Technology One (TNE) released FY22 results (Sept year end). From their release:

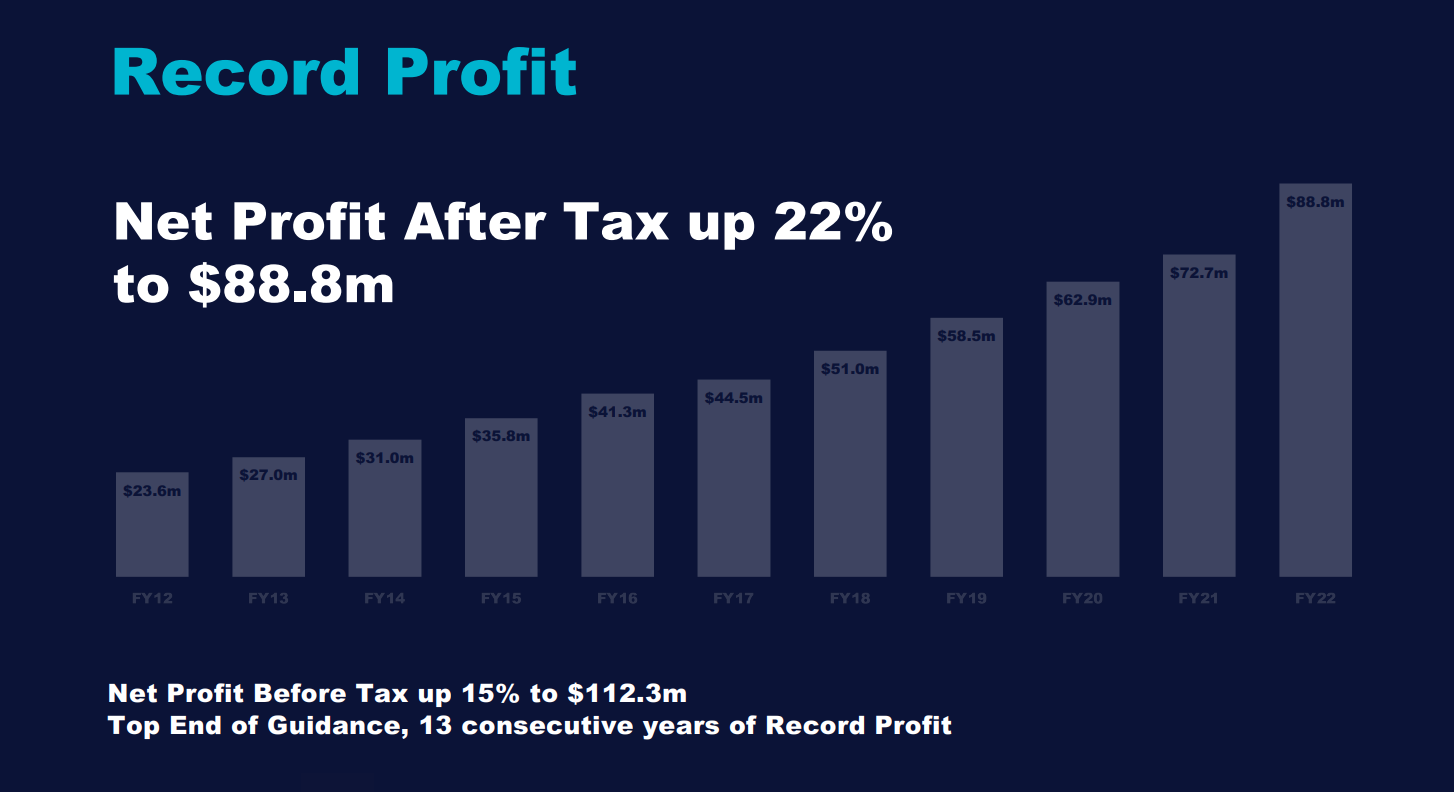

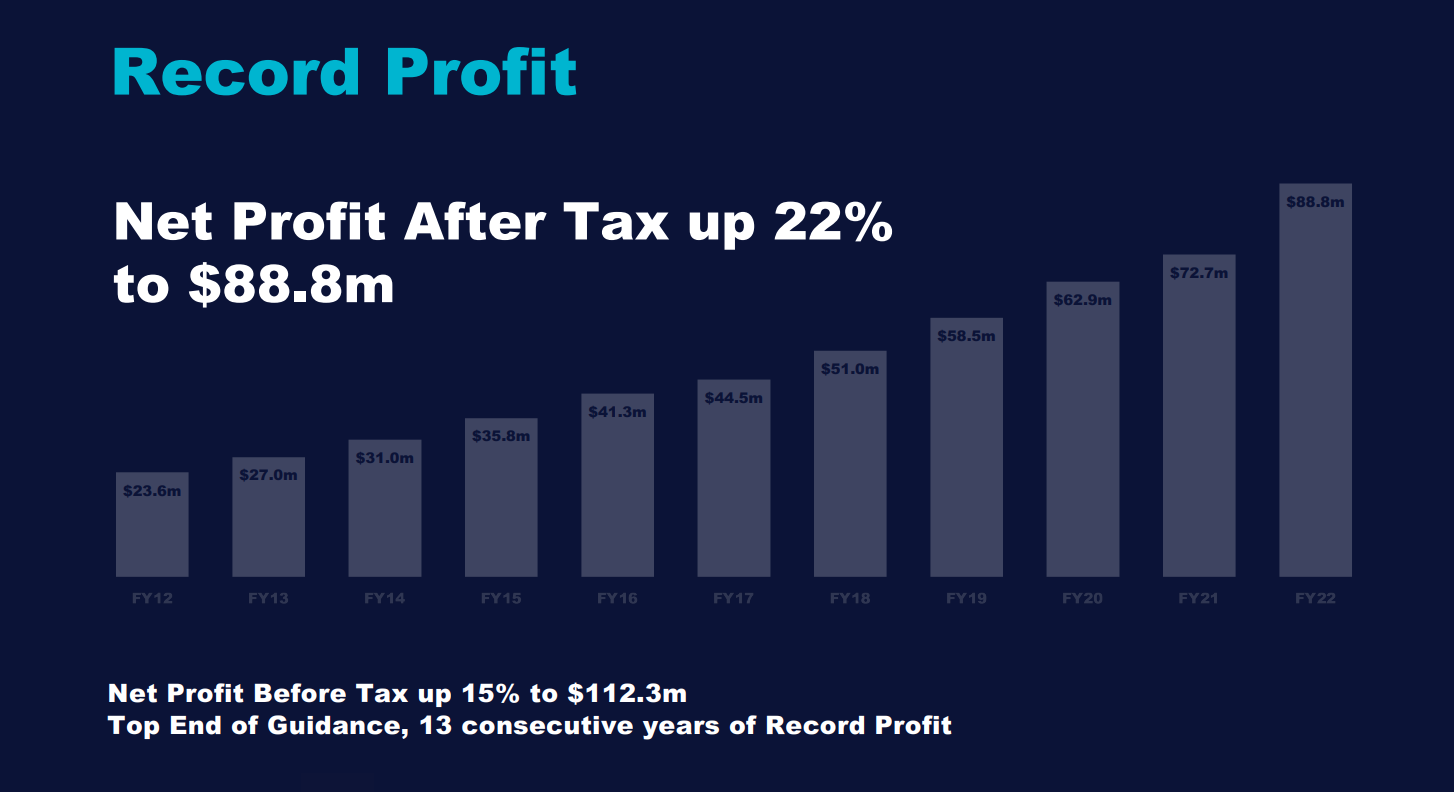

- Profit After Tax of $88.8m, up 22%

- Profit Before Tax of $112.3m, up 15%, at the top end of guidance

- SaaS Annual Recurring Revenue (ARR) of $274.2m, up 43%

- Total Annual Recurring Revenue (ARR) of $320.7m, up 25%

- Total Revenue of $369.4m, up 18%

- Revenue from our SaaS and Continuing Business of $358.7m, up 22%

- Expenses of $257.1m, up 20%

- Cash Flow Generation of $77.2m, up 21%,

- Cash and Cash Equivalents of $175.9m, up 22%

- Total Dividend of 17.02cps, including a special dividend of 2.0 cps, up 22%

- R&D investment of $92.2m before capitalisation, up 19.6%, which is 25% of revenue

Another fantastic year for TNE with NPAT growth of 22%. Management have had long term targets of $500m+ in ARR by 2026 and also to double the business every 5 years (implying 15% CAGR).

I have updated my valuation on Strawman to reflect these results. I still think the current share price is a bit expensive and have sold my shares in my real life portfolio but continue to hold on Strawman. However TNE is definitely one of the highest quality business' on the ASX and a company I will look to re-enter at the right price.

Full Announcement Here

Full Presentation Here

Full Report Here

Disc: Held on Strawman. Not held IRL.