Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Published in the Australian this afternoon.

Brisbane-based TechnologyOne has intensified its UK push, signing up its second London borough customer – a move that it says will help it win more market share from rivals Oracle and Workday and save ratepayers millions of dollars.

TechnologyOne, which is listed on the ASX with a market value of $13.25bn, develops resource planning software for councils, schools, universities, hospitals and government agencies.

If you have applied to build a pool in your backyard or a house extension, chances are it was through TechnologyOne’s software.

It has been expanding into the UK, capitalising on a disastrous IT rollout at Birmingham City Council, which contracted Oracle and has since been plagued by problems, with its cost blowing out from £19m ($39m) to more than £130m.

Birmingham’s auditors Grant Thornton said the botched upgrade has been a “contributory factor” to the financial woes of the council, which declared itself bankrupt in 2023 and has since been battling a rat infestation following an industrial dispute with garbage collectors.

TechnologyOne chief operating officer Stuart MacDonald – who splits his time between Australia and the UK – said the company had been gaining traction with its fixed cost SaaS+ product.

He said SaaS+ aims to end what is known as “consultant creep”, implementing enterprise resource planning (ERP) software in a fraction of the time that it takes its rivals. The goal is to get an ERP up and running in 30 days – this compares with its competitors taking 2000-plus days.

Mr MacDonald said signing up Greenwich, which is its second London borough customer after Islington displayed confidence in TechnologyOne’s product and promise.

“It’s validation that the SaaS+ is real, that we’re low risk and we’ll do this for them. We know their space,” he said.

“Councils are under enormous pressure to do more with less, and to get results from IT projects quickly. A modern platform like OneCouncil enables them to reduce costs, improve compliance and free up staff to focus on frontline services.

“SaaS+ takes away the risk that the promise will never be delivered or will cost tens of millions of pounds more than budgeted. We look forward to delivering strong results for the council and the community.”

Crucially, it aims to avoid what has plagued Birmingham – the UK’s second biggest city.

“Usually in a traditional ERP implementation, you have different business models and different stakeholders with different goals. You’ve got a software company that’s trying to sell software and an implementer that’s trying to stay onsite as long as possible and the two don’t usually mesh,” Mr MacDonald said.

“So you get things like Birmingham where Oracle sold something but now it is costing over £130m to implement it with no end in sight. They’re conflicting goals. So we go in with one goal, which is we want you to go live as quickly as possible, with one fee.”

And the risk for TechnologyOne if it goes wrong?

“If it takes us longer, if it takes more people, that’s on us. It’s the de-risking that is changing the landscape that’s making us grow so well in the UK,” Mr MacDonald said.

“It’s referenceability. We’re using them to get to the next county, the next unitary, the next borough.”

Winning London boroughs is particularly significant for TechnologyOne. “Borough’s can buy whatever they want. They buy the best,” MacDonald said.

“So it’s super exciting, it is the next foundational piece for us to grow in that space.”

Signing on TechnologyOne will allow Greenwich to cut costs and streamline processes by replacing outdated IT systems with a highly automated system powered by integrated artificial intelligence capabilities.

Greenwich will also implement TechnologyOne’s OneCouncil Financials to establish a “single source of truth, empowering leaders with real-time insights and forecasting tools to optimise budgetary management and better anticipate community needs”.

More than 50 local authorities across the UK now use TechnologyOne’s software, including Worcestershire County Council, Highland Council, Newport City Council and Antrim & Newtown Abbey.

TechnologyOne shares have soared more than 32.1 per cent to $40.46 this year. It listed on the ASX in 199 at $1 a share, believing the key to its success is to be consistent and focused, aiming to deliver 10-15 per cent profit growth each year.

My Assessment

It would be great if $TNE gets a reputation for seamless implementation with UK local authorities. It has certainly been talking this up, as it touts its SaaS+ offering. (I hope the delivery is there to back it up.)

The Birmingham City Council ERP botchup is a great one - with a cost blowout of QLD Health Payroll proportions! It is a high profile failure that will be front of mind in any UK Local Body IT procurement decision for years to come.

With almost 400 local authorities in the UK, $TNE having a few modules in only 50 means it is very early days indeed in that market.

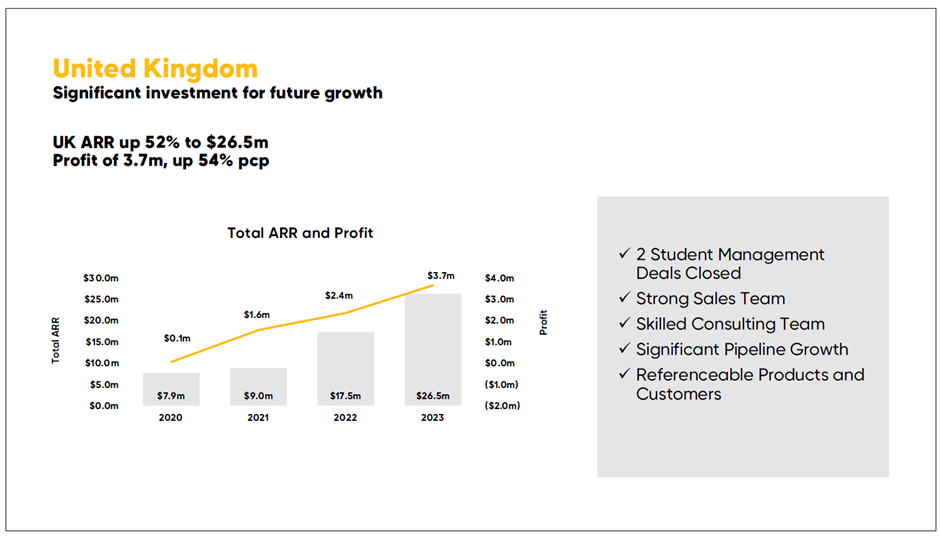

$TNE has been a slow burn in the UK, starting operations in 2006. It took until 2022 for UK ARR to get to $17.5m, nearly doubling from 2021. So let's say 15 years to go from zero to $9m in 2021 (whcih was the first year the business broke even), and then another 4 years to grow 4x to get to $43m.

The running room ahead in the UK in both local authorities, government and education institutions is a core part of my investment thesis.

$TNE is fully valued at the moment IMO, but with its ROE consistently above 30% and its NRR strong enough to double the size of the business every 5-years, you pretty much get an opportunity every year to load up - if that's your thing, and you are prepared to be patient.

(Note to self: I need to update my valuation on here, as its out of date.)

Disc: Held in RL only

I have this morning exited my entire RL $TNE position at $26.591.

It's a great company, but the decision was based on valuation. For me its $23.70 ($20.70 - $26.60).

Getting to my upper valuation limit of $26.60 requires strong sustained growth for 6 years, with an exit P/E of 45 in 2030 - which is high by any measure.

SP has run up over 67% since the stellar 1H result, and I fear expectations have started to run ahead of reality. For such a steady perfomer, a forward P/E of 72x and trailing of 79x just seems excessive. A result next week that does anything other than blow well-guided consensus out of the park could see a significant pull-back. The outperformance required to drive yet another leg up seems to be a stretch. (Let's see how well that prediction ages!)

Of course, whenever I hop off the bus like this, I know I risk missing the chance to get back on. But can I see it doing +15% from here over the next 12 months? Frankly, no.

I'm reasonably confident that this one will come back, and would be happy to get back on more around $21-$22. (Just wait for the next round of US inflation concerns to raise their heads!)

Disc: Not held

Interesting article this morning in The Australian. This is one thing look for in a CEO - a clear strategic focus, leading to an ability to decide what to chase and what to forego.

------------------------------------

Why TechnologyOne CEO Ed Chung turned down $500m

TechnologyOne chief executive Ed Chung celebrates the company’s 25th anniversary as a listed company. He says being consistent and focused is the key to longevity in tech.

TechnologyOne chief executive Ed Chung turned down $500m from an investor to expand in a new category. Why? He says the answer reveals the secrets to the company’s success.

The Brisbane-based software giant is celebrating its 25th anniversary on the ASX this year. It floated in 1999 at $1 per share, just before the dotcom bust, which ripped through the tech sector like a wrecking ball, demolishing companies such as Davnet and PocketMail. Names long forgotten.

But TechnologyOne has grown into one of Australia’s biggest companies with a market value of $7.94bn — larger than AGL Energy ($7.09bn), Lendlease ($4.64bn) and Ansell ($4.5bn) — making software for local councils and higher education.

It is a company proud to have a narrow focus, with Mr Chung believing it is better to excel at a few things than be spread too thin and make a mess.

And this is why, when one of his long-term investors offered what appeared to be a golden opportunity, he turned him down.

“He goes ‘Ed, I’m going to give you half a billion dollars. I need you to get into manufacturing and take over SAP space because these companies I invest in are burning all their money’,” Mr Chung said.

“I said ‘We don’t know that space. We’d stuff it up. We’ve got to keep focused’. It’s a running joke. We laugh every time.”

But it’s paid off for investors. If they bought one share for $1 when TechnologyOne floated, it would have yielded $216 today on a total return basis.

Overall, the company has raised $208m in follow-on capital since its listing and paid out almost $756m in dividends. Its share price has also rocketed to $24.31, gaining almost 60 per cent in the past year alone.

While TechnologyOne has attracted headlines recently as part of its efforts to take on the consulting giants, vowing to slash the time it takes to implement its SaaS+ software to 30 days by the end of the decade (rivals currently take more than 2000 days), Mr Chung normally prefers to keep a low profile.

He believes the key to success is to be consistent and focused, aiming to deliver 10-15 per cent profit growth each year.

“If you talk to the analysts they say we should be growing at 15 to 20 per cent not 10 to 15. And we agree, but we have to get there in a carefully measured way.

“Last year, we actually grew at 16 per cent. This year we might grow a little bit faster and a little bit faster every year after that, and inch our way up to 20 per cent because you’ve got to stop and pause and see that your systems, your process, your culture, your people, are all still operating.

“There is a lot of pressure to grow but to go outside your sweet spot. And we’ve been outside our sweet spot a few times, and every time we went outside our sweet spot, we made some mistakes and we say ‘well let’s not do that again’.”

But there is still pressure to grow via acquisitions, particularly after TechnologyOne posted a $129.9m net profit last year.

An on Friday it snapped up Melbourne-based education software provider CourseLoop for an undisclosed sum.

The CourseLoop deal aims to solidify TechnologyOne’s position as an SaaS provider for higher education institutions in Australia, New Zealand and Britain. But Mr Chung is picky when it comes to takeovers and there are others he has walked away from.

“If you look at our company, under the covers, we’ve got 1300 staff, but we’ve got 16-17 products. So each product is not very big. Years ago, we looked at Elmo, it got sold. Elmo’s HR payroll or HCM (human capital management software) I think had 500-800 staff, our HR payroll team’s about 30.

“And then we looked at buying Tribal in the UK a year ago. It’s student management. They’ve got 800 staff, we’ve got 100.

“So that says a few things to me. We’ve got our enterprise solution, we’re very focused on it, but it’s actually not about adding more people. It’s about finding those people who have got the innovation, grit and the determination, because we compete with all the world’s biggest and best and win.”

Disc: Held in RL

$TNE are holding their investor day today, and have lodged the massive 180 odd-slide deck on the ASX. I'd have liked to have attended today, but there is just too much going on. Clearly, judging by the presentation, there are a lot of slick management presentations giving investors the chance to see more of the broader management team. So I will certainly be keen to read the broker note. I particulary get a lot from the GS Research on $TNE. Their research is backed up by a lot of broader industry and competitor insights and, while I don't always agree with how they translate their insights into forecasts, Chris and Elise do a great job of backing up their analysis - which is more than many do. (For the record, GS have a TP of $19.70, are BUY rated, with a BULL case of $28.65)

There is a lot of content among the flashy slides, including detailed assessment of $TNE market positioning and major competitors in each of its industry segments. I imagine I'll return to the material in some detail over the coming weeks.

Looking at the material, one realises that although we might mainly consider $TNE a local government and educational institution ERP provider, they have year by year been extending and establishing footholds in a much broader range of industry verticals, with a growing range of functional modules. This is the broader platform for growth, to which we can add their recent foray into the UK (still early days).

The Major News Today

$TNE have a great track record of setting long term ARR targets and then hitting them early. While slowly expanding margins. No single result ever "knocks it out of the park", nor do they have bit nasty surprises. Its just relentless, grinding growth, at a decent clip.

Over the years, its probably the one stock I've devoted the least attention to: two results announcements per year, a quick check on the AGM for any updates, and a periodic model tweak. Plus the usual reading and keeping alert for news across its key verticles. In terms of $return per hour of effort invested, its the clear winner in my portfolio.

So, today's material news:

- From ARR = $500m in FY2025, to ARR = $500 by 1H FY25 (recently upgrade from FY26)

- ARR = 1bn by FY30

- NRR to be 115%-120%

- R&D to double their "APAC Whitespace" from $2bn to $4bn (i.e. growing functionality and verticles)

- Proft Margins to expand to 35% by 2030 (23.3% in FY23) "through significant economies of scale"

- ( ... and yes, yuk, total TAM $13.5bn .... for completeness)

Valuation

Plugging this info into my quick model, and treating FY30 ARR as revenue in that year (probably an over-estimate, but allowing for them to come in early, so I won't sweat the difference)

- EPS (FY30) = $1.045

- EPS CAGR 2023-2030 = 18.7%

- SOI growth og 0.5% p.a.

- Using a WACC of 10% (which is probably high for $TNE, which is more like 8-9%, but use this as an MoS) discounting back 7 years 2030 to 2024:

- P/E of 35 : Value/Share = $20.70

- P/E of 45: Value/Share= $26.60

Note: Average P/E over last 3 years has been around 47 (currently a bit spicey at 58.)

I'll put my Strawman valuation in between the two at $23.70.

Conclusion

At 7.3% of my RL ASX Portfolio, $TNE is my 3rd largest holding. Mr Market does present annual opportunities to buy, but today isn't one of them. (If the P/E fell back to around 40 - last there in Oct-22 - I'd add, and be happy to take it up to 10% weight. Who knows, maybe I'd get a little trigger-happy before then. But not today. )

Disc: Held in RL, not on SM

Some initial broker responses:

- GS from $18.10 to $18.85

- Jeffries from $18.00 to $19.00

- UBS unchanged on $16.40

GS (the only one I have the full note for) assumes PBT grows at just over 17% p.a. for the next two years. Seems about right. Never blowing the lights out, but also not underperforming. Steadily growing, high quality earnings.

More to come but, overall, mostly positive commentary, but the modest changes imply more was expected.

Disc: Held in RL

$TNE have just posted their 1H results. At first glance, another reliable 6 months of delivery. Not much to say.

Their Highlights

- Profit Before Tax of $61.5m, up 17%

- Profit After Tax of $48.0m, up 16%

- Total Annual Recurring Revenue (ARR) of $423.6m, up 21%

- Net Revenue Retention (NRR) of 117%, above our target of 115%

- Revenue from our SaaS and Recurring business of $223.1m, up 21%

- Total Revenue of $244.8m, up 16%

- Total Expenses of $183.2m, up 16%

- Cash Flow Generation of ($3.8m) as expected in H1, and will be strong over the full year

- Cash and Investments of $172.0m, up 24%

- Record Interim Dividend of 5.08 cps, up 10%

- R&D Investment (before capitalisation) of $56.9m, up 15%, which is 24% of revenue

- UK ARR $28.8m, up 36%

My Observations

As first glance, a characteristically good result. Like clockwork.

Revenue and profit growth both somewhat weaker than 1H FY23 over its PCP.

However, the strategic framework and investment thesis is for $TNE to double in size every 5 years, for which it requires revenue and profit growth of 15%.

Cashflow typically weak in 1H due to seasonality in payments and receipts cycles.

With ARR at $423.6m, and 1.5 years to go, on track to achieve ARR of $500m by FY25.

So tick, tick, tick.

Investor call at 11am this morning, so I'll leave it there unless there is anything of interest on the call.

SP is more or less on its long term growth trend, so I don't expect much SP action. That said, don't care, coz this is one of the true long term holds that I don't really bother much about looking at the SP. Probably around fair value.

Disc: Held in RL

(Now my 4th largest holding; was 5th, but I have started selling down $ALU as I require the funds.)

$TNE announced their FY23 results today. It is my largest RL holding, so I attended the call, and here will bring out a few points.

Their Highlights

• Profit Before Tax of $129.9m, up 16%, beating guidance of 10%-15% growth

• Profit After Tax of $102.9m, up 16%, beating guidance of 10%-15% growth

• Total Annual Recurring Revenue (ARR) of $392.9m, up 23%

• On track to surpass $500m ARR by FY25

• Net Revenue Retention (NRR) of 119%. Above our long-term target of 115%

• Total Revenue of $441.4m, up 19%

• Revenue from our SaaS and Recurring Business of $390.7m, up 22%

• Expenses of $311.5m, up 21%

• Cash Flow Generation of $104.6m, up 36%

• Cash and Investments of $223.3m, up 27%

• Total Dividend of 19.52 cps, including a special dividend of 3.0 cps, up 15%

• R&D investment of $112.0m before capitalisation, up 21%, which is 26% of revenue

My Analysis

The results are impressive, and the highlights above speak for themselves.

Yet the market had run up in anticipation of the results - both expecting a good result given the strong 1H and as part of the wider macro pick-up in recent weeks. So, $TNE closed the day down 2%, as those who play with a shorter-term horizon took some profits. This is often the pattern with this stock.

The presentation held some interesting insights, which continue to support my thesis to continue to hold $TNE long term.

Cash generation was particularly strong, reportedly due to good performance by the collections team, with Cash Flow Generation (a number they use which is close to FCF) was 102% of NPAT – something CEO Edward Chung claimed was a year earlier than expected.

$TNE upgraded their target to hit $500m ARR by 2026 pulling it forward to 2025 – again, this was widely expected.

Net Revenue Retention was a very strong 119%, aided by pricing increases in an inflationary environment. However, even excluding the inflation effect, Edward said the result was very close to their ongoing goal of having NRR of 115%. This "target" allows the company to double revenue every 5 years, from existing customers.

Churn remains low at 1%, which was also positive. As $TNE gets to the end of the transition to a 100% cloud SaaS company, this was expected to lead to the loss of some customers on legacy platforms.

Although profit growth beat consensus, it was weaker than indicated by the strong ARR growth because costs have increased, driven by increased spending in R&D to drive development of the SaaS+ platform, and building out their full One Education offering.

Two case studies presented on Slide 25 showed where they are winning full government department ERP and whole of university ERP deals (student management, finance, HR and payroll). So, it has taken a lot of development investment to get to this point.

Consequently, PBT margins have fallen back to 30% from FY21’s high of 31%, however, Edward said that this will now gradually ramp up towards 35% over the coming years. Given the prospect of strong, ongoing revenue growth, this should turbocharge earnings growth over the next 3-5 years.

Long Term Prospects

My thesis for long-term sustained growth rests on two pillars: 1) continued strong growth from existing customers and 2) UK as a material future growth horizon. I’ll update briefly on both.

1) Growing Existing Customer with SaaS+ the next phase

A lot of rubbish gets written about $TNE by analysts who talk about the company’s growth slowing as they run out of room in ANZ, and today’s presentation addressed this head on.

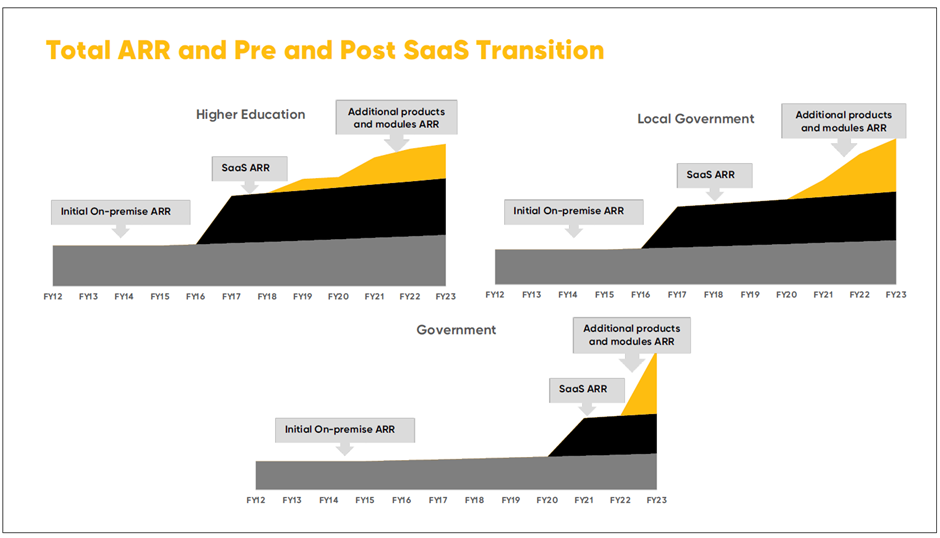

Without going through the detail of the product suit that makes this possible(but they now have 16 products and over 400 modules), I include on chart from the presentation below that shows how $TNE’s innovation allows it to grow revenue strongly from existing customers.

Presentation Slide 29: Case Study of Existing Customer Growth

The slide shows selected case studies indicating how the transition to SaaS from the on-premises legacy drove the initial step-up in ARR, to which over time they have added new modules. Nothing new here, it’s the classic SaaS modular land and expand model.

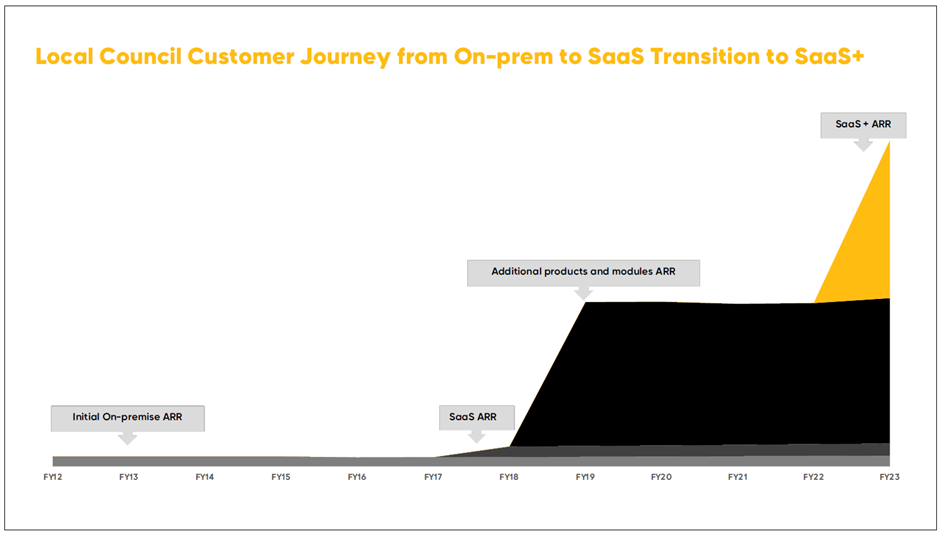

What’s exciting is the new SaaS+ model, which is an enhanced SaaS ERP service including support for implementation and training and other services bundled around it. The offering has been developed to enable customer to adopt the service without having to use system integrators to manage the implementation. Slide 30 shows how this added value creates a new horizon of growth – one that is not yet material at the portfolio level, but which drive growth over the coming years.

Slide 30: Impact of SaaS+ (Case Example)

Edward was at pains to point out that while their competition in education and local government (including SAP) have now moved their offerings to the cloud, unlike $TNE these systems have not been designed as SaaS, cloud native products. Edward stated that $TNE have rebuilt their entire tech stack 4 times over 36 years. He claimed that no other ERP player has even ever done it once. So, they have a massive advantage against competitors in having very low technical debt. Importantly, the architecture is design for ease of implementation, as well as modular expansion.

Customers of competitors, on the other hand, generally continue to face the historical implementation challenges, including hefty consulting bills. As evidence, Edwards showed that $TNE consulting revenues actually fell 11%, which was celebrated as a good thing, demonstrating the ease clients face in implementation.

SaaS+ is proving an early hit with clients. 2023 was the first year of implementation, and they had targeted 10 deals. They delivered 34.

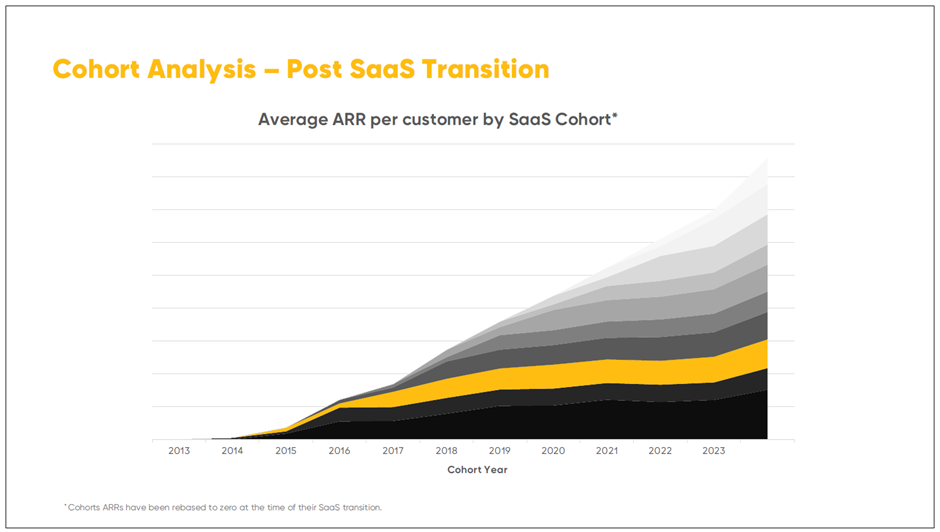

To show the enduring nature of the growth from existing customers, they included a cohort chart (which looks very much like what you see from $ALU and $WTC).

Slide 28 – Cohort Analysis

2) UK is making progress

The UK is the second part of my long term growth thesis.

$TNE started operations in the UK just before the pandemic, turning a profit in the first year, 2020. (Just think about that in the context of some of our other SaaS favourites here on SM that have spent 2-3 years around the inflection point!)

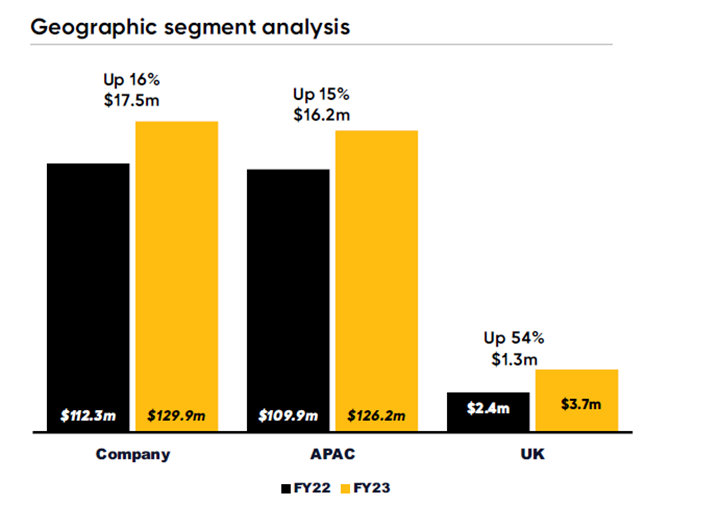

In FY23, ARR was $26.5m (up 52%) and profit of $3.7m was up 54%. It is still not a material part of the business, but it is intereesting nonetheless.

See the following two charts for an overview. (They have been just a bit naughty, in that the first chart is not to a consistent scale!)

One question mark in my thesis is whether $TNE can replicate their ANZ success in the UK. Or, are they late to the party in the UK, and up against established competitors who are all now also in the cloud. (Perhaps like we’ve seen with $XRO in its international expansion, where the international business is facing slowing growth, and represents objectively a lower quality business.)

While it is still early days, the signs are promising, and the management team expressed confidence that they are going to continue the trajectory established.

The reason for the confidence is the innovation their have built into their products which beats the competitor ERP offerings in the core verticals of education and local government. In fact, examples were presented where clients using competitor on-premises products, rather than risk a painful transition to the cloud used that transition decision as the opportunity to switch to $TNE. If $TNE develops an industry reputation as offering the best customer experience for on-prem to cloud transition, then perhaps they are just in the right place at the right time.

Progress in the UK is one I am watching closely. It’s not material at the moment, but looking out over 5-10 years, it could be a very important part of the long term growth story.

Valuation

$TNE is not cheap (understatement). Based on today’s result and closing price, the p/e is 51. That’s well into the upper half of its p/e range over the last 5 years (p/e range c. 35-60).

In my basic DCF models, I get valuations ranging from $13.50 – $22.00. With a stable margin structure, it really comes down to how long and how hard you believe it can continue to grow.

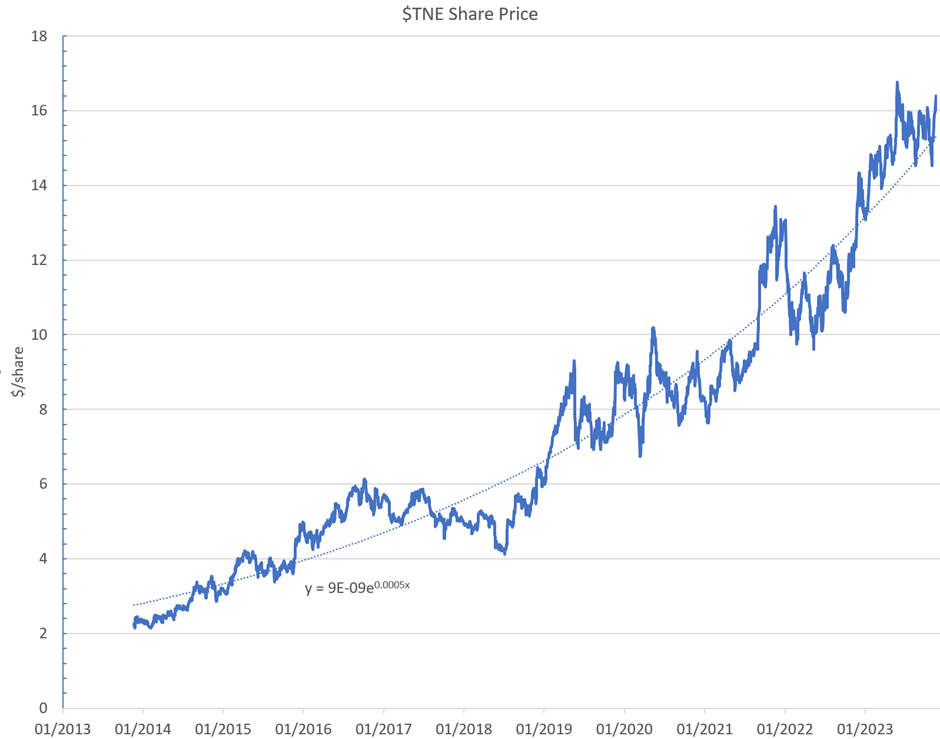

I’ve plotted the last 10 years SP below, with an exponential best-fit curve overlaid. If that curve is a good approximation to fair value, then pretty much every year you can get an opportunity to buy $TNE at a 10-20% discount to fair value. That is in fact when I last topped up in early 2022. But today, I’m not a buyer.

I’m certainly also not a seller, as I have a high conviction that with continued good management, this journey can carry on for the next 5-10 years. $TNE is my largest ASX holding in RL, and second only in conviction to $WTC.

My Key Takeaways

The FY23 was good on all fronts. There is really nothing to be critical about.

This is a high-quality business, and it appears to have a good runway ahead. In truth, it is hard to know just how good the market runway ahead of it is in ANZ. They claim to be no more than 15% penetrated in any of their verticals. I am happy to judge them year-by-year on delivery. The interest for me is the early progress in the UK – a market 2-3x ANZ. They’ve started well, and if the trajectory can be sustained, then even buying at today’s price will look like a great decision in 5 years’ time.

Disc: Held in RL (7.5%) not held on SM

$TNE announced H1 results this morning, with the investor call at 11:00am.

Their Key Results

• Profit After Tax of $41.3m, up 24%

• Profit Before Tax of $52.7m, up 24%

• SaaS Annual Recurring Revenue (ARR)1 of $316.3m, up 40%

• Revenue from our SaaS and Continuing Business of $200.0m, up 18%

• Total Revenue of $210.3m, up 22%2

• Total Expenses of $157.6m, up 21%3

• Cash and Cash Equivalents of $139.1m, up 20% from 31 March 2022

• Cash Flow Generation4 of $1.3m as expected, and will be strong over the full year

• Interim Dividend of 4.62cps, up 10%

• R&D expenditure (before capitalisation) of $49.4m, up 19%, which is 24% of revenue

• UK profit of $3.0m, up 29%

My Further Observations

With SaaS growing strongly and now the dominant revenue component, $TNE is forecasting a one-off unusally high annual churn of 1.6%, due to its End of On-Premises milestone later this year. Regardless, it is forecasting NRR of 115%-120% for the FY.

In reviewing the results it is important to recognise the historical pattern that cash receipts are stronger in H2, due to payment seasonality.

New SaaS large enterprise customers increased 27% to a total of 903.

All industry verticals are growing ARR strongly, with above average growth in the three smallest segments: Health and Com (+23%), Asset & Project Intensive (+28%), and Fin Serv. & Corp. (+33%). Only Government was significantly below average at +12% (vs. Group 22%). Strategically, if this trend continues, it will over time mark a further diversification in $TNE's customer base, and indicates a broader market appeal for its products.

The UK business is continuing to grow profitably with PBT up 29%, ahead of the group growth of 24%. UK is only making a small contribution to 1H FY23 profit of $3.0m in the total of $52.7m.

Overall, $TNE says it is on track to achieve $500m+ ARR by FY26. No change.

Wide range of guidance given for PBT growth for the FY of 10-15%. (Note: some commentators consider this guidance as conservative, expecting a "beat" in November.)

They re-iterated their view that SaaS-enabled economies of scale will see margins expand from 30% (32% ex-Scientia impact) to 35% over the coming years.

My Key Takeaways

$TNE continues to consistently deliver with nothing exceptional in this report.

Results are broadly in line with market consensus and the shares appear fully priced for the march to FY26. Of course, outperformance could drive further upside. Given this, I have recenltly halved my $TNE position, to deploy capital to holdings were I see greater upside opportunity. Of course, I'll be happy to pile back in should the market offer any opportunity!

I'll be listening for an update on the cyber breach on the call. No reference to this in the release or the slides.

Disc. Held RL (3.0%);not held in SM

Post a valuation or endorse another member's valuation.