I’m attempting to build the negative case for UWL, any insights would be appreciated, it’s a bit thin!

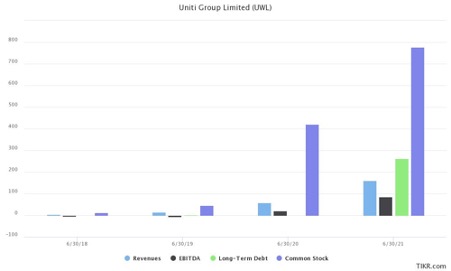

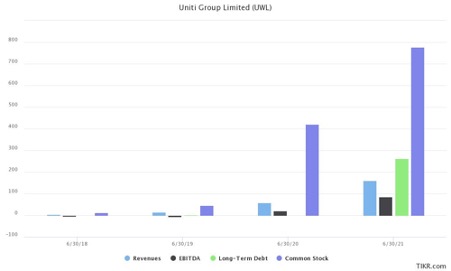

· Stock on issue has increased with acquisitions and options (Buyback could temper this?)

· Long term Debt 261.9m, Cash 57.3m

· Management: Vaughn and co are excellent storytellers and it appears “everyone” has bought into the story.

· Potential growth impacts if greenfield housing developments slow down or get delayed. (But yeah, who knows what happens next with the housing market and the "politics" of the housing market will probably keep it propped up.)

· Vaughn Bowen, insider trading allegations in relation to Optus share sales in 2019 may rear its head again.

· Renumeration: Performance bonuses 50% payable on short term incentives, 50% long term.

I admit it is easy to counter these points and build a bull case for UWL, however it is useful to look at the other side of the trade. Held RL

* Financials via Tikr