increased by 49.1 per cent to $797.7 million. Like-for-like sales increased by 48 per cent due to increased transactions and higher average transaction value. Online sales grew by 90 per cent to $86 million, representing 11 per cent of sales.

Boating, camping and fishing categories all grew strongly, reflecting elevated levels of domestic tourism and leisure activity. Caravan, 4WD, camp shelter & bedding, barbeque, trailer, water sports, footwear and apparel were among the fastest growing sub-categories.

Given the sales and earnings are in line with guidance, the record result is likely to be already factored in to the share price.

Highlights from the Announcement:

- Total Group sales up 22 per cent to $3.45 billion

- Group like-for-like sales growth of 23 per cent

- Online sales up 43 per cent to $415.6 million

- Segment earnings before interest and tax (EBIT) up 80 per cent to $476.8 million

- Segment normalised profit before tax (PBT) up 108 per cent to $435.8 million

- Normalised NPAT up 107 per cent to $306.8 million

- Basic EPS up 139 per cent to 133.4 cents

- Fully franked final dividend of 55.0 cents per share, bringing the full year dividend to 88.0 cents per share

- Active club members up 22 per cent to 8 million

Group Managing Director and Chief Executive Officer, Mr Anthony Heraghty said the record sales and earnings result for FY21 was driven by unprecedented consumer demand in our lifestyle and leisure categories. He said successful omni- retail execution, investment in the supply chain and focus on inventory management have been key in meeting elevated volumes of demand in both in-store and online channels.

In particular, the Group’s omni-retail business strategy and digital capability are providing the flexibility to pivot to online channels to meet shifts in consumer behaviour during COVID-19 lockdowns.

Disc: Held IRL

Super Retail Group has seen incredible growth for the first 44 weeks of FY21, with online sales and BCF being the real standouts due to covid-inspired demand, and a solid easter trading period.

Indeed, BCF has reporetd 59% like-for-like sales growth, while online sales were 87% higher (online sales have been growing at 64% per year, on average, over the last 4 years (albeit off a very low base).

With less promotions (ie discounts), the company has also seen solid gross margins.

Based on this, per share earnings should easily exceed $1, and could be as high as $1.20. At the lower end of that range, shares are on a PE of just 11.

Excluding this latest super-strong period, the company has managed to deliver pretty consistent growth over the years, averaging around 6%pa since 2012. That's nothing compared to what we've come to expect for a lot fo the tech stocks, but it's a solid effort for a well-established, largely bricks & mortar retailer. A PE of 11 seems pretty cheap.

That being said, 2021 is expetced to be somewhat anomolous and most expect a normalisation of earnings in subsequent years. The consensus guyidance for FY22 is 83c per share.

Still, that gives a forward PE of 14. And with investors able to reasonably expect a fully franked yield of 3-4% from here, the price seems pretty undemanding.

You can read more detail in their latest investor presentation.

I don't hold. I'm generally not a fan of retailers and think increasing competition, especially from large online players, will put pressure on margins over time. Nevertheless, it seems there's some potential here.

Super Retail Group (ASX: SUL) provides the following update on its trading performance for the 26 week period ending 26 December 2020. 1 SUMMARY • Record result driven by unprecedented consumer demand throughout the period

• Group sales growth of 23 per cent and like-for-like sales growth of 24 per cent

• Online sales increased by 87% to $237 million

• Group gross margin 270 bps higher than the prior comparative period (pcp) supporting higher EBIT margins across all four core brands

• Provisional segment EBIT (pre-AASB16) range of $253 million to $256 million, between 119 per cent and 122 per cent higher than pcp

• Provisional Normalised NPAT (pre-AASB 16) range of $174 million to $177 million, between 135 per cent and 139 per cent higher than pcp

• Statutory NPAT range of $170 million to $173 million, between 196 per cent and 201 per cent higher than pcp