A pretty outstanding set of results. Good organic growth and the addition of opticom has made them a much bigger and better buisness than a year ago. They have delivered on everything they said they would do last year and the commentary from the investor briefing was very positive. Despite this the market hated this result and sold it down by 12% after a similiar sell off yesterday. Its now trading around 3.26 down from $4 last week. Maybe market was expecting more immediate growth? To me its a pretty crazy reaction to a vertically integrated telecomunications infrastructure buisness that is profitable, has low maintenance costs on its long life infrastructure and has great cashflow generating capabilities. It wasn't cheap last week but I think it is becoming cheap now given the growth runway this buisness still has.

The only miss was a delay in construction revenue which has been delayed due to the covid shutdowns in Q2, they made it clear that this revenue has just been deferred not lost. Comentary around outlook was positive and they expect to meet full year guidance (145M EBITA - 70M for H1), but didn't want to go on record to exceed the current full year record, but my reading was as they are very happy with the way the buisness is running and the amount of revenue contracted into the future.

91% of their revenue is now recurring. In the call they did a very good job of explaining there competitive advantage around owning their own fibre network, the multiple revenue options this generates and how they are able to capitalise on this and how they still have a ways to go on extracting the full value out of there networks. The mentioned the high demand for high speed internet and how they are robust to inflationary environment and expect to pass along costs if inflation starts to impact. Currently not much inflation in there buisness but they can see some signs of it coming.

Not much talk about capital management, but they did say they have identified several opportunities (only in Australia) that they are exploring that would be valuable assests to there buisness but nothing material yet to be disclosed. It suggests to me that a buyback will probably not happen if they get keen on an aquisition. If they buy something it can be funded from cash reserves and debt (they paid 40M down t. They are meeting this week to discuss capital allocation. No plans to pay a dividend. No detail around any buyers for the company and I think this annoucement was more to support the shareprice than any real activity.

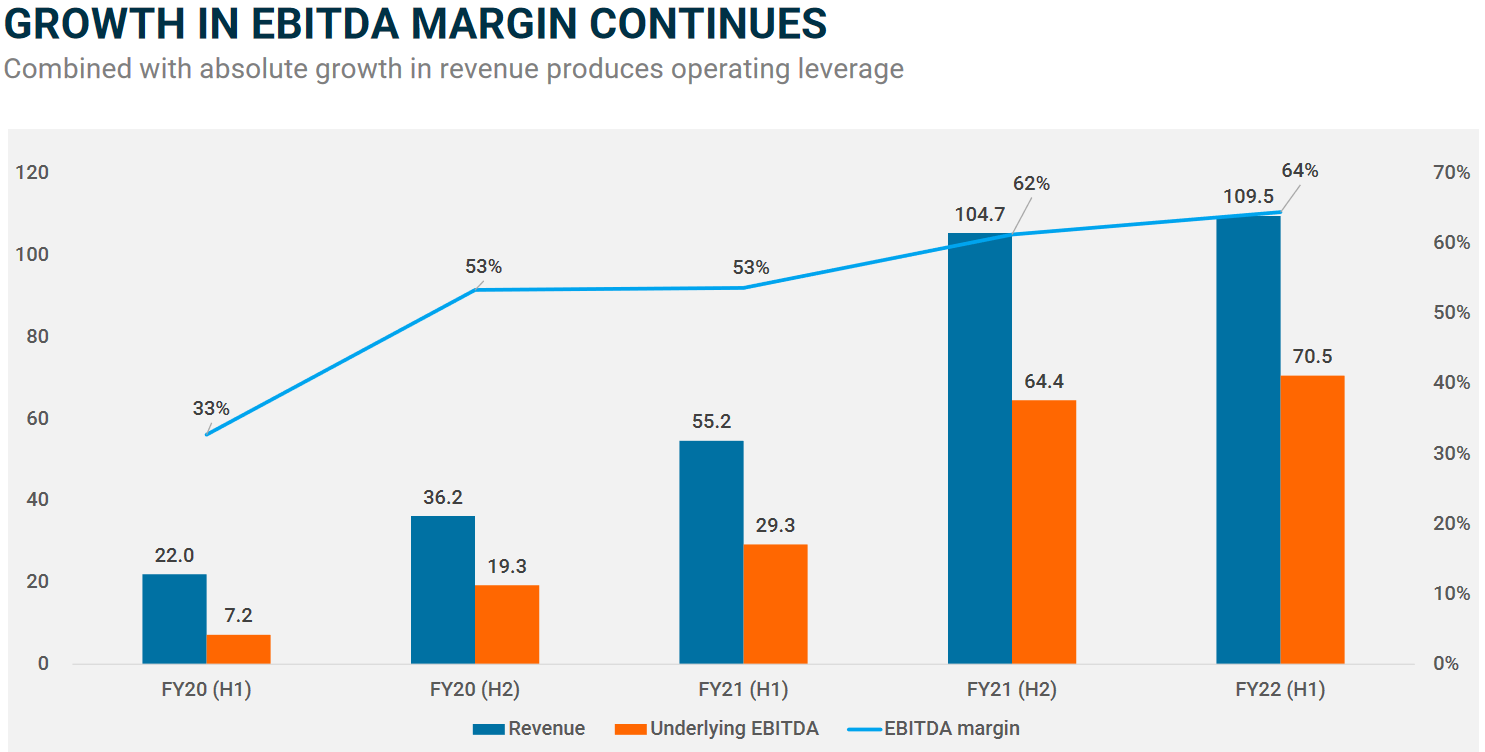

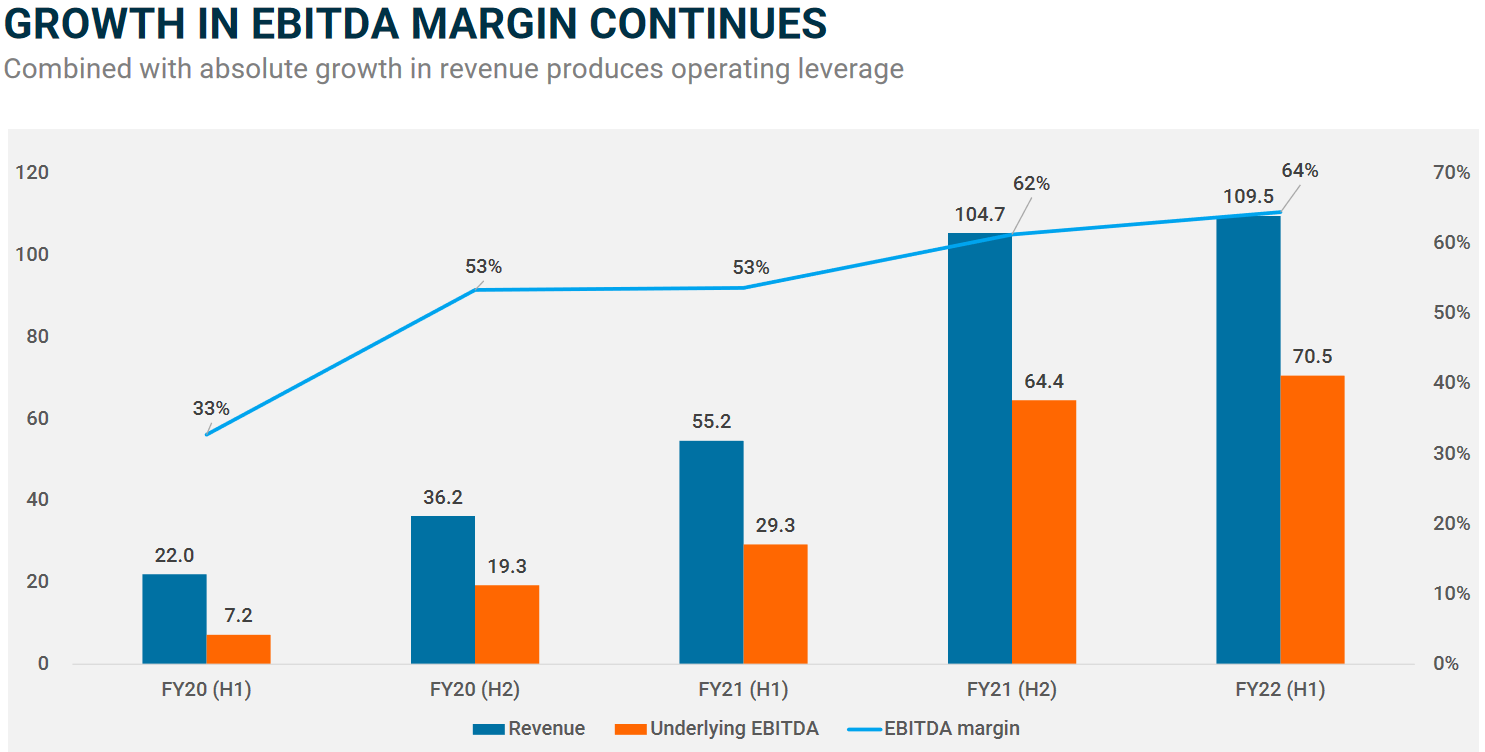

I think this graph from the report gives a pretty clear story on how front end revenue gets converted into cashflow.