$SUL released their 1H results this morning. Below are their highlights and some takeaways from the conference call, just concluded:

Their First Half Highlights:

• Sales up 15 per cent to $1.96 billion - driven by strong Black Friday and peak Christmas trading performance

• Group like-for-like sales growth of 11 per cent

• Group gross margin 46.2 per cent – reflecting price discipline and promotional effectiveness

• Segment PBT up 36 per cent to $218 million, at the top of previously announced guidance range

• Statutory NPAT up 30 per cent to $144 million and normalised NPAT up 36 per cent to $154 million

• Statutory EPS of 63.9 cents and normalised EPS of 68.0 cents • Fully franked interim dividend of 34.0 cents per share

• The Group has increased its provision to recognise amounts potentially payable as a consequence of proceedings filed by the Fair Work Ombudsman in January 2023

• Strong cashflow generation – EBITDA cash conversion of 108 per cent

• Continued growth in active club members – up 11 per cent to 9.7 million

• Store network expansion – eight new store openings plus successful launch of BCF superstore format in Townsville

• Conservative balance sheet - no drawn bank debt and $212 million cash balance

Group Managing Director and Chief Executive Officer Anthony Heraghty said “We are pleased to report a net profit before tax at the top end of the previously announced guidance range, following record first half sales. Once again, I would like to thank our team members whose tireless efforts and passion in serving our loyal customers have been instrumental in achieving this outcome."

“This result is a testimony to the strength of our four core brands, all of which delivered record first half sales off the back of strong peak period trading. The success of our new store formats (including rebel rCX and the new BCF superstore) and our club member programs, which have added one million members in the past 12 months, have helped to deliver a strong first half performance.”

My Takeaways

There was strong performance across all brands (Supercheap Auto, Rebel Sports, BCF, Macpac with BCF flat due to a strong competitive environment.)

Most of the 11% like-for-for like sales growth is driven by price in the PCP comparison.

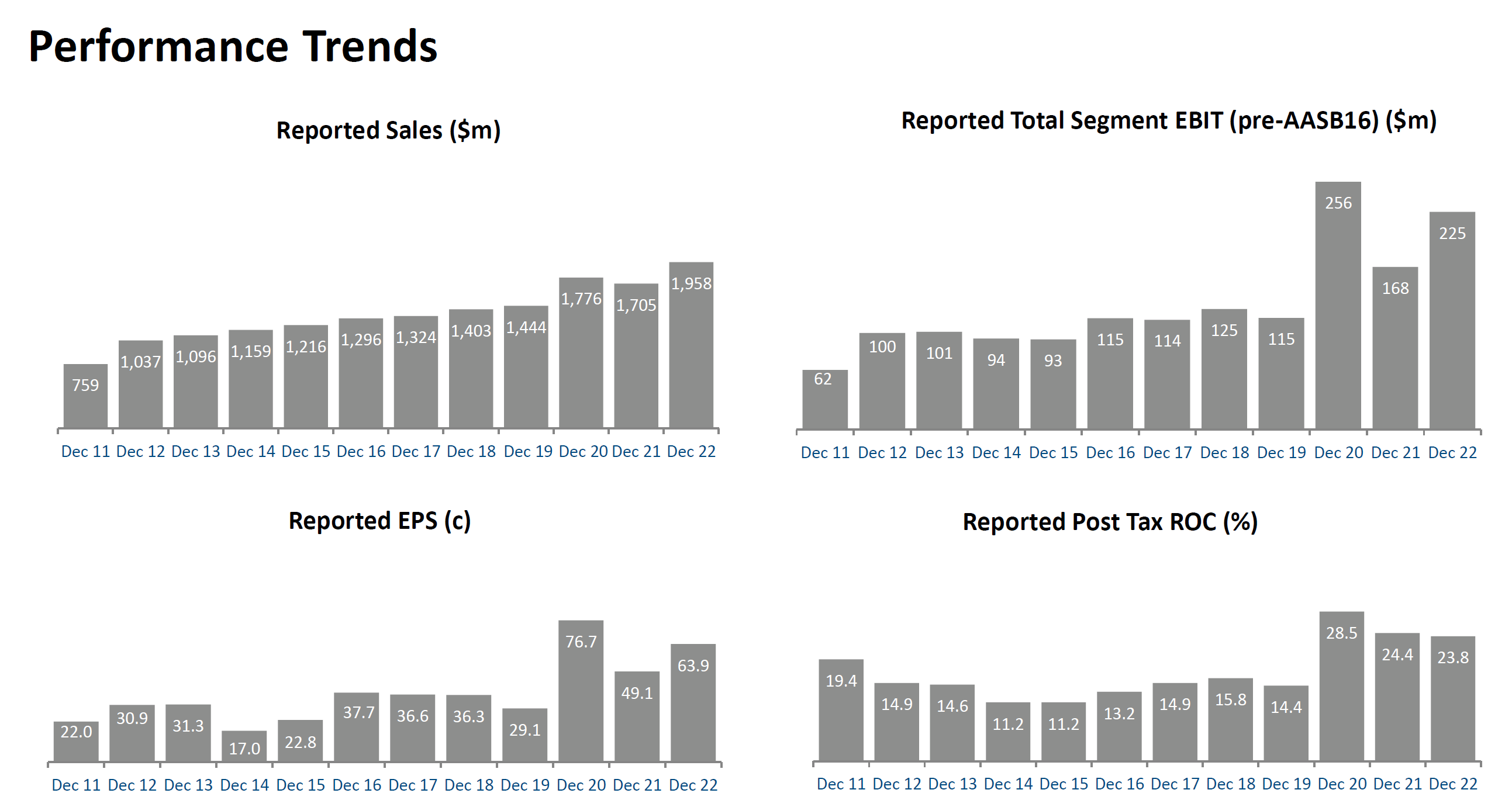

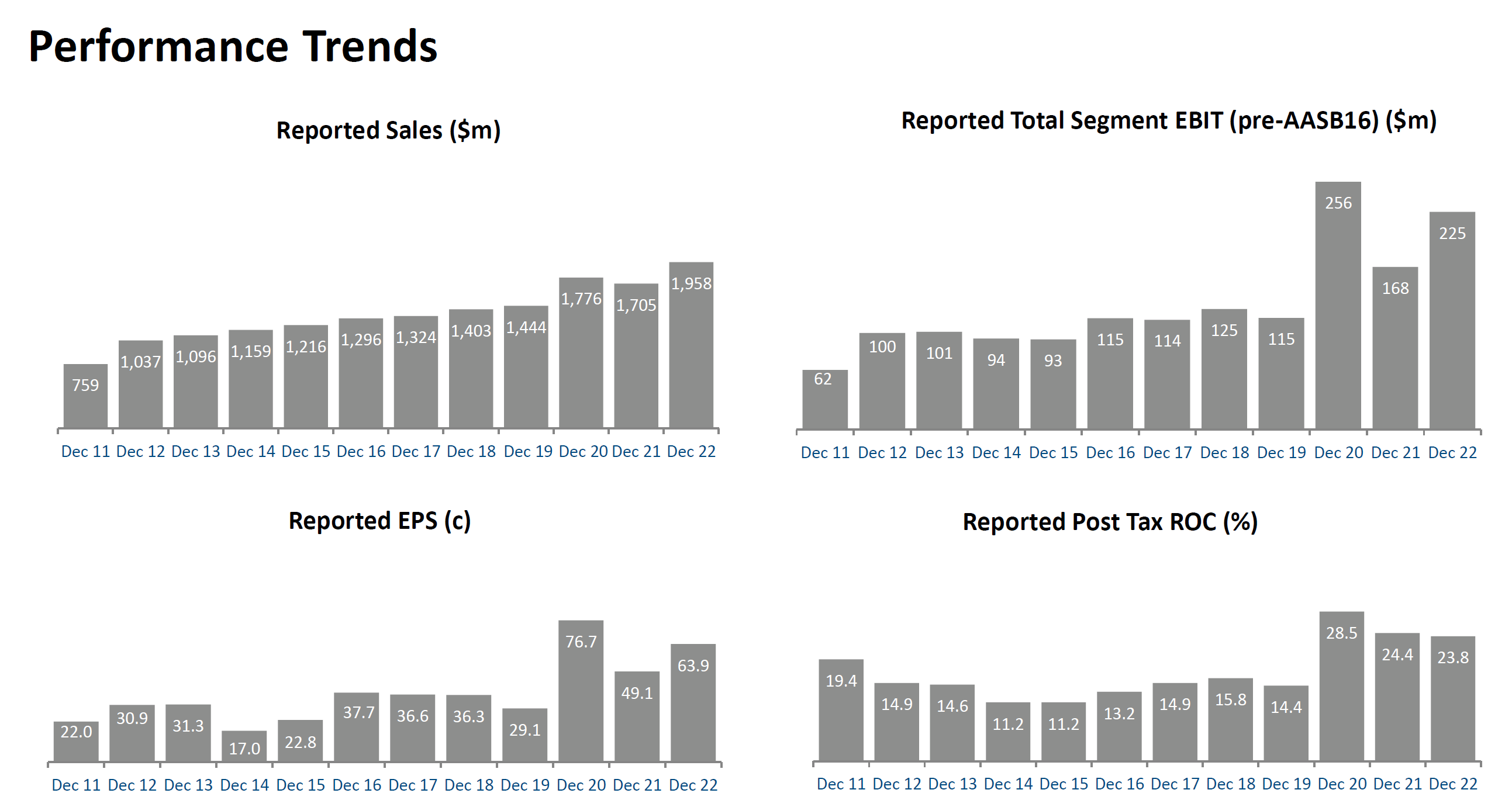

With retailers, it is really important to look through the COVID period. Figure 1 below shows that $SUL has emerged through COVID-as a more material and stronger retailer, focused on execution in its 3 category killers, with more recent addition Macpac now growing strongly.

Figure 1

Source: Slide 39 of Results Presentation

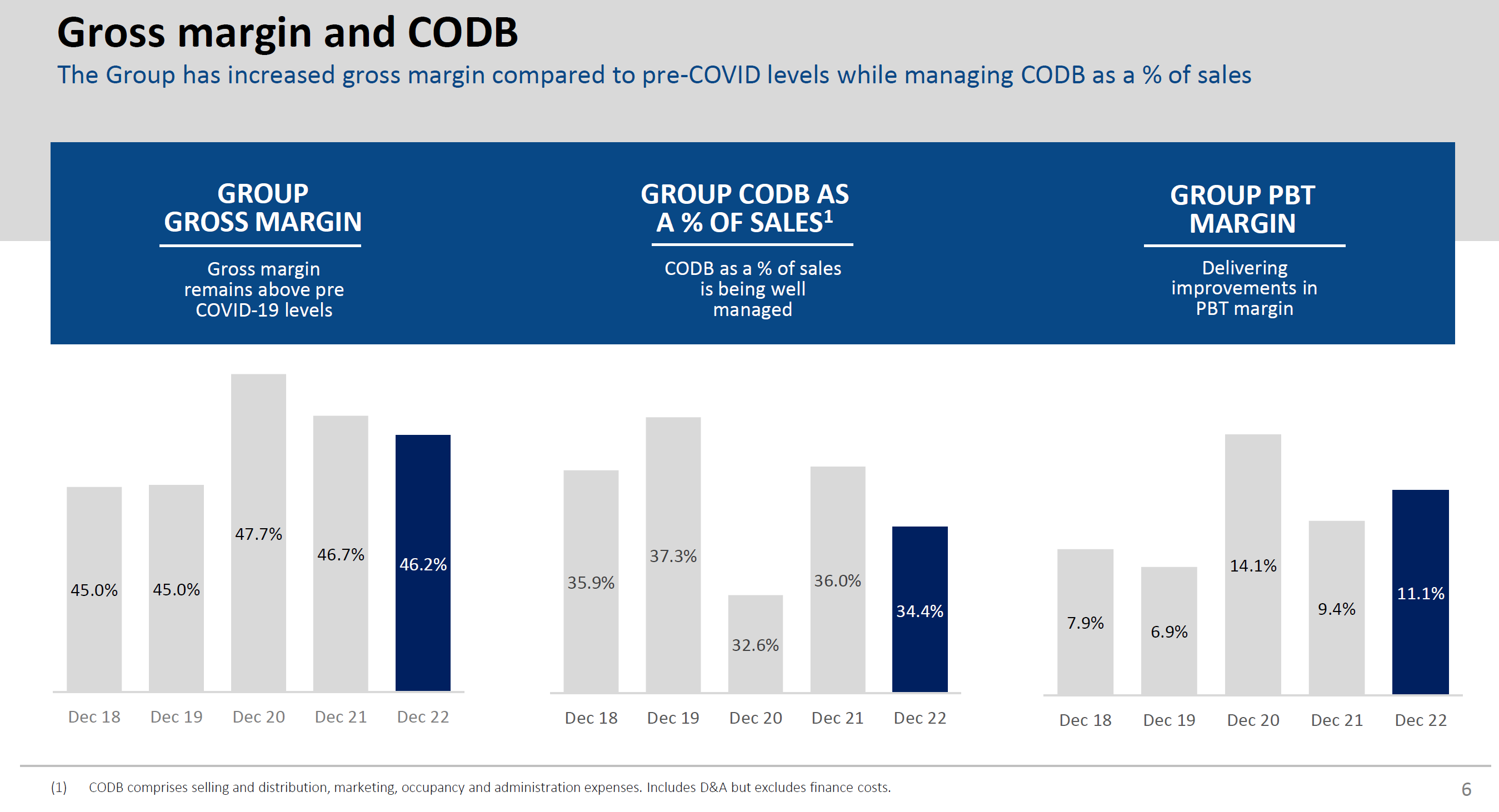

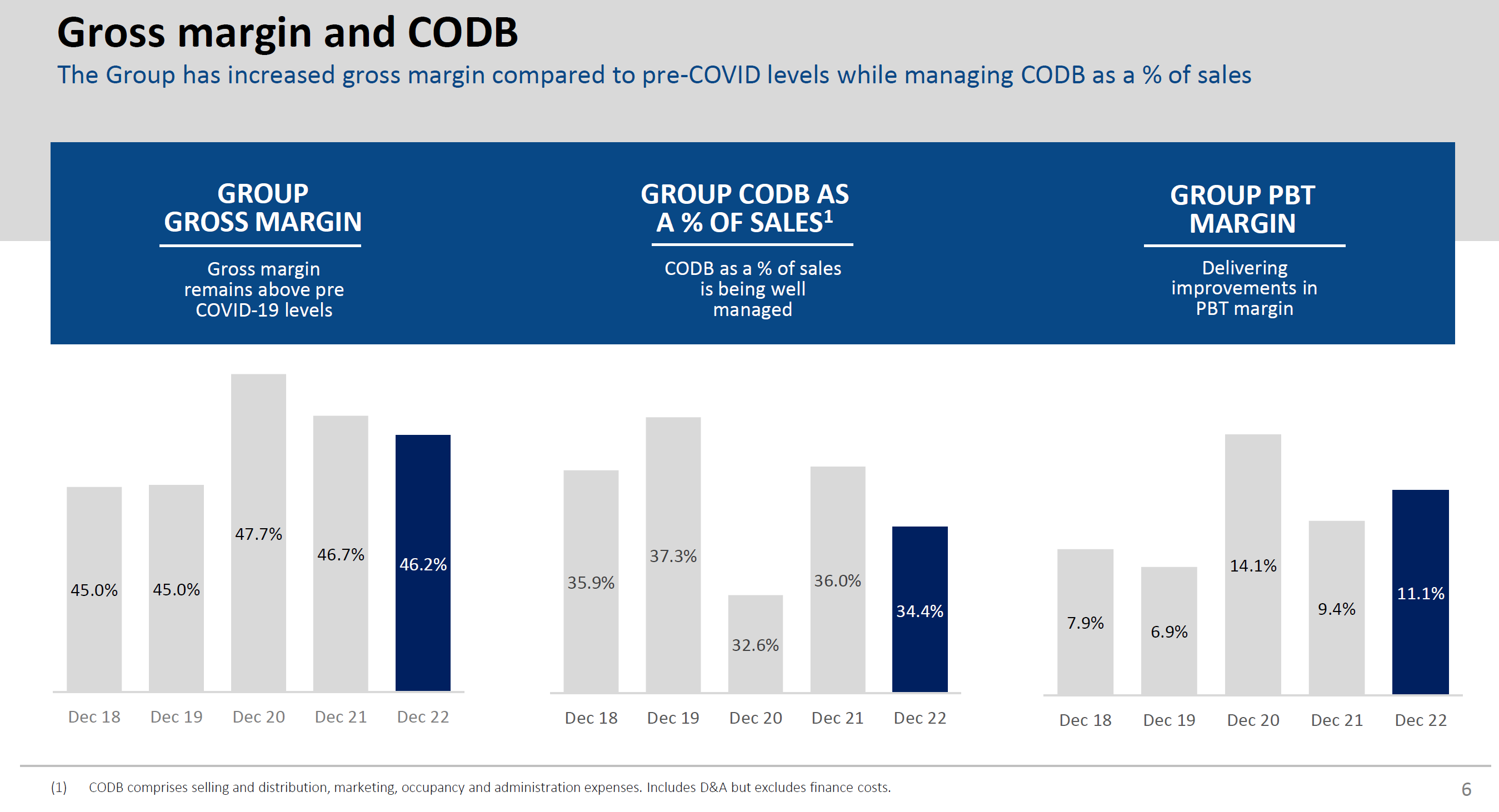

In terms of margin progression (Figure 2), management previously indicated a goal of holding onto half the COVID margin uplift, and today's result indicate that to be on track. There were repeated references to the business having achieved a new normal, with customers returning to instore shopping and supply chain pressures eased and largely on track towards pre-COVID conditions.

More specifically on supply chain, CEO Anthony Heraghty reported that there is now good availability of goods from all suppliers and freight arrangements are being renegotiated now that global freight has largely returned to pre-pandemic norms. There are still some local challenges in NZ and Aus due to pallet shortages, staff shortages with some supply chain partners and impacts of floods, but these were cast very much in the context of business as usual.

Figure 2

In terms of the outlook, Anthony is very confident about $SUL continuing to execute their strategy, with a strong program of store upgrades and new openings for this year.

Regarding the macro-environment, he was clear that "We don't see any reason why we would be immune to the macro-economic environment than any other retailer". He went on to say that the the supply chain re-normalising is a big prize that goes some way to offsetting inflation in the cost of doing business. So the margin outlook remains positive.

Given the economic uncertainty, $SUL are adopting a "prepare for the worst" strategy. With no debt and $212m in net cash, Anthony commented that they are holding "excess capital", which will be returned to shareholders. It is a question on when and not if.

Given the cash and debt capacity, there was a question about M&A. Anthony was clear that they wish to avoid distraction, being part way through delivering the current strategy. He said the right opportunity wouldn't be ruled out in the longer term.

It seem that progress is being made in developing their customer loyalty platform, with $10m spent in the half and more to come. On loyalty, they have laready achieved 9.7m active customers, and there was reference to revisting the 10m goal which is only due by end of FY24.

In terms of outlook, they gave no guidance, but indicated that LFL sales in the first 32 weeks of the year were up 10% over PCP. This is in line with macro-data indicating that inflation is offsetting any volume effects on spending, with interest rates yet to take full effect on discretionary spending, helped up strong employment

There was no discussion regarding the action by the Fair Work Ombudsman beyond the provision made, which account for most of the difference between statutory NPAT and underlying.

Conclusion

Another strong result from $SUL, which is executing well against its strategy and appears well-positioned to take on the head-winds that are widely expect in the second half of (calendar) 2023, as interest rate hike starts to bite into consumer discretionary spending.

This is a well-run company. I have recently reduced my RL holding to 1.5% taking advantage of recent SP gains, and wanting to manage my overall exposure to the concusmer cyclical sector to 10-15% of my portfolio. As the macro outlook clarifies, $SUL is certainly on my list of holdings I'd be happy to add to.

For now, a HOLD.

Disc: Held in RL